a

I

SUSTAINABILITY

AS

A

STRATEGIC

BUSIN

ESS

ORIENTATION

IN

GLOBAL

ECONOMY

RECOVTRY

PHASE

Prcicunding 1 ?lir lnklnrniinnal Annual

$YnrPosium on [4anagcnttnt

Maka*sar' **"?*TllilfiI;lilil1l,1[

PROCEEDING

The 1Zth UBAYA International Annual Symposium on Management

SUSTAINABILITY

AS

A

STRATEGIC

BUSINESS

ORIENTATION IN

GLOBAL

ECONOMY RECOVERY PHASE

Makassar, South Sulawesi, Indonesia 13th_1sth March201,4

Proceeding

The 12s UBAYA lnternational Annual Symposium

on

Management

SUSTAINABILITY AS A STMTEGIC

BUSINESS

oNENTATION IN

Gl6;iffiiol.ii',*

RECOVERY PHASE

Editors:

Dudv Anandya' Dr'

gdiitria Aieng P' SE'

Reviewers:

Candra S' Chayadi' Ph'D ' [School of Business' Eastern

lllinois

universityJ

tiversitas Surabaya)',liliJillli;iifltrti,q*'ffi

i,i*u.i.,:--.rdBank

r.,r in g c ao,

tl,

*tY:;;:ii

i*.,.,..r-, A naryst, WahYu Soedarmono'

'fllilx'*ur,'di, Ph'D' [citv of Hongkong UniversitvJ Pu:ll]ii'i.,1'll;r

Management' racultv or Business & Economics

I lniversitas SurabaYa

Il' RaYa Kalirungkut

(,, rrilrrr, lndonesia 60293

il;;'

: +62-3r'2e?rt3e;;;

t+62'3r-2eBr23e1SBN: 978-97 9'99365-9'2

c o pvri ght @ 2'l:*::,'Jffi:x:iot:}1;;;1ffi

nt' F a curtv o f

lsE

FOREWORD

INSYMA has become a tradition of its

own fbr the Management Department of universitas Surabaya

F;;;"."

than a decade this event

has become

a

forumfo. u"ui._l*

-"rApractitioners

to

shareknowledge. au.o

I:i]

l.turug.,o.ri-o"iur,_"r, atways brings theIl::::1.,r.

thar becomes an rmporrant iiue ro. the devetopmint ofThis year, INSYMA raise the theme

SUSTAINABILITY AS A

STRATEGIC BUS-INESS

ORIEiiITION

IN

GLOBALECONOMY RECOVERV

pffeiE.

This themeinreresring,

considering recently, the compani.r-;;

adapting to volatile and uncertain conditions as a way of life to su.ive.

There are some

important business issues and .u.f-r ,.qri.",

a specific and appropriate

response. These issues are namely gor..nun.., lnrorurion,ii;;;i;;r, operations, regulations, risks, strate-g, A-g.o."tfr,

*rrrir"Uifitf

irf:

tand the economy issues rn.. .o_p-un;;;;r.", rrs own way to deal wirh each ol these issue so rtrrr rn.

.lrplr,",

.un achieve business growth and survival.Hundreds of scientific papers are sent

to a conference committee, and the results oFa rigorous selection of ror.,frr, ,O elected.

This paper is

derived from a.variety of authors, u"ir,

.'rffi

and outside the countrv

academics and practitioners. Ail the articres

a;;;il#;#I;',,1;

symposium and documented inthese p.o.".aingr.

I.^ -n:r" that these proceeclings can contribute to the development of scrence and business

,,*i;'

j*ffi

ff

h.i*jfir

:;,ff.Hr {;:,::?

;Jr?rJi:,nt

ML SYMPoSIUM oN MANAGEMENT

Makassar,.,South Suiawesi, Indonesia

13'h-15,h March 2015

lS BN: 978-9 7 g -99365-9 -2

12h UgAYA

JNTqRN*:IIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

CONTENTS

FOREWORD

CONTENTS

H(IMAN RESOARCES

l1l

t

h"

|,

Itr

l.

h,,,

1.

DESIGN OF INDUSTRIAL RELATIONS ANDWAGE SYSTEMS BASED ONHLa4AN

RESOI,E.CE MANAGEMENT PERSPECTIVE

Agung Widhi Kurniawan, Zarah

puspitanirg,d-2.

ANALYSIS ON PERSONALITY AS MODERATING VARIABLE BETWEENINFLUENCE OF ORGANIZATIONAL

CITIZENSHIP BEHAVIOR AND PEMORMANCE;

AND MEDIATION BETWEEN WORK

ENVIRONMENT AND PERFORMANCE (STUDY

ON EMPLOYEES OF PI]BLIC SERVICE INSTITUTION)

Bambang Suko priyono, Euis Soliha, Noviana Dewi

3.

THE IMPROVEMENT OF LECTURERS'PERFORMANCE BASED ON SOCIAL CAPITAL

H.M. Fauzan

4.

ORGANIZATIONAL CITIZENSHIP BEHAVIOR(ocB) AS A STRATEGY TO WrN THE

COMPETITION

Hamsani

5.

PROFESSIONAL COMMITMENT OFACCOLINTANTSAND THE COMMITMENTOF

PUBLIC ACCOTINTING FIRMS ON AUDITOR'S JOB SATISFACTION

Mathius Tandiontong

1zth UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON Y

6. EFFECT OF BIOGRAPHICAL

E-rian,qcrERISTICS AND cULTURAL

OTVE,NSTTV ON PERFORMANCE

IioiisiurY:clVtL

sERvANrs lN rHEbovEnrurt,rrNT oF LUBUK Ll\GGAU)

Mauiana

A CLOSE,R LOOK ON THE

vrasiurnrrrY/FEMINTNITY DIMENSION

of-isi

i,qvANesE AND cHINE'sE' INDoNESIANFEMALE MANAGERS Mirwan SurYa Petdhana

8.

THE INFLUENCE OF LEADERSHIP STYLE ANDWONT SATISFACTION TOWARDS PERTORMANCE, OT EMPLOYEE \enah Sunarsih' Helmratrn

g.

SERVICE CAPABILITIES OF EMPLOYEE VTTT-ECE DISTRICTS TO PEOPLEiarrsracrroN IN sourH TANGERANG

SoekiYono

10. INTUITION

."

