To meet this need, a group of highly admired traders was brought together and Dhaka Bank Limited was established in 1995. I am here submitting my internship report titled "Financial Ratio Analysis of Dhaka Bank Limited" which was assigned to me as a requirement for the completion of the BBA program. This is to confirm that this internship report on “Financial Ratio Analysis of Dhaka Bank Limited”.

I have analyzed the financial ratio analysis of Dhaka Bank Limited to find out the ratios by using the past and present data.

Chapter- 1 Introductory Part

Normally with the word "Bank" we will simply perceive that the economic organization administers cash. But before we use the term "Bank" without preamble and limitations, it refers to commercial banks. In our country, second-tier banks lead the economic field and macroeconomic supervision, mainly the rest of the performance of commercial banks together with the investment division.

Of these, nine units are state-owned (including five special banks), 38 are private commercial banks and the remaining nine are commercial banks.

O RIGIN OF THE S TUDY

Primary sources

Secondary sources

Chapter-2

Organizational Profiles of Dhaka Bank Ltd

B RANCHES

Excellence in Banking" is our shibboleth and the most efficient functioning bank in the country is our goal. Since the month of the Gregorian calendar 2018, the bank is progressing step by step with the approval of Basel-3 because cooperation degree increases the control over capital and liquidity .To maintain capital adequacy in line with Basel-3 needs, the bank will divide itself into competitive financial risks and regulatory framework in the new post crisis, the bank has issued BDT Tk.

In 2020, the effects of credit risk and market volatility were still beyond the bank's blue damage. On the contrary, DBL has incorporated the real estate policy into the bank's daily activities. The inexperienced banking cell works on boring development policies, products and supervision of the bank's cheap financial activities.

To be one of the leading institutions in the country, providing top quality products and services through the latest technologies and also to provide superior banking services to a team of highly effective staff. For our common as a company national and our corporate social responsibility is useful in the progress of the state. Dhaka Bank Ltd is engaged in charity, welfare and alternative beneficial activities for the development of its own organization, which can serve as a tool to build awareness of development problems and build a bridge with the common goal of developing property of society, many developments and direct support from other people.

Dhaka Bank Ltd has CSR committee of 5 members under the leadership of director for management and. If the departmentation is not suitable for practical purposes, it will have a defective status and the performance of the selected category will not be measured.

H UMAN R ESOURCES D EPARTMENT

Page | 11 Dhaka Bank Ltd has invested money in the software system and assigning individual IT departments to fifty large integers. If the roles are not organized by taking into account their correlation and not classified into a very specific category, it will be very difficult to manage the system effectively. Dhaka Bank Ltd has a feature of central accounts department which monitors the square measure of accounts department of the individual branch.

This section is responsible for monitoring the development policies and guidelines of specific branches and at the same time monitoring the activities. This department is responsible for creating policies, setting advice, developing the operational pitch and keeping in mind the benefits and policies of the reward plan. This section is responsible for providing credit to buyers, risks of buyers live in the system, takes efficient decisions in the system and recovers the authorized debt on time.

This department is also responsible for establishing and establishing investment rates, lending and debt collection measures. The main part of the credit department consists of the measuring line account, line loan, PAD, LTR, packing loan, term loan, staff loan, housing loan, lease financing, letter of credit and bank guarantee. A special department of the bank, the investment department, deals with sales, receives shares on the stock exchange and manages the bank's own portfolio.

It is also possible to obtain the possibility of maintaining the account of an associate in nursing with the investment department. In order to attempt a trade agreement, the Commission must simultaneously maintain a minimum balance between the accounts.

P ERSONAL /G ENERAL B ANKING D EPARTMENT

Dhaka Bank Ltd is expanding its ATM booths and has organized a comprehensive program to expand its network in 2010. Dhaka Bank Ltd participated in the recently conducted SME Act 2009 at the Bangabandhu International Conference Center on May 27, 2009. The banking company of Dhaka Bank Ltd supplies similar banking services in support of large and medium-sized local organizations.

Dhaka Bank Ltd has jointly designed a comprehensive risk management system to monitor and manage their quality. Among the private sector banks, Dhaka Bank Ltd has already made its mark at the retail banking stage. There are four departments in Dhaka bank Ltd. Development, Operation, Consumer Loan and Consumer Cards.

Dhaka Bank Limited generally works for the development of banking services and the normal development of the People's Republic of Bangladesh. Islamic banking has become quite respectable in the People's Republic of Bangladesh and as a result Dhaka Bank Ltd started its primary Islamic banking branch on 2nd July 2003 in Motijheel Industrial Area, Dhaka. And it has resulted in a great increase in the overall profitability of Dhaka Bank Ltd.

Dhaka Bank Ltd is also a full member of Muslim Banks Consultative Forum (MBCF), Dhaka and Central Sharia Board of Islamic Banks of Bangladesh. In order to comply with Islamic Shariah rules, Dhaka Bank Ltd operates 2 Islamic banking branches that generally operate prohibitions on receipts in any form and prohibits payments. Dhaka Bank Ltd aims to create a real online industry that cannot completely satisfy your time needs but inevitably sets new dimensions in the banking world.

