BBA- Major in Finance, Batch: 43rd Department of Business Administration Faculty of Business and Entrepreneurship. I am very pleased to present my internship report on "Performance Analysis of ONE Bank Limited (OBL)". At the time of my internship, I was able to know all the details of managing the operations of ONE Bank LTD.

BBA- Major in Finance, Group: 43rd Department of Business Administration Faculty of Business and Entrepreneurship Daffodil International University. I am pleased to certify that the internship report on "Performance Analysis of ONE Bank Ltd." performed by Anne Silvia Gomes with #ID No of BBA Program, Department of Business Administration has been approved for presentation and defense. Anne Silvia Gomes worked with ONE Bank Limited (OBL), Tipu Sultan Road Branch, Dhaka as an intern under my supervision.

Enamul Kabir (Senior Officer) of ONE Bank Limited, Tipu Sultan Branch for their constant motivation to learn. Finally, my sincerest thanks to all the incredible people of Daffodil International University who accompanied me through this experience. The objectives of the study were set to analyze the bank's five-year performance.

Based on the analysis, to find out the loopholes in the bank and recommend the better way to overcome the missing ones.

Introduction

Scope of the Study

Objective of the Study

Methodology of the Study

Limitations of The Study

Due to the confidentiality and security of the organization, the employee did not provide much information.

Introduction of ONE Bank Limited

Corporate Mission & Vision Statements And Corporate Slogan of ONE Bank Limited

Vision statement

Mission statement

Corporate Slogan

Mode of Formation

Organization Hierarchy of ONE Bank Ltd

SWOT Analysis of ONE Bank Limited

This makes it possible for an organization to find out its current state and situation and predict its future position in relation to others. It can be considered one of the essential elements of an organization's advanced strategic management.

Deposit Products of ONE Bank Limited

Pyramid Savings: The consolidation of formal savings and recurring savings is called pyramid savings and provides an exclusive way to save forcefully and quickly. Probashi Sonchoy: Probashi Shonchoy is a taka savings account that earns daily interest and pays monthly interest to non-residents of Bangladesh. Monthly Money Maker: The Monthly Money Maker program is a unique type of fixed deposit account.

The complainant receives the accumulated monthly interest from the fixed deposit in the applicant's current/savings account. Accrued interest: After the end of 1 month after the first payment day, the bank credits the interest to the customer's account. Automatic account closure: The account will be suspended immediately in case of the depositor's demise.

Money Rotator: Money Rotator is structured to reach various government agencies as well as large corporations, semi-governmental agencies, universities, NGOs and various people as well as the concerns of various owners. Customers will have the option to open a Money Rotator account for less than 1 crown, in which case opening an OBL Gold & Silver Savings account will be crucial for the customer. Elegant Savings Account: Elegant Savings is such a savings account that earns daily and monthly interest for senior citizens in Bangladesh.

If the deposit slip is destroyed, the bank can provide a copy of the original receipt. OBL Youth Banking: Youth Banking is a savings account specially designed for the youth of Bangladesh. It offers a wide range of features with a fascinating interest rate on the daily money left in the account.

Quick Millionaire: OBL Quick Millionaire is a premium DPS product designed for energetic and prospective customers. Silver Savings Account: OBL Silver Account is a savings account that pays daily interest and monthly interest.

Comparison of Product Features

Loan Products

OBL Protect Personal Loan: is an unlocked and expired line of credit (based on EMI system) that fulfills a legitimate purpose. OBL Home Loan: To fulfill your home financing need, OBL Home Loan is an alternative package as the affordability and flexibility of features turn dreams into reality. OBL Car Loan: ONE Bank Car Loan is a long-term loan scheme to meet the need to finance the purchase of an unregistered refurbished vehicle for personal use only as part of the equivalent monthly installment (EMI) repayment.

OBL Student Loan: The purpose of the OBL Student Loan is to provide the necessary financial support to deserving students so that they can pursue higher professional or technical studies at home and abroad. ONE Bank Professional Loan: ONE Bank Professional Loan is a line of credit based on equal monthly installments (EMI).