BASED ON RELIGIONT'N,qMBWORK AND IT'S ROLE IN

SMALL-MEDIUM ENTERPRISES (SMES) MANAGER]AL oBCTSTON MAKING: (A CASE STUDY-Oj

PEI'\LONGAN BATIK INDUSTRY-INDONESIA)

Susminingsih

i1.

..

THE DESIGN O!'DESiCION SIJPPORT SYSTEM TOT. TUE ASSESSMENT OF THEPENTONT'I,qNCE OF LECTURE'RS Titik Mildawati

12. THE, EFFECT OF TRANSI'ORMATIONAI I-EADERSHIP ON PERFORMANCE BY TJSING

MOTIVATION WTiTT IOE CHARACTERISTICSS AS MODERATION ROLE

it",i^"^ nil"*i' Kis Indriyaningrum' Anik l(flst1ana

i3

l5

GeN' sza-sz s'99365'9'2

12th UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

13. POSITIVE EMPLOYER BRANDING A STUDY CASE AT NURUL HAYAT .

SURABAYA

H. Johny Rusdiyanto. Elsye Tandelilin

14. COLLABORATION ON SMEs rN AN INDUSTRY CLUSTER: APPLICATIONS OF COMPETITIVE STRATEGIES FOR INCREASING CAPACITY IN

THE GLOBAL ERA Nor iaty Kresna Darrnasetiauan

15. ON THE MODIFICATION OF LATFERTY'S 1973

..LIFE STYLE INVENTORY" THAT

APPLY TO SPECIFIC CONTEXT OF PUBLIC SERVICES IN

THE GOVERNMENT OFFICES OF EAST JAVA

PROVINCE, INDONESIA 20 14: ASSURING BUSINESS SUSTAINABILITY THROUGH

APPLICATION OF PSYCHOMETRIC MEASUREMENT FOR SELECTION OF EMPLOYEES WHO HAVE HIGH

PERTORMANCE AND SUPERIOR PROFII-E

T. Soemarman, J. L. Eko Nugroho

FINANCE & ACCOUNTIJ\IG

16. FINDING COMPANY W]TH DURABLE

COMPETITIVE ADVANTAGE

THROUGHINTERPRETINCOME STATEMENT (A

CASE STUDY OF GO PUBLIC POULTRY FEED'SCOMPANIES IN INDONESIA) Cliff Kohardinata

17. PLINDAMENTAL FACTORS OF BOND RATING

REGISTERED IN INDONESIA BOND MARKET

DIRECTORY 2OO8-2012 Felix. Agus Zainul Arifin

ISBN: 978-97 9 -99365-9 -z

23

21

Izth UBAYAINTTNry4lO

18. ANALYSIS

,"

oF CAPITAL ASSE',TPRlgryg--M;;;L

GAPM) AND SHARIACOMPLIANT ,ts-ser PiucING MoDE'L (scAPM)c'ise-srupv oN l'qKARi e ISLAMIC INDF'x

Kunto Ardianto, Sutdsno

19.

'-

THE INFLUENCE LEADERSHIP'eilvrnoNMENT '{ND LocATIoN

FoR---COMPENSATION AND JOB SATISFAC]IgN IN

pi-rtaaragam DE'PARTMENT sroRE' TBK' Lra Amatia, rtggY Bintang Nauli

20. OPAQUE FINANCIAL REPORTS AND STOCK

""

PNTCiCRASH RISKN INDONESIA i -,tu, prr.*oto, Eduardus Tandelilin

21. ANALYSIS OF FACTORS AFFECTING-_,

FINANCIAL PERFORMANCE IN MAINTAINING

LirsrsNcs oF sMALL AND MEDIUM

COMPANIES M.SienlY Veronica

22. THE,EFFECT OF RETURN ON INVESTME'NT (ROI) AND BARN-INCS PER SHARE (EPS) SHARE

i'mie PT ASURANSI DAYIN MITRA' TRK

-N1rlu

N,'hutu"uit, HM Hasbi Zaidi

23. VALUE VERSUS GLAMOUR N'{VESTING TN

-"

mioNsslA srocK EXcHANGE

Novan Reza Pahlevi

24. FACTORS THAT AFFECT PROFITABILITY IN TERMS OF COMPLIANCE

EMPIRICAL STUOGi IN BANKING^ COMPANY iHar usrBD IN IDx oN 2009-2013

Nur Aini, YeYe Susilowati

25. EFFORTS TO IMPROVE' COMPANY'S

PROFITABILITY

Rosemarie Sutjiati Njotoprajitno

25

26

28

33

12th UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

,=,+,r,,il *ljj;;;:4ie& ,gq#:ii4@

26. PREDICTING THE FUTURE, STOCK RETURN

AND ITS PERSISTENCE USING E-INFORMATION IN INDONESIA STOCK EXCHANGE

Sawidji Widoatmodjo 35

27. EFFECT OF FUNDING AND RISK DECISION ON

FINANCING DECISION EMPIRICAL STUDY ON

ISLAMIC BANKING IN INDONESIA

Sutrisno

3628. THE IMPACTS OF TRUST, RISK AND

TECHNOLOGY ACCEPTANCE MODELS ON CONSUMERS' DECISION W]TH CONSUMERS' INTEREST AS INTERVENING VARIABLE

Sri Ismulyaty, Wiu,in Siswantini

29. THE EFFECT OF LOAN DEPOSIT, CAPITAL ADEQUACY, CREDIT RISKAND LIQUIDITY TO

BANKS PERFORMANCE

EMPIRICAI STUDIES IN BANKING COMPANY THAT LISTED IN IDX ON 201O-2012

Yeye Susilowatr, Nur Ainr, Ida Nurhayati, Lrstiyani

30. THE ROLE OF CULTURE DIMENSION IN

MANAGEMENT CONTROL SYSTEM TO

ENHANCE EMPLOYEE'S MOTIVATION

Alex Chandra" Liliana Inggrit Wrjaya, Imanuel Goestaman

31. STOCKMARKET INTEGRATION BETWEEN

MALAYSIA AND INDONESIA

Christopher Tongku, Putu Anom Mahadu,artha

32. EMPIRICAI EVIDENCE OF PzuVATE DEBTS IN INDONESIA

Erick Sugito Suharso, Deddy Marciano, EndangErnawati

33. WORKING CAPITAL MANAGEMENT AND PROFITABILITY: A STLIDY ON CONSUMER

37

39

40

42

1Zth UBAYA INTERNATIONAL ANNUAL SYMPOSIUM qJ]{gM

GOODS INDUSTRY

Dita Yohana Putri Abrianto, Werner Ria Murhadi' Arif Herlambang

34. DAY OF THE WEE,K EFFECT: THE CASE OF ME,XICO, INDONESIA AND TURKEY

Werner R. Murhadi

O P E RAT I O T,{ MANAGE M E NT

INNOVATIVENESS SURVE,Y ON

MANUFACTURING COMPANIE,S IN

TASIKMALAYACITY

Edy Suroso, Ina Primiana

DISCOVERING THE RELIGIOUS

CONTRIBUTION IN HOSPITALITY ORGANIZATION

(BUSINESS CULTURE EXPE,RIENCE FROM

pBraroNcaN BATIK VILLAGE-INDONESIA)

