FAKTOR- FAKTOR YANG MEMPENGARUHI PERTUMBUHAN EKONOMI DI INDONESIA PERIODE 1981-2014

PENDEKATAN ERROR CORRECTION MODEL

UNDERGRADUATE THESIS

Written by: NADYA ROSE .P

20130430276

FACULTY OF ECONOMICS AND BUSINESS

INTERNATIONAL PROGRAM FOR ISLAMIC ECONOMICS AND FINANCE (IPIEF)

FAKTOR- FAKTOR YANG MEMPENGARUHI PERTUMBUHAN EKONOMI DI INDONESIA PERIODE 1981-2014

PENDEKATAN ERROR CORRECTION MODEL

UNDERGRADUATE THESIS

In partial fulfillment for the requirement for the degree of Bachelor of Economics

(Sarjana Ekonomi) at International Program for Islamic Economics and Finance

(IPIEF), Economics Department

Written by: NADYA ROSE .P

20130430276

FACULTY OF ECONOMICS AND BUSINESS

INTERNATIONAL PROGRAM FOR ISLAMIC ECONOMICS AND FINANCE (IPIEF)

Name : Nadya Rose .P

Student Number : 20130430276

I declared that this undergraduate thesis entitled “The Factors Influencing Economic Growth in Indonesia Period 1981-2014, Error Correction Model Approach” does not consist of any content that ever being proposed for any degree in other university, ideas of any research and publication of others, in exception all quotes and ideas which are purposely taken are considered as the research references and listed in the reference list. Therefore, if any violation of intellectual right is found in this study, I agree to accept any relevant academic consequences.

Yogyakarta, March, 18th 2017

Good to People. Being Good to People is a Wonderful Legacy to Leave Behind –

This Undergraduate Thesis I dedicate to my beloved parents, my sister Alya, and

In the name of Allah, the most Merciful, the most Gracious. All praise is due to Allah; we praise Him, seek His help, and ask for His forgiveness. I am thankful to Allah, who supplied me with the courage, the guidance, and the love to complete this thesis. Also, Peace and salutation always be to the Prophet Muhammad peace be upon him altogether with his accompanies.

This undergraduate thesis entitled “The Factors Influencing Economic Growth in Indonesia Period 1981-2014, Error Correction Model Approach” has

made as partial fulfillment for the requirement to achieve the bachelor degree of economics (Sarjana Ekonomi). So that, I would like to thank all the people who contributed in some way in this thesis. In particularly they are:

1. A special feeling of gratitude to my beloved parents; Ibu and Ayah. Thank you so much for endless love, prayers and encouragement, trust, and all the things you have done to me since I was a little girl until I can finish my undergraduate studies.

2. I also thanks to my beloved brothers and sister: Desmonth, Arief, and Alya fortheir support, understanding and good wishes whenever I needed. 3. I dedicated this work and give special thanks to my best friend Salma, for

the support of my research, for her flawless grammatical editing of my thesis, tolerating my crazy habits, for being by my side in any situations. Thank you for everything ma, and no words can describe our friendship.

4. I should not forget to acknowledge to all my best friends that are far away from me; Tika, Putri, and Trisna for the trust, love, and support long this way.

5. Sincere thanks to my childhood friend, Mbak Lia who also still give me support until now.

6. I would like to express my sincere gratitude to Dr. Masyhudi Muqorrobin

(Alm) for being a very good lecture as well as parent in this department. Thank you for all the lesson you have taught to me in this university.

Al-Fatihah…

7. My thanks must go also to my IPIEF fellas batch 2013 for all the fun we had in the last 3 years together at class.

10.I would like to express my wholehearted thanks to all my lecturers in IPIEF department who guide me from the beginning of university days until I can graduate from this university.

11.Last but not least, I’d like to congratulate myself for the sleepless night, the ups and downs mood, eating too much, uncontrollably tears and all the

efforts that I’ve done while making this thesis real in the end.

Yogyakarta, March, 18th 2017

SUPERVISORS AGREEMENT PAGE ... iii

CHAPTER I INTRODUCTION ... 1

A. Research Background... 1

B. Research Limitation ... 14

C. Research Questions ... 15

D. Research Objectives ... 15

E. Research Benefits ... 16

CHAPTER II LITERATURE REVIEW... 17

A. Theoretical Framework ... 17

1. Economic Growth ... 17

2. Foreign Direct Investment ... 30

3. Export ... 33

D. Operational Data of Variables ... 45

E. Analysis Method ... 46

1. Classical Assumption Test ... 47

a. Autocorrelation ... 48

b. Integration Degree Test ... 52

c. Co-integration Test... 52

d. Error Correction Model ... 53

CHAPTER IV RESULT & ANALYSIS ... 56

A. Research Variable Overview... 56

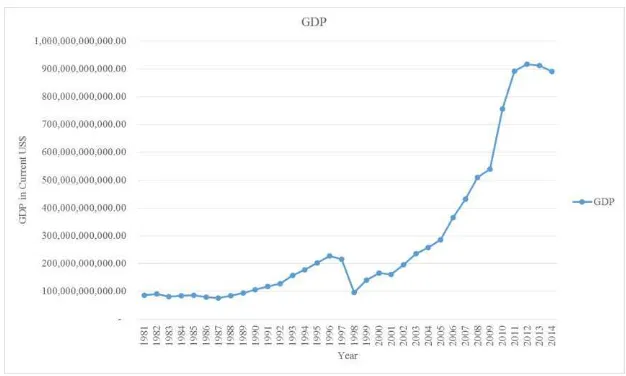

1. Indonesian Gross Domestic Product Overview ... 56

2. Foreign Direct Investment (FDI) Overview in Indonesia ... 58

3. Indonesian Export Overview... 59

4. Indonesia Infrastructure Overview ... 61

5. Indonesian Inflation Overview ... 62

B. Classical Assumption Test ... 63

1. Autocorrelation Test... 63

2. Normality Test ... 64

3. Heteroskedasicity Test ... 64

4. Multicollinearity ... 65

C. Dynamic Assumption Test ... 67

1. Stationary Test ... 67

1. The Influence of Foreign Direct Investment (FDI) on

Economic Growth (GDP) ... 75 2. The Influence of Export on Economic Growth (GDP) ... 78

3. The Influence of Infrastructure (Road Length) on Economic

Growth (GDP) ... 80

4. The Influence of Inflation Rate on Economic Growth (GDP) 83

CHAPTER V CONCLUSION & SUGESTION ... 86 A. Conclusion ... 86 B. Suggestion ... 87 REFERENCES

