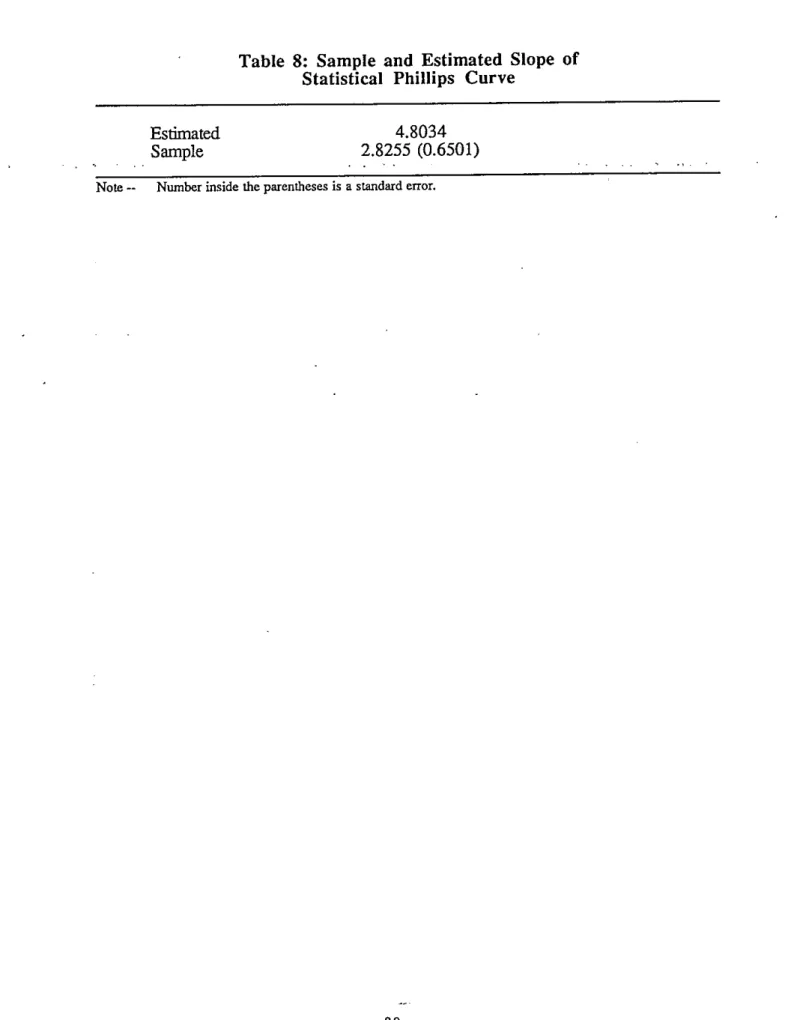

The empirical result shows that the slope of the statistical Phillips curve implied by the parameter estimates is large. While a contract in Taylor specifies the same wage rate in all sub-periods of the contract. Taylor's model was particularly popular because it is testable and appears to correspond to certain properties of the time series such as serial persistence in total employment.

To disentangle the role of time inseparability of preference, adjustment costs, and nominal wage rigidity, we estimate the structural parameters of the model rather than the reduced form. Its income consists of (1) wages earned from providing work for the firm and (2) dividends received by the firm. The importance of the intertemporal substitution factor in explaining fluctuations in economic variables has been emphasized by many (Lucas and Rapping (1969), Kydland and Prescott (1982)).

Intertemporal complementarity of free time could be one of the sources of serial persistence in work. This cost of adjustment, together with the aforementioned non-time-separable household utility function, is the source of serial persistence in employment in our model. That is, the nominal wage is set one period prior to the trading period.

As a result, deriving an explicit closed-form solution is impossible, and model evaluation is much more difficult.

Derivation of the Closed Form Solution

Since the negotiated wage is only the expected market-clearing wage, a labor rationing rule is necessary if agents forecast incorrectly (that is, if the actual realized values of the predicted variables are different from their values conditional). We will follow the convention in the macro literature of rational expectations on sticky prices (eg, Fischer (1977), Gertler (1982)) by assuming that employment is determined by the demand side in this situation. Since the current level of employment is determined by the demand side, the equilibrium stochastic processes { w } and { n } must also satisfy Euler's equation (8).

