ASSESSING ISLAMIC BANKING STABILITY

IN INDONESIA

Dimas Bagus Wiranata Kusuma Dedy Fahrul Rahman

Muhammad Fikri Maududi

Department of Economics,

International Program For Islamic Economics and Finance (IPIEF)

Universitas Muhammadiyah Yogyakarta

I N D O N E S I A

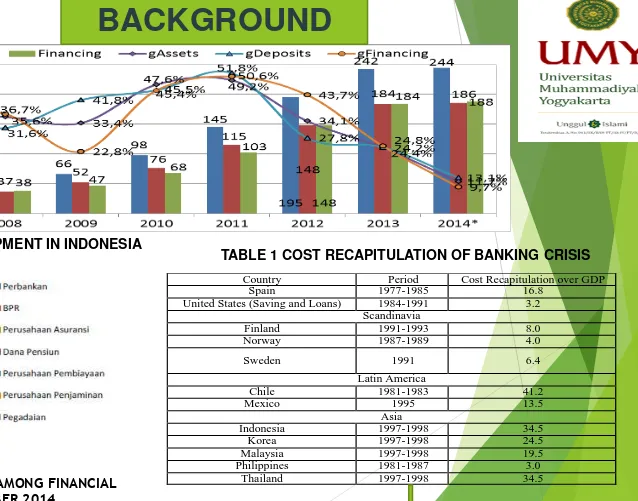

Country Period Cost Recapitulation over GDP Spain 1977-1985 16.8

United States (Saving and Loans) 1984-1991 3.2 Scandinavia

Finland 1991-1993 8.0 Norway 1987-1989 4.0

Sweden 1991 6.4

Latin America

Chile 1981-1983 41.2

Mexico 1995 13.5

Asia

Indonesia 1997-1998 34.5 Korea 1997-1998 24.5 Malaysia 1997-1998 19.5 Philippines 1981-1987 3.0

Thailand 1997-1998 34.5

FIGURE 1 COMPOSITION OF ASSETS AMONG FINANCIAL INSTITUTIONS PER DECEMBER 2014

TABLE 1 COST RECAPITULATION OF BANKING CRISIS FIGURE 2. ISLAMIC BANKING DEVELOPMENT IN INDONESIA

RESEARCH QUESTIONS

How is the level of stability of Islamic banking in Indonesia?

THEORETICAL AND LITERATURE REVIEW

1. Theory of financial system stability – The ability of the system to survive from

various shocks that can avoid from a financial crisis

2. The importance microprudential policy – This policy is intended to maintain the

resilience of individual banks in order to support the stability of banking system and financial system

3 The need for harmonization between Macroprudential and Macroeconomic

Policy

4 To assess the level of stability in Islamic banking where some financial ratios

DATA AND METHODOLGY

No Items

1. Research approach: quantitative time series

2.

3.

4.

Dependent Variables: The Islamic Banking Stability Index (ISPS) -weighted average index consisting of Non-Performing Financing (NPF), Return on Assets (ROA) and the Financing of Deposit Ratio (FDR) of Islamic banking

Independent Variable: M2/Reserve Ratio, Inflation, Real Effective Exchange Rate (REER), Financing Growth.

Method: Logit Model, VAR (Vector Autoregressive)

FINDINGS AND DISCUSSIONS

· Prompt Indicator

· Composite Indicator

· Outlook Financial System

Surveillance

Stress Test Risk Assessment

Regulator, Public, and Market Risk Signaling

6 5

Instrument of Macroprudential Policy Design and Policy

Implementation Policy Effectiveness Assessment

Element 1

Under or Closer to Threshold Macroprudential Surveillance Process

Planning Process & Implementation of Macroprudential Policy

Data, Information, and Research

CONVENTIONAL MACROPRUDENTIAL FRAMEWORK IN INDONESIA

INSTRUMENT LTV GWM LDR Transp’cyCBRT NOP CCB Capital Surchg.

