THE INFLUENCE OF TAXPAYERS CONSCIOUSNESS, TAX SERVICES AND TAXPAYERS COMPLIANCE ON TAX REVENUE

PERFORMANCE

(Survey on The Individual Taxpayer in South Tangerang)

Created By:

Septian Maulana Yusuf

(109082100006)

ACCOUNTING MAJOR

INTERNATIONAL CLASS PROGRAM

FACULTY OF ECONOMICS AND BUSINESS

SYARIF HIDAYATULLAH STATE ISLAMIC UNIVERSITY JAKARTA

CURRICULUM VITAE

Jakarta, September 23rd 1991

Permanent Address :

Pamulang Permai 1 Blok A.14 No.4 RT.02 RW.010 Pamulang, Tangerang Selatan

Sports, and learning new things

GPA :

Pamulang 1 Junior High School 1997

- 2003

Pamulang Elementary school

2012 UKM Batik “Putra Gobah” Klewer – Solo

2011 Comitte of Futsal Competition (FUSHION)

2013 - ASIAN Tax Community - International Tax Seminar 2012

- Financial Accounting Training - DAAD Seminar on Climate

Change Economy 2010 Insurance Day

2009

- Moderate Muslim Society ”islam in the west and the east: boosting democracy, Human Rights, Freedom and peaceful coexistence”

ABSTRACT

THE INFLUENCE OF TAXPAYERS CONSCIOUSNESS, TAX SERVICES AND TAXPAYERS COMPLIENCE ON TAX REVENUE PERFORMANCE

(Survey on The Individual Taxpayer in South Tangerang)

The purpose of this research is to know the influence of taxpayers consciousness, tax services and taxpayers compliance, as independent variables on the tax revenue performance, as the dependent variable. The data used in this variable is the primary data by using the method of spreading the questioner using convinience sampling method. The sample consists of individuals taxpayers in the South Tangerang. Total questioner that spread is 50. The analysis used multiple regression analysis. Level of significance for t-test of the research is 0.030 for taxpayers consciousness, 0.030 to tax services, and 0.039 for taxpayer compliance and the level of significance for the f-test is 0.000. This shows that taxpayers consciousness, tax services and taxpayers compliance have significant influence on the tax revenue performance.

Key words:

ABSTRAK

Pengaruh Kesdaran Wajib Pajak, Pelayanan Perpajakan, dan Kepatuhan Wajib Pajak terhadap Kinerja Penerimaan Pajak

(Survey Terhadap Wajib Pajak Individu di Tangerang Selatan)

Tujuan dari peneletian ini adalah untuk mengetahui pengaruh kesadaran wajib pajak, pelayanan perpajakan, dan kepatuhan wajib pajak, sebagai variabel bebas terhadap kinerja penerimaan pajak, sebagai variabel terikat. Data yang digunakan dalam variabel ini adalah data primer dengan cara menyebarkan questioner menggunakan metode convenience samping. Sampel terdiri dari wajib pajak individu yang berada di wilayah Tangerang Selatan. Jumlah questioner yang disebar adalah 50. Data diuji dengan analisa regresi linear berganda. Level signifikansi untuk t-test dari penelitian ini adalah 0.030 untuk kesadaran wajib pajak, 0.030 untuk pelayanan perpajakan, dan 0.039 untuk kepatuhan wajib pajak dan level signifikansi untuk f-test adalah 0.000. Ini menunjukan bahwa kesadara wajib pajak, pelayanan perpajakan, dan kepatuhan wajib pajak memiliki pengaruh signifikan terhadap kinerja penerimaan pajak.

Kata kunci:

PREFACE

Assalamu’alaikum Wr.Wb

All praise to Allah SWT and Shalawat always gives to our Prophet

Muhammad SAW

Now with the strength, intelligence, patience, and passion from Allah SWT,

author able to finish this thesis as one of requirements to achieve bachelor degree.

Author believes there is an invisible hand (God) which have helped me going

through this proces.

Author believes that this thesis cound not be finish properly without support

and guidance from various parties either direct or indirect. Especially my Father,

Mother, and my Sister.

Auhor believes author is nothing without each one of you who has helped me

to finish this thesis. Thus, in this very special moment, let author say thanks to all

of them who were helped author through the process of this thesis, including:

1. Prof. Dr. Abdul Hamid, MS as a Dean and my supervisor I who have give

a time to provide guidance, direction, and motivation to author so that

2. Wilda Farah, M. Si as my supervisor II who have give a time to provide

guidance, direction, and motivation to author so that author can finish this

thesis.

3. Mrs. Yulianti as Vice Dean II and my lecture who give author education

and help in finishing this thesis.

4. Mrs. Rahmawati as taxation lecturer who give a lesson about tax and for

help author in finishing this thesis..

5. M. Arief Mufraeni, Lc.,Msi as Head of International Program.

6. Ahmad Dumyathi Bashori, MA as Secretary of International Program.

7. Mr. Sugi Waluyo who give author all information about academic.

8. All lecturer who have taught author patiently and provide uncountable

knowledge, and also academic staff for giving good services.

9. All my friends in Accounting International Program 6th Batch (2009), who

helped author in finishing this thesis. Bunch of love for diah, evi, arini,

opi, aulia, dea, kokoh, angga, ucup, bimo, nanda, putri, pipit, nenek, tami,

cici, gamal, adnan, and osman to every support and motivation that you

gave to finish my thesis, and also for every joy and sorrow that we have

been through together.

10. Thanks to wayan, cimol, brian, fiki, eko, yayan, dhio, fauzi, septya,

danang, and all my friends in accounting B and regular class for helping

author to finish this thesis, and for everything that we spend together.

