ABSTRACT

THE IMPACT OF LOAN TO VALUE POLICY IMPLEMENTATION TOWARDS CAPITAL MARKET REACTION ON PROPERTY COMPANIES ENLISTED IN IDX

(Event Study)

By

SISKA MEILANDA SARI

This study aims to analyze the impact of the announcement Loan to Value (LTV) policy implementation by Bank of Indonesia towards capital market reactions particularly on property companies which enlisted in Indonesia Stock Exchange (IDX). This research uses event study method to analyze if public information related to Loan to Value policy has information content and relevant to the investors which was measured by abnormal return and trading volume activity. The population in this research are the companies which enlisted in Indonesia Stock Exchange and the sampling methodology utilized in this research is purposive sampling method. Analysis tools in this research are descriptive statistics, normality test and paired sample t-test.

BIOGRAPHY

The writer have the fullname Siska Meilanda Sari and was born in Bekasi in May 11th 1994. The writer is the second daughter from her father Purnomo and her mother Alam Pasti.

Her first education is on Sekolah Dasar Negeri 1 Rajabasa and she graduated on 2006, Sekolah Menengah Pertama Negeri 8 Bandar Lampung which she attended in 2006 and graduated in 2009, then Sekolah Menengah Atas Negeri 10 Bandar Lampung which she finished in 2012.

i CONTENT LIST

Pages

CONTENT LIST... i

LIST OF TABLES ... iv

LIST OF FIGURES ... vi

I. INTRODUCTION... 1

1.1 Background ... 1

1.2 Problem Formulations... 7

1.3 Research Objectives ... 8

1.4 Research Benefits... 8

1.5 Research Framework... 9

1.6 Hypothesis... 10

II. LITERATURE REVIEW... 12

2.1 Capital Market ... 12

2.2 Capital Market Efficiency... 12

2.3 Stock Return ... 15

2.4 Abnormal Return ... 19

2.4.1 Types of Abnormal Return ... 19

2.5 Trading Volume Activity ... 21

ii 2.7 Capital Market Reaction to The Announcement of Loan to Value Policy

Implementation ... 23

2.8 Event Study ... 25

2.9 Previous Research ... 26

III. RESEARCH METHODOLOGY ... 29

3.1 Type of Research ... 29

3.2 Type of Data ... 29

3.3 Data Collection Methods ... 30

3.4 Population and Sample ... 30

3.5 Operational Definition of Variable ... 31

3.6 Data Analysis Method... 32

3.7 Hypothesis Testing... 35

IV. RESULT AND DISCUSSION ... 37

4.1 Overview of Object Research ... 37

4.2 Result ... 38

4.2.1 Result of Actual Return Analysis ... 38

4.2.2 Result of Expected Return Analysis... 39

4.2.3 Result of Abnormal Return Analysis... 40

4.2.4 Result of Average Abnormal Return Analysis ... 41

4.2.5 Calculated Result of Trading Volume Activity Analysis ... 43

4.2.6 Calculated Result of Average Trading Volume Activity ... 43

4.3 Descriptive Statistics Testing... 45

4.4 Normality Testing ... 46

iii

4.5.1 Hypothesis 1 Testing ... 48

4.5.2 Hypothesis 2 Testing ... 50

4.6 Discussion ... 51

4.6.1 Discussion of Hypothesis 1 Testing Result ... 51

4.6.2 Discussion of Hypothesis 1 Testing Result ... 52

V. CONCLUSION AND SUGGESTION... 54

5.1 Conclusion ... 54

5.2 Suggestion... 55 REFERENCES

THE IMPACT OF LOAN TO VALUE POLICY IMPLEMENTATION TOWARDS CAPITAL MARKET REACTION ON PROPERTY COMPANIES

ENLISTED IN IDX (Event Study)

By:

SISKA MEILANDA SARI

Undergraduate Thesis As One of Requirement to Achieve BACHELOR OF ECONOMICS DEGREE

From

Management Department

Faculty of Economics and Business, The University of Lampung

MANAGEMENT DEPARTMENT

FACULTY OF ECONOMICS AND BUSINESS THE UNIVERSITY OF LAMPUNG

THE IMPACT OF LOAN TO VALUE POLICY IMPLEMENTATION TOWARDS CAPITAL MARKET REACTION ON PROPERTY COMPANIES

ENLISTED IN IDX (Event Study)

Undergraduate Thesis

By:

SISKA MEILANDA SARI

MANAGEMENT DEPARTMENT

FACULTY OF ECONOMICS AND BUSINESS THE UNIVERSITY OF LAMPUNG

With hope blessing and guidance of Allah SWT, I would like to present my undergraduate thesis to:

My greatest parent, Purnomo and Alam Pasti

“There aren’t enough words in the world to express my appreciation, but I think this is a good start. Mom and Dad, you’ve been the best,I am nothing without love and

support from both of you.Mom, you are the most incredible people I ever know, I always say I’m strong but deep down inside I know that I can never be as strong as you. Thanks for everything. Dad, thank you for showing me what hard work looks like. For showing me that nothing comes easy, and that countless hours of blood, sweat and tears really does pay off. Even though you are no longer here but I know

you are smiling up there by seeing me achieved my ultimate achievement.As I’m growing up, I realize just how much Mom and Dad did for me. And for that, I need to

truly thank you. So this is for you guys. I love you Mom and I miss you Dad."

For my brother Anggiat Genta Saputa and my sister in law Endriyana Titi Sari "Thank you for all support since I still a little girl until now I have a title behind my

name. I am trying my best to make both of you proud."

My lovely niece, Balqis Septiara Putri

"Thank you for your existence. You’re one of the reason why I have to finish this undergraduate thesis, graduate and get a job. I love you, kid."

Myself,

"Thank you for your ignorance to all the distract things, beat the feel of laziness, heal the pain of being ignored, hold on when feeling down, cheer up when get disappointed. Here is your ultimate achievement. Remember, the future doesn’t wait. Make more money, get a better job, and improve life with a higher education degree."