Ratio Analysis

Assumption of Ratio Analysis

Uses of Ratio Analysis

Decision support

Helps to communicate

Helps with co-ordination

Helps with the controlling

Other uses

Ratio analysis of ONE Bank Limited (2014 to 2018)

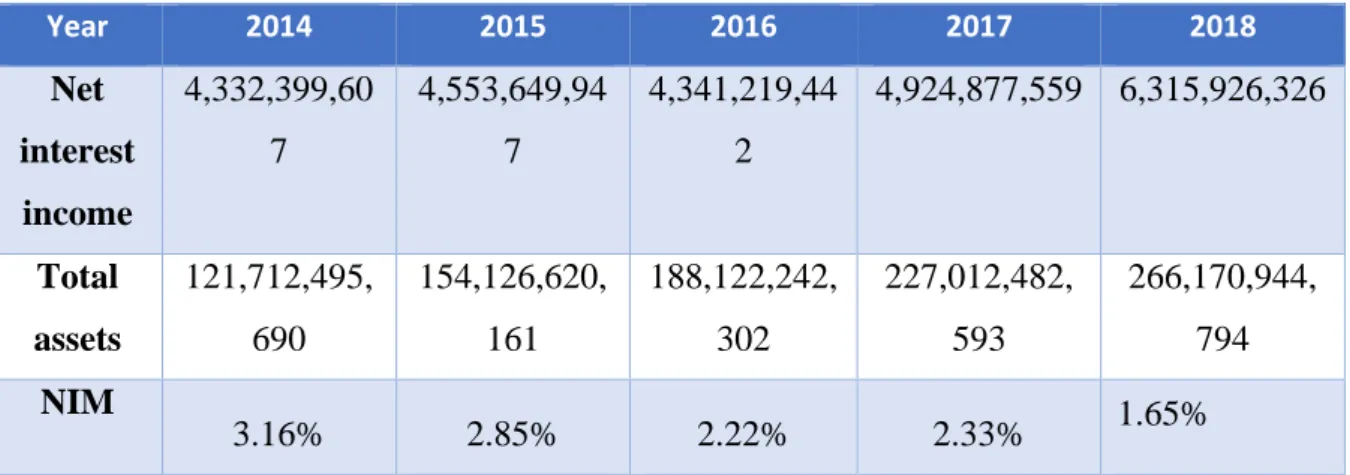

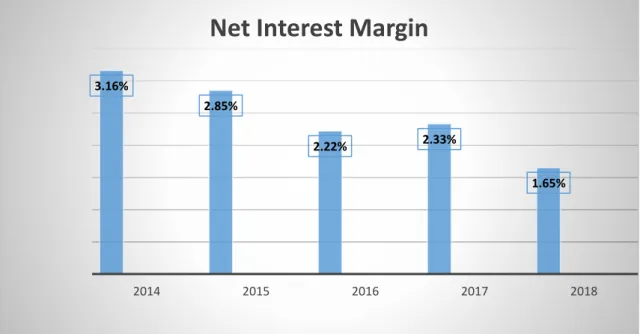

Analysis: Net interest margin is generally used to measure the difference between the interest generated primarily by loans made by banks and the interest that banks provide on deposits.

