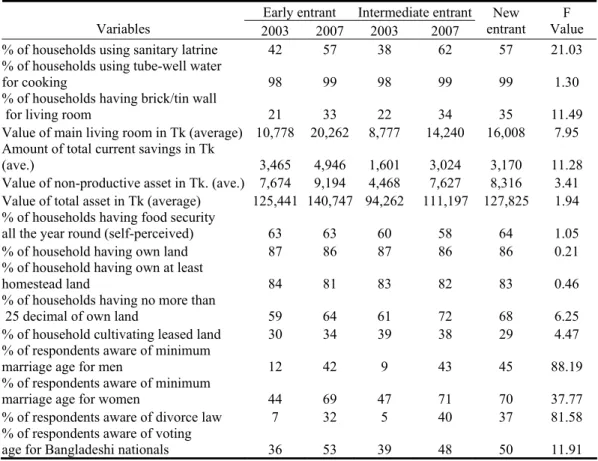

Full documentation of findings and explanation of statistical analyzes are presented in the full report. Changes in scores reflect changes in the overall well-being of families where higher scores mean better status. We found that the poverty scores of beneficiary households improved significantly and the poverty rate decreased, regardless of the endpoint used.

We found that additional months of involvement in BRAC-VO were associated with increases in the total asset value of the participants. An additional loan of 1,000 Taka (US$14) was associated with 0.41% increased in the total assets of the beneficiary households. Increased loan amount was found to have a positive impact on the welfare of the poor households.

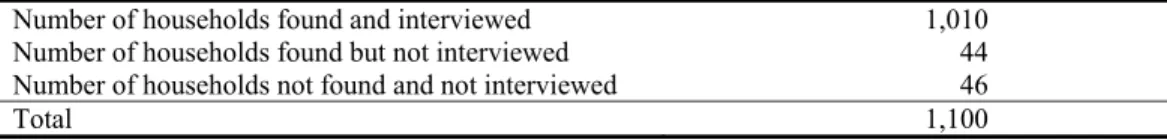

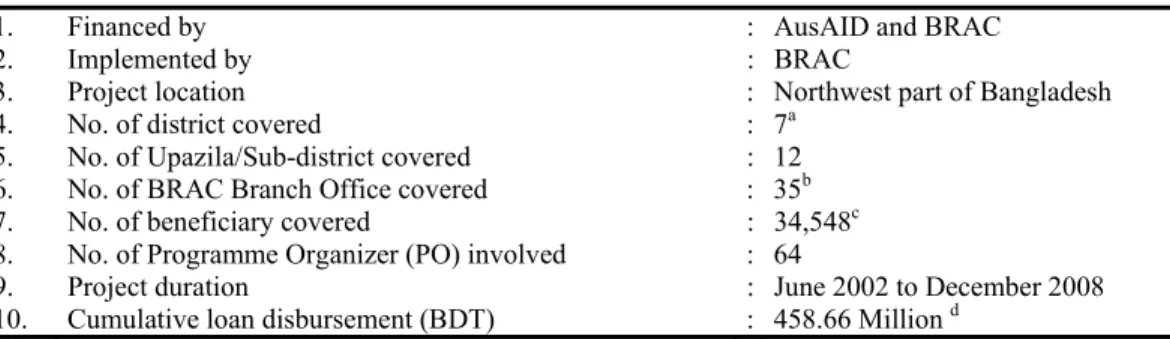

The vision of this project is to improve the livelihoods of the poor through microfinance services. The primary aim of this study is to empirically evaluate whether the program has any effect on the well-being of the beneficiary households and to examine the magnitude of the change. A possible relationship between the quality of participation in microfinance and the outcome variables of the households in the panel was examined.

Among other outcome indicators, Mark Schreiner's poverty scorecard (Schreiner 2006) was used to see the changes in the probability of poverty of the beneficiary households over time.