Imam Kanafi. Ade Dede Rohayana, Susminingsih

37. COMBINING ABC-I'UZZY CLASSIFICATION

MODEL FOR DRUGS INVENTORY PLANNING

IN A PHARMACIUTICAL TJNIT OF A PUBLIC

HEALTH CE,NTER (P U SKE S 1IL4 8 DJOMBANG

E,AST JAVA INDONESIA

Indrianawati Usman, MuiYani

38. ANALYSIS OF CI,E.RENT PERFORMANCE

MANAGEMENT PRACTICES OF STATE OWN ENERGY COMPANY IN INDONESIA

CASE STUDY PT XYZ

Muhammad Tresnadi Hikmat

39. MAPPING THE SUPPLY CHAIN OF SHEEP

MEAT DOMBAPADJADJARAN

Muhamad Dzikron, Ina Primiana

ISBN: 978-97 9-99365-9'2 35

36.

48

12th UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

PERCEPTION OF FOREIGN TOURISTS TOWARDS ORGANIC FOODS IN TOURISM

REGION UBUD, GIANYAR - BALI, INDONESIA

Ni Luh Suastuti, Lidjah Magdalena Massenga

QUALITY SERVICES OF LNIVERSITY BASED ON STUDENT PERSPECTIVE

Ratna Widiastutr

THE EFFECT OF TECHNOLOGY READINESS ON TECHNOLOGY ACCEPTANCE IN USING

SERVICES DELIVERY OF ACADEMIC INFORMATION SYSTEM

Rorim Panday

IMPLEMENTATION OF QUALITY FTINCTION

DEPLOYMENT (QFD) ON LEARNING PROCESS

IN LINIVERSITY X, SURABAYA

Alvin Chrixander Fernaldy, Siti Rahalu, Juliani Dyah T.

THE IMPACT OF SERVICE QUALITY AND

FOOD QUALITY:THE MODERATING ROLE OF ATMO SPHERICS OF KOREAN RE STAT]RANT

.MYOUNG GA' IN SI-IRABAYA

Evina Kurniawan, Fitri Novika Widjaja, Andhy Setyawan

THE EFFECT OF KPOP PRODUCT ON IMAGE

CHANGE AND TRAVEL INTENTION OF

INDONESIA'S RESIDENTS ON SOUTH KOREA AS TOURISM DESTINATION

Happy Lia Sanjaya. Fitri Nor.ika Widjaja, Dudi Anandya

SUSTAINABILITY SUPPLY CHAIN

MANAGEMENT ON MOBILE PHONE FEATURES ACCORDING TO CONSUMER PREFERENCES IN SI]RABAYA

Janice Hendrianto, A. Budhiman Setyawan, Prita A1u

Kusumawardhany

61

ISBN: 978-979 -99365-9-2

40.

55

57

4t.

4t.

43.

44.

45.

46

58

59

1"2th UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

THE MOTIVES TO JOIN THE SLIRABAYA COSPLAY COMMTINITY

Juliani DyahTrisnawatr

THE IMPACT OF WATCHING REALITY SHOW

MY TRIP MY ADVENTURE TO DESTINATION IMAGE, DESTINATION KNOWLEDGE,

PEOPLE'S ATTITUDE AND TRAVEL INTENTION TO MAKASAR

Regina Juwana, Fitri Novika Widjaja, Dudi Anandya

49. EFFECT OF MICE DESTINATION ATTRIBUTES ON FORMING BALI

TOUzuSTIC IMAGE

Threslia Regina Martha Leuw, Fitri Novika Widjaja, Erna

Andajani

50. EFFECT ANALYSIS OF SUPPLY CHAIN MANAGEMENT FOR COMPETITIVE

ADVANTAGE AND ORGANIZATIONAL PERIORMANCE IN EAST JAVA MANUFACTI]RING COMPANY

Yongky Kristianto Pramana, Stefanus Budy Widjaja, Prita

Ayr Kusumau'ardhany

MARKETING

51. AN INVESTIGATION CUSTOMER LOYALTY ON

INDONESI,{N AIRLINES COMPANY

Anas Hidayat, Wulan Yunita Istianila Dervi

52. THE iMPACT OF INSTITUTION IMAGE,

STUDENT SATISFACTION AND WORD OF

MOUTH

Andy Mulyana. Der i Ay'uni

53. INTEGRATED MARKETING MANAGEMENT

STRATEGY FOR PHARMACEUTICAL

ISBN: 978-979'99365-9'2

47.

48.

66

69

12th UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

PRODUCTS AND REVIEW FROM BUSINESS ETHICS PERSPECTIVE

Anr-usa Vera Carolina Krlstanto

54. PRODUCT QUALTTY AND PRICE PERCEPTION

BUYING DECISION AGAINST SALONPAS PAIN

RELIEF PATCH IN HYPERMART DAAN MOGOT WEST JAKARTA

Ari Anggarani Winadi Prasetyoning T1,as^ Desy \Vulandari

55. THE INFLUENCE OF PEOPLE SATISFACTION ON SERVICES ORGANIZATION PUBLIC PERFORMANCE VILLAGE DISTRICTS SOUTH OF TANGERANG

Deni Surapto

56. DETERX4INANTS INTERRELATION OF CUSTOMER LOYALTY SIMPATI PREPAID CARDS USERS

Devi Ayuni. Andy Mulyana

57. THE EFFECT OF CONSUMER ATTRIBUTES.

BRAND AWARENESS ATTRIBUTES AND BRAND IMAGE ATTRIBUTES ON BRAND EQUITY AND DECISION TO CHOOSE

EDUCATIONAL SERVICES (CASE STUDY AT

I,T{IVERSITIES IN PEKANBARU CITY)

Gatot Wijayanto

58. THE START UP BUSINESS PROCESS WITH THE USE OF BIRD IN HAND AND AFFORDABLE

LOSS PRINCIPLE

Gek Sintha

59. PERCEPTIONS AND USAGE BEHAVIOR OF THE

NATION-MDE COMMUNICATION AND DATA

MANAGEMENT SYSTEM:A

PHENOMENOLOGICAL STUDY

Grace T. Pontoh, Darwis Said, M. Ishak Amsari, M. Achyar Ibrahim

72

73

12th UBAYA INTqTU$]qY!

