THE IMPACT OF PROFITABILITY, LEVERAGE AND SIZE OF

BOARD COMMISSIONER TOWARD SUSTAINABILITY

REPORTING DISCLOSURE

(STUDY OF INDONESIAN COMPANIES THAT PARTICIPATED

SUSTAINABILITY REPORTING AWARD 2012 UNTIL 2015)

M. FADHLIL FERNALDY

NIM: 1112082100006

INTERNATIONAL CLASS PROGRAM

ACCOUNTING DEPARTMENT

FACULTY OF ECONOMICS AND BUSINESS

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH

JAKARTA

CURRICULUM VITAE

Personal Data

Name : M.Fadhlil Fernaldy

Nick Name : Ody

Address : Komp IPB BR Siang 4 Block c 38, Bogor, 16154

Mobile Phone : +6285716121560

Email : fernaldy49@yahoo.com

Place, Date of Birth : Palembang, 10-04-1994

Gender : Male

Religion : Islam

Nationality : Indonesia

Formal Education

University of Applied Science Würzburg-Schweinfurt (2014 – 2016)

State Islamic University Syarif Hidayatullah Jakarta (2012 – 2016)

SMA Negeri 7 Kota Bogor (2009-2012)

SMP Negeri 2 Kota Bogor (2006 – 2009)

SDN Papandayan 1 Kota Bogor (2000 – 2006)

TK Alisa Kota Bogor (1998 – 2000)

Informal Education

Louis-Massignon-Schule, German course (2014)

PPA FEUI, Akuntansi Keuangan (2013)

Working Experience

Inter in KJRI Frankfurt as Administration Staff (2015)

International Class project with DIFOX company (2014)

Organization Experience

Marketing Department of Java MUN (2016)

Committee of UIN Jakarta Bike Camp (2015)

President of Academic Introduction in International Program (2013)

Vice President of Orientation Day in International Program (2013)

Committee of International Islamic Conference on Media (2013)

Logistic Department of Fun Bike UIN Jakarta (2013)

Conference and Training Participations

Summer School in Weiden, Germany (2015)

Team Training held by FHWS (2014)

Islamic Finance on Infrastructure Project Development (2013)

Simulasi Pasar Modal (2013)

Conference of ISC Diplomatic Course (2012)

Activity of Co-curricular

Company Visit Goes to Direktorat Jendral Pajak RI (2015)

Excursion and visit to European Parliament (2014)

DAMPAK PROFITABILITAS, HUTANG DAN UKURAN DEWAN KOMISARIS TERHADAP PENGUNGKAPAN LAPORAN KEBERLANJUTAN

(STUDI PADA PERUSAHAAN YANG IKUT BERPARTISIPASI PENGHARGAAN LAPORAN KEBERLANJUTAN 2012 SAMPAI 2015)

ABSTRAK

Tujuan dari penelitian ini adalah untuk menginvestigasi pengaruh Profitability, Leverage dan Ukuran Dewan Komisaris terhadap pengungkapan laporan keberlanjutan. Penelitian ini mengunakan kuantitatif dan analisa regresi berganda sebagai metode statistik . Penelitian ini menganalisa laporan keberlanjutan yang terpisah dari laporan tahunan untuk perusahan yang mengikuti penghargaan laporan keberlanjutan dari 2012 sampai 2015. Variabel bebas Profitability diukur dengan ROA, Leverage diukur dengan DAR dan ukuran Dewan Komisaris diukur dengan BOC, sedangkan variabel terikat laporan keberlanjutan diukur dengan Index laporan keberlanjutan dan mengunakan index GRI sebagai pedoman. Berdasarkan purposive sampling dan kategori, telah terpilih 16 sample perusahaan dan peneliti menggunakan 4 tahun laporan data sehingga terdapat 64 unit sample. Hasil dari uji T menunjukan hanya Profitabilitas yg diukur mengunakan ROA mempunyai dampak terhdapat laporan keberlanjutan sedang variable lain seperti DAR dan BOC menunjukan tidak ada dampak terhadap pelaporan laporan keberlanjutan.

Kata Kunci: Sustainability Reporting, Profitability, Leverage, Size of Board

THE IMPACT OF PROFITABILITY, LEVERAGE AND SIZE OF BOARD COMMISSIONER TOWARD SUSTAINABILITY REPORTING DISCLOSURE (STUDY OF INDONESIAN COMPANIES THAT PARTICIPATED SUSTAINABILITY

REPORTING AWARD 2012 UNTIL 2015)

ABSTRACT

The purpose of this research is to investigate the impacts of profitability, leverage and size of board commissioners to sustainability reporting disclosure. The research use a quantitative analysis approach and multiple regression as statistical method. It examines sustainability reporting that separated from annual report for companies that participated Indonesia sustainability report award 2012 until 2015. The independent variables Profitability measured by ROA, leverage measured by DAR and size of board commissioners measured by BOC , while the dependent variable sustainability report index measured by GRI index as guideline. Based on purposive sampling method and the category there are 16 companies selected as sample and researcher use 4 years data , so there are 64 sample units. The result of T-test show that only profitability that proxy by ROA that has impact to sustainability reporting disclosure while the others variable like DAR and BOC show no impact toward sustainability reporting disclosure.

Keywords: Sustainability Reporting, Profitability, Leverage, Size of Board

FOREWORD

Assalammu‟alaikum Wr.Wb.

All praise to Allah SWT as the hearer, the seer and above all an abundance of

grace, Taufiq, as well as his guidance. So, because Allah SWT I can finish this research

on time. And shalawat always gives to our beloved Prophet Muhammad SAW and all

his families and friends who always helped him in establishing Dinullah in this earth.

With the strength, intelligence, patience, and strong desire from Allah SWT, I

am able to finish this mini thesis as graduation pre requirement for bachelor degree. I

believe there is an invisible hand which has helped me going through this process. Also

wonders of the Al-Quran nul Qarim and As-Sunnah which has become the light in this

life.

My special thanks for my Mom, Dewi Atika, who has been helping and

supporting his second son to finish the thesis. You are the embodiment of angle in

human form. So, I want to make you always smile because your smile is the efficacious

magic that can boost my spirit to reach my dream and face the world. Thank you for

every struggle that you made for your family. Thanks mom, even a thousand of word

can‟t explain how really happy I am to be your son ! .

I also would like to extend my gratitude to my father, Chaidir, who always

support my studying and teach me everything you know from your experience. Papa

. For my parents, I just can pray that Allah SWT will give you back for everything that

you have done. Thank you for every support that you give to me.

For my brother, M. Fridho Finantheo, who always support, while sometimes I

get bored to write a thesis. Thank you because if you are in Home , you always ask me

to hang in out with you and buy any stuff that I want so that become a big mood

booster to write again my thesis and finish it as soon as possible. Special thanks also for

Ariodilah family that always support me and pray the best for me.

