I am pleased to present my internship report on Service Strategy of Standard Bank Limited which I was assigned to complete. This report contains the Service Strategy of Standard Bank Limited, Jhenaidah Branch where I worked as an intern for three months. This internship report is aimed at providing different service areas of Standard Bank Limited.

Throughout the study, I have mainly tried to critically review the service strategy of Standard Bank Limited (Jhenaidah Branch).

CHAPTER- 01 INTRODUCTION

Background of the report

Objective Of the Report

Website of Standard Bank Limited • Annual Report of Standard Bank Ltd • Various publications on banking activities Scope of the report. This report covers Standard Bank's products and services, organizational overview, management and structural organizational functions performed by EBL.

Limitation of the report

CHAPTER-02

LITERATURE REVIEW

Literature Review

For this study, the validity of the literature search was considered by examining the selected. In the case of literature research, reliability is the repeatability of the research process; thus, it is necessary to comprehensively document the research process (Vom Brocke et al. 2009). Most articles were found using the second and third search terms; that is, they contained the terms "digital" or "electronic", but not "smart".

For the backward search step, the citations of the articles were manually screened for additional relevant literature.

CHAPTER-03

HISTORY OF BANK INDUSTRY AND BANKING SECTOR OVERVIEW IN

BANGLADESH

Financial System in Bangladesh

Short History of Financial System and Banking in Bangladesh

The Bangladesh government initially nationalized the entire domestic banking system and ensured that the various banks were recognized and renamed. The new banking system managed to establish fairly efficient procedures for managing credits and foreign exchange. Government encouragement of agricultural and private industry in the late 1970s and early 1980s brought changes in lending strategies.

Managed by Bangladesh Krishi Bank, a specialized agricultural banking institution, credit to farmers and fishermen expanded dramatically. Denationalization and private industrial growth led the Bangladesh Bank and the World Bank to focus their lending on the emerging private sector.

Banking Sector in Bangladesh

Commercial Bank: After independence banking industry in bangladesh started its journey with 6 nationalized commercial banks, 2 state owned specialized banks and 3 foreign banks. Scheduled Banks: The banks which are licensed to carry on business under the Bank Company Act, 1991 (amended up to 2013) are termed as scheduled banks. Non-Scheduled Banks: The banks established with a special and definite objective and operating under the laws enacted to fulfill these objectives are termed as non-scheduled banks.

There are 56 scheduled banks in Bangladesh operating under the full control and supervision of the Bangladesh Bank which is authorized to do so through the Bangladesh Bank order, 1972 and the Banking Company Act, 1991. wholly or substantially owned by the government of Bangladesh. So there are four commercial banks declared to be owned in Bangladesh such as Sonali Bank, Rupali Bank, Janata Bank and Agrani Bank.

Private Commercial Banks: There are 39 private commercial banks that are majority owned by private entities. Foreign Commercial Banks: 9 foreign banks operate in Bangladesh as branches of the banks incorporated abroad. There are now four unregistered banks in Bangladesh: Ansar VDP Unnayan Bank, Karmashangosthan Bank, ProbashiKollyan Bank, Jubilee Bank. Non-banking financial institutions are those types of financial institutions that are regulated under the Financial Institution Act of 1993 and controlled by Bangladesh Bank.

Activities of commercial banks: Bangladesh Bank Order 1972 and the Banking Companies Act 1991 mainly guide the commercial banks in Bangladesh. All banks operating in Bangladesh with various paid-up capital and reserves with a minimum of an aggregate value of Tk 5 million and carrying on their business to the satisfaction of Bangladesh Bank are scheduled banks in terms of section 37(2) of Bangladesh declare. Bank Order 1972.

CHAPTER-04

OVERVIEW OF THE STANDARD BANK LIMITED

Historical Background of Standard Bank Limited

Mission, Vision, Objectives & Core Values

Vision

Mission

Our Customer: To become the most caring bank by providing the most courteous and efficient service in all areas of our business.

Business Objective

Features of SBL

Managerial Hierarchy of Standard Bank Limited

Existing levels of Management at Standard Bank Limited (Jhenaidah Branch)

CHAPTER-05

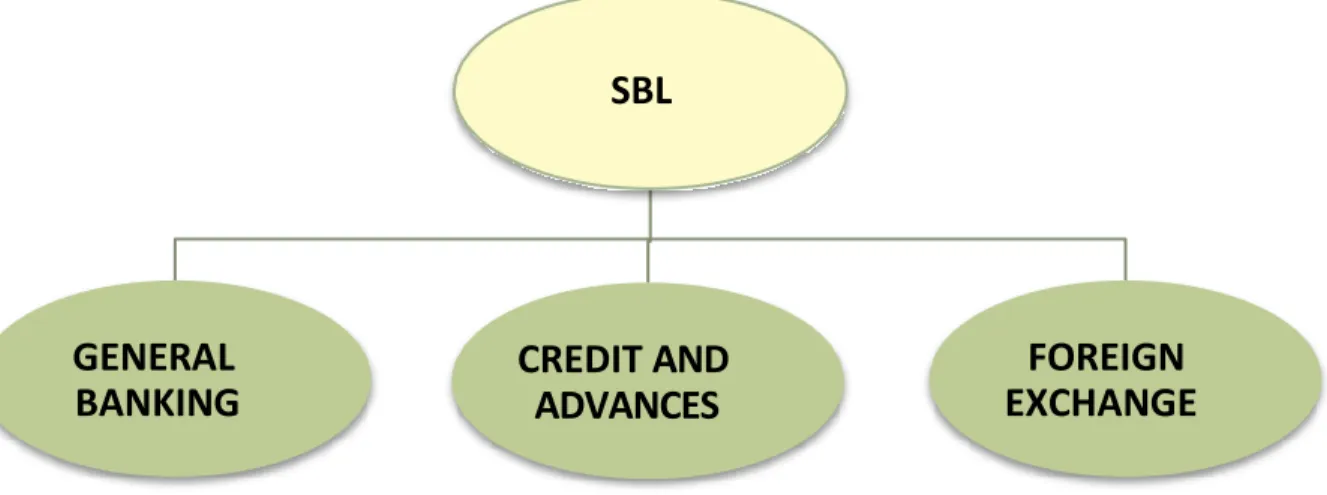

SERVICE STRATEGY OF STANDARD BANK LTD

The withdrawal amount should not be more than 1/4 of the total balance at a time and limit twice a month. Some terms and documents may differ, but the overall process for opening an account is similar to that of a savings account. Current account (individual): Branches use the forms distributed by SBL head office to open a personal/individual current account.