60 CI]STOMERDECISION MAKTNG STYLE' BASED

""

ON LOCAI CULTURE

KasnaenY K

61. ROLE OF IN\lovATloN CAPABIL''IYJ

o'

^-a-ir-osn'rc snARTH.LDER vALyEiil;1

;nootH As NTER,ENINGVARIABLE)

Masmira Kurniawati

b2 sT RArt'L', "'

!.'Y,tolr);#t$:il;fflli:

TACASE STL,DY (Monica Francc>ca Liando' Cluistina Yanita Setlauatt

61 THE INFLUENCE OF PREACHERENDORSER

"

iliir'd;-Pu ncunsr NrENrroN 'ti'r'"t*"a *:'anhazmi'Muchsin Muthohar

64. THE TNFLUENCF oF STRATECIc

ADVERTISING

d;

iionr

IY9SPHEREoN

cusr OMER Bu Y"fiCNTEREST s !9

llP

sruDYrN GIANT SUpBffi an*rgi Lrmp sututoH

ARJ o

^s-insBr

YoGYAKARTA)

Munvanto Sigit

65. ANALYSIS OF EFFECT OF IMAGE AND

oIJALITY SERVICE ON CUSTOMER ^.

85il,'*ii*

t*r'i'[r

u rRu sr MEDI Ar roNtA STUDY O, Oi'PUSGiI' "S IN-PATIENTS'

loriiruoN' RIGENCY oF PIJ'I)

',,-,-*''iiutlit"'

Alimuddin R R' Ali Muslthtn66. SURABAYA'S UNIVERSITIES ^STUDJNTS'

SELF

DEVELoPMEol"i'nuiuii * orcHING KoRE

AN

DRAMA ^'i Narl'

Rizky Hanna Ekaputri' Tias A lndarwati' Nadta

Asandimitra

"li:;3$3'HihYi,.'T'"""?**'9t+tr'i'#*

INDONESIA

Selina Gunawan' Lina

80

81

82

83

84

85

86

87

ffiffie-szs-se365'e-2

1 2th U B AYA I NT ERN ATI O N g'_{SgA'"

JM

68. IDENTIFYING INTERESTING THEMES --

-'"

iTsCARoING couNTRY oF oRiGrN EFFECT:A PRELIMINARY STUDY

Sulhaini, Junaidi Sagir

69. HAS THE IMPLEMENTATION OF GREEN

-"'

i'IARGTING BEE'N EFFEcTIvELY woRKED IN INDONESIA?

Wendra Hartono

70. WoRKMOTIVATION

"

AND SERVICE QUALITYol

iiaiE

clvlt- APPARATUS ASINiscBPTNT oF coMMUNITY

SATISFACTION Af THE PUBLIC-SERYCES IN

THE SUB-DISTRICT OF SOUTH TANGE'RANG

CITY

WiwinSiswantini''iamjuddin'DeviA)'uni'AndyMulyana

71. EFFECT oF wEBslrE DESIGN

gyflTY

oN

"'

"o"r-uncH,^s' N,E'NTI.N oF.ILIYP-CUSTOMER, WITTi TT,M,OU'TOR VARIABLE, OF

i,nirsr,ncrroN AND rRusr

T.JuYtu Uu*u-i Putri" Albari

72. SE,RVICE QUALITY COMPANSON BE{WEEN BLuE BIRD ra-ii'q'NJ onBNZ TAxI'BASED oN

CONSUMER'S PT,NCEPTTON IN SUX'{B

AYA

Alan Darmasap**

;;; ;;"

;nandva' chris tin aRahardia

Honantha

73. INFLUENCES OF CONSUMER AITTY'E TOWARD ONT-Ni SRAND COMIVTIJNITY

ON

REVISIT TNTEN iiO\i "ND BRAND^ TRU ST

IN

MAN cHE srER

uxl;r,

oNLiIl

:.YMLINITY ON FACEBOOT"TUNOUCH MODERATION TYPES OF COMN'I[r-|]ITY: MO-C "''9O:Andrerv Sufu'-t' Cfl*ttlu Rahardja Honantha'

Andhy

SetYawan

74. UTILITARIAN AND HEDONIC-MOTIVATORS

EFFECT OF SHOPPERS'DECISION TO

88

B9

90

92

94

95

1 2 th U B AYA I N T E RN ALI g N{L-*UY3}J:Y:-O#J;}:*j)j;*}JM

CONSULTATION WITH HARTONO ^-

--ELEKTRONIKA SALESPERSON IN SURABAYA

Ehrluiun Budianto' Dudi Anandya' Indarini

STRATEGIC MANAGEMENT

75.

'"

SURVIVING CONFLICT: A CASE STUDY OF ior,nrsu INDUSTRY IN MALUKUCharlY HongdiYanto

76. A CONCEPTUAL MODEL OF INCORPORATING

SUSTAINABILITY

iifo

nrNovATIoN AND ITS EFFECT oN BUSINESS PERFORMANCEEsti Dwi RinawiYanti

77. CORPORATE SOCIAL RESPONSIBILIII-1ND

PUBLIC RELATION (A LITERATURE REVIEW)

Helmiatin

78. RETAIL STRATEGY FOR TRADITIONAL MARKE,T IN SURABAYA

Casr sruPv: PASARI(APAS KRAMPUNG iJri Hup,uti, Markus Hartono' Andrianto Gunarvan

79. ORGANIZATIONAL DEVELOPMENT;

'-

iupiertrENTATroN oF THE vAluE-s FoR ON-AANTZATIONAL SU STAIN A BILIT,Y

iWayan Edi Arsawan' Ni Putu Santi Suryanttnt

80. STRATEGIC INNOVATION THROUGJI -. TECHNOLOGV GAONqESS AND ACCEPTANCE

IN IMPLEMENTING ICT FOR CORPORATE SUSTAINABILITY

John TamPil Purba

81. FROM THE SYMBOLIC

"

ICON OF LOTUS IN THE VIETNAME,SE CULTURE''

