A PROPOSAL WAS CONSIDERED BY MR. MICHAEL BLAIR OAM AND OWNED BY MR. TREVOR BLAND, THAT the minutes of the Audit Committee meeting held on June 15, 2017 be confirmed. The minutes from the above meeting were confirmed at the audit committee meeting on 21 August 2018.

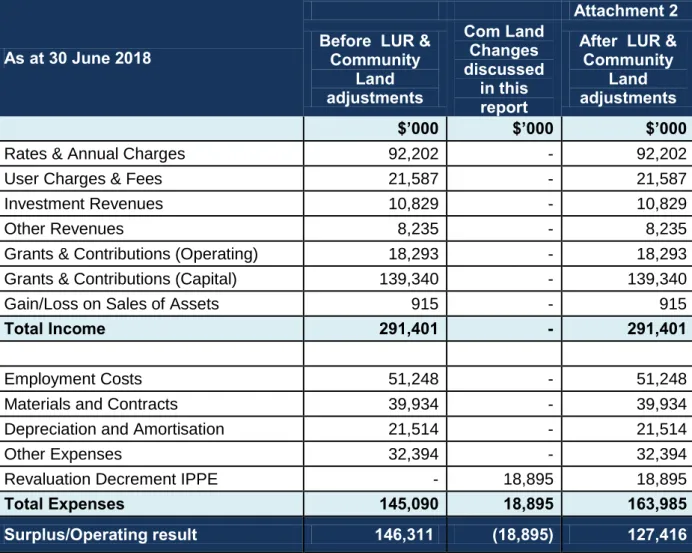

Income Statement

As at 30 June 2018

Before LUR &

Community Land

Com Land Changes

After LUR &

Community Land adjustments

Balance Sheet

Statutory Format before

LUR &

Adjustment LUR

Statutory Format after

IMPACTS Financial

Strategic Plan - Hills Future

RECOMMENDATION

The presentation from Council’s External Auditor be received

The Non-GAAP Financial Statements (Attachment 1) without the adjustments for Land under Roads and Community Land be received

ATTACHMENTS

NON-GAAP Financial Report for year ended 30 June 2018, Special Purpose Financial Reports for year ended 30 June 2018 and Special Schedules for year ended 30 June

General Purpose Financial Report for year ended 30 June 2018, Special Purpose Financial Reports for year ended 30 June 2018 and Special Schedules for year ended

Statement required by the Local Government Code of Accounting Practice (1 page) (ECM Doc No. 17166589)

AUDIT COMMITTEE MEETING 21 AUGUST, 2018

GENERAL PURPOSE FINANCIAL STATEMENTS for the year ended 30 June 2018

- Page 1

- Understanding Council’s Financial Statements 2. Statement by Councillors and Management

- Notes to the Financial Statements

- Independent Auditor’s Reports

- Page 3

- The Income Statement

- The Statement of Comprehensive Income Primarily records changes in the fair value of

- The Statement of Financial Position

- The Statement of Changes in Equity

- The Statement of Cash Flows

- Page 4

- Page 5

- Page 6

- Page 8

- Page 11

- Basis of preparation

- Basis of preparation (continued)

- Page 13

- Page 14

- Page 16

- Income from continuing operations

The municipality is obliged to send audited annual accounts to the municipality. The financial statements are presented in Australian dollars and are rounded to the nearest thousand.

TOTAL RATES AND ANNUAL CHARGES

Page 17

Income from continuing operations (continued)

TOTAL USER CHARGES AND FEES

TOTAL INTEREST AND INVESTMENT REVENUE

TOTAL OTHER REVENUE

Page 19

Page 20

TOTAL GRANTS AND CONTRIBUTIONS

Page 21

Add: operating grants recognized in the current period but not yet used Less: operating grants recognized in the previous reporting period now used Unspent and held as restricted assets (operating grants). Add: capital grants recognized in the current period, but not yet used. Less: capital support recognized in the previous reporting period, now used. Unused and kept as restricted assets (capital support).

Page 22

Add: Contributions recognized in the current period but not yet spent Less: Contributions recognized in the previous reporting period now spent Less: Transfer to City of Parramatta (Developer Contributions).