Author realizes that this thesis is still far from perfection. Suggestion and

LIST OF CONTENTS

CURRICULUM VITAE ... i

ABSTRACT ... ii

ABSTRAK ... iii

PREFACE ... iv

LIST OF CONTECTS ... vii

LIST OF TABLES ... x

LIST OF FIGURES ... xii

LIST OF APPENDIX ... xiii

CHAPTER I : INTRODUCTION A. Background ... 1

B. Problem Formulation ... 6

C. Research Objectives and Benefits ... 6

CHAPTER II : LITERATURE REVIEW A. Basic Concept of Taxation ... 8

1. Definition of Tax ... 8

4. Tax Rates ... 12

5. Taxpayers ... 12

6. Theory Witholding Tax ... 13

7. Tax Payable ... 15

8. Emergence of Tax Payable ... 15

9. Withholding Tax Principle ... 16

10. Withholding Tax System ... 17

B. Taxpayers Consciousness ... 18

C. Tax Services ... 20

D. Taxpayers Compliance ... 22

1. Type of Taxpayers Compliance ... 26

2. Factors Determining High Low Compliance ... 27

3. Criteria Compliant Taxpayers ... 29

E. Tax Revenue Performance ... 29

F. Previous Research ... 33

G. Logical Framework ... 38

H. Hypothesis ... 40

CHAPTER III : RESEARCH METHODOLOGY A. Scope of Research ... 43

B. Sampling Methods ... 43

C. Data Collection Methods ... 44

CHAPTER IV : RESULT AND ANALYSIS

A. Research Objects ... 54

B. Characteristics of Respondents ... 59

1. Return Questionnaire ... 59

2. Description Statistics Demographics of Respondents ... 59

C. Discovery and Discussion ... 62

1. Data Quality Test ... 62

2. Result of Classical Assumption Test ... 66

3. Hypothesis Testing ... 70

CHAPTER V : CONCLUSION AND IMPLICATION A. Conclusion ... 77

B. Implication ... 77

LIST OF TABLES

No. Description Page

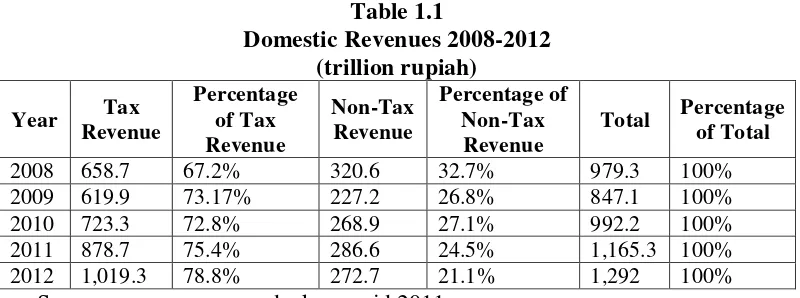

1.1 List of Domestic Revenue ... 1

2.1 Previous Research Table ... 33

3.1 Respondents Answer Score ... 44

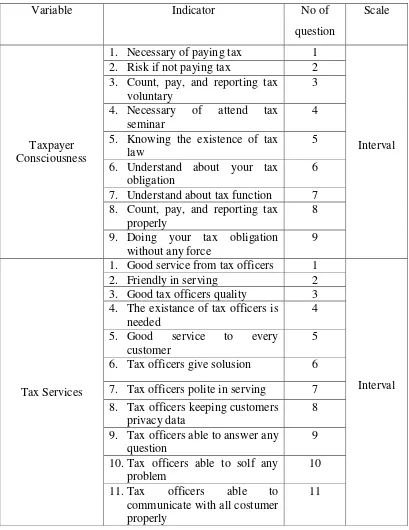

3.2 Variable Operational Research ... 51

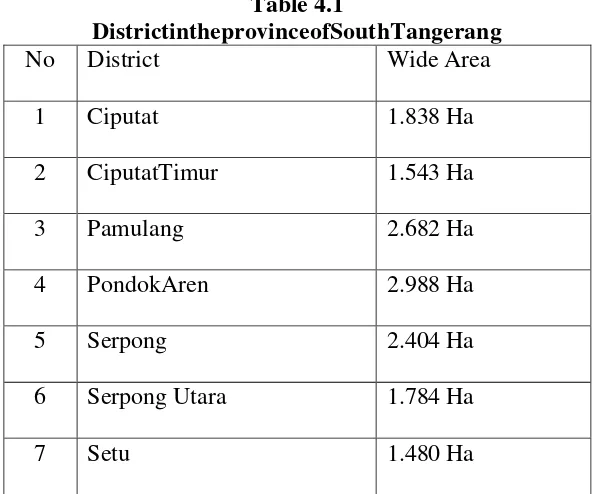

4.1 District in South Tangerang ... 58

4.2 Sample and Retun’s Rate ... 59

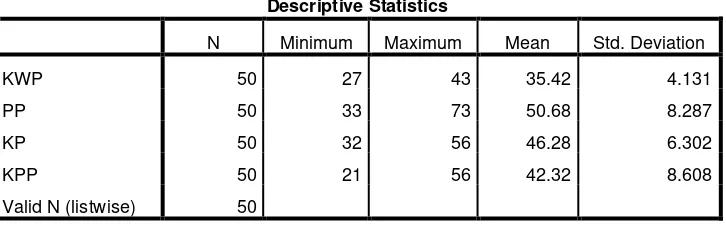

4.3 Descriptive Statistic ... 60

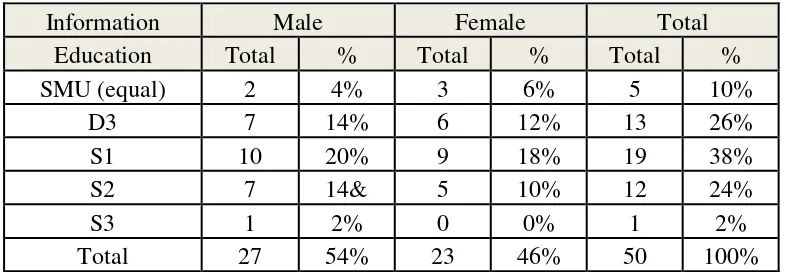

4.4 Description of Respondents Demographic Statistics By Education and Sex ... 61

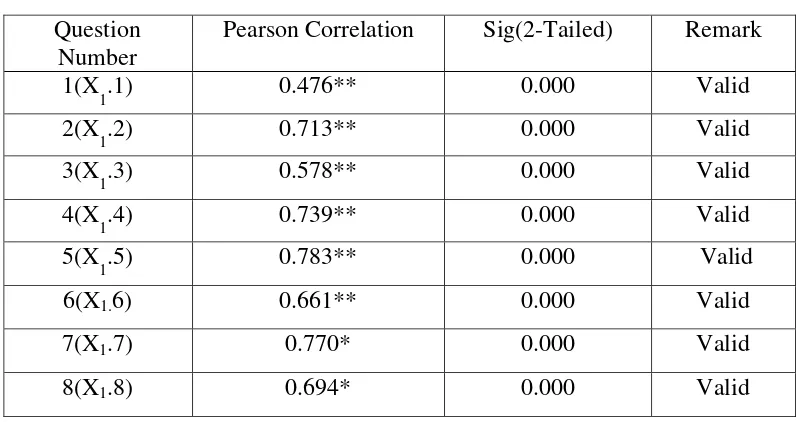

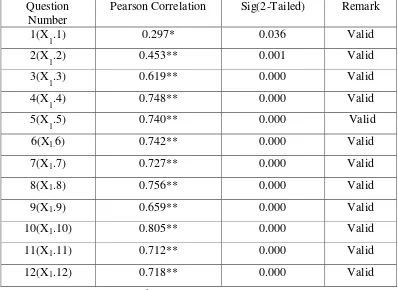

4.5 Taxpayers Consciousness Validity ... 63

4.6 Tax Services Validity ... 63

4.7 Taxpayers Compliance Validity ... 64

4.8 Tax Revenue Performance Validity ... 65

4.9 Reliability Test ... 66

LIST OF TABLES

4.11 Multiple Regression Test ... 70

4.12 Determination Coefficient Test ... 72

4.13 Statistic F Test ... 73

LIST OF FIGURES

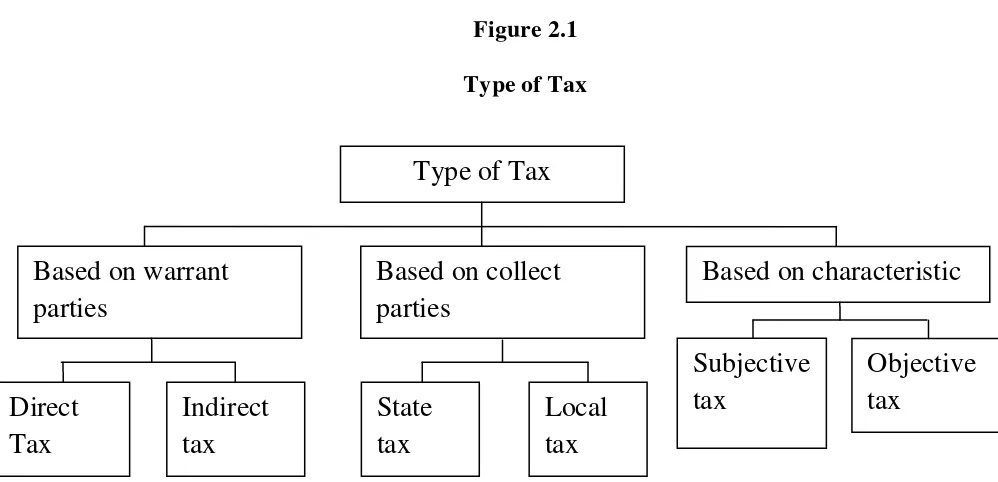

2.1 Type of Tax ... 11

2.2 Research Logical Framework ... 39

4.1 Scatterplot Graph ... 68

LIST OF APPENDIX

Appendix 1 ... 82

Appendix 2 ... 83

Appendix 3 ... 87

CHAPTER I

INTRODUCTION

A. Background

Currently, tax is the main source of domestic revenue fund Indonesia.

Most of the sources of revenues contained in the State Budget come from

taxes and, approximately 78.8% of total revenues derived from tax revenue in

2012(www.fiskal.depkeu.go.id). As the largest revenue, taxes are used to

finance government activities such as: expenditures for funding the

government’s administration build and improve infrastructure, provide education and health facilities, finance officers, and financing activities of the

government in providing the needs that are not generated by the private sector.

Government expenditures to finance it could not be fulfilled with good if not

supported by taxpayers and tax officials who are directly related to paying

taxes. The role oftax revenues from year to year has increased its overall

revenue it can be seen in Table1.1

From the table 1.1 it can be seen that the ratio of the percentage each year

in tax revenue and non-tax revenue, the amount of tax revenue is higher than

non-tax revenue, as in 2008 the percentage of tax revenue was 67.2%, and

non-tax revenue was 32.7%, as well as in 2012 the percentage of tax revenue

was 78.8% and non-tax revenue was 21.1%, thus it can be said that tax

revenue as a main source of income for the State.

In an attempt to optimize tax revenue, the government as policy makers

make an improvement in tax reform program through intensification that

seeks to increase tax revenues through increased taxpayer compliance,

taxation apparatus quality capability, excellent service to the taxpayer, and

guidance to taxpayers, administrative oversight , inspection, investigation and

passive and active collection, also law enforcement.

Taxpayers consciousness in paying their taxes correctly is in the spotlight

that not spared from the author's view, given the importance of public

taxpayer consciousness to increase the tax ratio where the Indonesia’s tax ratio

is still relatively low and has a tendency to fluctuate from year to year based

on calculations conducted by the International Monetary Fund (IMF) and

World Bank, and the Asian Development Bank (ADP) (bappenas.go.id).

Taxpayers consciousness formed by taxpayers perception dimensions, the

taxpayer's knowledge, the characteristics of the taxpayer and the tax