I believe I am nothing without each one of you who has helped me in finishing

this undergraduate thesis. Thus, in this very special moment, let me say many thanks to

all of them have been helping me in the process of this thesis, including:

1. Prof. Dr. Margareth Greferer as professor that always give me motivation and support to achieve double degree program . Thank you very much for every knowledge that you share to me .

2. Yessi Fitri, SE., M.Si.,AK.,CA. as head of accounting program that always help me and support me regarding the process of my double degree program and academic issue in UIN, so I able to graduate on time beacause of you .

3. Heppi Prayudiawan,SE.,MM.,AK.,CA as secertary of accounting program that support me for academic in UIN and help me for comprehensive exams.

4. Prof. Kiesel as the head of international program in FHWS that always help me in wurzburg.

5. Prof. Reiner as my mentor and person in charge for me in wurzburg, thank you very much for every your support to me and your help about my grade problem in FHWS .

7. Bang Bonx as the staff in academic. Thank you for always helping me in administrative things in UIN.

8. Kak Farah, Kak Pipit and ka Nanda thank you very much for your knowledge . all of you really help me to finish this thesis. I hope together we can go to Germany again and travel around Europe.

9. Revan as my friend that teach me how to manage data in SPSS and suport me to finish as soon as possible and Yudhi as my friend in regular class that always share his knowledge to me.

10.All of my friends in Accounting and Management for international program batch 2012. Andhiko, Syafiq, Siti, Lia, Hadyan, Faiz, Reza, Akang, Fajar, Priyo, Radit, Azka, Eva, Dita.Thank you so much for the friendship that we made so far, I do believe we will be success together in the age of 25 just like our whatsapp group name. Thank you my senior and junior that i couldnt say one by one.

I realize that this thesis is still far from perfection, thus suggestions and

constructive criticism from all parties are welcome, in order to improve my thesis.

Finally, only Allah SWT will return all and I hope this thesis will be useful to all

parties, especially for writers and readers in general, may Allah SWT bless us and

recorded as the worship of Allah‟s hand. Amin. Wassalammualaikum Wr. Wb

Jakarta, July 2016

TABLE OF CONTENT

Cover... Certification of Supervisor... Certification of Comprehensive Exam... Certification of Thesis Exam... Sheet Statement Authenticity Scientific Work... Curriculum Vitae... Abstarct... Foreword... Table of Content... List of Table... List of Figure...

CHAPTER I INTRODUCTION

A. Background... B. Problem Formulation... C. Purpose Research... D. Benefit Research...

CHAPTER II LITERATURE REVIEW

A. THEORITICAL FRAMEWORK... 1. Stakeholder Theory... 2. Agency Theory... 3. Legitimacy Theory... 4. Defination of sustainability... 5. Understanding Sustainability Reporting... a. Sustainability Reporting Guideline... 6. Corporate Social Responsibility... a. The difference Sustainability reporting and CSR reporting...

7. Sustainability Report Award... 8. Profitability... a. Profitability and SRD... 9. Leverage... a. Leverage and SRD... 10.Size of Board Commissioners... a. Size of Board Commissioners and SRD... B. Previous Research ... C. Logical Framework... D. Hypothesis ...

CHAPTER III RESEARCH METHODOLOGY

A. Scope of Research... B. Sampling Method... C. Data Collection Method ... D. Analysis Method... 1. Descriptive Statistics... 2. Classic Assumption... a. Normality Test... b. Heteroskidastity Test... c. Multicolinearity Test... d. Autocorrelation test... 3. Coefficient Determination ( )... 4. Hypothesis Testing... a. Simultaneous Testing (F-test)... b. Partial Regression (T- test)... E. Variable Operation... 1. Independent Variable... 2. Dependent Variable...

CHAPTER IV RESULT AND ANALYSIS

A. Description Research Object... 1. Overview Selected Companies... B. Analysis and Discussion ... 1. Descriptive Statistics... 2. Classic Assumption... 3. Coefficient Determination ( )... 4. Hypothesis Testing... a. Simultaneous Test (F-test)... b. Partial Regression test (T- test)...

CHAPTER V CONCLUSION AND RECOMMENDATION

A. Conclusion... B. Recommendation...

REFERENCE... APPENDIX...

51 51 52 52 54 59 60 60 61

65 66

LIST OF TABLE

No. Description

2.1The Facets of Sustainability...

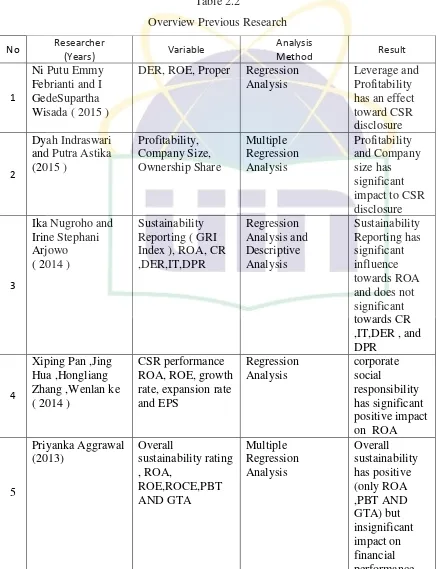

2.2Overview Previous Research...

