Trans Sumatera:

Source: MP3EI

Source : BPS

The Important of Sumatera’s Economic as growth

accelerator

Through

MP3EI,

will

put

Indonesia

as

developed country the end of 2025 with

condition:

In order acceleration of economic growth and distribution of infrastructure building, Sumatera has highest GDP after Java, potentially to be developed faster, in which expected as “National Economic gate to market of Europe, Africa, South Asia, East Asia and Australia.

Region Sharing for GDP

Income per capita: USD 14.250-USD 15.500

USD 4.0-4,5 Triliun GDP: 6,4%-7,5% in 2011-2014 & 8%-9% in 2015-2025 Economic growth is necessary:

The decline of inflation: 6,5% in 2011-2014 become 3% tahun 2025 0% 10% 20% 30% 40% 50% 60% 70% 2007 2012

Sumatera Development would become growth accelerator that in line with

Acceleration of MP3EI Spirit

Sumatera has experienced continuous economic growth and its potential is

even higher, yet growth has been hampered by poor connectivity

• 23.8 % of Indonesia’s GDP is generated in Sumatra • Average GRDP growth is 5% per year (BPS, 2008-2011) • Production and processing center of natural resources

and The National Energy Reserves

Sumatera’s economy has grown rapidly…

Committed future investments in Sei Mengkei Special Economic Zone are:

• IDR 3.74 Trillion in downstream palm oil sector • IDR 2.45 Trillion in oleochemical industry

• IDR 537 Billion in fertilizer plants

There are large investment opportunities in palm oil and coal downstream industry

…And its potential is even greater…

• Waiting times at 4 key ports in Sumatra is 3-4 days, resulting in significant cost increases for exporters. • Shipment cost by land transportation to Medan,

North Sumatera reaches IDR 10 million/TUE (double the cost of container shipment from Tanjung Priok to Belawan Port in Medan)

…But until now hampered by poor connectivity

Capital of

Province/Economic Center Rubber plantation area Palm Oil Plantation area Industry Cluster

Coal Mining area

Domestic Cruise Network

Rail way

Connecting line of Economic Center

Main Line to Exit Corridor Existing Line

Port

Pematang panggang Kayu Agung Betung Jambi Palembang Terbanggi Besar Rengat Pekanbaru Dumai Rantau Prapat Kisaran Tebing Tinggi Medan Binjai Langsa Lhokseumawe Sigli Banda Aceh In d rala ya M u ar a En im B en gk u lu Sib o lg a P ad an g B u kit Tin ggi

139

100

85

191

190

175

126

175

100

60

17

110

135

135

75

22

88

1

2

5

Lu b u k Lin gg au9

5

185

55

2

00

Bakauheni Koridor Utama Koridor PendukungTrans Sumatera Toll Road Consist of Main Corridor (1.813 km) and

Supporting Corridor (795 km), 23 Segments Totally (2.608 km)

Length of Indonesia’s Toll Road during 35 years (1978-2013) is 742

km.

Competitiveness Index quality of road infrastructure in Indonesia

ranked 90 out of 146 countries. Logistic Performance Index ranked 59

out of 155 countries. Quality improvement of highway infrastructure is

needed to enhance the infrastructure competitiveness on free trade

era.

Construction of Trans Sumatra Highway, 2,608 km length, is an

integrated part of other infrastructure development programs. Some

toll roads have been tendered in 2005-2008, but did not get investors.

In an effort to accelerate of infrastructure development, the

government uses its authority to conduct toll road development,

through assignment to State Own Enterprise (BUMN) that are wholly

owned by the state.

Trans Sumatera Toll Road is Necessary, It Can’t Be Delayed...

...From the indicator, development of Trans Sumatera Toll Road can’t become discussion agenda only, it has to developed as soon as possible.

