I am pleased to present my internship report titled “Financial Statement Analysis and Performance Evaluation of Bandar Steel Industries Limited”. I have tried my very best to find out the financial functions of Bandar Steel Industries. Certified that this project report entitled “Financial Statement Analysis and Performance Evaluation of Bandar Steel Industries Limited” is the bona fide work of Navid Hassan, who conducted the research under my supervision.

The main focus of this report is on Financial Statement Analysis and Performance Evaluation of Bandar Steel Industries Limited. Trend analyzes are mainly conducted to analyze the trend of liquidity, profitability, debt management and efficiency of Bandar Steel Limited. The recovery performance of Bandar Steel in the steel industry is also analyzed in the report.

Chapter: 01

Introduction

- Introduction

- Objectives

- Significance of the Report

- Methodology

- Research Design

- Data used in the study

- Data Analysing and Reporting

- Scope of the Report

- Limitations of Report

Financial performance analysis can identify the financial strengths and weaknesses of the firm by properly establishing the relationship between the items of balance sheet and profit and loss. Financial statement analysis involves reorganizing the entire financial data that the financial statements contain. This internship report is prepared as a compulsory course fulfillment of the requirement of BBA programme.

The main theme of the internship is together practical experience and knowledge of the company's activities in different sectors of the company. Software like Microsoft Word, Excel is used to analyze and report the purpose of the report. The main limitation of the study was insufficient information which was necessary for the study.

Chapter: 02

Literature Review

Theoretical framework

Various literatures identify that financial sustainability is one of the areas that we need to consider in order to assess the performance of microfinance institutions. This therefore means that we need to access the impact of microfinance programs on poverty reduction in order to assess their effectiveness. According to Meyer (2002), this aspect of poverty can be used to access the impact of MFIs on those receiving services.

Various studies of different countries on the performance of MFIs confirm this (Adongo and Stork 2005, Zeller and Meyer 2002, Meyer 2002, Robert cull et al. 2007). He also noted that POCSSBO's credit program had a positive effect on customers' income and savings. In addition, he stated that clients' access to medical, education and nutrition had improved.

Chapter: 03

An Overview of BSI

- Background and History of BSI

- Organizational Structure of BSI

- Products of BSI

- Position of BSI in Bangladesh Market

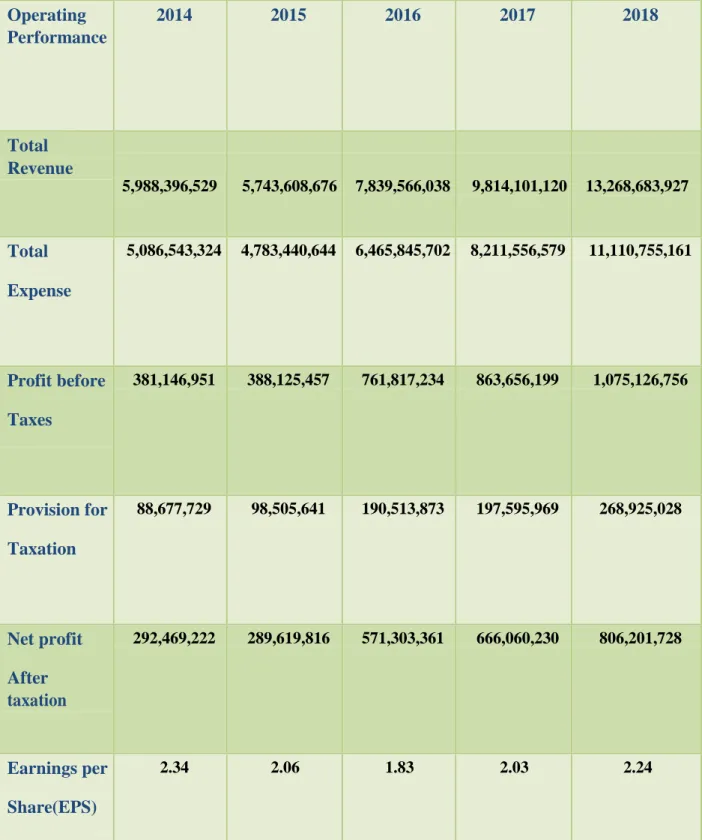

- At a Glance Operating Performance of BSI for last 5 years

- At a Glance Financial Performance of BSI for last 5 years

In the beginning, God created man” and after thousands of years of intelligence, precision, hard work and innovation, man created steel – one of the greatest inventions of all time. This super-hard, carbonized and alloyed form of iron is an element without which modern life is literally unimaginable. From skyscrapers and airplanes to syringes and forks, steel is an essential part of our daily lives.