1.2 The Foreign Direct Investment by Province in Indonesia ... 10

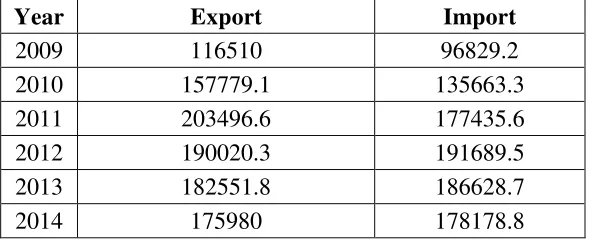

1.3 The Export and Import Growth in Indonesia in Million US$ ... 12

4.1 The Lagrange Multiplier Test (LM) Result ... 63

4.2 The Jarque-Bera Test (J-B test) Result ... 64

4.3 The White Heteroskedasticity Test Result ... 65

4.4 The Multicollinerity Test before being Transformed into First Difference Form (D) ... 66

4.5 The Multicollinearity Test Has Been Transformed into First Difference Form (D) ... 66

4.6 The Unit Root Test Result in Level Degree by Augmented Dickey-Fuller test Method ... 68

4.7 The Unit Root Test Result in First Difference Degree by Augmented Dickey-Fuller test Method ... 69

4.8 The Result of Co-integration Test in Long Term... 71

4.9 The Unit Root Test result toward the Residual Long Term Equation ... 72

4.10 The Result of Error Correction Model Estimation ... 73

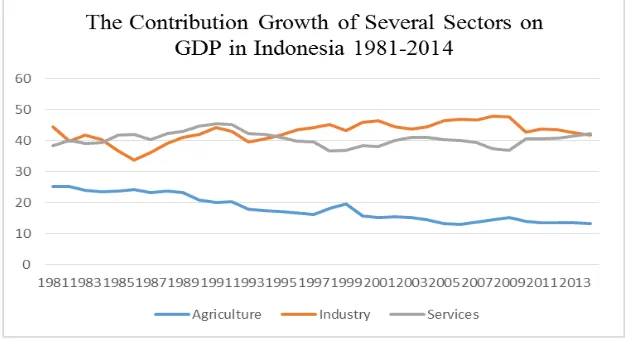

1.2 The Contribution Growth of Several Sectors on GDP in Indonesia 1981-2014 .... 4

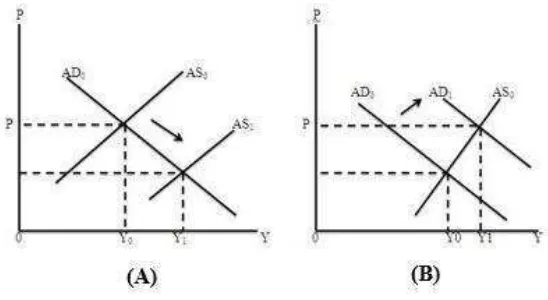

2.1 Aggregate Demand and Supply in a Balance Macroeconomic Situation ... 20

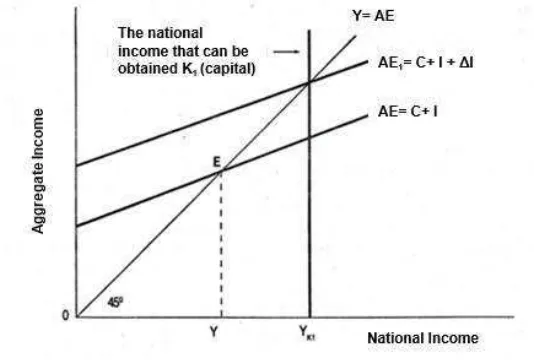

2.2 Theory of Harrod-Domar: TheRole of Investment in Economic Growth... 24

2.3 Neo-Classical production Function ... 27

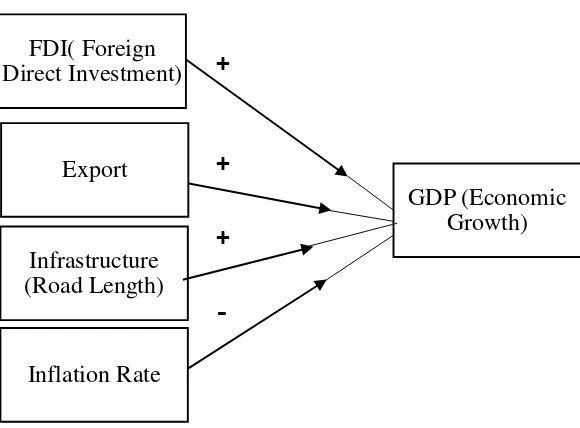

2.4 Research Framework ... 43

4.1 Indonesian Gross Domestic Product in 1981-2014 ... 57

4.2 Indonesian Foreign Direct Investment in1981-2014... 58

4.3 Indonesian Export in 1981-2014 ... 60

4.4 Indonesian Infrastructure in 1981-2014 ... 61

Indonesia. The study employed the quantitative approach by using secondary data from 1981 to 2014. Analysis tool that is used in this study is Error Correction Model (ECM). Variables that are used namely Foreign Direct Investment (FDI), Export, Infrastructure (Road Length), and Inflation Rate, in which economic growth represented by Gross Domestic Product (GDP).

The result of this study indicates that Foreign Direct Investment (FDI) and export have positive and significant impact in short and long run. Meanwhile, both in short and long run, the inflation rate has negative and significant impact. The different result shows by infrastructure (Road Length) that has negative and insignificant relationship on economic growth in Indonesia, both in short and long run.

mempengaruhi pertumbuhan ekonomi di Indonesia. Penelitian ini menggunakan pendekatan kuantitatif dengan menggunakan data sekunder periode 1981-2014. Alat penelitian yang digunakan dalam penelitian ini adalah Error Correction Model (ECM). Variabel yang digunakan meliputi Penanaman Modal Asing (PMA), Ekspor, Infrastruktur (Panjang Jalan) dan Inflasi. Pertumbuhan Ekonomi diwakili melalui Produk Domestik Bruto (PDB).

Hasil Penelitian ini menunjukan bahwa penanaman modal asing (PMA) dan ekspor berpengaruh positif dan signifikan pada jangka pendek dan panjang. Sedangkan inflasi berpengaruh negatif dan signifikan di jangka panjang dan pendek. Hasil yang berbeda ditunjukan oleh infrastruktur yang tidak berpengaruh signifikan di jangka pendek maupun jangka panjang.

1

CHAPTER I

INTRODUCTION

A. Research Background

Economic performance is an assessment of its success in areas related

to its assets, liabilities and overall market strength. Many countries take regular

stock in either formal or less formal basis of the general economic performance

of their countries to make sure that it remains on the right track financially.

Economic performance can be seen from economic growth. Economic growth

is an indicator to perceive a country’s performance whether in good or bad performance. The success of the development of a country can be seen from the

level of economic growth. Therefore, each country always set target of high

economic growth rates in the planning and development objectives. By high

sustainable economic growth means as the main condition for sustainable

development economy.