counseling. Taxpayers consciousness will increase if in the community when

positive perceptions of tax appear (Suryadi, 2006). With increasing taxation

education will have a positive impact on taxpayers consciousness to pay

taxes.Characteristics of taxpayers that represented by the condition of cultural,

social and economic will dominant forming taxpayers behavior which is

reflected in their consciousness in paying taxes. With taxation counseling

conducted intensively and continuously will be able to increase understanding

of the taxpayer's obligation to pay taxes as a form of national mutual

cooperation in raising funds for the benefit of government funding and

national development. With the increasing of revenue that government

obtained from tax revenue, will also raise development that will be

implemented by the government. Means that the increase in construction as a

proof that tax revenue performance is increased. Research about taxpayers

perception to tax revenue performance has been done by Maria Karanta in

swedia (Suryadi, 2006). The result of the research conclude that positive

society’s perspective influence taxpayers behave in paying their tax. So it will influence tax revenue performance.

Then after knowing and understanding the importance of taxation for

sustainable development and the wheels of government, citizens

consciousness to pay taxes is expected will be increased so the country’s tax

ratio is increase. A low tax ratio indicating of tax collection is not optimal. Not

optimal tax collection could be causes by several things such as low taxpayer

compliance and corruption. Therefore it is natural if some parties want DJP to

Tax services formed by the Human Resources (HR) dimensions, tax

regulations and Tax Information System (Suryadi,2006). Excellent service

quality standard to the community will be met if the human resources perform

their duties professionally, disciplined and transparent. In this condition the

taxpayer satisfied with the service provided to him, then they will tend to

perform the obligation to pay tax in accordance with applicable regulations.

Thus the tax information system and excellent human resources quality will

generate better service tax. This condition will be very influential in

improving tax revenue performance.Suryadi (2006), in his research shows that

the service tax formed by the dimensions of the quality of human resources

(HR), the provisions taxation, and taxation information system did not show

any influence on tax revenue performance.

Taxpayers compliance is formed by the dimensions of the tax audit, law

enforcement and tax compensation. The purpose of inspection is to test

taxpayers compliance in implementing tax obligations. If law enforcement can

provide justice and legal certainty so taxpayers will obey, obedient and

disciplined in paying taxes. If taxpayers feel that tax compensation already

fulfill as expectations then they will pay the tax in accordance with applicable

regulations. With contionus socialization to all society level, they will

understand the impact that will happen if they don’t pay tax. This is what

should be instilled by tax officers in order to create society that has complied

with the obligation to pay tax. With the compliance of the society as the

(2006) in his research shows that the taxpayers compliance formed by the

dimension of tax inspection, law enforcement, and compensation taxes show

the influence on tax revenue performance.

According to Finance Minister Agus Martowardojo (vivanews.com), the

compliance level of all elements in Indonesia toward tax still low. Such as

individual taxpayer is still about 8.5 million of the 110 million who are

actively working with SPT ratio only 7.7 percent. Meanwhile, the business

entities that pay taxes, he added, only 446 thousand compared with a business

that fixed domiciled and active as much as 12 million. "Only 3.6 percent the

compliance.Lower tax payments caused GDP (Gross Domestic Product) is

also low".

Several phenomena of cases occurring in the world of taxation Indonesia

recently made public andtaxpayers concern to paytaxes. One of the cases was

phenomenal from the Gayus Tambunan case. Former tax official IIIA group

was suspected of accepting bribes and gratuities, and stored in a safe deposit

box owned by him Rp74 billion. Gayus assets totaled reached 659.8 thousand

U.S. dollars and 9.68 Singapore dollars. Gayus was also involved incases of

alleged bribery prison chief Mako Brimob (Vivanews, Juny 2010). The

condition can affect tax compliance and reduced public trust of taxation,

because the taxpayers do not want any tax already paid by the tax authorities

Based on the description above, the author would like to further

investigate the problem and compile them in thesis entitled: "THE

INFLUENCE OF TAXPAYERS CONSCIOUSNESS, TAX SERVICES

AND TAXPAYERS COMPLIANCE ON TAX REVENUE

PERFORMANCE (Survey on The Individual Taxpayer in South

Tangerang)"

B. Problem Formulation

In this research the problem that will discussed can be formulated as

follows:

1. Is taxpayer consciousness significantly influence tax revenue

performance?

