Submitted in partial fulfillment of the requirements for the degree of Bachelor of Business Administration. With due respect, The Study would like to inform you that The Study has completed my internship report on the topic: “Financial Performance Analysis of South East Bank Limited” Dhaka, Bangladesh. This report is an integral part of our academic courses to complete the BBA program, which has given me the opportunity to understand the core part of the subject.

I hope that this report reflects on the contemporary issues in the field of finance that are practiced by organizations in our country. He has successfully completed his internship program at Southeast Bank Limited and has prepared this internship under my direct supervision. This is Mamun Kabir, a student of Bachelor of Business Administration, ID: BBA2003021056 of Sonargaon University hereby declares that the internship report titled "Financial Performance Analysis of South East Bank Limited" has been submitted as the requirement for the degree of Bachelor of Business Administration.

Finally, I express my gratitude to all those who have been helpful in the preparation of this internship report. By doing this report, a great knowledge is gained by me how to calculate all financial ratios and evaluate the performance of a financial institution. After analyzing the performance of South East Bank Limited, some important things regarding the bank are found in Last chapter and concluding part of this report which includes findings, recommendation and conclusion.

Some suggestions are given here which will surely help South East Bank Limited to improve their performance and hence its contribution to the entire economy.

Introduction

Background of the Study

Scope of the Study

Methodology of the Study

Data collection

Limitations of the Study

Organizational Overview

Chapter: 02

Profile of SEBL

- Vision of SEBL

- Mission of SEBL

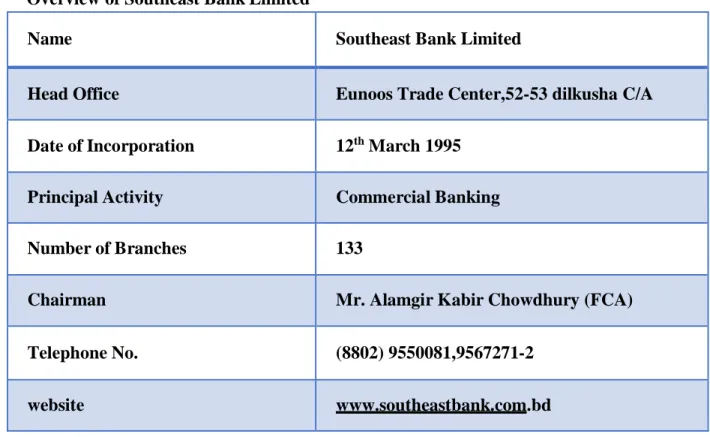

SEBL has achieved a continuous rate of growth in various spheres of banking operations since its establishment in 1995. The philosophy of the bank is "A bank with vision" that shows sincerity, integrity as well as strength of mind to face competition and advancement global. Southeast Bank Limited is one of the leading business banks in the private division and was incorporated under the Banking Company Act, 1991 and consolidated as a Public Limited Company under the Companies Act, 1994 on 12 March 1995. During this short period time, the Bank is fruitful in establishing itself as a dynamic and dynamic budgetary base in the country.

The bank was generally enlivened by the business network, from small businessmen to huge dealerships, and mechanical aggregates, including the best business borrowers, are excited by their first exchange development of work and their exercises. Accordingly, within a short period of time, it has had the opportunity to take a shot in this sector with their exploratory vision and furthermore ready to gain fame among the majority of the bank. Within a short period of up to twenty years, the bank made surprising progress and raised the capital requirements of the Bangladesh Bank.

It has developed rapidly as one of the pioneers of the new age banks in the private segment in terms of business and benefits as evidenced by the budget overviews over the previous 26 years. Southeast Bank Constrained currently has 133 branches across Bangladesh and its point is to be the main bank in the country's most important markets. The bank by focusing on customer assistance and practicing them in its locations to make extraordinary known.

The Bank is focused on ensuring consistent preparation of its staff to stay abreast of the latest current exercises in their respective areas of work and in this preparation has encouraged them to maintain their compliance to handle different types of clients and move them. on dedication to one's work. Southeast Bank Restricted promises to increase consumer loyalty through administrations and create trust in customer cooperation that has proven energy over the past twenty years. It is especially important that managers and executives in any organization agree on a basic vision for that company to achieve long-term goals.

Southeast Bank also established its vision to achieve its long-term goals and objectives. Their vision is to stand out as a pioneering banking institution in Bangladesh and contribute significantly to the national economy. Southeast Bank is particularly concerned about its core objective, as it must be disclosed by supervisors and determined through the mission statement.