My Alma mater,

iv LIST OF TABLE

Page

Table 1. Maximum Magnitude Determination of Loan to Value (LTV) for Credit

or Mortgages (KPR)... 23

Table 2. Previous Research ... 26

Table 3. Research Sample ... 31

Table 4. Calculated Result of Stock Expected Return Before and After Loan to

Value Policy Announcement ... 39

Table 5. Calculated Result of Average Abnormal Return of All Stocks Before and

After the Announcement of LTV Policy.... 42

Table 6. Calculated Result of Average Trading Volume Activity of All Stocks

Before and After The Announcement of LTV Policy ... 44

Table 7. Result of Descriptive Statistic Testing on Abnor Return and Trading

Volume Activity Before and After the Announcement of LTV Policy.. 45

Table 8. Result of Normality Testing on Average Abnormal Return Data Before

and After the Announcement of LTV Policy... 47

Table 9. Result of Normality Testing on Average Trading Volume Activity Data

Before and After the Announcement of LTV Policy... 47

Table 10. Result of Paired Sample T-Test of Abnormal Return Before and After

v Table 11. Result of Paired Sample T-Test of Trading Volume Activity Before and

MOTTO

“Langit tidak perlu menjelaskan bahwa dirinya tinggi. People know you are good if

you are good”

“Boleh jadi kamu membenci sesuatu, padahal ia amat baik bagimu, dan boleh jadi

(pula) kamu menyukai sesuatu, padahal ia amat buruk bagimu; Allah mengetahui,

sedangkan kamu tidak mengetahui.–Al-Baqarah, 216)

“One day I’ll be successful and people will ask me which college I went to. I’ll say,

PROLOGUE

Bismillahrrohmanirrohim,

Alhamdulillahirobbilalamin, all praise and gratitude shall be given to Allah SWT

which had gave the blessing and guidance, as of the writer may complete this

undergraduate thesis with the title“The Impact of Loan to Value Policy

Implementation towards Capital Market Reaction on Property Companies

Enlisted in IDX (Event Study)”.This undergraduate thesis is written as one of the

requirements to get Bachelor of Economics title in University of Lampung.

In writing this undergraduate thesis, the writer received the guidance, support,

encouragement, and suggestions from various parties, so that any difficulties can be

overcome with good.

On this opportunity, the writer express her gratitude to:

1. My beloved family. My Dad, Purnomo. My Mom, Alam Pasti. My brother,

Anggiat Genta Saputra. My sister in law, Endriyana Titi Sari, and my

beautiful niece Balqis Septiara Putri. Thank you for showing me true love in

its rarest form, what it feels like, and how it can extend beyondlife’s obstacles

and challenges. Because of your existence and support I can finish this

undergraduate thesis.

2. Prof. Dr. H. Satria Bangsawan, S.E., M.Si. as the Dean of Faculty of

3. Dr. Rr. Erlina, S.E., M.Si. as the Chief of Management Department in Faculty

of Economics and Business, The University of Lampung.

4. Ms. Yuningsih, S.E., M.M. as the Secretary of Management Department in

Faculty of Economics and Business, The University of Lampung.

5. Hj. Aida Sari, S.E., M.Si. as my academic advisor who have gave me so many

motivations and supports during college life.

6. Mr. Hidayat Wiweko, S.E., M.Si. as my advisor who had led, educate, gave

counsel, directing and gave advices in the writing process of this

undergraduate thesis.

7. Mr. Prakarsa Panji Negara, S.E., M.Si., as my co-advisor who had led,

educate, gave counsel, directing and gave advices in the writing process of

this undergraduate thesis.

8. Prof. Dr. Mahatma Kufepaksi, S.E., M.B.A. as the chief examiner who had

gave critics and advices on the writing of this undergraduate thesis. As well as

came to my previous seminars.

9. All lecturer and academic staff of Faculty of Economics and Business

University of Lampung.

10. Kemas Rahmat Zen Vani. Thank you for the help, motivations and supports

during college life until I can finish this bachelor thesis. You play an

important role in this achievement.

11. My beloved senior high school best friends. Agnes Uthami, Innez Regina,

Thama. Thank you for always be there when I need a source of laugh, thank

you for the support so I can finish this undergraduate thesis.

12. Management Bilingual Class class of 2012. Ayu Nadia, Marlia, Winy, Lele,

Ines, Laras, Reza, Fadil, Donna, Saput, Citra, Ikke, Ucang, Brenda, Elisa,

Baok, dan Abe. Thank you guys for the togetherness during college life. Your

cheesy jokes in classroom and during every presentation makes my life

sweeter. See you on top. I consider you guysas a family, so please don’t be

stranger.

13. My senior in Management batch 2011, Kak Ega, Kak Damar dan Kak Pandu,

thank you for helping me in writing this undergraduate thesis.

14. My lovely girls who always accompany me from the very first time of college

until I finished this undergraduate thesis, Deffa Trisetia, Selvi Rahayu, Meri,

Firdha, dan Rhenica.

15. All my friends in Financial Management. Rama Dewi, Albet, Sella, Ayu,

Dinda, Dewi, Rika, Ika, Endah, Delta, Susan, Liana, Yandi, and others. Thank

you for the motivations and advices during college and during the process of

writing this undergraduate thesis.

16. All my friends in Management class of 2012, Wahid Hidayat, Mpess, Hesta,

Ardi, Adri, Novi, Atsil, Akil, Naldo, Vicky, and others.

17. KKN family. Nung, Kak Friska, Mas Hen, Kak Aan, Kak Angga, dan Sipa

18. Zidane Satria Alfahri, Resky Mayang, Tante Lis, Zarra, Mbak Eka, Kak Idris,

Binda, Om Dani, Etek, dan Ibu Jaryati. Thank you for un-stopping supports

and motivations so I can finish this undergraduate thesis.

19. And every person who had gave contribution to the writer on completing this

undergraduate thesis who cannot be mentioned one by one. Thank you for all

of you.

The writer is aware that on the writing process of this undergraduate thesis there are

numbers of flaws and weaknesses. Because of that, every constructive inputs, critics

and advices is highly expected for the improvement of the next writing. Lastly, the

writer hoped that Allah SWT will return all of your kindness and hoped that this

undergraduate thesis will be beneficial for the writer in particular and all the reader in

general, amen.

Bandar Lampung, February 16th2016 Writer,

1. INTRODUCTION

1.1 Background

The property sector is one of the most important sectors that can be used as an

indicator to analyze the economic health of a country. Results of research

conducted by the Real Estate Developers Association of Indonesia (REI) and the

University of Indonesia in 2011 showed that the property sector accounted for

28% of economic growth in terms of consumption expenditure in the construction

sector. However, despite having high growth and a major contribution to

economic growth in Indonesia, the value of property in Indonesia alone in the last

few years have soared so high which is concerned to increase the price of property

assets in Indonesia, which does not reflect the actual price (bubble in property

values).

