BOARD SIZE, COMPANY SIZE, PROFITABILITY AND LEVERAGE ON CORPORATE SOCIAL RESPONSIBILITY REPORTING

IN THE ANNUAL REPORT

(Empirical Evidence of Mining Companies listed in Indonesia Stock Exchange Period 2009 - 2011)

By:

Oktavian Surya Pramono

107082103317

DEPARTMENT OF ACCOUNTING INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESS

SYARIF HIDAYATULLAH STATE ISLAMIC UNIVERSITY JAKARTA

iii

ENDORSEMENT SHEET COMPREHENSIVES EXAMS

Today is Wednesday, January23, 2013 A Comprehensive Examination has been conducted on student:

1. Name : Oktavian Surya Pramono

2. Student Number : 107082103317

3. Department : International Accounting

4. Thesis Title : Board Size, Company Size, Profitability and Leverage on Corporate Social Responsibility Reporting in the Annual Report (Empirical Evidence of Mining Companies Listed in Indonesia Stock ExchangePeriod 2009 - 2011)

After careful observation and attention to appearance and capabilities relevant for the comprehensive exam process, it was decided that the above student passed and given the opportunity to continue to thesis as one of the requirements to obtain a Bachelor of Economics in the Faculty of Economics and Business SyarifHidayatullah State Islamic University Jakarta.

Jakarta, January23, 2013

Prof. Dr. Ahmad Rodoni (______________________)

ID. 19690203 200112 1 003 Chairman

Rahmawati, SE, MM (______________________)

ID. 19770814 200604 2 003 Secretary

v

CURRICULUM VITAE

Personal Data

Name : Oktavian Surya Pramono

Place & Date of Birth : Jakarta, 22ndOctober1989

Address : Pamulang Indah (M.A) Jl. Edelweiss Blok B 7 No. 7

Religion : Islam

Nationality : Indonesia

Sex : Male

Hobby : Football and Travelling

Mobile Phone : 085697155110

Email : oktaviansuryapramono@gmail.com

Formal education

1. 1994-1995 TK Ananda U.T 2. 1995-2001 SD Dharma Karya U.T 3. 2001-2004 SMPN 1 Pamulang 4. 2004-2007 SMAN 1 Pamulang

5. 2007-2013 State Islamic University SyarifHidayatullah (UIN), Jakarta

Faculty of Economics and Business, Major of International Accounting

Non Formal Education & Training

vi

ABSTRACT

The objective of this study is to identify the influence of board size, company size, profitability and leverage to corporate social responsibility reporting in the annual report of mining companies listed in Indonesia Stock Exchange year 2009 - 2011. The dependent variable in this research is corporate social responsibility reporting, which is measured by ratio scale and then the independent variables consist of 4 variables namely board size, company size, profitability and leverage are measured by ratio scale. The data in this research include 16 mining companies which were selected by using purposive judgment sampling in the period 2009 – 2011 where the total of samples are 48. The methods used in this research are normality test, classical assumption test and hypotheses test by using multiple regression analysis.

vii

ABSTRAK

Tujuan penelitian ini adalah untuk mengidentifikasi pengaruh ukuran dewan, ukuran perusahaan, profitabilitas dan leverage terhadap pengungkapan tanggungjawab sosial perusahaan di laporan tahunan perusahaan pertambangan yang terdaftar di Bursa Efek Indonesia tahun 2009 - 2011. Variabel dependen di penelitian ini adalah pengungkapan tanggungjawab sosial perusahaan, yang diukur dengan skala rasio dan variabel independennya terdiri dari 4 variabel yaitu ukuran dewan, ukuran perusahaan, profitabilitas dan leverage yang diukur dengan skala rasio. Data dalam penelitian ini meliputi 16 perusahaan pertambangan yang terpilih dengan menggunakan purposive judgment sampling untuk periode 2009 – 2011 dimana total keseluruhan data sample adalah 48. Metode yang digunakan dalam penelitian ini adalah uji normalitas, uji asumsi klasik dan uji hipotesis dengan menggunakan analisis regresi berganda.

viii

ACKNOWLEDGEMENTS

Alhamdulillah, praise and gratitude be Allah SWT, God of universe, who already gives a gift, a bless, as well as affection to me and also regard to Prophet Muhammad SAW as our life-guide, so that I am able to finish my thesis in fulfilling one of the requirements to obtain my Bachelor Degree in Economics at the State Islamic University (UIN) Syarif Hidayatullah, Jakarta.

The writer realizes that this thesis is too far from the perfection, realizing that the limitation of the knowledge as well as experiences that the writer has, but because of many parties support, finally the writer could finish this thesis by hoping that it could be worthwhile for the readers.

In finishing this thesis, the writer was not alone since I was supported and taught by many parties. In this opportunity, the writer would like to say my huge thankful to:

1. My lovely parents, Suparmin, SE, MM & Sri Fachrida Ach for their effort to have their children to be the best we can be. I realize that I am nothing and impossible to be like now without their role model.

2. My lovely siblings who so beautiful and so kind, Andhianty Nur Pratiwi, Muhammad Fadhil Aldaffa, Siti Alfiani Fauziah for their essential role to support each other. Eventually it is my turn to have my degree in Economics after having completed my education in university. I wish we are able to accomplish our dreams. So we will be a successful people together and make our parents happy and proud of us.

3. All of my family that I can’t tell one by one.

ix

5. Prof. Dr. Abdul Hamid as a Dean of Faculty of Economics and Business, State Islamic University (UIN) Syarif Hidayatullah, Jakarta, who responsible for the teaching and learning processes at the faculty.

6. Dr. Amilin, SE, Ak, M.Si and Wilda Farah, SE, Ak, M.Si as my first and second thesis supervisor. Thanks for spending some times to guide, motivate and support accompanied by the knowledge in contributing for this thesis compliance so that the thesis can finish properly.

7. My expert comprehensive test examiner Prof. Dr. Ahmad Rodoni,Rahmawati, SE, MM and Prof. Dr. Azzam Jassin, MBA who had given me the contribution of knowledge and good mark in comprehensive test.

8. Lecturers and Staffs in UIN Jakarta, especially at international program secretariat FEB, Arief Mufraini Lc., M.Si (Head), Dr. Ahmad Dumyathi Bashori, MA (Secretary), and also Sugih Waluyo Romdlon, SE. Wish Allah SWT rewards back your nice contributions.

9. All of my friends in campus, especially at international program (Accounting & Management Department) where we have a great time in the last 4 years. Hopefully we will always keep in touch, guys.

10.All that I cannot mention one by one. I am very grateful for all the support and pray for me to make this process run properly. Hope you all will get the success in the future.

At the end, the writer opens for any critics as well as suggestions that could improve the content of this thesis. Hopefully this thesis could be worthwhile for all of us. Amin. Thank you.

Assalamualaikum Warahmatullahi Wabarakatuh.

