Islamic banks are unconditional and specialized financial institutions that carry out most of the standard banking services and investment activities based on a profit and loss sharing system in accordance with the principles of Islamic Shariah. The first goal of writing a report is to fulfill the partial requirements of the BBA program. We focused on interviews with staff involved in various departments, management and senior employees, business customers and account holders.

34;Islamic banking" means such a banking company whose aim, purpose and activities are to conduct banking business/activities in accordance with the principles of Islamic shari'ah, and no part of the company, either in form or substance, has elements that are not approved by Islamic shari'ah. It extends socio-economic and financial services to the poor, helpless and low-income group of the population for their economic enlistment, especially in the rural areas. Its objective is to achieve balanced growth and equitable development of the county through diversified investment operations, especially in the priority sectors and in the less developed areas.

MANAGEMENT OF IBBL

Organizational Structure

Chapter Three

Analytical Part of IBBL

PEST Analysis of Islami Banking System

Political > Economical > Social > Technological

PEST analysis: Bangladesh Perspective

SWOT ANALYSIS

It is scanning of the internal and external environment is an important part of the strategic planning process. Islamic banking will explicitly reorganize the deplorable condition of the poor and marginalized sections of society. Moreover, Islamic banking helps the weaker and unfortunate section of the society through various financial products.

Islamic banking finance (through joint ventures, partnerships and leasing) is provided to borrowers by investors or banks on the condition that the financial risk is borne by the investors and other risks by the borrower. Therefore, investments in harmony with the principles of Islamic banking will certainly stimulate the engine of economic growth in our country. We have seen the collapse of giants in the world of financial sector, such as Lehman Brothers, after the US sub-prime mortgage crisis.

Adverse selection has been one of the major obstacles in the world of Islamic banking. The market size will be very large if it can be targeted properly. It is important to note here that Islamic banking is not only for Muslims but non-Muslims can also benefit from it.

Islamic banking is an effective mechanism to overcome the liquidity and inflation problems along with allowing extensive growth. If Islamic banking is introduced, the insufficient working capital ratio of workers in informal sectors related to agriculture and manufacturing can be solved through equity financing, which can be a revolution in our agriculture and unorganized sector.

Chapter Four

Functions of IBBL

General Banking Operations

This is the busiest department and daily transactions of customers interested in withdrawing or depositing money, selling the instrument to them for remittance purposes, collecting their instruments providing other services to them and keeping the customer section busy . Maintenance of safe and strong room under joint custody for safe keeping of cash and vouchers.

Mobilizing Deposits

Al-Wadeah

Mudaraba

Deposit Products of IBBL

The depositor can deposit any amount in this account and the bank receives money from the customers for safe keeping on the condition that it returns the money on demand. The depositor can withdraw any amount at any time by check or any other acceptable means while maintaining the minimum balance in the account. As depositors do not bear the risk of losses with the Al-Wadeah account, they are not entitled to any profits from the use of their deposits by investors.

This account may be opened in the sole or joint name of the person or persons or any organization acceptable to the Bank. The account holders are generally allowed to deposit as many times as they require, but in case of withdrawal there are some restrictions as per the rules and practices of the commercial banks. The bank is authorized to invest the Mudaraba funds at the risk of the depositors.

The total profit resulting from such an investment is distributed between the bank and the depositors according to an agreed ratio. IBBL is the bank that is able to collect the highest number of deposits among all the banks. For this reason, the bank has the great opportunity to invest its huge sums.

And at the same time it never faces any kind of liquidity crisis despite holding this huge amount of deposits.

Local Remittance

Modes of Local Remittance

According to Section 85 (A) of the Negotiable Instruments Act, a demand draft is "an order to pay money drawn by one office of the bank on another office/branch of the same bank for a sum of money payable on order on demand." .

SS (Telegraphic Transfer)

Message to be immediately conveyed to the concerned branch under secret test through Telex, Telephone, Telegram followed by IBCA for confirmation.

Online banking

Modes of Investment of IBBL

Investing is the act of deploying funds with the intention and expectation that they will earn a positive return for the owner. Since Islam condemns hoarding of savings and an annual tax of 2.5 percent (Zakat) is imposed on savings, the owner of excess savings, if he is unable to invest in real assets, has no option but to invest his savings in financial assets. To diversify its investment portfolio by investment size, by sectors (public and private), by economic purpose, by securities and by geographic area, including industrial, commercial and.