Current Account (Property): To open a current account, a photocopy of the trading license attached by the concerned officer is required along with the procedure mentioned for individual current accounts. To open a Joint Stock Company, all formalities for opening an individual current account must be completed; In addition, the following documents must also be submitted to the bank. Name of the persons authorized to manage the bank account on behalf of the company.

SBL current account meets the needs of individual and commercial customers through its schedule benefit. Customers fill in the form, which contains the name of the customer, amount of money, duration, interest rate etc. After receiving the form from the customer, the respected officer looks for the cash stamp or transfer stamp.

If any of these are present and the form is properly signed, the officer gives the customer a sample signature card. The customer signs three times on the specimen signature card along with his full name.

SBL Regular Deposit Program (SRDP)

The loan portfolio of the Bank is well diversified and covers funding for a wide spectrum of businesses and industries including ready-made garments, textiles, edible oil, ship scrapping, steel and engineering, chemicals, pharmaceuticals, cement, construction, healthcare, real estate and loans under consumer credit schemes allowed to the middle class people of the country for acquiring various household items. Debit / ATM card and VISA credit card are two such products, the bank could hardly afford not to have and offer them to its customers. To do this the bank has further agreed to join and share existing network of ATMs currently available in the country.

The bank has also engaged IT Consultants Limited (ITCL) as a third party processor for Visa card management. Most of the preparatory work has been done and awaiting visa certification to issue the Standard Bank Visa credit card as soon as possible. After completion of all formalities including personnel, infrastructural facilities, renovation etc. The bank's MBW started operations from August 2009.

The Hong Kong and Shanghai banking corporation (HSBC), Citibank N.A., Standard chartered bank (SCB), American Express bank ltd., Mashreq bank PSC., Wcchovia bank, The bank of Tokyo-Mitsubishi ltd., Union De Banques, Et ArabesFrancaises , Danske bank ltd, A/S Commerz bank, Dresdner bank, Bank Islam Malaysia, Berhad, Nepal Bangladesh bank ltd., NIB bank ltd., Arab Bangladesh bank ltd., AB international finance limited, Bhutan national bank, UTI bank ltd. , The bank of Nova Scotia and ICICI bank limited , Habib bank, Ag Zurich, Nordea bank and Samen bank. Failure of this department can lead the bank to huge losses or even to bankruptcy. Foreign exchange operation of the bank has played a significant role in the overall business of the bank.

The bank contributes to the country's national economy by successfully managing foreign transactions and offers a wide range of trade finance products through its 17 A.D. branches. In 2013, the bank contributed to the national economy of the country by successfully managing the foreign exchange operations of VIZ.

Import Section

51036.10 million, which was 11.59% more than last year, the volume of export business increased tremendously from Tk. 42574.50 crore which was 4.74% higher than last year and the foreign remittance business also increased tremendously from Tk 703.45 crore to Tk.

Export Section

TT-Telegraphic Transfer

DD-Demand Draft

PO-Pay Order

INFORMATION TECHNOLOGY DEPARTMENT

CRITICAL OBSERVATION AND FINDINGS

Despite that, it was not an easy job to find so many things during the very short period of practical orientation program. Now I would like to present my observations and give my opinion to improve the banking service and make their customers more satisfied. As a number of new banks with their extended customer service pattern come into being in a completely competitive manner.

Moreover, they look for the bank that will provide more facilities and attractive offer compared to other banks. Therefore, SBL should seriously think about revamping their customer service and facilities which will be more attractive and innovative rather than traditional one. There is a shortage of photocopiers at Jhenaidah branch of SBL, so at the time of account opening if the customers want to photocopy a document, they have to go outside which makes the account opening procedure long .

Due to the lack of manpower, an additional burden falls on a person, which lowers his level of performance and hinders the discipline of the work environment. Customers sometimes have to wait to get the service they want, which is contrary to first class banking. Customers are not satisfied with the utility payment option offered by Standard Bank Ltd.

They often complain about short bill collection time and unavailability of the bank's ATM booth.

CHAPTER-7

RECOMMENDATIONS AND CONCLUSION

SBL needs to make its services fast so that people do not have to spend more time on banking activities and can easily perform all respective activities. Moreover, they need to come up with new facilities and offers that will attract more customers and help to ensure their premium and loyal customer forever. More gifts, discounts and differentiated interest rates on various loan and deposit programs for the Premium customers.

SBL's human resources departments must ensure a good division of labor within the office in order to efficiently handle the client load. Moreover, by expanding the workforce, they can try to maintain their premium banking objective. Moreover, short probation period and timely promotion will motivate the employee to perform well in his daily activities.

The bank must prepare an organized plan for its advertising and promotional activities, which should include billboards, internet advertising and sponsorship.

Conclusion

Bibliography

APPENDIX

Accounts

Schemes o FDR

Wholesale Banking (Corporate Banking) o Working capital finance

Risk Unit

Support Unit 1. Human Recourse

- Information Technology o Desktop Management