New Zealand food and drink consumer preferences for product attributes and alternative retailers, and in-market use of digital media and smart technology. New Zealand food and beverage consumer preferences for product attributes and alternative retailers, and in-market use. In addition, the New Zealand food and beverage retail market has become more sophisticated over time.

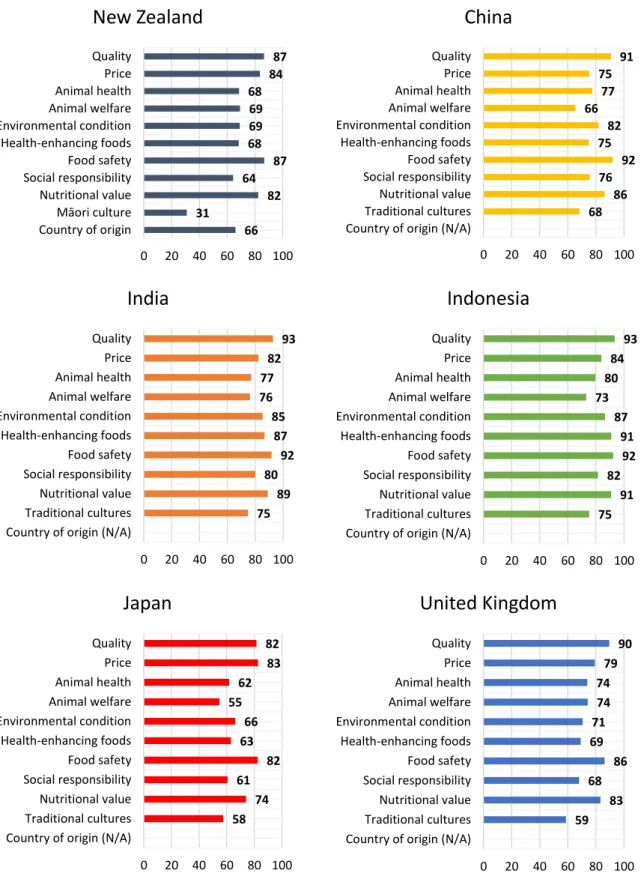

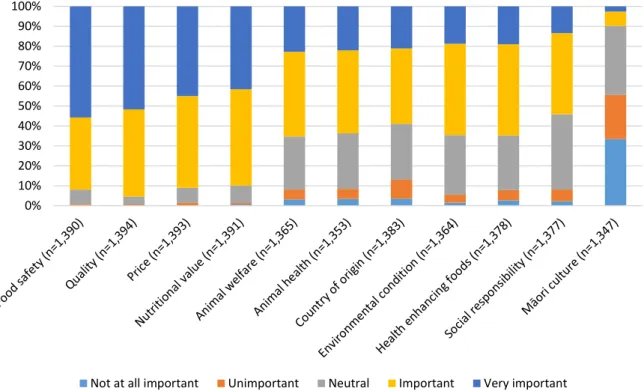

The role of Māori culture in relation to food and drink was considered the least important feature (considered important by 10 percent of respondents).

Introduction

At present, CE case studies on consumer preferences for credibility attributes in New Zealand are limited (e.g. Jaeger and Rose 2008; Kaye-Blake et al. New Zealand consumer use of digital media and smart technologies has increased in recent years , with most New Zealanders using the internet regularly. However, there has also been little research into the use of modern communication technologies (such as social media and smartphone use) in relation to the gathering of information about food and drink and the purchasing behavior of New Zealand consumers.

This project therefore aims to increase understanding of New Zealand's consumer preferences for food and drink attributes, as well as how they use technology to gather information about and ultimately purchase food and drink.

The New Zealand Food Market: An Overview

Market profile

Most domestically produced agricultural commodities are exported, as illustrated by the percentage of total production exported for selected agricultural commodities shown in Table 2.1 below.