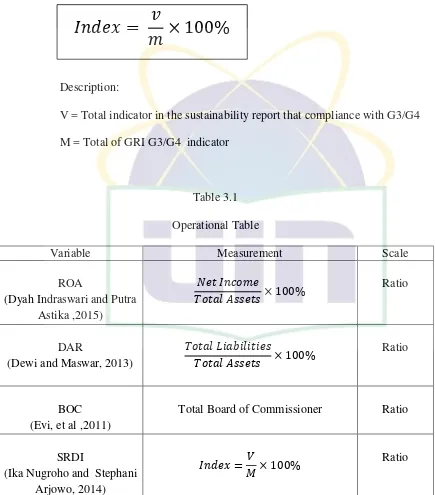

3.1 Operational Table...

4.1 Sampling Research...

4.2 Result of Descriptive Statistics...

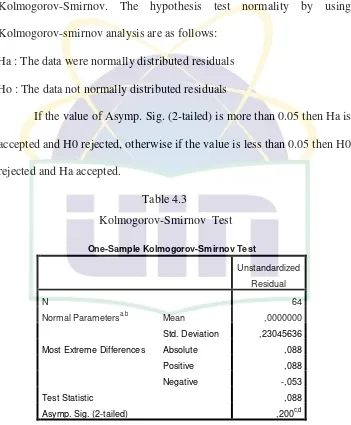

4.3 Kolmogorov-Smirnov Test...

4.4 Tolerance and VIF Test...

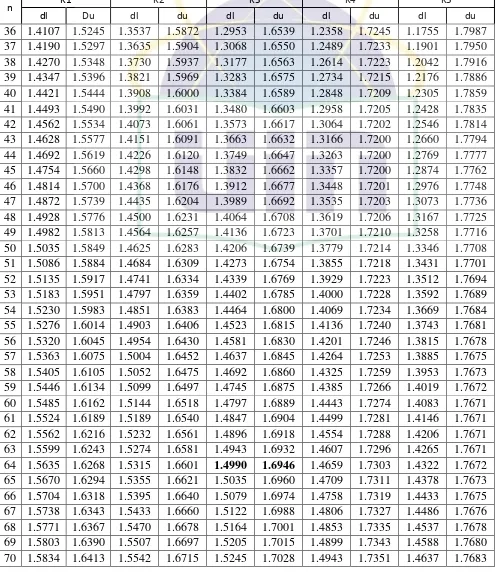

4.5 Durbin Watson Test...

4.6 Result of Coefficient Determination Test...

4.7 Result of F – Test...

4.8 Result of T-Test... 10

35

50

51

52

55

57

58

59

60

LIST OF FIGURES

No. Description

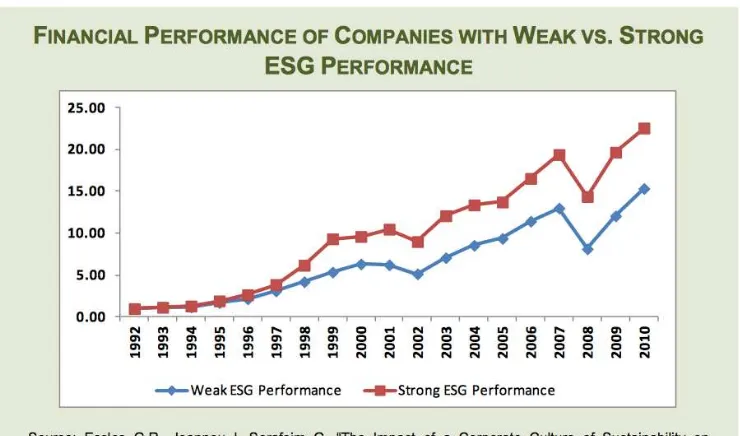

1.1Financial Performance of Companies Weak VS Strong...

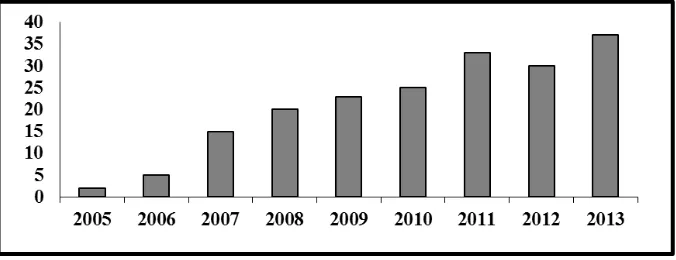

2.1 Indonesian Companies that Participated Sustainability Reporting Award...

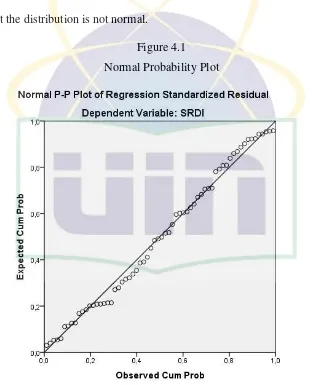

4.1 Normal Probability Plot...

4.2 Scatrerplot Test... 3

18

54

CHAPTER I

INTRODUCTION

A.

Background

One of major principles that is most prominent at the present time is

sustainability. Sustainability has recently become very important for businesses,

from large businesses into small businesses. One of the focus sustainanability

concept in businesses is that company cannot separated from the society and the

environment. The society and the environment is classify as involuntary

stakeholders, because the society and the environment cannot be able to make

choice to be not become stakeholder.

Stakeholder become aware of sustainability development regarding the

United Nation schedule agenda of sustainability development for 2030.

According to Jeffrey (2015) describe sustainable development is the way

looking the world with focus on interlinkages of social, economic and

environmental change and describe the shared aspiration also combine the

growth of economic, social regulation and environmental sustainability. Many

stakeholder try to reach sustainability development by practice sustainability

aspect in their business and disclose the sustainbility reporting.

Since 1990s, the number of companies disclosing information on their

many large multinational companies, sustainability reporting has become a

mainstream phenomenon.

According to McKinsey Survey (2011), 76 percent of CEOs consider

that strong sustainability performance contributes positively to their businesses

in the long term. Companies are capitalizing on local conditions and shaping

their business strategies to accommodate constraints on natural resources in a

way that allows them to develop innovative new products, services, and business

models. This also provides opportunities to increase companies growth,

profitability, and add societal value. (McKinsey Global Survey results 2011)

Three general aspect of sustainability reporting is economic,

environmental and social or as we know as triple bottom line. Due the long term

goal and short term profit many company only focus in the economic

performance and forget their environmental and social aspect that‟s why there

are various cases regarding the environmental and society aspect .

One of environmental and social issues happened in Negeria, when

Shell began oil production in 1958. The problem occur in 1960 and the United

Stated district cort just settle down the problem in 2009. Oil drilling has had a

devastating impact on the region‟s environment. Oil spills, gas flaring and

deforestation have stripped the land of its environmental resources, destroying

the subsistence farming and fishing based economy of the Ogoni.

In 1990 the local citizens founded Movement for the survival Ogoni

agreement with the Nigerian Government to fight back Ogoni people by military

dictatorship and did physical violence to Ogoni people .

Radio Canada programme Zone Libre published the news that Walmart

was using underage worker child at two factories in Bangladesh. 89 Children

aged 10-14 years old were found to be working in the factories for less than $50

a month making products of the Walmart brand for export to Canada. (Cristina

A. et al, 2013)

Developing a good environmental and social reputation can contribute to

a willingness among customers and investors to pay a price premium, which

directly affects the company‟s bottom line. According to a Harvard Business

School study, companies that has good performance in environmental and

social is outperform the companies that has weak performance in environmental

[image:20.595.114.484.511.729.2]and society.

There is an increasing expectation from stockholders and customers that

companies report how their performance work with sustainability. This

Phenomenon happened because stockholders increase their awareness not only

about the financial issues of the company but also about the social and

environmental impacts posed by the company in running its activities.

5,000 investors in 29 countries accessed more than 50 million

Environmental and Social performance indicators in the Bloomberg platform

and 29 percent increase over the previous year (Bloomberg, 2010). The sustainability reporting framework such as Global Report Initiative (GRI) and

Carbon Disclosure Project (CDP) have become important tools to informed

investor, so investor can make investment decision.

Recently, businessmen and academic researchers increase their interest

levels in sustainability report. Sustainability report is used by companies to

measure, to disclose, and to be accountable to internal and external stakeholders

with regard to their environmental, social, economic and organizational

performance.

Company that that perform better in economically are expected to

disclose more about sustainable development (Roberts, 1992). The researcher

interested to make a research and find out that company with good operating

performance are likely to have incentive to make environmental and social

performance disclosure.

