Section 28(1)(b) of the Act requires the report to contain any other information required by the Minister. Section 28(1)(a) of the Regional Royalties Act 2009 (the Act) requires the Regional Development Fund of Western Australia (the Fund) to submit a report to the Minister for Regional Development (the Minister) containing information on the Fund's activities during the financial year . Regional royalties have now become sufficiently developed to understand the wider impact of the investment.

Except for Parts 3 and 5, the Act was proclaimed on 27 March 2010 to provide for the operation of the Royalties for Regional Fund (Fund). Prior to the proclamation of the Act, the Royalties for Regions program came into force in accordance with section 10(a) of the Financial Management Act 2006. Section 5(1) of the Act states that the Royalties for Regions fund from the following subsidiary must exist. bills:. a) the National Fund for Local Government;.

Our people

Current members

Peter is Chairman of the Greater Southern Development Commission and was originally appointed to the Trust because of this position. Through his role as Chair of the Greater Southern Development Commission, Peter is also a member of the Regional Development Council, a key advisory body to the Minister on regional development matters. Peter has a strong interest in waste water recycling and led the community project that resulted in the netting of the Katanning Golf Course.

Ralph is the Chairman of the Kimberley Development Commission, a member of the Regional Development Council (Council), and Chairman of the Board's Governance and Strategy Committee.

Current members (Cont.)

Previously, Peter worked in the stock market and managed Wesfarmer's Equity Department, while working for Ernst & Young Aktieregister and later Computershare. He has also chaired and been a member of community, business and political boards, committees and associations, including parliamentary committees with statutory obligations. Paul Rosair was Director General of the Department of Regional Development and Lands and was (from 1 July 2013) Director General of the Department of Regional Development until he resigned on 1 July 2014.

Paul previously held the position of Executive Director at the Department of Local Government and Regional Development, where he established and implemented the National Government Regions License Fee Program. Previously, Paul served as Director of Regional and Business Operations at the Ministry of Water and previously at the Ministry of the Environment. Paul has worked in a number of senior government roles in regional development, environment, water, land management and Indigenous affairs.