2. Is tax service significantly influences tax revenue performance?

3. Is taxpayer compliance significantly influences tax revenue performance?

C. Research Objectives and Benefits

1. This research was conducted with the aim of:

a. To analyze the taxpayer consciousness in influencing tax revenue

performance.

b. To analyze the tax services in influencing tax revenue performance.

c. To analyze taxpayer compliance in influencing tax revenue

performance.

2. Benefits of Research:

a. As an opinion for government in determining the policies to improve

b. As a source of information for other researchers who are interested in

the same issues and analysis that can be obtained for those who need

the information.

c. For a comparison of the existing research, also as an opinion and

reference for researchers who will conduct similar research.

d. As an opinion for DJP to know how importance taxpayers

consciousness, tax services, and taxpayers compliance in increasing

tax revenue performance.

e. As an opinion for tax authority to give better services regarding about

taxpayers consciousness, and taxpayers compliance in order to increase

tax revenue performance.

f. To contribute a knowledge for the university in order to improve

quality of the university.

g. To finish the final assignment and finish the bachelor degree.

h. As an opinion for ministry of finance to know how much the taxpayers

consciousness, tax services, and taxpayers compliance in influencing

CHAPTER II

LITERATURE REVIEW

A. Basic Concepts of Taxation

1. Definition of Tax

According to Adam Smith tax isa contribution from citizen to support of the state.According to Feldmann (Suandy, 2008:9) taxes are achievement that unilaterally forced, and payable to the businessman, , no reciprocity, and its solely used to cover general expenses.

According to RochmatSoemitro(Resmi, 2009:1) tax is contribution from the people to the state treasury under the law (which can be enforced) by not getting reciprocal services directly addressed and used to pay for public expenditure.

From the various definitions of the tax, it can be drawn a conclusion

that tax possess some basic aspects (Setiyaji and Amir, 2005):

1. Tax payment should be based on laws;

2. It can be enforced;

3. No direct reciprocity perceived by taxpayers;

4. Polling conducted by the state, and

5. Taxes are used to finance government expenditure (routine and

development) for the public society.

From the various definitions of taxes, there are a few responses from

experts and practitioners taxation. RochmatSoemitro stated that tax is debt,

is society members debt to society. This debt is legally engagement.

related to civil law and customary law. On the other hand, the fulfillment

of tax obligations will have an impact on the economy, from

microeconomics to macroeconomics. If members of the society fulfill their

tax obligations properly, the economic mechanisms in the community will

go well.

2. Type of Tax

Taxes are divided into three types based on the warrant parties (direct

and indirect taxes), collector (state taxes and local taxes), and nature (taxes

subjective and objective).

a. Type of taxes based on warrant parties:

1. Direct tax, is a tax payment that should be bourne by the taxpayer

and is not transferable to another party.

Example: Income Tax

2. Indirect tax, is a tax payment that can be transferred to other

parties.

Example: Sales tax, VAT, VAT-duty, stamp duty and excise.

b. Types of taxes based on collect parties:

1. State tax or central tax, is a tax levied by the central government.

Central tax is one of the state revenue sources.

2. Local taxes, are taxes collected by local governments. Local tax is

one of local government revenue sources.

Example: Tax spectacle, advertisement tax, PKB (Motor Vehicle

Tax), UN dues cleanliness, parking levies.

c. Types of taxes by their nature:

1. Subjective tax, is a tax that pay attention to the condition of the

taxpayer. In this case there must be a objective reasons in

determining the amount of tax that directly related to the ability of

taxpayers to pay.

Example: Income Tax.

2. Objective tax, is a tax based upon the object itself regardless of the

taxpayer.

Figure 2.1

Type of Tax

Source: Data are processed

3. Tax Function

Tax has two functions as follows:

a. Revenue function (Budgetary)

Tax have budgeter function means taxes is one of revenue to

finance both routine and development expenditures, as a source of

state finance, the government attempted to put as much money for

the state treasury (Resmi, 2009:3).

b. Set function (Regulator)

Tax has a regulatory function, meaning that taxes as a gauge set or

fulfilling government's policies in social and economic sector, as

well as achieving certain objectives outside of the financial sector

liquor, so that sales can be controlled. Similarly the excise duty on

cigarettes.

4. Tax Rates

Tax rate is a measure or standard tax collection. There are four types of

tax rates, the proportional rate, fixed rate, progressive rates, and digressive

rates (Waluyo, 2006:56).

a. Proportional rate

The form of a fixed percentage rate to any amount that is taxable, so

the amount of tax payable proportional to the amount of value that is

taxable.

b. Fixed rates

Rates form of a fixed amount against any amount that is taxable, so the

amount of tax payable is fixed.

c. Progressive rates

Percentage rates used increase substantially if the amount taxed

increases.

d. Digressive rates

The percentage rate used smaller when the greater amount taxed.

5. Taxpayers

Understanding of Taxpayer under Law 16 of 2000 on General

Provisions and Tax Procedures Article 1 paragraph (1), namely: Taxpayer

determined to make a tax obligation, including collectors certain taxes or

cutting taxes.

Entities is a group of people or capital either as a union to do business

or not do business that includes a limited liability company, limited

partnership, the other company, State Owned Enterprises or Region

Owned Enterprises by name and in any form, firm, partnership,

cooperative, pension funds, partnerships, associations, foundations,

organizations, political social organization, or similar organization,

agency, permanent establishment and other types of entities.

Enterprise taxpayers tax obligations and individual agencies in

accordance with the Act KUP include:

a. Must register to nearby KPP to get a NPWP.

b. Must fill out and submit SPT correctly, complete and clear.

c. Must pay or deposit the tax due through the post office or a bank

designated perception.

6. Theory Witholding Tax

According Suandy (2005:28), about tax collection:

a. Theory of Insurance

State in carrying out their duties, also includes the duty to protect the

lives and property of the individual wealth. Therefore, the state is

to pay taxes as a premium. However, these theories have long been

abandoned and are now practically no defenders anymore.

b. Theory of Interest

According to this theory of tax payments have a relationship with the

individual interests that derived from state job. The more an individual

received or enjoying the services of a government job, the greater the

tax.

c. Theory of bear power

This theory says that tax collection should be paid according to the

strength of the taxpayer (individuals). Thus, the pressure of all taxes

shall be in accordance with the Taxpayers carry power with respect to

the amount of income and wealth, as well as the taxpayer expenditure.

d. Theory of Purchasing Power

According to this theory the tax collection function when viewed as a

symptom of society, can be equated with a pump that is taking the

purchasing power of the society household for the state household and

then maintain life and to bring in a certain direction. This theory

teaches that organizes public interest is what canbe considered as the

basis of justice tax collectors, not individual interests, nor the interests

e. Absolute Liability Theory

This theory is based on understanding of state organization

(OrganischeStaatsleer) which teaches that the state as an organization

has a duty to hold the public interest. States shall take the necessary

actions or decisions, including the decision in the field of taxation.

With such properties, the state has an absolute right to collect taxes and

people have to pay taxes as a sign of devotion. According to this

theory the basic tax law lies in the relationship between the people and

the state, which the state shall be entitled to tax and duty people pay

taxes.

7. Tax Payable

According to the law No. 28 year 2007 of tax payable is the tax that

should be paid someday, in a tax period, the tax year or in part in

accordance with the provisions of tax laws.