Mortgage loans (KPR) is a consumptive loans granted by the bank for the people

to have a home with guarantee or collateral of the house itself. The process of

granting mortgages itself includes various parties, which are banks, customers,

developers, government and Bank of Indonesia (BI) as a monetary policy makers

2

Hidayat in a research conducted by Setiawan and Mimba (2015) said that property

investment is an investment in buildings, land owned by the entity (lessee uses

finance lease) to earn rent income or capital gains on asset sales. There are several

reasons why Indonesia used as the location for property investment. First, the

political and economic stability in Indonesia is considered very helpful in creating

foreign investment climate in Indonesia which is currently increasing. Second,

society needs toward property is very high. Based on a survey conducted by the

Central Agency on Statistics (BPS), the housing needs in Indonesia reached

900,000 units per year with housing demand reach the number of 13 million units,

but the supply of housing available is only 80,000 units per year (BPS, 2012). The

unbalanced demand and the supply makes investment opportunities in property

sector becoming more promising for investors to make profits in the future. Third,

in the beginning of free trade known as the ASEAN Economic Community (AEC)

in 2015 which contribute in the increasing quantity of property requirements for

foreigners in Indonesia (Schreiben, 2013). This of course implies the property

asset price increases.

The growth in property sector which is extremely high becomes a concern to Bank

of Indonesia. According to Residential Property Price Survey on first quarter in

2013, the funding sources composition of property establishment is equal to

33.71% funding for establishment on property industry which comes from loan

from Bank of Indonesia (Residential Property Price Survey, 2013). If later the

property industry collapse because the property price experiencing a bubble is

corrected on the market which make property price fall below its intrinsic value,

3

growth in property prices and mortgage growth is reinforced with additional

information on the ground that there is a property purchase in bulk (more than 1

unit, even 10 units at a time), either using a mortgage or by cash /cash gradually.

Data of Information Debtor System (SID) per April 2013 indicates that there are

35.298 borrowers have a mortgage facility more than one (about 4.6% of the total

mortgage debtors). With such behavior, the demand for housing is expected to

continue to increase and it is feared to continue pushing the house prices up. The

increase in price is quite high and it may trigger the event of financial instability if

there is "failure to pay" by the people who use banking services as a source of

financing in the purchase of property.

Bank of Indonesia issued Circular Letter No.15/40/DKMP dated 24 September

2013 to all commercial banks in Indonesia about the policy of limiting the loan to

value (LTV) in granting mortgages property, property-backed loans consumer

financing in order to maintain the stability of the financial system and strengthen

banking system. This regulation regulate the determination of the amount of the

loan to value on the property collateralized loans and mortgage the property, as

well as the down payment for motor vehicle loans. Loan to value ratio or

financing to value, or called LTV or FTV, is the ratio between the value of the

credit or financing that may be provided by the Bank to the value of collateral

property at the time of credit or financing based on the price of the last assessment

(Bank Indonesia Circular Letter No.15/40/DKMP). The impact of the

implementation of LTV policy is that people should pay a higher deposit (down

payment) mortgage to buy a house, thismatter will affect the community’ ability

4

Survey conducted by Bank of Indonesia in 2013 about the volume of residential

property sales in the fourth quarter of 2013 showed there is a slowed down

especially for small type as a result of the policy of the loan to value (LTV). A

slowdown in property sales is also reflected in the slowing of the distribution of

mortgage in the fourth quarter of 2013. The decline in demand for property will

affect the performance of the company so that the company's profitability to

decline, the consequences will affect the stock price changes in the property

sector.

Source: www.yahoofinance.com

Figure 1 Jakarta Composite Index and Sectoral Stock Price Chart Movement on Research Period

Figure 1 shows that the JCI (Jakarta Composite Index) and IHSS (Sectoral Stock

Price) before and after the implementation of LTV looks aligned and relatively

5

policy stock prices both sectoral and JCI stock prices tend to decline or adversely

towards LTV policy. However, prices stabilized in the next weeks.

Loan to value policy is a policy adopted by Bank Indonesia to hold the excessive

growth in the property sector and improve the prudential aspects of banks in

lending properties (increase in the risk management aspect). The circular letter

No. 15/40/DKMP issued on September 24, 2013 were revised from LTV

restriction policy in 2012 because they are still less stringent and not been able to

suppress the growth of motor vehicle loans and Non Performing Loan (NPL)

nominal. NPL is the percentage of non-performing loans (substandard, doubtful,

loss) to total loans. Bank Indonesia expects NPLs maximum of 5%.

Reason Bank of Indonesia issued Bank of Indonesia Circular Letter

No.15/40/DKMP are as follows; First, the increased demand for housing loans

(KPR) and credit of motor vehicles (KKB), so banks need vigilance in lending.

Second, the growth of housing loans that are too high can cause bubble or a rise in

asset property price that does not indicate the actual price of the asset. Third, this

rule arises is intended to protect the economy in order to remain productive and

able to face the challenges of the financial sector in the future, it needs policies

that can strengthen the resilience of the financial sector to reduce the sources of

vulnerability that can occur, including excessive growth in mortgages and vehicle

loans. Fourth, this policy was made in order to increase the prudence of bank in

granting credit or financing property ownership, property-backed consumer loans,

as well as to strengthen the resilience of the financial sector by setting the amount

6

policy is created by means to increase bank circumspection on credit loaning or

property ownership funding, property backed consumption credit, as well as

strengthening financial sector’ resilience which done through loan to value or

financing to value establishment (Bank Indonesia, 2013).

Marzuki in Anoraga (2003) capital markets is complementary in the financial

sector towards the other two institutions, namely banks and financial institutions.

The existence of capital market in Indonesia has been very important for

economic activities in Indonesia. In trading activity in the capital markets,

information is one of the important factors to be known by market participants.

Therefore, the public information on LTV will affect investor decisions in

particular investors who own bank and property stocks. Market reaction to the

public announcements are indicated by changes in stock prices as measured by

using the return as the value of changes in prices or by using abnormal return

(Jogiyanto, 2010). Abnormal return is the difference between the actual return and

the expected return.

Rokhman (2009) said active stock trading can increase the volume of trade and

shows that the stock is favored by investors. When the announcement of the

implementation of LTV policy has information content which is beneficial it will

affect the stocks that comes from changes in trading volume activity. Changes in

trading volume measured by trading volume activity (TVA) by comparing the

number of stocks traded at a certain period. If there are significant differences

7

Loan to value policy implementation inGunanta’s research(2012) have an impact

in the stock price on property’sstocks and have a significant market reaction

towards the announcement of LTV policy. While in the research conducted by

Setiawan and Mimba (2015) there is a significant market reaction to the

announcement which on the day t-1, t-0, and t + 2. For paired samples t-test

showed that there is no difference of market reaction before and after the

announcement of loan to value policy. Implementation of loan to value policy in a

research by Bei (2015) also suggest that there is market reaction which shown on

abnormal return and changes in trading volume activity on property stocks on the

period before to when and when-after.