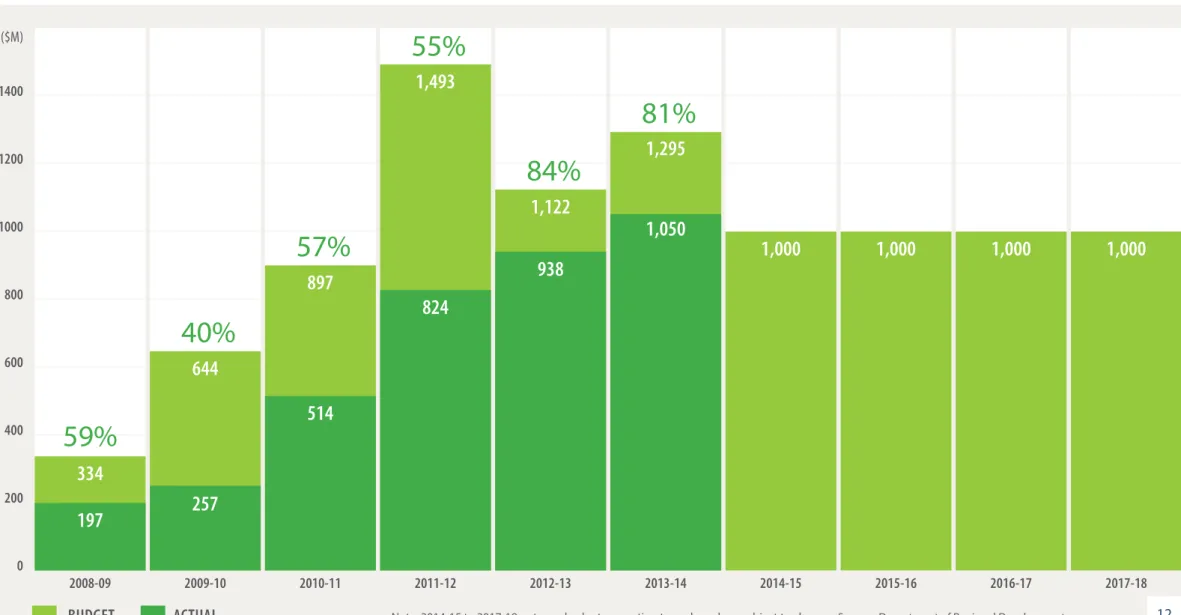

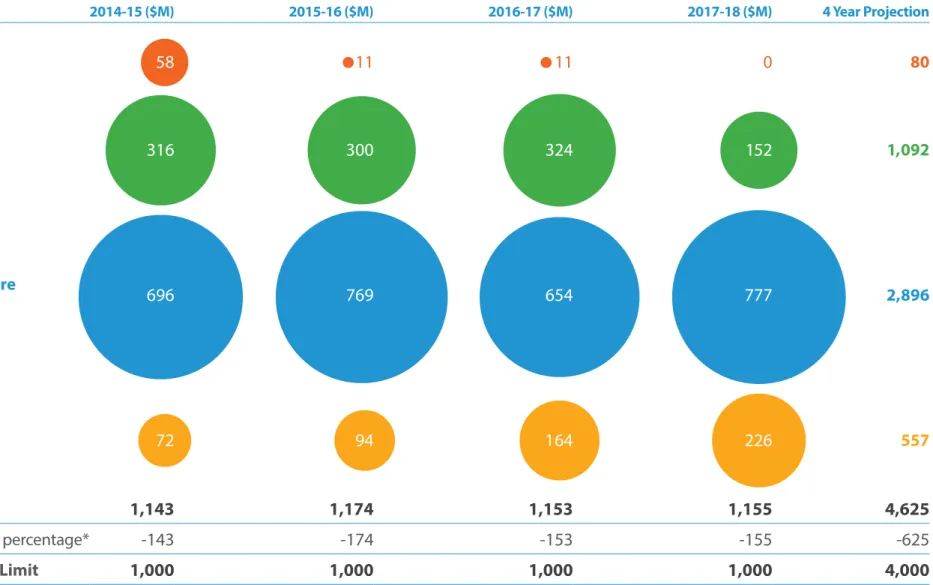

The Regional Community Services Fund $371 million The Regional Infrastructure and Headworks Fund $977 million Any other account determined by the. Overprogramming recognizes that there will be individual project underspending by adding an overprogramming percentage to the Royalty for Regions budget. The Trust commented on this limit in its budget advice to the Minister which is set out in a later section of this report.