9-IO

10:

10-:

10i

106,

12d,UBAYA INTERNATIONAL ANNUAL SYMPOSIUM ON MANAGEMENT

RECOMMENDING THE NEW IDEA OF

ORGANIZING THE LOTUS FESTIVAL IN DONG THAP PROV]NCE OF VIETNAM

(PERTOD OF 2015-2020)

Phan Thi Hong Xuan 108

82. BUSINESS CLIMATE FOR SMALL MEDIUM

ENTERPRISES AND E-GOVERNMENT

INITIATIVE

Rizal Hari Magnadi

APPLYING SUSTAINABILITY STR{TEGY FOR SOCIOPRENEUR

Sonata Christian

THE INFLUENCE OF COMPANIES'

CHARACTERISTICS AND ENVIRONMENTAL

CERTIFICATION TOWARDS THE DISCLOSURE OF CSR IN INDONESIA

Wiwiek Dianawati

THE SELECTION OF CLASSIFICATION METHODS IN KANO MODEL FOR SERVICE

INDUSTRY

Yenny Sari

FOR\,I LJI,A'IING }3USINESS STRATHGY FOIi. l'ASI{tflN RHT,qti- BUSTNESS: A CASB STUDY

Yuke Felicia. Liliani

109

111

84.

85.

115

Department of Management Faculty of Business and Economics Universitas $urabaya

EC Building lst Floor

Jl. Raya Kalirungkut, Surabaya, 60293 Ph: +62 31 2981139 Fax +62 31 298123'l ernail: [email protected]

rsBN 1?S-1?1-313t5-1-e

ilililililflilil]tiltililil

ANALYSIS OF FACTORS AFFECTING FINANCIAL PERFORMANCE IN MAINTAINING EXISTENCE OF SMALL AND MEDIUM COMPANIES

M.Sienly Veronica Universitas Kristen Maranatha Email: [email protected]

ABSTRACT

Small and medium companies are companies that can sustain the economy of Indonesia. It can be seen that when the monetary crisis, small and medium companies can survive and thrive, especially small and medium companies engaged in the field of trade, services and investment. In order for the existence of small and medium companies can be maintained and can be improved, the researchers wanted to find out and analyze the factors that affect the financial performance of small and medium companies because by knowing and analyzing these factors, it can be known what factors affect the financial performance of small and medium companies so that small and medium companies may pay attention to these factors in improving its financial performance. In this study, the sampling technique used is probabilistic sampling with simple random sampling method to obtain 54 companies listed with medium size on the Indonesia Stock Exchange on the sub-sectors of trade, services and investment with the observation period from 2009 to 2012. Research variables used in this study are the independent variables consisting of the current ratio (CR), inventory turnover ratio, total asset turnover (TATO), debt to equity ratio (DER), firm size and firm age and the dependent variable is the financial performance measured by return on assets ratio (ROA). The method used to perform hypothesis testing is multiple linear regression. The results of the hypothesis testing is current ratio (CR), inventory turnover, total asset turnover (TATO), debt to equity ratio (DER), firm size and firm age impact the financial performance of the company simultaneously, while partially only current ratio (CR), inventory turnover and the size of the companies that give effect to the company's financial performance. Based on the results of hypothesis testing in general small and medium companies need to consider all the factors that impact the company's financial performance as current ratio (CR), inventory turnover ratio, total asset turnover (TATO), debt to equity ratio (DER), the size of the firm and age of the firm, in particular small and medium companies should pay more attention to the current ratio (CR), inventory turnover and the size of the company in improving the company's financial performance and maintain the company's existence.

Keywords: small and medium companies, financial performance and the existence of the company.

INTRODUCTION

The role of small and medium company is seen from his position as a major player in the various sectors of economic activity, the largest provider of employment, an important player in the development of regional economic activity and community development, creators of new markets and innovation, for small and medium companies that have go international, the small medium companies contribute in maintaining the balance of payments through its contribution in generating export (Urata, 2000 in Harahap, 2014).

and accounts for 59.08% of the Gross Domestic Product (GDP) (Gomulia and Manurung, 2014) so that small and medium companies became the supporting of the Indonesian economy, especially small and medium companies engaged in trade, services and investment. By looking at the role and contributions made by small and medium companies, the small and medium companies need to improve its performance in order to maintain its existence.

One way to improve the performance of companies, especially financial performance of the company is to analyze financial performance through financial statements. The financial report is a tool that describes the condition of the business, decision-making tool that is accurate and timely, and accountability in the management (Harahap, 2014).

Financial performance analysis is used to determine the extent to which the effectiveness of the company's operations in achieving its objectives. To assess the financial performance of companies can use ratio analysis where the ratio analysis is a tool that can explain or give an idea of the good or bad financial condition of a company (Munawir, 2007).

There are various types of ratios that can be used in the analysis of ratios such as liquidity ratios, solvency ratios, activity ratios, profitability ratios and the ratio of the market, to measure the financial performance can use the ratio of profitability due to a consistent level of profitability will be a benchmark of how the company is able to survive in the business to obtain an adequate return compared to the risks (Prihadi, 2008). One of the profitability ratio that can be used to measure a company's financial performance is return on assets (ROA) where ROA is a measure of the rate of profit to assets used in generating profits (Prihadi, 2008).

Another factor that can influence in improving the performance of the company is the size of the company and the age of the company. The size of a company plays an important role indetermining the kind of relationship the company enjoys inside and outside its operating environment, and itaffects its financial performance in many ways. Company size has been considered as an important determinant of company profitability (Babalola, 2013). The age of the company also has an important role in measuring the financial performance of companies in which the older the company, the cost to produce goods and services become low so that it will affect the earnings and profits (Pathirawasam and Wickremasinghe, 2012). The age of the company can show that the company still exists and is able to compete. Thus, the age of the company can be attributed to the financial performance of a company. If a company has good financial performance, the company will be able to maintain business continuity (Sembiring, 2003).

Based on the description above, the author is interested to analyze the factors that impact the financial performance in maintaining the existence of small and medium companies.

LITERATURE REVIEW AND DEVELOPMENT OF HYPOTHESES

Small and Medium Business

In accordance with Act No. 20 of 2008, the definition of small and medium companies are: (depkop.go.id in Veronica, 2014)

a. Small businesses: productive economic activities that are carried out by the independent individual or business entity that is not a subsidiary or branch company not owned, controlled or become part either directly or indirectly, of a medium or large businesses that meet the criteria for small businesses as referred to in this law.

b. Medium-sized businesses: productive economic activities are independent, which is done by an individual or business entity that is not a subsidiary or branch company owned, controlled or become part either directly or indirectly with a small business or large businesses with total net assets or results annual sales as stipulated in this law.