New Zealand food retail history

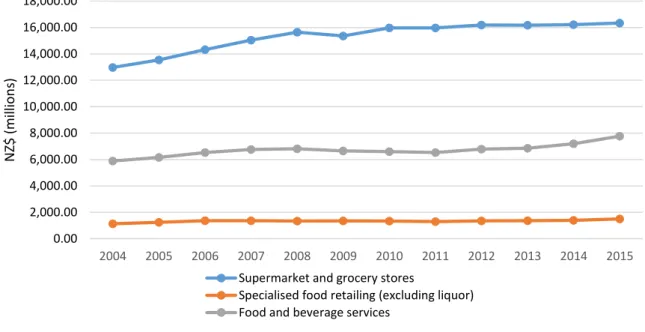

13 percent of participants choose to buy from butchers, 25 percent to buy from supermarkets and 14 percent to buy from supermarkets and butchers (Brodie 1977). Similarly, a 1988 study of food shopping behavior of New Zealand consumers found that a greater proportion of consumers used milk delivery services than purchased dairy products at the supermarket (Sheppard 1988). The volume of sales in supermarkets and grocery stores in New Zealand has increased steadily in recent years, as shown in Figure 2.2.

Supermarkets had the highest sales volume between 1997 and 2015, increasing sales volume by approximately 145 percent over this period, with total sales of approximately NZ$17.3 billion in 2015.

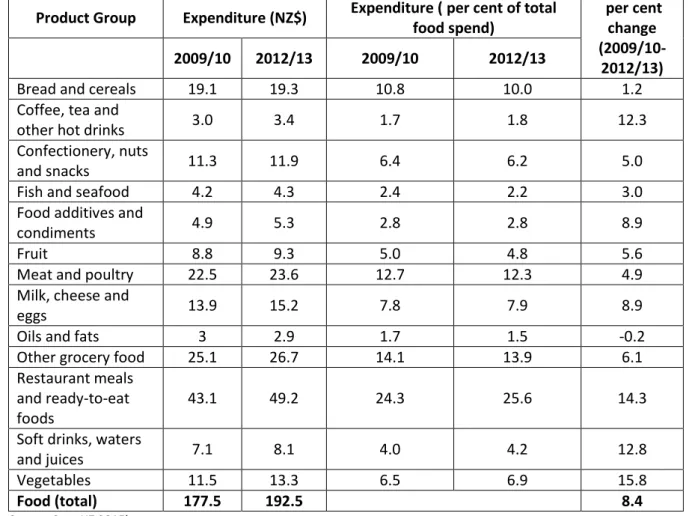

Household expenditure

While New Zealand supermarkets have diversified their stock in recent years (such as the introduction of beer and wine products in the 1990s), most supermarkets have retained their structure and structure in place since the 1970s, catering almost exclusively for weekly and non-occasional food shoppers. buyers (Parsons and Wilkinson 2014). It has been estimated that in 2005 between 20 and 30 percent of all items in New Zealand supermarkets were imported (Gray 2005). There are currently two major food distributors operating in New Zealand - Foodstuffs and Progressive Enterprises.

Food currently accounts for 42 percent of value in grocery retail in New Zealand (Euromonitor 2015).

Alternative food markets

In summary, New Zealand's food retail sector has undergone some important developments over the past century. By allowing the consumer to select items themselves, followed by the establishment of stores in which a greater variety of products were available in one place, the current paradigm of supermarket shopping was established in New Zealand. This eventually led to a greater diversification of products, including a greater variety of ethnic foods, to be stocked in New Zealand supermarkets.

While these studies generally show mixed international consumer preferences for different food retail formats, they may not directly apply to New Zealand consumers.

Conclusions

Different methods were used to examine the use of alternative food webs in one European and several Australian cases. Another recent Australian study focusing on fruit and vegetable purchases asked participants why they shop at a particular store and which store they prefer (Batt 2014). Andrée et al (2010) studied Australian farmers' participation in alternative agri-food networks using semi-structured interviews, finding that farmers' participation was based on perceptions of higher food product returns through value capture through alternatives to conventional supply chains.

The authors also found that an increasing number of farmers are engaging in sales via alternative agri-food networks as a means of taking independent control of the supply chain for their own produce.

