REPAYMENT PERFORMANCE OF FARMERS:

MADAGASCAR STUDY

ARIESKA WENING SARWOSRI

GRADUATE SCHOOL

BOGOR AGRICULTURAL UNIVERSITY BOGOR

STATEMENT OF THESIS, SOURCE OF INFORMATION AND

COPYRIGHT*

I hereby declare that master thesis entitled “Repayment Performance of Farmers: Madagascar Study” is my work under the direction of the advisory committee and has not been submitted in any form to any other universities. Sources of information derived or quoted from works published and unpublished by other authors have been mentioned in the text and listed in the References at the end of this master thesis.

I hereby assign the copyright of my master thesis to the Bogor Agricultural University.

Bogor, February 2016

Arieska Wening Sarwosri

H 351130571

SUMMARY

ARIESKA WENING SARWOSRI. Repayment Performance of Farmers: Madagascar Study. This master thesis is under SUHARNO and NUNUNG KUSNADI supervision.

The initial microfinance institution(MFI) was established with the noble aim of poverty eradication, thus MFIs were operated with donor and subsidies from both the government or NGO. However there are facts that MFIs were urged to acquire their financial sustainability as well as become more commercial and profit oriented. In this circumtances, MFI might dismiss or applied the credit rationed for specific types of borrowers which expected to have bad repayment performance.

Farmers are disadvantages due to the high risk of farming business as well as the seasonality of income. Those might influence their eligibility in acquiring loan. Notwithstanding omitting farmers from the MFI is not wise since they are abundant in numbers, a fact which makes them to be potential candidate of borrowers. Madagascar, a country in which this study conducted are poor country with 35.54 percent of them are farmers. There is a gap of study regarding repayment performance of farmer borrowers in Madagascar, therefore farmer borrowers which expected to have bad performance are still receiving low share of loan disbursement.

Therefore, the objectives of thismaster thesisare giving information whether farmers are more risky borrowers compare to non-farmer borrowers and givingmore detail information of which farmers that are more risky especially by sector and by genderin commercial MFI. The underlying data set was derived from AccèsBanque Madagascar (ABM) which covers 53,258 observations from the year 2007 to 2012. The punctuality of payment include short arrears (1 day of arrears) and longer arrears (30 days of arrears) were used to indicate the reliability and commitment of the farmer borrowers toward the due date of installment as well as the capacity of the borrowers to settle their debt. Logit was employed to model the effect of the variable farmer; farmer by gender: woman and man farmer; farmer by sector: cultivation farmer and animal farmer.

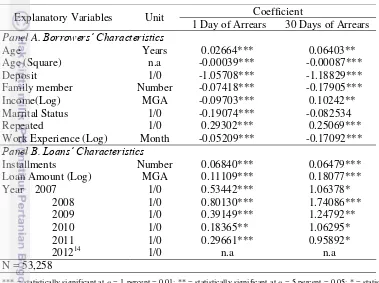

The findings of this master thesis include: the variable “farmer” have positive and significant effect, indicating that farmer borrowers are less reliable and have poor commitment toward their due date of installment. Yet variable farmer is not statistically significant at 30 days of arrears, indicating that farmer and non-farmers borrowers share the same risk of having 30 days of arrears. This findings clarify the common assumption that farmer borrowers perform bad repayment performance. This finding do not confirm the empirical previous studies regarding repayment performance which found that farmers are better than non-farmers. Therefore it contributes to the knowledge of repayment performance by giving new insight that the hypothesis of farmers‟ repayment performance is not can not be concluded generally. For more comprehensive discussion, the

to man farmer. Yet those two groups dhare the same risk of 30 days of arrears, indicating that woman and man farmer have the same capacity in settling the

installment.Finally, the findings of “farmer by sectors” are cultivation farmer are

statistically significant in influencing 1 day of arrears and 30 days of arrears. Those finding indicate that cultivation farmer are not only less reliable and have poor commitment toward the due date of installment but also have bad reayment performance. In the other hand, although the effect of animal farmer are not statistically significant affecting the arrears, but it showed negative effect.

Unexpectedly, almost all of the variables which are part of borrowers‟ and loans‟ characteristics are statistically significant. This finding lead to the idea that

MFI should pay attention on borrowers‟ and loan characteristics. The

characteristics of the borrowers and loan often become the guidance of the commercial MFI to asssess the eligibility of farmer, yet the fact is those are also influence the repayment perfromance. Therefore, MFI should not neglected the

consideration of borrowers‟ and loans‟ characteristics beyond the grouping system

of “borrowers type”.

The application of the study finding is limited on borrowers of commercial MFI which located in the country with similar social-economics condition. The repayment performance report will be necessary for further loan allocation and for delinquency handling. In addition, the repayment performance could be the successfulness indicator in order to give an overview regarding the effect of loan accessibility as one of development and empowerment on the prosperity of farmers.

RINGKASAN

ARIESKA WENING SARWOSRI. Repayment Performance of Farmers: Madagascar Study. Dibimbing oleh SUHARNO dan NUNUNG KUSNADI.

Pada awalnya institusi mikrokredit didirikan untuk membantu mengurangi kemiskinan, sehingga institusi ini mendapatkan bantuan dari pemerintah dan juga

non-government organization (NGO). Seiring dengan perkembangannya, institusi mikrokredit didorong untuk mampu bertahan secara finansial dalam jangka waktu yang lama; institusi mikrokredit juga menjadi lebih komersial dan berorientasi pada keuntungan. Pertimbangan-pertimbangan tersebut bisa jadi menjadi faktor pendorong bagi institusi mikrokredit untuk tidak mengindahkan calon peminjam yang dianggap akan mempunyai pola pembayaran yang bermasalah.

Petani menjalankan bisnis yang berisiko dan umumnya pendapatan mereka adalah pendapatan musiman yaitu pada saat musim panen datang. Hal tersebut mungkin akan mempengaruhi kelayakan petani di mata institusi mikrokredit terkait dengan upaya mereka untuk mendapatkan kredit. Namun demikian, mengesampingkan petani sebagai calon peminjam bukan merupakan tindakan yang bijaksana karena petani jumlahnya sangat banyak. Madagaskar, yaitu negara dimana penelitian ini dilaksanakan merupakan negara miskin dengan 35,54 persen penduduknya adalah petani. Hasil penelitian berkaitan dengan pola pembayaran petani di Madagaskar belum tersedia dan mereka dianggap tidak mempunyai pola pembayaran yang bagus sehingga mendapatkan porsi yang kecil pada institusi mikrokredit.

Dengan demikian, master tesis ini bertujuan untuk memberikan informasi dengan menjawab pertanyaan apakah benar petani akan menjadi peminjam yang berisiko berkaitan dengan pola pembayaran. Lebih jauh lagi, master thesis ini akan membahas lebih detail mengenai karakter petani terutama berdasarkan jenis kelamin dan sektor pertanian. Penelitian dilakukan di institusi mikrokredit komersial, yang artinya institusi tersebut tidak mendapatkan donor dari pemerintah maupun NGO. Data didapatkan dari AccèsBanque Madagascar (ABM) dengan observasi sebanyak 53.258 pada tahun 2007 sampai 2012. Ketepatan petani dalam membayar akan menjadi indikator untuk menentukan baik atau buruknya pola pembayaran petani. Indikator tersbut meliputi 1 hari keterlambatan dan 30 hari keterlambatan untuk melihat reliabilitas dan komitment petani pada tanggal jatuh tempo yang telah ditentukan serta mengatahui kemampuan petani untuk membayar angsuran.

