In partial fulfillment of BBA degree requirements, I have completed my internship with “South Bangla Agriculture & Commercial Bank Limited” under your supervision. This is to confirm that the Internship Report “Analysis of Credit Risk Management of South Bangla Agriculture & Commercial Bank Limited” was prepared as part of the completion of BBA program at Sonargaon University (SU) Department of Business Administration conducted by Israfil Bhuiyan, Bearing ID : BBA1803015009 under my control. I am Israfil Bhuiyan, Bachelor of Business Administration student, ID: BBA1803015009 from Sonargaon University, I solemnly declare that this is a report on “Credit Risk Management Analysis of South Bangla Agriculture & Commercial Bank Limited”.

Certified that this project report titled "An Analysis of Credit Risk Management of South Bangla Agriculture & Commercial Bank Limited" is the bonafide work of Israfil Bhuiyan, who conducted the research under my supervision. I would like to express my gratitude to all the people who helped me to achieve my report title, "An Analysis of Credit Risk Management of South Bangla Agriculture & Commercial Bank Limited" at Narshingdi. Shamim Ahammed, Branch Manager of South Bangla Agriculture & Commercial Bank Limited for being my internship supervisor.

Introduction

Origin of the Study

Objectives of the Study

Methodology of the Study

Primary Sources

Secondary Sources

This is Thesis Paper using a credit risk from the executives of South Bangla Agriculture & Commercial Bank Limited. To monitor the mystery of the bank, the workers of South Bangla Agriculture &. South Bangla Agriculture & Commercial Bank Limited (SBAC) is a banking company registered under the Companies Act, 1994 of Bangladesh with its head office currently at BSC Tower, (Floor 5 - 16) 2-3 Rajuk Avenue, Motijheel, Dhaka- 1000, Bangladesh.

The Bank gives a wide range of assistance to exchange, trade, industry and the general affairs of the nation. South Bangla Agriculture & Commercial Bank Limited has just made enormous progress since its inception. The bank has just developed notoriety as one of the value specialist organizations of the country.

In South Bangla Agriculture & Commercial Bank Limited they follow the accompanying rule while giving advances and advances to the customer. South Bangla Agriculture & Commercial Bank Limited offers loans for virtually all areas of business with a profit motive. Credit bureaus are stretched according to the rules of Bangladesh (Central Bank of Bangladesh) and operational methods of the bank.

The bank would grant loans if the reason for the advances can do more for the overall financial improvement of the country. There are a lot of targets that the bank's recovery still falls short of. Before granting loans, Sometime South Bangla Agriculture & Commercial Bank Limited fails to adequately analyze the business hazard of the borrowers and the bank cannot anticipate whether the business will succeed or fail.

In the event that by all accounts it is a feasible one, the HO sends it to the Board of Directors for endorsement of the Investment. After getting the HO's approval, the branch issues sanction letter to the borrower. To further improve credit risk management, South Bangla Agriculture & Commercial Bank Limited should improve in some areas.