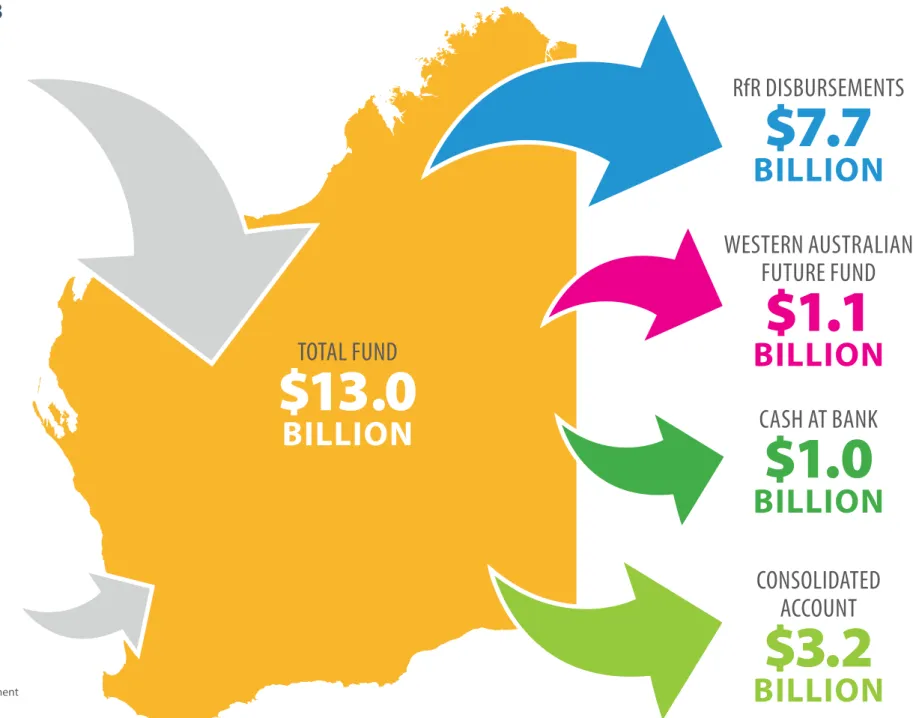

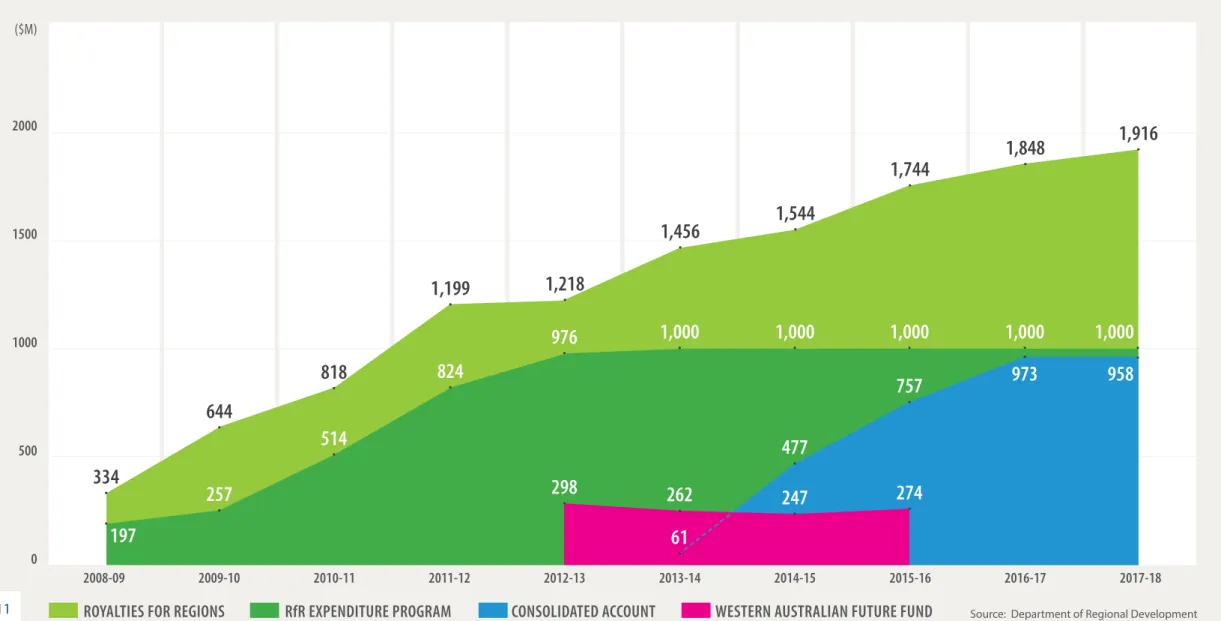

In the seven program years, 7.7 billion dollars will be invested in Royalties for Regions projects in the regions. 1 billion will be available at all times in the Royalties for Regions fund.

2008-09 to 2017-18 TOTAL ROYALTIES

BILLION

BILLION $7.7

WESTERN AUSTRALIAN FUTURE FUND

BILLION $1.1

CASH AT BANK

BILLION $1.0

CONSOLIDATED ACCOUNT

BILLION $3.2

INTEREST EARNED /REFUNDS

BILLION $0.3

TOTAL FUND

The diagram illustrates that expenses have delayed royalty payments, so the bottom line is the $1 billion limit in the revenue fund for the regions has been reached. In the 2013–14 financial year, the Trust either provided advice and recommendations to the Minister on the following matters, or received comments from the Minister. Section 5(2) of the Act prescribes that the Treasurer, on the recommendation of the Minister, shall from time to time determine the manner in which moneys standing to the credit of the Fund shall be allocated between the relief accounts.

In section 9 of the Act, subsection 1, it appears that the minister, with the consent of the treasurers, can authorize the expenditure of money that is due to the fund, for the following purposes:

Royalties for Regions 2013-14 Budget Proposals

The Trust pointed out that both transfers and royalty income to the regions have threatened a breach of the cap under Section 8 of the Act. The previous Minister advised the Fund that from 1 July 2013, the DRD, the Council and the new Commissions will be financed entirely from the Rent for the Regions. The Trust's view is that the removal of the State Consolidated Account contribution to the DRD, Council and Commissions represents a direct cost shift to royalties for the regions.

In the fund's view, this means that more will be spent on administration than would otherwise have occurred, and there is a risk that the administration fee will grow as a proportion of the fund. The Trust further recommended that the former minister consider the merits of seconding DRD staff to the commissions. The trust informed the former minister that the importance of the agricultural initiatives for royalties for regions 2013-14 requires that lead agencies and other issues be resolved from the outset.

