The study revealed the trend analysis of private commercial banks and gave an overview of the performance of private commercial banks in Bangladesh. However, the performance of the banking industry has attracted much comment in recent years.

Introduction

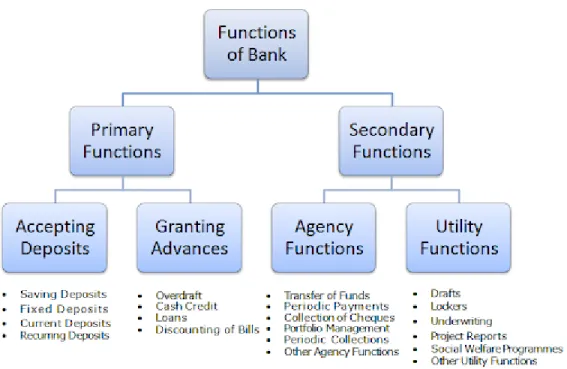

The primary or traditional functions of banks are to receive deposits in the form of deposits in a fixed account, in the form of a checking account, in the form of a savings account and in the form of a safe home account etc. Since these banks have a have a huge impact on the country's financial and economic market.

Background of the study

Research problem

Research objectives

Research questions

There is a positive relationship between overall productivity and profitability in terms of financial performance for the nationalized commercial banks in BD. There is a negative relationship between the factors and the performance of the nationalized commercial banks in BD. Moreover, the study will try to focus more on the problems and performance of the nationalized commercial banks in the country.

This part of the research is focused on the factor affecting the performance of the nationalized commercial banks in Bangladesh. A large number of studies have been done on the crisis in the banking sector in Bangladesh. RQ3: What are the factors that contribute to the performance of the nationalized commercial banks in Bangladesh.

The main objective of the study is to examine the profitability and productivity of the nationalized commercial banks in BD as a whole. To make the data collection easy and convenient of the study, the three nationalized commercial banks have been taken into account. The results also reveal that the financial factors affected the overall performance of the banks.

Therefore, there are other known or unknown factors that directly affect the performance of the nationalized commercial banks of BD. This may happen due to other factors that affect both the profitability and productivity of the nationalized commercial banks of Bangladesh. Finally, to achieve financial performance (profitability and productivity), the nationalized commercial banks of BD cannot avoid the non-financial performance or indicators of the industry.

Research hypotheses

Significance of the study

Conclusion

The chapter started with an introduction of the study followed by the background of the study and chronologically with research objectives, research questions and hypothesis. The upcoming chapters of the study will be like literature review, research methodology, result analysis and results and finally the recommendation and conclusion.

Concept of the commercial bank

Background of the three selected nationalized commercial banks------------------ 16-18

Immediately, productivity data is used to analyze the ultimate impact of the labor market and manufacturing on the performance of the economy. The researcher further mentioned that studying bank performance and efficiency would cause some problems. Most bank customers understand the value of the bank's monetary goods better than managers do.

This part will be explained from the different angles of the factors and their influence. The internal factors reflect the banks' management policies and decisions about the bank's overall results. The lack of excellent governance is another excuse for the deterioration of the health of the banking sector.

This implies that non-performing loans can be classified into different categories depending on the length of time of non-payment (Choudhury, 2002). According to Woo, non-performing loans are seen as a byproduct of a country's financial crisis, but the reason for this is also the deliberate lending process. The issues with bad loans is that it lowers investor confidence in an economy, but it also affects the allocation of resources.

The dependent variable will be return on assets (ROA), which is very comprehensive as it includes both the banks' profit and total assets.

Conclusion

The research aims to find out the determination of Bangladesh's profitability and productivity, the factors and the overall performance of the nationalized commercial banks. Therefore, the independent variable will consist of ROE, cost/income, net profit, and asset utilization.

Introduction

- General view of the methodology

This is a very general page | 26 views regarding the relationship between theory and research (Bell, 2003). In contrast, for the matter of the inductive procedure, efforts and theories must be constructed with an understanding of the world from which the data are set as a set. According to Mallhotra, the inductive approach is recommended as fragmented if there is no adequate knowledge.

Inductive approach can be applied when the prior knowledge about the research is not enough to explain a phenomenon (Kynga, 2007). In addition, an inductive approach, to be aggregated into a general or larger statement, shifts the data from the specific to the general examination of the specific case.

Research design

The motive of quantitative research is to investigate the relationship between one factor (independent variable) and another (dependent variable) in a population design for experimental or descriptive (All Root, 2007).

