Evaluating Electronic Banking Activities of Rupali Bank Limited: A Study on Ruet Branch, Rajshahi” under my supervision and guidance. The topic of the report is “Evaluation of Electronic Banking Activities of Rupali Bank Limited: A Study on RUET Branch, Rajshahi”.

OVERVIEW

As an important part of the financial system, banks efficiently allocate money from depositors to borrowers. Therefore, it is inevitable that electronic banking can play the best role.

OBJECTIVE OF THE PROGRAM

This sector offers specialized financial services to its various stakeholders, making the economic sector dynamic. Considering the importance of the banking sector and the use of digital technology in the economic development of the nation, I decided to do my internship report in the banking sector to assess the activities of electronic banking.

SCOPE OF THE PROGRAM

THE SIGNIFICANCE OF THIS PROGRAM

METHODOLOGY

Data Collection

The main input of this report is secondary data collected from the industry database.

Data analysis

LIMITATION OF THE PROGRAM

There is very little time to gain in-depth knowledge of a huge organization like RBL. Therefore, they cannot always provide enough time to enlighten the internees every time, even if they intended to do so.

Corporate Vision

Corporate Mission

Core Values

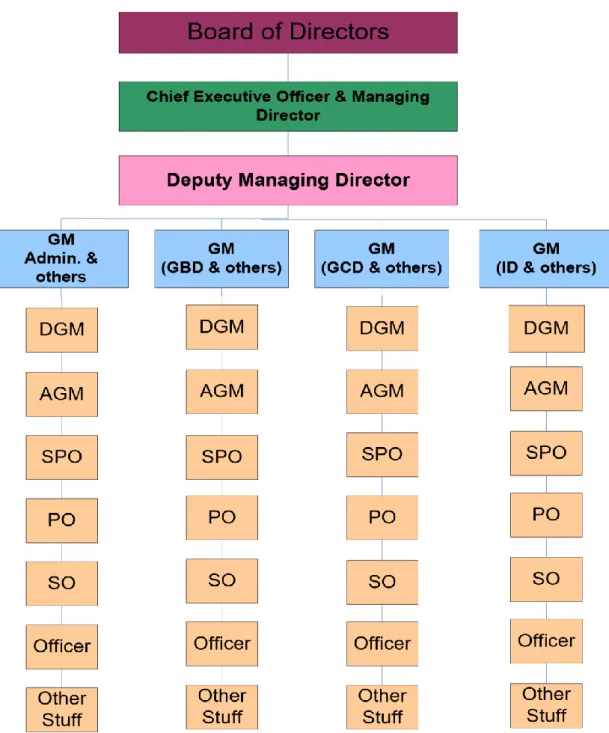

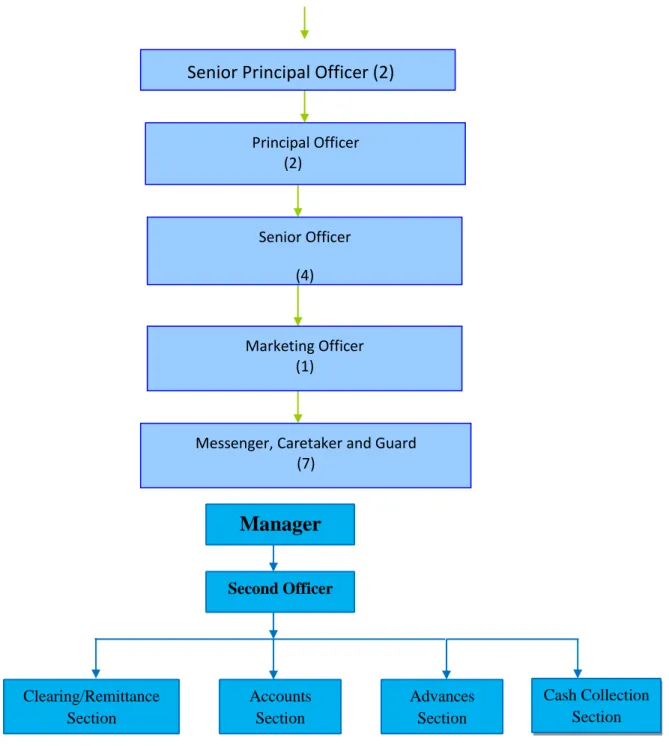

Organizational Structure

Corporate Profile

Strategic Objectives

Leverage our technology platform and scalable systems to achieve cost-effective operations, efficient MIS, improved deliverability and high service standards. Maintain a high quality asset portfolio to achieve strong and sustainable returns and to continuously build shareholder value.