Expenses from continuing operations

TOTAL EMPLOYEE COSTS EXPENSED

Expenses from continuing operations (continued)

TOTAL MATERIALS AND CONTRACTS

Expenditures from regular operations (continued). c) Depreciation and impairment (continued) Impairment / revaluation of IPP&E.

TOTAL DEPRECIATION, AMORTISATION AND IMPAIRMENT / REVALUATION DECREMENT COSTS EXPENSED

Page 25

TOTAL OTHER EXPENSES

Page 26

Gains or losses from the disposal of assets

NET GAIN/(LOSS) ON DISPOSAL OF ASSETS

Page 27

TOTAL CASH ASSETS, CASH EQUIVALENTS AND INVESTMENTS

Page 28

Investments are first recognized at fair value with the addition of transaction costs for all financial assets that are not recognized at fair value via the income statement. Financial assets recognized at fair value via the income statement are recognized for the first time at fair value, and transaction costs are expensed in the income statement.

Page 29

When securities classified as available for sale are sold, the accumulated fair value adjustments recognized in equity are recognized in the income statement as gains and losses from investment securities. In the case of equity investments classified as available-for-sale, a significant or prolonged decline in the security's fair value below its cost price is considered an indicator that the assets are impaired.

Receivables

TOTAL NET RECEIVABLES

Page 31

Receivables (continued)

Inventories and other assets

TOTAL INVENTORIES (b) Other assets

TOTAL OTHER ASSETS

- Page 32

- Inventories and other assets (continued)

- Page 33

- Non-current assets classified as held for sale (and disposal groups)

- Page 34

- Page 36

- Page 37

- Investment property

- Page 38

- Page 39

- Provisions

Increases in book value due to revaluation are credited to the revaluation reserve. There are no restricted funds (external or internal) for the above obligations and loans.

TOTAL PROVISIONS

Page 40

Provisions (continued)

The present value of the defined benefit obligation is based on the expected future payments arising from membership in the fund up to the reporting date, calculated annually by independent actuaries using the projected credit unit method. The council is a signatory to an industry pension scheme under a local government pension scheme called 'Local Government Pension Scheme - Group B'. There is insufficient information available to account for the scheme as a defined benefit plan (in accordance with IAS 119) because the scheme assets are pooled across all Councils.

The amount of employer contributions to the Local Government Superannuation Scheme defined benefit plan and recognized as an expense and disclosed as part of the pension expense in Note 4(a) for the year ended June 30, 2018 was $316,508.

Accumulated surplus, revaluation reserves, changes in accounting policies, changes in accounting estimates and errors (continued).

Accumulated surplus, revaluation reserves, changes in accounting policies, changes in accounting estimates and errors (continued)

Page 44

Statement of cash flows – additional information

Page 45

Commitments for expenditure

Page 46

Contingencies and other liabilities/assets not recognised

- Guarantees

- Other liabilities (i) Insurance

Page 47

Contingencies and other liabilities/assets not recognised (continued)

- Other liabilities (continued) (iv) HIH Insurance

Page 48

Financial risk management

Page 49

Financial risk management (continued)

Page 50

The main risk associated with these receivables is credit risk – the risk that debts due and payable to the Council may not be settled in full. Payables and borrowings are both subject to liquidity risk – the risk that insufficient funds may be available to meet payment obligations when due. Borrowing is also subject to interest rate risk – the risk that movements in interest rates may adversely affect funding costs and debt service requirements.

The Board manages this risk by borrowing long-term and setting the interest rate on a 4-year renewal basis.

Page 52

The Council manages this risk by monitoring its cash flow requirements and liquidity levels and maintaining an adequate liquidity buffer.

Material budget variations

Material budget variations (continued)

Page 54

Fair value measurement

Unadjusted quoted prices in active markets for identical assets or liabilities that the entity can access at the measurement date

Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly or indirectly

Inputs for the asset or liability that are not based on observable market data (unobservable inputs)

Total

Page 55

Fair value measurement (continued)

Fair value measurement hierarchy

Level 2

Page 56

Council's fixed assets are fully revalued over a period of at least 5 years in accordance with the fair valuation policy. Buildings were last revalued on June 30, 2015 by Scott Fullarton Valuation Pty Ltd in accordance with fair valuation policies as mandated by the Office of Local Government. The fair value of these assets was based on their current replacement cost using internal unit prices and condition assessment.