To ensure mutual benefit to both the Bank and the investment client through professional assessment of investment proposals, judicious sanctioning of investments, close and continuous supervision and monitoring thereof. Financing various development programs for poverty alleviation, income generation and employment with a view to accelerating sustainable socio-economic growth and uplifting society. To invest in the form of goods and raw materials instead of spending cash on the investment clients.

Foreign Exchange Operations

Shari’ah aspects Foreign Exchange Operations

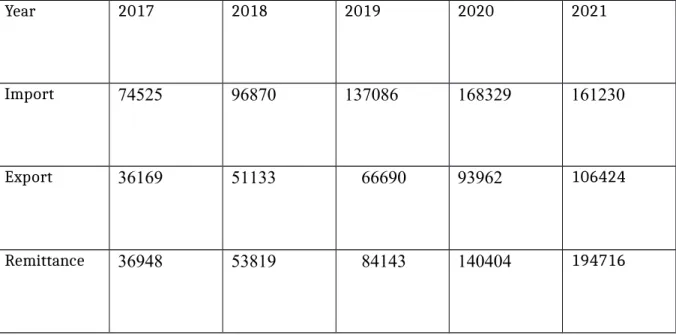

Trend of Export and Import and Remittance over the years

Welfare Activities of IBBL

Thus, it can be said that welfare services are those that ensure conditions of good health, comfortable living and working conditions, which are generally one's basic needs. But if real income is not sufficient to purchase necessities of life, welfare services become essential in a society to maintain the minimum standard of living of the people. Their condition cannot improve if welfare services remain absent and wealth remains concentrated in certain segments of society.

The Quran also encourages people to contribute generously to social welfare and help the needy in society. Thus, the Qur'an establishes the general principle of generous welfare spending, while encouraging sacrificial levels of spending, perhaps for social crises and for conditions that require high financial support. Thus, Islam calls for the fulfillment of the basic needs of the poverty groups through welfare services which may include.

In a broad sense, it is only for social welfare purposes as specified by the Qur'an: "Zakat is (meant) only for the poor and the needy, those who collect the tax, those whose hearts are to be won, for the liberation of people from slavery, for relief of those overwhelmed by debt, for God's cause (all priority social needs) and for the wayfarer: (this is) an ordinance from God, and God is All-Knowing, Wise." [9:60]. Some banks give the privilege of interest-free loans to holders of investment accounts in the bank. Some other banks have the option of providing interest-free loans to needy students and other economically weaker sections of society.

However, some other banks provide interest-free loans to small producers, farmers, entrepreneurs who are not qualified to get financing from other sources. The purpose of these interest-free loans is to help them become financially independent or to help increase their income and standard of living.

Chapter Five

Findings, Recommendations, Conclusion

Findings

They have not yet been successful in devising an interest-free mechanism to place their funds in the short term. The risk associated with profit sharing appears to be so high that almost all the Islamic banks in Bangladesh have resorted to the financing techniques that provide them with a fixed, secure return. As a result, there is a lot of sincere criticism that these banks have not abolished interest, but have actually only changed the nomenclature of their transactions.

The Islamic banks do not have the legal backing of the Central Bank of Bangladesh and do not have the necessary expertise and trained manpower to assess, monitor and evaluate the projects required for financing. Fortunately, significant progress has been made in Iran in government bonds and short-term instruments such as National Participation Certificates and Central Bank Mushrakah for such issuance. Islamic banks have historically been forced to keep a larger portion of their assets in reserve accounts at central banks or in correspondent accounts than conventional banks.

This has had a major impact on their profitability as the central bank returns these reserves minimally or not at all. This, in turn, affected their competitiveness and increased their potential for external shocks with their consequences. Lack of an effective and reliable system of Sharia law to enforce financial contracts.

Salam contracts (purchases with deferred delivery) expose Islamic banks to credit and commodity price risk. Ixhara also contains credit and commodity price risk because this contract does not provide Islamic banks with the ability to transfer substantial risks and rewards to the lessee as the leased assets must be held on the banks balance sheet for the duration of the issue.

Recommendations

The number of human resources in the documentation department is really insufficient to provide services to a large number of clients. Majority of the human resources should have basic knowledge about money, banking, finance and accounting. All the officers have to give concentration to the customers while maintaining the customer files.

Conclusion

Bibliography

Islamic Banking Books - Habibur Rahman

Handout provided by IBTRA

The financial Express (Online News Portal)