Diskusi yang lebih lengkap meliputi pengaruh variable petani yang dikolaborasikan dengan pengaruh jenis kelamin dan sektor pertanian pada pola pembayaran peminjam. Temuannya adalah peminjam petani wanita tidak reliabel dan komitmen pada jatuh tempo angsuran seperti terlihat pada hubungan positif variabel tersebut pada keterlambatan 1 hari secara statistik. Namun demikian, peminjam petani wanita tidak terkait pada keterlambatan 30 hari. Akhirnya,

temuan “petani berdasarkan sektor” adalah petani tanaman secara statistik

berpengaruh pada 1 hari dan 30 hari keterlambatan. Temuan ini mengindikasikan bahwa petani tanaman tidak reliabel dan komitmen terhadap jatuh tempo angsuran serta menunjukan pola pembayaran yang buruk. Di lain sisi, petani yang berbasis usahatani hewan (peternakan dan perikanan) menunjukkan hubungan yang negatif pada 1 hari dan 30 hari keterlambatan walaupun secara statistik tidak terbukti.

Tanpa diduga, ternyata hampir semua variable yang termasuk pada

“karakter peminjam” dan “karakter kredit” mempunyai pengaruh yang signifikan

secara statistik. Institusi mikrokredit tidak bisa mengacuhkan karakter peminjam dan karekter kredit. Karakter peminjam dan karekter kredit seringkali menjadi acuan untuk menetapkan kelayakan peminjam dan ternyata hal tersebut juga berpengaruh pada pola pembayaran. Dengan demikian, MFI sebaiknya tidak mengacuhkan karakter peminjam dan kredit di luar pembagian tipe-tipe peminjam.

Penerapan hasil dari penelitian ini terbatas pada peminjam pada komersial institusi mikrokredit yang terletak pada negara dengan kondisi sosial ekonomi yang mirip. Informasi mengenai pola pembayan penting untuk keputusan alokasi kredit dan penanganan keterlambatan. Pada bahasan yang lebih luas lagi, informasi mengenai pola pembayaran petani bisa menjadi indikator keberhasilan program pembangunan pada kesejahteraan petani berdasarkan asumsi bahwa jika petani tersebut sudah sejahtera maka mereka akan menunjukkan pola pembayaran yang bagus.

©

All Rights Reserved by Bogor Agricultural University, 2016

Copyright Reserved by Law

It is prohibited to quote part or all of this paper without including or citing the source. Quotations are only for purposes of education, research, scientific writing, preparation of reports, critics, or review an issue; and those are not detrimental to the interests of the Bogor Agricultural University.

Master Tesis

as one requirement to acquire the degree of

Magister Sains

in Agribusiness Study Program

REPAYMENT PERFORMANCE OF FARMERS:

MADAGASCAR STUDY

GRADUATE SCHOOL

BOGOR AGRICULTURAL UNIVERSITY BOGOR

2016

External Examiner :Dr Ir Netti Trinapilla, MM

ACKNOWLEDMENT

This master thesis will not be accomplished without helping from several people who are involved. This master thesis was used both in Bogor Agricultural University-Indonesia and Georg-August-Universität Göttingen-Germany since the

author‟s study program is Joint Degree Program between these two universities.

Theferefore, sincerely gratitudes from the author are addressed to Dr. Ir. Suharno, MAdev; Dr. Ir. Nunung Kusnadi, MS; Prof. Dr. Oliver Musshoff, Ulf Römer through their participation and kind helps during the writing process.

An honor also adressed to LPDP (Lembaga Pengelolan Dana Pendidikan), Ministry of Finance since the author accomplished her master degree education by their scholarship granting.Finally, deep gratitudes also addressed for the author‟s parents, sister, families, friends and for any silent support. This master thesis is expected to have the benefits as already stated study objectives. Any critique and suggestions regarding the cotent for better working in the future are well welcomed by the author as she can be reached in [email protected].