One of the leaders in Bangladesh in steel manufacturing promises a super strong future and economy with its world class products. As BSI ensures the highest quality products in Bangladesh as per various international and national standards, BSI steel pieces and bars are exported to other countries following nourishing national demand. In 2016, the company started its expansion project in Sitakundu, Chittagong in collaboration with Primetals Technology, a joint venture between Siemens VAI and Mitsubishi Heavy Industries &.

For the first time in the world, it will use Win Link Flex technology for a rolling mill. Steel billet: Steel billet is a secondary product produced in the steel bar manufacturing process. Crude steel cannot be used in its pure form, it must be formed before use.

The freshly made steel, which is still shaped like a metal bar or rectangle, is called steel billet. A steel bar with surface projections that increase bond strength when used in reinforced concrete. Steel exports from Bangladesh, especially to Africa, have been steadily increasing, boosting the country's hopes for foreign exchange earnings by exploring new markets for its diversified exports.

Although Bangladesh's entry into the steel export market is not that old, it had already built a good reputation for its quality products.

Chapter: 04

Financial Statement (Ratio) Analysis

Financial Statement Analysis Company

Financial statement analysis (or financial analysis) is the process of reviewing and analyzing a company's financial statements to make better economic decisions. Financial statement analysis is a method or process that involves specific techniques for evaluating the risks, performance, financial health and future prospects of an organization. The information required can take a variety of forms, but typically includes comparisons such as comparing changes in the same item for a healthy company over several years, comparing key ratios over the same year, or comparing the performance of several different companies in the same industry.

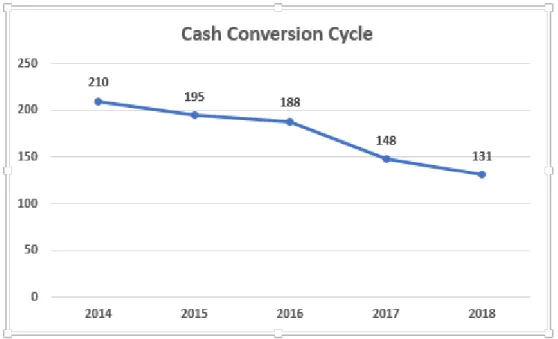

Common methods of analyzing Bandar Steel Industries' financial statements include fundamental analysis, horizontal and vertical analysis, and the use of financial ratios. Number of days of open sales = 365 / accounts receivable turnover ratio. Inventory Days Outstanding = 365/Inventory Turnover Ratio Days Outstanding Debt = 365/Accounts Receivable Turnover Ratio Cash Conversion Cycle = DSO + DIO − DPO.

