Introduction

Topic of the Report

Objectives of the Report

- Broad Objectives

- Broad Objectives

Scope of the Report

Methodology of the Report

- Primary Sources

- Secondary Sources

Limitations of the Report

Literature Review

Marketing

Managing customer relationships profitably, acquiring new customers while maintaining and growing existing ones, and managing customer acquisitions are all crucial to a company's marketing success.

Concept of SWOT Analysis in Banking Industry

With the introduction of the MBL Contact Center 16225, Mercantile Bank is now able to provide convenient financial services at the doorstep of its customers, at any time of the day or night. Despite the unstable state of the macro economy, MBL is also dedicated to growing its business model to keep its finances in good shape. Another duty of the front desk is to provide the daily portfolio to the customers.

Mercantile Bank Securities Limited, which is based out of the main branch, also provides a number of additional services. As a direct result of this, there has been an adverse impact on the viability of the immediate future. The lack of a marketing department was one of the most obvious shortcomings in the account opening and shipping sector.

In order to provide superior support to its clientele, Mercantile Bank Limited should increase the number of employees working at its various locations. It is recommended that Mercantile Bank Limited establish a marketing department that is separate from the rest of the organization. Mercantile Bank Limited is committed to developing all its activities and services to the highest quality standards.

I am grateful that I had the opportunity to work at Mercantile Bank Limited (Bijoynagar Branch) during my internship.

Overview of the Organization

World Range of Banking Services

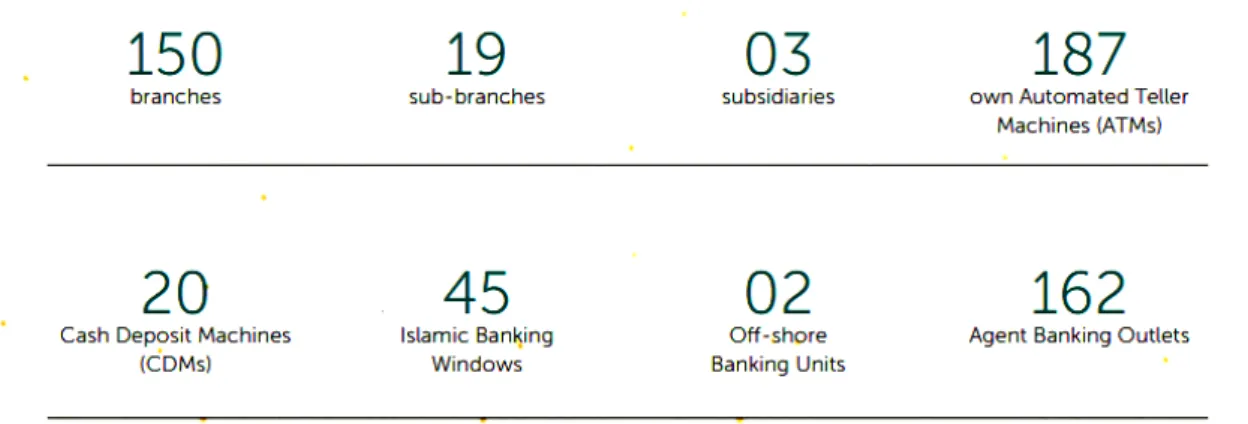

MBL has been able to establish itself as a prominent third generation private commercial bank as a result of its conservative policy guidelines coupled with good execution, a wider range of banking products and exquisite customer service. Providing a wide range of commercial banking services such as deposit mobilization, corporate banking, small and medium enterprise (SME) and retail business banking, bill discounting, foreign exchange, offshore banking, finance functions, card business, mobile. MBL provides a wide range of card services to its customers, including a VISA dual prepaid card, credit card, debit card, medical card, student card, hajj card and international/dual card, all of which have advanced features.

