This report gave me the probability to have a brief data about Mercantile Bank Ltd Loans and Advances. This is to confirm that the internship report on "loans and advances from Mercantile Bank Ltd" submitted for the award of the degree of Bachelor of Business Administration (BBA) from Daffodil International University. Loans And Advances Of Mercantile Bank Ltd” is uniquely prepared by me after the completion of three months of work at Mercantile Bank Limited.

This report is prepared based on my three months temporary position with Mercantile Bank Limited.

Chapter one

Introduction

Significance

This entry-level position report is an important midway point in the need for a four-year BBA graduate program. I accepted the open door to fill my entry-level position at The Mercantile Bank Limited (MBL). My entry-level position has been approved by the MBL administrative center. My personnel director M.

Type: As I am going to find out the internal process of The Mercantile Bank Limited”.

Primary source

Secondary source

The essential information is collected from different gathering exchanges, individual perception of hierarchical culture, their internal liquidity supervision procedure and from various factual measures and investigations that I have shown later in this report. From working in this association, I have the office to experience the limit of the documented document with the issue of liquidity. Moreover, it was simple for me to make a positive connection with the director of the account office and collect the entire annual report from him.

Information investigation is a procedure of examining, cleaning, changing, and demonstrating information in order to present useful data, propose goals, and support basic leadership.

1.6) Scopes of the Study

The tool I used to imply the techniques for analyzing data is simple MS Word and MS Excel.

1.8) Limitations of the Report

Chapter Two

Organizational Profile of “The Mercantile Bank Limited”

- History of the Mercantile Bank Limited

- Bank’s Core Business

- Mission

- Ancillary Services

The bank is governed by the Banking Associations Act 1991. According to CAMEL's assessment, the bank was ranked first for applying all ten rules required to condemn a bank to general execution, money sources said. The primary part of MBL was opened in Dhaka's Dilkusha business region on the bank's inception day. Near the end of 2011, the number of banks remained at 80, including 5 SME/Krishi branches, of which 57 branches are arranged at major trading points in the country and the remaining 23 branches are in provincial areas of the country.

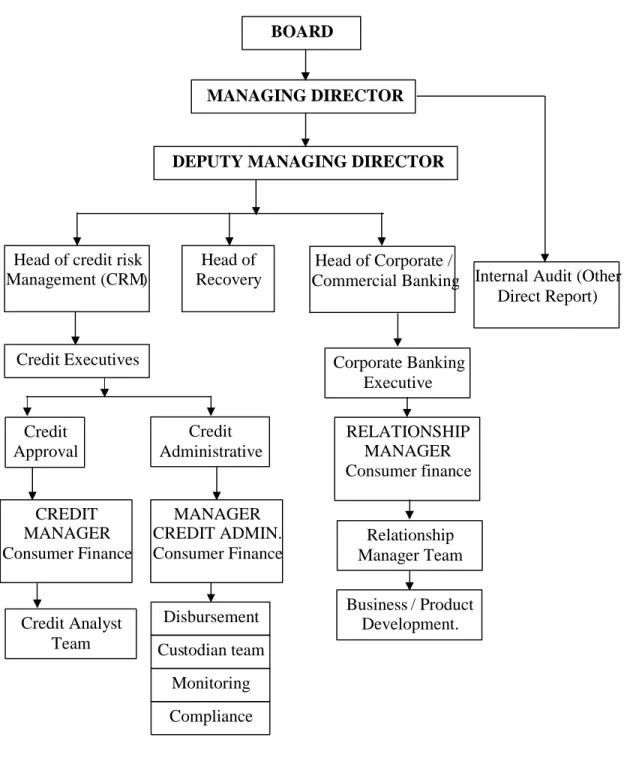

The Bank offers a wide range of money related organizations to its clients and business customers. The Board of Directors consists of well-known figures from the country's exchange and adventure world. The former governor of the Central Bank of Bangladesh was the bank's chief advisor.

Mercantile Bank Limited offers several special services with its network of branches across the country in addition to its normal banking activities.

Chapter Three

Internship Requirement & Learning Points

Types of Account

- Fixed deposit A/C

- Short term deposit A/C

- Deposit pension scheme (DPS)

- Savings Deposits Account

This record is opened for a fixed time commitment. This kind of record is extremely remarkable for the workers with regular wages. Exchange Bank, Dhaka keeps track of various terms of this store and shifts of credit costs with the range of terms. A holder of a fixed store account must store his money immediately in the bank and the share of the storage is determined when improving the record.

Be that as it may, should there be an emergency event, a fixed store A/C holder can withdraw his money before improvement. This item melts the store, which is stored for a period ranging from 7 days to 89 days.

Account Opening

- Closing an Account

- Remittance

- Types of Remittance

- Foreign Remittance

- Customer Services

- Local remittance section

Only the bank account holder or CD account holder of the individual branch can be the introducer of the SD A/C opening candidate. Two duplicate continuous identification size photographs of the candidate must be attested by the presenter. In the wake of tolerating the application, the bank will deduct the organization fee to a significant extent for the various records as the closing cost from the arrangement and the rest of the money is given to the record holder.