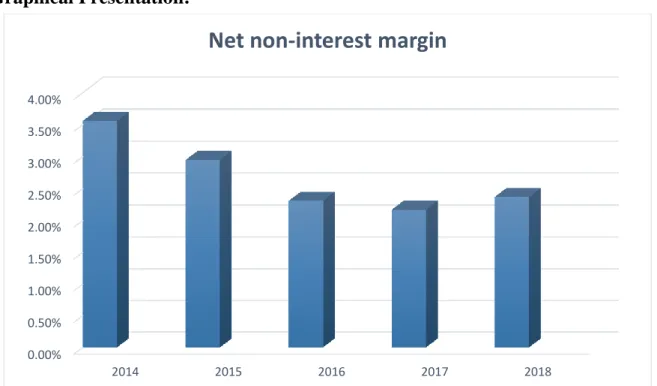

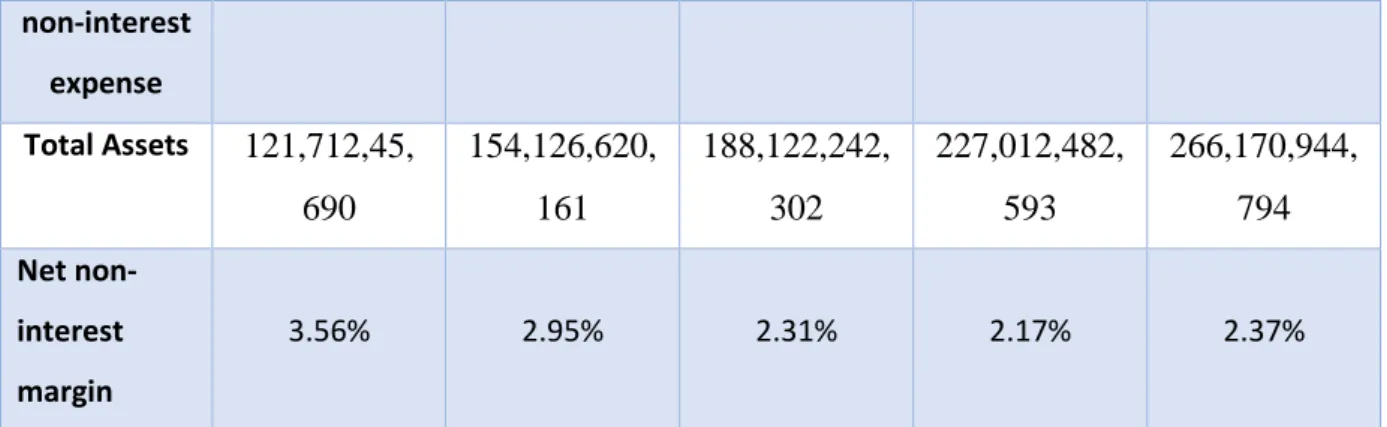

Net Non-interest Margin

Net Interest Margin

Net non-interest margin

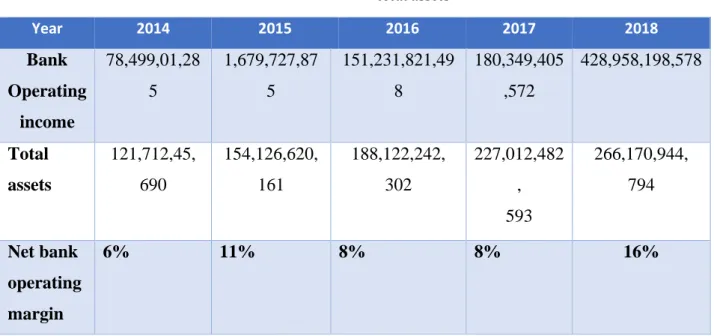

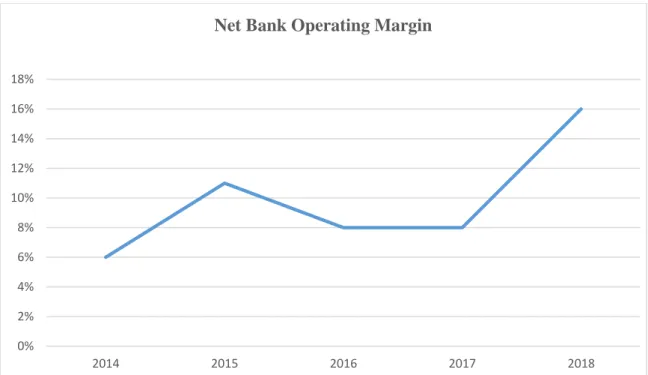

Net Bank Operating Margin

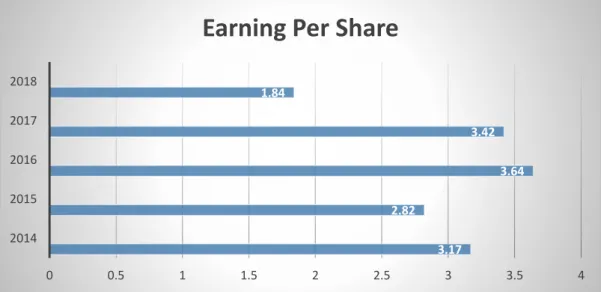

Earnings per share (EPS)