MBL’s Resilience

Sustainable Business Practices

Mission, Vision and Core Values

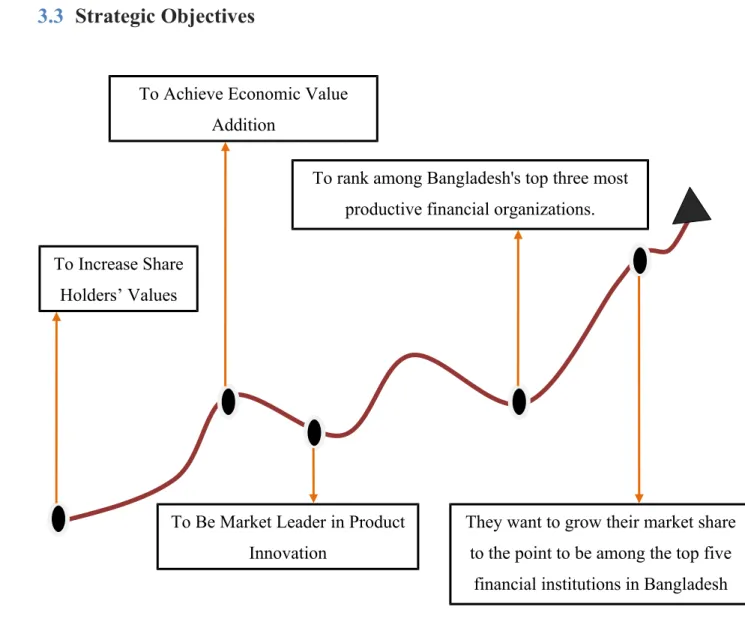

To achieve these goals, MBL plans to cultivate an army of dedicated employees who are passionate about delivering value and who embody the company's vision. In both their thoughts and actions, they will continue to act in a responsible, ethical, honest and transparent manner.

Strategic Objectives

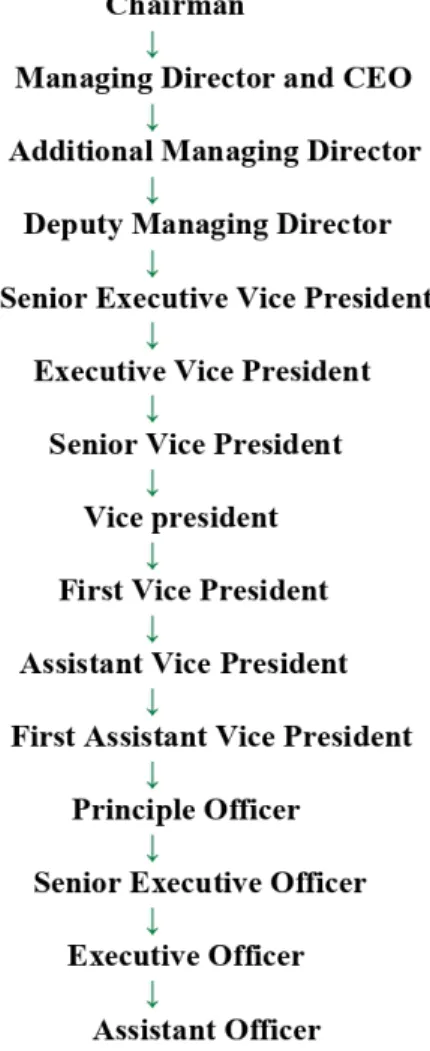

Organizational Chart

Products and Services at MBL

- Corporate Banking Division

- Credit Management Risk Division

- Retail Banking Division

- Card and ADC Division

- SME Financial Division

- Agriculture Credit Division

- Mobile Banking Services

- Agent Banking

An efficient risk management process of credit facilities brings a stable development regardless of the market condition. In accordance with the standards set out in Bangladesh Bank's Credit Risk Management (CRM) Guidelines for banks, Mercantile Bank Limited has established a nine-member Credit Risk Management Committee to provide direction and oversight for CRM and to monitor the credit risks of the bank as a whole. This includes a look at the bank's underwriting policies, lending practices, collection procedures and delinquent loans.

In line with its concept of serving the customer as a one-stop financial service provider, Mercantile Bank has addressed the issue of understanding customer needs and focused on creating solutions. Since September 3, 2006, MBL has a department dedicated to financing SMEs, which operates in accordance with the credit norms set by the Bangladesh Bank. As a result, the bank's small and medium-sized enterprise (SME) portfolio has grown significantly over the past five years.

MYCash is committed to providing a variety of banking services to the people of Bangladesh through mobile devices. It provides an entire ecosystem where individuals can get the most out of money, not just the ability to 'give and receive'. Enabling individuals to participate in the financial system even if they do not have access to the services offered by traditional banks. MYCash is committed to becoming the most progressive company in the growing mobile financial services sector in Bangladesh.

On December 28, 2019, we opened our first Agent Banking location after receiving permission from Bangladesh Bank.