Bogor, February 2016

LIST OF CONTENTS

LIST OF TABLES xiv

LIST OF FIGURES xiv

LIST OF APPENDICES xiv

LIST OF SYMBOLS xv

LIST OF ABBREVIATIONS xv

1 INTRODUCTION 1

Background 1

Problem Statement 3

Research Objectives 5

Benefit of Studies 5

Scope and Study Limitation 6

2 LITERATURE REVIEWS 6

Microfinance and Farmer Borrowers 6

Farmer Borrowers : by Gender and Sector 7

3 FRAMEWORK 9

Empirical Framework 10

Theoretical Framework 11

Operational Framework 13

4 RESEARCH METHOD 14

Dependent Variable 14

Explanatory Variables 15

Estimation Model 18

5 DATA AND DESCRIPTIVE STATISTICS 20

Data 20

Descriptive Statistics 21

6 RESULT AND DISCUSSIONS 23

Repayment Performance: Type of Borrowers 23

Repayment Performance: Control Explanatory Variables 25

Discussion and Policy Implications 27

7 CONCLUSSION AND SUGGESTIONS 29

Conclussion 29

Suggestions 29

REFERENCES 30

APPENDICES 34

LIST OF TABLES

1. Share of Woman Borrowers in Top 5 Madagascar MFI 4

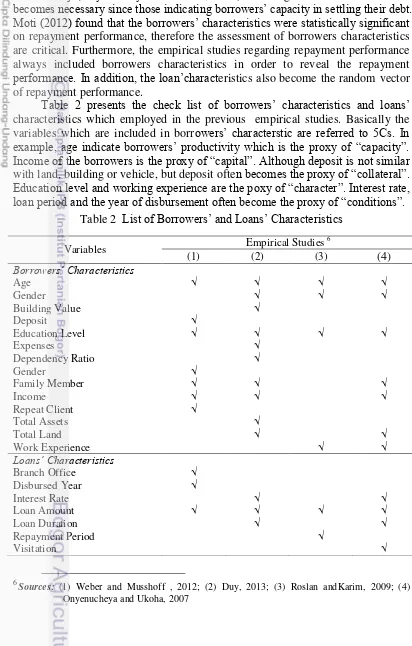

2. List of Borrowers‟ and Loans‟ Characteristics 12

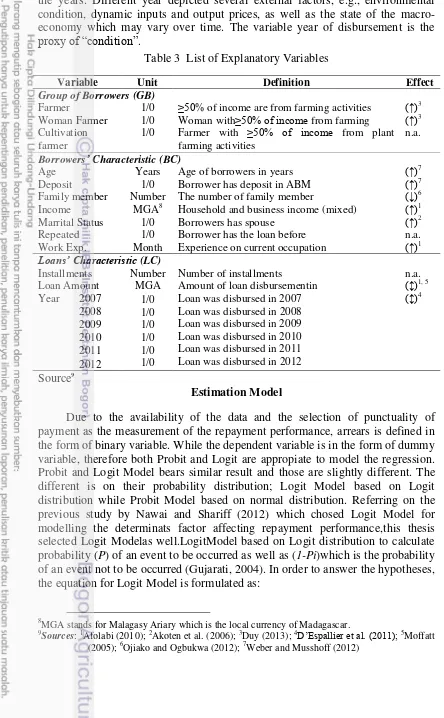

3. List of Explanatory Variables 18

4. Descriptive Statistics 22

5. Repayment Performance based on Type of Borrowers 25

6. Control Explanatory Variables 27

LIST OF FIGURES

1. Microfinance Distributions among Regions 1

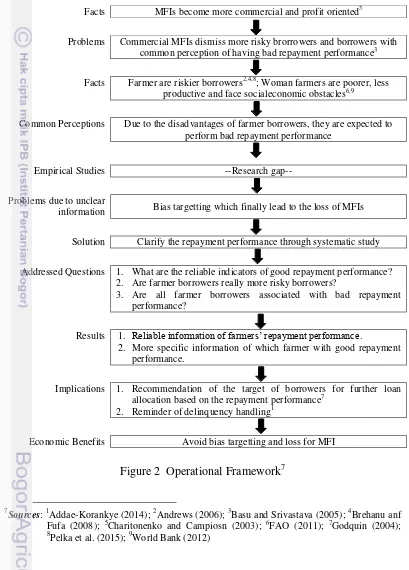

2. Operational Framework 13

LIST OF APPENDICES

1. Logit Regressin: Farmer 1 Day of Arrears 34

2. Logit Regressin: Farmer by Gender 1 Day of Arrears 35 3. Logit Regression: Farmer by Sector 1 Day of Arrears 36 4. Logit Regression: Farmers 30 Days of Arrears 37 5. Logit Regression: Farmers by Gender 30 Days of Arrears 38 6. Logit Regression: Farmers by Sector 30 Days of Arrears 39 7. Logit Regression: Control Variables on 1 Day of Arrears 40 8. Logit Regression: Vontrol Variables on 30 Days of Arrears 41

LIST OF SYMBOLS

α = significant level

βo = intercept

β1, β2, β2 = parameter vector

i = observation i Li = logistic

P = probability

u, ε = disturbance or error term

x = explanatory variables

Y = dependent variable

LIST OF ABREVIATIONS

ABM = AccèsBanque Madagascar

BC = Borrowers‟ Characteristics

CECAM = Caisses d‟Epargne et de Credit Agricole Mutuels FAO = Food and Agricultural Organization

IMAGES =Intervention with Microfinance for AIDS and GenderEquity LOC = Loans‟ Characteristics

MFI = Microfinance Institutions MGA = Malagasy Ariary

MIS = Management Information System MIX = Microfinance Information Exchange NGO = Non-Governmental Organization SSA = Sub Saharan Africa

14% 3%

34% 16%

10% 23%

South Asia Middle East

Latin America &Caribean Eastern Europe & Central Asia East Asia & Pacific

Africa

1

INTRODUCTION

The chapter “Introduction” presents the background of the study which

mostly contains the overview of microfinance issue in general and some consideration that need to be addressed regarding commercial MFI and the farmer borrowers. It is then continued with the problem statement which discusses the importance of the repayment performance report for microfinance. Afterwards, research objectives is presented and followed by the benefit of study. Finally, the last part of this chapter is the scope and limitation of the study.

Background

The initial MFIs mainly attempt to give financial access to the poor as the very firstMFIwhich established in Bangladesh in 1983 was aimed to escape the poor people who trapped in informal moneylender. Muhammad Yunus started microfinance by serving 42 people and hardly convinced local bank to support his movement, but afterwards it turned into a formal bank which called Grameen Bank (Yunus, 2004). Since the focus of MFIs was poor people, this type of bankings were well-developed especially in developing countries, showed terrific growthand became the poverty eradication programs for many countries (Morvant-Roux, 2011; United Nations, 2013). Imai et al. (2012) found that the growth of loan portfolio was significantly correlated with the depression of poverty and income disparity in developing countries. Further, microfinance becomes tools for development projects such as women empowerment (Roxin et al., 2010; Kim et al, 2007).

Based on the noble aim of MFIs in helping the poor, they try to increase the number of clients and the coverage as well as pay more attention to the types of borrowers based on the socioeconomics conditions of the borrowers (Lafourcade et al., 2005). Microfinance Information Exchange (MIX) listed that there were 866 MFIs in the world which serve around 90 million of active borrowers. The distribution of MFIs across regions can be seen in Figure 1.

Figure 1 Microfinance Distributions among Regions1

1

2

In Africa, microfinance was initiated in the early of 90s and often associated with economic growth and poverty eradication. Africa was the poorest continent among all of the continents in the world, as 46.80 percent of people there were under income poverty line (WB,2012). UnitedNations (UN) reported that economic development of Africa depends on small enterprises, but they face obstacles which is lack of finance access (Buckley, 1997). MFIs therefore were established to give them an access to finance (United Nations, 2013). There are 196 MFIs operating in Africa (MIX2) and there are four types of MFIs: Non-Bank Financial Intermediaries, Bank, Non-Governmental Organization (NGO) and Credit Union / Cooperatives (MIX, 2010). MFIs in Africa serve both lending and saving, they gained low profitability but showed high outreach in terms of number of clients that can be served per staff member and low average portfolio at risk (Lafourcade et al., 2005).

However, MFIs should have long term sustainability if they want to be a solution of poverty eradication, thus they are expected to have good financial performance rather than merely depends on donor and subsidies. Moreover, there is trade off between the outreach of MFIs and the efficiency (Hermes et al., 2011). Thus, focus merely to the poor borrowers which often associated with bad repayment performance harms the effort of MFIs in gaining the financial sustainability. In addition there is a concern that MFI become more commercial, put profit as their uppermost heading and do the expansion i.e. move to the rural area in order to reach more clients since urban areas are to dense with other MFIs(Charitonenko and Campiosn, 2003). MFIs attempt to minimize losses or avoide extra expenditure in order to acquire maximum profit oriented(Dedu and Nechif, 2010).

In this circumtances, MFIs would concern on borrowers targetting and might dismiss poor borrowers which are suspected to perform bad repayment performance due to their disadvantages. Regarding MFIs, agriculture based borrowers which are small scale farmer is considered as a risky borrowers since agriculture often associated with many uncertainty and depend on several factors

that beyond farmer‟s control (Andrews, 2006). The price of input and output (yield) which are very dynamics lead to the income uncertainty. In addition there is long time gap between capital investment (planting) and capital return (harvesting). The seasonal income of farmers is not match with standard procedure of MFIs that require immediately payment after loan disbursement. Therefore farmers often got credit rationed (Weber and Musshoff, 2012), have to pay higher interest rate as the compensation of the risk (Duy, 2013) and got small portion of loan portfolio (Akudugu et al., 2009).

The concern of MFIs might dismiss poor farmer borrowers is not an empty myth without prove. Basu and Srivastava (2005) conducted a study of commercial MFI in rural India and revealed that commercial banks became the main source of rural finance in India; yet they only serve the richer among farmers and afterwards the poorest still suffer in accessing loan. This isssue become critical since almost half of African are poor people which might considered to have bad repaymnt performance. Whereas, repayment performance can no be assessed only by glance and based on common perception. The repayment performance should be

2

3 adrressed thoroughly based on reliable and valid indicator. Since farmers are more disadvantages and poorer, there are common perceptions that they have bad repayment performance. This untested belief might lead MFIs to omitt farmer borrowers from their target and loan allocation. Therefore the main discussion of this master thesis is about repayment performance of farmer borrowers. These groups of borrowers become interesting to be discussed based on the fact that major people in developing countries are farmer.