8. Emergence of Tax Payable

There are two teachings that regulate the emergence of tax debt (as the

recognition of the tax debt), material teaching and formal teaching (Resmi,

2009:13).

a. Material Doctrine (Self Assessment System)

Tax debts emerge from applying of tax legislation as well as fulfill

subject terms and object terms. "Naturally" means that the emergence

of the tax debt intervention of tax officials is not necessary, as long as

because of some condition and action. This doctrine is applied to the

self-assessment system.

b. Formal Doctrine (Official Assessment System)

Tax debt emerge because the law at the time of tax assessment issued

by the Director General of Tax. So, as long there is no tax assessment

then no tax debt and there will be no billing although subject terms and

object terms conditions have been met. The doctrine is applied to the

official assessment system,

9. Withholding Tax Principle

To achieve collecting purposes, tax need to uphold collecting

principles in choosing alternative levied. So there is harmony in tax

collection with the purposes and principles required. In the book An

Inquiri into the nature and cause of the wealth of nations (Mansyuri,

2002:70), Adam Smith states that tax collection should be based on the

following principle:

a. Equality

Withholding tax must be fair and equitable, means that the taxes

imposed on an individual who should be proportional with the ability

to pay and according to the benefit received.

b. Certainty

Tax assessment was not determined arbitrarily. Therefore, the taxpayer

must have a clear and definite amount of tax payable, when it must be

c. Convenience

When the taxpayer must pay, is accordance with the best moments that

do not complicate the taxpayer, for example, when taxpayers earn fee.

This collection system is called pay as you earn.

d. Economy

Economically, the cost of collection and fulfillment of tax obligation

costs for taxpayers is expected to a minimum, as well as the burden

borne by taxpayers.

10. Witholding Tax System

Basically there are 3 applicable tax collection system, the official

assessment system, self-assessment system, and withholding system

(Suandy, 2008:17). Official assessment system is a tax collection system

where the amount of tax to be paid or payable by the taxpayer calculated

and set by fiskus/tax authorities. Next, self assessment system, in this

system Taxpayers calculate, pay and report taxes payable by himself

where the tax officials in charge of conducting counseling and supervision.

And last witholding system where in this collection system amount of tax

payable is calculated and deducted by a third party.

Initially the tax collection system in Indonesia using the official

assessment system, but after the introduction of the first tax reformation,

the system was changed to self assessment. The changes are aimed to

prevent fraud that would arise if a tax official in direct contact with the

impact on state revenues is meaningful. Taxpayers report their business so

they pleased. The trend, reporting taxpayer is far below its actual

This system is actually only be executed well in an economic system

that has been established. In these countries, the accounting system has

been developed making it easier for tax officers to conduct surveillance

and the existence of a complete transaction evidence. Our society is not yet

mature enough to be asked to fill in the amount to be payment of properly.

This is because we are still in the transition phase is often characterized by

low consciousness of the law.

Lack of consciousness of the law is shown by the many cases of

taxation that occurs. If the government wants to use this system, the

government should increase public consciousness of the importance of

taxes for the taxpayer so that the taxpayers with his own consciousness

pay taxes in accordance with the actual conditions.

B. Taxpayers Consciousness

Consciousness is the behavior or attitude of an object which involve

assumptions and feelings as well as the tendency to act in accordance the

object. Thus it can be said that the Taxpayer Consciousness in paying taxes is

a form of taxpayer behavior or outlook feelings involving knowledge, belief

and reasoning with tendency to act on the stimulus provided by the system and

The tax provisions. Of literature and the results, several internal factors that

1. Taxpayers Perception

Taxpayer consciousness to fulfill their tax obligations increased if the

public perception appears positive against taxes. Torgler in Ritonga

(2011) states that the payer consciousness taxes to dutifully pay taxes

associated with the perception that include paradigm will be the tax

function for financing development, usability taxes in the provision of

public goods, as well as justice (fairness) and legal certainty in the

fulfillment of tax obligations. Availability public goods is a matter of

confidence in the use of taxpayer taxes paid. If taxpayers feel that the

taxes paid can not be properly managed by the government, so that

taxpayersfeel the real benefit of tax paid, University of North Sumatra

Taxpayers would then tend not to obey.

2. The level of knowledge of the provisions of the applicable tax.

The level of knowledge and understanding of the provisions of the

taxpayers existing taxpayers effect on behavior of consciousness to

pay taxes. Taxpayers who do not understand the tax laws are clearly

taxpayers tend to be disobedient, and vice versa taxpayers increasingly

aware of the tax laws, the more taxpayers also aware of the sanctions

that will be accepted if the neglect tax obligation. Research conducted

by Prasetyo (Ritonga, 2011) provide results that taxpayers

understanding of regulatory taxation significant effect on the

3. The financial condition of the taxpayers

Financial conditions are factors that affect the economy tax

compliance. Financial condition is the ability of financial companies

are reflected in the level of profitability and cash flow. Corporate

profitability is onethe factors that influence the consciousness to

comply with regulationstaxation. Companies that have high

profitability tend tax reporting honestly from the companies that have

low profitability. Companies with low profitability inUniversity of

North Sumatra generally experiencing financial difficulties and tend to

tax non-compliance. Similarly, the cash flow condition and the

liquidity.

C. Tax Services

Service is a way to serve (or preparing to help take care of all the needs

that a person needs). Meanwhile, fiskus is tax authorities. So that the tax

authorities service means as a way to help take care or prepare all someone’s necessities needed (in this case the taxpayer).

According to the Toy Prastiantono quoted by AgusNugrohoJatmiko

(2006), the success rate of tax revenue not only influenced by tax payer but

also influenced by tax policy, tax administration, and tax law. Last three

factors inherent and controlled by the tax authorities themselves, while the tax

carrying out their duties to serve the public or taxpayers is highly affected by

the tax policy, tax administration and tax law.

Study Singh (Ritonga, 2011) also showed that the taxpayers were satisfied

with the services provided by the government, taxpayers will feel obliged to

comply with the law, including tax law. It is suggests that satisfaction with the

tax services can determine the levels of tax compliance. Services have certain

characteristics that distinguish the product goods. Zemke in Collins and

McLaughlinm (Ritonga, 2011) identified several characteristics of the service

as follows:

1. Consumers have the memories. Experience or memory is not can be

sold or given to anyone else.

2. Purpose the provision of services is unique. Every consumer and each

contact is special.

3. Occurs when a particular service, which can not be stored or

sent an example.

4. Consumers are partners involved in the production process.

5. Consumers do quality control by comparing hope to experience.

6. If an error occurs, the only way that can be done tofix it is apologize.

7. Employee morale plays a very decisive.

Macaulay and Cook (Ritonga, 2011) said that the ministry is the image

organization. Satisfactory service consists of three components, and all

the resulting products and services, (b) how employees provide services,

and (c) personal relationships formed through the service.

The tax authorities in charge and utilize human resources needed to

increase taxpayers compliance. Empirically it has been proved by Loekman

Sutrisno in Jatmiko (2006 )who found that there is a relationship between the

payment of taxes to the quality of public services to taxpayers in the urban

sector. The tax authorities are expected to have competence in the sense of

having the expertise (skills), knowledge, and experience in this case tax

policy, tax administration and tax laws. Besides the tax authorities should

have high motivation as a public service (Jatmiko, 2006).