FINDINGS

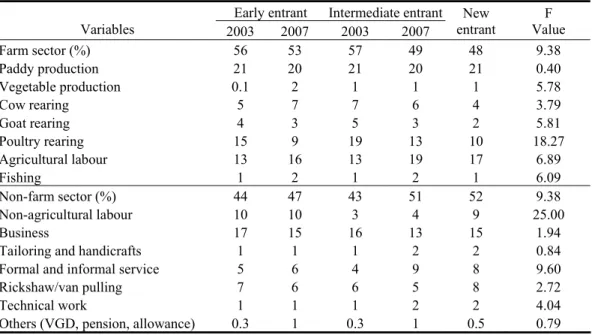

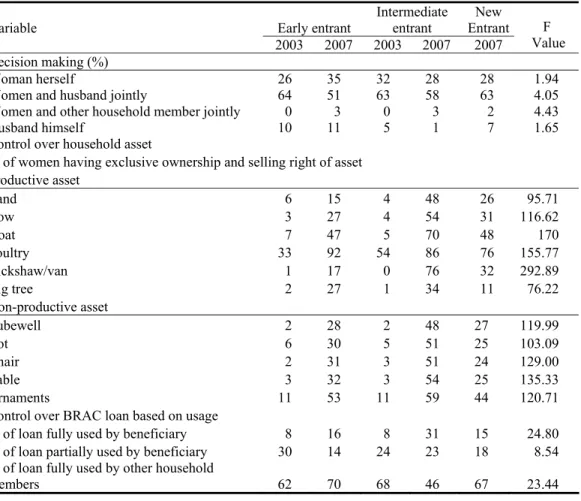

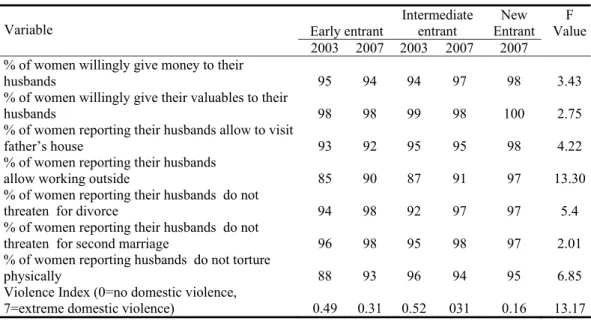

Other (VGD, pension, allowances) On the other hand, the small business subsector dominated the non-farm sector in terms of job creation, although it has declined over time. It is interesting to note that women do not have full control over their exclusive assets (i.e. ornaments) let alone land and large tree, although control increased over time. The exclusive control of the BRAC loan in terms of use by the women also increased over time.

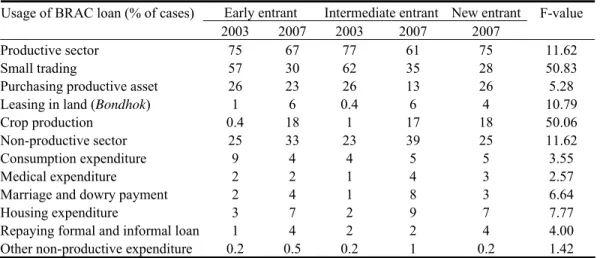

Other members of the household used a large portion of the BRAC loan, which has been increased. However, the use of loans to the productive sector decreased over time, while it increased in the non-productive sector (Table 8). So it is not necessarily falling investments on the purchase of durable productive assets over time.

