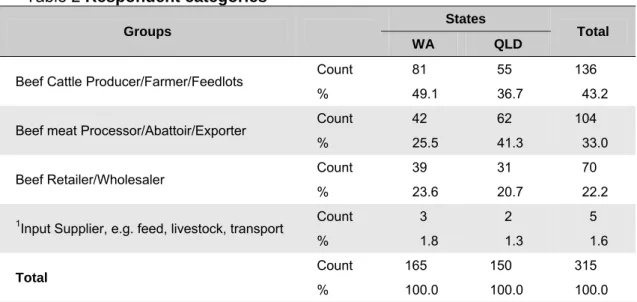

As it is essential to the economy that the beef industry maintain profitability and sustainability, it is believed that the performance, competitiveness and success of the industry depends on improving the cost efficiency and productivity of the entire supply chain in the industry. This study is based on a survey conducted among supply chain (SC) members of the Australian beef industry. Thus, the results indicate a major profitability problem among upstream producers in the WA beef supply chain.

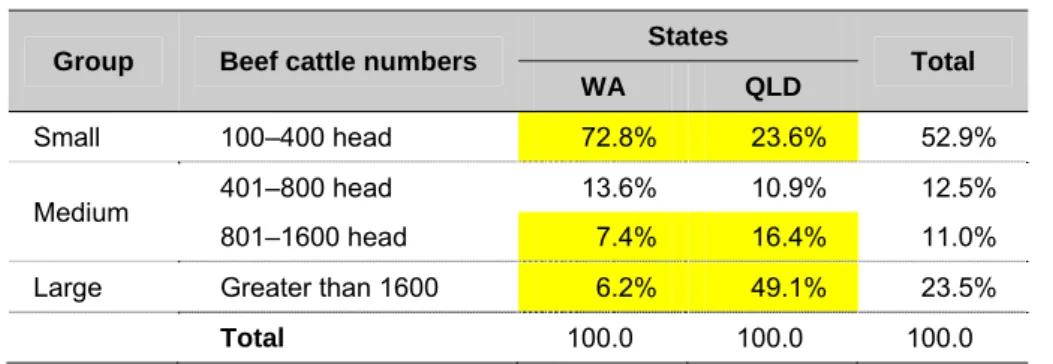

The adoption of a lean supply chain is unlikely to be successful without a degree of bargaining power between supply chain participants. As it is critical to the economy that the beef industry maintain profitability and sustainability; It is believed that the performance, competitiveness and success of the industry depends on the improvement of cost efficiency and productivity, which requires a study of the entire supply chain (SC) and the relationships between the participants in the industry. This study specifically aimed to investigate within the states of WA and QLD to compare supply chain structure and outcome.

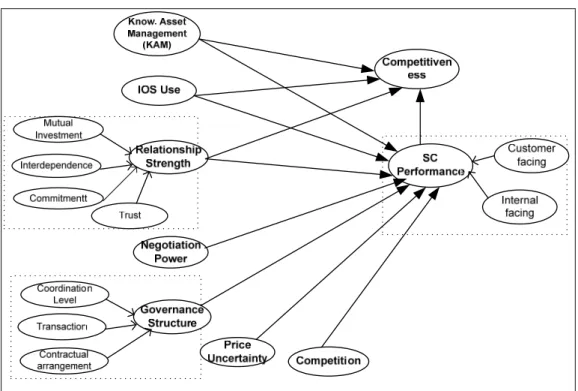

To examine the existing formal and informal relationship structure between companies in the beef industry and their effects on supply chain performance. iii). Identify how and to what extent KAM, IOS and Transactional relationship create competitiveness and performance differentials in the supply chain in the beef industry.

Background Literature

To examine which elements of KAM, IOS and transactional relationships influence/significantly influence supply chain performance improvement. iv). In a recent study Lee et al. 2007) showed that a well-integrated supply chain can be a primary business strategy to improve performance by reducing lead time and reducing the negative effect (supply and demand-related problems) in the supply chain. Based on the above discussion, this study hypothesizes that a perfect synergy of economic and behavioral factors that ensure the strength of a supply chain relationship such as mutual investment, interdependence/bargaining power, mutual commitment and trust will influence agri-food performance. . industry, especially in the beef industry and will affect their competitive advantage.