In the narrow sense, economic growth means the increase in total

production of both goods and services. This is measured by the change in real

gross domestic product (GDP) and by the change of real gross domestic product

per capita. GDP is the total value of all final goods and services produce in a

country in a one-year period. The value of GDP would give a view of how a

Indonesia is one of the developing countries in the world. As a

developing country Indonesia has been joined as a member in G-20 major

economies and classified as the newly industrialized country. Based on the data

from world-bank in 2013, the gross domestic product of Indonesia reached

3,475.25 USD. Indonesia experienced a GDP growth of 5.8% per 2013, it is of

course a good hope for the Indonesian’s government to realize the improvement

of people's welfare.

Source: World Bank

The graph above explained about the development of economic growth

in Indonesia for 34 years from 1981 until 2014. Given the fact from World

Bank, it can be concluded that the economic growth in Indonesia moving into

-15 -10 -5 0 5 10 15

1970 1980 1990 2000 2010 2020

GDP growth (annual %)

FIGURE 1.1

fluctuation ways for 34 years. In the crisis 1998, the economic growth in

Indonesia decreased dramatically around -13.12%. As for Indonesia, the main

cause of financial crisis happens because of the internal source at that time. The

crisis started when huge capital flight out from Indonesia. The direct result of

capital flight that occurred in Indonesia, result in Indonesia's national currency

(rupiah) then deteriorated against the US dollar. Moreover, many companies

bankrupted and the national banking sector collapsed (Tambunan T. , 2010).

Indonesia has suffered a crisis in 12 years, for example, in 1997/1998

and 2008/2009. Because of those crises, Indonesia economy is exposed to

economic shocks, either from internal sources or external sources, for the

following main reasons. Firstly, Indonesia's economy becomes more open to

other countries. Therefore, any volatility which happens in global economics

will effect on Indonesian economic as well. Secondly, Indonesia is still depend

on the primary commodities, especially agriculture sector. So when, the price

instability happens in the primary commodities, became a shock for Indonesian

economy. Thirdly, because of the instability of these commodities, it is also

impact the domestic consumption and food security in Indonesia (Tambunan T.

, 2010).

In fact, economic growth in a country cannot be separated from the role

of government from policy makers both fiscal and monetary, and the role of

economic cycle. Hence, gross domestic product has become a measure of the

ability of a society to produce a product that can enhance the economic growth

of a country.

One of the important things by using of national income data is to

determine the rate of economic growth which is achieved by a country year to

year. Data from national income can also be an indicator to see the economic

performance. By observing the growth of a country from year to year, it can be

assessed achievements and success in controlling the country's economic

activity in the short term and in the long term. Comparisons may also be made

between the level of the country's success in controlling and build its economy

achieved when compared with other countries. (sukirno, 2013)

FIGURE 1.2

The Contribution Growth of Several Sectors on GDP in Indonesia 1981- 2014

Gross domestic product cannot be separated from that contributions

given by various sectors produced in Indonesia. With an area of 1,905 million

km which is owned by Indonesia, there are a wide variety of sectors

contributing. The figure 1.2 above shows the development contribution of

several sectors on gross domestic product in Indonesia.

The income which is gained by the government come from three major

sectors; agriculture, industry, and services. The development of the three

sectors fluctuates for 34 years. The highest contributing sector is industry,

followed by service, and the last is agriculture. The agriculture sector trend

tends to decrease each tear although it once increases after the Asian crisis in

1997. The previous contribution is 16% increased to 19% after the crisis. In the

beginning of 1995, the industry sector surpassed the service sector until 2014;

while since 1981 to 1995 the service sector contributed the most to the national

income

In macroeconomic analysis, besides explaining the supporting factor

that possibly affect the economic growth, it also discusses on the issues such

as; inflation. Inflation is a process of rising prices in general and continuous

(continuous) for a certain time. In other words, inflation is also a process in

which the declining in currency values continuously. Inflation is a process of

an event, not the high-low level of a price. That is, if the high price level it has

happen and influence each other means there is inflation. To achieve

sustainable economic growth along with price stability continues to be the main

objective of economic policy macro to most countries in the world today.

Based on the data from World Bank, the rate of inflation in Indonesia

has fluctuated over the time. The highest level of inflation is happen when Asia

financial crisis in 1997. Because of that problem, the inflation rate reach 58.3%

and 20.48% in 1999. It became the hardest-hit country because the crisis not

only had economic but also significant and far-reaching political and social

implications. And after that, the inflation rate in Indonesia gradually back to

normal.

There are three main components in the growth for each country,

namely capital accumulation, population growth, and technological advances.

As discussed above, the economic growth associated with the state's ability to

produce goods and services and the increase in per capita income of the

population. The accumulation of capital is reinvested earnings with the aim to

increase output (Todaro, 2000).

In this globalization era, foreign direct Investment (FDI) plays an

important role in international business. Economic integration occurs between

the countries in the world encourage the emergence of cooperation in the

economic, political, social and cultural. As the developing country in the world,

is due to the undertakings in pursuit of the underdevelopment of the developed

countries in the world globally. The fact that Indonesia itself is not able to

provide the fund for development itself.

The sources of financing in development could come from domestic and

abroad. One of the external types of is Foreign Direct Investment (FDI).

According to (Panayotou, 1998) in (Sarwedi, 2002) tells that FDI is more

importantto ensure the continuing development in a country compared to other

funding streams such as, portfolio, because the presence of FDI will be

followed by the transfer of technology, know-how, management skills, business

risk is relatively smaller and productive (Sarwedi, 2002).

According to Jhingan (2004) In Agma tells that foreign investment in

the need to build economic acceleration. This is because the foreign capital can

help in the process of industrialization in order to create wider opportunities.

Foreign capital could be aid technology.

Foreign investment in Indonesia, has become a funding source that can

be used as financing for development and economic growth. By using foreign

investment, it is intended to replace the use of foreign debt as a source of

financing. Because with the increasing uncontrolled interest rates on foreign

debt and the rupiah exchange rate against foreign currencies make Indonesia

Based on the legal basis, Foreign Direct Investment has been regulated

by UU No.1 year 1967 and UU No.11 year 1979. In this basis, FDI means that

foreign investment activities directly undertaken by or under the provisions of

this law and used to run a company in Indonesia, and the owners of the capital

directly bear the risk of the investment.