These assets were last revalued on June 30, 2015 in accordance with the fair valuation policy as mandated by the Office of Local Government.

Page 57

The Council employs outside, independent and qualified appraisers to determine the fair value of Council buildings. The Council's Community Land was revalued on 30 June 2018 in accordance with the Fair Valuation Policy as mandated by the Office of Local Government. The Council's operating land was revalued on 30 June 2018 in accordance with the fair valuation policy mandated by the Office of Local Government.

The Council's Land under Roads has been reassessed per 30 June 2018 in accordance with the fair value valuation policy as mandated by the Office of Local Government.

Page 58

Community land valuations by the Council have been carried out internally based on Valuer General valuations for assessment purposes where available, or the average total Valuer General rates divided by the total land area to derive the unit rate. For parcels not on the General Appraiser's report, the value is derived from the unit average of the community land parcels and not the municipal average. The fair value for the land under the roads was worked out internally using a unit rate per square meter per suburb derived from a Valuer General valuation carried out for appraisal purposes and discounted by 90% based on the Englobo method.

Since the Valuer General considers land in all zones, average unit rates derived from the Valuer General's assessment are considered the most viable approach to the valuation of land under roads.

Page 59

Statement of Developer Contributions(continued) $ '000 SUMMARY OF CONTRIBUTIONS AND CHARGES Drainage Roads Traffic Facilities Open Space Community Facilities Other1 (Specify) Other S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 6 - Extractive Industries Roads. Statement of Developer Contributions(continued) $ '000 S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 8 - Rouse Hill Drainage Roads Traffic Facilities Open Space Community Facilities Other1 (Specify) Other. Statement of Developer Contributions(continued) $ '000 S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 9 - Castle Hill Town Center Roads Open Space Other CONTRIBUTION PLAN NUMBER 11 - Annangrove Industrial Roads Traffic Facilities.

Statement of developer's contributions (continued) $'000 S7.11 CONTRIBUTIONS – NOT ACCORDING TO A PLAN Drainage Roads Traffic facilities Parking Open space Other.

Local government industry indicators – consolidated

- Operating performance ratio

- Own source operating revenue ratio Total continuing operating revenue (1)

- Unrestricted current ratio

- Debt service cover ratio

- Rates, annual charges, interest and extra charges outstanding percentage

- Cash expense cover ratio Current year’s cash and cash equivalents

- Page 69

- Page 70

- Page 71

- Council information and contact details

- Page 72

Statement of Developer Contributions without Internal Loans (continued) $ '000 SUMMARY OF CONTRIBUTIONS AND CHARGES Drainage Roads Traffic Facilities Open Space Community Facilities Planning Agreement Other S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 6 - Extractive Industries Roads –8,406–Total. Statement of Development Contributions without Internal Loans (continued) $ '000 S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 8 - Rouse Hill Drainage Roads Traffic Facilities Open Space Community Facilities Planning Agreement Other –40,711–Total. Statement of Development Contributions without Internal Loans (continued) $ '000 S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 9 - Castle Hill Town Center Roads Open Space Other CONTRIBUTION PLAN NUMBER 11 - Annangrove Industrial Roads Traffic Facilities –(4,244)–Total.

Statement of development contributions without internal loans (continued) $ '000 S7.11 CONTRIBUTIONS – UNDER A PLAN CONTRIBUTION PLAN NUMBER 12 - Balmoral Road Drainage Roads Traffic Facilities Open Space Community Facilities Other CONTRIBUTION PLAN NUMBER 13 - North Kellyville Drainage Roads Traffic Facilities Open Space Community Facilities Other –98,835– Total.

SPECIAL PURPOSE FINANCIAL STATEMENTS for the year ended 30 June 2018

- Page 80

- Statement by Councillors and Management 2. Special Purpose Financial Statements

- Auditor’s Report

- Page 81

- Page 82

- Page 83

Income Statement - Business Activity Water Supply Income Statement - Business Activity Sewage Income Statement - Other Business Activities Statement of Financial Position - Water Supply Business Activity Statement of Financial Position - Sewerage Business Activity Statement of Financial Position - Other Business Activities 3. These special purpose financial statements have been prepared for use by both the Council and the Local Government Office in meeting their the requirements of the national competition policy.

For the Council, the principle of competitive neutrality and public reporting only applies to declared business activities.