If we evaluate our model in terms of deviations from trend values, removing the constant terms and assuming zero-mean driving processes do not affect our result. 3 This assumption, together with the fact that we dropped the constants from (12) and (8), implies that our model is evaluated in terms of deviations from trend values. 5 The proof of the existence and uniqueness of the solution and the derivation of that solution is available upon request.

An Estimable Model

Trivariate ARMA Representation

So if we use the ARMA representation for (n w p )', the maximum likelihood time domain approximation will not work because we. will always get a zero root in the moving average part.

Bivariate ARMA Representation

Likelihood Function

By multiplying both sides of (25) by S(Lr1) we can derive the following representation of the world stage moving average for y =(n w . 1 p. The elements of LT can be calculated as functions of the vector cl> of underlying parameters using the covariance generating function g (z) defined in (32) The impact of these initial fis becomes negligible :s T • 00 if none of the roots of the determinant of R* (z)=I+R.

Empirical Results

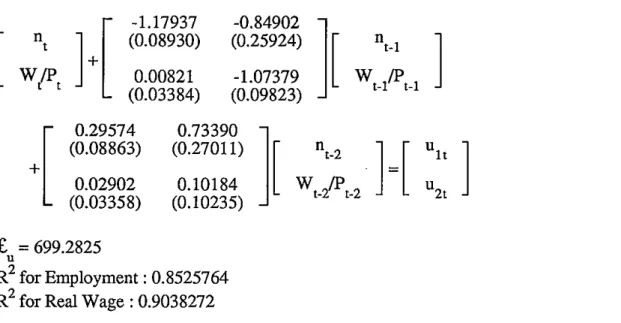

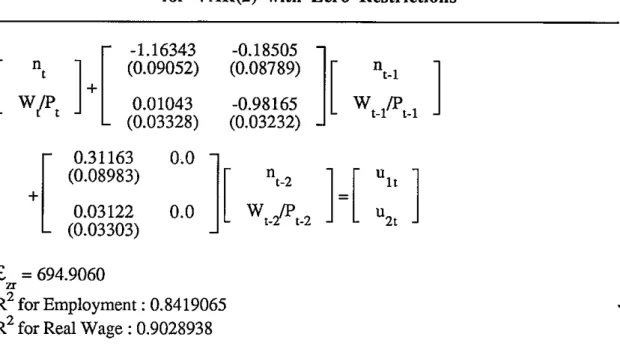

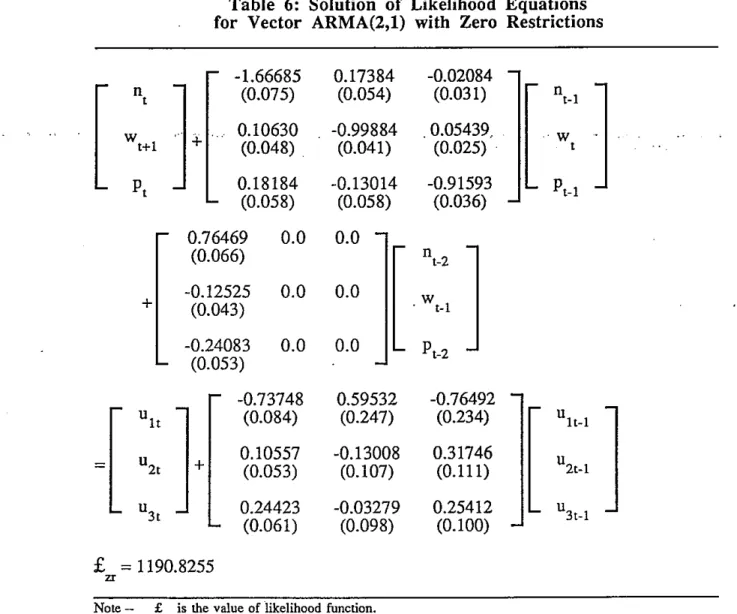

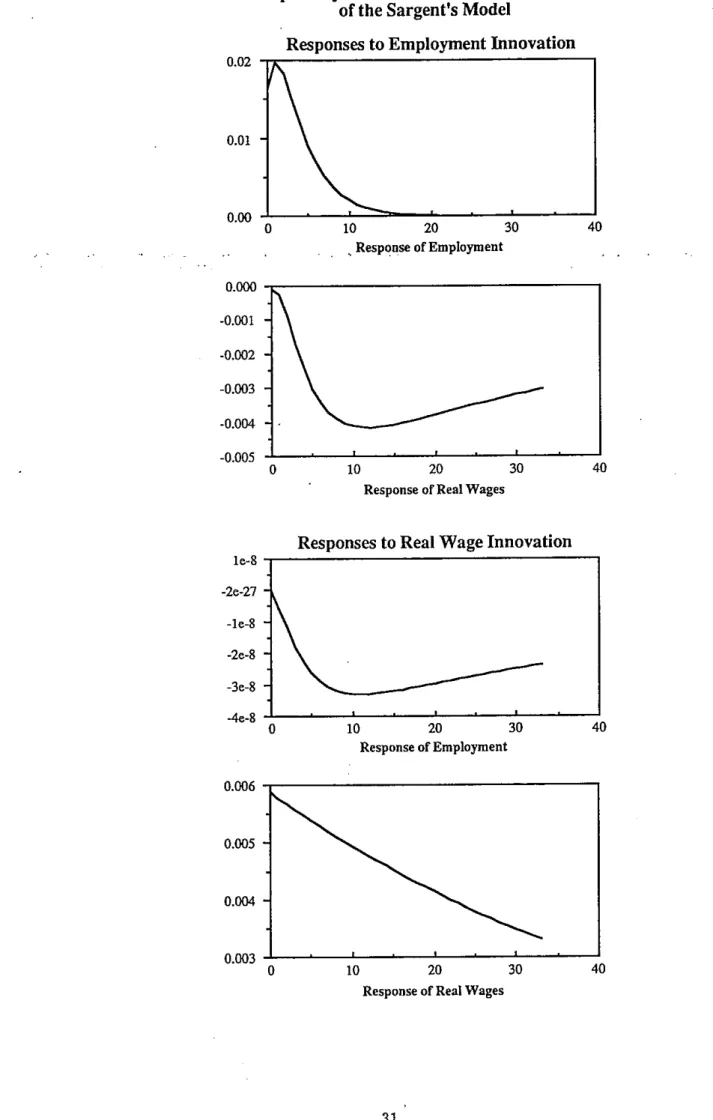

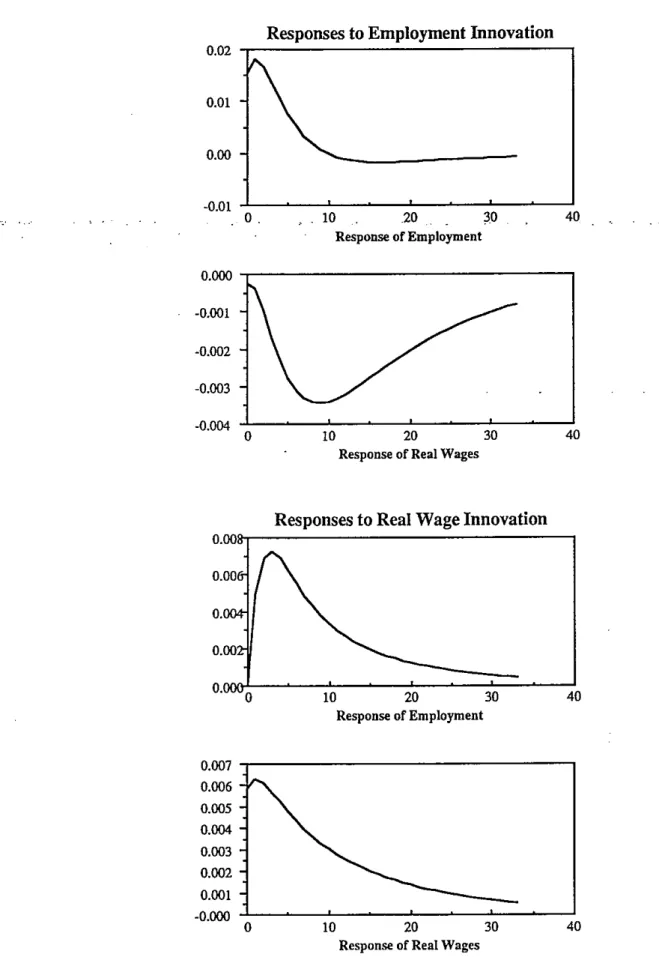

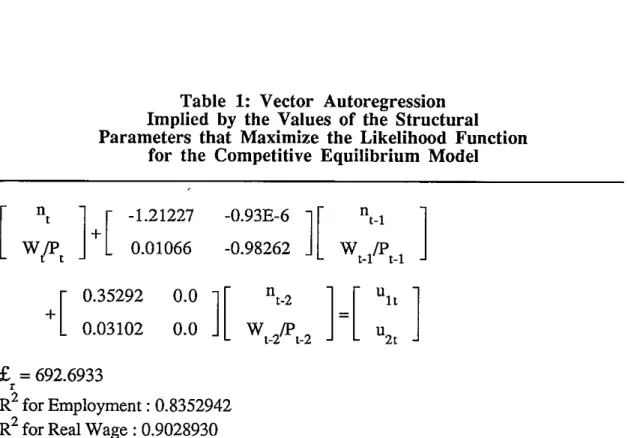

Note that there are two zero restrictions.17 The coefficients on twice lagged real wages for employees and real wages are zero. To test the restrictions imposed by Sargent's competitive equilibrium model, we estimate an unrestricted V AR(2) for employment and real wages. The above facts suggest that the employment response to a real wage shock implied by Sargent's model estimates would be very small compared to that implied by the unrestricted VAR.