Therefore, this research titled“THE IMPACT OF LOAN TO VALUE

POLICY IMPLEMENTATION TOWARDS CAPITAL MARKET

REACTION ON PROPERTY COMPANIESENLISTED IN BEI”(Event

Study)

1.2 Problem Formulation

From the background of the problems, the issues to be discussed in this research

are:

1. Is there a significant difference in abnormal return on property companies

sector listed in BEI before and after the announcement of loan to value policy

8

2. Is there a significant difference in trading volume activity in the property

companies sector listed on the BEI before and after the announcement of loan

to value policy conducted by Bank Indonesia?

1.3 Research Objectives

From the formulation of the problems above, the purpose of this research are:

1. To determine whether there is a significant difference in abnormal return on

property companies listed on BEI before and after the announcement of the

loan to value policy conducted by Bank Indonesia.

2. To determine there is a significant difference on trading volume activity on

property companies listed on BEI before and after the announcement of the

loan to value policy conducted by Bank Indonesia.

1.4 Research Benefits

The benefits that can be gained with the implementation of this research are:

1. For Investors

Results of this research is expected to provide information on the impact of

the loan to value policy implemented by Bank Indonesia, especially in stocks

of property companies in the Indonesia Stock Exchange.

2. For Other Researcher

9

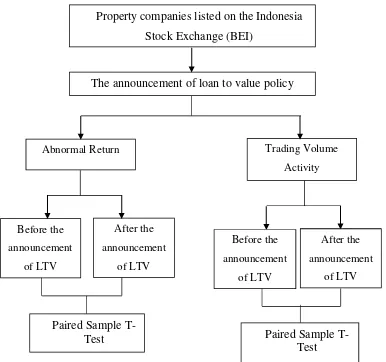

1.5 Research Framework

Loan to value ratio which is a policy implemented by Bank Indonesia is the ratio

between the value of the credit or financing that may be provided by banks toward

the collateral value of the property at the time of credit or financing based on the

price of the last assessment.

Issues raised in the study which is to determine whether there is an effect of the

Loanto value (LTV) policy implementation to the reaction of the capital market in

Indonesia Stock Exchange (BEI) particularly in the stocks of property companies,

using indicators of abnormal return and trading volume activity which is

examined using event study.

Jogiyanto (2010), stated that the event study is a study of the market reaction to an

event that information is published as an announcement. In the event study, the

market reaction is measured by calculating the abnormal return.

The implementation of LTV policy also affects the liquidity of stocks that can be

seen from trading volume activity. When the announcement of the implementation

of LTV policy has information content which is beneficial it will affect the stock

that comes from changes in trading volume activity.

Time period used in this study is 30 days with the window period of 15 days

before the announcement of the Loan to value policy and 15 days after the

10

Based on the background of the problems and objectives that have been

mentioned in the previous section, it can be made in the framework of this

research as follows:

Figure 2: Research Framework

1.6 Hypothesis

Hypothesis testing conducted in order to determine whether there is a difference

of abnormal return and trading volume activity in the property companies before

and after the announcement of the Loanto value policy. Thus, based on the The announcement of loan to value policy

Paired Sample T-Test

Property companies listed on the Indonesia

11

explanation of the background and the problems that have been formulated, the

hypothesis to be studied is as follows:

H1 : Allegedly there is a significant difference on abnormal returns in property

companies listed on the Indonesia Stock Exchange before and after the LTV

policy announcement conducted by Bank Indonesia.

H2 : Allegedly there is a significant difference on trading volume activity in

property companies listed on the Indonesia Stock Exchange before and after

II. LITERATURE REVIEW

2.1 Capital Market

Indonesian capital market plays an important role in mobilizing funds to support

the growth of the national economy. The main target is to increase work

productivity through business expansion and revamping capital structure to

enhance enterprise competitiveness.

Husnan (2001) said the capital market is the market for the various long-term

financial instruments (securities) that can be traded, either in the form of debt and

equity capital, whether issued by governments, public authorities, and private

companies. The capital market is a means of funding for companies and other

institutions (government), and as a means for investing activities for the

community.

2.2 Capital Market Efficiency

In trading activity in the capital markets, information is one of the important

factors to be known by market participants. Information on the capital market is

✁

portfolio. There are variety of information published in capital market whether

information that affects some companies and information that have an impact on

all companies in the capital market.

An efficient market is a market where the price of all securities traded reflected all

available information (Tandelilin, 2007). According to Husnan (2001), an

efficient capital market is a market that the prices of the securities already reflect

all relevant information. The faster the new information is reflected in securities

prices, the more efficient the market. Thus it would be very difficult for investors

to gain profit over the normal level consistently while doing trade transactions on

the Stock Exchange. Some of the conditions that must be met to achieve an

efficient market, are: 1. There are many investors who are rational and strive to

maximize profits, 2. All market participants can obtain information at the same

time in a way that is easy and inexpensive, 3. Information that occurs is random,

4. Investors react quickly to new information, so prices securities change

according to changes in the actual value due to such information.

According to Fama in Jogiyanto (2010) the form efficient market can be grouped

into three, known as the efficient market hypothesis:

1. The Weak Efficient Market Hypothesis

Market efficiency is said to be weak (weak-form) because the

decision-making process of selling and buying stock the investors use price data and

volume of the past. Based on past price and volume the various models of

technical analysis used to determine the price, whether the direction of price

✂ ✄

decided to buy. If the direction of the price will go down, it was decided to

sell. Technical analysis assumes that stock prices always recur, which after

rising in a few days, it will certainly go down in the next few days, then up

again and down again, and so on.

2. The Semistrong Efficient Market Hypothesis

Market efficiency is said to be the half strong (semi strong-form) because the

decision-making process selling - buying stock the investors use past price

data, the volume of the past, and all published information such as financial

reports, annual reports, announcements exchanges, financial information

internationally, government regulations, political events, and other things that

can affect the national economy. This means that investors use a combination

of technical analysis and fundamental analysis in the process of calculating

the value of the stocks, which will be used as a a guide in the purchase price

bid and offer prices.

3. The Strong Efficient Market Hypothesis

Market efficiency is said to be strong (strong-form) as investors using more

complete data, that is: the price of the past, the volume of the past, the

information published and unpublished private information in general.

Calculation of price estimated by using information that is expected to

generate more sales decisions - to buy stocks more precise and higher return.

Here are some strong form market efficiency indicators:

a. Profits earned is very thin due to the low price fluctuations.

☎ ✆

c. Symmetric information that investors have an equal opportunity to obtain

information.

d. Investor analysis capabilities relatively different.

e. Markets react quickly to new information.