The previous Minister informed the Trust that the Regional Expenditure Bonuses of the Country Local Government Fund (CLGF) are being greatly reduced and that the CLGF sub-fund will be phased out in a few years. He further stated that this decision represents a reversal of the state government's support for and response to the Trust's review of the CLGF. The Trust believes that project development and implementation by local local governments remains valid and valuable.

The trust had advised the previous minister on regional development policy, regional royalties and Aboriginal affairs. Given the sustainability of these approaches, the Trust recommended to the previous Minister that he ensure and facilitate inter-agency cooperation.

Advice and Recommendations to the Minister

The Trust will continue to consult on this strategic thematic area as it believes it is vital to the regions growth and development potential. In June 2013, the Trust was informed of the structure of the new Department and the division of the Lands Department. The Trust's view is that charging an administrative cost to the Fund is a valid expenditure under sections 9(2)(b) and 9(2)(d) of the Act.

The Fund will consider any necessary amendments to the Regional Development Commissions Act of 1993, and the budget proposals of the Council and the Commission will form part of the Fund's consultation with the Minister in the future. On 4 March 2014, the Fund wrote to the DRD requesting information on a range of matters in order to fully brief the Fund on the upcoming royalty budget for the regions. The Minister advised the Trust that the future focus of the license fee program period for the regions is the theme of investing in key economic development activities in the regions.

The Trust's response is that there may be financial terms under which the Secretary and Treasurer can agree on a strategy for royalties for regions-funds to be applied to meet the immediate budgetary goals of the state government. The Trust believes that the intent of the law is that 25 per cent of expected royalty income for the financial year should be credited to the Fund. The Trust has informed the previous minister of the risk of administrative funds as a percentage of total expenditure which is growing now that the administration of DRD, Commissions and Council is funded by Royalties for Regions.

The Fund also reiterated its ongoing concern about the significant reduction in CLGF funding. In April 2014, the Trust wrote to the Minister and noted that the plans play a very important role in informing and strengthening the overall royalty policy framework for the regions.

Review into the Vocational Education and Training Sector

Review of the Small Business Centre Program

The fund expressed the view that the focus of small business centers on start-ups and micro-enterprises was too narrow and that including the development of medium-sized enterprises would improve investment outcomes. The fund proposed a three- to four-way partnership model to increase the effectiveness of the program, working with regional development commissions and a regional network of chambers of commerce and industry. In some cases, closer cooperation with local authorities would also contribute to the achievement and effectiveness of the license fee program for the regions.

The Trust also outlined lessons from their research into entrepreneurship and innovation in regions and the elements that make a difference in this area.

Inquiry into Microeconomic Reform in Western Australia

2011-12 Water (in the context of regional development) 2012 Planning for new major Royalties for Regions projects 2012 Proposed Review of Regional Housing.

Regional Development Fund

Building Human Capacity in Western Australian regions

Proposal to form a Regional Policy Think Tank

Country Local Government Fund Review

The CLGF was continued for capacity building with local local governments, completion of strategic cross-local government projects and funding of the regional centres. The Trust continued to advise that the CLGF fits a key purpose and niche in funding smaller local infrastructure requirements of the regions, and should be restored to its revised form as recommended by the Trust in 2012 and accepted by the State Government.

Water (in the context of Regional Development)

Planning for new large Royalties for Regions projects

Proposed Review of Regional Housing

Review of the Western Australian Community Resource Network

The FOI request sought copies of all documents to and from the Trust relating to the Regions Royalties Act 2009, in particular advice and recommendations from the Trust on the function and the Trust for the period 1 August 2013 to 8 May 2014. On 7 August 2014 forwarded the trust a notice of decision and granted access to these documents within the framework of the application.

Trust Finances Operating budget

Western Australian Regional Development Trust

Both the past and present chairmen of the Trust have traveled to and within the regions of Western Australia. Western Australian Community Resource Network Review Budget The Trust completed its work on the Community Resource Network Review for 2012-13 and it was noted in the previous Trust Annual Report that there would be some carryover costs in 2013-14 for the printing and distribution of the Review Report .

Provision of services and facilities to the Trust

Trust Meetings

Trust Governance Framework

Charter

Code of Conduct

Conflict of Interest Policy

Trust Administrative Functions

FOI Freedom of Information PSC Public Sector Commission RDF Regional Development Fund RfR royalties for regions.