Regarding repayment performance of farmer borrowers; a study was conducted in Madagascar, a developing country in which farners are the main occupation. The study was conducted with set of data which derived fromAccèsBanque Madagascar (ABM), is the second largest MFI in Madagascar in term of loans amount. ABM started to concern on rural area in which majority of people in rural area are farmers. It was reported that in the year 2014, 25

percent of ABM‟s active borrowers were located in rural area3

.The ABM defines

“farmers borrowers” as the borrowers who acquire more than 50 percent of their

income from farming activities.

In order to give more comprehensive information, the discussion of farmer borrowers will include farmer by gender to know the effect of gender on repayment. Women often got benefit regarding loan accessibility under the concept of empowerment projects (Kim et al, 2007; Roxin et al., 2010)as well as support the MFIs to fulfil the target of outreach (Lafourcade et al., 2005). However as the MFIs become more comercial, the empowerment aims and outreach target might not be the main concern of MFI, thus the repayment performance as the proxy of their capacity of debt settlement should be reveald to avoid woman farmers; discrimination.

Finally, further discussion would be about farmer borrowers based on sector. The ABM divided the farmer borrowers into two, “cultivation farmer” and

“animal farmer”. “Cultivation farmers” are those who acquire ≥ 50 percent of

income from planting actifities. While “animal farmers” are are those who acquire

≥ 50 percent of income from animal related farming actifities such as poultry, rice cropping together with lack funding for spreading seed reduce the production of rice to 25 percent lower (ABM, 2013). Yield losses are the main problem of farming in Madagascar, those are driven by pest, disease, poor storage and weather problems (Harvey et al., 2014). Pelka et al. (2015) revealed thatrainfall during harvest impairs the production, this threaten is deemed as disadvantages

condition which lead to the consideration that credit risk of farmers‟ loan in

Madagascar is higher compare to loans which disbursed for non-farmer borrowers.

3

https://reports.mixmarket.org/mfi/acc%C3%A8sbanque-madagascar 4

4

These facts might impair the eligibility of the Madagascar small scale farmer regarding loan accessibility although the repayment performance of Madagascar farmers have not revealed yet. However, they are several empirical studies in other countries which argued that granting loan to farmers actually brings advantages for the MFI. Weber and Musshoff (2012) revealed that in Tanzania, farmers are indicated with good repayment performance since they are asssociated with more punctual installment compare to non-farmers borrowers. Duy (2013) found that 95 percent of farmers paid their installment and interest on-time while only 79percent of non-farmers borrowerd do. Finally, Raghunathan et al. (2011) also found that more farmers in a group lending are associated with higher repayment efficiency. In addition, since the numbers of farmers in Madagascar are abundant, dismiss them as the candidate of borrowers is not a wise decision. Therefore it is necessary to clarify whether farmers perform bad loan due to their unfavorable conditions.

Furthermore woman borrowers often have higher share on loan portfolio in many areas; e.g. 96 percent of the Grameen Banks clients are women (Yunus, 2004) and 73 percent of all borrowers in multi–countries study are female borrowers (D‟Espallier et al., 2011). Table 1 depicts the share of woman borrowers in top 5 of MFIs in Madagascar. Half of the active borrowers in Madagascar are women, on average. The discussion of gender becomes interesting since they are abbundant in number. In addition, most of the woman in Africa are working in agricultural sector.

Table 1Share of Woman Borrowers in Top 5 Madagascar MFI

Microfinance Institution Total Active worse than man farmers. Women‟s role as labor in agriculture hardly becomes an issue;however, there are social problems related with gender issues against woman farmers. In Nigeria the share of woman labors in agriculture remains high, but they lack rights in decision making regarding agricultural development (Ogunlela and Mukhtar, 2009) and in Senegal, only 3.5 percent of them are able to make contract farming (Maertens and Swinnen, 2012). African women farmers often become part-time workers as they work seasonally and get lower wage compare to men (FAO, 2011). In addition, although the roles of woman and man farmers are dynamics but woman hardly substitutes man farmers (Doss, 2001).Finally, they are poorer, less experience and less productive(FAO, 2011; WB, 2012).

5

5

However the empirical studies regarding women‟s repayment performance

remain unclear. Roslan and Karim (2009) found that in Malaysia women perform better repayment performance than men. D‟Espallier et al. (2011) also revealed that woman borrowers are associated with lower portfolio risk and write-off rate. In the other hand, Weber and Musshoff (2012) found that Tanzanian women perform worse repayment performance. The share of loan portfolio for women are huge but the repayment performance of them remain unclear. Since bias targetting will drive to the loss of MFIs thus the repayment performance of women borrowers should be discuss more thoroughly. Although the condition of Madagascar women farmers might be simillar with African women farmers which are more disadvantages andmight associated with bad repayment performance. Nevertheless omiting them from the microloan accessibility is inappropiate decision before the MFIs are well informed about their repayment performance.

Finally, those considerations regarding farmers‟ condition and their

repayment performance lead to the main question of whether the disadvantages of farmers borrowers lead to bad repayment perfromance. Afterwards this information is necessary in order to avoid bias targetting of commercial MFIs on candidate of borrowers. This question lead to several following questions include:

1. What are the reliable indicators of good repayment performance? 2. Are farmer borrowers really more risky borrowers?

3. Are all farmers borrowers associated with bad repayment performance?

Research Objectives

The main discussion of this master thesis regards to repayment performance of farmer borrowers with the objectives include:

1. To discuss the reliable indicator of good repayment performance.

2. To investigate whether farmers are more risky borrowers compare to non-farmer borrowers.

3. To provide more detail information of which farmers that are more risky especially by sector and by gender.

Benefit of Studies

This master thesis provides information about repayment performance of farmer borrowers. Repayment performance of borrowers often become the discussion of study regarding microfinance since repayment performance report are neccesarry for further loan allocation (Godquin, 2004). Further loan allocation should be discuss more carefully as bias targeting will drive MFIs into loss. Repayment performance also necessary for quick delinquency handling (Addae-Korankye, 2014), it could be soft warning for MFIs to take action regarding improvement of repayment performance.

6

farmers, women and woman farmers; then they will show good repayment performance. If the farmer borrowers are proven to have better repayement performance or share the same risk with mom-farmer borrowers regarding delinquency, thus farmer borrowers will get benefit by not excluded from loan allocation by commercial MFIs.

Scope and Study Limitation

This master thesis attempts to investigate the repayment performance of African farmer borrowers. In order to measure the repayment performance, a study was conducted in Madagascar ABM which is fully commercial MFI. The data was derived from Management Information System (MIS) of the MFI. Based on the definition given by the MFI, farmer borrowers are those who acquire >50 percent of their income from farming actifities.

There are several measurement of repayment performance, this master thesis use the punctuality of installment as the indicator of good repayment performance. The scope and limitation of the study is on the study result application. The repayment performance of farmers borrowers might be different on the non-profit MFI. The application of the result is also limited to other country which have simillar socio-economics condition.

2

LITERATURE REVIEWS

This chapter presents empirical literature reviews about repayment performance of farmer borrowers. Therefore it is divided into two parts; first part is literature review about microfinance for farmer borrower; second partdiscusses more detail about farmer borrowers by gender and farmer borrowers by sector.The hypotheses of this master thesis is developed by the empirical studies. The benefit of building the hypothesis from previous empirical study is to re-examine the findings that has not adequate yet to build a general inference. Finally there are three hypotheses which are proposed in order to investigate the repayment performance of farmers, farmers by gender and farmers by sector.