2.3 Stock Return

Tandelilin (2001) stated return is the profit earned by the investor of the

investment. One thing that is very reasonable if investors demanded a certain level

of return on funds that have been invested. In the context of investment

management, it is necessary to distinguish between the expected return and the

actual return. Actual return is the rate of return that has been obtained by the

investor. While the expected return is the rate of return anticipated by the

investors in the future, so the nature of expected return has not occurred. Actual

return a capital gain/loss is the difference between the current stock price period

( ) with stock prices in the previous period ( ). Mathematically return

realization can be formulated as follows (Jogiyanto, 2010).

=

Explanation:

= rate of stock return

= stock prices in the period t

✝6

While the expected return can be calculated using 3 estimation models (Jogiyanto,

2010) :

1. Mean Adjusted Model

Mean adjusted model assumes that the expected return is constant, that is

equal to the mean value of previous actual return during the estimation

period, as follows:

[ ] =

Explanation :

[ ] = securities expected return i on t period

= securities actual return i on j period

T = the span of estimation period from t1 until t2

The estimation period is generally a period before the event. Event period

also called the observation period or event window.

2. Market Model

The calculation of expected return using market model done in two stages :

1. Form the expectation models using realization data during the estimation

period.

2. Using this model of expectation to estimate the return in the window

period.

Model expecatations can be formed using the OLS regression techniques

17

= i + i.

Explanation :

= securities actual return i on j period

αi = intercept for i securities

βi = coefficient slope which is Beta from i securities

= market return index on estimated j period

3. Market Adjusted Model

This model assumes that the best predictor for estimating the returns of a

security is the market index return at that time. By using this model, it is not

necessary to use the estimation period to form estimation model because

securities estimated return is the same as the market index. Market index that

can be chosen for IDX market, for example Composite Stock Price Index

(IHSG). Return market index can be calculated using the following formula

(Jogiyanto, 2010):

=( )

Explanation :

= market return

= market price indeks in t period

18

Other expected return calculation models :

a. Capital Asset Pricing Model (CAPM)

Expected return measured by considering the market return and risk-free

interest rate. CAPM model is used as the basis for calculating the expected

return is as follows :

( ) = = ( )

Explanation :

= risk free rate

= market return

= beta of each stocks which calculated using interpolation with

daily return data

Capital Asset Pricing Model (CAPM) has several weaknesses which

include (Andyono, 2009):

1. Model CAPM calculate the expected return of an asset, but using

historical return data (actual) that cause bias in the calculation..

2. The CAPM is a single-period models where testing is done in a matter

of months or years. However, in the meantime there are a lot of

economic fluctuations that cause noise in the results.

3. Market risk premium and beta must be constant in the period.

The expected stock returns (expected return) is the expected revenue from a stock

in the future, in accordance with the risk level of the stock. Before calculating the

19

regressing with Rmt during the period. Calculating the normal return by

using alpha and beta values that previously calculated, while market return used is

the market return during the research period.

2.4 Abnormal Return

According Jogiyanto (2010) abnormal returns is the difference between the actual

return happens with the expected return. Abnormal return is the difference

between the actual return and expected return that may occur before the official

published information or the information leak has occurred before the official

information published (Samsul, 2006). According to Samsul (2006), to calculate

abnormal return of i stock on t day, can use this following formula:

= ( )

Explanation :

= securuities abnormal return i on t event

= securuities actual return i on t event

( ) = securuities expected return i on t event

2.4.1 Types of Abnormal Return

Abnormal return can be classified into 4 groups (Samsul, 2006) :

a. Abnormal Return (AR)

Abnormal return happens every day in every type of stock, which is the

20

a daily basis. Because it is calculated daily, then within a window period it

can be seen which stock that has highs or lows abnormal return, and may

also be known on what day the most powerful reactions occur in each type

of stock.

b. Average Abnormal Return (AAR)

Average abnormal return is the average - average abnormal return (AR) of

all types of stocks that are being analyzed on a daily basis. AAR can show

the strongest reactions, both positive and negative, of all types of stocks on

a certain days during the window period.

c. Cummulative Abnormal Return (CAR)

Cummulative abnormal return is a daily cumulative AR from the first day

untilthe next day of every types of stock. So the CAR during the period

before the event will be compared with the CAR during the period after

the event.

d. Cummulative Average Abnormal Return (CAAR)

Cummulative average abnormal return is a daily cumulative of AAR from

the first day until the next day. From the graph of CAAR it can be seen

daily the tendency of increase or decrease that occurred during the window

period, so the positive or negative impact from the events to the overall

21

2.5 Trading Volume Activity

Trading volume activity is the ratio between the number of stocks traded by the

number of stocks outstanding during a particular period. Trading volume activity

(TVA) is used as an indicator of the liquidity of a stock.

Trading volume is the number of stocks traded in a single trading day. In terms of

its function, it can be said that the trading volume activity is a variation of the

event study. Trading volume activity approach can be used to test the weak form

efficient market hypothesis because in the markets that are not efficient or

efficient in the weak form, the price change is not immediately reflect the

available information so that researchers could only observe the reaction of the

capital market through movement trading volume on the capital markets studied

(Sunur, 2006). According to Mulatsih (2009), to calculate trading volume activity

of a stock can use this following formula:

= the amount of stocks from company i traded on t time

the amount outstanding stocks from i company on t time

2.6 Loan to Value

Definition of loan to value according to Investopedia is a lending risk assessment

ratio that financial institutions and others lenders examine before approving a

mortgage. Meanwhile, according to Justin Pritchard (The New York Times

Company), loan to value tells you how much of a property is being financed. It is

22

ratio between the loan value with the estimated value of assets which is used as

collateral. Related to loan to value the problem is about mortgage (KPR).

Ratios loan to value or financing to value, hereinafter called LTV or FTV, is the

ratio between the value of the credit or financing that may be provided by the

Bank to the value of collateral property at the time of credit or financing based on

the price of the last assessment (Bank Indonesia Circular Letter

No.15/40/DKMP). Loan to value policy tightening issued by Bank Indonesia to

anticipate and minimalize growth in mortgages and properties that are too high

may encourage an increase in the price of property assets that do not reflect the

actual price, thus increasing credit risk for banks with large exposure to property

loans.