Quality service is the service that can provide satisfaction to customers and

stay within standards of service that can be justified and must be done

continually. In a simple definition of quality is a dynamic state associated with

products, human service, process and environment that fit or exceed the

expectations of those who want it. If the services of an agency does not meet

customer expectations, the services are not qualified (Supadmi, 2006).

D. Taxpayers Compliance

According to Milgram (Ritonga, 2011) compliance associated with

compliance on the authority of the rules. In a more detailed sense, Hasseldine

(Ritonga, 2011) suggests that compliance is to report all property wealth

taxpayer of record at the specified time and returns report accurate tax

the application is recording. According Safri Nurmantu (Ritonga, 2011), tax

compliance is defined as a state where the taxpayer meets all tax obligations

and exercising the right of taxation . There are two kinds of compliance by

Safri Nurmantu (Ritonga, 2011), namely: formal adherence and compliance

material. Formal complianceis a state where the taxpayer to meet the tax

obligations formal accordance with the provisions of the tax laws. For

example provisions deadline Income tax returns (SPT VAT) held on march

31. If the taxpayer had reported income tax returns yearly on or before march

31, then the taxpayer has to meet.

In the context of the Self Assessment System adopted by Indonesia,

complianceis expected that compliance is voluntary and not a forced

compliance. Compliance is required by the Government against the taxpayer

in the system Self Assessment , of course, not adherence without supervision ,

because veryrisky and occurs on the experience in many countries that are not

all taxpayers comply, in many ways they try to minimize evenavoid taxes,

either through tax avoidance , which exploit loopholesbecause the tax laws are

not set or have a lot of interpretationdifferent , or through tax crime is

smuggling taxes (taxevasion).In this case Brooks (Ritonga, 2011) states there

1. Economic Approach

According to the economic approach to tax compliance

ismanifestations of human behavior that make a rational decisionbased on

an evaluation of benefits and costs.Factorsdetermine compliance with this

approach is the tariff rate, the structure of sanctions, andchance ofdetection

by law.

2. Psychological approach

The approach recognizes the tax compliance behavior is influenced

byfactors of one's perspective on the morality of smugglingtax -related

ideasand its values , perceptionsand attitudes toward the possibility

probablitasdetected, the fineand others, changes in behavior, subjective

framework for decisionstaxes.

3. Sociologicalapproach

This approach saw the causes of deviant behavior onethrough the

framework of the social system. According to sociologists,

encouragementor social pressure will form just as effective behaviorwith a

system of reward and punishment made by the Government.Therefore

according to this approach the factors that affect the taxavoidance and tax

evasion is the attitude of the government, a viewconcerning the

enforcement by thegovernment , views onjustice and taxation systems ,

contact the tax office and demographic characteristics.

Gibson in AgusBudiatmanto (Jatmiko,2006)said that compliance is

with established rules. Someone submissive behavior is the interaction

between the behavior of individuals, groups and organizations (Jatmiko,

2006).

In terms of taxes, the rules that apply are the rules of taxation. So in

relation to abiding taxpayers, the Taxpayer compliance is a sense of devotion

to carry out the provisions or taxation rules that are required or requested to be

implemented (Jatmiko, 2006). Since the tax reform in 1983 and the last in

2000 with the reversal Tax Act into Law no.16 of 2000, Law no. 17 of 2000

and Law no. 18 of 2000, the tax collection system in Indonesia is the Self

Assessment System. According Mardiasmo (2009), Self Assessment System is

tax collection system that authorizes taxpayers to determine for themselves the

amount of tax payable. In this system implies that taxpayers have an

obligation to count, calculate, pay and report income (SPT) right, complete

and timely.

Eliyani in AgusNugrohoJatmiko(2006) stated that the Taxpayer

compliance is defined as the time to enter and report the required information,

fill out the correct amount of tax payable, and pay taxes ontime without

coercive action. Noncompliance arises if one define requirements are not met.

Another opinion on compliance Taxpayers also presented by Novak as quoted

by Kiryanto (Jatmiko, 2006), which states a climate of taxpayer compliance

are:

2. Filling out tax forms correctly;

3. Calculating the correct amount of tax;

4. Paying taxes on time.

So the higher the correct count and taking into account rate, accuracy of

deposit, as well as filling and fill the Notice Letter (SPT) taxpayer, it is

expected that the higher the level of compliance and taxpayer in fulfilling their

tax obligations (Jatmiko, 2006).

1. Type of Taxpayer Compliance

According Nurmantu (2009), there are 2 (two) types of compliance,

namely formal adherence and compliance material.

a. Formal Compliance

Formal compliance is a situation where the taxpayer to meet tax

obligations with a focus on the name and form of liability only,

without regard to the nature of that obligation. For example, submit

SPTPPh before 31 March to the Tax Office (KPP), regardless of

whether the content of Tax Notice Letter (SPT) PPh it is correct or not,

and the most important thing SPT PPh be submitted before March 31.

b. Material Compliance

Material compliance is a situation where the taxpayer in addition to

meeting obligations associated with the name and form of tax

obligations, as well as particularly fulfilling nature of taxation

According Gunadi (2005:5) Taxpayer compliance is a taxpayer has a

willingness to meet its tax obligations in accordance with applicable

regulations without the need to hold the examination, investigation,

carefully, warning, or threat, and sanctions participation in law and

administrative.

Thus, it can be concluded understanding of taxpayer compliance is a

condition in which the taxpayer has a willingness to meet tax obligations

without any examination or sanctions imposed and voluntarily willing to

pay its obligations in the form of taxes in accordance with applicable

regulations.

2. Factors Determining High Low Compliance

According Nurmantu (2009), there are several factors that determine

the level of tax compliance, including clarity laws and regulations

implementing the tax, the cost of compliance, and a role model.

a. Clarity

The more clear the laws and regulations implementing the tax, the

easier for taxpayers to meet tax obligations. The more complicated the

implementation of the tax rules, especially when there is uncertainty

and disjunctive rules, the more difficult for taxpayers to meet tax

obligations.

b. Cost of Compliance

fees issued by the government to collect taxes called administrative

cost and expenses incurred by the taxpayer for taxation obligations is

called compliance cost. Compliance costs are all costs both physical

and psychologically to be borne by the taxpayer to meet tax

obligations. Compliance costs consist of fees for consultants /

accountants, personnel costs, transport costs to the tax office / bank /

treasury, photocopy costs as the physical cost and psychological costs

in the form of stress, curiosity, and anxiety. The lower the cost of

compliance, the easier it is for taxpayers to implement tax obligations.

Request copies more than once by section / official tax office under

one roof is an example of unnecessary compliance costs.

c. Modeling

Model system in the taxpayer’s community in Indonesia to be "the

greatest" taxpayer can be a factor that can increase the sense of tax

compliance. Being one of the 100 largest tax payers pushing

conglomerates in both central and regional levels toincrease the tax

payments which also leaned on the level of compliance. The example

given by president to fill SPT and submit to the Tax Office (KPP)

before March 31 contributed to the department heads, business leaders

to encourage members of organizations to follow the lead of the

president of the SPT before the deadline. Conversely, if the head of

yet have a NPWP would be a negative role model for community

members not to implement Taxpayers tax obligations.