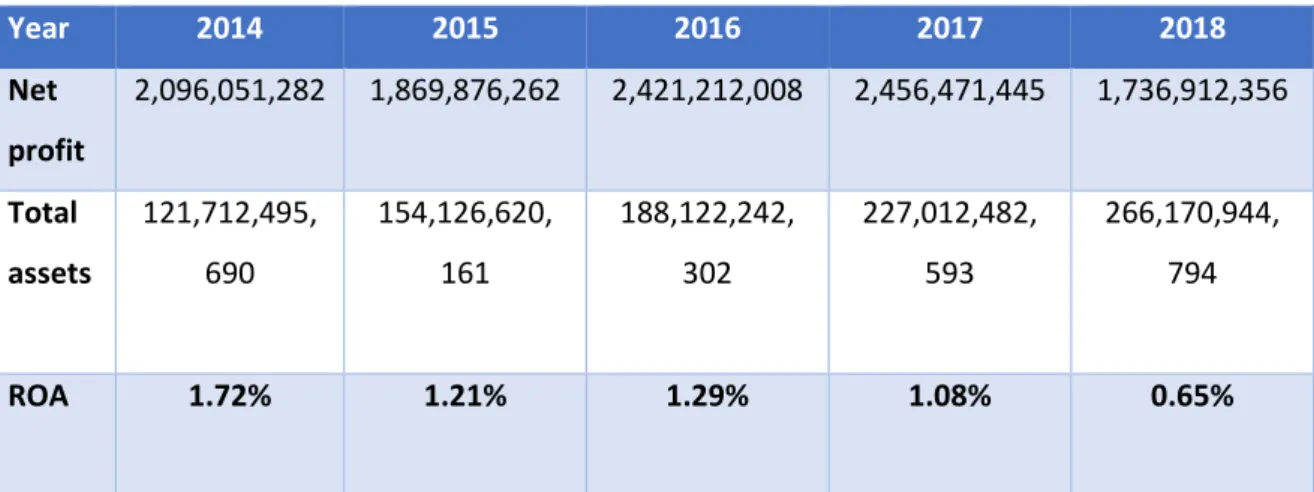

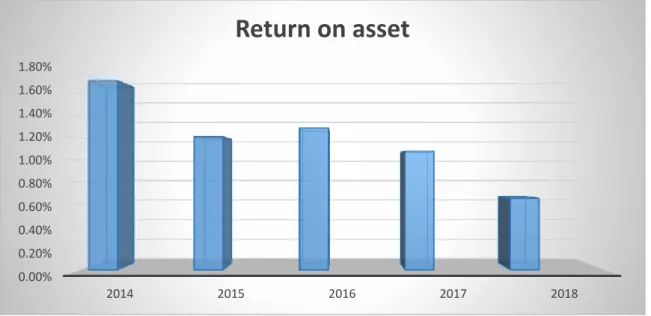

Return on Asset (ROA)

Earning Per Share

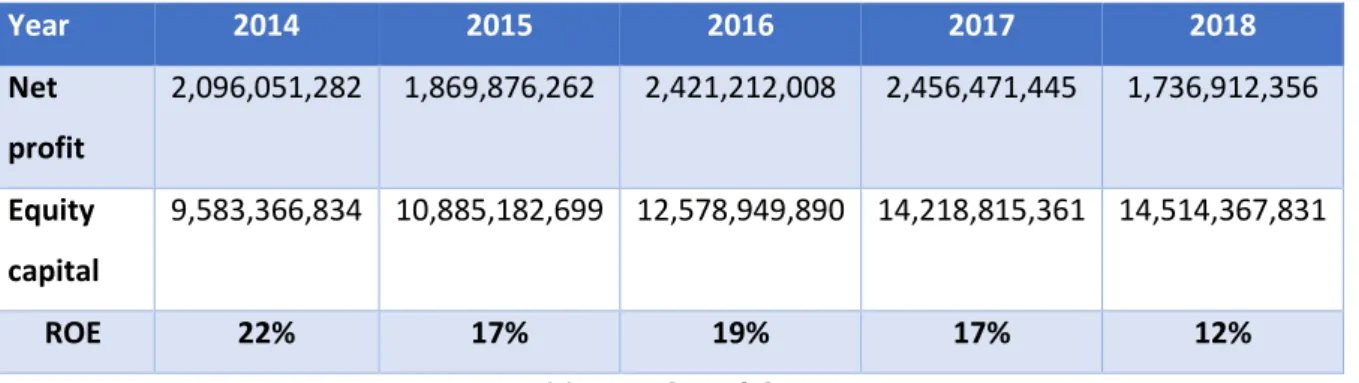

Return on Equity

Return on asset

Net Profit Margin: Net Profit margin is the percentage of income remaining after all expenses have been deducted from sales. The measure reveals the amount of profits that

Return on Equity

The degree of asset utilization

Net Profit Margin

Equity Multiplier: The equity multiplier is a leverage ratio that calculates the amount of a company's assets that are funded by its shareholders in comparison with total assets with

Equity Multiplier

Earnings spread: For institutions that capture deposits, such as banks, differential income is the difference between their assets, loans or securities and the cost of their

Earnings Spread

Findings

The fluctuation in ROA was found and finally it decreased in the year 2018 which is not a good sign for the company. In 2014 ROE was quite good and after year it decreased and in 2018 it means they were not able to make that much profit by investing in equity capital. The earnings margin has increased in the last year, but it is still not very satisfactory.

Recommendation

Conclusion

OBL plays an important role in various areas of the economy such as industry, agriculture, trade and commerce, transportation and many other areas. As the survey shows, this bank's performance is up to the mark. Various financial tools were used to calculate the financial performance of this bank and ONE Bank Limited has been found to be a developed bank and at the same time they are improving theirs.

To maintain this rate of growth and development, they should now pay more attention to their customer service and should pay more attention while providing loans to customers to reduce the churn rate.