Literature Review

- New Zealand consumer preferences

- Quality and nutritional value

- Health-enhancing food

- Food safety

- Country of origin

- Production methods

- Animal health and welfare

- Environmental condition and social responsibility

- Māori culture

- New Zealand consumer use of digital media and smart technology

- Online shopping

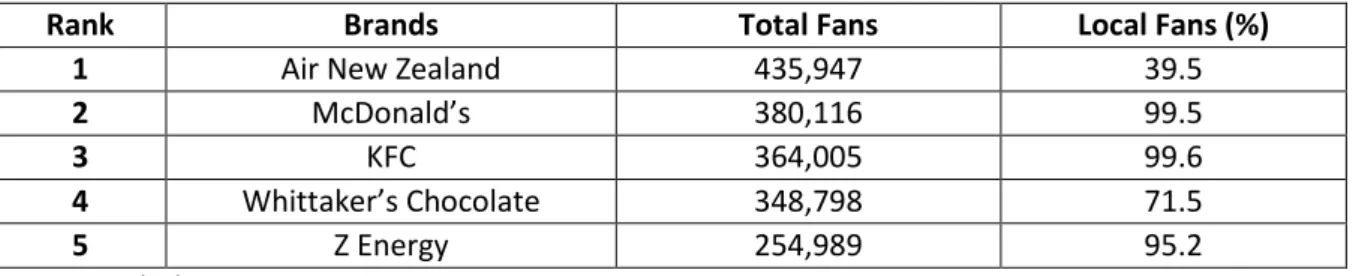

- Social media

- Mobile

- Future technology opportunities for producers and retailers

- Conclusions of literature review NZ and overseas, and implications for further research

- Survey development

- Survey structure

- Credence attributes and purchases

- Alternative retailer, smart tech and demographic questions

First, the authors examined purchase intentions regarding GM food products for 701 New Zealand consumers. The next sub-chapter considers environmental sustainability and social responsibility in relation to New Zealand consumer preferences for food and drink products. Finally, there is sparse evidence regarding New Zealand consumers' attitudes towards Māori culture in relation to food and drink.

These results show that New Zealand consumers (approximately n=1000) use their computers on a weekly basis to look up product information (27 percent) and purchase products/services (9 percent).

Survey Results

- Sample

- Importance of attributes in food and beverages

- Importance of basic attributes in food (Q7)

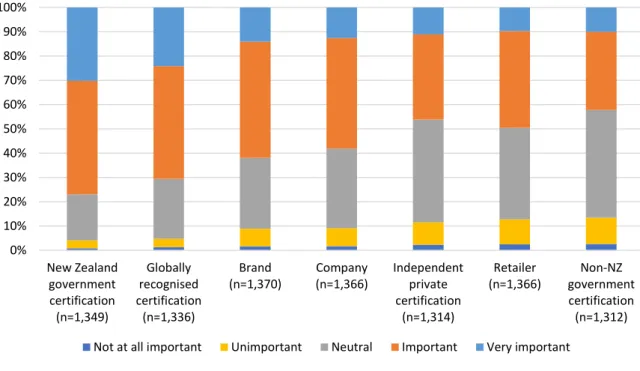

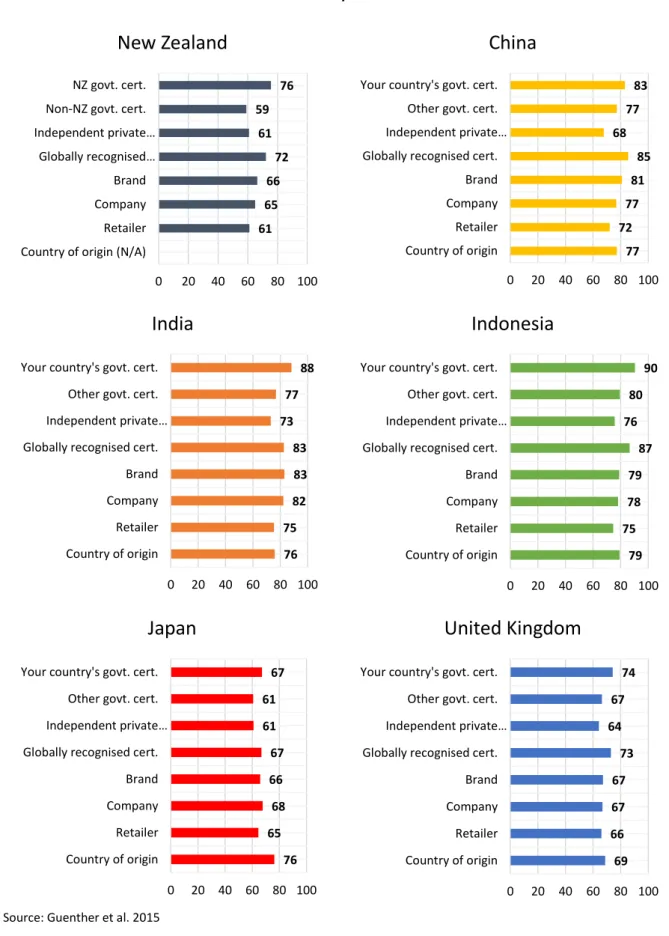

- Authentication of attributes in food and beverages (Q8)