General Banking Activities

Types of Account & deposit products

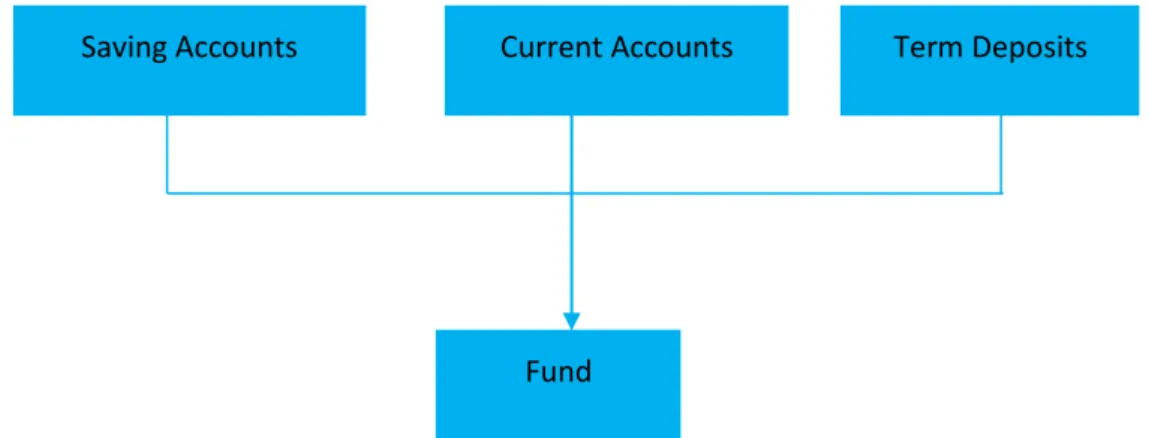

- Current Account

- Savings Account

- Fixed Deposit

- Other Types of Deposit

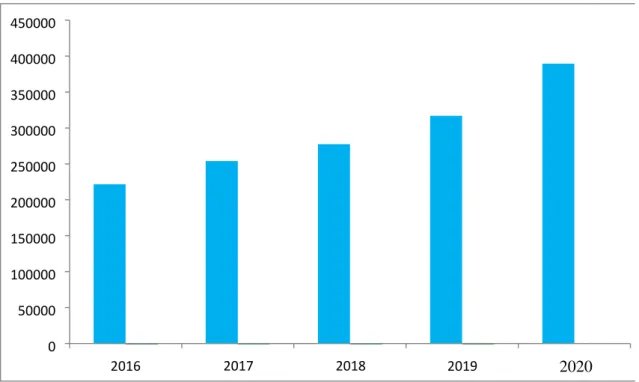

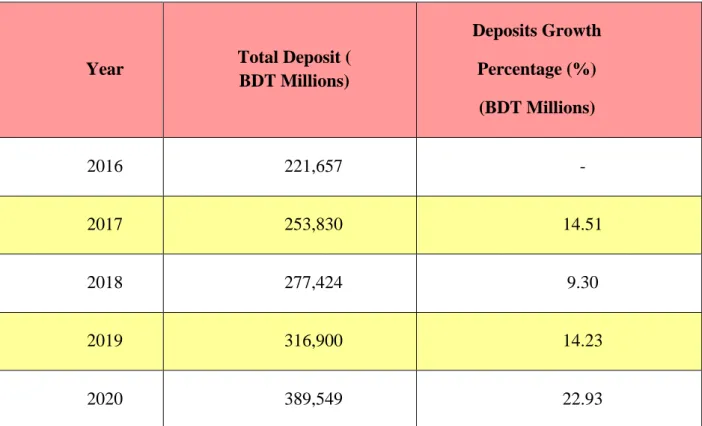

The graph shows the total deposits of Rupali Bank Limited, during 2016 to Source: Loan and Advance Division of Rupali Bank Limited. So, the table shows the amount of the total deposit and the percentage of the deposit very clearly. It is basically justified when funds need to be raised and money needs to be paid at regular intervals.