International trade is one of the main commercial activities managed by Dhaka Bank Ltd.

Chapter-3

Financial Ratio Analysis Of Dhaka Bank Limited

Ratio Analysis

Assumption of Ratio Analysis Purpose and Use of Ratio Analysis

Ratio Analysis of Dhaka Bank Limited

Assumption of Ratio Analysis

Purpose and Use of Ratio Analysis

Purpose of Ratio Analysis

Use of Ratio Analysis

Suppliers: Use liquidity as a result of suppliers square measure very curious about knowing the flexibility of the business to meet its short obligations as and after they square measure owe. Management: Uses all relationships because management is curious about all aspects, that is, every monetary performance and status of the business. Credit rating agencies: while debt holder's square measure provider's square measure involved regarding short-term liquidity and income, credit rating agencies go a step further.

They use financial statements to accurately analyze whether or not the corporation is ready to meet its obligations within the end of the day.

Ratio analysis of Dhaka Bank Limited from 2016 to 2020

Liquidity Ratio

- Current Ratio

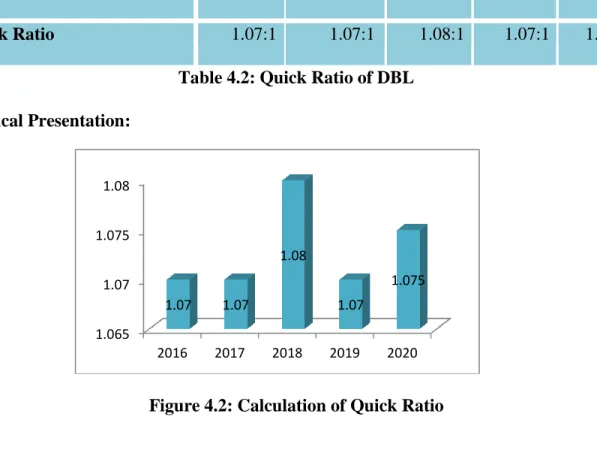

- Quick Ratio or Acid Test Ratio

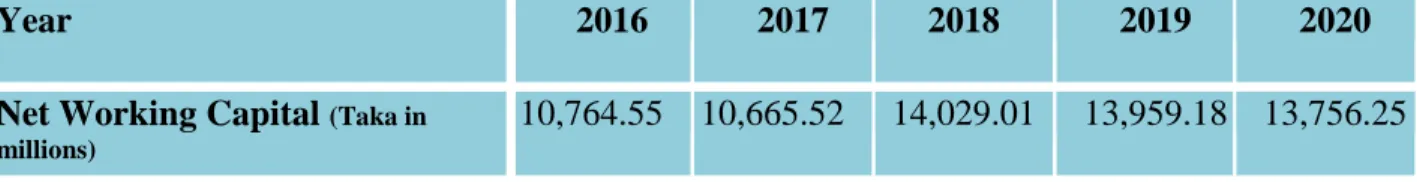

- Net working capital

- Cash Ratio

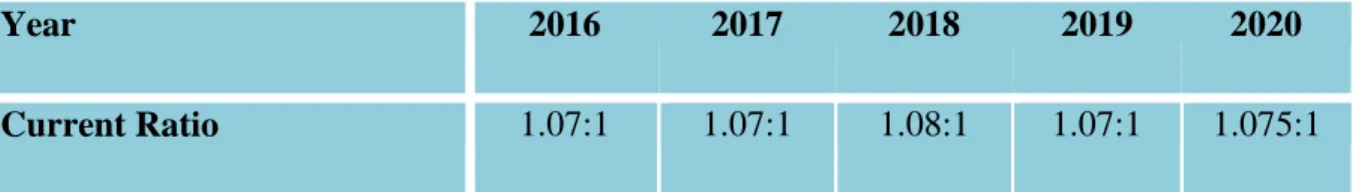

On the other hand, above 1 is good for every company because they have the ability to pay off its obligations. The working capital ratio measures the company's liquidity, where an organization's ability to pay its obligations. This ratio shows the relative potential of an entity's current assets to its current liabilities with the ability to pay for its current liabilities.

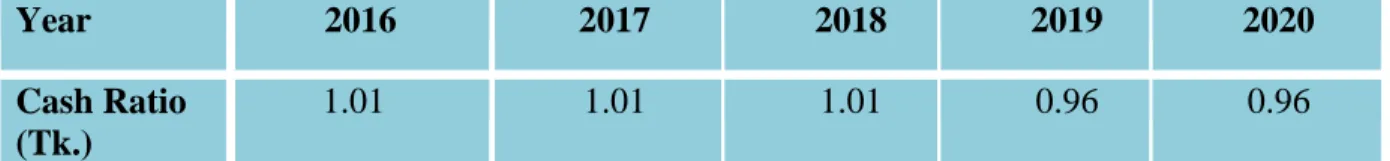

The cash ratio is the ratio that measures a company's ability to pay off its current liabilities with the cash. This is extreme liquidity ratio because only cash and cash equivalents are compared to current liabilities. The cash ratio shows how well any resources can pay for its current liabilities with only cash and cash equivalents.