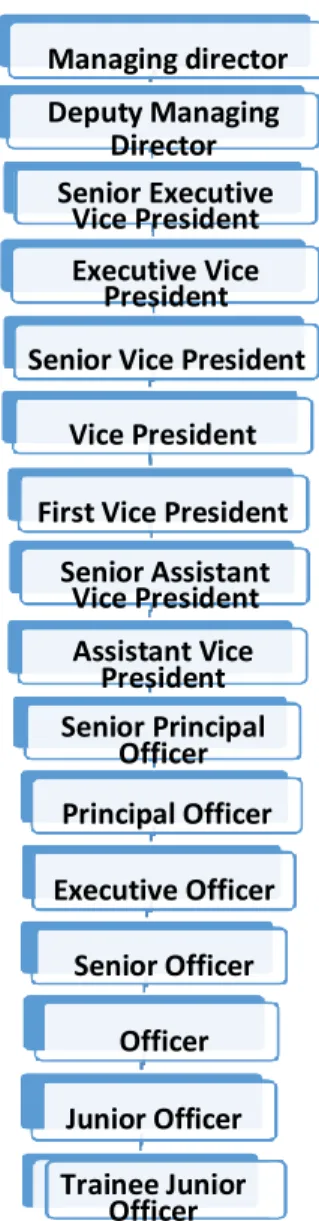

Organizational Structure

Products &Services of SEBL

Chapter: 03

Theoretical Analysis

Ratio Analysis

- Liquidity Ratio

- Activity Ratio

- Efficiency Ratio

- Profitability Ratio

- Credit Risk Ratio

It is used to assess different parts of an organization's operation and monetary execution, for example, its productivity, liquidity, benefits, and solvability. Various customers, for example, speculators, the board, investors and loan bosses, use the ratio to break down the money-related circumstances of an organization for their fundamental leadership reasons. Ratios are among the more commonly used devices for fiscal summary research because they provide bits of information about and side effects of fundamental conditions.

A proportion can enable us to reveal conditions and patterns that are difficult to identify by examining single segments that make up the proportion. Liquidity refers to the accessibility of assets of an organization to meet short-term cash requirements. It is influenced by the planning of cash inflows and increases along with prospects for future execution.

In the event that an organization neglects to fulfill its current commitments, its continued presence is imaginary. Despite the fact that accounting estimates expect the organization to continue as a going concern, our investigation should consistently verify the validity of this suspicion using liquidity measures. Action ratio is a metric that determines an organization's ability to turn its cash registers into revenue.

Action ratios measure a company's overall ability, depending on the use of its advantages, influence, or other comparatives, and are important in deciding whether an organization's board is adequately generating revenue and cash from its assets. These ratios are most valuable when compared to a competitor or industry to determine whether a substance's procedures are great or ominous. Movement ratios can form a starting point for correlation over different reporting periods in order to arrive at changes after some time.

Transitional liquidity problems are also influenced by the organization's customers and providers, and it is faster if it is a financial organization. After all, it can be characterized as the risk that the borrower will not repay half or all of the principal amount or related installments (or both). It could very likely be due to any of the accompanying reasons – poor borrower cash flow making it difficult to pay the premium and principal, rising financing costs, should there be advances mimicking the cost of the loan, changes in economic conditions. situations, business disappointment, unwillingness to repay, etc.

Common Size Analysis

- Common Size of Balance Sheet

- Common Size of Income Statement

An articulation of the usual salary size is a salary announcement where each record is communicated as a level of offer evaluation. It is used for vertical investigation, in which every detail in a fiscal summary is recorded as a level of a basic figure within the notice, to make examinations simpler. An examination of the explanation of common pay sizes makes it simpler to perceive what drives an organization's benefits and compare that exhibit to its companions.

By looking at how that exhibit changed over time, common size fiscal reports help speculators slants that a rough budget summary might not reveal. Large changes in the level of revenue used by various cost classes over a given time frame may indicate that the plan of action is changing, or that assembly expenses are evolving.

Trend Analysis

- Trend Analysis of Balance Sheet

- Trend Analysis of Income Sheet

Flat survey (otherwise called pattern survey) is a survey strategy for budget reports that shows changes in the measures of comparison of fiscal summary items over a period of time. The most punctual period is typically used as the base timeframe, and the stuff on the announcements for each individual later period is contrasted and the stuff on the announcements in the base timeframe.

Chapter: 04

Financial Performance of SEBL

Ratio Analysis & Graphical Presentation

Liquidity Ratio

Efficiency

Profitability

- Liquidity Ratio

Liquidity Ratio

Activity Ratio

Interpretation: The turnover percentage of benefits is determined by isolating all intrigue wages from the absolute normal sources. The intrigue wage, found in the wage explanation, is used to calculate this proportion of returns, and deductions must be drawn from versatile deals to gauge the real amount of the association's advantage capacity to produce deals.

