Submitted in partial fulfillment of the requirements for the degree of Bachelor of Business Administration. I completed the internship report on “Financial Performance Analysis of Jamuna Bank Limited”. With due respect, I submit my internship report on the above title in fulfillment of the requirements for the Degree of Bachelor of Business Administration. Abul Hashem , a student of Bachelor of Business Administration ID: BBA2001019139 of Sonargaon University hereby declares that this internship report on "Financial Performance Analysis of Jamuna Bank Limited" is uniquely prepared by me.

Shahbub Alam, Lecturer, Department of Business Administration, Sonargaon University. Without his guidance and help, I would not have completed my internship report. Finally, I express my gratitude to all those who were helpful in the preparation of this internship report. The purpose of the study is to determine the performance of Jamuna Bank Ltd. to analyze by doing relationship analysis, identifying problems and recommendations.

This article is intended to provide an enhanced analytical framework to present the various aspects of the performance of Jamuna Bank Limited in Bangladesh. As part of my BBA programme, I used 5 years of financial statements data from Jamuna Bank Limited's annual report to calculate the ratio. This relationship helps me to find out the past situation of Jamuna Bank which can help them to overcome the past blunder and also help them for a better future decision.

Last but not the least, some problems found during the analysis of the financial performance are shared and in the later chapter some suggestions are mentioned for the improvement of the Bank so that manager of Jamuna Bank can take precautions as they feel the proposals are good enough.

Background of the Study

Rationale of the study

Objectives of the study

Methodology

Research Design

Nature of Data

Sources of Data

Scope of the Report

Significance of the report

Limitations of the Report

An Overview of Jamuna Bank Ltd

- Vision

- Mission

- Strategic Priority

- Values

- Objectives

- Ethical Principles

- Product and Services

- Deposit Product

- Loans Product

- Card & ADC Product

- Corporate Banking

The Bank provides all types of support to the trade, commerce, industry and general affairs of the country. The bank was founded by a group of local entrepreneurs who have a good reputation in the trade, commerce, industry and business of the country. The bank is managed and operated by a group of highly skilled and professional teams with diversified experience in finance and banking.

As customers' needs change day by day with the changes of time, the bank endeavors to devise strategies and introduce new products to cope with the change. The bank has already built a reputation as one of the country's quality service providers. At present, the bank has real-time online banking branches (in both cities and rural areas) network throughout the country with smart IT backbone.

In addition to the traditional delivery points, the bank has its own ATMs, which it shares with other partner banks and consortiums throughout the country. To become a leading banking institution and play an important role in the development of the country. The Bank strives to meet the diverse needs of its clients through a range of products at a competitive price, by using the right technology and by providing timely service, ensuring sustainable growth, a reasonable return and a contribution to the development of the country can be ensured with a motivated approach. and professional workforce.

Ensuring organizational efficiency by continuous improvement of human capital and motivation level, dissemination of information and thereby ensuring sustainable growth of the organisation. Pursue CSR activities for our continued support to future generations, needy people and for the advancement of underprivileged people in the country. To remain one of the best banks in Bangladesh in terms of profitability and asset quality.

The Bank's responsibility is to provide financial solutions taking into consideration various socio-economic factors. Jamuna Bank emphasizes the importance of bringing people of all segments under the banking system. Corporate Banking of Jamuna Bank Limited offers customized corporate banking solutions to both its local business houses and multinational companies.

Analysis & Findings

- Liquidity Ratio

- Efficiency and profitability Ratio

- Leverage Ratio

- Market Performance Ratio

- Diagram of financial ratios

- Ratio analysis for Jamuna Bank

- Efficiency and Profitability ratios

- Liquidity ratio

- Debt ratios or leverage ratio

- Market performance ratio

This process helps identify the strength and weakness of the bank by building the relationship between the balance sheet and the income statement. A low rate of return on assets indicates that the bank is not making enough income from the use of its assets. Return on equity is the most important efficiency profitability ratio and this ratio measures the return on its shareholders' investment in the bank.