Criteria for small businesses is to have a net worth of more than fifty million Rupiah up to at most five hundred million Rupiah, excluding land and buildings, and has annual sales of more than three hundred million to a maximum of two and a half billion Rupiah.

Criteria for medium-sized businesses is to have a net worth of more than five hundred million Rupiah up to at most ten billion rupiah excluding land and buildings, and has annual sales of more than two and a half billion to at most fifty billion Rupiah.

Factors Affecting Financial Performance

The financial performance of the company is a picture resulting from the financial analysis tool that shows the company's financial condition is good or bad. There are various factors that may affect financial performance, among others, the company's liquidity, the amount of the company debt, the use of company assets, firm size and firm age. The relationship between these factors with the company's financial performance will be explained as follows:

1. Liquidity Ratio and Financial Performance

Liquidity company shows the company's ability to fund its operations and repay its short-term liabilities. Liquidity of the company can be measured through financial ratios such as: current ratio, cash ratio and quick ratio. Liquidity of the company is able to be a predictive tool to measure the level of financial performance. Current ratio is often used as a measure of liquidity (Asiah, 2011). In this study using the current ratio to measure the liquidity of the company in which the current ratio is the abilitiy of the current assets to pay the short-term liabilities. Short-term liquidity is important because the problems in the short-term cash flow could make the company be bankrupt (Darsono and Ashari, 2005). Several studies like Asiah (2014), Khalifa and Shafii (2013), Carvalho et al (2013) and Shakoor et al (2012) stated that the current ratio influence on financial performance.

2. Leverage Ratio and Financial Performance

Leverage or solvency ratio is the ratio to determine the company's ability to pay its obligations if the company is liquidated and assess constraints in the company to borrow money (Darsono and Ashari, 2005). Any use of debt by the company will influence the risk and return. The debt ratio can be used to see how big the company's financial risk (Asiah, 2011). Solvency ratio used in this study is the debt to equity ratio. The results of the study of Asiah (2011), Noor (2011), Pathirawasam and Wickremasinghe (2012) and Shakoor et al (2012) concluded that the debt-to-equity ratio influence on financial performance in which a large amount of debt that will affect the profitability of companies due to the more large debts then there are large interest to be paid so that will reduce the profit, on the other hand if the company is unable to pay the debt shows the company's financial performance is not good.

3. Activity Ratio and Financial Performance

4. The Size of the Company and Financial Performance

According to Rajan and Zingales (1995) in Izati and Margaretha (2014) size is expected to be one factor in the performance of the company. Size can have a positive effect on firm performance. Margaretha (2011) in Izati and Margaretha (2014) explains that the amount of assets of the company will make the company more easier to raise capital compared with companies that have a lower asset, in addition to the existence of sufficient assets to be able to increase sales and could increase profits. Several studies like Khalifa and Shafii (2013), Mishra et al (2009) and Babalola (2013) states that there are significant between firm size and financial performance.

5. Age Company and Financial Performance

Age company can show that the company still exists and is able to compete.Thus, the age of the company can be attributed to the financial performance of a company. If a company has good financial performance, the company will be able to maintain business continuity (Sembiring, 2003). The age of the firm is an important variable in determining its financial performance. When the firm becomes older, it enjoys economies of scale. This means that the firm can produce products at lower costs and this will cause an increase in revenue and profits (Pathirawasam dan Wickremasinghe, 2012).

Based on the description above, the development of the hypothesis is:

H1: There is the influence of the current ratio, debt to equity ratio, total asset turnover, inventory turnover, firm size and age of the company to the company’s financial performance simultaneously.

H2: There is the influence of the current ratio, debt to equity ratio, total asset turnover, inventory turnover, firm size and age of the company to the company’s financial performance partially.

Research Model

H1

X1: Current Ratio

H2

X2: Debt To Equity Ratio

X3: Total Assets Turnover Y : Financial Performance

X4: Inventory Turnover

X5: Firm Size

X6: Age

RESEARCH METHODOLOGY

Types of Research

The purpose of this study was to determine what factors are to give effect to financial performance in maintaining the existence of small and medium companies. Based on the purpose of this study, the type of this research is the research hypothesis testing. Research hypothesis testing research is designed with the aim to test the hypothesis typically used to determine the relationship between the variables that are causal and correlation relationship (Suliyanto, 2009).

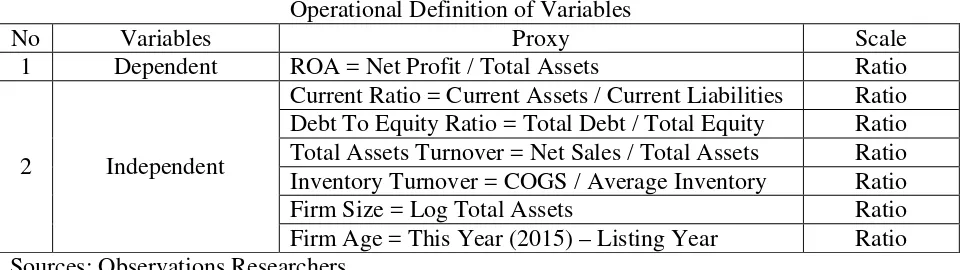

Operational Definition of Variables

In this study using two types of variables: the independent variables and the dependent variable. Defining variables used can be seen in the table below:

Table 1

Operational Definition of Variables

No Variables Proxy Scale 1 Dependent ROA = Net Profit / Total Assets Ratio

2 Independent

Current Ratio = Current Assets / Current Liabilities Ratio Debt To Equity Ratio = Total Debt / Total Equity Ratio Total Assets Turnover = Net Sales / Total Assets Ratio Inventory Turnover = COGS / Average Inventory Ratio Firm Size = Log Total Assets Ratio Firm Age = This Year (2015) – Listing Year Ratio Sources: Observations Researchers

Population, Sample and Sampling Techniques

The population used in this study are all companies listed in Indonesia Stock Exchange are included in the category second board. The samples are companies listed in Indonesia Stock Exchange in the category seconf board with sub-sector in trade, services and investment, the observation period 2009 - 2012 in which there are 54 companies were used as samples. Sample selection at the Indonesia Stock Exchange on second board because of the similarity criteria between small and medium companies and criteria listed company on second board that is on net worth where the small and medium companies have net assets is between five hundred million to at most ten billion Rupiah and listed companies on second board must have a net worth of at least five billion rupiah, beside that many small and medium companies engaged in the field of trade and services (Veronica, 2014).

