It is my due respect to inform you that it gives me great pleasure to present my internship report on general banking and credit risk management at city bank ltd. I want to express my gratitude for giving me full support and guiding me as a mentor during my internship. I also want to thank the employees of City Bank Limited, Islampur Branch for sharing their knowledge with me.

I am already completing 3 months internship in city bank limited as it is the part of my BBA program. The purpose of this report is to analyze and reflect my internship responsibilities, experiences and learnings. The city bank limited is one of the famous and popular banks in Bangladesh.

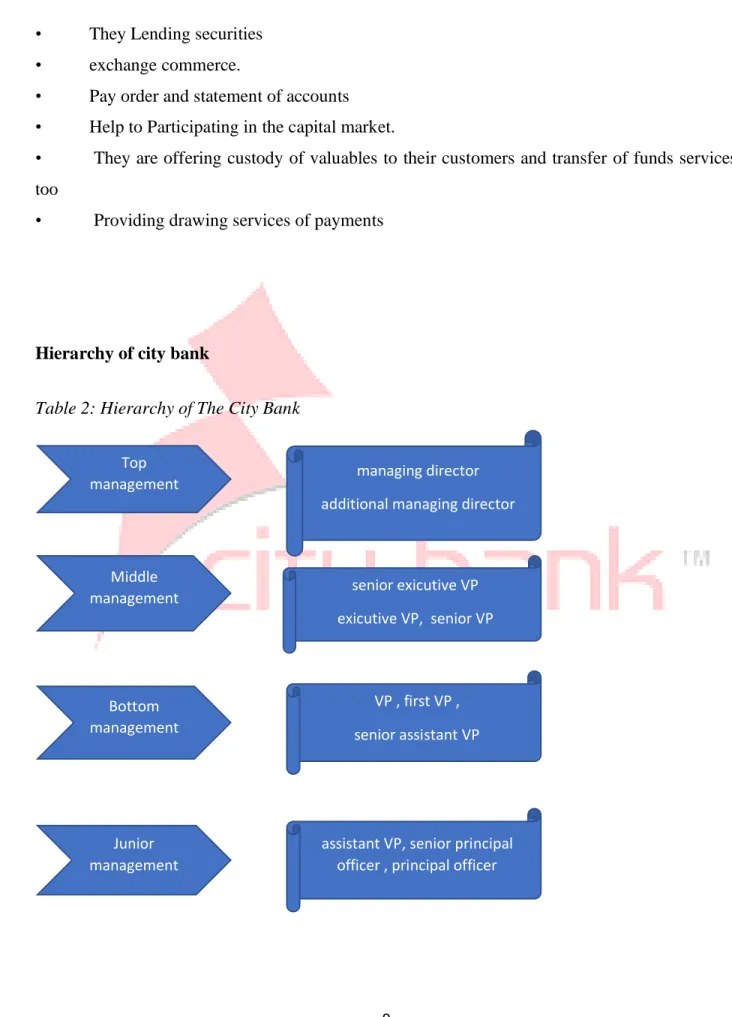

I analyze the general banking and credit risk management of City Bank Limited at Islampur branch. I am completing my internship in city bank under my supervisor Rebeka sultana AVP&SCS manager of islampur branch. 2nd chapter represents the overview of the city bank limited, its banking history, objectives, missions, visions, products and SWOT analysis.

The third and fourth chapter contains the main topic of my internship report, which is the overall banking risk management and credit of city bank limited.

Introduction)

In connection with this study, the overall banking system and credit risk management of City Bank Limited are discussed. City Bank Limited's websites and annual reports provided the majority of the data for this report. The main objective is to learn more about CBL's overall banking and credit risk management.

To know more about the fundamental functions of general banking at city bank Islampur branch. Even though the city bank's limited staff members were very busy, they gave me their full assistance. Furthermore, the internship's overall duration was too short for me to have more than a passing familiarity with the workings of the various departments through which I was rotated.

The majority of the data and information is restricted, and as an intern I was only given access to a very small subset of the information system and to the entire general banking system. I learned some general information about banking activities, but I had very little knowledge of analytical banking skills, leaving me almost completely ignorant of the banking system.