Scop of the Study

Limitations of the Study

- Profile South Bangla Agriculture & Commercial Bank Limited

- Vision of South Bangla Agriculture & Commercial Bank Limited

- Mission of South Bangla Agriculture & Commercial Bank Limited

- Objectives of South Bangla Agriculture & Commercial Bank Limited

- Strategies of South Bangla Agriculture & Commercial Bank Limited

- Products and services of South Bangla Agriculture & Commercial Bank Limited

- Types of loan of what are offered by SBAC

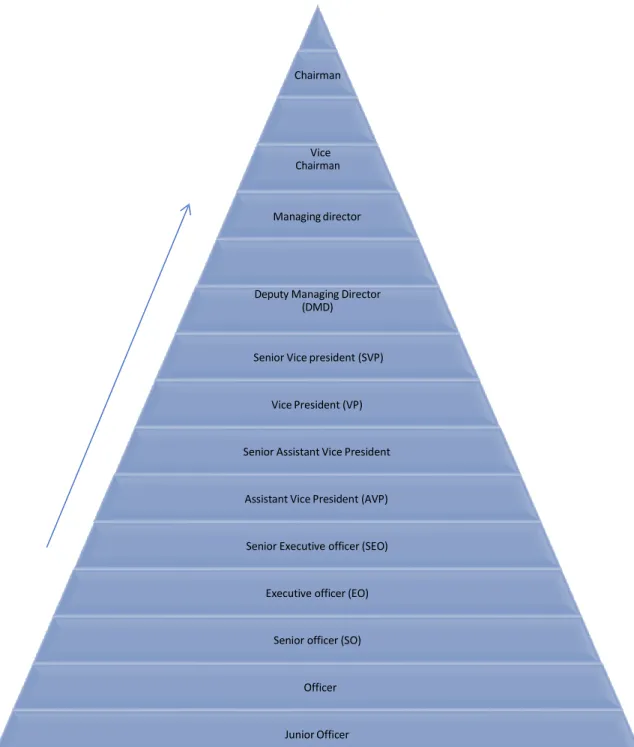

- Management Hierarchy of South Bangla Agriculture & Commercial Bank Limited

The bank was built by a meeting of businessmen from the neighborhood, about whom rumors are circulating everywhere in the field of exchange, trade, industry and business in the country. The bank is supervised and staffed by a group of deeply educated and skilled groups that deal more with money and banking. Since the needs of clients change step by step over time, the bank tries to design procedures and introduce innovations by adapting to the changes.

At present, the bank has a continuous online financial network (of both urban and rural) network across the country with a brilliant IT backbone. Apart from usual remittance focus, the bank has its own ATMs which mediate to other complicit banks and consortia across the country. To become a leading banking institution by playing a significant role in the development of the country.

The bank is committed to meeting the diverse needs of its customers with a range of products at a competitive price, using appropriate technology and providing timely services, so that it is possible with a motivated approach to ensure sustainable growth, reasonable returns and contribution to the development of the country. and professional workforce. Strive for a compelling management arrangement by ensuring compliance with moral standards, directness and accountability at all levels. Commercial Bank Limited Ltd has additionally introduced Q-money cards for its esteemed customers which provides 24 hours banking administration through debit cards.

- Introduction

- Credit Risk

- Credit Risk Management System

- Credit Principles of South Bangla Agriculture & Commercial Bank Limited

- Credit Facilities of South Bangla Agriculture & Commercial Bank Limited

- Lending Criteria of South Bangla Agriculture & Commercial Bank Limited

- Technical Viability

- Commercial viability

- Financial Viability

- Economic Viability

- Credit Evaluation Principles

- Different Types of Credit Facilities by SBAC

- How South Bangla Agriculture & Commercial Bank Limited recover their Loan

- Problems in Loan Recovery

- Problems created by economic environment

- Problems created by government

- Problems created by the bank

- Overall Procedure for Sanctioning Loan

- Computation of Credit Risk Grading

He thoroughly improved the culture of executives and established a standard for the isolation of liabilities and duties related to the bank's credit operations. The difference between the premium earned on the drive and the premium paid in the store forms a significant part of the bank's salary, and the foreign trade business is also extremely profitable. A Recruit Purchase is a kind of partial credit whereby the lessee agrees to take the goods on hire at a stated rent, which includes a principal repayment as well as the excitement of a change of advance over a predetermined period.

It is an extraordinary credit plan of the Bank to finance the acquisition of buyers who are strong in collecting steady wages to increase their life expectancy. It is an interval advance related to importation and is broadly exchanged for installments normally paid by the meeting for withdrawing the reports on the arrival of imported products from the authority of the tradition. Often problems can arise in authorizing prepayment methods, conducting a survey of the company and investigating the credits, and so on. That is, the issue of pre-recovery demonstrates the results of the standard cycle in pre-dispensing.

The banks sometimes sanction loans to the losing healthcare sector for further improvement of the concerned sector, but in most cases they fail to make progress. After being satisfied with the client's application, the respected official sends an application to the SBAC head office for approval of the loan. While generating cash, the banks create a large number of records, which must be approved by the borrowers before the credit is extended.