The realizations of foreign direct investment in every country fluctuate

every time. The following data is the development net inflows of FDI in

Indonesia among the other ASEAN-4-Nations based on the World Bank from

2011 until 2014 in Million US Dollar:

Based on the table above, Indonesia has become the largest foreign

direct investment realization among the ASEAN-4-Nations. The realization of

Year

2011 2012 2013 2014

Indonesia 20,564,938,227 21,200,778,608 23,281,742,362 26,277,377,236

Thailand 2,468,144,240 12,894,549,139 15,822,132,057 3,718,726,247

Malaysia 15,119,371,191 889,577,425 11,296,278,696 10,619,431,770

Philippines 2,007,150,725 3,215,415,155 3,737,371,740 5,739,574,024

Source: World Bank

TABLE 1.1

foreign direct investment (net-inflows) in Indonesia always increase from 2011

until 2014. Similarly, the net inflows of FDI always increase over 4 years in

Philippines. On the contrary, the foreign direct investment of the other countries

fluctuates at that time. Surprisingly, for 4 years, the FDI of Malaysia decreased

on 2012, and keep increasing in 2013 and 2014. The smallest foreign direct

investment is Thailand among ASEAN-4-Nations.

Investors invest in Indonesia with various forms. Usually investors

come to a province or region that have advanced development. This is because

of the stability that the investors can have from that advanced province.

Province in Java Island mostly become the choice from the investors to be the

right place to invest. The difficulty is that not every province has the same

growth and stability. So, there is the amount gap in each province.

Indonesia is an archipelago with many islands and is divided into 34

provinces. The investments that are in Indonesia are scattered throughout the

area in Indonesia. Each province has its uniqueness to offer to investments.

Indonesia is rich with the natural resources, so that the investors can choose to

invest on this development. There are various types of industries in Indonesia

that the investors can also choose. The following is an overview of the

distribution of foreign direct investments in each region in Indonesia taken from

the Investment Coordinating Board of the Republic of Indonesia in January-

TABLE 1.2

The Foreign Direct Investment by Province in Indonesia in 2014

NO PROVINCES INVESTMENT

(US$/Million) Project

1 West Java 6,561.90 1,671

2 Special Teritory of Jakarta 4,509.40 3,053

3 East Kalimantan 2,145.70 191

The table 1.2 above explains about the foreign direct investment based

on the locations in Million US Dollar and the total project for each location.

According the table above, in January- December period, the highest realization

of FDI was located in West Java with the total Investment 6,561.9 Million US

Dollar. On the other hand, the lowest realization of FDI was located in

Gorontalo with the total investment only 4.1 Million US Dollar. Besides the

total investment, the highest number of the total project was located in Special

Territory of Jakarta with 3,053 project in 4,509.4 Million US Dollar total

investment. At last, the lowest total project was located in West Sulawesi with

only 7 project in 2014.As we have discuss previously, the size of the economic

growth in each country, depending on the capital invested by each country. The

need for productive investments in supporting social and economic necessity to

carry out the process of development in a country

Beside investments, Export also play an important role in the economic

activities of a country. Exports will generate income that will be used to finance

imports of raw materials and capital goods needed in the production process

that will create value-added. Aggregation value added generated by all

production units in the economy is the value of products GDP (Sutawijaya &

TABLE 1.3

The Export and Import Growth in Indonesia in Million US$

Net exports is the difference between the value of goods and services

export to other countries for goods and services imported from other countries.

In this case, exports in Indonesia has fluctuated in the last 6 years. From the

table 1.3 above, it conclude that the total import is greater than the total export

in Indonesia. It means that the directions net export growth rate of Indonesia

are in a negative direction within the last 6 years.

Through productivity gains, from the micro level, infrastructure can

promote economic growth. Kuznets in his theory mentioned that the economic

growth of a country is affected by the accumulation of capital, natural resources,

human resources, with a view of quantity and quality. On the other hand,

infrastructure can be categorized as capital accumulation. So, infrastructure can

be used as inputs to production indirectly.

Year Export Import

2009 116510 96829.2

2010 157779.1 135663.3

2011 203496.6 177435.6

2012 190020.3 191689.5

2013 182551.8 186628.7

2014 175980 178178.8

The developing countries has made an investment of 200 billion US

dollars each year for the construction of the new infrastructure (World Bank,

1994). With the investments were acquired, the expected increase value of

infrastructure will be better in the future, in fact sometimes the performance of

infrastructure is disappointing. One of the causes is an error in the allocation of

funds. For example, the development of infrastructure continued without

maintaining the existing infrastructure.

The effort to revamp the infrastructure conditions to realize an

important role in reducing inequalities of income and long-term effects for

gross domestic product is important. Improvements in infrastructure have

contributed to increasing productivity and is expected to support economic

growth in the long term (Maryaningsih, Hermansyah, & Savitri, 2014)

In this research, it focuses on the long road infrastructure in Indonesia

in Kilometer units. By having the best quantity and quality road infrastructure

in Indonesia, country will able to provide convenience in the distribution of

economic activities in the community. Based on World Bank in 2013, Roads

are the main transport in Indonesia, and the total road network recorded more

than 477,000 km with an asset value of more than 15% of GDP. However, the

number and quality of road infrastructure in Indonesia is still below neighboring

way to 70 trillion Rupiah per year (USD 7 billion per year), representing 40%

of total spending on infrastructure.

However, the level of investment of this magnitude cannot pursue

increased demand and growth in the last ten years. Productivity and efficiency

management of national roads are still less than optimal. The spending of

national roads has tripled in real terms between 2005 and 2011, but output

which is generated in the road length only rose 20% whether if counted from

the existing road or the road under construction.

With the progress that has been achieved, Indonesia still has to face the

problems that are faced by other countries, especially developing countries,

who are on development. The process of economic performance is affected by

two kinds of factors, namely, economic factors and non-economic factors.

Based on the terms describe above, the need for scientific assessments

of the factors that affecting economic growth in Indonesia is highly needed. In

this case the factors that will be analyzed are the factors in economic which are

foreign direct investment, export, infrastructure, and inflation rate.

B. Research Limitation

This research only limit in Foreign Direct Investment, Export and

Infrastructure especially in Road Length (in Km2), and Inflation Rate on

C. Research Questions

Based on the background, the researcher needs to formulate the problem

as the ultimate goals of this research which includes:

1. What is the impact of foreign direct investment on economic growth in

Indonesia in short and long run?

2. What is the impact of export on economic growth in Indonesia in short run

and long run?

3. What is the impact of infrastructure on economic growth in Indonesia in

short and long run?

4. What is the impact of inflation on economic growth in Indonesia in short

and long run?

D. Research Objectives

Based on the research questions, thus the objectives of this paper are:

1. In order to know about the impact of foreign direct investment on economic

growth in Indonesia in short and long run.

2. In order to know about the impact of export on economic growth in

Indonesia in short and long run.

3. In order to know about the impact of Infrastructure on economic growth in

Indonesia in short and long run.