This seems to suggest that the cross-equation restrictions as well as null restrictions contribute to the rejection of the Sargent model. We can also see whether Sargent's model can generate a reasonable dynamic between real wages and employment by looking at the moving average representation implied by the model's estimates. As expected, the employment response to an innovation of one standard deviation in real wages implied by the estimates of Sargent's model is very small.

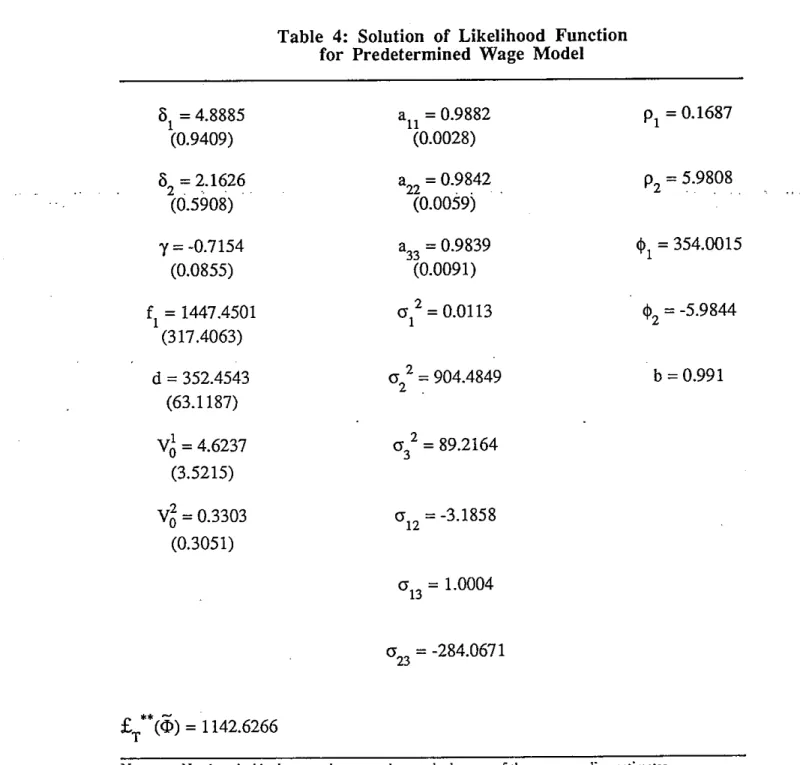

This means that the non-time-separable utility function for households can contribute to the continuation of the survival of work. 1 comes from the fact that the coefficients for quadratic terms (6 .. 1) are larger than the coefficients for inter-temporal adjustments (6. We also check the performance of our model by using the vector moving average representation for employment and real wages compared implied by our model and Sargent's competitive equilibrium model.