To measure the actual risk associated with the advance paid by the bank to the specific customer, we must follow a few stages and determine an actual limit of the danger. In conclusion, this takes advantage of the danger of disappointment due to the low slice of the pie and the helpless development of the industry. Risk of counterparty default due to poor management capabilities, including management experience, succession plan and teamwork.

The risk that the bank may be exposed to because of the poor quality or strength of the security in the event of default.

Financial Data Analysis

- Loan and Advance

- Loan to Deposit Ratio

- Standard Loan

- Sub-standard Loan

- Doubtful Loan

- Bad/Loss Loan

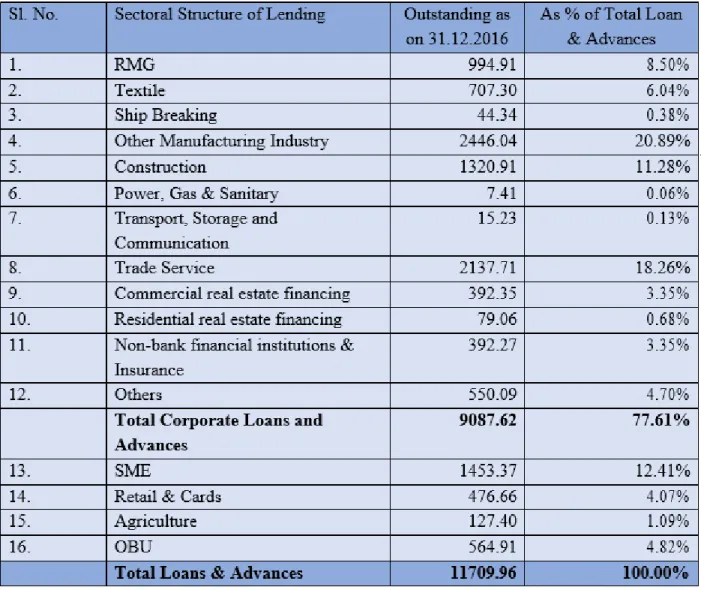

- Sector wise Distribution of Loan and advances

From the past 5-year annual report, I have shared some important information about SBAC's lending activities. The loan-to-deposit ratio refers to a bank's liquidity by comparing a bank's total loans to its total deposits over the same time periods. If the ratio is too high, it means that the bank may not have enough liquidity to cover any unexpected store conditions.

From the chart it can be seen that SEBL's total deposit loans are increasing due to their attractive and flexible loan packages. From the table above it is evident that in 2019 the growth rate of their substandard loans is 58%, which is higher than other years, but unfortunately in 2020 their growth rate will decrease, the rate is (-91%) ) which is very unfortunate for South Bangla Agriculture & Commercial Bank Limited, so the last years of 2021 are respectable to increase the rate where the rate is 48%. This plan contains where the question of full credit recovery exists and the advance near a catastrophe cannot be measured anyway at this stage.

From the chart shows SBAC's bad loan in 2017, their bad loan growth rate was -213% which is much lower than other years and next years 2018 their growth rate is 37 % and 2019 increased to 41% but the last and the last years of 2021 their growth has gone down which is -19%. Bad loan/loss is a specific decline of loan and advance in this class when it appears that such advance and advance is uncollectible or worthless even after all security has been exhausted. From the above graph it shows that the overall bad loan/loss and its growth rate were fluctuating.

The above chart reflects that SBAC maintained a balanced approach in lending to various industrial sectors and enjoyed a fair share of RMG and textile industry business. Manufacturing industry credit dominated SBAC's total loan portfolio, accounting for 20.89%, and trade service loans accounting for 18.26% of the total outstanding credit.

Findings of the Study

Recommendations

Bank SBAC must create a community that will peer review the framework of credit management. Standard Prepaid Share Bank SBAC should introduce and improve data management and verify that executives fully comply with credit guidelines. To reduce substandard advance, SBAC Bank may increase several reformed parameters for credit approval process as per Bangladesh Bank General Rule.

To reduce the terrible and unhappy credit, SBAC bank should emphasize the customer for appropriate repayment and take the essential legitimate step against the stubborn advance defaulter.

Conclusion