Asset Management/Efficiency Ratio

Debt Management period

- ROA =

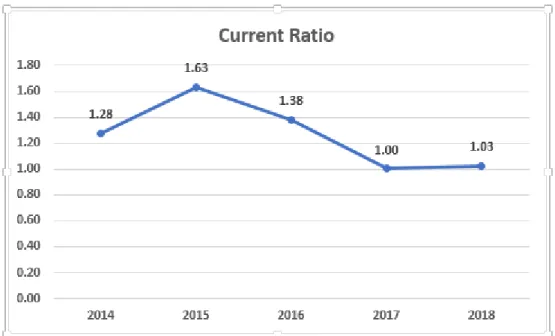

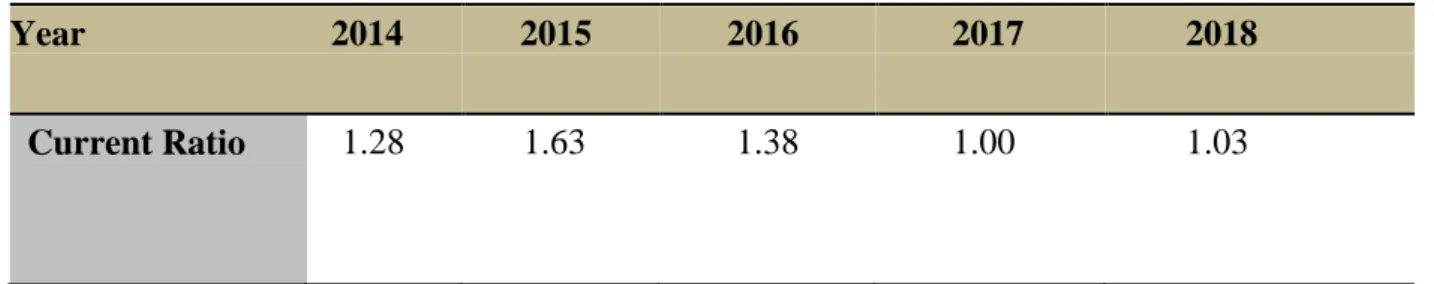

Liquidity Ratio .1. Current Ratio

- Current Ratio

- Inventory Turnover Ratio

- Total Asset Turnover Ratio

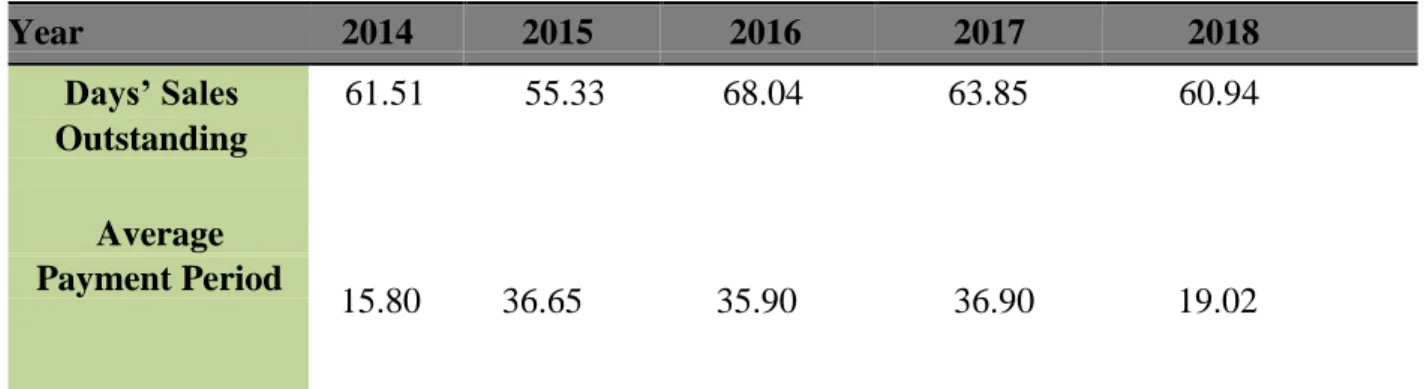

- Average Collection Period/Days’ Sales Outstanding

- Average payment Period

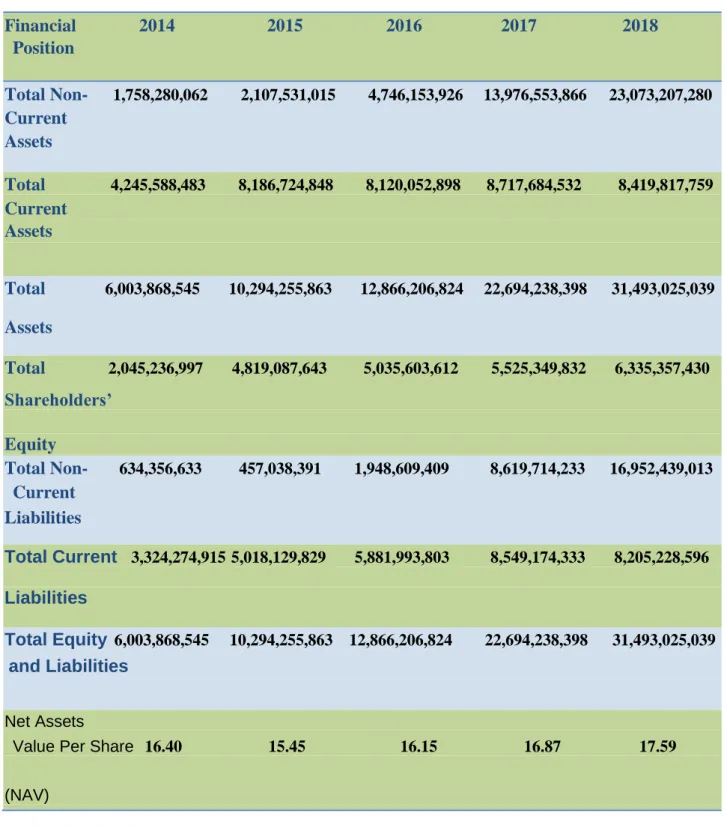