Jakarta, July 25th 2013

x

TABLE OF CONTENTS

SHEET STATEMENT AUTHENTICITY SCIENTIFIC WORKS ... i

SUPERVISOR APPROVAL SHEET ... ii

ENDORSEMENT SHEETCOMPREHENSIVES EXAMS ... iii

CERTIFICATION OF THESIS EXAM SHEET ... iv

CURRICULUM VITAE ... v

ABSTRACT ... vi

ABSTRAK ... vii

ACKNOWLEDGEMENTS ... viii

TABLE OF CONTENTS ... x

LIST OF TABLES ... xiii

LIST OF FIGURES ... xiv

LIST OF ATTACHMENTS ... xv

CHAPTER I INTRODUCTION A. Background ... 1

B. Problem Identification ... 7

C. Objective and Benefit of Research ... 7

1. Objective of Research ... 7

2. Benefit of Research ... 7

CHAPTER II LITERATURE REVIEW A. Theory Basis ... 10

1. Corporate Social Responsibility (CSR) ... 10

xi

b. Benefit of CSR ... 12

c. CSR in Indonesia ... 12

2. Corporate Social Responsibility Reporting ... 15

a. Definition of CSR Reporting ... 15

b. Motivation and Reason for Doing CSR Reporting ... 17

c. Categories of CSR Reporting ... 19

d. CSR Reporting in Annual Report ... 21

1) Annual Report... 21

2) CSR Reporting in Annual Report... 22

3. Company Characteristics ... 23

a. Board Size ... 24

1) Definition of Board Size ... 24

2) Board Size and CSR Reporting ... 25

b. Company Size ... 26

1) Definition of Company Size ... 26

2) Company Size and CSR Reporting ... 26

c. Profitability ... 28

1) Definition of Profitability ... 28

2) Profitability and CSR Reporting ... 30

d. Leverage ... 32

1) Definition of Leverage ... 32

2) Leverage and CSR Reporting ... 32

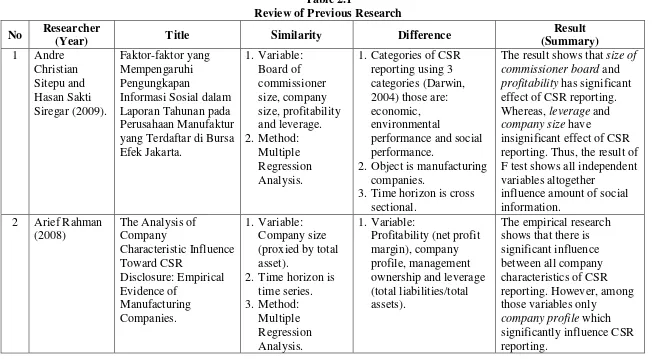

B. Previous Research ... 42

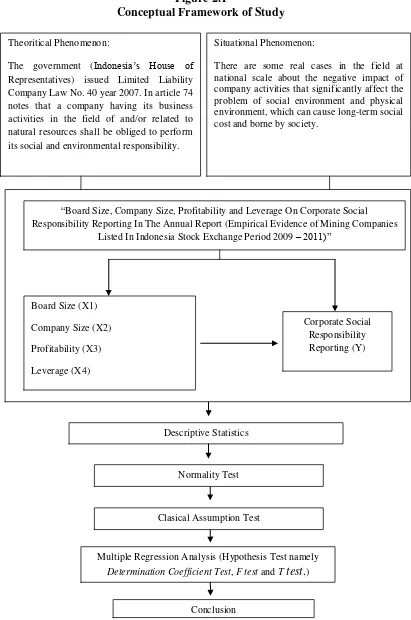

C. Logical Framework ... 50

D. Hypothesis ... 51

CHAPTER III RESEARCH METHODOLOGY A. Scope of Research ... 54

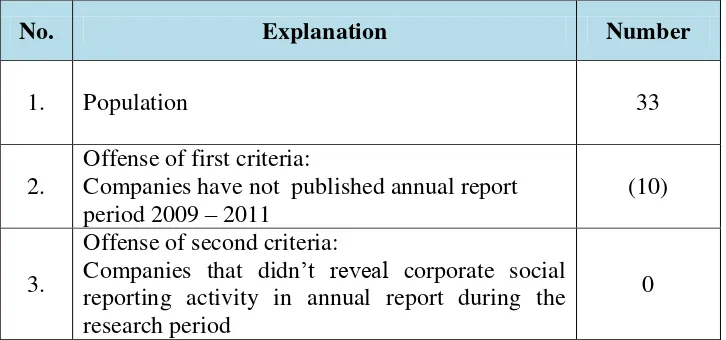

B. Sampling Method ... 54

xii

D. Data Analysis Method ... 57

1. Descriptive Statistics ... 57

2. Normality Test ... 57

3. Classical Assumption Test ... 59

4. Multiple Regression Analysis ... 61

5. Hypothesis Test ... 62

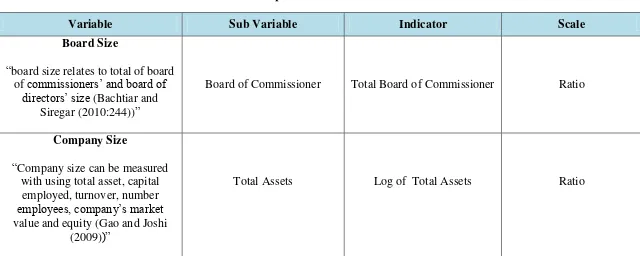

E. Operationalization Variable ... 63

CHAPTER IV ANALYSIS AND DISCUSSION A. Overview of Research Object ... 71

1. Description of Research Object ... 71

2. Description of Selected Companies’ Sample ... 72

B. Analysis and Discussion ... 74

1. Descriptive Statistics Analysis ... 74

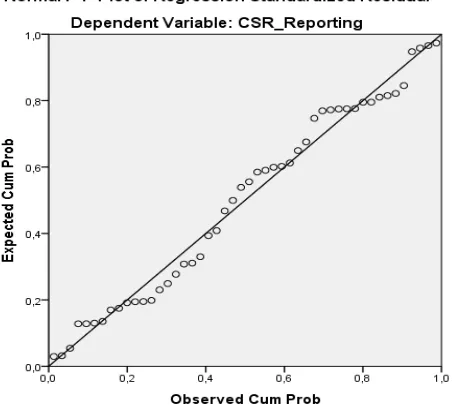

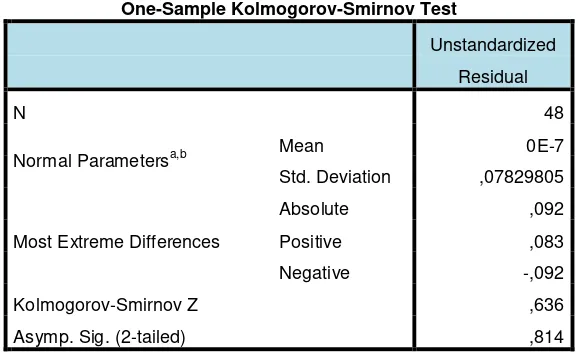

2. Normality Test ... 77

3. Classical Assumption Test ... 79

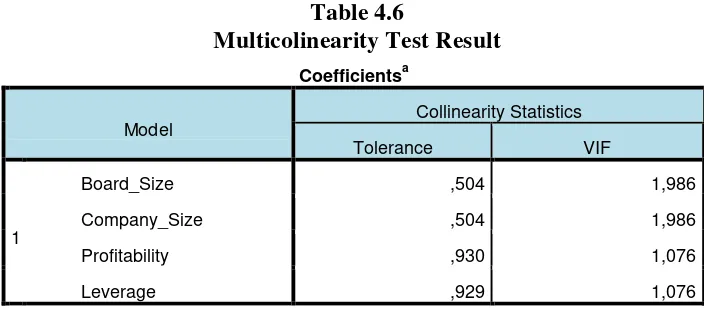

a. Multicolinearity Test ... 79

b. Heteroskedastisity Test ... 80

c. Autocorrelation Test... 81

4. Hypothesis Test ... 81

a. Multiple Regression Analysis ... 81

b. Hypothesis Test ... 83

1) Determination Coefficient Test ... 83

2) Simultaneous Regression Analysis ... 84

3) Partial Regression Analysis ... 85

CHAPTER V CONCLUSION AND IMPLICATION A. Conclusion ... 93

B. Research Finding Implication ... 94

C. Limitation and Suggestion ... 96

xiii

LIST OF TABLES

No Details Page

1.1 Sample Cases of Environmental and Social Issues ... 2

2.1 Review of Previous Research... 42

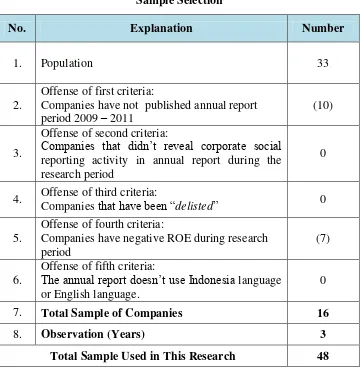

3.1 Sample Selection ... 55

3.2 Durbin Watson ... 60

3.3 Operational Variable ... 69

4.1 Sample Selection ... 72

4.2 List of Companies’ Sample...73

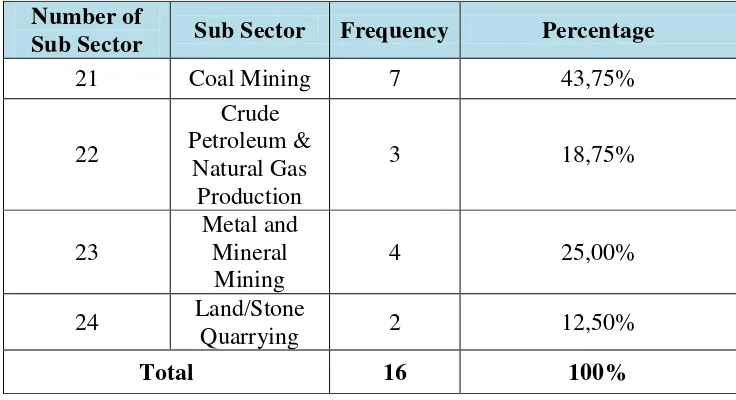

4.3 Distribution of Sample According to Sub Sector ... 74

4.4 Descriptive Statistics ... 75

4.5 Kolmogorov-Smirnov Test ... 78

4.6 Multicolinearity Test Result ... 79

4.7 Autocorrelation Test Result... 81

4.8 Result of Multiple Regression Analysis ... 82

4.9 Result of Determination Coefficient Test ... 83

4.10 Result of F Test ... 84

4.11 Result of T Test ... 85

xiv

LIST OF FIGURES

No Details Page

2.1 Conceptual Framework of Study ... 50

4.1 Normality Test Result... 77

xv

LIST OF ATTACHMENTS

No Details Page

1. Dimensions and Classification CSR Disclosure ... 102 2. Research Data ... 105 3. Outputs SPSS ... 108

1 CHAPTER I

INTRODUCTION

A. Background

Business and academic researchers have shown increasing levels of

interest in corporate social responsibility (CSR) during recent years. The