Microfinance and Farmer Borrowers

7 Regarding microfinance, agriculture has some characteristics which influence their eligibility of getting loan disbursement as well as their repayment performance. Those condition therefore resulting on the poor access of African farmer borrower to microloan. For example, in Ghana, shared of agriculture credit Rural Banks is only 26.24 percent on average (Akudugu et al., 2009). In Tanzania, farmer borrowers got credit rationed and they had 3 percent lower probability of accessing credit compare to non-farmer (Weber and Musshoff, 2012). However, Raghunathan et al.(2011) found that the efficiency of group lending scheme increased as the percentage of farmer borrowers inside the group increased. Morvant-Roux (2011) argued that if MFIs want to implement specific program

such as using farmers‟ production as collateral, the repayment performance of farmers would increase as well.

Regarding repayment performance of farmer borrowers, they are several previous empirical studies. Weber and Musshoff (2012)conducted a study in Tanzania to investigate whether agricultural firms have different delinquency with non-agricultural firm. They revealed agricultural firms show better repayment performance compare to non-agricultural firms since agricultural firms‟ probability of delinquent is 14 percent lower than non-agricultural firms. They argued that the prejudice of bad repayment performance due to risk exposition is not proven, in the inproper scheme of loan might be the trigger of bad repayment performance. Duy (2013)conducted study in Vietnam and found that almost all the loan which disbursed for farmer borrowers repaid on-time. The variable wich were statistically improve the repayment performance were level of education, gender (female borrowers) and the expected loan amount by the applicant.

Those previous empirical studies argued that bad repayment performance of farmers borrowers are actually only a common perception. Empirical studies revealed that farmer borrowers are negatively accosiated with delinquency. Those lead to the idea that farmers in Madagascar might manifest similar repayment performance which is better than non-farmer borrowers. Therefore the first hypothesis is:

H1 “Farmer Borrowers”:Repayment performance of farmerborrowers

isbetter than repayment performance of non-farmer borrowers.

Farmer Borrowers : by Gender and Sector

The discussion of gender regarding microfinance and farmers borrowers becoes necessary since the share of woman borrowers are high and most African women are working in agriculture sector. Shares of woman borrowers in microfinance are relatively high. In Sub Saharan Africa, 62 percent from total number of active borrowers of MFIs are women (MIX, 2010). A study in multi-countries by D‟Espallier et al. (2011) revealed that 73 percent out of borrowers are and almost all (96 percent) of the clients of Grameens‟ Bank are women (Yunus, 2004). Moreover, in low trust countries in which the information is usually delivered imperfectly and followed by the presence of high transaction cost, MFIs prefers women to be their clients (Aggarwal et al.,2015).

8

the clients of MFIs was driven by the idea that helping woman to have access to microfinance is believed to build better future of household sequentially (Yunus, 2004). Concerning women to participate in microfinance with the extent of women empowerand equality is important in MFIs projects since women are usually responsible for the income allocation especially for food and children education. Those arguments match with the basic idea of microfinance, help the poor. Second, including women to microfinance may also happen because MFIs

want to get good evaluation. One method to assess the outreach of MFIs is „depth‟

which means that MFIs are able to serve the most vulnerable group such as woman and very poor group (Lafourcade et al., 2005).

Third, including women in microfinance is related with repayment performance. Although women are indicated with shortage of property right for land, collateral ownership and decision; yet, women usually show better repayment performance. A research by Roslan and Karim (2009) revealed that in Malaysia, woman borrowers show better repayment performance compare to man

borrowers. D‟Espallier et al. (2011) also conducted a study about the relationship

between woman borrowers and microfinance among 70 countries and he found that by giving more opportunities for women to get loan disbursement would improve MFI‟s conditions that indicated by lower portfolio risk and write offs as well as higher profit.

However, African woman borrowers seem to manifest different condition. Hietalahti and Linden (2006) conduct a research to compare two groups of woman borrowers in southern part of Africa. First group was a group of poorest women; they were unskillful business runner and got low amount of loan. At the end of loan period, they were facing difficulties in repayment. Second group was a group of wealthier and more skillful women, yet they still performed bad loan repayment since there were problems of free rider among the members and income disparity. Further, a research in Tanzania by Weber and Musshoff (2012) revealed that woman borrowers perform higher installment default compare to man borrowers.

Anyhow, there are many development and empowerment programs for women in Africa. Under those specific programs, women are trained to run keep high repayment of loan and contribute in health issue (Pronyk et al.,2008).

9 decision making (Ogunlela and Mukhtar, 2009). In Senegal, the portion of woman labors in agriculture also remains high, but only 3.5 percent of woman are able to make contract farming (Maertens and Swinnen, 2012). In Malawi, 90 percent of women are part-time worker as they work seasonally and get lower wage compare to men (FAO, 2011).

Further, woman farmers have different conditions compare to man farmers in the term of productivity. Women perform lower productivity compare to men (FAO,2011; WB, 2012).It happens because women have little chance of mobility since they are under norms and culture limitation(Butt et al., 2010) and strong dependency to agricultural extension (FAO, 2011). In addition, Fletschner(2010) found that woman farmers are slower in adopting new technology, less competitive and risk averse compare to men.

In order to provide further information about woman farmer borrowers regarding microloan, examining their behavior regards to repayment performance is necessary. Since they are facing less favorable conditions compare to man farmer borrowers, hypothesis related with installment repayment performance for woman farmer borrowers in Madagascar is as follows:

H2 “Farmers by Gender”: Repayment performance of woman

farmerborrowers islower than repayment performance of men farmer borrowers.

In addition to more detail discussion regarding microfinance and type of farmers by sector, that are cultivation farmer or animal farmers. “Cultivation farmer” indicated farmers whose main activities of farming are related with

planting. While “animal farmers” are farmer whose main activities of farming are

related with animal. Plant grower have characteristic which embedded in agricultural business especially cultivation farmers i.e.seasonality. There‟s quite long time gap between capital investment(seed, fertilizer, employee, information, technology, etc) and capital returns (harvesting time).Since the characteristic of agriculture which is seasonality does not fit with MFI in general, then MFIs have to make specific policy to get deal with farmers‟ characteristic. For example, MFIs create loan product in the form of flexible loan to guard the enhancement of installment default (ABM, 2013; Field and Pande,2008). In flex loan, loan payment frequency is more flexible compare to standard loan. Regarding with the regularity of income, animal farmers are less seasonal and moreover the effect of weather is less affected compare to cultivation farmers. Therefore the third hypothesis is formulated as:

H3 “Farmers by Sector”: Repayment performance of cultivation farmers

islower than repayment performance of animal farmers.

3

FRAMEWORK

10

Each measurement of repayment performance will be followed by indicator which is based on empirical studies. The repayment performance could be assessed based on the punctuality of borrowers towards the due date, the amount of loan repaid and both of them. The theoretical framework discuss about the concept of 5Cs which are very common for the commercial bank, the concept of the 5Cs would be implemented to the commercial microfinance. Finally, the last part is the operational framework of how this master thesis was conducted.