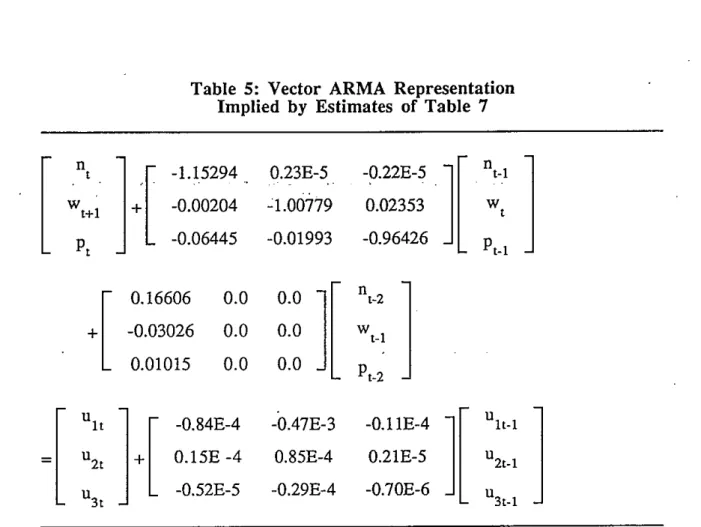

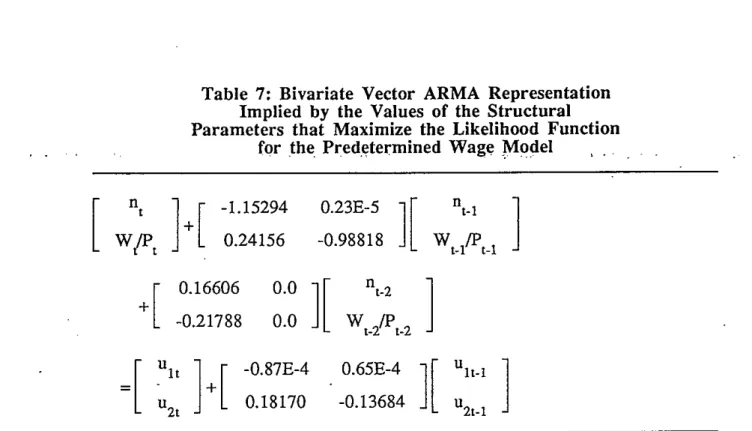

To compare our model with Sargent's competitive equilibrium model, a bivariate ARMA(2,1) representation of employment and real wages implied by our model was derived using the method described in Section 5.2. In essence, our model has the same problem as Sargent's model in explaining the effect of real wages on employment. This, together with the zero bound, means that the impulse response of employment to real wages is very small according to our model estimates.

One thing to point out is that both the restricted models significantly underestimate the response of employment to innovations in real wages. In short, our contract model failed to make a noticeable improvement in explaining the dynamics between employment and real wages. 21 While estimating Sargent's competitive equilibrium model, I found some other points of convergence where the response of employment to real wages was large enough.

Concluding Remarks

It is encouraging that we can have sufficient positive correlation between inflation rate and employment with this weak assumption. Singleton, 1988, A Time Series Analysis of Representative Agent Models of Consumption and Leisure Choice under Uncertainty, Quarterly Journal of Economics 103, 51-78. Fischer, S., 1977, Long-term contracts, rational expectations, and the optimal money supply rule, Journal of Political Economy.

Sargent, 1980, Formulering en skatting van dinamiese lineêre rasionele verwagtingsmodelle, Journal of Economic Dynamics and Control 2, 7-46. Eckstein, red., The Econometrics of Price Discrimination (Board of Govenors. van die Federal Reserve System, Washington). T., 1973, The Estimation of Parameters in Multivariate Time Series Models, Journal of Royal Statistics Society ser.

Appendix 1: Description of Data

Appendix 2: Note on the Calculation of Approximate Standard Errors Using