theme of environmental and social responsibility appears in a number of

political and legal documents and is gaining ever-greater importance at the

international level and national level. Survey of PriceWaterhouseCoopers

(Pwc) of 750 Chief Executive Officers showed that increasing pressure to

implement CSR was second ranking of the other business challenges in 2000

(Suharto, 2008:1).

Under the pressure of various stakeholders and the public, many

companies have begun to deal with social and environmental issues firmly,

which is evidenced by increase in the communication of social and

environmental issues (Gao and Joshi, 2009:27). This happens because over

time, society increasingly aware of social and environmental impacts posed by

the company in running its activities to achieve the maximum profits that the

longer the bigger and more difficult to control (Lubis, 2010:466).

There are some real cases in the field both at national and international

scale about the negative impact of company activities that significantly affect

the problem of social environment and physical environment, which can cause

2 Table 1.1

Sample Cases of Environmental and Social Issues

No. Cases Environmental and Social Issues

1. PT. Freeport Indonesia

1. Mass labor strike because the labors demanding improved wages and welfare. 2. Communities around the company

demanding to be given job opportunities. 3. Get protests from local communities and

public and international concern regarding problems with the waste of industry and environmental pollution.

2. PT. Lapindo Lapindo mudflow in Sidoarjo in the middle of overcrowding caused by human error. Many people left homeless and lost sources of income.

3. Nike Had ignored business ethics, such as extortion

to workers in developing countries (employment of underage children).

6. In the World Global Warming can also be triggered by the release of (product) of carbon from industrialization. It can cause a gradation of environment due to waste pollution in rivers and air pollution from factory emissions of gases that are not controlled.

Source: Bachtiar and Siregar (2010) and Nor Hadi (2011)

The occurrence of the various cases as described above is a reflection

of the lack of a sense of corporate responsibility towards the environment in

the vicinity. So in the midst of society gave birth to a critique of the corporate

existence of the company's activities should be expected to have the feedback,

both socially and economically (Nor Hadi, 2011:20).

This has increasingly lead to the development of corporate social

responsibility (CSR) in both the international and national scale which

3

to achieve sustainable development based on the balance of the pillars of

economic, social and environmental, to minimize and compensate for negative impacts and maximize the positive impact on each pillar (Elkington (1987)

cited in Nor Hadi (2011:55).

Concern with corporate social responsibility (CSR) in Indonesia has

been increasing and continues to grow since the government (Indonesia’s

House of Representatives) issued Limited Liability Company Law No. 40 year

2007. In article 74 notes that a company having its business activities in the

field of and/or related to natural resources shall be obliged to perform its

social and environmental responsibility (Bachtiar and Siregar, 2010:242).

As an integral part of the company, accounting aims to accommodate

the changing trend by establishing a sub-discipline of social accounting. There

was an essential change by the accounting discipline through this issue, that is,

the change in paradigm of responsibility. During times, accounting products

were purposed as a management responsibility to stockowners. Nowadays,

that paradigm was extended as a responsibility to all stakeholders. This

extended paradigm of responsibility is a large contribution by the accounting

discipline for the community. There is an acknowledgment that the users of

financial reports are not only stockowners, future investors, creditors, and

government, but have extended to other stakeholders (Mirfazli, 2008:389).