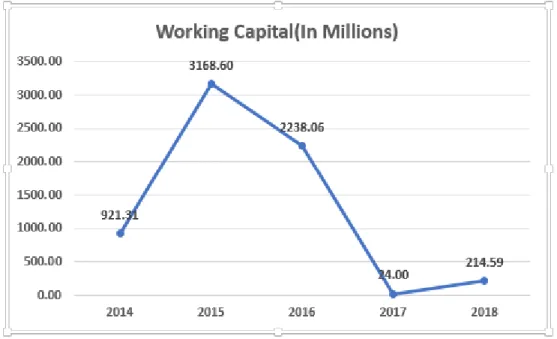

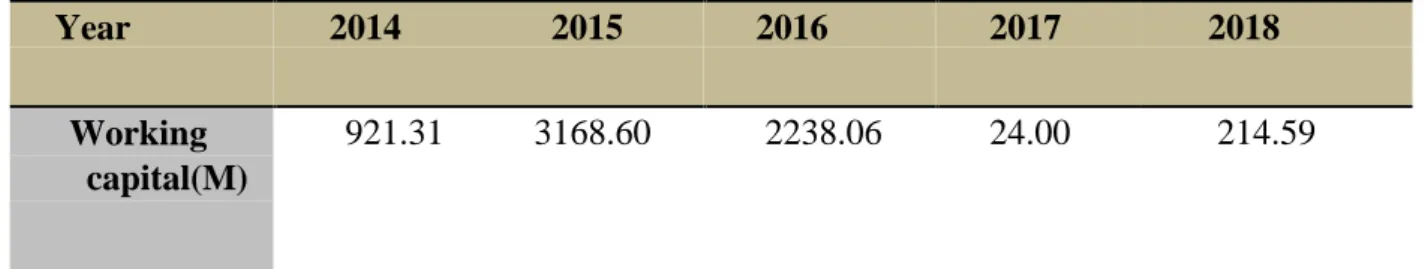

This shows, over time, Bandar Steel Industries is losing its capacity to pay its current liabilities using its current assets. All five-year ratios are less than 2, which indicates that they are in a risky position in the current ratio. The cash conversion cycle is the time it takes a company to convert its committed resources into cash.