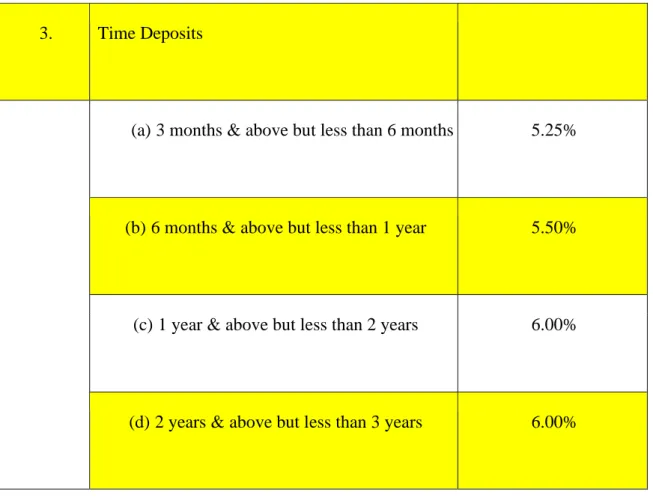

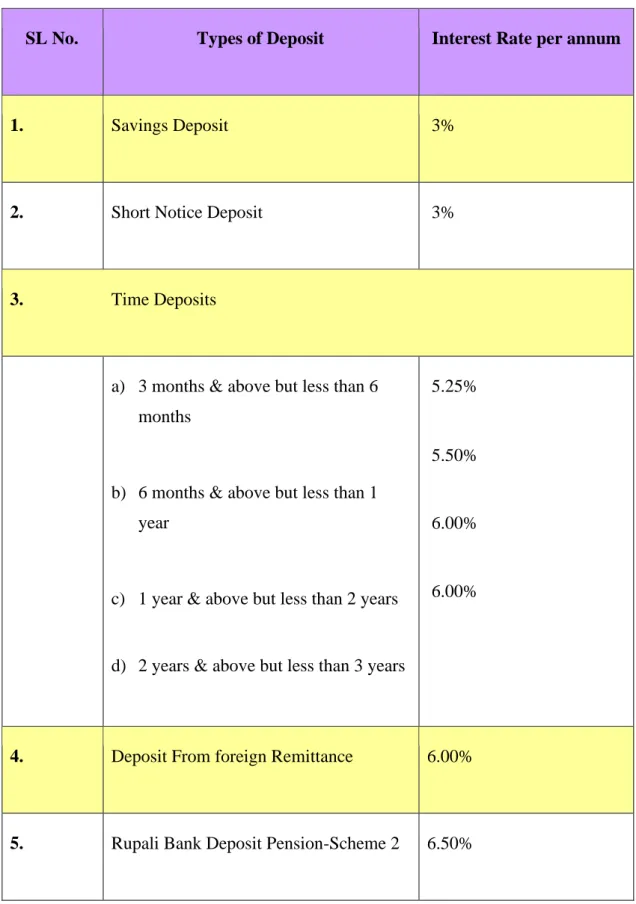

These are deposits that are concluded with the bank for a predetermined period. The bank is not required to maintain cash reserves for these deposits, so the bank offers a higher or lower profit on such deposits. RSSA: Rupali Student Savings Account can be opened with taka 100/interest 4% savings twice a year.

Loan Department

This loan is provided to the cottage industry, small traders, small-scale industries and other self-employed people. To grant this loan, the bank collects the necessary information about the loan holder and the nature of the business. v) Housing Loan (general):. Rupali Bank employees can get this loan, which is a good opportunity for Rupali Bank employees.