4. In order to know about the impact of Inflation on economic growth in

E. Research Benefits

This study contributes useful information for parties which are

interested in Economic performance in Indonesia. The detailed of research

objectives will be explained below:

1. It can help to explain about the impact of foreign direct investment, export,

Infrastructure, and Inflation on economic growth in period 1981-2014.

2. It can help to increase the knowledge, experience, and as a place to practice

and apply science sciences knowledge has been gained while studying on

campus.

17

CHAPTER II

LITERATURE REVIEW

A. Theoretical Framework

1. Economic Growth.

a. The Definition of Economic Growth.

Economic growth can be defined as an increase in per capita real

output. It also defined as a broad perception that refers to the process of

economic growth that has capacity to raise the welfare of its people

(Berg, 2001).

According to Boediono (1982) economic growth is the

increasing of output per-capita in the long run. Economic growth is a

process, not an economic condition at a time. In this case, the dynamic

economic growth seen from the aspect of an economy, which is to see

how an economy grow or change over time. It is emphasized in itself to

changes or developments.

The economic growth represent as the development of the

activity in the economy that causes the good and services produced

increases in economic activity in the community, regarding growth and

development dimensional measured by the increased production and

income (Sukirno, 2002). It also can be said as one indicator is in seeing

development, growth is one of the conditions required in a development

(Meier, 1989).

b. Measuring the Economic Growth.

Economic growth occurs when an increase in the production of

goods and services. In the real world to record the number of units of

goods and services is a difficult thing to do. This is due to a wide variety

of goods and services produced in one period that have different sizes.

Therefore, the calculation uses to estimate the change in output which

is the value of money is reflected in the value Gross Domestic Product

(GDP). Gross Domestic Product (GDP) is the market value of all final

goods and services, produced in the economy in a country in a period

(Mankiw G. N., 2006).

There are two approaches to see the amount of GDP. The first

one is GDP as the total income from every person in the economic

activity, the second one is by seeing the GDP from the total output

(Mankiw G. N., 2007) . The income approach can be differentiated from

4 different types; wage or salary, rent and interest, and profit. While the

spending approach from each sector, namely; Consumption (C) from

household, Investment (I) from firm, Government Expenditure (G), and

Based on the explanation above, it can be concluded that the

economic growth is the growth on economy activity from the increasing

GDP and GNP in long-term without considering the population growth

and the economic structure change.

c. Economic Growth Theory.

The theory of economic growth determine as an explanation of

what factors determine the increase in output per capita in the long term,

and the explanation of how these factors interact with each other,

resulting in a process of growth. On these descriptions below are the

theories on economic growth(Boediono, 1982):

1) The General Theory of Economic Growth.

Based on Tambunan (2001), the economic growth can be

seen from two sources in which the aggregate demand from the

aggregate demand side. Based on figure 2.1, the equilibrium can be

reached if the demand curve and supply crossed on each other,

where the economic equilibrium result in output aggregate (GDP)

with the certain level. Next, the aggregate output will result in

national income. On the figure below, it will describe the initial

period (t = 0) output is the form from Y, that the economic growth

is the output from the following period, which is output=Y1, where

Based on the picture, it can be seen that the economic growth

occurred because the shift from the aggregate supply (AS) along

with the demand curve (part A) or the movement from the

aggregate demand (AD), along with the supply curve.

From the aggregate demand, the AD curve movement to the

right shows the increasing demand in the economic due to the

increasing factors of national income, including: consumers

demand, company and government. While from the aggregate

demand, the GDP usage namely; the household consumption, the

investment (I), government spending (G), and net export means the

goods and services export (X) minus the goods and services import Source: Tambunan, 2001

FIGURE 2.1

(M). The aggregate demand in the economy can be describe by the

equation below:

= � + ��+ + −

From the aggregate supply, there are two ways on describing

the phenomenon, which are; neo-classic theory and modern theory.

The neo classical theory regards the production function such as

labor and capital are influencing the output growth. While the

modern theory shows that the production functions are not only the

influence but also other variables, such as technology, energy,

entrepreneurship, and material. As an addition, the modern theory

also regards the economic growth is influenced by; infrastructure,

law, regulations, politic condition, the bureaucracy, and exchange

rate.

2) Adam Smith’s Theory.

Based on Adam Smith’s Theory in Sukirno (2002) total output in the economy is affected by the factors of production. The

factors of production namely capital, labor, and technology. From

those factors, it can be seen from the formulas the following

equation:

∆ = � �, , �

Y= Economic Growth

C= Capital

L= Labor

T= technology

Smith explains that country's production system consists of

three elements namely, available natural resources, human

resources or population, and the stock of capital goods. First,

Natural resources provided a means that most fundamental of the

production activities of a society. The second element is human

resources or population. In the process of growth of output

element is considered to have a passive role, in the sense that the

population will adapt to the needs of the community labor. The

last element is capital. Capital actively determines the output

level. Smith give a central role to the growth of the capital stock

or capital accumulation in the growth process output. In other

words, the output level depends on what happens to the stock

capital (Boediono, 1982).

3) Harrod-Domar Theory.

Harrod-Domar theory is the development of macro theory

Keynes short-term into long-term macro theory. This theory was

describes a long-term economic growth, because the keynes theory

is less complete in the long-term economic problems.

There are 4 assumptions in economic growth in

Harrod-Domar Theory. Firstly, in the economy there are full employment

and maximum use of capital. Secondly, the economy consists of

two sectors, namely the household sector and the corporate sector.

Thirdly is the amount of public savings is proportional to the

amount of national income, which means saving function starting

from the zero point. The last is the propensity to save in fixed

amount, as well as the capital output ratio and the incremental

capital output ratio (Jones, 1975).

In these assumptions explained that in order to increase the

rate of economic growth, country must increase savings. However,

economic growth is also seen in increasing the productivity of the

output from investment activities. The productivity of investment

is the amount of output that can be produced from one unit of

investment generated, where productivity can be measured by the

inverse of capital ratio output (∆�/∆� . Then, to determine the rate

of growth of total output is by multiplying the level of investment

that is contained in the savings ratio, s= I/Y with investment

The figure 2.2 above explaining the Harrord-Domar theory

much further. The aggregate spending is the shape from AE = C +

I. The equilibrium in the point E describes; (i) national income is

Y and (ii) shows the national income from the economy reaches the

maximum capacity. For example, the capital in this equilibrium is

K0. Harrord-Domar theory shows that investment that invested in

the beginning of the year leads to the increasing value in the

following year, which is the capital from K1 = K0 + I, where K1

results in national income; so that, the initial equilibrium can be

reached again. This analysis shows the economic from two sectors

FIGURE 2.2

Theory of Harrod Domar: The Role of Investment in Economic Growth

that investment should always increase in order to increase the

economic growth. The increasing investment is highly needed to

increase the aggregate spending.