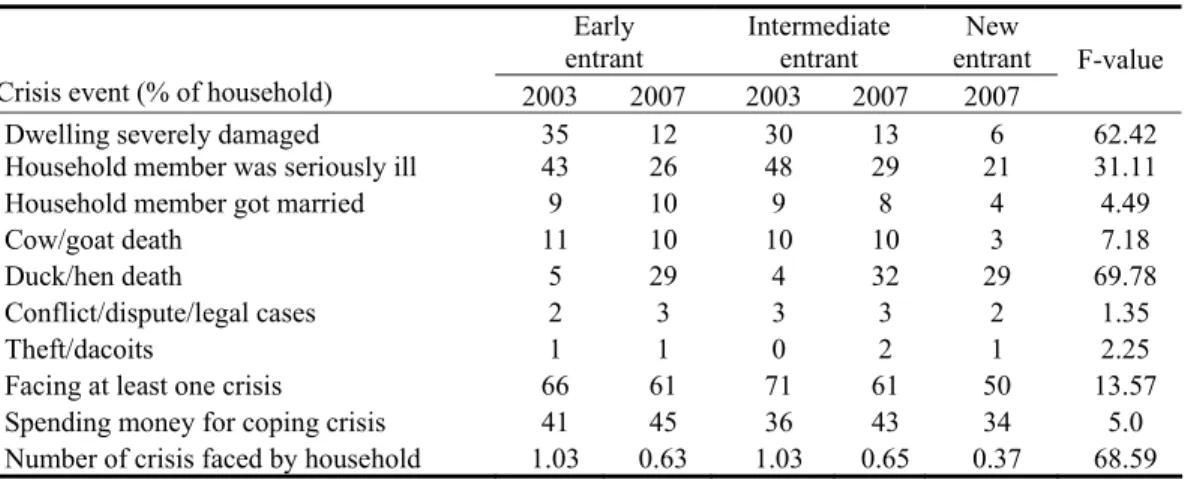

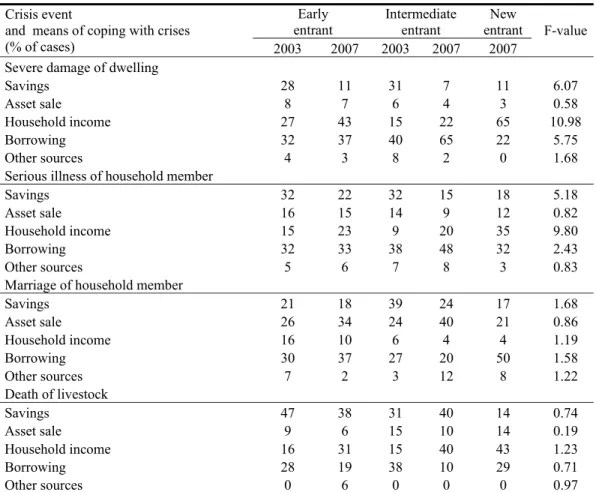

The use of BRAC loan in housing and marriage expenses appears to have more than doubled over time, except for marriage expenses of early entrants. Number of crises faced by households This reflects that knowledge of the beneficiary about health care has increased over time due to close supervision of health workers. Spending of household income was found to be more common for dealing with major household crises.

Because a larger amount of savings allows them to eventually take out a larger loan amount that could meet their financial needs in times of crisis. The poverty status of eligible households over time can demonstrate overall change in welfare. Using Mark Schreiner's simple poverty indicator, we identified the poverty status of beneficiaries over time.

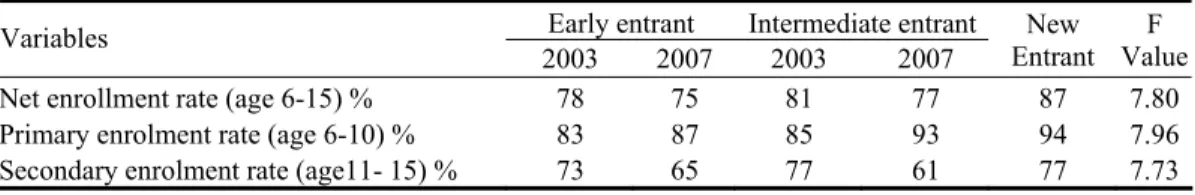

In Equations 2 and 3, education of household members, beneficiaries' involvement in economic activities and diversified source of income available in the household appear to be important in changing household well-being over time. Households with a daily wage earner are less likely to accumulate household assets, which ultimately reduce well-being over time. It is interesting to note that households are less likely to use BRAC savings to cope with the crisis over time.

In Equation-1, an increase in loan size by one thousand taka is associated with a 4% increase in the value of household assets. Thus, it is undoubtedly said that microcredit plays a causal role in improving the welfare of the beneficiary's household over time.

CONCLUSION

Furthermore, a greater proportion of dropout clients from extremely poor households leave the system as a whole (55% of dropouts from extremely poor versus 48% for the rest dropouts). If the VO has a high level of variation in poverty (as measured by coefficient of variation in poverty scores), clients have a slightly higher chance of dropping out compared to a VO with lower variation. While the regression analysis sheds some light on the pattern of client churn, a straightforward way to identify the reasons for churn is to ask the churning clients.

More than 42% of them reported that they were having trouble repaying their outstanding loans as the reason for dropping out. Only one of the three attributes where the customers have the least satisfaction came out in the list of main reasons for leaving BRAC. Four percent of drop-out customers reported problems with savings withdrawal as a reason for dropping out.

However, if we look further into the reason for problems with repayment, the degree of necessity for flexibility in savings withdrawal may increase. Nevertheless, only 6 out of 492 out-of-pocket customers indicated high interest on loan as a reason for their decision to stop being a member of BRAC and none reported low interest on savings. Participatory product design using conjoint analysis in the rural financial market of Northern Vietnam.

The mystery of vanishing benefits: analyst Speedy's introduction to valuation', World Bank, Washington DC, USA. How many living rooms does the house have (excluding those used for business and kitchen). Stages IV: In the 2SLS estimation process, the final loan amount is predicted by the instrumental variables and other exogenous variables in the first stage.

Justification of IV: To estimate J-statistics, the number of instrumental variables must be greater than the number of included endogenous variables, which is the case here. The residual is regressed against the instruments and other exogenous variables; and endogenous size of loan are excluded. Partial F-statistics of the instruments from the final regression multiplied by the number of instruments yield the J-statistics.

North-West Microfinance Expansion Project Repeat Survey

Deterioration 1=highly

Source of money 1 =savings

What is the correct law of divorce. inform chairman= 1 wrong/don't know= 2 What is minimum age to vote. 18 years = 1 wrong/don't know= 2 Is it ok to draw or give a thumb impression on a white paper. Generally, we are seen to be satisfied with some service and dissatisfied with some service.

So, we offer you different activities on loan service to know the level of satisfaction. highly satisfied= 1 moderately satisfied= 2 moderately dissatisfied=3 highly dissatisfied= 4 Level of satisfaction Sl . no. Highly satisfied Moderately satisfied Moderately dissatisfied Highly dissatisfied 01 b) Loan application system Waiting time to receive loan 1 2 3 4 03. If someone comes to you for advice on NGO registration, which NGO would you suggest.