- Importance of factors in relation to key attributes

- Perceived levels of the key attributes in NZ (Q15)

- Conclusion of the key factors, factors under the key attributes, and current levels

- New Zealand consumers food product purchasing behaviour (Q17 and Q18)

- Use of alternative retailers in New Zealand

- Reasons for shopping in particular retail settings (Q23-26)

- Summary of reasons for shopping at alternative retailers

- Digital media and smart technology use in New Zealand

- Summary of digital media and smart technology use in New Zealand

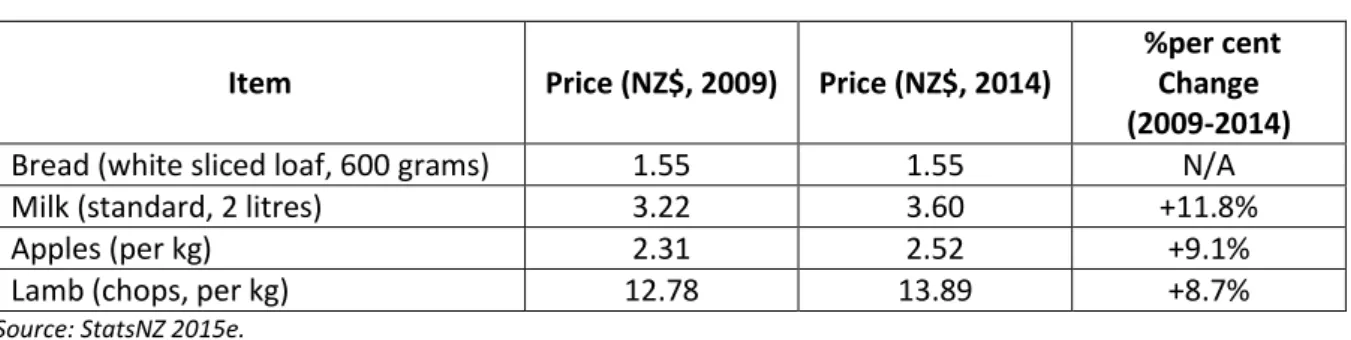

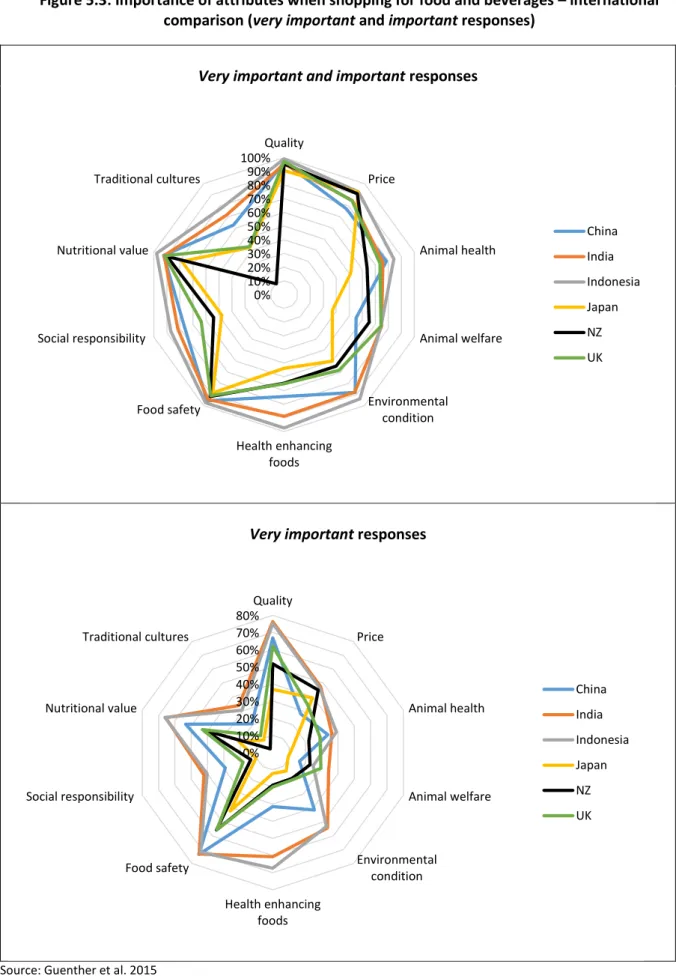

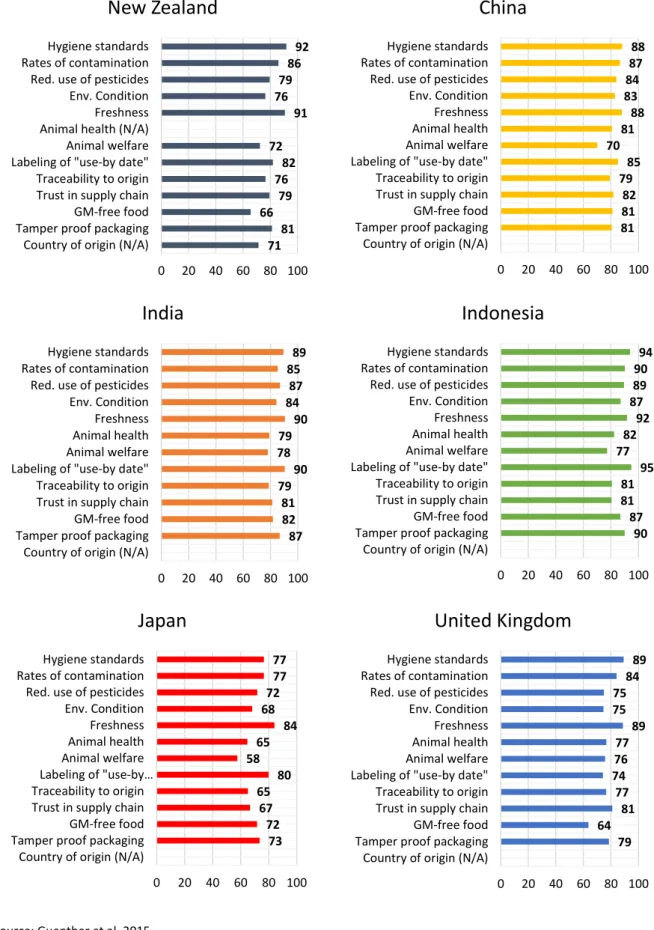

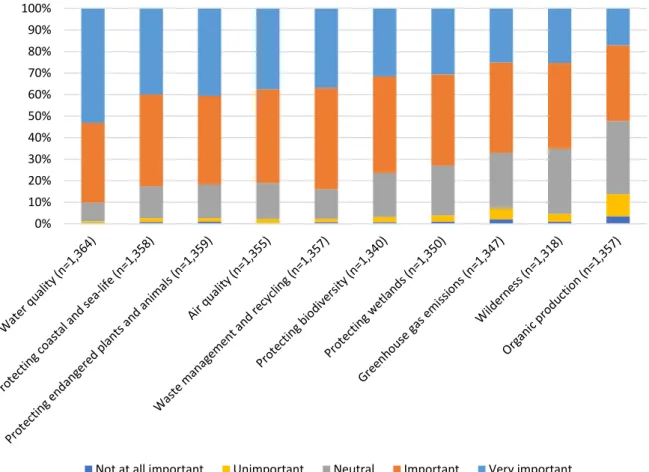

As shown in Guenther et al. 2015) as well as earlier international research (Saunders et al, 2013; Saunders et al. 2015a), food safety is often considered one of the most important attributes in relation to food and drink. The next question asked participants to rate the importance of factors associated with animal welfare5 in food and beverage production and supply. In summary, New Zealand participants rated quality, food safety and price as the most important attributes when shopping for food and drink.

The next set of questions asked participants to consider their use of smart technology (particularly smartphones) in relation to food and beverage purchases. Use of mobile apps for more information about food and/or drinks (international comparison) (percent yes). As shown above, New Zealand participants reported the lowest overall use of mobile devices for food and beverage purchases of all countries.