NET ASSETS

TOTAL EQUITY

- Page 84

- Page 85

- Significant accounting policies (continued)

- Page 86

- Page 87

- Page 88

A statement summarizing the supplementary accounting policies adopted in the preparation of Special Purpose Financial Statements (SPFS) for reporting for the National Competition Policy (NCP) follows. Certain taxes and other costs, appropriately described, have been imputed for the purposes of national competition policy. In accordance with Pricing and Costing for Council Businesses – a Guide to Competitive Neutrality, the Council has declared that the following are to be considered business activities:. where gross operating revenue is over $2 million) a.

However, where the Council does not pay certain taxes which are generally paid by private sector businesses, such as income tax, these equivalent tax payments have been applied to all business activities designated by the Council and are reflected in the Financial Statements for Special Purposes.

END OF AUDITED SPECIAL PURPOSE FINANCIAL STATEMENTS

Page 89

Operating profit before capital income + interest expense I,PP&E stated value on June 30. As a minimum, business activities must generate a return equal to the 10-year Commonwealth bond rate of 2.25% at 30/6/18.

SPECIAL SCHEDULES

Page 90

Special Schedules 1

- Page 91

- Page 92

- Page 93

- Page 94

- Page 95

Transport and communication Urban roads (UR) – local Urban roads – regional Paved rural roads (SRR) – local Paved rural roads (SRR) – regional Unpaved rural roads (URR) – local Unmade rural roads (URR) – regional Bridges on UR – local. Plus (or minus) last year's carry-forward total Fewer valuation objections claimed in previous year Subtotal. The OLG takes these amounts from the Board's Special Schedule 2 in the Financial Disclosure Statement (FDR) to manage this process.

The Hills Shire Council's special Schedule 7 – Report on Infrastructure Assets as at 30 June 2018 (continued) $'000 Notes: aRequired maintenance is the amount identified in the Council's asset management plans.

Infrastructure asset performance indicators * consolidated

Buildings and infrastructure renewals ratio (1) Asset renewals (2)

Infrastructure backlog ratio (1)

Asset maintenance ratio Actual asset maintenance

Cost to bring assets to agreed service level

Page 98

Page 99

Page 1

ITEM-3 INTERNAL AUDITORS REPORT DOC INFO

STRATEGY

Ensure Council is accountable to the community and meets legislative requirements and support Council’s elected

MEETING DATE: 21 AUGUST 2018

INTERNAL AUDIT COMMITTEE

AUTHOR: INTERNAL AUDITOR KERRIE WILSON

RESPONSIBLE OFFICER: GENERAL MANAGER MICHAEL EDGAR

EXECUTIVE SUMMARY The Internal Audit report

REPORT

RECOMMENDATION The report be received

Internal Audit Report to 1 August 2018 (40 pages)

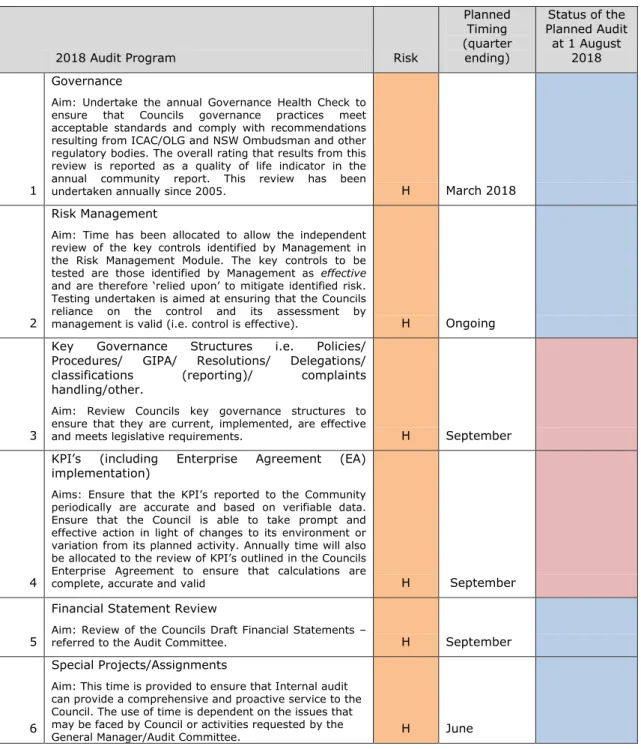

This report outlines the findings of the audit's review of the council's high risk activities as identified in the internal audit plan adopted by the council.