Purpose and nature of the research

Research paradigm

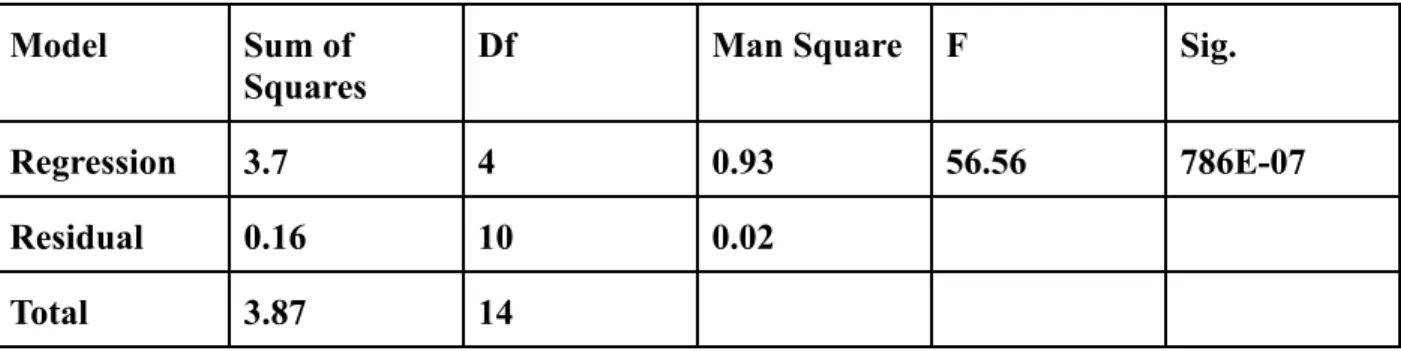

Among these four banks, three of them were considered for the purpose of the study. The correlation analysis found that there is a strong relationship between the financial performance and the overall performance of the nationalized commercial banks of Bangladesh, according to the objective. Regression analysis consists of the model summary, the ANOVA and the results of the regression coefficients.

The table 4.6 below summarizes the overall results of the OLS regression analysis in the present study. The hypothesis is therefore not acceptable and proved wrong, in terms of the results of the study. Therefore, the findings of the results recommend that the overall performance of NCBs of BD is both a negative and positive combination.

The negative correlation of the study implies that the nationalized banks of Bangladesh are still in a weak situation. 56 The overall performance of the banks can be achieved if the factors affecting the performance can be related and solved together with the financial performance.

Population and sampling

Source of data and data collection

The data collection is a systematic process, by using this the researchers collect the research information to analyze and find the result, the data also help to find the research result problems, help to test the hypothesis and evaluate the final results. At the time of data collection, researchers must confirm what type of data will be perfect for the study. It must also ensure how and when the data will be collected (Business Jargons, 2018).

However, first, to build the theoretical premises, standard textbooks, reference books, local magazines and other relevant literature were consulted. In the next stage, the relevant secondary information is collected from the annual reports and other official data of the banks. Qualitative data can be collected from different types of sources such as transcripts, diaries, interviews, newspapers, etc.

The main advantages of the secondary data is the source, which means the data is easily available compared to the primary data and data can be obtained within a short period of time. To complete the present study, the secondary data was considered, the financial statements of the banks will be considered as the source of the secondary data.

Coverage of the study

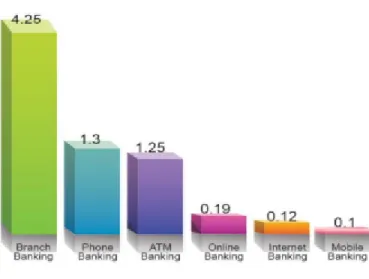

From the finding of the above calculation and analysis the worst ROE has been in Sonali bank in 2013. The rest of the taxes can also be another reason for the low profits, asset depreciation can also affect the profitability of the banks. The most important since the bank has the cost per transaction, so the high cost in each transaction can affect the overall profitability performance of the banks.

OLS regression analysis of the results was used to test all hypotheses of the current study. Moreover, the actual performance indicators of nationalized commercial banks of Bangladesh may not only be productivity and profitability, but there are other indicators that determine the overall performance of BD nationalized commercial banks along with productivity and profitability performance. In the chapter, we also found different types of relationships between independent and dependent variables.

The last chapter described the three research objectives and questions together with a test of the hypothesis. In conclusion, the nationalized commercial banks are supported by the government of the country, so if they take seriously all the factors explained in the study, they can go further.

Methods of the data analysis ----------------------------------------------------------------- 37-38

Ethical issues

Financial tools ----------------------------------------------------------------------------------- 39-40

Two numbers in a financial statement can be used to calculate a ratio because it is a simple number expressed in terms of another number that shows the relationship between two variables. Return on assets (ROA) shows how profitable a company is relative to its total assets. A company's ability to make a profit on shareholders' investments is measured by return on equity, or ROE.

- Analysis of data and results --------------------------------------------------------- 41-42

- Regression analysis

- Analysis and discussion on finding of the study

- Conclusion

The results of the table show that the average profitability proxy by ROA ratio of the nationalized commercial banks in BD is 0.55 with maximum and minimum ROA of 1.64 and 0.06 respectively. The year and the banks made the lowest ROA may due to the low return or the banks fail to utilize the total assets means that the current long-term assets of the banks have. From the above table it is clear that the revenue cost of the nationalized advertisement for BD is very high, these are almost more than 50% for all the five years and for the three banks.

If revenue growth is difficult, then cost reduction can improve the ratio. The illustration from the figure shows that the profitability of banks is not in any standard form, the same banks profitability is different in different periods of time or years. The regression results did not represent the overall scenario of the study using the financial ratio, as the significance of the ANOVA test was not zero.

Perhaps the factors are related to performance other than directly related to the economic performance, these may be the country's lack of technological development, poor bank management systems, banks' long-term loans do not collect effectively, all these factors may affect the nationalized commercial banks in BD. The following sections explain in detail the results and thus the fulfillment of the first three research objectives.

Recommendation

Limitation of the study

Conclusion