Operational Activities and Environment

Despite this, employees of Mercantile Bank Securities Limited will go after a client whose Head Office account has negative portfolio equity to force the client to turn things around. Since its inception, Mercantile Bank has always operated in a manner that is fully compliant with all tax and VAT requirements imposed by the Bangladesh Bank and the National Board of Revenue. Mercantile Bank's exposure to the retail and small and medium-sized enterprises (SME) industries is quite low when compared to other market leaders.

Since Mercantile Bank has no other significant sources of income, the bank's interest income and total income fell as a result of the lower deposit-to-loan ratio of 6-9 percent. The amount of funds that Mercantile Bank invests in the IT sector to upgrade software and build physical infrastructure is insufficient, and the bank also imposes restrictions on the software upgrade process. As a result of these advances, Mercantile Bank is ready to work together with many important stakeholders to address any potential challenges that may develop.

At Mercantile Bank for Women Entrepreneurs, there are service desks tailored specifically for women. The Mercantile Bank Hajj Prepaid Card is an innovative solution for your financial needs when traveling to the Holy Land in Saudi Arabia to perform Hajj. Mercantile Bank Limited provides its employees with incentives, benefits and other benefits such as performance bonuses, profit sharing and risk sharing incentives to motivate them to perform well under a salary based compensation structure.

There has been a proliferation of commercial banks in recent years, increasing interests in the banking business. Mercantile Bank Limited is moving forward with plans to introduce foreign services at this time.

Analysis Part

Strengthen (Internal Factor)

Mercantile Bank managed to effectively maintain their CRAR (Capital-to-Risk Weighted Assets Ratio) at 13.64 percent, and their cost-to-income ratio was reduced to a level that was appropriate. The bank's board of directors regularly reviews the bank's compliance with the Central Bank and ensures that the company operates ethically. The Board of Directors recognizes the importance of good corporate governance standards in creating value for shareholders and safeguarding the interests of the company in general.

They have a healthy working atmosphere as well as a well-developed pool of human resources that enable them to deliver the most potential value to the company. To provide information about the condition of a human asset, such as whether it is effectively maintained and whether it is worth appreciating or depleting, and to provide information about the condition of a human resource and. The development of effective HRM practices can be aided by classifying the monetary consequences of various human resource management strategies.

Mercantile Bank offers its valued clients a wide range of cutting-edge corporate, retail and small and medium-sized enterprise (SME) products, in addition to a full complement of regulatory services.

Weakness (Internal Factor)

It is now working on steps to improve its cyber security, but there is still more work to be done in this area.

Opportunities (External Factor)

Since the majority of the population is Muslim, an Islamic economy based on Sharia law is practiced. Today, a growing number of people in the banking industry are opting for Sharia-compliant products and services, in addition to Islamic financial services. To this end, Mercantile Bank, a subsidiary of Islamic banks, is being developed as part of the larger Sharia-based financial system.

Threats (External Factor)

Financing is an essential part of Bangladesh's stimulus package and the banking industry will need to be actively involved in the implementation of this plan in 2021. Effective management of the stimulus package is crucial not only for Bangladesh's economy but also for state-owned banks and other financial institutions. An open rationalization strategy involves the identification and selection of companies to be affected and the monitoring of the entire process to ensure appropriate controls.

The Corporate Banking Division of Mercantile Bank Limited is more meticulous and systematic when it comes to finding and selecting the affected firms that are most likely to benefit from the stimulus packages. This ensures that the most favorable results are achieved. The Russia-Ukraine war and Covid-19 pose major challenges to the traditional banking business model due to low interest rates, high capital requirements, growing competition from shadow banks and new digital entrants. Due to the fact that many or some customers are unable to visit the bank during the banking transaction time, the bank inevitably loses a certain number of customers who are preoccupied with their professional responsibilities.

The job at the bank could perhaps have been made much easier if there had been a marketing department that was completely separate and distinct from other departments. The number of ATMs should be increased and the services offered at such booths should see an improvement. It is important to provide the bank with the appropriate technical instrument as soon as possible.

In general, I believe that every sector has good and bad characteristics, and if I think about Mercantile Bank Limited, the positive aspect is that they are committed to improve their current strategy and introduce new, useful items to win the choice and loyalty of their customers.

Findings, Recommendations and Conclusion

Recommendations

It is essential to have an understanding of some aspects of internal politics as they contribute to adverse conditions.

Conclusion