There are research gap from the previous research since there are lot of

positve and negative correlation between profitability, leverage and size of

board commissioners toward sustainability disclosure. Based on previous

research, researcher want to continue the research and focused the research into

3 independent variable that will influence to sustainability reporting disclosure.

The thesis title is :“ The Impact of Profitability, Leverage and Size of Board

of Commissioners toward Sustainability Reporting Disclosure (Study of

Indonesian Companies that Participated Sustainability Reporting Award

2012 until 2015)

B. Problem Formulation

In problem formulation, the gap between the present situation and

desired situation is formed as structured description of problem formulation. The

purpose problem formulation is to explicit description statement of problem and

provides a shared understanding of problem relevant aspect. The problem

formulation in this research is :

1. Does Profitability has impact to sustainability reporting disclosure ?

2. Does Leverage has impact to sustainability reporting disclosure ?

3. Does size of Board Commissioner has impact to sustainability reporting

disclosure ?

C. Purpose of Research

The purpose of this research is to investigate the impact of 3 independent

variables to sustainability reporting and to investigate what extent printed

report award or exceed the requirements provided in GRI guideline. The

purpose is as follows :

1. To analyze impact profitability to sustainability report

2. To analyze impact of leverage to sustainability report

3. To analyze impact of size board commissioner to sustainability report

4. To determine relationship between Profitability, Leverage, Size of Board

Commissioners with sustainability reporting.

D. Benefit of this Research

1. For companies : This research can be as reference to make decision making

for managers about environment and social disclosure in order to attract

investor

2. For students : This research can contribute to new knowledge in financial

accounting, particularly about how the companies financial performance

may affect the disclosure of sustainability reporting .

3. For society : This research will be wider the knowledge of researchers on

CHAPTER II

LITERATURE REVIEW

A. Theoritical Framework.

The purpose of this literature review is to understand the theories and to

reveal the overview about sustainability and the term applied in this research.

There are selected literature from different journal and report like literature

sustainability, sustainability report with GRI guideline and after that literature

review will describe about profitability, leverage and size of commissionerr as

factor that followed by sustainability report.

1. Stakeholder Theory

According to R. Edward Freeman (1994) Stakeholder theory is

theory of organizational management and business ethics that addresses

moral value in managing company or organization. According to Thomas

Donaldson and Lee E.Preston (1995) describe stakeholder theory into

several means. First stakeholder theory is unarguably descriptive that

present a model describing what the companies is and describe company as

a constellation of cooperative and competitive interest possessing intrinsic

value. Second stakeholder theory is instrumental that establishes a

framework for examining between the management practice and company

goal. Third stakeholder theory is managerial in broad sense of term.

Stakeholder theory recommends attitudes, structures and practice

One of the strategy of to maintain the relationship stakeholder and

shareholder is to disclose sustainability reporting that give information about

economic performance, social performance and environmental performance.

Sustainability reporting disclosure is expected to meet the needs of

information that required and to manage managers to gain support from all

stakeholder and shareholder in order to make company do good performance

for triple bottom line aspects and for the continuity life of company as well.

2. Agency Theory

Agency theory is concern about the relationship between the

principle (shareholder or investor) and the agent (managers), this theory

believe there is different interest and information asymmetry between the

principal and the agent so it will make conflicts that called agency conflict

(Kathleen, 1989).

In the companies scope, companies tend to select the information to

be disclosed, detracting the one that negatively affects their strategic and

financial positioning. Sustainability report will help to reduce the

information asymmetry and to reduce risk and uncertainty perceived by

principal

3. Legitimacy Theory

Legitimacy theory has become one of most used theory within social

and environmental accounting area. James Guthrie et al (2006) found that In

this theory there is a social contract between company and society so

report help companies tell their performance to society, so society can accept

companies. with the acceptance of society company can increase their profit

and interact with the investor

These theories prove the line between company performance and

sustainability. Company that have good performance especially company

that have good profitability should disclose their performance in proper

sustainability report

4. Definition of Sustainability

The concept of sustainability was originally in forestry concept,

where it‟s mean never harvesting more than what the forest yields in new

growth. This concept concern about preserving natural resources to the

future (Wiersum .,1995 in Tom Kuhlman and John Farrington, 2010).

According to United Nation World Commission on Environment and

Development that more famous as Brundlatnd Report in 1987 defined

sustainability is concerned with which action taken in present has upon the

options available in the future (Tom Kuhlman and John Farrington,2010).

World Commission on Environment and Development (1987)

defined sustainable development as concept that has meaning “development

that meets the needs of the present without compromising the ability of

future generations to meet their own needs”. The are 2 main concepts of

sustainable development first is the needs of world poor that overriding

priority should be given, second is the idea to have limitation of technology

Sustainability has become a wide-ranging term that can be applied to

almost every facet of life on earth from local to global scale. The term of

sustainability in management literature refer as continuity, Sustainability is

how companies demonstrate their activities to continue and still exist into the

future (Aras & Crowther, 2008). Aras & Crowther prefer to not use

sustainability term and use durability term. Aras & Crowther (2009) focus

durability in 4 key aspects that will distribute sustainability.

Table 2.1

The Facets of Sustainability

Manageble ( Strategic )

Measurable (Financial )

Equitable (Distributional )

Effecient (Technological)

Source: Güler Aras and David Crowther, 2009

The Durability Term can describe just like the 4 key aspects above :

1. Efficiency is concerned with the best use of scarce resources. This requires a

redefinition of inputs to the transformational process and a focus upon

environmental resources as the scarce resource

2. Efficiency is concerned with optimizing the use of the scarce resources (ie

environmental resources) rather than with cost reduction

3. Value is added through technology and innovation rather than through

expropriation

5. Understanding Sustainability Reporting

The goal of United Nations decade of education sustainable

development that started in 2005 is to integrate the principles, values and

practice of sustainable development. This education enables business leader

and business practice to improve mindset of all aspects like customers,

vendors, suppliers etc. Business leader and business practice need to disclose

their activity business in sustainability reporting.

Sustainability reporting is becoming a mainstream business practice

in the globalization era. Sustainability reporting is the critical first step in

implementing a strategy that can help an organization understand the impact

on its stakeholders, and a ways in which it might mitigate a negative impact

on the economy, society and the environment (EY and GRI, 2014)

The practice to measure the performance of company in economic,

social and environment is known as sustainability reporting. Sustainability

reporting is use to report the result of performance to the stakeholder‟s and

to show the company contribution to sustainable development.

Sustainability reporting is report that not only give the information

about company financial performance but also non financial performance

which consist of social and environmental and show the continuity growth of

company (Elkington 1997). Non-financial information can be both

quantitative, such as tons of greenhouse gas, or qualitative, such as

governance processes, the reputation of an organization or the organization‟s

According to United Nations Environment program sustainability

reporting is the practice of measuring and disclosing sustainability

information alongside, or integrated with companies existing reporting

practices. Sustainability information can be understood as any information

having to do with how companies use and affect financial, natural and

human resources, and how company corporate governance is conducted.