The sampling technique used was simple random sampling in which every member of the population is given an equal opportunity to be sampled (Suliyanto, 2009).

Data Analysis Methods

The method used to perform data analysis is multiple linear regression. This method was chosen for this study aimed to investigate the influence of the independent variables and the dependent variable. Used multiple linear regression to see how the relationship between a dependent variable with more than one independent variable (Nazir, 2011). Multiple linear regression equation is:

Y = a + b1 X1 + b2 X2 + b3 X3 + b4 X4 + b5 X5 + b6 X6 + e ...(1)

in which:

b1,b2,b3,b4,b5 dan b6 is regression coefficient

X1 is Current Ratio (CR) X5 is Firm Size

X2 is Debt To Equity Ratio (DER) X6 is Firm Age

X3 is Total Asssets Turover (TATO)

X4 is Inventory Turnover

RESULTS AND DISCUSSION

Data

The data used in this study are the companies listed on the Indonesia Stock Exchange on second board with sub-sector trade, services and investment. The number of companies that are used by 54 companies which can be seen in appendix 1 and the observation period from 2009 - 2012. Data of financial ratios and other factors also can be found in appendix 1.

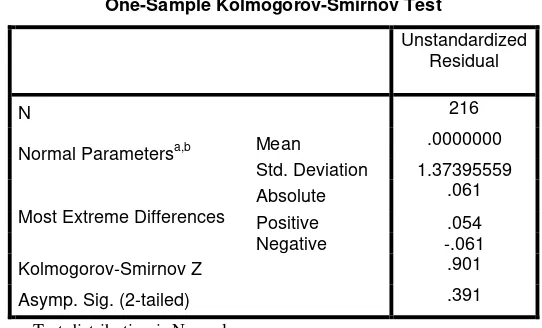

Classical Assumption Test

Normality test is to see whether the value of the residuals are normally distributed or not. Good regression model is to have a residual value that is normally distributed (Kurniawan, 2014). Results of tests of normality in this study are:

Table 2

Result For Normality Test

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 216

Normal Parametersa,b Mean .0000000 Std. Deviation 1.37395559

Most Extreme Differences

Absolute .061 Positive .054 Negative -.061

Kolmogorov-Smirnov Z .901

Asymp. Sig. (2-tailed) .391

a. Test distribution is Normal. b. Calculated from data.

Sources: SPSS 20.00

Based on these results it can be concluded that the data used in this study were normally distributed because the value Asym.Sig (2-tailed) which is greater than the value of alpha (α) used in this study is equal to 0.01 or 1%.

Table 3

Result For Multicollinearity Test

Model Collinearity Statistics Tolerance VIF

1

(Constant)

CR .600 1.666 DER .473 2.115 TATO .508 1.967 InvTurnover .618 1.617 Size .806 1.240 Age .870 1.150

a. Dependent Variable: ROA

Sources: SPSS 20.00

Based on the results it can be concluded that multicollinearity test all the independent variables used free of multicollinearity because VIF produced no more than 10 and the value of Tolerance not less than 0.1

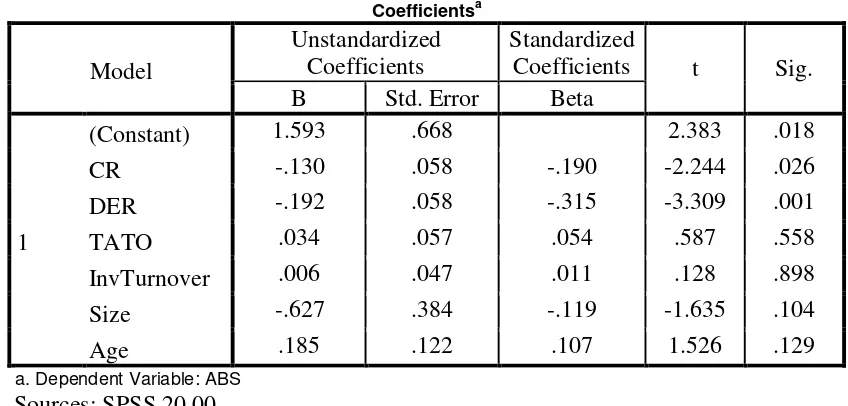

Heteroscedasticity test is to see whether there is inequality of variance of residuals one observation to another (Kurniawan, 2014). Heteroscedasticity test results in this study are:

Table 4

Result For Heteroscedasticity Test

Sources: SPSS 20.00

Based on the results it can be concluded that the heteroscedasticity test only variable debt to equity ratio (DER) that do not pass the test because of significant heteroscedasticity is smaller

than the value of alpha (α) used in this study is equal to 0.01 or 1%. Therefore variable debt

to equity ratio (DER) were excluded from the research.

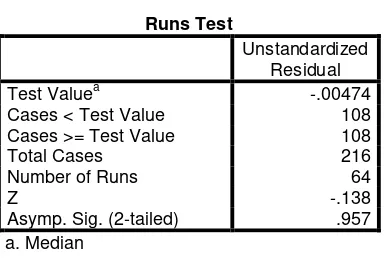

Autocorrelation test aims to determine whether there is a correlation between confounding variables at certain periods with variable disturbance previous period. Good regression model

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients t Sig. B Std. Error Beta

1

(Constant) 1.593 .668 2.383 .018 CR -.130 .058 -.190 -2.244 .026 DER -.192 .058 -.315 -3.309 .001 TATO .034 .057 .054 .587 .558 InvTurnover .006 .047 .011 .128 .898 Size -.627 .384 -.119 -1.635 .104 Age .185 .122 .107 1.526 .129

requires no error autocorrelation (Kurniawan, 2014). Autocorrelation test results in this study are:

Table 5

Result For Autocorrelation Test

Sources: SPSS 20.00

Based on the results of autocorrelation test concluded that all the independent variables are free of autocorrelation because Asym.Sig (2-tailed) its value is greater than the value of alpha

(α) used in this study is equal to 0.01 or 1%.

Classic assumption test conducted showed that all the independent variables and the dependent variable was eligible classical assumptions except the variable debt to equity ratio (DER) so that all of variable can be used for hypothesis testing using multiple linear regression.