Knowledge Asset Management (KAM) refers to the dynamic ability to create and utilize knowledge assets in the supply chain. The nature of the agri-food supply chain implies that knowledge is derived from internal business processes and learning from past experiences (such as contracts, investments, trust). Therefore, this study hypothesizes that the dynamic opportunities to acquire and exploit new knowledge in the supply chain and the ability to use IOS to integrate the transaction partners in an information and knowledge chain can affect the company's performance and competitiveness compared to other companies that lack such resources .

Research Plans, Methods & Techniques

Interdependence A firm's degree of dependence on a partner and their need to maintain a relationship with that partner (Clare et al.). Trust Belief that the exchange partner is honest/reliable and will not take advantage of the other party's vulnerability (Mayer et al. 1995). The ability of one firm to influence the intentions and actions of another firm (Cox et al. 2007).

Based on the RBV/KBV, and the work of Hult et al. 2007), the following five KAM dimensions were used. The result from a coordinated knowledge and relational mechanism in SC in the form of reliability, accountability, quality, cost and assets of SC (SCOR, 2006; Gunasekaran et al. 2004). Capabilities that allow an organization to differentiate itself from its competitors, such as cost efficiency, productivity, marketing and innovation (Porter, 1985, Han et al.

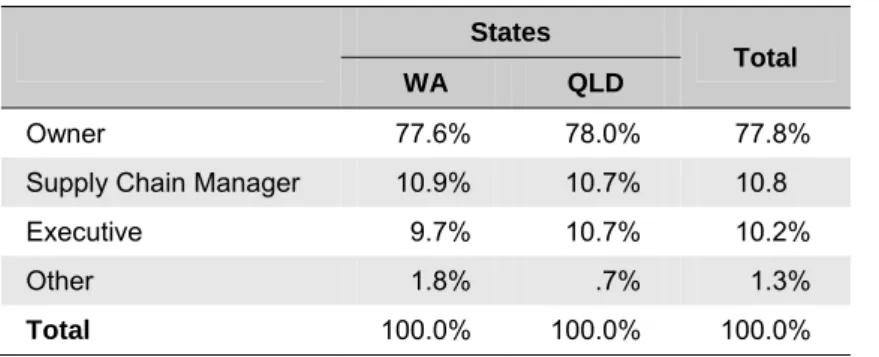

Results and Discussion

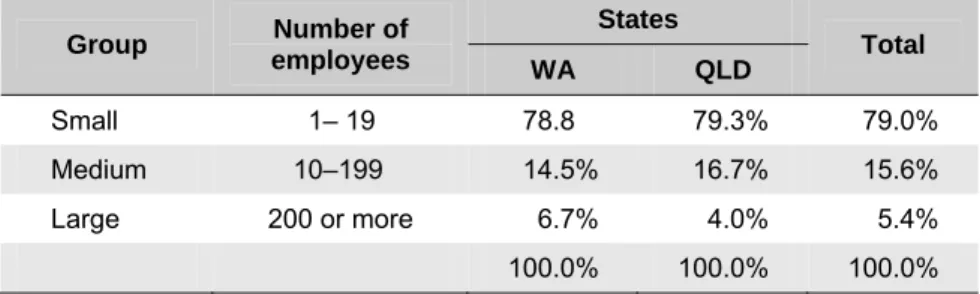

- Demographic Statistics

- Governance Structure of the Beef Market

- Power Structure

- Relationship Strength

- Knowledge Asset Management (KAM)

- Use of Electronic System/Inter-Organizational System (IOS)