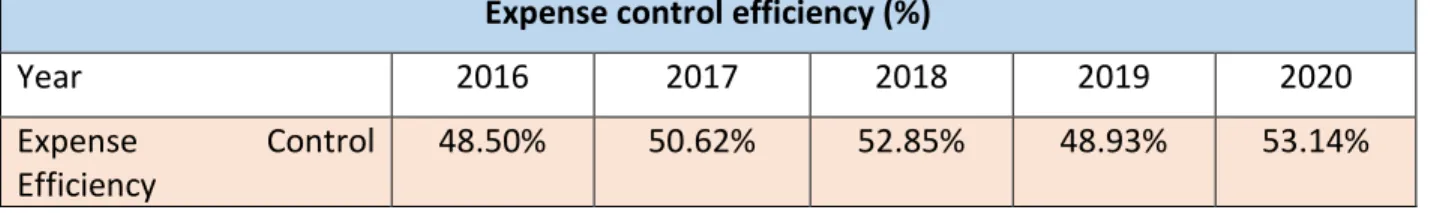

This graph shows that the bank's return on investment capital has fluctuated over the years. This graph shows that the bank's return on investment capital has fluctuated over the years. Except for 2019, the overall trend of expense control effectiveness is upward, which means the bank has a good grip on its expenses.

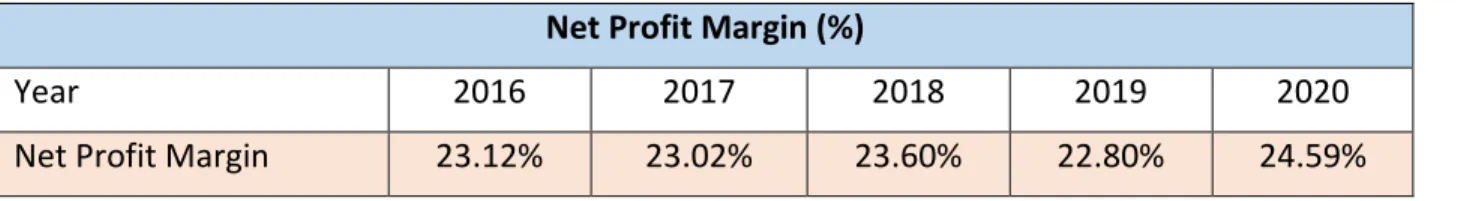

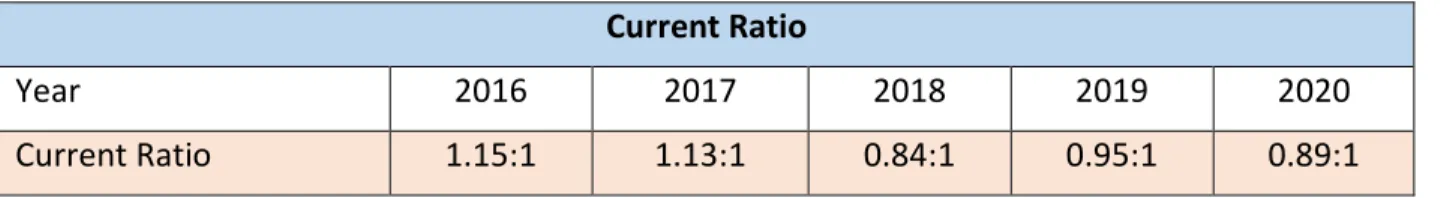

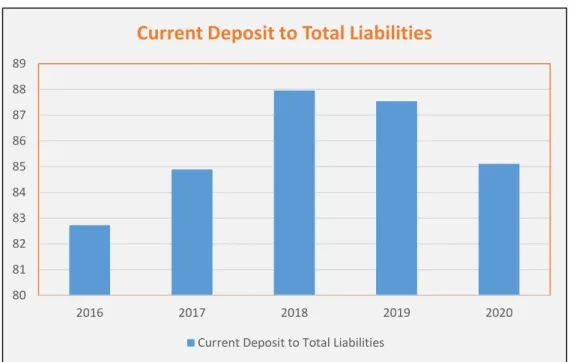

This graph shows that the bank's net profit margin was relatively stable over the 5-year period, but in 2019 there is a decrease in the net profit margin, which may be due to higher operating costs in that year. In 2020, however, the net profit margin increased by 1.79% compared to the previous year, which is a good sign for the bank. Current ratio indicates the bank's ability to pay its current liabilities through its current assets.