Therefore, the increasing concern with CSR has impacted also on

4

Siregar, 2010:242) and has encouraged researchers across the globe to study

various aspects in CSR (P and W, 2011:46).

CSR disclosure has been a research subject of many academicians for

over two decades. Two major issues of those studies are factors that determine the level of CSR reporting and whether CSR reporting affects a firm’s future

performance (Haniffa and Cooke (2005) cited in Bacthiar and Siregar

(2010:242)).

In this study concern with factors that determine the level of CSR

reporting (CSR disclosure). As we know that many empirical studies about

factors that determine the level of CSR reporting had been done by previous

researchers both nationally and internationally such as Al-Haj et al. (2011), Bachtiar and Siregar (2010), Darwis (2009), Gao and Joshi (2009), Janggu et al. (2007), Rahman (2008), Reverte (2009), Siregar and Sitepu (2009) and others.

Their study have found that various factors which determine the extent

of CSR disclosure such as company size, profitability, leverage, board size (board of commissioner and board of director), company age, company profile, auditor size, foreign ownership and others. In addition, their study also has found different result of their empirical study.

5

(2009) indicated that board size positively affects corporate social responsibility reporting. Even though, a very large board could limit the

communication and coordination among board members and consequently

will hamper monitoring process.

Then, research result of Al-Haj et al. (2011), Bachtiar and Siregar (2010), Darwis (2009), Gao and Joshi (2009), Janggu et al. (2007) and Reverte (2009) indicated that company size positively affects corporate social responsibility reporting. Whereas, study of Rahman (2008) Siregar and Sitepu

(2009) indicated that company size negatively affects corporate social responsibility reporting.

Afterward, variable of profitability also indicated different results

where the study of Gao and Joshi (2009), Janggu et al. (2007), Mohamed Zain & Janggu (2006) cited in Al-Haj et al. (2011) and Siregar and Sitepu (2009) indicated that profitability positively affects corporate social responsibility reporting. While, study of Al-Haj et al. (2011), Bachtiar and Siregar (2010), Darwis (2009), Rahman (2008) and Reverte (2009) indicated that profitability

negatively affects corporate social responsibility reporting.

Likewise with variable of leverage, where within study of Al-Haj et al. (2011), Bachtiar and Siregar (2010), Darwis (2009), Janggu et al. (2007), Rahman (2008), Reverte (2009), Siregar and Sitepu (2009) indicated that

6

voluntary information in order to reduce their agency costs and, as a result,

their cost of capital.

In previous research has been inconsistent between the theory and

result of empirical study. Reconciliation of inconsistent research results

requires further research to determine whether the company characteristics

consist of board size, company size, profitability and leverage influential toward corporate social responsibility reporting.

Based on the description above, the researcher is motivated to conduct

this research because researcher want to know the practice of corporate social

responsibility reporting (CSR disclosure) of companies in Indonesia as a

manifestation of social responsibility that made the company, especially

mining companies because it is a sector that has the most extensive range of

stakeholders including employees, communities, investors, creditors,

government, customers, suppliers and also related to natural resources (planet) where the its implementation and disclosure is also influenced by several

factors owned by the company like company size, profitability, leverage,

board size and others. Therefore, researcher is interesting to take the title of

7 B. Problem Identification

1. Is the corporate social responsibility reporting influenced by board size?

2. Is the corporate social responsibility reporting influenced by company

size?

3. Is the corporate social responsibility reporting influenced byprofitability?

4. Is the corporate social responsibility reporting influenced by leverage?

C. Objective and Benefit of Research 1. Objective of Research

a. To get empirical evidence related to effect of board size toward

corporate social responsibility reporting.

b. To get empirical evidence related to effect of company size toward

corporate social responsibility reporting.

c. To get empirical evidence related to effect of profitability toward

corporate social responsibility reporting.

d. To get empirical evidence related to effect of leverage toward

corporate social responsibility reporting.

2. Benefit of Research

The expected benefits in this research are:

a. Theoretical Contribution

1) For Next Researcher

This research is expected to be a reference for next researcher that

8

2) For Teaching Material

This study is expected to provide input to the learning program

because the issue of CSR has been increasing during recent years

both in international and national level. Where learning program

that not only provides knowledge about the financial records

solely, because now the company is no longer only concerned with

financial records (single bottom line), but has been covering the financial, social, and environmental aspects of the so-called Triple Bottom Line. This is a synergy of three key elements of the concept of sustainable development.

b. Practical Contribution

1) For Company

For consideration in formulating policies related to the

implementation of CSR in the company's operations and disclosure

in corporate reports.

2) For Government

Provide relevant information about how big the contribution of

Indonesia mining companies in implementing CSR activities as

well as disclosure in corporate annual reports.

3) For Stakeholders

a) For Society

Provide relevant information about what factors are pushing

9

activities and also give information about practice of CSR

activities that disclosed in mining companies annual report.

b) For Investor

This research can provide an overview for investors who has

been or will be invested in the capital market about how the

influence of company characteristics on corporate social

responsibility reporting. So that, in the future investors can

10 CHAPTER II

LITERATURE REVIEW

A. Basis Theory

1. Corporate Social Responsibility (CSR) a. Definition of CSR

As a concept, although CSR has become a trend that much

discussed both international and national scale, CSR doesn’t have a

commensurate limitation. Many experts, practitioners and researchers

do not yet have similarities in providing definitions. Although in many

cases have the same essence (Nor Hadi, 2009:46).

The concept of CSR is still in the early stages in developing

countries, there appears to be a growing recognition within the

business community of the importance key stakeholders attach to the

social, environmental, and ethical behavior of companies (Zadek et al.

(1997) cited in Hassan and Harahap (2010:205)).

In this paper will introduce to CSR-definitions from:

1) The World Business Council for Sustainable Development

(WBCSD)

Continuing commitment by business to behave ethically and

contributed to economic development while improving the quality

of life of the workforce and their families as well as of the local

11

2) Commission of the European Communities

A concept by which “companies decide voluntarily to contribute to

a better society and a cleaner environment”. It states that behaving

in a socially responsible way amounts to “going beyond

compliance and investing „more’ into human capital, the

environment and the relations with stakeholders”. (P and W,

2011:45).

3) CSR Ghana

CSR is about capacity building for sustainable likelihoods. It

respects cultural differences and finds the business opportunities in

building the skills of employees, the community and the

government (Nor Hadi, 2011:46).

4) CSR Asia

The company's commitment to operate in a sustainable based on

the principle of economic, social and environment, while balancing

the diverse interests of its stakeholders (Suharto, 2008:5).

5) CSR Indonesia

CSR can be defined based on the Law of the Republic of Indonesia Number 40 Year 2007 regarding Limited Liability Company that CSR is company's commitment to participate in sustainable

economic development in order to improve the quality of life and

environment that are useful, both for the company itself, the local

12 b. Benefit of CSR

According to Wibisono (2007) cited in Irawan (2008:4) that

company gets several benefits because implement its social

responsibility such as:

1) Maintaining and improving the company’s reputation and brand

Image.

2) Social License to Operate.

3) Reducing the risk of company’s business.

4) Expands the access to resources for business operations.

5) Expands the opportunities market.