- Uncertainties

- Competitors and Environmental Management Practice

- Supply Chain Performance and Competitiveness

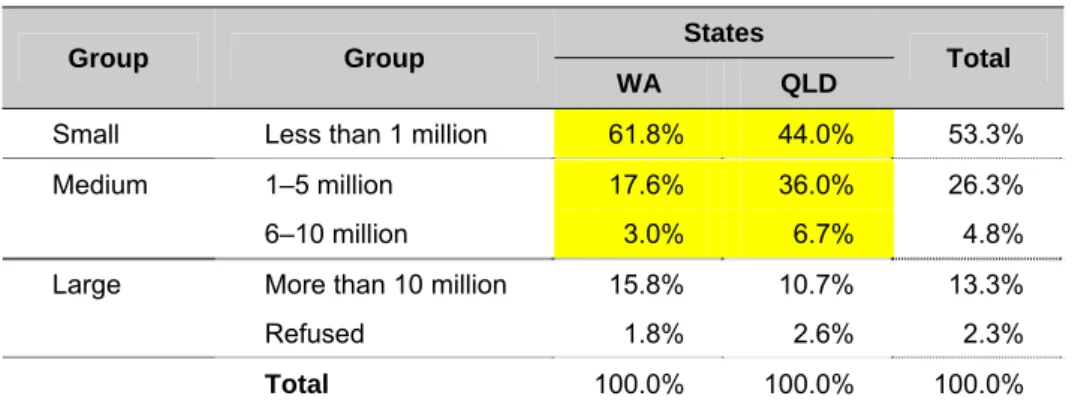

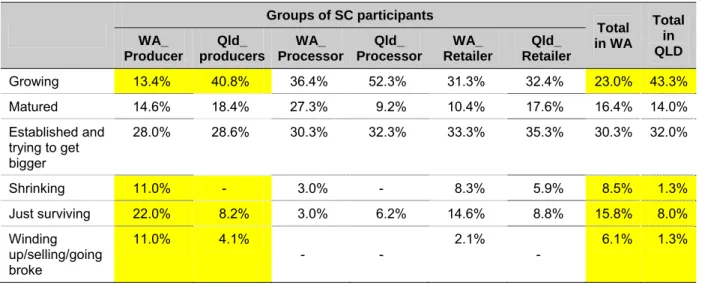

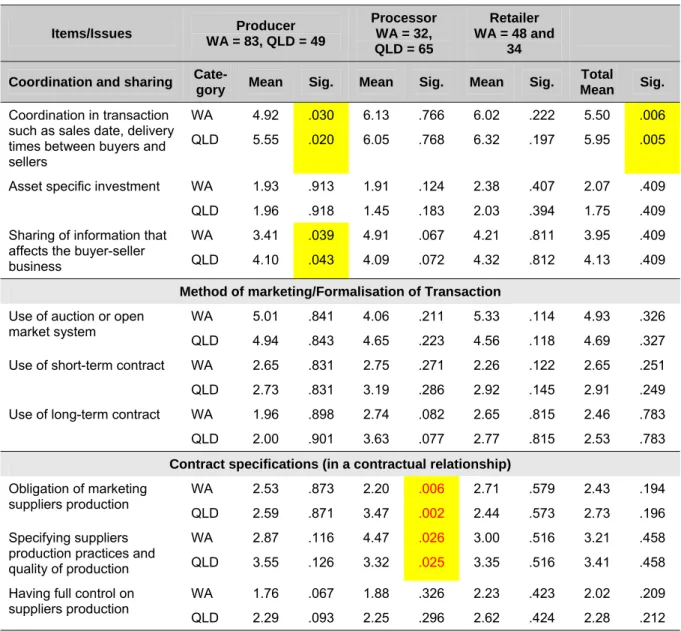

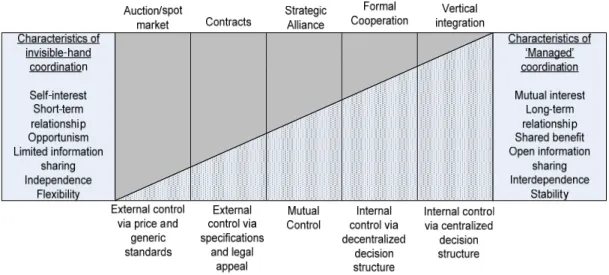

In terms of growth, Table 7 shows a better performance of the QLD producers, processors and retailers. It is also important for the commercial viability and adaptability of the producers and other actors in the supply chain in a rapidly changing market, where consumers dictate both domestic and export market conditions (WY and Associates 2009, WA Farmers 2009). In Table 9, an attempt is made to divide the nature of transactions of the beef industry into a series of components in order to develop coordination and contracting model for the supply chain participants.

In the absence of a highly coordinated supply chain, the value added cost and price of the beef rises to 80% for a retail sale compared to the price in a farm gate (WA farmers, 2009). The total result therefore indicates a significant power imbalance between producers and the other members of the supply chain. The results reflect the true nature of the beef industry power structures in WA and QLD; and generally in Australia.

It was found that 10-15 percent of the participants strongly disagreed about the existence of trust, commitment and a good relational climate in the supply chain. WA producers were behind QLD in all issues of gathering and exploiting knowledge in the supply chain. It also reflects the nature of the overall WA production-driven supply chain where profitability is a key issue for some of the upstream participants.