Assigntment*

Private

Gov

BOT

SBOT/HYBRID

O&M/LEASE

Toll Road Development Scheme

√

EIRR >>>

FIRR >>>

EIRR >>>

FIRR Marginal

EIRR >>>

FIRR <<<

Construction

O & M

√

√

√

√

√

√

√

√

√

Land

Acquisition

√

Private : Toll Road Company

Gov : Government

SOE : State Own Enterprise

EIRR >>>

FIRR <<<

√

√

√

SOE

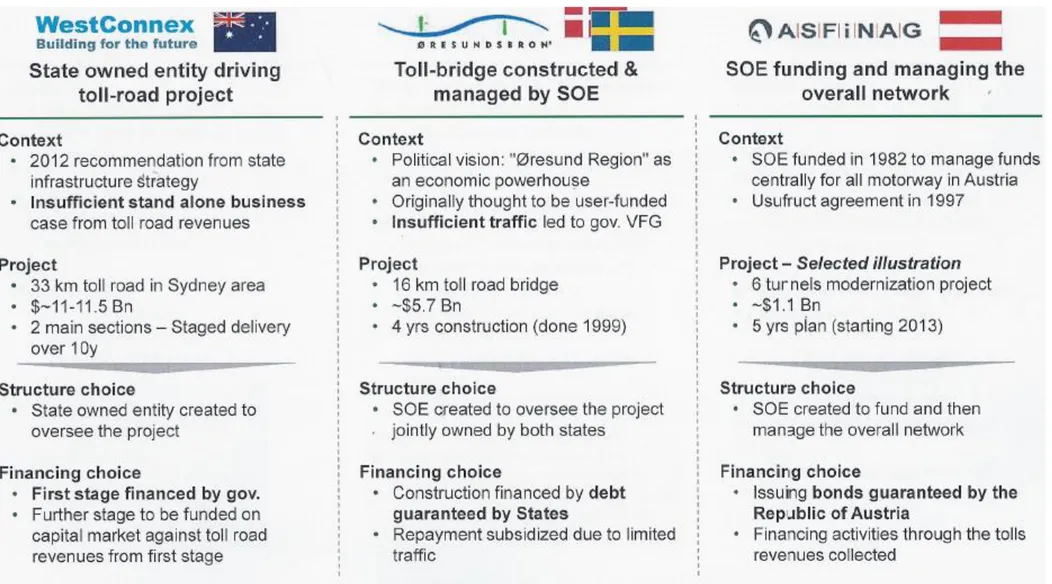

*) PP 43 /2013Illustration of Similar Context Where a Separate Government Entity

Model Have Been Preferred and Successfully Applied

Source : PU-BPJT, Presentasi di BKF bulan Februari 2013

Financial Feasibility (FIRR) of Trans Sumatera Still Low

Condition:

• IRR average is below

10% while IDR

commercial interest rate

is above 10%

• Projection of investment

Phase 1 (2014-2018)

Economically:

• Land is free relatively • Economic center

• Have been tendered but not successfull

Financally:

• Is the best segments traffically, so that potential for sales the consession for spesific period;

• Sales result from phase 1 can be used for next phase

Phase 2 (2016-2020)

Economically:

• Connecting the economic central of phase 1

Financially:

• After phase 1 is developed, traffic phase 2 corridor will be generated because of economic centers connectivity.

Tahap 3 (2019-2025)

• Trans Sumatera toll road as one network Banda Aceh Sibolga Dumai Padang Jambi Bakauheni Bengkulu Pekan Baru Palembang Kayu Agung Terbanggi besar Binjai Medan Bandar Lampung Batam Hang Nadim Batu Ampar PHASE 1 PHASE 2 PHASE 3 Indralaya No Segment KM 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 139 24 62 53 17 17 35 44 47 15 7 10 10 20 60 15 30 40 15 60 100 15 30 55 20 40 6 19 20 45 45 81 20 50 50 70 25 50 100 20 50 50 65 10 45 15 50 50 85 10 25 53 20 30 30 45 10 30 55 15 60 10 40 60 10 50 75 20 50 65 17 91 204 304 - - 31 140 330 545 - - - - - 30 215 530 1.053 1.514 1.759 17 91 235 444 634 879 1.064 1.379 1.902 2.363 2.608 126 4 Palembang-Indralaya 22 5 Terbanggi Besar-Pematang Panggang 100 1 Bakauheni-Terbanggi Besar

