JERA. 28.199 EI PUBLISHED. pdf

Teks penuh

Gambar

Garis besar

Dokumen terkait

This study aims to examine the effect of leverage, profitability, liquidity, dividend policy, size, and growth toward firm value. Population that are used in this study

From the sixth hypothesis calibmtion. It indicates significant and strong value which means that learning organization has direct influence to the MSMEs, and it

The One-Way ANOVA procedure is used to test the hypothesis that several sample means are equal. You can alternately use the Means procedure to obtain a one-way

The analysis result of the period of the year of 2000 up to 2004 shows that investment, size, and liquidity influence positively toward profitability; debt and structure of

Emporia Similarly the University of North Carolina—Chapel Hill Program Presentation indicates that possible specializations at the School of Infor- mation and Library Science include:

With K-means clustering al- gorithm, Silhouette and Dunn’s indexes suggest the 2 cluster solution while Davies-Bouldin index indicates that the 8 cluster solution is the optimal number

Furthermore, the value of a1 = 0.83 indicates that market share is positively influenced by product strategy of 0.83 or 83%, which means if the product strategy changes by 1 unit then

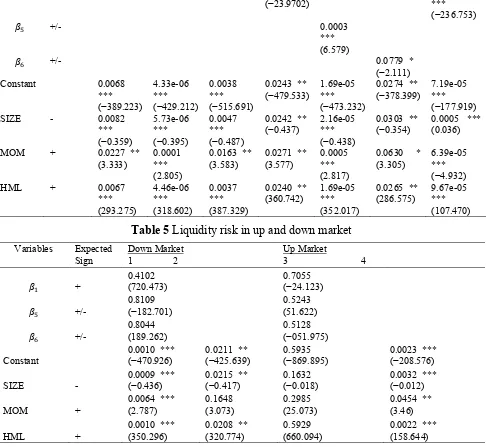

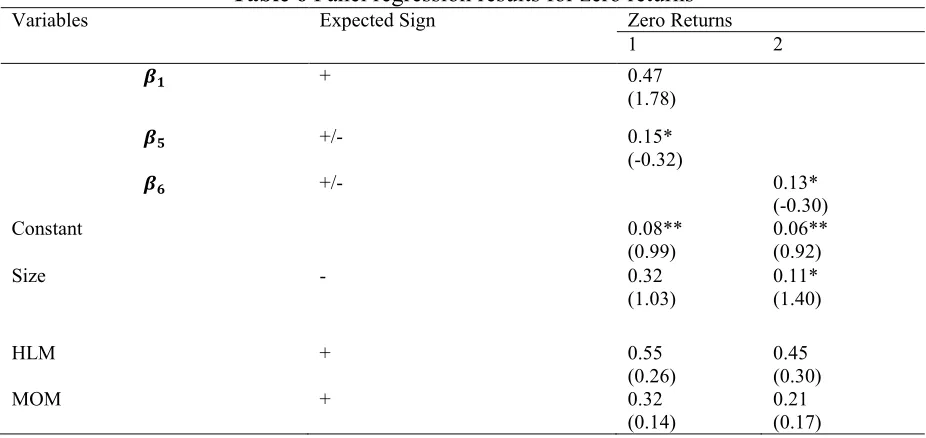

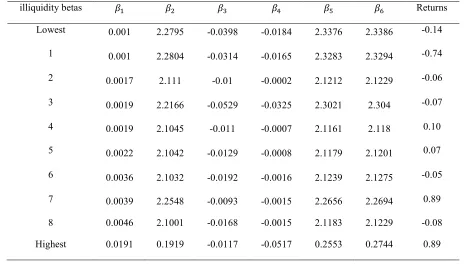

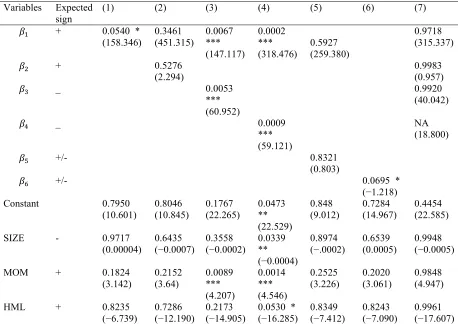

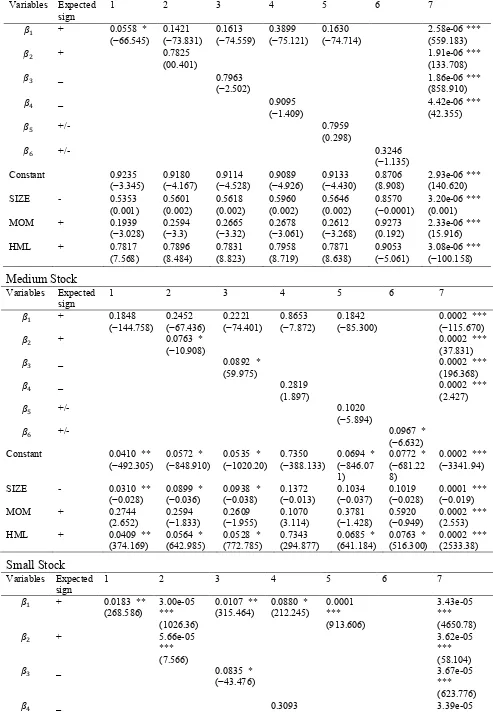

The results reveal that i funds’ returns are closely linked to market performance, ii effect of fund managers’ stock selection and market timing skills are both weak and insignificant