Empirical Framework

On-time Installment

Basically, repayment performance of the borrowers of MFIs is assessed based on the behavior of the borrowers towards their installment. Several empirical research defined good repayment performance based on the purpose of the studies. Some empirical research stated that good repayment performance is indicated by on-time installment. Borrowers usually are categorized into two, those who repay on-time as the due date and those who do not repay on-time.

Raghunathan et al. (2011) use the “ratio of on-time installment” which calculated by dividing the number of on-time installment and total number of installment. With the ratio on-time installment as the dependent variable, those who have good repayment performance are the borrowers who have positive coefficient.

Weber and Musshoff (2012) use “ratio delinquency” which calculated by

dividing the number of loan with delinquent and the total number of installment.

With the “ratio delinquency” as the dependent variable, those who have good

repayment performance are the borrowers who have negative coefficient while a regression is applied. They use ordiary least square to model the repayment performance of farmer borrowers.

Finally, Godquin (2004) stated that the first level repayment performance of MFI could be achieved if 100 percent of the borrowers repay on-time (p. 1909). The definition of good repayment perormance as the borrowers repay on-time could be manifested in several indicators. He created dummy dependent variable with value 1 if the borrower repay on-time and 0 for otherwise. Probit was employed in order to know the repayment performance. the coefficient is expected to have positive sign to indicate good repayment performance.

Proper Amount of Installment

Several empirical studies prefer to use the proper amount of installment as the measurement of good repayment performance. This measurement could be

manifested into several indicators. Breahanu and Fufa (2008) use the “proportion

of credit repaid” which calculated by dividing the amount of loan repaid and the

total amount of loan. Afterwards the borrowers are grouped into three include non-defaulters which are those who repay properly, complete defaulters which fail to repay whole amount of installment and partial defaulters which are those who repaid part of the installment. The “proportion of credit repaid” is in the form of ratio, therefore the range is between 0 and 1, two-limit Tobit model was employed

11 variable, those who have good repayment performance are the borrowers who have positive coefficient.

Afolabi (2010) used the percentage of loan repaid as the dependent variable to measure the repayment performance. Ordinary Least Square (OLS) was employ to model the effects of several factors on the repayment performance. This study focused on the repayment performance of farmer and found that non-farm income as well as family size have negative coefficient; indicating that non-farm income and family size impair the repayment performance.

On-time and Proper Amount of Installment

Further, good repayment performance is not merely about on-time installment but also repay the overall amount of installment as agreed on the contract. Nawai and Shariff (2012) categorize the installment of borrowers into

three include: 1) “On-time installment” if the payment which is done as the due

date scheduled; 2) “Delinquent” which is occured if the installment is paid late or

if the borrowers do not pay the full amount of installment; 3) “Default” is defined as late payment more than three months. The dependent variable is presented in the form of dummy variable; y = 1 if the borrower paid on-time, y = 2 if the borrower have delinquency, y = 3 if the borrower perform default and Logit was employed. Higher probability of the borrower to repay the installment on-time is depicted with positive coefficient of the explanatory variable, vise versa.

Theoretical Framework

Several standards and requirements applied by the MFI for the agricultural

borrowers, yet in general 5Cs become the benchmark of the borrowers‟

characteristics. The 5Cs include: capacity, capital, collateral, character and

conditions (Gustafson, 1989). “Capacity” of the borrowers indicate the ability of

the borrowers to settle ther debt. Durguner (2007) argued that the repayment

capacity could be the proxy of the “borrowers capacity”. Regarding farmer

forrowers, the repayment capacity could be explained by the ratio of debt to asset

and the soil productivity. “Capital” refers to the financial condition of the small

firm which usually indicating by several health financial measurement. Capital could be indicated by liquidity (Durguner, 2007) and income which generated from investment (Ruiz-Vargas, 2000). “Collateral” indicating the assets which owned by the borrowers that can be used to be the guaranty of the loan. Collateral could be in the form of valuable assets such as land, building or even the yield of farming i.e. rice yield (Bouquet et al., 2009).The presence of collateral might not important for the non-profit MFI; yet for the commercial MFI, collateral is

neccesary regarding borrowers‟ eligibility. Moreover, Müller et al. (2014) argue that collateral is neccesary since collateral reduce the loan risk. “Character”

indicating the borrowers‟ characteristics which often becomes the consideration of

12

repayment performance of the borrowers, those might be include the interest rate and several macroeconomy conditions.

Regarding microfinance, the study of borrowers‟ repayment performance often bring together with the study of borrowers‟ eligibility reagarding loan

accessibility (Onyenucheya and Ukoha, 2007). The eligibilities of the borowers

becomes necessary since those indicating borrowers‟ capacity in settling their debt. Moti (2012) found that the borrowers‟ characteristics were statistically significant

on repayment performance, therefore the assessment of borrowers characteristics are critical. Furthermore, the empirical studies regarding repayment performance always included borrowers characteristics in order to reveal the repayment

performance. In addition, the loan‟characteristics also become the random vector

of repayment performance.

Table 2 presents the check list of borrowers‟ characteristics and loans‟

characteristics which employed in the previous empirical studies. Basically the variables which are included in borrowers‟ characterstic are referred to 5Cs. In

example, age indicate borrowers‟ productivity which is the proxy of “capacity”. Income of the borrowers is the proxy of “capital”. Although deposit is not similar

with land, building or vehicle, but deposit often becomes the proxy of “collateral”.

Education level and working experience are the poxy of “character”. Interest rate, loan period and the year of disbursement often become the proxy of “conditions”.

Table 2 List of Borrowers‟ and Loans‟ Characteristics

13

Operational Framework

Afterwards the benefit of borrowers‟ repayment performance is proper loan

allocation as the commercial MFIs want to avoid bias targetting which finally will drive to loss. In addition, it could be soft warning for MFIs to take action regarding improvement of repayment performance. There are several steps to address this objectives, thus a systematic step rearding repayment performance for loan allocation could be seen in Figure 2

Facts MFIs become more commercial and profit oriented5

Problems Commercial MFIs dismiss more risky brorrowers and borrowers with

common perception of having bad repayment performance3

Facts Farmer are riskier borrowers2,4,8; Woman farmers are poorer, less productive and face socialeconomic obstacles6,9

Common Perceptions Due to the disadvantages of farmer borrowers, they are expected to

perform bad repayment performance

Empirical Studies --Research gap--

Problems due to unclear

information Bias targetting which finally lead to the loss of MFIs

Solution Clarify the repayment performance through systematic study

Addressed Questions 1. What are the reliable indicators of good repayment performance? 2. Are farmer borrowers really more risky borrowers?

3. Are all farmer borrowers associated with bad repayment

performance?

Results 1. Reliable information of farmers‟ repayment performance.

2. More specific information of which farmer with good repayment performance.

Implications 1. Recommendation of the target of borrowers for further loan allocation based on the repayment performance7

2. Reminder of delinquency handling1

Economic Benefits Avoid bias targetting and loss for MFI

Figure 2 Operational Framework7

7

Sources: 1Addae-Korankye (2014); 2Andrews (2006); 3Basu and Srivastava (2005); 4Brehanu anf Fufa (2008); 5Charitonenko and Campiosn (2003); 6FAO (2011); 7Godquin (2004); 8

14

4

RESEARCH METHOD

The chapter “Research Methodology” is divided into three parts. First part is

dependent variable, which discusses the reasons of the selection of the dependent variables. Second part presents the list of explanatory variables as well as discuss the effect of each explanatory variables based on previous empirical studies. Third part is the Model Estimation, in this part the selection of statistic tool as well as the regression are presented.