Sustainability reporting is a two-way practice, first it‟s supports

understanding of the impact of business on the wider societal and

environmental stage and second it‟s enables companies to appreciate the

impact of society and the environment on business (EY and GRI ,2014).

Many company realized the importance of disclose the sustainability

reporting, according to sustainable Investment Research Analyst (2008)

more than half of the United States 100 largest traded companies reported

on their sustainability efforts. One of the drivers behind the increase in

sustainability reporting has been the acknowledgment that to be meaningful,

a sustainability strategy must be based on reliable, concrete data. This can

only be the case once the mechanisms and systems for reporting the facts are

put in report(EY and GRI, 2014).

The proponents of sustainability reporting support its potential to

make company more accountable and transparent about their social and

environmental impacts. Sustainability reporting is a voluntary report but

some countries like Germany, Russia, Japan, Finland and many more has

a. Sustainability Reporting Guideline

The last two decades there were increasing pressure on company

to take into account their social and environment impact. Company need

a standard to make sustainability report, those standard can basically

defined as voluntary, commonly used and has specific set of rules.

(Brunsson., 2012 in Vigneau J et al 2015)

Global Reporting Initiative (GRI) is the best-known framework

for voluntary reporting of environmental and social performance by

business and other organizations worldwide. GRI provides a framework

for sustainability reporting that is globally applicable. The Framework

creates four key areas of sustainability which enables all organizations to

measure and report their economic, environmental, social and

governance performance. GRI framework consists of sustainability

reporting guidelines (Halina Szejnwled Brown et al 2009)

GRI is an international independent organization that develops

and publishes report guidelines for reporting on economic,

environmental and social performance. The mission of GRI sustainability

reporting is to provide a trusted credible framework for sustainability

reporting that can be used by organizations of any size, sector, or

location.

GRI report standard try to helps businesses, governments and

other organizations understand and communicate the impact of business

corruption and many others. GRI give the world‟s most widely used

standards on sustainability reporting and disclosure.

According to GRI sustainability reporting is a report published by

a company or organization about the economic, environmental and

social impacts caused by its everyday activities. sustainability report also

presents the organization's values and governance model it‟s a key

platform for communicating sustainability performance and impacts

whether positive or negative. Until now GRI has released four

sustainability reporting guidelines , the latest version of guidelines is G4.

G4 guidelines are an update and evolution of the third generation

of GRI's sustainability reporting guidelines G3.1, G4 released in May

2013. What makes G3 and G4 different is G4 introduces 7 new

disclosures, a new structure for the guidance documents and two levels

for reporting „in accordance‟ with the Guidelines. In G4 guidlines there

are two kind standards disclosure. First standard is general standard

disclosure that has 7 types of disclosure. In this disclosure companies

will describe the organizations and provide overall context for the

report. The second standard is specific disclosure that divided into two

areas : first area is management approach that provide overview of

companies approach in sustainability issues. Second area is indicator

that provide comparable information of company triple bottom line

Another best voluntary organization to make social responsibility

framework is ISO 2600. ISO is one of the largest developer of voluntary

international standard. ISO standards are developed through a consensus

process by groups of experts from all over the world, who are aware of

the standards that are needed in their respective sectors.

ISO standards contribute to all three dimensions of sustainable

development economic, environmental and social. ISO draw on

international consensus from the broadest possible base of stakeholder

groups and develop the standard from the input stakeholder group

(ISO 26000:2010)

The ISO 26000 guidance standard emphasizes the principle of

transparency and the value of public reporting on social responsibility

performance to internal and external stakeholders while GRI guideline of

Reporting Principles are fundamental to achieving transparency in

sustainability. The GRI Guidelines and ISO 26000 both aim at improving

organizations social responsibility and sustainability performance.

GRI and ISO 26000 have signed the memorandum of

understanding to increase cooperation in sustainable development on 5

September 2011. ISO 26000 make guidance of social responsibility and

sustainability standard reporting provided by GRI. (GRI G4 Guidelines

6. Corporate Social Responsibility

In the last decades, corporate social responsibility (CSR) and

corporate sustainability have become some of the major developments for

global corporations (Stanny and Ely 2008, in Petra F 2010), this two

concepts has become interlinked.

Corporate social responsibility (CSR) concerns a corporate‟s

strategy, operations, and governance structure that create environmental and

social values in addition to maximizing enterprise value for the benefits of

its shareholders by monitoring and ensuring compliance with the spirit of

the law, ethical standards, and international norms (Eli Bartov and Yan Li

,2015).

According to the UN Global Compact survey (2010) 93 percent of

the 766 participant CEOs from all over the world declared CSR as an

important factor for their organizations future success and that‟s why many

companies disclose their CSR report.

According to the legitimacy theory, CSR disclosure may be analyzed

in the view of how the company is going to justify social and public

expectations. CSR reporting standards are evolving to take into account a

whole range of stakeholders and their actions to address the requirements of

interested parties while financial reporting standards simply address the

needs of the powerful therefore it can lobby for their own interest most

a. The difference Sustainability Reporting and CSR Reporting

Sustainability reports are modern concepts of interdisciplinary

reporting that indicate the simultaneous integration of economic,

environmental and social elements (Reiner Quick, 2008 in Ratu Farah

2012). CSR are the concept of governance that has been long time made

before the sustainability concept made and the CSR concept had been

used by the ancient Greece since the government set the rules for

merchant.

Apparently CSR is one of the mechanisms for sustainability. CSR

is aimed at social aspect in general while Sustainability is a much

broader term aimed at reduction of negative Social, Economic &

Environmental effects while carrying out businesses. Therefore, with a

broad scope, sustainability reporting is responsible by all of part not only

part of CSR within the company (Committee CSR-LPT PT. Antam,Tbk,

2011 in Ratu Farah 2012).

So, the conclusion from the different approaches between

sustainability reporting and CSR reporting, from the article and forum

discussion that researcher have read, sustainability reporting is the

modern concept of communication to internal and external stakeholder to

show the performance of company in economic, social, environment and

to contribute to sustainable development that‟s why CSR reporting is

7. Sustainability Report Awards

Sustaianability Report Awards is an annual awards for companies or

organizations that made and published their sustainability reports or their

CSR reports. The purpose of Indonesia Sustainability report is to appreciate

Indonesian companies that disclose the triple bottom companies

performance.

Article 66.C of the Limited Liability Company Law no. 40 Year

2007 is Indonesian regulation that require companies should disclose their

environmental and social responsibilities through their annual report. From

that moment many company try to combine their social, environmental and

financial performance in 1 line that refer to sustainability report.

Figure 2.1

Indonesian Companies that Participated Sustainability Reporting Award

Source : Cynthia Dewi and Putu Sudana, 2015.