Profitability Ratio

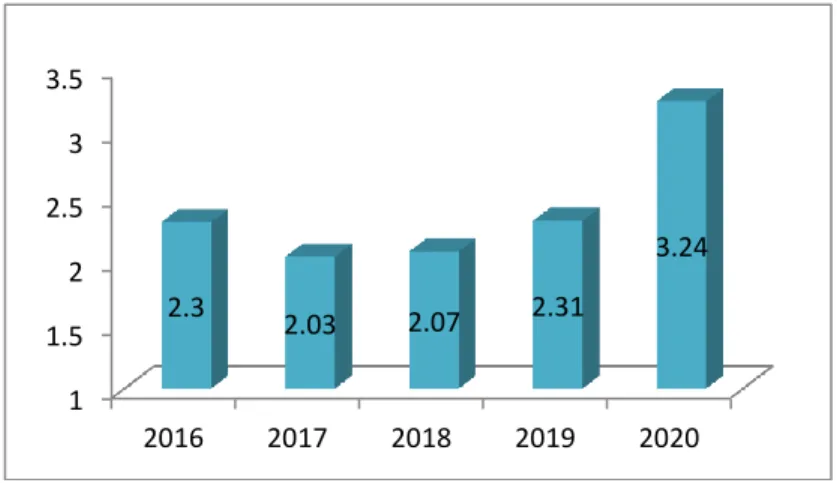

Earnings per share (EPS)

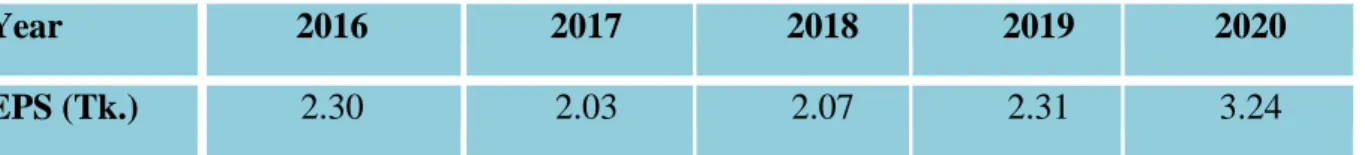

Return on Asset (ROA)

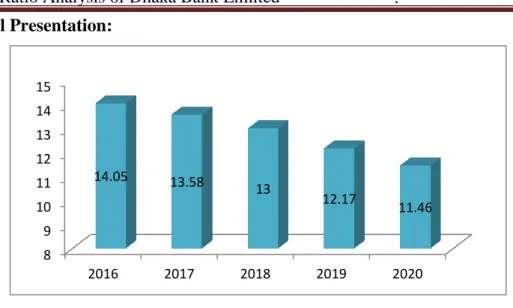

The main reason for the fall of this ration in 2017 is that the total income is decreasing. In these five years, the best performance of the year 2020 and the year 2016 show the worst performance. The main reason for the decrease in this ratio in the year 2016 is that the total income is decreasing.

Return on Equity

Solvency Ratio

Debt Ratio

- Debt to Equity Ratio

The debt ratio is a ratio of a company's financial risk. The risk is that it may not be enough to pay off its debts relative to the company's total assets and its interests. Because the company cannot be harmed as a result of ceasing debt and interest payments, the debt ratio is an important indicator of a company's long-term financial stability. The debt-to-equity ratio is also a financial liquidity ratio that calculates the company's total debts and liabilities based on its equity.

High debt to equity ratios are unresponsive because it means the creditor is dependent on the company, so it is high risk, especially high interest rates.

Chapter- 4

Findings, Recommendations & Conclusion

Presented below are the results associated with various aspects of the analysis of the financial statements of Dhaka Bank Ltd: -. The bank's liquidity position is much better than a sign of continued improvement. The return on assets ratio is higher than the effective management performance of Dhaka Bank.

The shareholder profit is much higher as evidenced by the return on capital. To increase asset turnover, Dhaka Bank had to use its sources of funds for those assets that bring more income to the bank. Deposit loan Dhaka Bank has taken more financial stress by giving excessive loans and also shows risk to meet the depositors.

It is clearly informed that Dhaka Bank has been gradually increasing its revenue since the early period. Dhaka Bank Ltd should increase its current assets and reduce current liabilities to manage its operations. Dhaka Bank Ltd has played an important role in industry, agriculture, commerce, transport and many other fields.

From this lesson, various trading parameters are considered to evaluate the financial performance of this bank and Dhaka Bank Ltd is available as a wild developing bank and at the same time performing well in almost every space. Dhaka Bank Limited is busy working to promote the business environment for the development of people's lives.