OBJECTIVE Credit-related Credit,

Liq.-related

Single/Multiple Single Multiple Single Single Single Single Broad-based/

Targeted Targeted Targeted Broad-based Targeted Broad-based Targeted Fixed/

Time-varying Fixed Time-varying Fixed Fixed Time-varying Fixed

Rule/ Discretion Rule Rule Rule Rule Discretion Rule/ Rule

Category of instrument

Need repeated calibration

Developed to mitigate systemic risk

Developed to mitigate systemic risk

Need repeated calibration

Developed to mitigate systemic risk

Developed to mitigate systemic risk Source: Bank Indonesia

FINDINGS AND DISCUSSIONS

THE MOVEMENT OF ISLAMIC BANKING STABILITY INDEX IN INDONESIA

FINANCIAL SYSTEM STABILITY INDEX INDONESIA Heat Map Risk Level Range

Green Normal ISPS < -6.98

Yellow Alert -6.98 < ISPS < - 6.93

Orange extra alert -6.93 < ISPS < - 6.75

Crisis Red -6.75 < ISPS < - 6.06

Year

PKK

PGK

PPK

PLK

2004-0.0377

1.677 0.31396 -0.3564

20050.03295 4.80093 0.86723 0.50411

2006-0.0287 0.89575 -0.2505 -0.1953

20070.02885 1.21101 1.18474 0.64013

2008-0.0999 1.22504 -2.5352 -1.5135

20090.0961 -0.1635 2.91464 1.49951

20100.00226 0.82214 0.6306 0.2704

2011-0.0061 -0.1613 0.02869 -0.0885

20120.00457 0.93952 0.23337 0.12223

2013-0.003 1.76902 -0.1796 -0.0489

2014-0.0093 -0.147 0.39647 0.01606

-0,8-0,6

ISPS M2RES IFL GRED REER

THE PROBABILITY MAGNITUDE OF ISLAMIC BANKING INSTABILITY IN VARIOUS THRESHOLD

LEVELS IN 2004-2014 (YEARLY BASIS)

IRF ISPS M2RES IFL GRED REER VDC ISPS M2RES IFL GRED REER

4 0.9334 0.14122 -0.0333 0.05819 -0.0769 4 99.2544 0.01261 0.37153 0.20902 0.15245 8 1.08326 0.13864 -0.0741 0.0485 -0.1628 8 98.6431 0.07041 0.53147 0.21043 0.54464 12 1.11573 0.11016 -0.109 0.02559 -0.2474 12 98.0228 0.16928 0.63591 0.23126 0.94075 16 1.13034 0.07539 -0.1412 0.00116 -0.3291 16 97.449 0.28929 0.72113 0.25265 1.28791 20 1.14202 0.03807 -0.1711 -0.0229 -0.4074 20 96.9282 0.42212 0.79361 0.27134 1.58478 24 1.15297 -0.0006 -0.199 -0.0461 -0.4821 24 96.458 0.56222 0.85551 0.28722 1.83702 28 1.16347 -0.0398 -0.225 -0.0685 -0.5531 28 96.0355 0.70505 0.90826 0.30063 2.05061 30 1.16857 -0.0595 -0.2373 -0.0793 -0.5871 30 95.841 0.77631 0.93159 0.30651 2.14463

VARIANCE DECOMPOSITION OF SOME SELECTED MACROEOKONOMIC

INDICATORS

MICROPRUDENSIAL POLICY

SUMBER DANA PENGGUNAAN DANAA/D PRIORITAS

P R O S E S iGiro

iTabungan

iDeposito Jangka Menengah Dana Jangka

Pendek

Dana Jangka Menengah Dana Jangka

Panjang iDeposito Jangka

Panjang

SUMBER DANA PENGGUNAAN DANAA/D PRIORITAS

POOLING APPROACH OF FUNDS

CONCLUSIONS AND RECOMMENDATIONS

Conclusions

1. Based on logistic test of various thresholds (Kamisnky, Garcia, Lestano, and Park), we found that there

was very small possibility of pressure from selected macroeconomic variables in providing the possibility of crisis or instability in Islamic banking

2. Based on VAR/VECM test, it shows that both the response and the contribution of selected

macroeconomic variables are very small in transmitting pressure and contributing to the movement of the ISPS variable.

3. This paper offers three concepts in enhancing the resilience of the Islamic banking under

microprudential framework; (1) The application of integrated banking models; (2) the development of pooling of funds concept; and (3) development of allocation of funds concept.

Recommendations

1. Need to develop microprudensial instrument of real sector.

E N D OF P R E S E N T A T I O N

THANK YOU FOR YOUR PRECIOUS TIME

MAY ALLAH BLESS US WITH KNOWLEDGE AND WISDOM