Over view of the city bank limited)

The Prime Minister of the People's Republic of Bangladesh also presented the city's bank with the "Top Ten Company" honor. The previously regionalized, geologically controlled, industry-based corporate or profit structure is not used in the city. The bank currently has 132 branches spread across the nation, one of which is devoted to Islamic banking.

Participating in economic growth by increasing the productivity of the bank's resources is another important objective. One of their main goals is to create a degree of connection with their customers with the modern banking system through the use of advanced information technology, so that the customers feel inspired and happy to associate with city bank. Their secondary objective is to increase the bank's assets by participating in syndicated massive loan funding with agreeing national banks to meet the current need.

Through the effective implementation of the central risk management program, their ultimate goal is to maintain investment ability, satisfied liquidity and asset superiority. The mission of city bank limited is to become the financial services group of choice in Bangladesh. The bank started operations in 1983 and is the oldest of the five commercial banks in the country.

This is the realization of the dream of some 13 local businesses who bravely and diligently took on many risks and uncertainties to make the establishment of the bank and the groundbreaking possible. One of the few regional banks, Citibank does not operate according to the branch-based, decentralized, geographically controlled business model. The length and breadth of the country is covered by centers and 11 SME/Agriculture branches.

It is competing in the market by offering a variety of its products and services, which is very important for its success. Treasury and Market Risks - All treasury services are provided by specialist teams at City Bank. Recent activities include fighting terrorism, supporting the martyrs of the BDR rebellion, drawing attention to Down syndrome, supporting the country, distributing worm dressings and also promoting public health and education.

General banking)

The customer can open an account in the city bank limited if he meets all the standards. Aside from getting a free checkbook they can use to withdraw money, City Bank checking account customers earn no interest on their deposits. With its many branches, City bank limited offers its savings account customers high quality facilities and important services.

In this scheme, the client receives a considerable sum of money in exchange for the term secured deposit after the deposit expires or at the end of the term. In addition, the customer can have the interest or profit, but not the principal amount of the deposit before it is due. A variety of large businesses, organizations or government agencies deposit money into short-term deposit accounts with City Bank.

Receiving and disbursing cash to customers in exchange for payment orders, checks, receipts and bills of exchange is the primary responsibility of the cash department. If necessary, he then validates the bearer of the signature of the money, after which the teller receives a callback confirmation. The cashier gives the money to the beneficiary when it is determined that everything is in order.

The expiration date of the check is the information needed to pay out any cash. Checks and other items are sent to banks outside the clearing house for collection purposes. The city bank limiter's other branches as well as other branches are where the Islampur branch gets the instruments indicated by its customers.

Demand drafts, pay orders and telegraphic transfers are the main instruments used by the city bank, Islampur branch, for money transfers. Check the accuracy of all vouchers, as well as the compliance of activity reports. Prepare a branch status report every week to be provided to the head office to meet the branch's cash reserve requirements.

Prepare a monthly report on the status of the branch with regard to meeting the legal liquidity requirement and send it to the head office. To reconcile transactions between all branches, a process known as extraction provides a summary of the transactions from the branch and head office.

CREDIT RISK MANAGEMENT)

Processing and approving credit proposals from the branches Documentation, CIB (Credit Information Bureau) report etc. Before approving the proposal, the Cr RM must ensure that all required documentation has been collected. To verify that new borrowers, originators and guarantors are indeed who they say they are, the Cr RM must understand their customer and conduct due diligence on each of these parties (known as “knowing your customer”).

A proper introduction, photographs of the signatories on the accounts, a passport, a trading license, the company's memorandum and articles, a certificate of incorporation, a certificate indicating the start of operations, director's name.

Internship Experience, responsibilities and learning

In addition to working in the branch's customer care, CS team and clearing departments, I also worked in regular banking. When I had time to build skills, I had to show up at my boss's office at exactly 10. But as long as I finish my work on time and am available when they need me.

I was able to improve my time management skills just by coming to work and leaving on time. Using FINACLE Software for common tasks helps me develop my skills and also gain expertise in databases, applications.