2 Medan-Binjai 3 Pekanbaru-Dumai

60 10 Batu Ampar-Bandara Hang Nadim 25 11 Betung-Jambi 191 85 7 Dumai-Sp. Sigambal-Rantau Prapat 175 8 Rantau Prapat-Kisaran 100 6 Pematang Panggang-Kayu Agung

9 Kisaran-Tebing Tinggi Bukit Tinggi-Padang 55 16 Tebing Tinggi-Sibolga 200 190 13 Rengat-Pekanbaru 175 14 Pekanbaru-Bukit Tinggi 185 12 Jambi-Rengat 15 19 Lubuk Linggau-Curup-Bengkulu 95 20 Sigli-Banda Aceh 75 17 Indralaya-Muara Enim 88 18 Muara Enim-Lahat-Lubuk Linggau 125

Operation Lenght of Stage III (km) Total Operation Lenght (km) 23 Lhokseumawe-Sigli 135

Operation Lenght of Stage I (km) Operation Lenght of Stage II (km) 21 Binjai-Langsa 110 22 Langsa-Lhokseumawe 135 No Land Acquisition KM 2014 2015 2016 2017 2018 1 Stage I 304 29 177 98 2 Next Stage 2.304 484 668 1.152 2.608 29 206 788 1.456 2.608 Comulative

Development Phase of Trans Sumatera Toll Road, And Become a Road

Network in Sumatera

Business Scheme of Trans Sumatera Toll Road

Equity Debt

bridging finance Shareholder Loan (SHL)

Gov. Inj Government

guaranteed Corporate bond & direct lending Direct lending SLA Govnt. Injection SLA SPV SOE

Multi Donor Fund

Investor

Local/Foreign Partner

Partner Commercial Loan Other SOE

Foreign Partner Local Parnter

Market PIP, SMI etc

SOE Bank(s) State budget Governtment’s Loan WB JICA ADB Partner Equity 1 2 3 4 5 SOE Government Equity 30% HK 21% Partner 9% Loan 70%

Source Of Fund Simulation: Phase I (4 Segments)

Govr. Injection6.481

Direct Lending10.980

Equity Partner2.777

Corporate Bond10.627

Investment Cost (IDR Billion) Debt Service Coverage Ratio ADSCR Min DSCR 1,2 3,6 1,9 2,7 0,7 0,2 0,6 -0,4Ending Cash at the lowest DSCR Rp 381 Billion Rp 11.989 Billion Rp 44 Billion Rp 8 Billion 3,4 0,3 Rp 15.822 Billion

Bakauheni - Terbanggi Besar

Pekanbaru – Dumai Palembang – Indralaya Medan – Binjai Total Segment 1,2 0,6 Rp 301 Billion Selling Concesion 7 x EBITDA

Disburstment Investment Estimate

Source of Fund for 23 Segments exclude

Land Acquisition

Equity

: Rp 92,26 trillion (30%)

Loan

: Rp 215,37 trillion (70%)

Total

: Rp 307,53 trillion

Source of Fund for 4 Segments exclude

Land Acquisition

Equity

: Rp 9,26 trillion (30%)

Loan

: Rp 21,6 trillion (70%)

Financing Trans Sumatera Toll Road

Keseluruhan 23 Ruas

Financing of Medan – Binjai

Pinjaman menggunakan direct lending KMK untuk memenuhi kebutuhan operasi setiap awal tahunCicilan pokok pinjaman dengan tenor 25 tahun & grace period 7 tahun Pengembalian KMK

Succesfullness of Development Scheme depent on sinergy that

created by related Stakeholder

Indonesian Government

SOE as Toll Road Entreprises

Toll Road Entreprise or SPV

Equity Partner

Lender Institution

(Bilateral/Multilateral)

Financing Institution

(Bank, Dana Pensiun, PT SMI, PT IIF)

Stakeholder

Partisipation in Trans Sumatera Toll Road Development• Giver assignment to SOE through “Peraturan Presiden”