As we can see in figure 2.1 above that there is an increasing

participant to participated Indonesia sustainability report awards, it happen

because many Indonesian company start to aware not only in the importance

to disclose their social and environmental aspects but also to have good and

[image:35.595.172.510.464.594.2]8. Profitability

The purpose company do a business is to get a profit. Profit is the

excess revenue that minus expense and Profit usually used to measure the

performance of company or to determine earning per share. The goal of

financial management is to maximize the profit and to reach the wealth or

welfare of the company and society.

In this modern era many company are required to have competitive

advantage and are able to maintain the success and continuity in improving

profitability. According to Don Hofrand (2009) profitability is measured

with an income statement that listed income and expense during period time

for the entire business. Don Hofrand defines profitability as accounting

profit or economic profit.

It‟s a common in business life that financial ratio are the practical

financial and planning analysis tool that already used for several decades.

Financial ratio appeared in the mid of nineteenth century and used by

accountants or managers to show company potential and to make economic

decision including investing and evaluation of company financial

performance (Majed Abdel et al, 2012)

According to Majed Abdel et al (2012) defined financial ratio as

relationship between two individual quantitative financial information

connected with each other in logical manner and it‟s consider as meaningful

example a stockholder need financial ratio to indicate the progress and the

rate return investment.

One of the classifications and most common used by companies in

financial ratio is profitability ratio. Profitability ratios are an indicator for the

firm's overall efficiency, Profitability ratios measures earning capacity of

the firm, and it is considered as an indicator for its growth, success and

control.

The long term profitability in company is very important in order to

survive, to sustain company life and to give benefit to shareholder.

Profitability ratio gives important information to investor and creditor,

that‟s why many of Investor or creditor use profitability ratio in order to

make judgment to invest or not to invest their money in companies. A

research conducted by Cynthia Dewi and Putu Sudana (2015) show that

Profitability has significant effect to ROA so, high and good profitability

ratio of companies will lead companies to disclose more about their

sustainability disclosure.

In this Research the profitability ratio used is :

Return on Asset (ROA)

This ratio measure how well company use asset to generate Income. This

ratio also show how company success in use asset to earn income for

investor (Dyah Idraswari and Putra Astika,2015).

a. Profitability and Sustainability Reporting disclosure

Profitability is one the ability of companies to generate the profit

so it can increase the value of share in companies. The increasing

profitability companies make companies can spend their profit to do

social and environmental activities.

A higher profitability of company will make a higher chance of

companies to disclose about their social and environmental activities

that company done. Sustainability reporting disclosure is a voluntary

report that can be done by company to show their social and

environmental performance.

Company that has higher profitability than other company in the

same sector incline to disclose more information to public about their

social, environmental and financial performance that has been done

by companies. Company also want to show to investor that the

operational of company in a good condition. With the disclosure of

the Sustainability Report which is done by the company, it is

expected to provide tangible evidence that the production process is

carried out by the company, not only for profit-oriented purpose but

also for paying attention to social issues, and the environment.

A research conducted by Dyah Indraswari and Putra Astika show

that there is relationship between profitability and CSR disclosure.

Their reveal that the higher profitability is the higher of intention to

9. Leverage

Companies need a financial capital to run out their operational,

capital can come from the companies owner or come from debt. Leverage or

many people call it as borrowed capital is one of financial ratio. Leverage

ratio show how much capital comes in form of loans and debt and to show

how much company can full fill their obligation.

Leverage ratio help measures the financing that company use from

debt compare their capital and their ability pay the interest or return the

investment. Leverage is the use of fixed cost on asset or expense in order to

get profit and increase the return. According to Katia D Hustler (2009)

Leverage allows a financial institution to increase the potential gains or

losses on a position or investment beyond what would be possible through

a direct investment of its own funds.

The higher debt of company the higher company takes the risk and it

will be dangerous for company if the margin cannot cover the fixed cost. It

also applies to high interest expense and dividends,, it will lead company to

bankrupt if the margin operational cannot cover the expense

In this research the leverage ratio used is :

Debt Asset Ratio

This Ratio Measures percentage of company assets that provided by debts

(Dewi and Maswar, 2013)

a. Leverage and Sustanainability reporting Disclosure

The higher the debt ratio is show that company has a high risk to

not meet their obligation of debt to investor or creditor. Companies

with high leverage incline to report a high income and decrease any

cost also cost to disclose their social performance.

In line with agency theory that a high leverage ratio has agency

cost so companies try to decrease any cost that related to social and

environmental performance. High debt ratio will bring bad image for

company to public

low debt ratio will bring positive image of company to public.

The low debt ratio show that company can pay the debt on time and

it increase the credibility of company that make stakeholder trust

their money on the companies and try to support the operational of

companies

One of the way to increase the credibility of company is to

disclose company activities that show companies care about

environmental and social issues. Social and environmental disclosure

can be done by the companies through making the sustainability

reporting disclosure.

A research conducted by Emmy Febrianti and Supartha Wisada

(2015) reveal that leverage has positive impact toward sustainability

report disclosure. This research used Debt to Asset ratio to describe

10. Size of Board Commissioner

The Board of Commissioners is the highest internal control

mechanism that is responsible for managing the company effectively. The

Board of Commissioners consists of inside and outside directors who will

have access to specific information that is valuable and very helpful board of

commissioners as well as making it an effective tool in controlling decision

(Mulyadi,2002 in Evi et al,2011)

The functions of board commissioner is to observe the managers

work and to determine that managers full fill their obligation to develop and

running out the companies. The more of board of commissioner, the more

effective and easier to control and to monitor CEO and managers.

Board of commissioner is one the part of good corporate governance

in order to create efficiency and transparent market. The proportion of

independent board commissioners can make a strict control to managers so

it will lead an increasing company credibility and prevent any agency

interest that lead company to destruction.

In this Research the size of board commissioners ratio used is :

Board ofcommissioners ratio

This ratio is show how much board commissioner that 1 company have

(Evi, et al, 2011).

a. Size of Board Commissioner and Sustainability reporting

disclosure

Size of Board Commissioners is total of board commissioners

member in one company. The board commissioners meetings are one

communication media and coordination between board

commissioners to do their job in order to control the managers.

Purpose of meeting of board commissioners is to discuss the

strategy of company , to evaluate the company performance, to see

rule that have been made and done by managers and to solve any

special interest in company. The more board commissioner make a

meeting its the better, because board commissioner can make

company to disclose social and environmental performance.

The bigger size of board commissioners also has an impact to

make managers disclose the information about company social and

environmental activities that has been done by company. This is in

line with research that have been done by Eyi, Zuraida and Devi

(2011) reveal that size of board commissioners has an influence

toward CSR disclosure. With the control and monitor from board

commissioners, directors can arrange a strategy to implement social

and environmental activities, so company will disclose more about

B. Previous Research

1. Pengaruh Hutang, Profitabilitas, Tanggung Jawab Lingkungan pada

CSR disclosure perusahaan pertambangan (Ni Putu Emmy Febrianti, I

Gede Supartha Wisada, 2015)

This research want to determine the effect of debt, profitability and

environment responsibility toward CSR disclosure. This research used

purposive sampling to collect the data and get 10 samples of mining

companies that listed in Indonesia Stock Exchange from period 2011 – 2013,

so there were 30 data to analyzed

The researchers used GRI G3 as guideline to analyze CSR disclosure.