6) Reducing costs, such as costs associated with the impact of waste

disposal.

7) Improving relationship with stakeholders.

8) Improving relationship with regulators.

9) Raising the employees’ spirit and productivity.

c. CSR in Indonesia

The issue of corporate social responsibility (CSR) in Indonesia

has grown steadily since the government (Indonesia’s House of

Representatives) issued Limited Liability Company Law about the

company's obligation to implement Corporate Social Responsibility

(CSR) which proper with the Article 74 in the Limited Liability

Company Law No. 40 year 2007 forces all companies in the field of

13

According to Harahap (2002) cited in Irawan (2008:5), social

involvement is done by the company based on the situation in the

Indonesia country, namely:

1) Environment, among others: surveillance of the effects of pollution, improvement of natural destruction, conservation of

nature, the beauty of the environment, reducing the noise pollution,

land use, waste management and wastewater, research and

development of environment; cooperation with energy, among

other things: conservation and energy savings are made by

companies in their activities.

2) Human resources and education, among other: safety and health of employees, employee education, family needs and recreation

employees, increase and broaden employees' rights, efforts to

encourage participation, pension improvements, scholarships,

assistance to schools, the establishment of schools, help the higher

education, research and development, requirement of employees

from poor, and enhancement of employee career.

3) Honest business practices, among others: pay attention to the rights of female employees, honesty in advertising, credit, service,

products, and warranties. Thus, control of product quality,

government, universities, and the building of recreational place.

14

not intervene in the structure of society, building the health clinics,

schools, worship houses, improvement of village or city,

contribution to social activities, improvement of rural housing,

financial assistance, improvement the market transport vehicle.

5) The activities of art and culture, among others: helping arts and cultural institutions, arts and cultural sponsored, using arts and

culture in advertising, recruiting talented people in arts and sports.

6) Relation with shareholders, among others: openness of directors to all limited liability company, rising of disclosure in financial

statements, disclosure of company involvement in social activities.

7) Relation with the government, among other: obey of government regulations, limiting the lobbying activities, control the company’s

political activities, helping government agencies in accordance

with enterprise capabilities, helping as general of enhancement of

social welfare society, help the project and government policies,

improve the productivity of the informal sector, development and

innovation of management.

According to Nor Hadi (2011:170) noted that typology of

social responsibility seen from the direct and indirect involvement of

companies in practice, there are two implementation strategies,

15

1) Pattern of Self Managing

CSR practice is performed by the company to assign employees or

through foundations and social organizations that formed the

command of the company through corporate secretary/public affair

manager/ public relations firm and the like.

2) Pattern of Outsourcing

This is an implementation of CSR strategies are handed by third

parties, either partnered with professional parties such as NGOs,

Red Cross (PMI), universities, mass media and others.

2. Corporate Social Responsibility Reporting (CSR Reporting)

According to Douglas et al. (2004) cited in P and W (2011:46) and Zadek et al. (1997) cited in Hassan and Harahap (2010:205) that CSR reporting is variously called CSR disclosure, social accounting, corporate

social reporting, social auditing, social and environmental reporting, social

review, or sustainability reporting.

a. Definition of CSR Reporting

According to Finch (2005) cited in Sutantoputra (2009: 37) that

companies used CSR reporting as means to communicate to their stakeholders over their management performance. The external

communication of CSR activities can help a firm to build a positive

image among its stakeholders (Fombrun and Shanley, 1990; Lafferty et

16

Thus, according to Gray et al. (1987) cited in Sutantoputra (2009:37) defined CSR reporting as the process of providing information designed to discharge social accountability and the

medium may cover annual report, special publications or reports or

even socially orientated advertising. CSR is executed through triple

bottom line reporting which declares not only financial results but also

social and environmental impact of a business (Elkington, 1999).

While, according to GRI Sustainability Reporting Guidelines

2002 cited in Sutantoputra (2009:38) that GRI used the term

sustainability reporting for CSR reporting and mentioned that:

Sustainability reporting is the practice of measuring, disclosing, and being accountable to internal and external stakeholders for organizational performance towards the goal of sustainable development”. The report can provide important information that is not included in financial reports but is crucial for business decision making. Companies can use sustainability reporting to measure their sustainability performance (i.e. economic, social and environmental performances) over time and use them as basis to improve their internal business practices and external communication.

After that, according to Gray et al (1987) cited in Bachtiar and Siregar (2010:242), CSR disclosure (CSR Reporting) is:

17

In addition, according to Hackston and Milne (1996) cited in

Rahman (2008:26) stated that corporate social responsibility disclosure

(CSR Reporting) is communication process of social effect and environment from organization economics activity toward public

society as a whole.

b. Motivation and Reason for Doing CSR Reporting

Within research of Mirfazli (2008:396) stated that some

motivation is possible to push the environmental and social

performance information disclosure, namely:

1) To maintain the legitimacy of company operation (Legitimacy Theory). According to Legitimacy Theory, company conduct certain activity, included in matter of information disclosure, in

order to obtain the legitimacy from society where the company

operates and also as a strategy to keep the good relation between

the company with the outside party (especially stakeholders).

2) To manage or influence certain group stakeholders who have a strong influence. In stakeholders’ theory, a company considers the

existence of expectation, which differ from each group of

stakeholders that have an affect on operation and policy of

information disclosure.

3) To increase properties of all stockholders and managers. Positive Accounting Theory has the assumption that everyone does the

18

accomplishment. If everybody has an activity to fulfill its private

interest, it can be that managers set their mind to disclosure of the

environmental and social information because they expect to get

the make-up of properties from the disclosure activity. Make-up of

properties is possible from profit improvement or assessing the

company.

4) Manager confidence that companies have the accountabilities or duty to provide certain information. Disclosure of social and environmental responsibility performance information can be

pushed because a manager believes that various group stakeholders

are entitled to know the operate implication for the company to

environmental and social quality.

5) To hinder or preceding the effort recognition/making of disclosure regulation that more weighing. Managers do the environmental and social performance information disclosure in order to hinder

governments and depress the pertinent industry. It is very possible

to disturb this when too much reporting occurs.

Thereafter, according to Nor Hadi (2011:159) noted that there

are two paradigm approaches in doing social performance

improvement and disclosure, which is based on:

1) Motive Approach, means the practice of social responsibility and disclosure based on certain motive, either social motive or

19

practices to be volunteer accordance with the requirements and

corporate interests such as the existence of direct linkage and

positive between financial performances with social disclosure and

there is linkage between social performances with social

disclosure. Research has proven this paradigm is Belkaoui and

Karpik (1989), Bowman and Haire (1975), Ulmann (1985), Strand

(1983) and others.

2) System Approach, means that company hold social spending, including disclosure because of the demands and conditioning an

existing system. This system may be rules and policies that must be

complied such as determination of management which is the

translational code of conduct, vision and mission as well as

company strategy and regulations arising from the government

(Law of the Republic of Indonesia Number 40 Year 2007 regarding Limited Liability Company), Standard, Regulation of Capital Markets, social customs or conventions. Thus, a violation of the

implementation of social performance and disclosure will have

implications on the company.

c. Categories of CSR Reporting

Douglas et al. (2004) cited in P and W (2011:46) noted that reporting of the CSR behavior is different in different countries, which

is attributed to the government policies, cultural differences, and stage

20

disclosure does not necessarily reflect the quality of corporate social

reporting.