Efficiency Ratio

Efficiency Ratio

Profitability Ratio

Profitability Ratio

Profitability Ratio

Credit Risk Ratio

Credit Risk Ratio

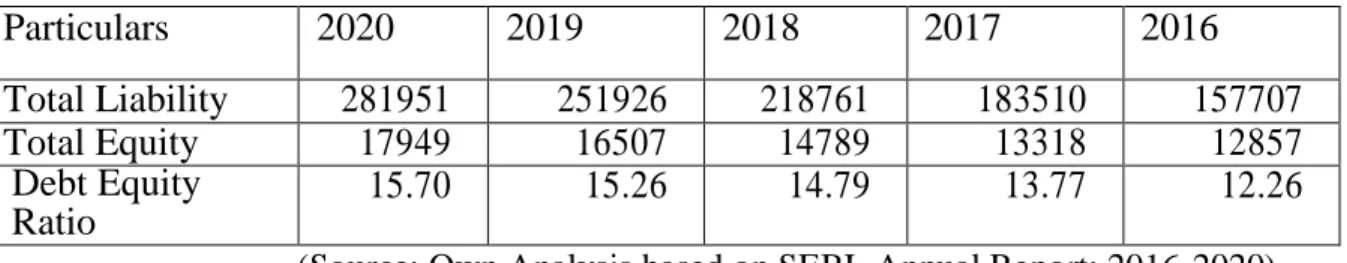

Leverage Position

There is an unstable trend in the debt to equity ratio of South East Bank Limited from 2016 to 2020. This means that their liability is increasing at a higher rate than their equity from 2016 to 2020. This higher outcome over the years not only increases the risk but also increases the profit.

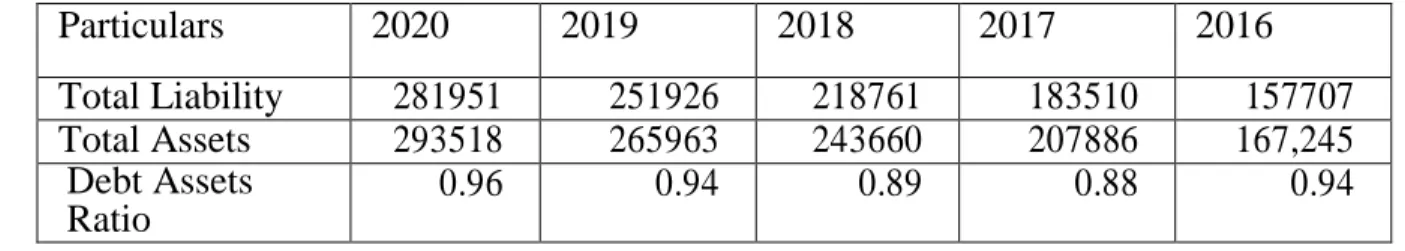

Although there are small fluctuations, South East Bank Limited has been able to maintain an average debt ratio of 0.94 from 2016 to 2020.

Return on Equity (ROE)

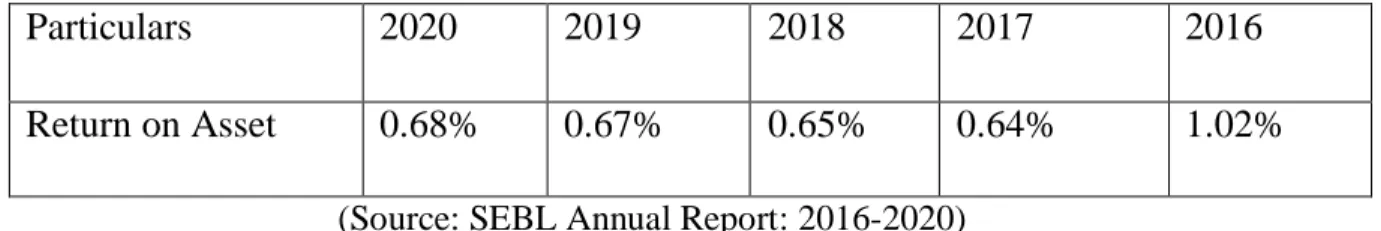

Return on Asset (ROA)

Chapter: 05

Problems, Recommendation & Conclusion

Problems Identified

Since the asset turnover ratio is often used as an indicator of efficiency, the bank should take care of it. Banks' return on assets (ROA) is decreasing between 2016 and 2018, but the last two years have been better. The equity to assets ratio of SEBL is decreasing in the middle of the report and increasing in the next year from 2016 to 2020.

Recommendations for SEBL

Conclusion