Harrord-Domar theory doesn’t focus the requirement to reach the maximum capacity if the economic is consisted with 3

sectors or 4 sectors. On that condition, the capital increases if AE1

= C + I1 + G1 + (X – M)1, where equal with I1 + G1 + (X – M)1. The

conclusion from Harrord Domar theory is that the theory completes

the Keynesian analysis. Keynesian focuses on the short-term

economic problem. While on Harrord Domar theory, it describes

the long-run economic problem. It describes the long aggregate is

needed to be reached to realize the economic growth. The robust

economic growth can be reached if I + G + (X – M) increases significantly with positive relationship.

4) Solow – Swan Theory.

The theory developed individually by Robert Solow from

MIT and Trevor Swan from the Australian National University and

the model is known as the Neo-classical growth model. This model

is similar to Harrod- Domar theory model that focuses on how the

and outputs interact each other in the process of economic growth

(Boediono, 1982).

Although the general framework of the Solow-Swan model

is similar with Harrod- Domar model, the Solow- Swan model is

more flexible. This is because the Solow- Swan models more easily

manipulated algebraically.

This model connects the output, capital, and labor in the

production function where the coefficients are unchanged (Qp = hK

and Qn = nN). This growth theory used general production

function, which can accommodate a wide range of possibilities for

substitution between capital (K) and labor (L). This function can

avoid the problem of instability and take new conclusions about the

distribution of income in the growth process the form of the

production function are:

� = ,

Assumptions used in the Solow model that tends to run into

diminishing returns capital. When labor supply is held constant,

then the accumulation of capital to increase output will always be

less than the addition earlier, reflecting the product of capital is

diminishing if it is assumed that there is no technological

capital indicates that the one point, increasing the amount of capital

(through savings and investments) is only enough to cover the

amount of capital losses due to depreciation. At this point the

economy will stop growing, because it is assumed that there is no

technological development or growth of the workforce.

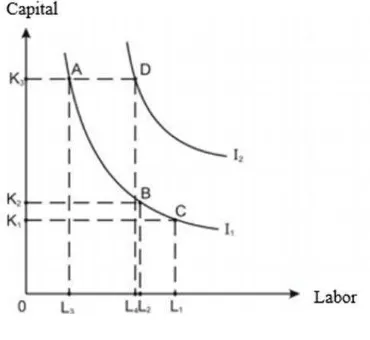

The Theory of Neo-classical illustrated in Figure 2.3.

Production function indicated by I2, I2, and so on. In the form of

the production function, a certain level of output can be created by

using various combinations of capital and labor. For example to

create an output of I1, a combination of capital and labor which can

be used include (a) K3 with L3, (b) K2 with L2, and (c) K1 with L1.

Source: Arsyad, 2004

FIGURE 2.3

Thus, even though the amount of capital changed but there is a

possibility that the output level unchanged.

Although the amount of fixed capital, the amount of output

produced can be changed. For example, if the amount of fixed

capital of K3, the amount of output can be enlarged to I2, if the

labors that work are added from L3 to L4.

In contradict to the Harror-Domar theory that assumes a

constant return with raw coefficients, meanwhile the neo-classical

solow growth model uses the concept of diminishing return from

worker and capital amount, if the two use distinct analysis. When

analyzed simultaneously, the assumption of neoclassical also use

the concept of constant return to scale. The advances in technology

are just set as residual factor to explain the long-term economic

growth. High or low growth is assumed to be exogenous or not

influenced by other factors.

d. The Factors that Determine Economic Growth.

1) Land and Other Natural Resources.

The wealth of a country includes extensive and good soil

quality, climate and weather, the number of forest products and

marine, and type of minerals produced. Natural wealth will be to

facilitate efforts to develop the economy of a country, especially at

Although the above stressed the importance of the role of

natural resources in the economic development of a country,

especially in the early days of the growth process, it does not mean

that economic development is highly dependent on the amount of

wealth of a country.

2) The Number and Quality of the Population.

The increasing of population time to time can be the trigger

or the barrier to the economic growth. The increasing the number

of population will raise the amount of labor, so it can increase the

amount of production. Another matter arising from population

growth to economic growth is the development of the broad market

and the goods produced by the company sector will increase.

Therefore, population growth will be conducive to stimulate the

increase in national production and the level of economic activity.

If the additional labor cannot increase the national

production level faster than the rate of population growth, per

capita income will decline. Thus, the excess population will lead to

decline in the people's welfare

3) Capital and Technology.

Capital is very important because it can improve the

efficiency of economic growth. Capital and modern technology

capital is increasing, but the quality of the technology has not

increased, the progress that occurs will not be significant.

4) Social System and Society Demeanor.

Social system and Society Demeanor is important in

realizing economic growth. Traditional customs that might

hamper the public to use modern producing system and increase

the productivity. Therefore, economic growth cannot be brought

forward.

2. Foreign Direct Investment.

There are two kinds of foreign investments in Indonesia which are

foreign direct investment and foreign indirect investment. Foreign direct

investment is the investment that apply in Indonesia territory by foreign

investor which investment comes in form of building and buying a company

or acquiring a company. Meanwhile, indirect foreign investment is made by

the capital market instrument such as securities, stock, and bond.

Foreign Direct Investment based on UU No. 25 year 2007 is the

planting of assets in the form of money or other forms that are owned by

foreigners in the form of individual or business entity.

Foreign direct investment is direct investment that has done by an

individual or company of another country, that focus into production or

business either by buying a company or expanding operation of an existing

According to (Macaulay, 2012) In (Kunle, et al. 2014) World Bank

in 1996 states foreign direct investment as an investment that is made to

promote a long-last management interest in an enterprise and operating in a

country other than that of the investors (define based on to residency) the

investor desire being an effective voice to earn long term capital as shown

in the nation balance of payments. Based on the UU No. 25 year 2007 in

(Agma) represent the purpose of investment as follows: increase national

economic growth, to create a vocation, to Increase the sustainable economic

development, to increase the capacity and capability of national technology,

and to develop community economy.

Generally, there are three main sources of foreign capital in a country

that apply open economic system, namely foreign debt, foreign direct

investment and portfolio investment. According to Wuryaningsih, et al.

2008 foreign borrowing by the government bilaterally and multilaterally.

Portfolio investment is investment made through the capital markets. Then,

foreign direct investment is an investment made by a private foreign

company to a particular country. The form can be a branch of a

multinational company, a subsidiary of multinational companies

(subsidiary), licensing, joint venture, or more.

Foreign capital inflows have been viewed by developing countries in

of foreign technology. This viewed is relevant, especially given the failure

of import substitution and the slowdown of technological progress in many

developing economies. The developing countries coveted the foreign direct

investment (FDI) by multinational enterprises (MNEs), FDI is seen as a

major tunnel for technology transfer. MNEs are the firms that produce and

market their products in more than one country (Berg, 2001).