Until now, there are still differences of opinion about the

contents of the disclosure of CSR itself. . The study is conducted by P

and W (2011:48) noted that types and categories of disclosures (both

mandatory and voluntary which are disclosed by the companies in

annual reports among others:

1) Environment

2) Fair business

3) Equal opportunity

4) Personnel or human resources

5) Community involvement

6) Product quality or safety/consumer

7) Political

8) Energy

Meantime, cases in Indonesia, many companies do social

responsibility, although each company has the interpretation and

availability differently. Implications of social responsibility practices

are carried out voluntarily and without a commensurate standard so

that content and implementation strategies to be different (Nor hadi,

21

The study result of Nor Hadi (2009) cited in Nor Hadi

(2011:134) find that social responsibility that has been done by

company includes six dimensions, namely:

1) Environmental

2) Community

3) Energy

4) Employee

5) Product

6) Others

d. CSR Reporting in Annual Report 1) Annual Report

According to Mirfazli (2008:398) definition of an annual reportis at the top every analyst’s list (of financial reports used by

analysts) is the annual report to shareholders. It is the major

reporting document and every other financial report is in some

respect subsidiary or to it.

Annual Reports are obliged to be submitted by companies

enlisting in Stock Exchange as activity reporting during one

previous year to interested parties (stakeholders). Overall, content

from the annual report is not arrange by a professional authority in

charge like Indonesia Accounting Association (IAI), but is

22

The objectives of annual report involve:

a) Useful to users of the annual report in making investments,

credits, and other decisions.

b) Providing comprehensive reports about the company prospect

in future of operation activity, finance, and other relevant

information

c) Providing information about the claims of company resources

and also its charge.

2) CSR Reporting in Annual Report

According to Sutantoputra (2009) cited in P and W (2011:

46) that generally, the main medium of disclosing CSR activities is

the annual report. However, if they are not disclosed in the annual

report, and are published separately, then they are known as social

and environmental report, CSR report or sustainability report.

Nevertheless, the most common form of disclosing CSR is

disclosure in annual report. Adam et al. (1998) cited in Bacthiar and Siregar (2010:243) found that firms in Germany, France,

Switzerland, UK, and Dutch firms, generally disclose their CSR

activities through annual reports. In Indonesia, CSR reporting is

also revealed in the annual report. Based on those studies, our

study focuses on the annual report also as the source of CSR. Kent

and Chan (2003) provided a number of reasons why it is justified

23

a) Annual report is the principal source of corporate

communications to investors and it is widely used by firms to

disclose their social activities.

b) The presentation of financial and social information within one

document (which is the annual report) is one way of reducing

costs of disclosure.

c) Annual report is also the type of information most actively

sought by pressure groups.

d) Disclosures through other media, such as the popular press, are

subject to the risk of journalistic interpretations and distortions,

whereas disclosures through annual report are completely

editorially controlled by management.

3. Company Characteristics

Empirical study has shown that disclosure activism and CSR

disclosure activism varies across companies, industries, and time. For

disclosure activism, Fuad (2006:82) research the factors that influence

disclosure of manufacturing companies where he explained that the level

of corporate disclosure is influenced by several factors contingency. Several factors are considered as a contingency independent variable for

the level of disclosure is a Debt to Total Assets, Return on Assets,

Company Size, Auditor Size, and Disclosure Level one year before.

For CSR disclosure activism varies across companies, industries,

24

(2009), Gao and Joshi (2009), Janggu et al. (2007), Rahman (2008), Reverte (2009), Siregar and Sitepu (2009), and others), where they had

researched about CSR reporting that analyze whether company

characteristics are potential determinants of CSR reporting practices by

various countrieslisted firms.

Each company has special characteristic that different between one

entity to another (Lang & Landholm (1993) cited in Rahman (2008:28)).

According to Willance (1994) cited in Rahman (2008:28) divided

company characteristics into three, namely:

a. There are structured related variables, like company size, leverage, and

type of stock ownership.

b. Performance related variables like profitability, company type, and

company basis.

c. Market related structured like industry type.

Company characteristics explain wider variation of CSR reporting

in the annual report. Company characteristics in this research refer to

board size, company size, profitability and leverage.

a. Board Size

1) Definition of Board Size

Within research of Bacthiar and Siregar (2010:244),

Indonesia Country adopts a two-tier board system, board size relates to total of board of commissioners’ and board of directors’

25

Then, within research of Siregar and Sitepu (2009:4), board

size is total of board of commissioner.

2) Board Size and CSR Reporting

Collier and Gregory (1999) cited in Bactiar and Siregar (2010) and Siregar and Sitepu (2009:4) argued that larger board of commisioners’ size and directors’ size will make it easier to control

the CEO and the monitoring process will be more effective. But, a

very large board could limit the communication and coordination

among board members and consequently will hamper monitoring

process. So, larger board size will have positive influence on CSR,

but a very large board size will have negative effect on it.

Result of research conducted by Bachtiar and Siregar

(2010), Sembiring (2005), Siregar and Sitepu (2009) indicated that

board size positively affects corporate social responsibility reporting.

In this study, researcher only using board of commissioner as one of factors related to CSR reporting in the companies’ annual

reports. Eventhough, in Indonesia adopts a two-tier board system, board size relates to total of board of commissioners’ and board of

26 b. Company Size

1) Definition of Company Size

According to Abrams (1993:69) that company size can be

measured with using total revenue, total units sold or volume and

total employment. Meantime, according to Indriani (2005) cited in

Sudaryono (2007:109) explained that the company's size can be

measured using total assets, sales, or capital from company.

Likewise, according to Gao and Joshi (2009:39) noted that

to measure the company size can be measured in a number of

ways, such as total asset, capital employed, turnover, number employees, company’s market value and equity.

2) Company Size and CSR Reporting

Company size is the independent variable which is usually used to explain disclosure variation in the company’s annual

report. In this study, researchers use total assets as company size. According to Al-Haj et al. (2011:194) that one of benchmarks to indicate whether company is big or small with see

its total asset. The company has big total assets shows that the

company has reached maturity stage, generally company has a

positive cash flow and considered to have good prospects in a

relatively long period of time, moreover it also reflects that the

27

companies has small amount of total assets (Indriani (2005) cited

in Sudaryono (2007:109)).

According to Belkaoi (2004) cited in Sudaryono

(2007:109), the asset is one element of the financial statements

relating directly to the measurement of financial position (balance

sheet) an economic entity. The larger size (total assets) of

company, the greater of information required to be disclosed than

small firms. The statement was based on agency theory in which

large firms have greater agency costs than small firms.

Generally, large firms have greater agency costs. To reduce

the agency costs, company tend to disclose more extensive

information. Then, large company is issuers of the most

highlighted. The greater disclosure is reduction of political cost as

a form of corporate social responsibility (Darwis, 2009:54).