To check the legitimacy of the check, the next official thinks about the customer's digits mentioned on the check and those on the marking card in his possession. The process of transferring or sending money, starting from one branch and then to the next branch of a comparator bank, or starting from one bank and then to the next bank within a country or outside the country, is known as repayment . I have gathered some judicious experience on how money is transferred, starting from one branch and then to the next part of a bank, or starting from one bank and then to the next bank. 2.15.

Hold cannot be sent from one bank and then via TT to the next bank. The framework for moving money starting from one country, then moving through the bank or another government to the next country. One of the most necessary parts of the investment bank is to connect its customers.

34; Refund" means sending cash starting from one place, and then through post to the corresponding place and sending. Banks similarly release this office to their customers by devising strategies to get cash from one branch of the bank and make a play for segmenting to another branch in the country. The corporate banks' reimbursement work environments to their customers are intended to enable them to continue operating in a crucially decent manner against creating threats or contingencies at the passing of real money, starting with one place and then to the accompanying or participating person in another place.

Activities of Foreign Exchange

Considering the forex topic, until then it suggests a wide range of trade related to foreign money, similar to cash instruments, for example, DD, TT, MY, TC, partial demand and foreign trade.

Chapter Four

Analysis of Mercantile Bank Ltd

- Sources of Credit Investigation

- Loan documentation

- Loan classification

- Unclassified

- Classified

- Substandard

- Loan renewal

The credit assessment will include: Prevailing lending practices in the market. a) Validity of the loan, history and registered tracks of the borrower. Borrowers' risk-taking capacity. n) Entrepreneurial and managerial capacities of the borrower. o) Reliability of repayment sources. p) The volume of risk in relation to the ability to take risk of the banking company in question. Like other commercial banks, one of the main functions of the Somali bank is to provide credit facilities to its valued customers.

The whole reason for the archive is that reliance on the reality of the announcement can be contained within it. The reports should be effectively taken by the bank to book the required charges on the protection deficiencies for the bank, the best possible and correct documentation is fundamental from the point of view of the well-being of the bank premium. This classification includes where there is doubt about the full recovery of the loan and advance together with together is expected, but cannot be quantifiable at this stage.

Stock valuation of the business thing or the property (mastered by the bank or the development holder). From the above different types of loans, I have described some of the loan based on information. With the unwavering improvement of the mechanical and the administration segments in Bangladesh, the degree of individual utilization has recorded dynamic development.

MBL remained one of the market leaders in terms of asset and liability growth among the 3rd generation private commercial banks. Coordinated efforts and exhibitions to acquire stores with the least effort with the ultimate goal of reducing the cost of stores and improving the Net Interest Margin (NIM) of the Bank. With the two extensive rural returns, make job openings produce pay from the country individuals, Mercantile Bank Ltd.

As the country's largest commercial bank, Mercantile Bank Ltd is taking on an inconvenient task in the country's modern progress by expanding credit offices into agro-based ventures.

Chapter Five SWOT Analysis

Connection with other bank compared: They have compared the collaboration with another bank, so that the bank can provide their customer's administration. Since the commercial bank has numerous branches, there are extraordinary opportunities to enter the financial field.

Chapter Six

Findings & Recommendations

- Findings

- Recommendations

- The bank exercises ought to up dated contrast and the other bank

- If the enter general Banking framework is modernized then the SBL fulfill the client by giving quick help

- Conclusion

They should make sure that they give the loans in a simple way, they should not make it difficult. Every one of the officials need to offer fixing to the clients, while doing this they cannot properly finish and keep the client records straight. Advertising and advancement is one of the fragile purposes of Mercantile Bank Limited has no convincing special exercises through commercial, yet different banks have better special methods.

The innovation of the industry needs to be expanded as the client base evolves. The standards and condition of the bank are solid, so the client pays his advance to face the bundles of problems. If the entry general framework of banking is up-to-date, then SBL fulfills the customer with quick assistance.

Mercantile Bank Limited extremely appreciates the notoriety of being the central bank manager of Bangladesh in such a place where the gatekeeper of the cash market has decided not to operate independently of anyone. Under small business and shopper financing, a diverse range of credit bureaus were available, namely: diagnostic center advance, micro credit, long term loan, small and medium business advance, merchant bank deposit conspiracy, rural credit bureau, micro credit, industrial finance, trade finance etc. further under the buyer financing given by the accompanying administration: education loan, health loan, monthly income scheme, advance for any reason, customer credit, marriage savings scheme, special small credit scheme and so on. The bank offers rural credit and micro credit to the customer and these two advance types are offered uniquely by Mercantile Bank Limited.

By providing a few forms of progress, the Bank is undertaking the fundamental task for the betterment of the economy of Bangladesh. The part of the MBL is present all over the country so that individuals can get their administration effectively.

Appendix

Questionnaire

Housing Building Loan What is the Nature of loan?

Export Loan

Import loans

Special Agricultural credit program What are the objectives of SACP?

Industrial project loan SME loan What is the Nature of loan?