Under Circular No. 15/40/DKMP scope of the policy applied to commercial banks

that provide mortgages or property. The calculation of a credit value and the value

of collateral in calculating the LTV for commercial banks are:

a. Credit value is determined based on a credit limit that is received by the debtor

as specified in the credit agreement.

b. Collateral value is determined based on the estimated value of the bank against

the collateral property to the guidelines on Bank Indonesia regulation

23

Table 2.1 Maximum Magnitude Determination of Loan to Value (LTV) for Credit or Mortgages (KPR)

No. Credit Facility or Funding to: Building Area The Magnitude of LTV

Source: Bank Indonesia Circular Letter No.15/40/DKMP

2.7 Capital Market Reaction to The Announcement of Loan to Value

Policy Implementation

The market will react to the events that contain informations. The market reacted

because of the events contains an information that has economic value that could

affect the value of the company. This information will provide a signal for

investors in making decision for investment so it is also take effect toward the

fluctuations in price and trading volume in the capital market. If the market

(investors) and public considers the information of implementation LTV policy as

good news for the property and banking sectors, the market will respond by

buying stocks of the banking and property sectors as the stock price will rise, so

the return obtained is also high.

Society and investors believe with company's performance and trust to invest their

capital in capital market. That is means the implementation of LTV policies will

have a good influence for the company and in the long term it can be a good

24

However, if the market (investors) and public considers that the information of the

implementation LTV policy as bad news for the property and banking sectors, the

market will respond by selling the property and banking sector stocks because

stock prices will fall, so the return earned also decreased. Society and investors

considered that the implementation of LTV policies have a bad effect on the

performance of the banking sector and property, so that the society decided not to

invest especially in banks and property stocks. If public and investor trust to the

company decreases it will affect the performance of the company and of course

have a negative impact on the economy

The implementation of LTV policy impacted on the distribution of housing loans

or property. With the decline in mortgage, it is successfully suppress the growth

of property loans and reduce the risk of non-performing loan (NPL). Credit

growth is reduced because consumers have to pay a higher down payment. This is

why people are afraid to make loans to banking institutions for disrupting the

ability of the consumer installment.

The implementation of loan to value (LTV) policy by the central bank to

commercial banks on 24 September 2013 causing a decrease in lending facility

(mortgage). The reduced of mortgage distribution caused the demand for property

decreases. Based on Residential Property Price Survey on quarter VI in 2013

conducted by Bank of Indonesia, it is suggesting that the mortgage remains the

main source of financing the purchase of residential property. The impact of

policy implementation LTV according to mass media will affect the value of the

25

purchasing power. This condition will affect the company's performance and it

will caused the profitability of the company and it is expected to decrease the

price of property stocks and property stocks trading volume.

Hersini (2013) stated by the issuance of Bank Indonesia's policy, is expected to

have an impact on decline in housing units sales volume. This was caused by the

declining consumer purchasing power due to increased down payments. The

declining sales also give a ripple effect on the property sector as a provider of

property. Developer target sales assigned at the beginning of the year in order to

improve the profit are threatened cannot be reached, resulting in the declining in

the profitability of the company. This decrease will affect the performance of the

property and it is expected to affect the stock price as well as expectations of

investors toward property stocks in obtaining the return in the future.

2.8 Event Study

Jogiyanto (2010), stated event study is the study of market reaction to an event

that the information is published as an announcement. Event study is a research

technique that allows the researchers to assess and learn the effect of an event on

stock prices in the capital market. Event study can also be used as an analytical

tool to know is there any significant reaction in capital market toward events

which can influence the stock price of a company in the capital market. For test

the information content it is more focused on monitoring the market reaction due

26

expected that there will be a reaction in the market at the time when the

announcement was accepted by the market.

The market reaction is characterized by changes in the price of concerned

securities. The market reaction can be measured by using the return as the value of

changes in prices or by using abnormal return. If the abnormal return is used to

measure the reaction then an announcement that has information content is

expected to deliver the abnormal return to the market. Otherwise, if an

announcement does not contain information that can be said it is not give

abnormal return on the market. So based on that definition, event study

methodology can be used to see the reaction of the capital market, which is

reflected in the company' stock price, for a particular event.

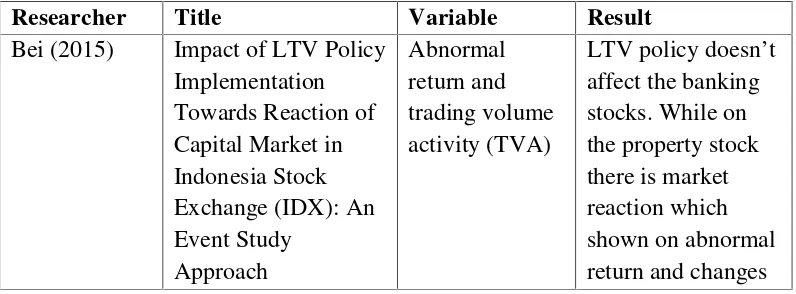

2.9 Previous Research

In this research, the researchers tried to examine the effect of loan to value policy

implementation towards capital market in property companies enlisted in IDX.

Some of the results of previous studies related to this research are as follows:

Table 2. Previous Research

Researcher Title Variable Result

27

Impact of the Loan to Value Regulation Limitation towards Property Stock Price

III. RESEARCH METHODOLOGY

3.1 Type of Research

This research is an event study which is a research technique that allows

researchers to assess the impact of a particular event on the company's stock price.

This research will be done within a period of 30 days with the window period for

15 days before and 15 days after the announcement of loan to value policy

conducted by Bank of Indonesia.

3.2 Type of Data

The data used in this research is secondary data obtained via internet through the

sites of securities to get daily stock price data. Secondary data are data that are not

directly obtained from the first party. The necessary data in this study consist of

daily closing price data, daily stock price of the property sector, daily trading

volumes, the number of outstanding shares, and market index of IDX (JCI) during

30

3.3 Data Collection Methods

1. Literature Research

Research literature means read a variety of literature, references, and financial

journals both in the form of books, magazines, newspapers, and news on the

internet and learn the theories associated with this research.

2. Field Research

Field research conducted by visiting the sites related to the Indonesian capital

market. The method used is the method of documentation, that collect data

and recording the necessary data in this research.