As shown above, New Zealand participants showed the lowest overall use of mobile devices in relation to barcodes and/or QR codes to find more information about food and drink products for all countries (5 percent). As with the previous question, New Zealand participants indicated the lowest overall use of mobile devices in relation to barcodes and/or QR codes for food and beverage purchases for all countries (15 percent). The final questions in this part of the survey asked participants to consider using smart technology for food and beverage credential verification.

As shown above, New Zealand participants showed the lowest overall current use of any of the above food and beverage credentials authentication technologies, especially microchip reading technology. As shown above, the New Zealand participants' goal of using these technologies for food and beverage verification was the second lowest of all countries surveyed, with results comparable to those seen in other developed countries. New Zealand participants also reported the lowest overall use of mobile devices in combination with barcodes and/or QR codes for finding more information about and buying food and drink for all countries.

New Zealand participants also showed the lowest overall current use of any of the above technologies for food and drink product reference verification.

Conclusion

Taken together, a clear difference can be seen between New Zealand consumers and their international counterparts. Therefore, this study also revealed implications for New Zealand food and beverage exporters seeking access to international markets. Based on the observed differences between New Zealand and international countries in this study, it is clear that achieving market access requires a clear understanding of international consumer preferences and attitudes towards the country.

By taking a New Zealand-centric view of international consumers, exporters may underestimate the potential value to be gained in these markets.

Survey Questionnaire

MER NZ Survey (13-14 May, 17-24 May 2016)

Q7 How important do you think the following attributes are when shopping for food and drink. Q8 Given the authentication of attributes in food and drink, how important do you consider the following? Q9 Considering safety in the production and delivery of food and beverages, how important are the following factors.

Q10 Given the environmental conditions in the production and delivery of food and beverages, how important are the following factors. Q11 Considering animal welfare in the production and supply of food and beverages, how important are the following factors. Q13 Given the social responsibility in the production and supply of food and beverages, how important are the following factors.

Q14 To what extent would you associate the importance of the following factors with Māori food and drink products. Q73 What is your perception of the current levels of the following attributes for food and drink production and supply in New Zealand.

Choice Experiment component

Sample Demographics

Education (b) Up to upper secondary school 11 per cent. 21 per cent Secondary school qualification 24 per cent. 33 per cent other higher education than graduation 30 per cent. 19 per cent Bachelor's degree or similar 20 per cent. 14 per cent Postgraduate degree/diploma/certificate 15 per cent. 6 per cent

Focus Group Sessions Summary Focus Group 1

Animal welfare/health: While the recent problems in New Zealand dairying were discussed, concern for animal welfare influenced the purchasing behavior of only one group member, whose decision to buy organic meat where possible. Country of origin: Group members had a strong preference for purchasing New Zealand food and drink where possible and were very supportive of country of origin labelling. The group was asked how they would like information about food and drink properties to be presented, but there was no consensus on this.

Lack of buyer security was also seen as a barrier to buying online, for example from overseas retailers; one participant also mentioned that he was skeptical about online shopping and cited a lack of confidence in using the necessary equipment; and finally some said they would like to support local shops. Group members acknowledged that online shopping will become more important to New Zealand consumers in the future, although free delivery may be required to encourage wider use initially. For example, one participant mentioned that they could use online shopping to order to buy culture.

The group believed that the use of self-checkout systems in supermarkets has already reduced jobs in that sector and that increasing online shopping will have a negative impact on employment in New Zealand. Farmers' markets were considered more of a social experience (e.g., meeting friends, drinking coffee, and visiting specialty stores) than a major source of regular fruit, vegetable, and other food stores. Some group members viewed shopping at local farmer's markets as a way to support local producers, possibly find better quality produce, and that it was possible to meet the producer directly.

The results of this focus group show that New Zealand consumers are interested in a wide range of issues related to the production and sale of food, but believe that food in New Zealand is generally healthy, safe and produced using good agricultural practices. Members of this target group did not use online shopping to any great extent and generally viewed online shopping and related opportunities in New Zealand as still a developing and limited system compared to overseas.

Focus Group 2

Attributes and Factors: Overseas Survey/NZ Survey