Dependent Variable

The selection of the dependent variable to indicate the repayment performance is a critical point in determining the indicator of repayment performance. Here, the punctuality of the borrowers to settle their installment is selected to be the indicator of repayment performance. This indicator has advantage that is the ability to reveal the reliability and commitment of the borrowers toward the due date which already scheduled and informed at the loan disbursement. In this circumtance, those who are not reliable and do not have commitment will be indicated by short term of late payment (arrears). In addition, this indicator also could be used to reveal the capacity of payment; borrowers are considered to be incapable in settling the installment if the borrowers late or longer period of arrears.

One day of arrears could be an adequate indicator to depict the reliability and commitment of borrowers towards the due date of installment. Afterwards, 30 days of arrears could be an adequate indicator to depict the capacity of borrowers to settle their installment. 30 days of arrears become adequate since most of the installments are monthly payment. Thus, if the borrowers are deemed incapable on settling their debt if they paid their installment by at least 30 days late.

As the depedent variable, 1 day of arrears and 30 days of arrears arepresented in the form of dummy variable. In dummy, value 1 is given for such categories and 0 otherwise (Gujarati, 2004). The dependent variable is under the concept of dichotomous or binary model. In binary model, the dependent variable (Y) could be presented as Y = 1 refers to success and Y = 0 refers to failure (Wooldridge, 2002). Y could be formulated as:

P (x) = P (Y = 1 | x) = P (Y=1 | x1, x2, ..., xi) Eq. 1 where the probability of Y = 1 is denoted by P (x) based on Bernoulli probability distribution as written in (Eq.1); P (x) will be equal with conditional expectation of Y given x, denoted by E (Yi | Xi), then Y = 0 can be calculated by P (Y = 0) = 1

– P (Y=1 | x) = 1 – P (x). As the probability is always lied between 0 and 1; E (Yi |

Xi) would be 0 ≤ E (Yi | Xi) ≤ 1 as well. For Yas the dependent varibale is determined by one or several explanatory variables (independent variables); x is the series of explanatory variables whih include several explanatory variables of x

15 Later, this basic concept of binary variable is given to support the concept of analysis model that is selected.Therefore regarding the dependent variable which already selected, there are two dependent variables include:

Y = 1 if days of arrears ≥1; Y = 0 if otherwise Eq. 2

Y = 1 if days of arrears ≥30;Y = 0 if otherwise Eq. 3

The dependent variable Y which indicate 1 day of arrears, value 1 is given if the borrowers are being late for at least one day and value 0 if otherwise. Afterwards for 30 days of arrears, value 1 is given if the borrowers are being late for at least 30 days and value 0 if otherwise. One day of arrears and 30 days of arrears are a latent variable for indicating repayment performance. As the dependent variable, Y is determined by several explanatory variables. The explanatory variables are grouped into three, thus the function of Y could be formulated as:

Y = f (Ti, Bi, Li) Eq. 4

where Y is the latent variable for repayment performance; f denotes a function of how Y is determined. While T indicates the type of farmer borrowers. B is the borrowers characteristics and L indicates loans‟ characteristics.

Explanatory Variables

The variable farmer is also categorical variable, hence it is presented in the form of dummy variable. Afterwards, for more comprehensive discussion of farmers borrowers there will be additional regression which distinguish farmers into two groups based on gender: woman farmer and man farmer; and two groups of farmers based on sector: cultivation farmer and animal farmer.

Table 3 gives summary of explanatory variables and the definition of each variable which are used as the explanatory variables in this master thesis. In addition, there isinformation about the effect of each variable on repayment performance which is based on previous empirical studies. There are some possibilities of the effects: “improves” the repayment performance which is denotes by the sign (↑);“impairs” the repayment performance which is denotes by the sign (↓); “both improves and impairs”, this means that some studies reveal positive effect on repayment performance while other studies reveal negativeeffect on repayment performance. This is denotes by the sign (↕) and

“n/a” if the empirical previous studies did not find the influence of the variable on repayment perfromance or the variable has not be used in the previous study yet.

Although the variable farmer, woman farmer, man farmer, cultivation farmer and animal farmer are the main concern and discussion, yet there are several control explanatory variables which added. Those additional explanatory variables have advantages of supporting the need of regression model. Thus the

regression of borrowers‟s type always completed with the control explanatory

variables. However as already discussed in Chapter 2 regarding the importance of

borrowers‟ and loan‟s characteristics on repayment performance, the control

16

allocation. Therefore all the explanatory variables will be necessary to give more detail information about which farmer with good or bad repayment performance.

Farmer

The variable “Farmer” is in the form of dummy variable, value 1 if the

borrower is farmer and 0 if otherwise. Based on the definition given by ABM, farmer borrowers are those who acquire more than half of income from farming actifities.

Woman and Man Farmer

The variable “woman farmer” and “man farmer” are created as the

explanatory variables. Woman farmer is female and gain ≥ 50 percent of income

from farming actifities. While variable “man farmer” indicate male borrowers and gain ≥ 50 percent of income from farming actifities. These variables are included

in order to reveal the gender effect on the repayment performance.

Cultivation farmers and Animal Farmer

ABM distinguish farmers based on sector into two, cultivation farmer and animal farmer. Cultivation farmer are those who acquire ≥ 50 percent of income from planting actifities. While animal farmers are more about animal farming actifities such as husbandry and fisheries.

Age and Age Square

On the regression, the variable “age” is presented as age and age square.

Based on the theory, the effect of age will be in the form of diminishing return. Thus, age square is necessary in order to fullfil the mathematic requirement. Age

is included on the regression as it is a proxy of farmers‟ productivity which

indicate income. Regarding the concept of 5Cs, age is the proxy of “capacity”.

Deposit (Dummy)

The ownership of deposit often become the variable of borrowers eligibility

in accessing loan since deposit is proxy of candidate‟s worthiness and it is proved

that having deposit increase the loan accessibility (Akudugu et al., 2009). Deposit is included as the explanatory variable since the variable deposit is often considered as a proxy of “collateral”.

Family Member

The presence of family supports the accumulation of household income that ultimately leads to better repayment performance. Moreover, it is also common for small scale farms to utilize family members as labor; thus, having more family members means having more sources of working capital instead of more burden.

Therefore, the variable family member is the proxy of “capital” .

Income

17 could not be distinguised to be household income or farming business income.

Income is the proxy of “capital”.

Marrital Status

Marrital status is included as the explanatory variables since marrital status could be a proxy of combined income and/or a spouse as a guarantor. The finding might be neccesary regarding further loan allocation whether the MFI will disbursed loan for borrower with married status or not. Regarding the 5Cs concept,

the variable marrital status could be the proxy of “capital” as well as “character”.

Repeated Borrower

The variable “repeated borrowers” means that the borrower is not the new

client, since he already have the loan before his current loan. Repeat borrowers are very normal for the MFIs. Repeat borrowers often expected to be positively associated with good repayment performance. Weber and Musshoff (2012) however did not find the statistically significant effect of repeated borrowers. Normally, if the MFI found that the borrower have goog repayment performance, thus the MFI will disbursed the recurring loan. Repeat borrower could be the

proxy of “character”.