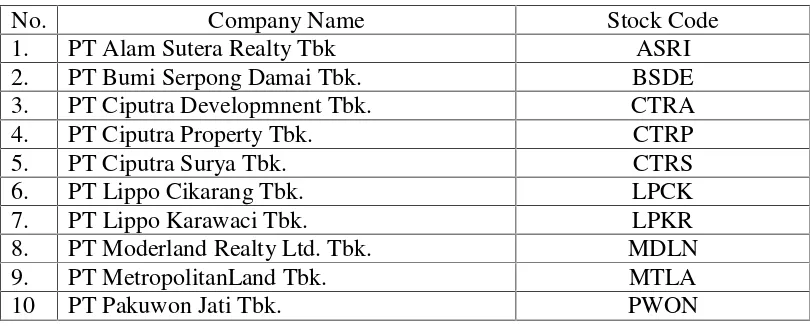

3.4 Population and Sample

The population used in this research are all property stocks listed on the Indonesia

Stock Exchange (IDX) and 10 samples was taken with purposive sampling

method. Criteria for sample selection is a property company which the stocks are

listed on the Indonesia Stock Exchange (IDX) in the period of research and see

the change in the stock price of the property sector during the period of research

because there are some stocks that are categorized as“sleepingstocks”which the

31

Table 3. Research Sample

No. Company Name Stock Code

1. PT Alam Sutera Realty Tbk ASRI

2. PT Bumi Serpong Damai Tbk. BSDE

3. PT Ciputra Developmnent Tbk. CTRA

4. PT Ciputra Property Tbk. CTRP

5. PT Ciputra Surya Tbk. CTRS

6. PT Lippo Cikarang Tbk. LPCK

7. PT Lippo Karawaci Tbk. LPKR

8. PT Moderland Realty Ltd. Tbk. MDLN

9. PT MetropolitanLand Tbk. MTLA

10 PT Pakuwon Jati Tbk. PWON

The research period is 30 days with the window period of 15 days before and 15

days after the announcement of the implementation of the loan to value policy.

3.5 Operational Definition of Variable

The variables that will be analyzed in this research consisted of the dependent

variables and independent variable, which will explain the impact of the abnormal

return and trading volume in property companies listed on the Indonesia Stock

Exchange on loan to value policy announcement by Bank Indonesia.

• Dependent Variables

• According Jogiyanto (2010) abnormal return is the difference between the

actual return of stock with the expected return of stock. Jogiyanto (2010),

to calculate the abnormal return of i stock on t day can use the following

formula:

32

• Trading volume activity is the number of stocks within a certain period.

Trading volume activity (TVA) is used as an indicator of the liquidity of a

stock. The formula for calculating the TVA according Mulatsih (2009) is

as follows :

✟

✠ ✡☛☞ ✌✍✎ ✏ ✠✍✑✒ ✠ ✍✓✔✒✑✕ ✍✌✓✍ ✌✖☞✏✗✘✠✕ ☞✙ ☛✙✍✏✠✠✘ ✌☛

✠ ✡☛☞ ✌✍✎ ✏ ✠✍✎✠✒ ✠☞ ✏✙ ✘ ✏✚✒ ✠ ✍✓✔✒✑✕ ✍✌✘✓ ✍✌✖ ☞ ✏ ✗✍✏✠✠✘ ✌☛

• Independent Variable

The independent variable in this reserach is the loan to value policy. loan to

value or LTV is the ratio between the value of credit that can be granted by the

lender (bank) to the value of collateral in the form of property during the

beginning of the loan that based on the price of the last assessment (Bank of

Indonesia, 2013).

3.6 Data Analysis Methods

1. Qualitative Analysis

Qualitative analysis done by using the existing theories and approaches

related to the research to solve problems and explain the problems with the

data obtained that will be used in this research.

2. Quantitative Analysis

− Abnormal return analysis method:

a. Calculate the daily actual return of stock during the period of research

(Jogiyanto, 2010):

33

Explanation :

R = rate of return of the stock

= price of stock on t period

= stock price on previous t-1 period

b. Calculate the expected return with market-adjusted model by using the

following formula (Jogiyanto, 2010):

✢

( ✣ )

Explanation :

= IHSG t period

= IHSG t-1 period

c. Calculate the abnormal return using this formula (Jogiyanto, 2010) :

✢ ✣ ( )

Explanation :

= abnormal return i security on t period

= rate of return i security on t period

( ) = expected return i security on t period

d. Calculate average abnormal return of each stock during the period of

research using this formula (Suryawijaya in Bei, 2015):

34

✤

e. Calculate average abnormal return for all stocks during the period of

research (Jogiyanto, 2010) :

✤

Explanation :

= average abnormal return of i stock on t period

= abnormal return of i stock on t period

= number of period

− Trading volume activity analysis method:

a. Calculate the TVA of each stock during the period of research (Mulatsih,

2009):

✥

✦ ★✩✪✫✬✭ ✮✦✬✯✰✦ ✬✱✲ ✰✯✳ ✬✫✱ ✬✫✴ ✪✮✵✶✦ ✳ ✪✷✩ ✷✬✮✦✦ ✶ ✫✩

✦ ★✩✪✫✬✭ ✮✦✬✭ ✦ ✰✦ ✪✮ ✷ ✶✮✸✰✦ ✬✱✲ ✰✯✳ ✬ ✫✶✱ ✬✫✴ ✪✮✵✬✮✦✦ ✶ ✫✩

b. Calculate average TVA each stock during the period of research

(Suryawijaya in Bei, 2015):

✤

35

c. Calculate average TVA of all stocks during the period of research

(Suryawijaya in Bei, 2015):

✹

3.7 Hypothesis Testing

The steps in conducting statistical hypothesis testing are as follows:

1. Formulate the hypothesis :

Hypothesis 1 :

• Ho : Allegedly there is no significant difference on abnormal returns in

property companies listed on the Indonesia Stock Exchange before and

after the LTV policy announcement conducted by Bank Indonesia.

• Ha : Allegedly there is a significant difference on abnormal returns in

property companies listed on the Indonesia Stock Exchange before and

after the LTV policy announcement conducted by Bank Indonesia.

Hypothesis 2 :

• Ho : Allegedly there is no significant difference on trading volume activity

in property companies listed on the Indonesia Stock Exchange before and

after the LTV policy announcement conducted by Bank Indonesia.

• Ha : Allegedly there is a significant difference on trading volume activity

in property companies listed on the Indonesia Stock Exchange before and

36

2. Determine the selection of statistical test

• Normality Test

Before testing the hypothesis, firstly test the normality of the data which

are the data abnormal return and trading volume activity. To see whether

the data were normally distributed or not. Normality testing of data using

statistical tools SPSS which is Kolmogorov-Smirnov test. Criteria for

normality test is if the probability values> level of significant (α = 5%)

then the data is normally distributed, otherwise if the probability value <

level of significant (α = 5%)then the data is not normally distributed.

• Paired Sample T-Test

This test is conducted to determine whether there are significant

differences in abnormal return and trading volume activity as a result of

the implementation of the policy loan to value. This testing process using

SPSS. The researcheruses a confidence level of 95% or α = 5% with the

following criteria:

• If the probability value < level of significant (α = 5%) it can be

concluded that Ho refused and Ha accepted which means that there

are significant differences.