3. Criteria Compliant Taxpayers

According to the Decree of the Minister of Finance numbers

544/KMK.04/2000, complianttaxpayers criteria are:

1. Timely submit SPT

Timely submit of SPT include submitting SPT that are not too late in

the last year for the tax period January to November is not more than

three (3) tax period each type of tax and consecutively. Notice Letter

Period of late has been submitted no later than the deadline for

submission of next tax Notice Letter Period.

2. It has no tax arrears for all types of taxes, unless the delinquent taxes

that have been licensed in installments or defer tax payments.

3. The financial statements audited by a public accountant or Government

Oversight Financial Institutions unqualified for 3 consecutive years.

4. Never convicted of a crime in the field of taxation based on court

decisions that have been legally binding for a period of 5 (five) years.

E. Tax Revenue Performance

According Rivaland Fawzi (Ritonga, 2011) performance is a function of

motivation and ability. To complete the task or job, one must have a degree of

willingness and a certain level of ability. Willingness and skills of a person is

performance can be measured through the four aspects of performance,

namely: the aspect of speed, quality aspects, aspects of the service, and value

aspects. Jewell & Marc (Ritonga, 2011) says that assessment performance is

the process used by organizations to assess the extent to which

members have been doing their job satisfactorily. Performance assessment can

be conducted on the performance of individuals and groups of people who

work in organized.

Understanding of the organization's performance is the answer to success

or failure of organizational goals that have been set. The supervisor or

managers often do not notice it unless it's already very bad or anything so

completely wrong. Too often managers do not know how bad the performance

has dropped so companies / agencies face a serious crisis. Bad impressions

profound organizational consequences and ignore the warning signs of

diminished performance. Some management experts formulate the definition

of performance as follows:

a. Stoner in his book Management suggests that performance is a function of

motivation, skills and role perception.

b. Bernardin and Ruseil (Bandarsyah, 2009) as presented in the book

Achmad S. Ruby defines performance as the recording of the results

obtained from the job functions and specific activities for a certain period.

c. Handoko in his Personnel and Resource Management defines performance

d. Prawiro Suntoro (Bandarsyah, 2009) in book Dandian Flag Merry suggests

that the performance is the result of work that can be accomplished person

or group of people within an organization in order to achieve

organizational goals within a certain time period.

e. According to John Whitmore in Coaching for Performance (Bandarsyah,

2009) performance is the implementation of the functions required of

someone . So, the performance is an act, a performance, a public

exhibition ability. Furthermore, John Whitmore argues that performance is

a condition that must be known and confirmed to certain parties to

determine the level of achievement of an agency linked to embrace the

vision of an organization or company and find out the positive and

negative impacts of an operational policy. Performance is an overview of

the implementation of an activity level of achievement in realizing the

goals , objectives , mission and vision of the organization as stated in the

strategic planning of an organization.

f. As'ad (Bandarsyah, 2009) defines performance as a person's success in

carrying out a job.

g. Kurb (Bandarsyah, 2009), defines performance as a combination of work

and organizing one's personal characteristics.

h. Gilbert (Bandarsyah, 2009) suggests that the performance is what can be

done in accordance with the duties and functions.

i. Moh. Pabundu Tika (Bandarsyah, 2009) in his book Culture and

elements contained in the performance are the results of the work function,

the factors that influence employee performance such as motivation, skills,

perceptions of the role and so on , the achievement of organizational goals

as well as the period of time particular.

So it can be concluded that the definition of the performance are the results

of the work or activities of individuals or groups within an organization that is

affected by a variety of factors in order to achieve organizational goals within

a certain time period.Tax revenueisallstate revenueconsisting ofdomestic

taxesandinternationaltradetaxes(Article 1 paragraph3of LawNo.4 of 2012).

From those definitions it is the overall tax revenue performance can be defined

Reasercher

1. Spiritual intelligence has a

significant influence on

the taxpayers motivation

variable

2. Performance of tax service

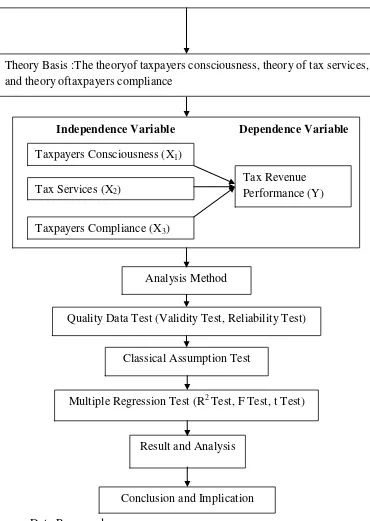

G. Logical Framework

State revenue in the tax sector is the largest contributor to the state budget.

Since the revenues from oil and gas cannot fulfill most of the national budget,

the government is focusing tax sector as a state revenue sector. So, the

taxpayer consciousness and compliance needs to be improved in order to

increase tax revenues. As well as the service of the tax authorities (fiskus)

should also be addressed so that the revenue that obtained can be optimal.

Hopefully with improved consciousness, tax compliance and services of tax

authorities will have a positive impact on tax revenue performance. Logical

Research Logical Framework

Figure 2.2

Taxasa significant source ofstate revenue, so thattaxrevenue performanceis essentialfornational development, and there are some factors which can

influence tax revenue performance

Theory Basis :The theoryof taxpayers consciousness, theory of tax services, and theory oftaxpayers compliance

Independence Variable Dependence Variable

Taxpayers Consciousness (X1)

Tax Services (X2)

Taxpayers Compliance (X3)

Tax Revenue Performance (Y)

Analysis Method

Quality Data Test (Validity Test, Reliability Test)

Classical Assumption Test

Multiple Regression Test (R2 Test, F Test, t Test)

Result and Analysis

H. Hypothesis

According Indriantoro and Supomo (2002) hypothesis in quantitative

research is the answer to a problem or a question based on research developed

theories need to be tested through the process of selecting, collecting, and

analyzing data. The hypothesis states that supposedly logical relationship

between two or more variables in the formulation of propositions that can be

tested empirically. This hypothesis has multiple functions in the study are as

follows:

1. Hypothesis explaining and solving research problems rationally.

2. Hypothesis states that the research variables need to be tested empirically.

3. Hypothesis are used as guidelines for selecting test data methods.

4. Hypothesis became the basis for making conclusions.

1. Taxpayers Consciousness to Tax revenue performance

Taxpayers consciousness formed by taxpayers perception dimensions,

the taxpayer's knowledge, the characteristics of the taxpayer and the tax

counseling. Taxpayers consciousness will increase if in the community

when positive perceptions of tax appear (Suryadi, 2006). With increasing

taxation knowledge of society through tax education both formal and

non-formal education will have a positive impact on taxpayers consciousness

to pay taxes. Characteristics of taxpayers that represented by the condition

of cultural, social and economic will dominant forming taxpayers behavior

counseling conducted intensively and continuously will be able to increase

understanding of the taxpayer's obligation to pay taxes as a form of

national mutual cooperation in raising funds for the benefit of government

funding and national development.. Research on taxpayer perceptions of

the tax revenue performance is doing by Maria karanta, et. al (2000) in

Sweden, concluded thatthe positive public perception can affect the

behavior of the taxpayer to pay taxes that would significantly affect the

performance of the Swedish National Tax Board.

H1: Taxpayer consciousness has significant influence ontax revenue

performance.