• Giving Capital injection Support and Guarantee of primary loan and loan interest that obtained by PT.Hutama Karya for investment required

• Accepting Assignment from Indonesian Government

• Making Toll Road Development Agreement with Toll Road Institution • developing Toll Road directly or join with another enterprises

• Forwarding Government loan to Toll Road Enterprises of each segments

• SOE stand alone or joint with another enterprises to created consortium Toll Road Enterprise than it will called Special Purpose Vehicle (SPV)

• SPV have charge to develop certain Toll road

• Supporting Trans Sumatera Toll Road development by giving capital support to Toll Road Enterprise or loan with certain requirement and provision.

• Partner come from State owned Enterprise or Regionally Owned Enterprise or Private Company local and international

• Giving soft loan (long maturity and low interest) to SOE based on Government guarantee on primary loan and interest loan.

• Could be Bilateral or multilateral institution or another financing institution such as PIP • Absorbing Corporate bond that issued by Toll Road Enterprise to investment required. • Giving Capital work loan to operasional required

Benefits of The Development of Trans Sumatra Highway On The

Acceleration For Economic Development

Benefits of The Development of Trans Sumatra Highway , such as:

1. Reduce the cost products through cost savings logistics. Nationally, the cost of logistics charge against the product was 14 % ( 24 % of GDB ). In the end of 2025 ( MP3EI) is targeted to the cost of logistics <10 %. Logistic cost of Sumatra between 15 % to 20 % ( source GPEI ). The infrastructure development is expected to reduce the logistics cost of Sumatra <12 % to support the target MP3EI.

2. Refers to the average long-term elasticity of infrastructure development, it will increase the value of GDP between Rp 10 trillion to Rp 15 trillion per year or 0.13% up to 0.19% per year.

3. Increase government revenues as tax revenue

EXIT 2 PEMULUTAN EXIT 3 KTM EXIT 4 SP. INDRALAYA STA 21+930 STA 0+000 EXIT 1 PALEMBANG Jln. Lintas Timur Jln. Palembang – Indralaya (existing) STA 12+000

TAHAPAN KETERANGAN STA JARAK

SECTION 1 PALEMBANG – PEMULUTAN 0+000 s/d 7+100 7 KM SECTION 2 PEMULUTAN – KTM 7+100 s/d 12+000 5 KM SECTION 3 KTM - SP. INDRALAYA 12+000 s/d 21+930 10 KM STA 7+100 Betung Kayu Agung Jln. Lingkar Selatan Palembang

Jln Tol K.Agung - Betung Jln Tol Plm - Indralaya

PALEMBANG – INDRALAYA

MEDAN – BINJAI

Semayang – Binjai

4,51 km

Helvetia -Semayang

4,95 km

Medan - Helvetia

7,64 km

Main Road

= 17,1 km

Access Road

= 8,87 km

Binjai

Semayang

Helvetia

Tj. Mulia

STA 5+920

STA 10+870

STA -1+720

STA 15+380

BAKAUHENI – TERBANGGI BESAR

Seksi III : Tegineneng – Terbanggi Besar Seksi II : Babatan - Tegineneng Seksi I : Bakauheni - Babatan Jalan Tol Penghubun g JSS 1. Access Sunda’s Strait Bridge : 11 km2. Bakauheni – Babatan : 27 km 3. Babatan - Tegineneng : 59 km

PEKANBARU – DUMAI

Pekanbaru Minas Petapahan Kandis Duri 1 Duri 2 Dumai

9,25 Km 23,95 Km 17 Km 26,3 Km 29,925 Km 25,075 Km

Seksi III : Duri Utara - Dumai Seksi I :

Pekanbaru - Kandis

Seksi II : Kandis – Duri Utara

Pekanbaru Sta 0+000 Minas Sta 9+250 Petapahan Sta 33+200 Kandis Sta 50+200 Duri Selatan Sta 76+500 Duri Utara Sta 106+450 Dumai Sta 0+000 Duri Utara “ Sta 25+075 Sta 97+500