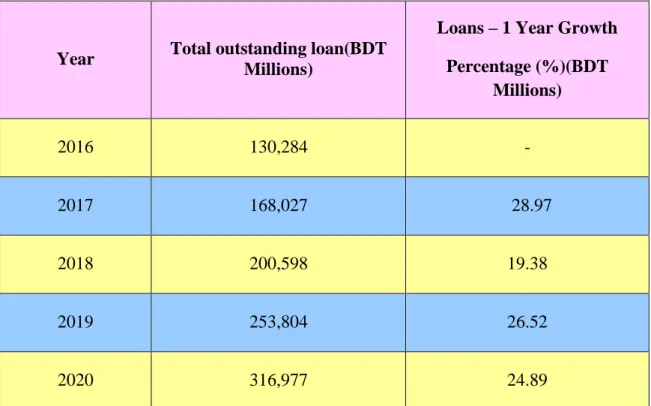

Notes: The chart shows that the total outstanding loan of Rupali Bank Limited, during 2016 to 2020. So the table describes that the total outstanding loan of Rupali Bank Ltd.

Rupali Bank Services

- Rupali Bank SureCash

- Utility Services

- Cash Section

- Foreign Exchange

- Main task of this department

- Functions of Foreign Exchange

- Investment Portfolio

- Letter of Credit

Every day a portion of the cash that is opening the cash balance is transferred to the cash officers from the vault. The net figure of these cash receipts and payments is added to the cash balance. And this is the final cash balance figure for the bank at the end of any given day.

In such a situation, commercial banks ensure these things simultaneously by opening letters of credit guaranteeing payment to the seller and goods to the buyers. By opening a letter of credit on behalf of a buyer and for the benefit of a seller, commercial banks undertake to make payment to a seller subject to the presentation of documents drawn up in strict accordance with the terms of the letter of credit, giving the buyer ownership of goods. Documentary letter of credit is an arrangement whereby a bank, acting at the request and in accordance with a customer's instructions, must make payment to or to the order of a beneficiary or must pay accept or negotiate bills of exchange drawn by the beneficiary against prescribed documents and compliance with prescribed conditions and conditions.

All parties to a letter of credit must have the same understanding of the terms and conditions used in the credit.

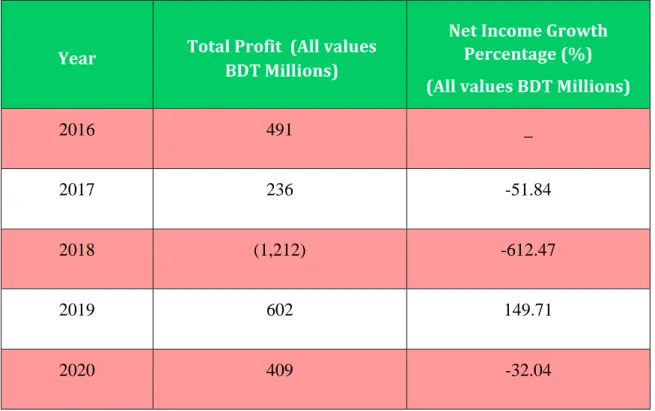

Profit Scenario of RBL

To become one of the best branches of Rupali Bank Limited by contributing significantly to its growth. The graph shows the total profit of Rupali Bank Limited RUET branch from 2016 to June 30, 2020. Rupali Bank Limited provides various types of electronic banking services (e-banking) to its customers.

As part of Rupali Bank Ltd., RUET Branch provides Automated Clearing House services for automating clearing of payment systems in the country. Rupali Bank Ltd .Introduced Electronic Fund Transfer Network (EFTN) for better service to the customer. This chapter presents the results of the program conducted at Rupali Bank Ltd., RUET Branch.

In this program I was assigned to observe and assess the electronic banking services of Rupali Bank Ltd., RUET branch. The report shows that RUET branch provides six different e-banking services among all nine services provided by Rupali Bank Ltd. The report shows the findings on Electronic Banking Activities of Rupali Bank Limited, RUET Branch as a requirement for the partial fulfillment of BBA degree.

Branch Objectives

Some features of Rupali Bank Ltd. RUET Branch

It is the pioneer in introducing and launching various customer friendly deposit schemes to harness people's savings to channelize the same into the productive sectors of the economy. In order to raise the standard of living of the group with limited income of the population, the Bank has introduced the Consumer Credit Scheme, offering financial assistance in the form of loans to consumers for the procurement of stable households, which already have encouraging reactions. The bank is committed to continuous research and development in order to cope with modern banking.