2. Tax Service on Tax revenue performance

Tax services formed by the Human Resources (HR) dimensions, tax

regulations and Tax Information System (Suryadi,2006). Excellent service

quality standard to the community will be met if the human resources

perform their duties professionally, disciplined and transparent. In this

condition the taxpayer satisfied with the service provided to him, then they

will tend to perform the obligation to pay tax in accordance with

applicable regulations. Thus the tax information system and excellent

human resources quality will generate better tax service.

Quality services should be pursued to provide safety, comfort,

smoothness and legal certainty can be counted for (Supadmi, 2006). Nerre

to taxpayers by making the tax system and tax policy and good practice

which historically have to consider the culture of a country. Karanta, et. al

(Suryadi, 2006), emphasizes the importance of the quality of personnel

(HR) taxation in providing services to the taxpayer. All in all a good job

means that the tax authorities should be completely capable and expert on

all the expertise in their respective fields.

H2: Tax Service has significant influenceon tax revenue performance.

3. Taxpayer Compliance to Tax revenue performance

Taxpayers compliance is formed by the dimensions of the tax audit,

law enforcement and tax compensation. The purpose of inspection is to

test taxpayers compliance in implementing tax obligations. If law

enforcement can provide justice and legal certainty so taxpayers will obey,

obedient and disciplined in paying taxes. If taxpayers feel that tax

compensation already fulfill as expectations then they will pay the tax in

accordance with applicable regulations. Taxpayers compliance that

measured from tax audit, law enforcement and tax compensation

significantly influence the tax revenue performances. Nominal tax

assessment has increased tax revenue, but the increase in nominal

acceptance is not followed by a significant increase in the average ratio of

profit before tax on sales and the average tax revenue based on the ratio of

income tax to sales (Suryadi, 2006).

CHAPTER III

RESEARCH METHODOLOGY

A. Scope of Research

The study takes the research object inSouth Tangerang. Which is this

research is a causality that is research that aims to determine the relationship

and influence between two or more variables. Variables to be analyzed in this

study were independent variables taxpayer consciousness, taxservice, and the

taxpayer compliance against the dependent variable istax revenue

performance.

B. Sampling Methods

The sampling techniqueis done byconvenience samplingmethod, which is

ageneral termthat includesvariations in thelevel ofrespondent

selectionproceduresthememberpopulationsampling techniqueis based

onconveniencealone. Someonesampledby chancepeoplehadbeen

thereorinvestigatorsknow the person. This type of samplingis very

goodifusedfor researchassessment, which is thenfollowed byadvanced

researchsampletakenat random(Sugiyono, 2007:56).

Sampling method used in this study is convenience sampling is a general

term that includes a wide variety of respondent selection procedures.

Convenience sampling means that the sample units drawn easily reachable, no

C. Data Collection Methods

In this study, data collection is done by the following techniques:

1. This study used a questionnaire instrument that will be distributed to the

respondents made reference to the Likert scale models. Each of the five

alternative answers available answers given weight value as follows:

Table 3.1

Respondents Answer Score

No Respondents answer Score

1 Strongly Agree / Always 5

2 Agree / Often 4

3 Less Agree / Sometimes 3

4 Disagree / Never 2

5 Strongly Disagree / Not Ever 1

Source: Data are processed

2. Literature (Library Research), which is getting the data and information

needed during the writing of this paper were derived from literature /

relatedresource and can be thought of which are related to thesis writing

D. Method of Data Analysis

The method of data analysis is a method used to process the research data

by using the simplification of data in a form thatis easy to read and interpreted

(Ghozali, 2011:5). The method used in this study is a quantitative method.To

find out how much the level of consciousness of the taxpayer, the tax service

quality, and taxpayer compliance, variablesmeasurement tools required that is

using scale model or called Likert type format. Likert method designed to

measure the level of consciousness, service, and compliance by answering

various questions about the variables that will be tested.

Development usage of procedures which represent a bipolar continuum. At

the end of the left (a small number) represents a negative answer, while the

right end (with a large number) describing the positive.

1. QualityTest Data

In a study to obtain valid and reliable data should be tested against the

data. Instrument used for testing data are:

a. ValidityTest

The validity means that how far the precision and accuracy of a

measuring instrument in doing the measuring function. A test or

measuring instrument can be said to have a high validity when

measuring instrument doing their functions properly. Validity indicates

how farthe measuring device is able to measure what you want to

Testing the validity of the thesis is done by comparing the value of

r count and r table for the degree of freedom (df) = n-2, in this case n is

the number of samples.

b. Reliability Test

If a measurement tools has been declared valid the next step is to

measure the reliability of the tools. As a measure that shows the

consistency of the measuring instrument to measure the same

phenomenon in other occasions. Reliability tests aim to see the

consistency of a measuring instrument will be used whether the gauge

is accurate, stable, and consistent.

2. Classical Assumptions Test

In this classical assumption test that used is the normality test data,

multicollinearity, autocorrelation and heteroscedasticity.

a. MulticollinearityTest

Multicollinearity test aims to test whether the regression model found a

correlation between the independent variables (independent). A good

regression model,corelation should not happen between independent

variables (Ghozali, 2011:91). To detect the presence or absence

multicollinearity in the regression model can be seen from the amount

of the value of the Tolerance and VIF (Variance Inflation Factor). Free

regression from multicollinearity trouble if the Tolerance value> 0.10

b. HeteroscedasticityTest

Heteroscedasticity test aims to test whether in the regression model

there is unequality variance from one residual observation to other

observation. If the variance from one residual observation to another

observation is fixed, then it is called homokedastitas and if it is

different called heteroscedasticity. A good regression model is a

regression model that is homokedastitas. Detection the presence

ofheteroscedasticitycan be do by looking at whether there are a

particular pattern in scatterplot graph between the predictive value of

the dependent variable (ZPRED) with the residual (SRESID) where

the Y axis is the predicted while X is residual. If there are certain

patterns so that will indicate there has been heterokedestitas, but if

there is no clear pattern and the points spread above and below zero on

the Y axis, so it heteroscedasticity does not happen (Ghozali,

2011:105).

c. Normality test

Normality test data aims to test whether the regression model, both

independent and dependent variables, have been distributed normally.

Good regression models is regression model with normal distribution

data or near normal. To determinewhether or not the normal

distribution of the data can be detected by looking Normality

Probability Plot (P-Plot). If the data (dots) spread around the diagonal

then showed a normal distribution pattern and regression models have

met the assumptions of normality (Ghozali, 2011:149).

3. Hypothesis Testing

Hypothesis testing is done through coefficient determinant testing

Adjusted R Square (Adj R ²), F test and t test.

a. Test Adj R ²

The coefficient of determination (Adj R ²) was essentially to measure

of how far the ability of the model in explaining the variation in the

dependent variable. Adj R ² value is between zero and one. If the value

of Adj R ² ranges from almost one, then the stronger the ability of the

independent variables in explaining the dependent variable, and vice

versa if Adj R ² values closer to zero, meaning the weaker the ability of

the independent variables in explaining the dependent variable

(Ghozali, 2011:98).

a. F Test

F statistical test basically shows whether all the independent variables

included in the model have an influence together on the dependent

variable. To accept or reject a decision by comparing the error rate

0.05 (Ghozali, 2011:88). Basis for decisionmaking are as follows:

1. If the probability> 0.05 and then Ha rejected.