Internal Audit Report At 1 August 2018

Executive Summary;

Summary of the actual internal audit work undertaken in the period to the date of this report;

Details of the actual internal audit work undertaken in the period to the date of this report;

Detail of recommendations outstanding at the date of this report and the action taken by Management to implement these recommendations;

Internal Audit and Audit Committee Key Performance Measures

Background to the Internal Audit Function, the Audit Committee, and the audit reporting practices at The Hills Shire Council

Risk Assessment Matrix (currently being reviewed)

Attachment 3: List of outstanding audit recommendations (including management comments) at the reporting date

Part A: Executive Summary

Audit Committee

The Hills Shire Council

Internal Audit

January 2018 Internal Audit has been addressing Year 2 (2018) of its 4 year Strategic Audit Plan. This plan was adopted by the Audit Committee at its

AUDIT COMMITTEE MEETING 21 AUGUST, 2018 For the calendar year to 1 August 2018, Internal Audit has completed 9 or 45%

August 2018, the number of direct days spent on internal auditing was 96%

- External Audit

April 2018 the Audit Office published their ‘Report on Local Government 2017’ which provides guidance, and includes recommendations to councils and

- Regulatory Bodies

Objective: This time is provided to ensure that Internal Audit can provide a comprehensive and proactive service to the Board. Purpose: To ensure that the Council's activities are legally compliant through the implementation of robust systems/. Purpose: To ensure that the Council's general procurement activities comply with the Council's purchasing guidelines and its legal requirements.

SDRO/Pins/Compliance System Management Ensure legislative compliance and that processes are.

Summary of Table 1

- Details of the actual internal audit work undertaken in the period to the date of this report

- Status of Recommendations

- Service Delivery Benchmarks

- Cost Control benchmarks

- Key Information to be reported in the Annual Community Report Concerning the Audit Committee

To ensure the validity of the results of this exercise, the checklist outlined in the Audit Office publication was also completed. The purpose of the audit was to ensure that the requirements in TOAA were in place in the period ending 30 June 2018. Method The audit was carried out in accordance with the requirements of the agreement on access conditions.

Confirmation that the rates applied in the calculations by the operators correspond to the requirements of the Contribution Plan.

THSC Risk Matrix

Audit observations Impact Risk assessment Recommendation and agreed action plan Responsible manager Implementation to date: Status 1 August 2018 Police. Audit observations Impact Risk assessment Recommendation and agreed action plan Responsible manager To be implemented by date: Status 1 August 2018 4 The allocation of tasks within the finance group does not provide the independent review necessary to ensure segregation of duties. Audit observations Impact Risk assessment Recommendation and agreed action plan Accountable manager Implementation to date: Status 1 August 2018 7 Opportunities available to ensure the Council's risk management system reflects best practice.

Audit Observations Effect Risk assessment Recommendation and agreed action plan Responsible manager To be implemented by date: Status on August 1, 2018 14 Exception There is no reporting to the payroll system. The 6 monthly assessments by IA are relied upon.

ITEM-4 GENERAL MANAGER'S EXPENSES DOC INFO

Ensure Council is accountable to the community and meets legislative requirements and support Council’s elected

AUTHOR: GENERAL MANAGER MICHAEL EDGAR

HISTORY

After Approval, the expenses be submitted to the Audit Committee for notation

ATTACHMENTS Nil

ITEM-5 STATUS REPORTS - AUDIT COMMITTEE MEETING 15 AUGUST 2017

DOC INFO

The Hills Future - Community Strategic Plan

COUNCILLORS QUESTIONS WITHOUT NOTICE

AUGUST 2017

92 DRAFT STATUTORY FINANCIAL STATEMENTS

GENERAL MANAGER

93 REDUCTION IN RATES GENERAL MANAGER Mr Bland requested an explanation for why rates had dropped from $95m

94 THANK YOU TO THE MAYOR AND COUNCILLORS

SCHEDULE OF OUTSTANDING RESOLUTIONS

DATE OF MEETING

SUBJECT: IT SECURITY STRATEGY

BACKGROUND

The presentation be received

A Briefing on Council’s Security be brought to a Councillor Workshop