Organizational Structure of RUET Branch, Rajshahi

General Banking

Section 3(b) of the Negotiable Instrument Act, 1881 provides: Deposits accepted by the banker are repayable upon demand or otherwise and may be withdrawn by check, draft, order or otherwise. The total deposits held by the banker are broadly classified as demand deposits and term deposits, the former being due on demand and the latter according to the terms of the deposits. Rupali Bank Special Deposit & Pension Scheme (SDPS) 5. Current Deposits 2. Demand Deposits 3. Miscellaneous Deposits c) Miscellaneous Deposits.

Remarks: The table shows that the percentage of classified loan of different years is very low and in the year 2018 there is no classified loan. Notes: The graph shows the total profit of Rupali Bank Limited RUET Branch, during 2016 to 30 June 2020.

Remittance Section

So the profit of the RUET Branch is favorable. . use this payment order and there is no need to open a bank account here. It is a money order drawn by one bank branch on another branch of the same bank for a specified sum of money payable on demand. The test number is set to DD if no. of the issuing bank and the reimbursement bank becomes the same only when a certain amount of money is paid to the customer on the DD.

Bank charge is same as DD but customer has to pay postage which is Tk. It is an invaluable and powerful tool that promotes development, supports growth, encourages innovation and increases competitiveness. From the date of inception, RBL has always moved with the latest technology and from time to time the bank has adopted various advantages of technology to enrich its IT infrastructure.

The bank's technological development has tremendously increased customer service and stakeholders' trust in the bank.

Overall Automation of RBL

Branch Computerization

Electronic Banking Services

- SMS Banking

- Debit Card

- Facilities

- Transaction limits

- Fees

- Online and Internet Banking

- BACH & BEFTN

- Rupali Bank SureCash

- Utility Bill Collection

- Website

Rupali Bank Limited is affiliated with a national payment switch that allows our debit/credit card customers to withdraw money from ATMs of any other bank in Bangladesh. Rupali Bank Limited Chairman Manzur Hossain inaugurated the online service for all branches by cutting a cake at the bank's corporate office in Dilkushi, Dhaka on Tuesday while the bank's Managing Director and Chief Executive Officer (CEO) AtaurRahmanProdhan was also present at the event. ceremony. Rupali Bank Limited Chairman Manzur Hossain said, “All the services of all the branches of our bank are connected with online connectivity.

All branches of Rupali Bank Limited offer online banking services through its core banking system namely “SonaliIntellect”. Transfer of funds to another bank's accounts via BEFTN is available to customers through online banking. By using real-time internet banking, our customers can avail the services of Rupali Bank Ltd. Rupali Bank SureCash enables the customer to send money to anyone using advanced technology available on your mobile phone.

Rupali Bank Limited has an informative website containing descriptions of its various products, services, annual accounts, citizen charter and other up-to-date information about the bank.

Branch Computerization

Notes: Among all the nine e-banking services of RBL, the RUET branch offers only six. Branch officials say the remaining two services, namely "utility bill collection" and "home banking" services, are under consideration for incorporation.

E-Banking Services of RUET Branch

- ATM

- Debit Card

- Facilities

- Eligibility

- Transaction limits

- Fees

- Automated Clearing House

- SMS Banking

- EFTN

- Demand Draft

Any mobile phone user who has an account with Rupali Bank can use the services through their mobile phone. This report shows a four-year projection of the branch's deposit profile. The report shows that the total volume of branch deposits is on an upward trend, showing a growth rate of 10% from 2016 to 2020.

A four-year projection of the branch's total outstanding loan profile is shown in this report. The report shows that the branch's total loan volume is in an increasing trend with a growth rate of 27% from the year 2016 to 2020. A four-year projection of the branch's performance profile is shown in this report.

The report shows that the branch's total profit volume is on an upward trend showing a growth rate of 16% from 2016 to 2020.

Recommendation and Future Project Direction

Conclusion