While the independent variables like Leverage used DER as proxy,

profitability used ROE as proxy and environment responsibility used a color

from ministry of environment.

The research conducted by Ni Putu and I Gede used regression

analysis with 3 panels data which are CEM, FEM, REM. First the

researchers want to determine which one of the best panels data from 3 panel

data that researcher used and the result is researcher used REM as method to

test the data. The result of test show that Leverage and Profitability has an

positive effect toward CSR disclosure while there is no effect for CSR

2. Pengaruh Profitabilitas, Ukuran Perusahaan, Kepelikan Saham publik

terhadap Pengungkapan CSR (Dyah Indraswari and Putra Astika,

2015)

The Purpose of research that have conducted by Dyah and Putra is to

find impact of profitability, company size, ownership share of CSR

disclosure. This research used purposive sampling and took 11 food and

drink companies that listed in Indonesia stockExchange (IDX) from 2010 –

2012, so the researcher had 33 sample data.

From the researcher point of view that companies in high profile is

better to disclose their CSR than companies in low profile. At the present

time in Indonesia, CSR disclosure is not something voluntary anymore but

already become mandatory because it has been arranged by Indonesia Law

No 40 Year 2007 about company regulation (UU PT).

Researcher analyst data by use descriptive anaylsis and classic

assumption. The analysis method to test the hypothesis that researcher used

is multiple regression analysis. The result of descriptive analysis show that

companies has good responsibility to social and environment and investor

will respond it through company share.

The result of multiple regression analysis is that profitability and

company size has significant impact to CSR disclosure while Ownership

share has not significant impact. Researcher reveal that higher profitability

and company size it will make high intention to disclose their CSR but the

3. The Effect of Sustainability Report Disclosure Towards Financial

Performance (Ika Nugroho and Irine Stephani Arjowo, 2014)

This study research try to find out effect of sustainability report

disclosure on the company‟s financial performance and the tools to measure

financial performance is profitability, liquidity, leverage activity and

devidend payout ratio. In this research sample were taken from Indonesia

Stock Exchange (IDX) and focus for manufacturing company that disclose

the sustainability report from 2010 as annual report.

The independent variable in this research is sustainability report that

used GRI index and dependent variables that used in this research is ROA,

CR, DER, IT, DPR. The researcher makes 5 hypotheses that Sustainability

report will affect those 5 aspects. There are two analyses used to achieve the

purpose of this research. First analysis is descriptive analysis to describe the

variables and second regression analysis to examine the influence of

independents variables towards dependent variables.

The result from analysis show that the first hypotheses about ROA is

significant and show manufacturing company that disclose sustainability

report tends to get big ROA. The test about another dependents variables

show sustainability report disclosure does not have any significant effects

4. Relationship between Corporate Social Responsibility and Financial

Performance in the mineral Industry (Xiping et al, 2014)

The researchers investigated the relationship Corporate Social

Responsibility (CSR) and Corporate Financial Performance (CFP) for

mineral firms in China. This paper classified of mineral firm into 5 sectors:

Metal Fabrication, extractive Industry, oil and gas, water industry.

The researchers get the data from HEXUN website and this study

used a regression model to investigate relation between social and financial

performance. The financial performance indicators are ROA, ROE, growth

rate, expansion rate and EPS on the other side for social performance are

shareholder responsibility,, employee responsibility, customer and supplier

responsibility, environmental responsibility and public responsibility.

Researcher r try to find the relation of Corporate Social responsibility

and corporate financial performance by calculated the financial performance

ratio and corporate social responsibility. The calculation result show that

corporate social responsibility has significant positive impact on ROA, CSR

has long run effect for asset and equity companies. Corporate Social

Responsibility will help companies reduce the cost and lead company to

increase of profit. Shareholder responsibility also show a positive result of

the effect on financial performance because shareholder responsibility

composed of profits, debts, retun, credit and innovation that one of the

5. Impact sustainability performance of company on its financial

performance (Priyanka Aggrawal, 2013)

This study evaluates the sustainability performance in India. The

purpose of this paper is to find whether sustainable companies are more

profitable and examine the impact of sustainability rating of company on its

financial performance. The researcher also try to analyze the four

components of corporate sustainability: Community, employees,

environment and government on company financial performance.

The Independent variable in this research is overall sustainability

rating and the dependents variable is return on asset, return on equity, return

on capital employed, profit before tax and the last is growth variable. This

research used 2 model test with multiple regression analysis as a tools. The

first model is try to analyze the overall sustainability performance on

company financial performance. The second model wants to examine the

separate components of corporate sustainability (Community, employees,

environment and government) on company financial performance.

The result of first model analysis is OSR has positive and has no

impact on financialperformance company. The second model is show only

community that has insignificant relation with financial performance. The

conclusion is corporate sustainability only has positive influence to

ROA,PBT, GTA while ROE and ROCE is negative. The sustainability

performance along employees, environment, and governance has significant

6. Pengaruh Karakteristik Perusahaan Terhadap Corporate Social

Responsibility Disclosure Pada Perusahaan Manufaktur yang Terdaftar

di BEI (Sukmawati Safitri Dewi and Maswar Patuh Priyadi, 2013)

Safitri Dewi and Patuh Pridyadi try to investigate the relation

between company characteristic and CSR disclosure. The object of this

research is manufacturing companies that listed in Indonesia stock exchange

from 2009 until 2011.

This research is quantitative research and took classic assumption test

first as requirement to used multiple regression in order to analyze the 102

sample data. The independent variables in this research are size (Log Asset),

profitability (ROA), Leverage (DAR), Management ownership (share of

managers), Board commissioners (BOC) while the dependent variable is

Corporate social responsibility index.

The result of researchers analysis is found that only size,

management ownership and board commissioners has influence to CSR

disclosure while profitability and leverage show no influence to CSR

disclosure so researcher first conclusion is the bigger size of company the

bigger of risk that company has related to social and environment. The

second conclusion is the more share of managers in company the more

contribution of managers to company so managers try to disclose more about

CSR performance. Third conclusion the more board commissioner is the

better and higher to monitor and to make managers do more social and

7. Sustainability Practice and corporate financial Performance (Rashid

Ameer and Radiah Otman, 2011)

This research aim to know companies that has high responsibility

with sustainability practice have a higher financial performance e compare to

those who do not use sustainability practice. In the paper research told me

that the researcher used top 100 sustainable global company in 2008 as

sample of research by using four indices highlighting companies

commitment and give a grade company sustainable contribution to select the

companies. The researcher used sales/revenue growth, return on assets, profit

before tax and cash flow from operation income as indicator to measure the

companies financial performance.