• If the probability value> level of significant (α = 5%) it can be

concluded that Ho is accepted and Ha rejected, which means there are

V. CONCLUSION AND SUGGESTION

5.1 Conclusion

Based on the analysis of data and the results of the discussion that has been done

in previous chapters, it can be concluded that:

1. The announcement of the loan to value policy implementation has no effect

towards abnormal return on property stock. This means that the information

of the announcement of loan to value policy implementation has been

absorbed by the market or investor so that the market does not react to events

LTV policy implementation.

2. The announcement of loan to value policy implementation affected the

trading volume activity of property stock. This means that investors consider

the announcement of LTV policy implementation has information content so

that the market reacted to the implementation of LTV policy which can be

seen from the declining in the stock trading volume. The declining of TVA

average is because investors consider the implementation of LTV as bad news

so investors decided to release their shares as investors felt the

implementation of LTV policy will result in falling stock prices and stock

✺✺

3. The information of loan to value policy implementation only affect the

transactions in the stock market, especially on the property stock but not

affect the return of the property stock.

5.2 Suggestions

After getting the results of the conclusions above, the researchers propose

suggestions for future research as follows:

• For the investor, it is better to make decisions not only see events such as the

announcement of the implementation of LTV policy, but also pay attention to

other external factors that may affect the price of stocks on the capital market,

as consideration in the decision to invest in the capital market.

• For the next researcher who will conduct similar research in order to develop

the research by conducting research on the impact of LTV policy

implementation towards other sectors companies with a larger sample.

• For the next researcher also will conduct similar research in order to use

different methods of calculating the expected return in addition to those

already used in this study. Similar research with different calculation methods

REFERENCE

Andyono, Raditya Christian. (2009). “Analisis Pengaruh Faktor Fundamental

Perusahaan dan Kondisi Makroekonomi Terhadap Tingkat Imbal Hasil

Saham Perusahaan Industri Pertambangan di Bursa Efek Indonesia

Periode 2004-2008”.Skripsi. Jakarta : Universitas Indonesia.

Anoraga, Pandji dan Piji Pakarti. (2003).“Pengantar Pasar Modal.”Jakarta: PT.

Rineka Cipta.

Badan Pusat Statistik. (2012).“Statistik Perumahan dan Permukiman”. Jakarta.

Bei, Viktoria. (2015).“Dampak Penerapan KebijakanLoan to Value Terhadap

Reaksi Pasar Modal di Bursa Efek Indonesia (BEI): Sebuah Pendekatan

Event Study.”Jurnal Ilmiah pada Fakultas Ekonomi dan Bisnis Universitas

Brawijaya, Malang.

Ghozali, Imam. (2007). “Aplikasi Analisis Multivariate Dengan Program SPSS.”

Badan Penerbit Universitas Diponegoro, Semarang.

Gunanta. (2014).“Dampak Aturan Pembatasan Loan to Value terhadap

Perubahan Harga saham Sektor Properti.”Jurnal Akuntansi pada Fakultas

Ekonomi Universitas Negeri Surabaya, Surabaya.

Hersini, Noor Sargita. (2013).“Dampak Implementasi Kebijakan Bank Indonesia

Dalam Pembatasan Loan To Value Pada Kredit Pemilikan Rumah dan

Indonesia (BEI).”Tesis Pascasarjana Program Studi Magister Akuntansi

pada Fakultas Ekonomi dan Bisnis Universitas Gajah Mada, Yogyakarta.

Hidayat, Rony Wahyu. (2014).”Peluang dan Tantangan Investasi Properti di

Indonesia.”Jurnal Akuntansi pada Fakultas Ekonomi Universitas Negeri

Surabaya,Surabaya.

Husnan, Suad.(2001). “Manajemen Keuangan Teori Dan Penerapan (Keputusan

Jangka Pendek).”Yogyakarta : BBFE.

Jogiyanto, H.M. (2010).Teori Portofolio dan Analisis Investasi. Yogyakarta:

BPFE.

Mulatsih, LS. (2009).“Analisis Reaksi Pasar Modal Terhadap Pengumuman

Right Issue Di Bursa Efek Jakarta (BEJ).”Wacana, Vol.12,(No.4).

Natidya. (2014).“Reaksi Pasar Terhadap Kebijakan Bank Indonesia Tentang

Pembatasan Loan to Value pada Kredit Pemilikan Rumah: Analisis Saham

Sektor Perbankan dan Properti.”Skripsi. Universitas Gajah Mada,

Yogyakarta.

Rokhman, TN. (2009).“Analisis Return, Abnormal Return, Aktivitas Volume

Perdagangan Dan Bid-Ask Spread Saham Di Seputar Penguman Stock

Split”.Wacana, Vol.12, (No.4).

Samsul, Mohammad. (2006). “Pasar Modal Dan ManajemenPortofolio.”Jakarta

: Erlangga.

Saraswati. (2014).“Analisis Kebijakan Bank Indonesia Tentang Loan to Value

pada PT Bank Tabungan Negara (PERSERO) Tbk. Cabang Singaraja.”

Jurnal Jurusan Pendidikan Ekonomi, Fakultas Ekonomi dan Bisnis

Universitas Pendidikan Ganesha Singaraja, Indonesia.

Schreiben, Reiys. (2013).“Prospek Indonesia Menjadi Tujuan Utama Investasi

Setiawan dan Mimba. (2015). “Reaksi Pasar Pada Regulasi Loan to Value.”

Jurnal Akuntansi Universitas Udayana, Bali.

Sunur, Irene.(2006). “Pengaruh Peristiwa Pergantian Presiden Republik

Indonesia Terhadap Return Dan Trading Volume Activity: Event Study

Pada Tanggal 20 September-20 Oktober 2004”. Surabaya : STIE Perbanas.

Tandelilin, Eduardus. (2001). “Analisis Investasi DanManajemen Portofolio.”

Yogyakarta : BPFE.

Tandelilin, Eduardus. (2007).“Portofolio dan Investasi(Teori dan Aplikasi).”1st ed. Yogyakarta: Kanisius.

Wirawan. (2014).“Reaksi Pasar Modal Indonesia Terhadap Pengumuman

Kebijakan Loan to Value.”Tesis Pascasarjana Program Studi Magister

Manajemen pada Fakultas Ekonomi dan Bisnis Universitas Gajah Mada,

Yogyakarta.

http://www.bi.go.id/id/peraturan/perbankan/Pages/se_141012.aspx. Accessed on

18 June 2015.

http://www.bi.go.id/id/peraturan/perbankan/Pages/SE_154013.aspx. Accessed on

18 June 2015.

http://www.bi.go.id/id/publikasi/survei/harga-properti-primer/Pages/shpr_primer_tw413.aspx. Accessed on 18 June 2015.

www.idx.co.id . Accessed on 25 July 2015.