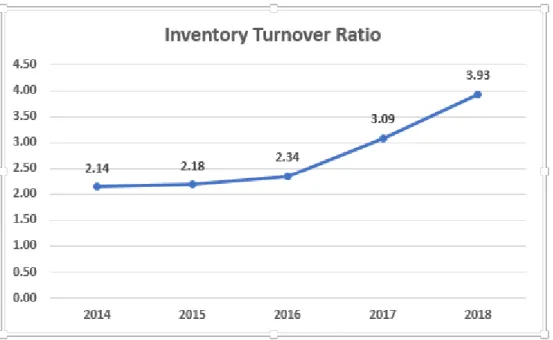

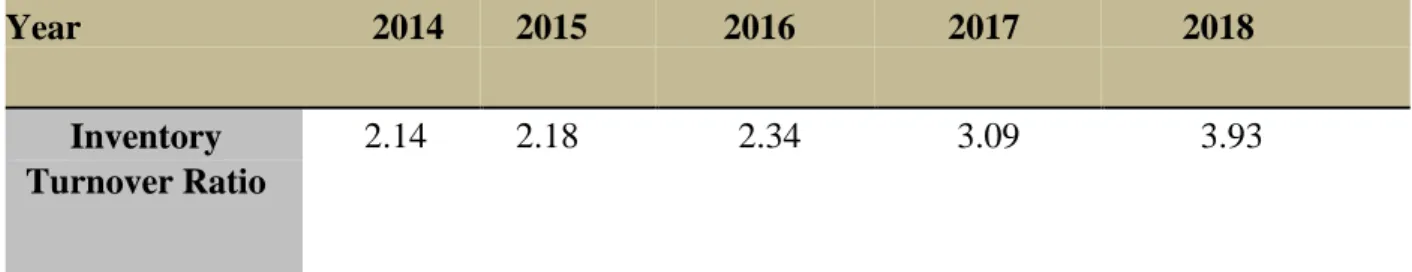

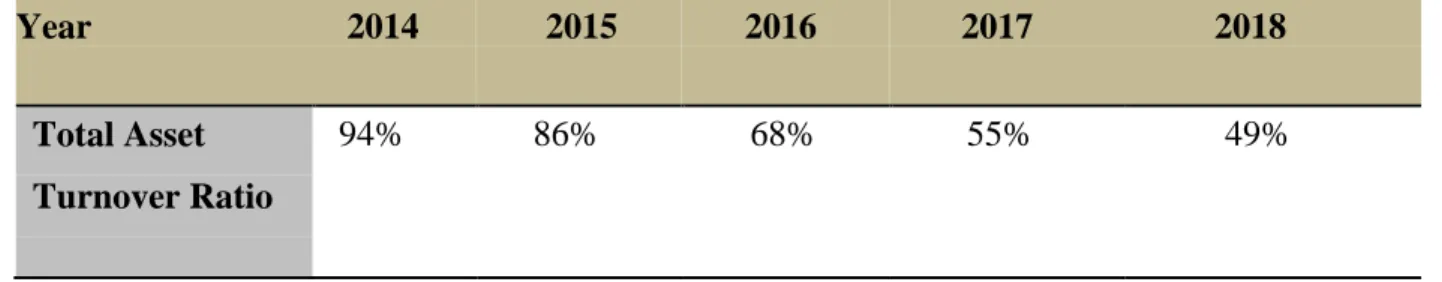

Liquidity ratio expresses a company's ability to repay short-term creditors out of its total cash. Inventory turnover ratio measures how effectively inventory is managed by BSI, comparing cost of goods sold to average inventory for a period. After that, it declined and reached only 49% in 2018. Which means that BSI had lower ability to generate sales from its assets during that time.

This ratio also indicates that BSI is not efficient in using its assets to generate sales. Average payment period means the average period the company takes to make payments to its creditors. But a very short payment period may be an indication that the company has not made full use of the credit terms allowed by suppliers.

Efficiency ratios, also called activity ratios, measure how well companies use their assets to generate revenue. Total inventory turnover ratio is in a good position and in 2018; it peaked at 3.93, indicating strong selling or ineffective buying. On the other hand, BSI is not efficient in using its assets to generate sales.

Overall, efficiency ratio of BSI is medium position if they can continue it, they can improve the company.

Debt Management Ratio

- Debt to Asset Ratio

- Times Interest Earned (TIE) Ratio

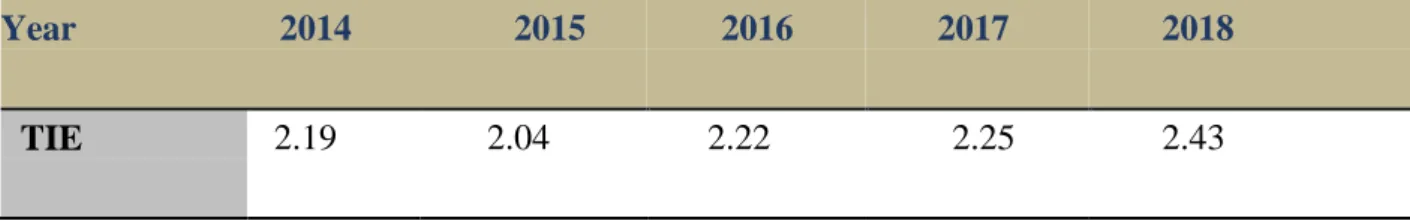

The times interest earned ratio (TIE) shows how many times the annual interest expense is covered by the company's net operating income (earnings before interest and taxes). Debt management ratios attempt to measure the use of financial leverage and a company's ability to avoid financial problems in the long term. The overall position of debt management is in the middle position due to the time relationship of interest earned.

There is an upward trend in the debt-to-assets ratio; means that the company has a higher level of liabilities compared to assets and is considered to have a high level of financial leverage and high risk. On the other hand, the interest earned ratio is suitable for protecting the creditor's interest in the company.