This is perhaps due to the vibrant export market and more forward and backward integration between supply chain players. WA Farmers (2009) reported that inconsistency in product supply, limited labor resources and the lack of profitability combined to cause a rapid decline in processors and feedlot capability. They experience a knowledge gap in market-driven operation/value-adding activities in the supply chain (Uddin, Quaddus and Islam 2010; WY and Associates 2009).

Other studies (Proactive Communication, 1996; Lee, 2002; Ketchen & Hult, 2007) have argued that performance improvement in supply chain provides competitiveness of the industry as a whole. Customer-Facing' and 'Internal-Facing' considering the context and domain of the beef supply chain. Between the supply chain groups, the other important finding is that QLD industry has no significant difference in performance outcome, while WA producers differ significantly between the processors and retailers on most of the issues.

Key Findings, Lessons and Policy Issues

Policy and Priority Issues

The results show that success requires a shift from a production-oriented supply chain to a market-oriented one and closer ties between upstream and downstream partners to achieve greater communication and commitment. For the operational adoption of a lean supply chain between producer and processors or processors and retailers, the key success factors in the beef industry are transparent interdependent relationships with strong consolidation/integration of business activities, strong communication and knowledge flow, and greater compliance with carcass specifications in the supply chain. Coordination strategies can be developed through different types of supply chain in the beef industry, such as: (a) the main supply chain led by supermarket retailers; (b) a direct marketer supply chain run by a producer group for direct supply to consumers/niche markets; and (c) an intermediary supply chain for a local product that reaches consumers through one or more intermediaries, such as supermarket traders, independent butchers and food cooperatives.

Alliance can be developed to achieve marketing leverage for each of the supply chains, based on some common goals or values and can share knowledge about a specific race, health and marketing management program. Collective organizations and infrastructure of knowledge and services in the supply chain such as: farmer's market, web guides and new technologies for improving cooling, transport and communication capabilities can also improve the competitiveness of the industry. Being part of the supply chain is important for this improved competitiveness with an intention to compete against other supply chains rather than competing as a single firm against other individual firms.

This study provides some useful frameworks and inputs for developing these business-to-business relationships, knowledge management, and using electronic systems in the supply chain to align the best principles of value-creating strategy across businesses and industry for competitive advantage. Finally, the following suggestions can be made on the key roles, attitudes and knowledge of the three supply chain groups and relevant governments to help improve supply chain performance and create the competitiveness of the Australian beef industry. Companies need to build their supply chain as a substantial resource, by developing and sharing their knowledge assets and developing a cooperative relationship structure by becoming more market-driven, less resource-based players in the domestic and export markets.

A collaborative structure of knowledge-based relationships between farmers/producers, processors, wholesalers, retailers and/or other supply chain partners should be developed to help improve their innovation at the firm level and to specified contingencies of problems related to supply and demand. A government partnership with industry stakeholders is required to support their needs and resolve issues through consultation, joint planning and action. Government can take a role in providing tax support/incentives for the development of new slaughterhouse facilities, reducing impractical regulations to increase pastoral rents and diversify producer incomes, and to increase support for international trade and activities of R&D for innovation in productivity and efficiency along the supply chain.

Evaluating structural equation models with unobservable variables and measurement error, Journal of Marketing Research, Vol. Performance Measure and Metrics in a Supply Chain Environment, International Journal of Operations & Production Management, 21(1/2), p. The joint effect of supply chain integration and quality management on the performance of pork processing firms in China,.

Closer vertical coordination in agri-food supply chains: a conceptual framework and some preliminary evidence, supply chain management. Supply Chain Practices, Supply Chain Performance Indicators and Competitive Advantage of Australian Beef Enterprises: A Conceptual Framework, Australian Agricultural and Resource Economics Society (AARES) 51 Annual. 2000), “Control Mechanisms and the Life Cycle of Relationships:. implications for securing specific investments and building commitment,” Journal of Marketing Research, Vol. 2005), The impact of environmental regulation on competitiveness in the German manufacturing industry, a comparison with other countries of the European Union, Journal of Cleaner Production, vol.

The relationship between supply chain performance and the level of connectivity between the supplier, internal integration and the customer. The Effectiveness of Using E-Collaboration Tools in the Supply Chain: A System Dynamics Evaluation Study, Journal of Purchasing and Supply Management, Vol. Customer satisfaction with relational exchange throughout the life cycle of the relationship, European Journal of marketing, vol:41, no.