The research use qualitative and quantitative methods by use analysis

procedure for qualitative and statistical data for quantitative. For the

qualitative methods the researcher try to analyze the commitment of

companies such as : community, environment, diversity and ethical

standards and use a grading to make code in order to reach the conclusion .

The finding of the research is global sustainable companies put more

emphasison the eco-centric issues compared to ethnocentric issues and the

statistical result show the researcher that companies emphasis on

sustainability practices have higher financial performance measured by

Return on asset, profit before taxation, and cash flow operation if we

compare to companies who in the same sector but do not use sustainability

8. Pengaruh ukuran perusahaan, profitabilitas dan Ukuran Dewan

Komisaris terhadap pengungkapan corporate social responsibility pada

perusahaan manufaktur yang terdap di BEI ( Evi Mutia et al, 2011 )

The aim of study that has been conducted by Evi, Zuraida and

Andirani is to analyses the effect of company size, profitability and size of

board of commissioner on the corporate social responsibility disclosure. The

researchers use purposive sampling and focus to manufacturing companies

that listed in Indonesia Stock Exchange from 2006 – 2008 .

There were 37 companies that have been analyzed by researchers

with the criteria that disclose the CSR activity. The researchers used

secondary data from Indonesia stock exchange and researchers used multiple

analyses regression and classic assumption as method to analyze the data.

The dependent variable is CSR disclosure ( dummy variable ) and the

3 independents variable are company size that proxy by number of

employees, profitabilityy proxy by earning per share and Size of board

commissioner proxy by total board commissioners.

The result of analysis is for overall independent variable has

significant impact to CSR disclosure but as partial test only size of board

commissioners and size of company that has significant influence correlation

9. Research on sustainability reporting in Hong Kong (Tang Fuk Yi and

Chan Ka yu, 2010)

Tang Fuk Yi and Chan Ka yu investigated the relationship between

economic performance, social and environmental disclosure in Hong Kong.

The purpose of this research is not only want to test the independent

variables of economic performance have a effect on sustainability disclosure

but also want to know the different sustainability reporting in different

business sectors is different or not .

In this research for the evaluation of economic performance used 4

aspects: firm size, profitability, leverage level and growth opportunity of

company. For environmental and social indicator the researcher used 12

aspects on it which are : water, waste, energy, biodiversity, emission,

environmental management system, employment, occupational health and

safety, training and education community involvement and customer health

and safety.

For the profitability test the result is return on assets (ROA) and

sustainability reporting index show non-significant relationship which means

return on asset does not play significant role on sustainability reporting only

firm size and leverage level that play significant role in sustainability

reporting. The test also told us companies in Hong kong that has higher

profitability have more CSR disclosure and financial industry business sector

Table 2.2

Overview Previous Research

No Researcher

(Years) Variable

Analysis

Method Result

1

Ni Putu Emmy Febrianti and I GedeSupartha Wisada ( 2015 )

DER, ROE, Proper Regression Analysis

Leverage and Profitability has an effect toward CSR disclosure

2

Dyah Indraswari and Putra Astika (2015 ) Profitability, Company Size, Ownership Share Multiple Regression Analysis Profitability and Company size has significant impact to CSR disclosure

3

Ika Nugroho and Irine Stephani Arjowo ( 2014 )

Sustainability Reporting ( GRI Index ), ROA, CR ,DER,IT,DPR Regression Analysis and Descriptive Analysis Sustainability Reporting has significant influence towards ROA and does not significant towards CR ,IT,DER , and DPR

4

Xiping Pan ,Jing Hua ,Hongliang Zhang ,Wenlan ke ( 2014 )

CSR performance ROA, ROE, growth rate, expansion rate and EPS Regression Analysis corporate social responsibility has significant positive impact on ROA

No Researcher Variable Analysis Result 6 Sukmawati Safitri

Dewi and Maswar Patuh Priyadi (2013)

CSRI, Profitability, Leverage,

Management Ownership, Board Commissioners

Multiple Regression analysis and classic Assumption

Size,

Management Ownership and Board of Commissioner has influence to Corporate Social

Responsibility

7 Rashid Ameer and Radiah Otman (2011)

Sustainability Report (GRI Index) ,SG ,ROA,PBT,CFO Analysis Procedure and statistical analysis Companies with sustainability practices has high financial performance

8 Evi mutia , Zuraida and Devi Andirani ( 2011)

CSR disclosure (Variable dummy) , Company size, Earning per share, Total Of Board Commissioners

Multiple Regression analysis and classic Assumption

Overall independent variable is significant with CSR .As partial Only company size and BOC that significant with CSR. 9 Tang Fuk Yi and

Chan Ka yu (2010)

Sustainability Reporting (GRI Index), firm size ,profitability, leverage level and growth opportunity of company

Regression Analysis Profitability and company growth has no relationship with SRDI while

D. Logical Framework

In this new age lot of companies consider to disclose report not only

about their financial performance but also companies environmental

performance and social performance this condition is supported by 3 theories

that are stakeholder theory, agency theory and legitimacy theory.

One of the main finding in this literature review is lot of companies need

a standard to disclose companies social and environmental performance and lot

of companies use GRI sustainability guideline report as a standard to disclose

companies performance. Positive and negative correlation were found from the

previous research about relationship sustainability disclosure, profitability,

leverage and size of board commissioners.

According to the research of sustainability practice by Fuk Yi and Ka Yu

(2010) that one of leverage analysis DER has significant relationship with

sustainability reporting disclosure while ROA has no relationship on the other

hand Ika Nugroho and Irine Stephani Arjowo (2014) found that sustainability

disclosure has no significant to leverage but significant to profitability so

company with extensive sustainability report disclosure tends to get big ROA .

The study conducted by Evi, Zuraida and Devi (2011) reveal that size of

board commissioners has positive correlation with CSR disclosure, in line with

that Indah and Rahmawati (2013) did a research with positive result for size of

board commissioner and CSR disclosure, while Fadhila Adhipradana (2014)

found that board commissioners has no relationship with sustainability reporting

Logical Framework

Sustainability Reporting Index

(Y)

Impact Profitability, Leverage and Size of BC

to Sustainability Reporting Disclosure

Hypothesis Test : Multiple Regression

Analysis

Supporting Theory : 1.Stakeholder Theory 2. Agency Theory 3. Legitimacy Theory

Profitability (X1)

Leverage (X2)

Size of Board

E. Hypothesis Development

Hypothesis is considered as tentative statement that proposes a possible

explanation to some phenomenon or event. The hypothesis of this research

concern whether there is significant impact of independent variable to dependent

variable simultaneously or partially. Hypothesis can be formulated as follow:

a. H1 : ROA has significant impact to Sustainability reporting

b. H2 : DAR has significant impact to Sustainability reporting

CHAPTER III

RESEARCH METHODOLOGY

A. Scope of Research

This research is quantitative research by using step descriptive

relationship and evaluation to prove the relationship between profitability,

leverage, size of board commissioner and sustainability disclosure. The