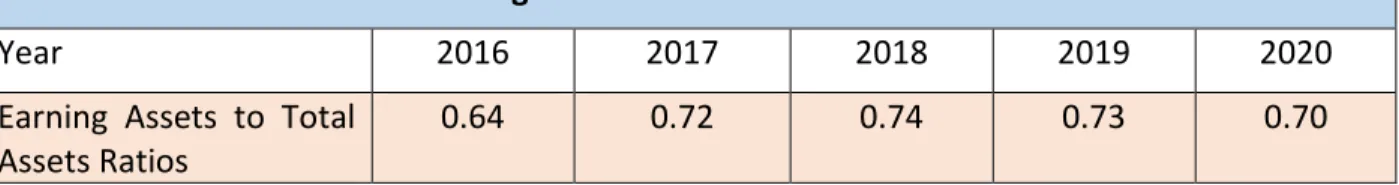

The current ratio of Jamuna Bank Limited shows a downward trend which is a worrying sign for the bank. If the ratio is too high, it means that the bank may not have enough liquidity to cover any contingencies. Conversely, if the ratio is too low, the bank may not be earning as much as it could be.

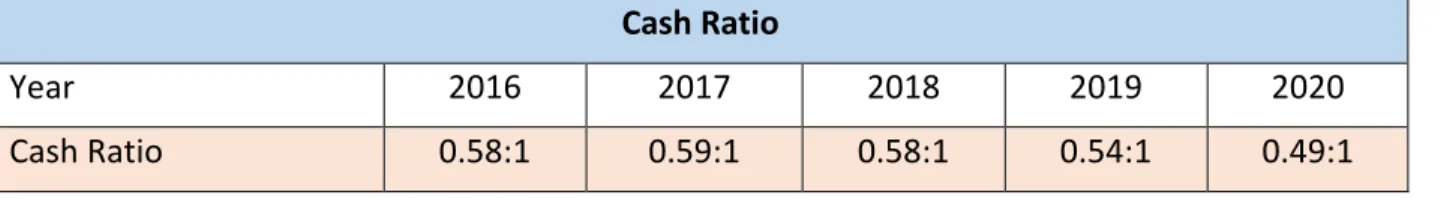

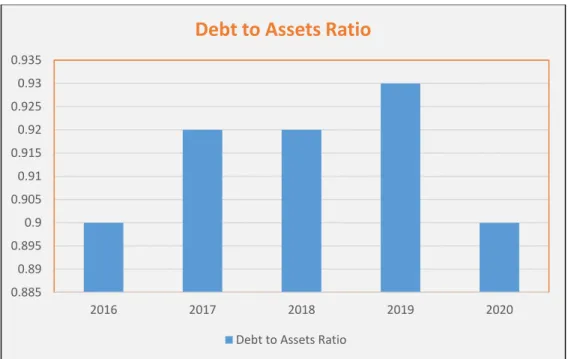

The chart shows that JBL's cash ratio is declining, which is not a good sign for the bank. If the bank relies solely on debt financing, it will need to raise more cash flows to meet its obligations. A higher equity multiplier means that the bank relies more on debt to fund its assets.

Higher multiplier ratios are risky for the bank because they indicate that more assets were financed with debt to pay for banking operations. However, JBL maintains a 5-year average P/E ratio of 5.91, which is good for bank investors.

Findings and Recommendations

Findings regarding overall financial position of the bank

In terms of operating income and operating profit, 2019 was the best year for Jamuna bank during the five-year period from 2016 to 2020. Because the bank records its highest operating income and operating profit in that year, which is 11,439.53 and 5,841.84 million taka respectively. Net profit after tax was the highest (in million taka) over the five-year period and also shows an upward trend over that period.

Although it fell by 13.45% in 2017 compared to the previous year, the bank's total investments increased. There has been growth in the number of employees and the number of branches during the 5-year period from 2016 to 2020.

Findings specific to ratio analysis

Recommendations for JBL

Conclusion

It started with the vision of being the most efficient financial intermediary in the country and believes that the day is not far away when it will achieve its desired goal. Therefore, it has adopted new technologies to make every part of the bank more transparent to central management. It has reduced processes that used to take hours to complete, but can now be done in minutes.

However, in recent times, the banking sector has continued to face challenges such as rising bad loans, excess liquidity, lower capital adequacy, etc. By introducing innovative ideas and new technology, Jamuna Bank always strives to be the best. If this continues, I hope Jamuna Bank Limited will develop further in the future.