Profitability Ratio

- Net Profit Margin Ratio

- Gross Profit Margin Ratio

- Operating Profit Margin Ratio

- Return On Equity (ROE) Ratio

- Return On Asset (ROA) Ratio

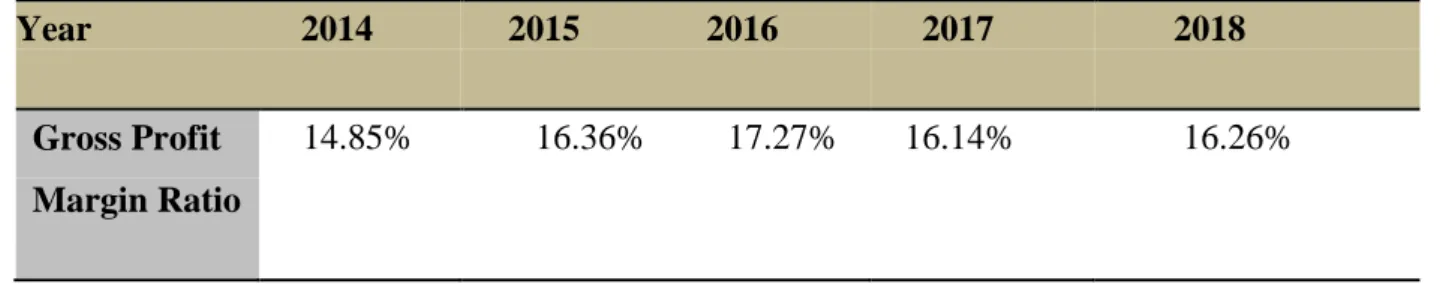

Gross margin ratio is a profitability ratio that compares the gross margin of a business with the. Operating profit margin ratio of BSI has varied over time, it increased 2015 to 2016 and reached 13.76% which is higher value and favorable for company which indicates. It falls dramatically from 2014 to 2015 and reached only 10.67% and then slowly increased in the following years.

It turns out that, in the span of five years, the return on assets of BSI dropped dramatically and went to 6.40% in 2018. BSI is in a high position in profitability by the amount of net income earned in all years except 2014. BSI's Operating Profit Margin ratio fluctuated over time and overall operating profit margin ratio is good position except for 2014.

Therefore, in profitability, BSI is quite good and they should focus more on their capital, assets and sales.

Chapter: 05

Performance

Evaluation of BSI

- Performance Evaluation of Bandar Steel Industries Limited

- Days Sales Outstanding to Average Payment Period

- NAV of 2018 of BSI compare with BSRM, KSRM & GPH

- Revenue of 2018 of BSI compare with BSRM, KSRM & GPH

- Net Income of 2018 of BSI compare with BSRM, KSRM & GPH

- EPS of 2018 of BSI compare with BSRM, KSRM & GPH

- Findings

- Recommendation

- Conclusion

It declined in the following year 2017, indicating that they are increasing their leverage to collect cash from their customers and that it is increasing liquidity and cash flows with a lower day. On the other hand, the average payment term fluctuated and fell when outstanding sales fell. It is clear that BSI's net profit is well positioned in the steel market.

Earnings per share is generally considered the most important variable in determining a stock's price. Bandar Steel Industries greatly loses its ability to pay its current liabilities by using its current assets, which indicates that they are in a risky position based on their current ratio. BSI has a higher level of liabilities compared to assets and is considered high leverage and high risk.

BSI has higher earnings per share, which means that the company is profitable and has sufficient profits to distribute to its shareholders. To recover their liquidity performance, they should collect their receivables as soon as possible, on the other hand, delaying payment to their suppliers (creditors) can help to recover liquidity position. Times The interest income ratio can be improved by increasing the operating profit, and the operating profit can be increased by reducing administrative and selling expenses.

Farr Ceramics limited is one of the limited company in steel industry in Bangladesh which started in 2006. BSI product line is not much diversified in terms of goods and design. On the other hand, FCL is in a high position in terms of profitability by improving net profit, gross profit and operating profit.

Comparing BSI's net income, NAV in 2018 with BSRM, KSRM and GPH, it is in second position and it also already covers 19% of the market by their sales.