FDI can also be divided into two types, namely Greenfield and

Acquisition. Investments by type Greenfield will build a new production

unit while FDI is a type of acquisition that buy part ownership of a company

that already exists (Kurniati, et al. 2007).

In macroeconomics, investment has two important roles in the

economy. First, investment is a major component of spending and provide

changes in demand and the business cycle. Second, the investment is a form

that leads to the accumulation of capital. If the additional shares of buildings

and equipment, it can affect the country and increase potential output

growth in the long term.

Based on the theory raised by Keynes, the investment amount is

determined by the interest rate. For employers, the interest rate is considered

to invest in a country. Then, the other factors that determine the behavior of

entrepreneurs in investing that the current economic situation and the future

3. Export.

Export is the activity of selling and sending goods from the origin

country to other countries. These activities can bring the flow of

expenditure will be flowed into the enterprise sector. Furthermore, the

aggregate expenditure will increase, this is because the export activities of

goods and services, and therefore the national income will also increase. If

net exports in a positive state, the aggregate expenditure will increase. Then

this will increase the national income and employment (Sukirno, 2013).

Exports are one of the component in aggregate spending on the

open-economy. Aggregate expenditure in an open economy means that the

household expenditure on domestic production, investment, government

spending, spending on imported goods and foreigner who spend the export

goods. The aggregate expenditure can be expressed by this following

formula:

� = ��� + � + + −

Another theory that is used in the export is the basic theory of export.

The basis theory is that the economic basis that is developing from the basis

export becomes the city basis. From all of the theories, all are stressing on

the demand from the external sides. On the city theory, there is a division

In export theory it can be described as the autonomic factor. It means

that export is a factor to increase the income and economic growth directly.

To reach the high export level, then it needs the strategy to increase the

appropriate export value and appropriate investment with the high

technology to be implemented punctually (Adisasmita, 2013).

4. Infrastructure.

Infrastructure is the capital stock that provides public goods and

services. Infrastructure will affect the production activities and quality of

life for the households. Infrastructure is a fundamental factor behind

economic growth. This variable has shown its long-enduring significance

(Yoshino & Nakahigashi, 2000).

Infrastructure refers to the physical facility and organizational

framework, knowledge and technology that is essential to society and

economic growth. Infrastructure includes laws, public health and education

systems, distribution systems, and transportation systems and public

utilities.

In the economics, infrastructure is a form of public capital, which

formed from the investment made by the government. In this study,

infrastructure including roads, bridges, and sewer system (Mankiw G. ,

Infrastructure means that the relatively of large physical capital

facilities and organizational, knowledge and technological frameworks that

together become a fundamental to the organization of communities and the

economic development of the communities. Besides that, legal, educational

and public health systems, water treatment and distribution, garbage and

sewage collection, treatment and distribution system, treatment and

disposal, public safety systems, such as fire and police protection,

communications systems, public utilities and transportation systems. The

federal government’s principal involvement in infrastructure formation

involves the military, legislative and judicial functions(Tatom, 1993).

Modernization of the economy requires modern infrastructure as

well, due to various economic activities require the infrastructure to

develop, such as roads and bridges, airports, ports, industrial estates,

irrigation and water supply, electricity and telephone networks need to be

developed. The various types of infrastructure is needed by the company to

the efficiency of its operations.

Infrastructure development should be in harmony way with

economic development. At a low stage of development, the necessary of

infrastructure is still limited. At this level of development is based on the

construction of roads, bridges, irrigation, electricity and other infrastructure

the economic development that has been achieved and realized and that will

be realized in the future(Sukirno, 2013).

Based on the type, the infrastructure is divided into 13 categories as

follows (Grigg, 1988):

- The water supply system: reservoirs, water storage, transmission

and distribution, and water treatment facilities (treatmentplant),

- Waste water management system: collection, processing,

disposal, and recycling,

- Facility waste management (solid),

- Facilities flood control, drainage and irrigation,

- Inland waterways and navigation facilities,

- Facility of transport: road, rail, airports, as well as other

complementary utilities,

- Public transit systems,

- Electrical systems: production and distribution,

- Natural gas facilities,

- Public Buildings: schools, hospitals, government buildings, etc.,

- Public housing facility,

- Garden City: the park is open, plaza, etc., as well as

Based on the thirteen types of infrastructure above, then the type of

infrastructure is grouped into seven major groups as follows:

- Transportation (roads, highways, bridges),

- Transport services (transit, airports, ports),

- Communications,

- Flooded (water, wastewater, flooded the system, including the

water that rivers, open channels, pipes, etc.),

- Waste management (solid waste management system),

- Building, as well as

- Distribution and production of energy.

5. Inflation Rate

Inflation is an increase in the general price level of commodities and

services during a specific time period. Inflation is regarded as a monetary

phenomenon due to the impairment of the monetary calculation unit to a

commodity (Greenwald, 1998).

Inflation is one of the problems that need most attention by the

government. The long term goal of government is to keep the inflation rate

at the lowest level. The three kinds of inflation based on the causes of

inflation that is demand-pull inflation, cost-push inflation, and imported

Demand-pull inflation occurred in the economy is growing rapidly.

The higher employment causes high levels of income, and this will cause

expenses that exceed the ability of the economy to pull out of goods and

services. Excessive spending will cause inflation.

Cost-push inflation happens when the level of unemployment at the

lowest level. If the company is still facing the increasing of production

demands, they will keep increase the production cost by providing the

higher salaries to their workers, and look for new workers with higher

payments. Consequently, the increasing of cost production will increase the

price level of goods.

Imported inflation occurs when the price of import goods

increasing. This kind of inflation can be illustrated by the real problem in

the world, the effect of increasing oil price on 1970s toward to western

economies, and the other oil-importing countries.

Based on the rapidity of the increasing level of price, inflation can

define as three categories such as, creeping inflation, moderate inflation,

and hyperinflation. The creeping inflation occurred when the rapidity of the

increasing level of price is slow. The increasing of price level does not

exceed 2 or 3 per cent a year. Then, the hyperinflation is a process of the

rapid level of increasing price. In the developing countries, the level of

average level of the inflation is 5 until 10 per cent a year, and this is called

as the moderate inflation.

The high inflation will not trigger the economic growth. The

increasing of production cost causes the productivity is not beneficial.

Usually, the owner of capital prefer to use their capital as the speculation.

The increasing of price level can give bad impact on international trade. It

causes the goods from that country in high inflation, cannot compete in

international market. As the result, export will decrease and the price of

import goods will decrease as well. The decreasing price of import goods

will effect on frequently import activities. Finally, from those problem can

cause the instability of the exchange rate circulation and the worsening of

balance of payment.