Work Experience

Work experience is the proxy of repayment capacity since work experience indicate the accumulation of wealth, productivity and income. Therefore Afolabi (2010) reveal that work experience improve the repayment capacity by increasing the percentage of installment payment. Regarding the 5Cs concept, the variable

work experience could be the proxy of “capacity”.

Installment

The variable “installment” indicates the number of installment. Microloan

usually a short term credit, yet the loan duration is different among borrowers. Therefore, this variable is included to reveal the information of whether the longer or the shorter loan period which able to improve the repayment performance. Regarding the 5Cs concept, the variable installment could be the proxy of

“conditions” since here, the effect of how the number of installment would effect

the repayment performance will be revealed.

Loan Amount

Loan amount is included to the model since this variable is necessary reagarding loan allocation decision. It is important to know whether higher loan amount would associate with better repayment performance or not. If the borower have the capacity to repay, the variable should not have effect on repayment.

Therefore this variable is the proxy of “capacity”. However, it could be the proxy

of “condition” as well since how loan amount influence the repayment

performance will be revealed.

Year of Disbursement

18

the years. Different year depicted several external factors, e.g., environmental condition, dynamic inputs and output prices, as well as the state of the

macro-Income MGA8 Household and business income (mixed) (↑)1

Marrital Status 1/0 Borrowers has spouse (↑)2

Repeated 1/0 Borrower has the loan before n.a.

Work Exp. Month Experience on current occupation (↑)1

Loans’ Characteristic (LC)

Installments Number Number of installments n.a.

Loan Amount MGA Amount of loan disbursementin (↕)1, 5 payment as the measurement of the repayment performance, arrears is defined in the form of binary variable. While the dependent variable is in the form of dummy variable, therefore both Probit and Logit are appropiate to model the regression. Probit and Logit Model bears similar result and those are slightly different. The different is on their probability distribution; Logit Model based on Logit distribution while Probit Model based on normal distribution. Referring on the previous study by Nawai and Shariff (2012) which chosed Logit Model for modelling the determinats factor affecting repayment performance,this thesis selected Logit Modelas well.LogitModel based on Logit distribution to calculate probability (P) of an event to be occurred as well as (1-Pi)which is the probability of an event not to be occurred (Gujarati, 2004). In order to answer the hypotheses, the equation for Logit Model is formulated as:

8

MGA stands for Malagasy Ariary which is the local currency of Madagascar. 9

19

Li = �� ��

1−��= β0+ β1Xi+ εi Eq. 5

(L) is dichotomous variable. β0as well asβ1 are parameter and X is explanatory variable. εindicates disturbance or error term.Refers to Logit Model in (Eq. 5) and the function of repayment performance in (Eq 4), the equation of Logit model:

�� 1−���� = Yi = β0+ β1TBi + β2BCi+β3LOCi+ ui Eq. 6

where the natural log (ln) is given in order to make the model linear both in terms of parameters and variables. The probability of arrears to be occurred is indicated by P for a borrower i. Yiindicates the probability of arrears to be occurred and β0 is intercept. Parameter is denoted asβifor the vector variables. The explanatory

variables aretype of borrowers (TBi) which include farmer in general, woman

farmers, man farmers, cultivation farmers or animal farmers; borrowers‟ characteristics (BCi)which include include age, deposit ownership, family

members, income, marrital status, repeated status and work experience; and loans‟ characteristic (LOCi) which include include the number of installments, loan

amount and the year of loan disbursement start from 2007 to 2012. The error term is denoted by u which is assumed to be normally distributed and homoscedastic.

In order to reveal the effect of the type of borowers on the arrears, the regression will be done separately based on the type of borrowers. Thus there will be six regression which focus on the type of borrowers, therefore consider BC and

LOC as the control variables. Further, there will be additional regression in order to reveal the effects of BC and LOC on arrear. In total, there will be eight regression, include:

1. The effect of farmer borrocwers on 1 day arrears

Y1 day arrears = β0+ β1Dummy_Farmer + β2BCi+β3LOCi+ ui

2. The effect of farmer by gender on 1 day arrears

Y1 day arrears = β0+β1D_WomanFarmerβ2D_ManFarmer+β3BCi+β4LOCi+ui

3. The effect of farmer by sector on 1 day arrears

Y1day arrears=β0+β1D_PlantGrower+β2D_AnimalFarmer+β3BCi+β4LOCi+ui

4. The effect of farmer borrocwers on 30 days arrears

Y30days arrears=β0+β1Dummy_Farmer+β2BCi+β3LOCi+ui

5. The effect of farmer by gender on 30 days arrears

Y30days arrears=β0+ β1D_WomanFarmer+β2D_ManFarmer+β3BCi+β4LOCi+ ui

6. The effect of farmer by sector on 30 days arrears

Y30days arrears=β0+β1D_PlantGrower+β2D_AnimalFarmer+β3BCi+β4LOCi+ ui

7. The effect of borrowers‟ and loans‟ characteristics on 1 day arrears

Y1 day arrears = β0+ β1BCi+β2LOCi+ ui

8. The effect of borrowers‟ and loans‟ characteristics on 30 days arrears

Y30 days arrears = β0+ β1BCi+β2LOCi+ ui

20

(Gujarati 2004, p. 148). Therefore, log transformation will be applied for the skewed explanatory variable.

Logit Regression Interpretation

The interpretation of Logit model regression can be simply look for the sign of the coefficient to know the direction effect of the explanatory variabes on the dependent variable since the sign of the coefficient show the estimated slope of the variable. However, if the magnitute of the effect is neccesary to be explained, using the value of the coefficient might not be too attractive since the Logit model is in the form of log. Therefore for regression model such as Logit, the odds ratio should be included for more appealing interpretation of Logit model (Jann and Long, 2010).

The odd ratio can be derived by calculating the antilog of the coefficient, this can be done simply with the calculator or in Stata Program could be done by giving

the command of “logistic” instead of “logit” while making the regression. By

having the value of the odd ratio thus the percentage of change in the odds for an increase of a unit in the explanatory variable could be calculated by substract the odd ratio by 1 and multiply by 100 percent (Gujarati, 2004, p. 602)

5

DATA AND DESCRIPTIVE STATISTICS

The chapter “Data and Descriptive Statistics” is divided into two parts. First part contains information about the location, institution in which the study conducted as well as the data preparation. Second part contains information about the descriptive statistics.

Data

Research Location

This master thesis was conducted with country focus in Madagascar. Madagascar is a low income country with gross national income per capita is 440 $ (PPP in the year 2013) which is located in southeastern of Africa. There, 75.3 percent of the population live under poverty line income (World Bank10). The pioneer of MFIs in Madagascar was Caisses d‟Epargne et de Credit Agricole Mutuels (CECAM) which was emerged under the NGO subsidies (WB, 2005).

CECAM‟s program was microcredit which was based on inventory credit concept

in which the borrowers used stock as the collateral, for example: the farmer could use their crop yield (i.e. rice) as inventory collateral (Bouquet et al., 2009).

In Madagascar, MFIs was aimed to contribute in increasing the performance of small informal enterprises through finance access, yet, only 14 percent of household were able to get microloan (Gubert and Rouband, 2011). There are 16 MFIs in Madagascar and CECAM is number one MFI in terms of the number of borrowers, as it serving around 51 thousand borrowers, though MicroCred Madagascar is number one in terms of total-loan amount (138.4 Million US$).

Research Institution

10