Theoretically, larger companies tend to receive more

attention from the public and are under greater public pressure to

exhibit social responsibility (Cowen et al.(1987) cited in Gao and Joshi (2009:33)). Larger companies can be expected to disclose

more social and environmental information to prove their corporate

citizenship, thereby legitimizing their existence. That is because additional disclosure may influence society’s perception about the

28

In addition, signaling theory suggest that companies with

superior performance (or good companies) use information to send

signals to the market (Ross (1979) and Morris (1987) cited in Gao

and Joshi (2009:33)). Employing signaling theory, Inchausti (1997)

cited in Gao and Joshi (2009:33) finds that management with “good news” disclose more information than that with “bad news”.

So, company size frequently been assumed as a factor

determining CSR reporting. The study is done by Al-Haj et al. (2011), Darwis (2009), Gao and Joshi (2009), Bachtiar and Siregar

(2010), Janggu et al. (2007) and Reverte (2009) indicated that

company size positively affects CSR reporting.

c. Profitability

1) Definition of Profitability

According to Jordan et al. (2010:61), profitability is intended to measure how efficiently a firm uses its assets and

manages its operation. The focus in this group is on the bottom

line, net income.

According to Suharli (2006:294), the ratio of profitability is closely related to profits and the sources used to produce it. Ideally

companies generate as much as possible profit from a given source.

Ratio needs to be calculated is the ROA, ROE, and EPS.

Whereas, according to Kieso (2010:803), profitability ratios

29

period of time. Income, or lack of it, affects the company’s ability

to obtain debt and equity financing. It also affects the company’s

liquidity position and the company’s ability to grow. As a

consequence, both creditors and investors are interested in

evaluating earning power – profitability. Analysts frequently use profitability as the ultimate test of management’s operating

effectiveness. This ratio can be measured with profit margin, asset turnover, return on asset, return on common stockholders’ equity,

earning per share (EPS), price-earning ratio and payout ratio. Likewise, according to Sudaryono (2007:111) that level of

profitability of a company is a measure of the ability to get profit

through all the existing capabilities and resources such as sales

activities, cash, capital, the number of employees, and the number

of branches.

Profitability becomes more important than profit problems

in the literal sense, because the high profit is not necessarily the

size that the company has worked with efficiently. Thus,

companies should not only pay attention to how the effort to

increase profit but more important is the effort to enhance its

profitability, because of high profitability is reflection efficiency is

30 2) Profitability and CSR Reporting

Theoretically, based on the legitimacy theory, one of the

arguments in the relationship between profitability and level of

CSR disclosure is that when a company has a high rate of

profitability, the company (management) considers not need to

report things that can disturb the information about the company's

financial success. Conversely, when low rate of profitability,

company hopes to the users of report will read good news of

company's performance, for example in the social sphere and thus

investors will still invest in the company and also other investors

will be interested to investee in its company. Thus, it can be

concluded that profitability has a negative relationship of the level

of CSR disclosure (Donovan and Gibson (2000) cited in Darwis

(2009:55)).

Nevertheless, according to Shinghvie & Desai (2001) cited

in Sudaryono (2007:112) stated that firms with high profitability

will encourage managers to provide more detailed information so

that it can convince investors and creditors of the company's

profitability.

Then, according to Heinze (1976) and Hackston and Milne

(1996) cited in Rahman (2008:29) stated that profitability is a factor that makes the management free and flexible to disclose

31

profitability rating so the bigger the social information disclosure

(Bowman and Haire, 1976; Preston, 1978; Hackston and Milne,

1996; cited in Rahman, 2008:29).

In addition, according to Belkaoi and Karpik (1989) cited in

Rahman (2008:29), social care wants the company (management)

to make the company profitable. Therefore, we may assume that

the profitability has a positive relation with company social

responsibility.

Moreover, according to Mohamed Zain & Janggu (2006)

cited in Al-Haj et al. (2011:183) find the results provides strong evidence that the corporate social disclosure is positively related to companies’ profitability. This indicates that, the bigger, in terms of

size a company is, the more the company discloses its social and

environmental information.

The result of studies of Gao and Joshi (2009), Janggu et al.

(2007), Zain & Janggu (2006) cited in Al-Haj et al. (2011) and Siregar and Sitepu (2009) indicated that CSR reporting is

positively related to profitability.

In this study, researcher use return on assets (ROE) to

measure the profitability variable. According to Ross, et al.

(2006:65), ROE is measure of how the stockholders fared during

the year, because benefiting shareholders is our goal, ROE is, in an

32

Formula for calculating ROE is as follows:

d. Leverage

1) Definition of Leverage

Leverage ratio is usually also called solvency ratio.

According to Ross et al. (2006:60), leverage is intended to address the firm’s long-run ability to meet its obligations.

Then, Solvency ratio or leverage ratio is ratio used to

measure the extent of corporate assets financed by debt. In a broad

sense it is said that this ratio is used to measure a company's ability

to pay its liabilities, both short and long term (Kasmir, 2012:151).

Then, according to Kasmir (2012:155), kind of leverage

ratio consist of seven namely debt to equity ratio (DER) and debt

to asset ratio (debt ratio), long term debt to equity ratio, tangible

assets debt coverage, current liabilities to net worth, times interest

earned and fixed charge coverage. In this study, researcher use debt

to equity ratio (DER).

2) Leverage and CSR Reporting

Leverage is one of company characteristics that influence

corporate social responsibility reporting practice (Al Haj et al., 2011:183).

ROE

=

33

There are only few studies conducted to find out the

relationship between social responsibility and financial leverage of

the corporation. Within study of Darwis (2009:55), Janggu et al

(2007:11) and Reverte (2008:387) explain that the context of the

agency theory, Jensen and Meckling (1976) argue that more highly

leveraged firms disclose voluntary information in order to reduce

their agency costs and, as a result, their cost of capital.

Empirical evidence of Trotman and Bradley (1981) cited in

Janggu et al. (2007:11) show that positive relationship has been found between financial leverage and the extent of social

disclosure.

However, Brammer and Pavelin (2008) sustain that a low

degree of leverage ensures that creditor stakeholders will exert less

pressure to constrain managers’ discretion over CSR activities,

which are only indirectly linked to the financial success of the firm

(Reverte, 2008:387).

Al-Haj et al. (2011), Bachtiar and Siregar (2010), Darwis (2009), Janggu et al. (2007), Rahman (2008), Reverte (2009), Siregar and Sitepu (2009) show that leverage negatively affects CSR reporting, where management with high leverage will reduce

its CSR to avoid creditor scrutiny.

Thus, we do not make any a priori assumption about the

34

In this study, researcher use debt to equity ratio (DER).

According to Kasmir (2012:157), debt to equity ratio is a ratio used

to assess the debt to equity. This ratio is useful to know the amount

of funds provided by creditors with the owner of the company and

also provides a general indication of the company's financial

viability and risk.

Formula for calculating leverage (DER) is as follows:

B. Previous Research

1. Factors Affecting Social Disclosure in Annual Report on Manufacturing Companies Listed in the Jakarta Stock Exchange (Andre Christian Sitepu and Hasan Sakti Siregar, 2009)

The purpose of this research is to examine the effect of corporate

characteristics, consist of size of board of commisioner, leverage,

company size and profitability to corporate social responsibility

disclosure. This research can explain the decision making about the

corporate social responsibility disclosure done by manufacturing

companies listed in JSX for the year 2007. The data used are in form of

annual reports from 33 companies used as sample for the year 2007.