Besides inflation give a bad effect on the country, inflation can also

give a bad effect on the individual and society. Firstly, inflation will reduce

the real income of the people who have a fixed income. Generally, the

increasing of wage level not as fast as the increasing of price level.

Therefore, inflation will decrease the individual real wage who have the

fixed income. Secondly, inflation will reduce the amount of wealth

(money-from). Thirdly, inflation makes the distribution of wealth unwell. As

explained earlier, the fixed income will experience the degradation in the

real-income, but the owner of the fixed asset such as; land, houses can

B. Previous Study.

According to Pranoto (2016), simultaneously exports has a significant

and positive effect on the gross domestic product, while foreign direct

investment has a significant and negative impact in Indonesia 2004 until 2013.

This analysis was performed using linear regression analysis.

Based on Irsania and Noveria (2014) in their research titled “the Relationship among Foreign Direct Investment, Inflation Rate, Unemployment

Rate, and Exchange Rate to Economic Growth” reveals that FDI, inflation rate,

and exchange rate has a significant influence towards economic growth. But

FDI and unemployment have a positive correlation. The rest variables have

negative correlation. This research used multiple regression as a method.

From the result of Koojaroenprasit (2012) by using the multiple

regression, the findings shows that foreign direct investment has a strong

positive impact on South Korean Economic Growth. Furthermore, this finding

indicates that human capital, employment and export also have positive and

significant impact, while domestic investment has no significant impact on

economic growth in South Korea.

Research from Mofrad (2012) shows the study on The Relationship

between GDP, Export, and Investment: Case Study Iran shows that there exist

a positive and significant long-term and short-term relationship between

investment and export with GDP in 95% confidence level. This study used the

According to Sojodi, et al. (2012) the research that used ARDL Method

indicated the transportation facilities distinctively length of railway. Roadway,

and telecommunication infrastructure (fixed phone line) have positive and

significant impact on economic growth.

Study from Wibowo (2016) explains that the road infrastructure has no

significant impact on economic growth in Indonesia period 2006 until 2013. On

the other hand, electricity, health, and education has positive significant impact

on economic growth in Indonesia.

The development of infrastructure in a country is a major influence on

economic growth in a country (macro and micro) and the development of a

country. However, it is not easy to apply in Indonesia. Moreover, since the 1997

crisis which eventually widened into a multidimensional crisis impact can still

be felt today (Haris, 2005).

The other study finds that foreign direct investment has significant

impact on gross domestic product in Indonesia and vice versa. This study shows

that there is two way relationship between FDI and GDP. This study used Engle

Granger (EG-ECM) based on the theorem of granger’s representation

(Wuryaningsih, Setyowati, & Kuswati, 2008).

Research from Kasidi and Mwakanemeda (2013) investigated that

inflation has a negative impact on economic growth in Tanzania. There was no

co-integration between inflation and economic growth during the period 1990

economic growth in Tanzania. This research used regression equation as the

method.

Study from Acyumida and Eko (2013) employs that the Granger Causality of GDP has no causality relationship on inflation. On the contrary, there is a causality relationship between Inflation on GDP in Indonesia period

2000 until 2013.

From the result of Izuchukwu and Patricia (2015) noted in their study

about the Impact of Inflation on Economic Growth in Nigeria period 2000 until

2009 that the inflation has a significant impact on economic growth in Nigeria.

In addition, exchange rate has a positive impact on economic growth and that

high interest rate discourages investment and hence forestalls economic growth.

C. Hypotheses

On the paragraph below are the hypotheses based on the previous study

and theoretical framework:

1) Foreign Direct Investment has a significant and positive impact on

economic growth in Indonesia both in long-run and short-run.

2) Export has a significant and positive impact on economic growth in

Indonesia both in long-run and short-run.

3) Infrastructure has a significant and positive impact on economic growth in

Indonesia both in long-run and short-run.

4) Inflation has a significant and negative impact on economic growth in

+

+

+

-

D. Research Framework

FIGURE 2.4

Research Framework

GDP (Economic Growth) FDI( Foreign

Direct Investment)

Export

Infrastructure (Road Length)

44

CHAPTER III

DATA AND RESEARCH METHODOLOGY

A. Research Object

This research used quantitative method, so this research using deductive

approach. Quantitative method is a method that stems from numerical data to be

processed into information. So that the quantitative method is a method that is

numeric and statistical analysis and then processed into information (Kuncoro,

2003).

In quantitative research there are two variables that serve as a model, the

independent variables and the dependent variable. In this study, there are five

variables that will be used i.e. one dependent variable, and four independent

variables. The dependent variable used is economic growth denoted as gross

domestic product, while the independent variable is foreign direct investment,

exports, infrastructure, and inflation.

B. Type of Data

This research used secondary data annually in times series data. The

observation period is from 1981 to 2014. The data that used in this study are as

follows:

1. The data of Indonesia economic growth using gross domestic product (GDP in

2. The data of Indonesia foreign direct investment in this research using the net

inflows in current US$ which is collected from World Bank and The

Investment Coordinating Board (BKPM).

3. The data of export in Indonesia using the data of export in current US$ which

is collected from World Bank publications.

4. The data of Infrastructure is focused on the total length of roads in Indonesia

(kilometers) which is collected from Central Bureau of Statistics (BPS)

publications.

5. The data of Inflation Rate in Indonesia using the percentage data which is

collected from World Bank publications.

C. Data Collection Technique

Data collection technique that is used in this study was a non-participant

observer, where researchers only looked at data that is already available without

become part of a data system.

D. Operational Data of Variables

The definition of research variables is used to prevent errors in analyzing

the data. The definitions of each variable is described as follows:

1. Economic growth Gross Domestic Product (GDP) is the market value of all

final goods and services, produced in the economy in a country in a period

2. Foreign direct investment is direct investment that has done by an individual

by buying a company or expanding operation of an existing business in that

country.

3. Export is the activity of selling and sending goods from the origin country to

other countries.

4. Infrastructure is a form of public capital, which formed from the investment

made by the government. In this study, infrastructure including roads, bridges,

and sewer system.

5. Inflation is an increase in the general price level of commodities and services

during a specific time period. Inflation is regarded as a monetary phenomenon

due to the impairment of the monetary calculation unit to a commodity.

E. Analysis Method

The analysis method in this research is Error Correction Model (ECM). By

using descriptive quantitative approach, error correction model is used to determine

the effect of independent variables on the dependent variable in the long term and

short term. Short term is usually an economic behavior less than one year. It could

be monthly, quarterly, or annually. Yet in this research, the short term could be

define as the effect for one to two years. However, in the long term is usually an

economic behavior for more than one year. The period is rarely determined by the

researchers. This could be periods for more than two years. Especially in this

research, the effect might occur during the periods of research (33 years).

The quantitative approach is used by using the econometric model