I am submitting my internship report on ''loan and advance analysis of Sonali Bank Limited (Prime Minister's Office Corporate Branch, Dhaka''. I have completed internship from Loan and Advance of "Sonali Bank Limited", this internship report has been done under your supervision. This is to confirm that the Internship Report on Overview of “ Loans and Advance Analysis of Sonali Bank Limited (Prime Minister's Office Corporate Branch, Dhaka) has been prepared as part of completion of BBA program of Department of Business Administration Sonargaon university Conducted by Suparna Hoque, ID BBA1603009012 under my supervision.

ID BBA1603009012 of Sonargaon University would like to declare here that this report on “ Loan and Advance Analysis of Sonali Bank Limited ” has been prepared by me. The winds of globalization have also touched Bangladesh. Sonali bank is being woven into the psyche of the local business community. Lending constitutes the most important asset and the bank's primary sources of earnings.

Loans and advances mean lending made by the bank to poor customers to earn interest. Analysis of Loans and Advances of Sonali Bank Limited (SBL), (Prime Minister's Office Corporation Branch, Dhaka). The main objective of the study is to analyze the loan and advance operation of Sonali Bank Limited and also fulfill the partial requirements of the BBA program.

The following aspects can be mentioned as the specific objectives of this practice orientation in Sonali Bank Limited.

Significance of the Study

Methodology

Data Collection

Data Analysis

Scope & Limitations of the Study

Limitations

Profile of Sonali Bank Limited

- Mission

- Vision

- Slogan of the bank

- Organizational Overview

- Corporate Culture of SBL

- Strategies of the Sonali Bank Limited

- Core values

Dedicated to expanding a wide range of quality products that support diverse needs of people, aiming to enrich their lives, create value for stakeholders and contribute to the socio-economic development of the country. To strive for customer satisfaction through quality control and delivery of timely services c) To identify customers' credit and other banking needs and monitor their perception of our performance in meeting those requirements. To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

The values will help the bank to see its employees to work as a team to accomplish assigned duties and responsibility for achieving desired goals. Excellence: Excellent performance and efficiency are prerequisites for ensuring quality service to the large customer base of the bank. Innovation: New and innovative products are the needs of the time for which continuous action oriented research is carried out.

Commitment: Every employee is committed to work at the expected level to ensure the satisfaction of their valued customers. Self-reliance: Every employee will have a proprietary attitude towards the bank and self-confidence in his work for the betterment of the bank. Transparency: Information should be kept open to all, so that stakeholders have proper ideas about the bank's activities.

Accountability: All employees are responsible for their activities and will be accountable to their supervisor for their achievements. Sonali Bank Ltd., the only commercial bank, was founded by a group of successful local entrepreneurs who envisioned creating a model banking institution with a different outlook to offer its valued customers a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The bank is managed and managed by a highly educated and professional team with diverse experience in finance and banking.

The banking business scenario changes from day to day, so it is the responsibility of the bank to develop the strategy and new products to deal with the changing environment. Already known as one of the quality service providers, the bank is known for its reputation.

Profile of Sonali Bank Limited, Prime Minister Office Corporate Branch

Product of Sonali Bank Limited

Loans & Advances

Principles of General Advances

Classification of General Advances

Total Credit Line

Loan Sanction procedure

- Selection of the Borrower

- Verification of the Cultural

- Requirements of Loan Proposal

- Disbursement of Loan

- Sanction of Loan

A prudent Banker should always note the background, Character, capital, Capacity and purpose of the Borrowers/Entrepreneurs. The head of the branch should always observe the verification of the securities collateral that the Bank has sanctioned to the borrower. Enforce the sale value of the security as if the bank could secure it when the borrower fails to repay.

No letter of objection from his superior (if he is a government employee) Statement of tangible/intangible assets/liability. In the case of Company Attest copies of Deed of Articles of Association, Articles of Association, Certificate of Incorporation, Commencement of Business. Viability study / Viability study of the project from different aspects such as technical Management, socio-.

Loan disbursement must be made after completion documentation and compliance with the sanction conditions for the sponsor's equity increase as stipulated. Payment against imports must be made through an opening or irrevocable L.C favoring the foreign supplier on execution or contract. Payment against local machines and building structures must be made to the supplier of Equipment through Inland L/C.

Each phase of the loan disbursement must be supervised by a bank employee so that the borrower has the ability to divert funds anywhere for purposes other than the project and phase. If the branch manager writes a letter to accept all the terms of the loan, it is called a loan sanction. A cash credit is an agreement under which the customer can borrow money up to a certain limit.

General interest rate 16%. It is managed in the same way as an account to which an overdraft has been applied. This is the most favored form of borrowing among large companies and companies because of the advantage that a customer does not have to borrow in one go. He can repay the advanced amount in whole or in part at any time. Hypothecation: In case of "hypothecation", possession if the goods have not been transferred to the Bank &.

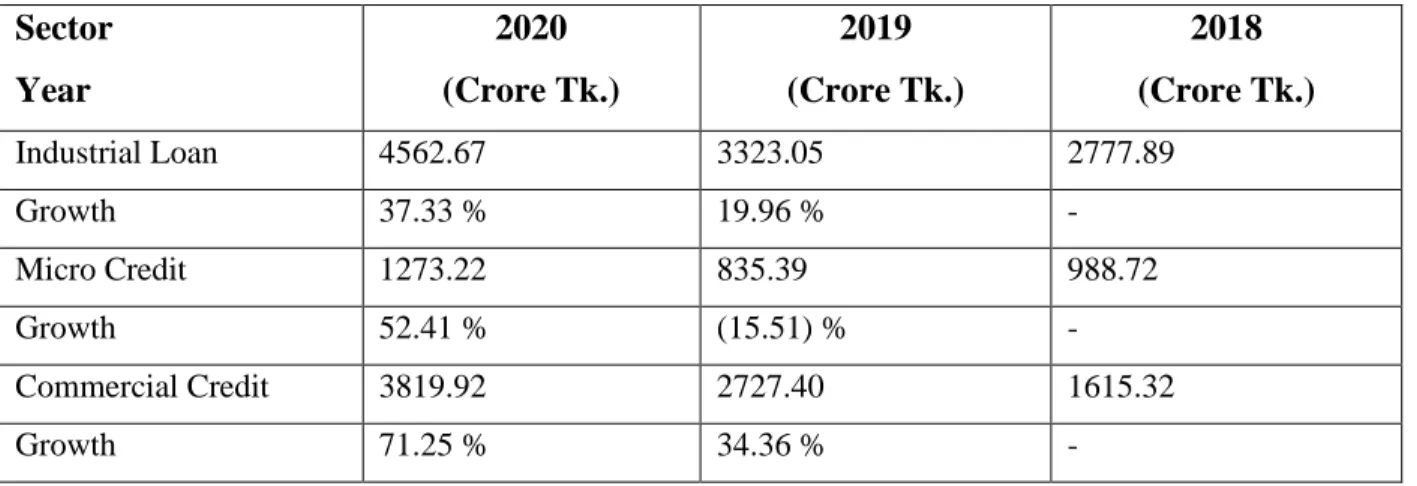

Sector wise loan position of the Bank

Table: showing classified loan

Table: showing provision for classified loan

Table: showing provision for unclassified loan

Conclusions

Recommendations