The statistical methods use in this research is multiple regressions.

The result of this research shows that size of board of commisioner and

Debt to Equity Ratio (DER)

=

35

profitability have significant effect to corporate social responsibility

disclosure , while leverage and company size have insignificant efect to

corporate social responsibility disclosure.

2. The Analysis of Company Characteristic Influence toward CSR Disclosure: Empirical Evidence of Manufacturing Companies (Arif Rahman, 2008)

This research investigates the influence of company characteristic

toward CSR disclosure. The research is using the proxy of management

ownership, leverage, size, profitability and company profile as the

variable of company characteristic, while the CSR disclosure, unlike the

previous researches, is proxied by dummy score from the companies’

mandatory disclosure based on the items of Public Environmental

Reporting Initiative (PERI) and Global Reporting Initiative Social

Performance (GRISP) issued by Global Reporting Initiative (GRI).

It found that simultaneously, company characteristics significantly

influence CSR disclosure. Whereas based on the partial test, among the

characteristics observed, only company profile which significantly

influences CSR disclosure. The result indicates that legitimacy from the

society is the big concern of companies and therefore drives the actions

of companies. However, the disclosure presumably depends on the

awareness of the management toward social and environmental

36 3. Determinants of Corporate Social Responsibility Disclosure Ratings

by Spanish Listed Firms (Camelo Reverte, 2009)

This paper is to analyze whether a number of firm and industry

characteristics, as well as media exposure, are potential determinants of

corporate social responsibility (CSR) disclosure practices by Spanish

listed firms. Empirical studies have shown that CSR disclosure activism

varies across companies, industries, and time which is usually justified

by reference to several theoretical constructs, such as the legitimacy,

stakeholder, and agency theories.

It findings evidence that firms with higher CSR ratings present a

statistically significant larger size and a higher media exposure, and

belong to more environmentally sensitive industries, as compared to

firms with lower CSR ratings. However, neither profitability nor leverage

seem to explain differences in CSR disclosure practices between Spanish listed firms. The most influential variable for explaining firms’ variation

in CSR ratings is media exposure, followed by size and industry.

Therefore, it seems that the legitimacy theory, as captured by those

variables related to public or social visibility, is the most relevant theory

37 4. Company Size, Profitability and Financial Leverage on Social Responsibility Disclosure of High Profile Companies in Indonesia Stock Exchange year 2005 (Herman Darwis, 2009)

This study aimed to give empirical evidence that company size,

profitability and financial leverage influenced social responsibility

disclosure. Research finding proved that company size significantly and

positively influence CSR disclosure. It was based on agency theory that

the bigger a company was the bigger its agency theory cost was. To

reduce such agency cost, a company tended to disclose information

extensively.

Company’s profitability had negative and insignificantl

association. This study was in conflict with legitimacy theory that

profitability had a negative influence to corporate social responsibility

disclosure.

Financial leverage had no influence to corporate social

responsibility disclosure this study failed to support agency theory that

predicted a company with higher leverage ratio would disclose more

information because agency cost of a company with such capital

38 5. CSR Disclosures and Its Determinants: Evidence from Malaysian Government Link Companies (Nor hawani, Mustaffa M. Zain and Norashfah Hanim Al-Haj, 2011)

The main aim of this study is to assess the level of corporate social

responsibility (CSR) disclosure of 44 government-linked companies

(GLCs) listed on Bursa Malaysia and to ascertain the relationship of

certain company characteristics; namely size, age, profitability and

leverage on the total CSR disclosure from the year 2005 to 2006.

The major finding of this study is that the theme of disclosure has

shifted from human resource to marketplace. This is followed by human

resource, community and, finally, environment. Ironically, companies are

not only disclosing good news, but also bad/negative news. This study

provides further evidence that is, to a certain extent, some GLCs have influenced other companies’ practices to disclose CSR information.

Company size was found to be positively significant associated with the

total disclosure. The remaining variables were found to be insignificant

in explaining the total disclosure.

6. Multinational Corporations’ Corporate Social and Environmental Disclosures (CSED) on Web Sites (Prem Lal Joshi and Simon S.Gao, 2009)

The purpose of this paper is to investigate multinational corporations’ (MNCs) voluntary practice of including corporate social

39

characteristics that inspire MNCs to be more accountable in this regard.

This study adopts discrimination analysis to test six hypotheses to

determine which variables influence the MNCs to post their CSED on the

web sites. Data from a sample of 49 MNCs were analyzed with

STATISTICA. The independent variables tested include log of total

assets (size) and log of total equity (size), return on assets (profitability),

debt ratio (risk), auditor (Big4 and non-Big4), country effect (origin the

USA or non-USA) and industry effect (manufacturing versus services).

The results show that companies with a strong equity base and in a

good financial condition have a propensity to voluntarily disclose more

environmental information. For social disclosure, company size and the

profitability are significant variables that influence CSED on websites..

These results are in line with evidence found in some prior studies.

7. Corporate Social Reporting: Empirical Evidence from Indonesia Stock Exchange (Sylvia Veronica Siregar and Yanivi Bachtiar, 2010)

The purpose of this paper is to investigate the effect of board size,

foreign ownership, firm size, profitability, and leverage on corporate

social responsibility (CSR) reporting and the possible effect of CSR

reporting on a firm’s future performance.

Evidence was found that board size has a positive and non-linear

(quadratic and concave) relationship with CSR. This result confirms

predictions that a larger board will be able to exercise better monitoring,

40

Firm size has a positive effect on CSR. This suggests that larger

firms have more resources to devote to social activities and a larger asset

base over which to spread the costs of social responsibility. They also

face more pressure to disclose their social activities for various groups in

society.

Profitability and leverage, however, do not have significant

influence. Little evidence was found of positive impact of CSR on future

performance. This result could encourage firms to disclose their CSR

activities because there seems to be a positive effect on future

performance.

8. The Current State of Corporate Social Responsibility Among Industrial Companies in Malaysia (Tamoi Janggu, Corina Joseph, and Nero Madi, 2007)

The main aim of the study is to find out the level and trend of CSR

disclosure pattern of industrial companies in Malaysia and its relationship with companies’ characteristics. Content analysis is used to analyse the

data from the corporate annual reports of the companies from 1998 to

2003. Samples are selected using simple random sampling technique.

Research findings, inter alia, indicate that there is positive relationship between CSR and companies’ turnover but no apparent

relationship is noticed with companies’ capital. Relationship between

CSR and companies’ profitability is also found to be positive but weak.

41

parts is another noteworthy finding. Overall, CSR level of industrial

companies in Malaysia is increasing both in terms of amount of the

Continued on the next page 42

Table 2.1

Review of Previous Research No Researcher

(Year) Title Similarity Difference

Result

3. Time horizon is cross sectional.

The result shows that size of commissioner board and

profitability has significant effect of CSR reporting. Whereas, leverage and

company size have