Hypothesis Testing

Simultaneously, the research hypothesis (H1) is "There is the influence of the current ratio,

total asset turnover, inventory turnover, firm size and age of the company's financial performance simultaneously."

Hypothesis statistics:

H0: There is no influence of the current ratio, total asset turnover, inventory turnover, firm

size and age of the company's financial performance simultaneously.

H1: There is the influence of the current ratio, total asset turnover, inventory turnover, firm

size and age of the company's financial performance simultaneously. The results of hypothesis testing can be seen in the table below:

Table 6

Hypothesis Testing Results Simultaneously

Sources: SPSS 20.00

Based on the results of simultaneous testing can be concluded that all the independent variables used in this study is the current ratio, total asset turnover, inventory turnover, firm size and age influence on the company's financial performance because the Sig value is 0,000

Runs Test

Unstandardized Residual

Test Valuea -.00474

Cases < Test Value 108 Cases >= Test Value 108

Total Cases 216

Number of Runs 64

Z -.138

Asymp. Sig. (2-tailed) .957 a. Median

ANOVAa

Model Sum of Squares df Mean Square F Sig.

1

Regression 56.487 6 9.415 6.095 .000b Residual 290.372 188 1.545

Total 346.859 194 a. Dependent Variable: ln_ROA

less than the value of alpha ( α) used in this study is equal to 0.01 or 1% so that the research

hypothesis (H1) is accepted.

These results are supported by research conducted by Noor (2011) and Asiah (2011) which concluded that the simultaneous current ratio, total asset turnover and inventory turnover give effect to the company's financial performance.

Partially research hypothesis (H2) is "There is the influence of the current ratio, total asset

turnover, inventory turnover, firm size and age of the company's financial performance partially."

Hypothesis statistics:

H0: There is no influence of the current ratio, total asset turnover, inventory turnover, firm

size and age of the company's financial performance partially.

H1: There is the influence of the current ratio, total asset turnover, inventory turnover, firm

size and age of the company's financial performance partially. The results of hypothesis testing can be seen in the table below:

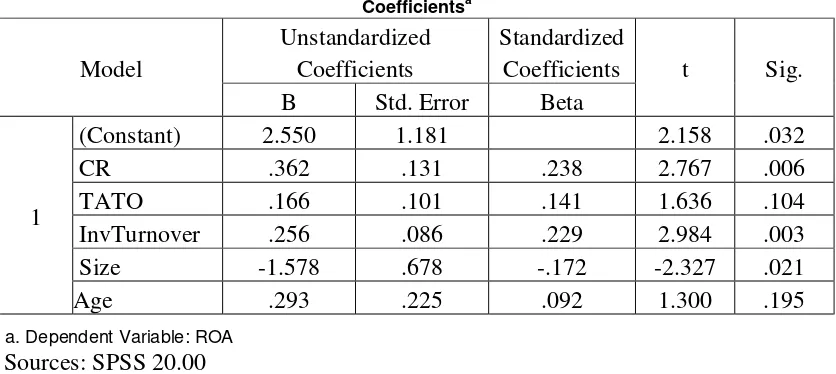

Table 7

Hypothesis Testing Results Partially

Sources: SPSS 20.00

Based on the partial test results concluded that the only variable current ratio, inventory turnover and size that gives effect to the company's financial performance, while total assets turnover and age did not affect the financial performance of the company. The results are consistent with several studies such as Asiah (2011) which states that the current ratio and inventory turnover affect the company's financial performance, Khalifa and Shafii (2013) stated that the current ratio, inventory turnover and size influence on the company's financial performance and Carvalho et al (2013) stated that the size and liquidity affect the company's financial performance.

Current ratio influence on the financial performance because the current ratio is used to measure the liquidity of the company, so that when the liquidity of the company was high, it shows that the company is able to pay all its short-term debt that the company reduced debt and financial performance measure from profitability will be good because the company liquid.

Inventory turnover impact the financial performance because inventory turnover indicates how quickly inventory is converted into products that will make money, the faster inventory turnover made the inventory not accumulate in warehouse and companies will quickly earn money and profit will increase, so will affect the company's financial performance.

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients t Sig. B Std. Error Beta

1

(Constant) 2.550 1.181 2.158 .032 CR .362 .131 .238 2.767 .006 TATO .166 .101 .141 1.636 .104 InvTurnover .256 .086 .229 2.984 .003 Size -1.578 .678 -.172 -2.327 .021 Age .293 .225 .092 1.300 .195

Firm size indicates how many assets the company has, the more assets that the company has made the company has a large working capital. With a large working capital, the company can make an investment, the purchase of raw materials or the payment of debts of the company so that can enhance the company's revenue and financial performance will be good.

CONCLUSIONS AND SUGGESTIONS

Based on the research results it can be concluded:

1. Simultaneously with using α = 1% of all study variables except the debt to equity ratio (DER) impact on financial performance.

2 Partially by using α = 1% only variable current ratio, inventory turnover and size that gives

the effect on the financial performance.

Suggestions can be given to companies and research in the future are:

1. For small and medium companies need to consider all the factors that impact the financial performance such as current ratio, inventory turnover ratio and firm size in order to better financial performance so that the company can maintain the existence of the business.

2. For further research, researcher can add the factors that impact the financial performance as the net profit margin, receivable turnover, besides adding the time of observation and the sample used.

BIBLIOGRAPHY

Asiah, Antung Noor, 2011, Analisis Faktor-Faktor Yang Mempengaruhi Kinerja Keuangan Industri Tekstil Yang Terdaftar Pada Bursa Efek Indonesia, Socioscientia (Jurnal Ilmu-Ilmu Sosial), Volume 3, Nomor 2.

Babalola, Yisau Abiodun, 2013, The Effect of Firm Size on Firms Profitability in Nigeria,

Journal of Economics and Sustainable Development, Vol.4, No.5.

Carvalho, Pedro Guedes de; Serrasqueiro, Zélia; Nunes, Paulo Maçãs, Profitability Determinants of Fitness SMEs: Empirical Evidence from Portugal Using Panel Data,

Amfiteatru Economic, Vol. XV, No.34.

Darsono dan Ashari, 2005, Pedoman Praktis Memahami Laporan Keuangan, Penerbit ANDI, Yogyakarta.

Gomulia, Budiana dan Manurung, Elvy Maria, 2014, Identifikasi Modal Keluarga Pada 3 Ukm Di Bandung, Bina Ekonomi Majalah Ilmiah Fakultas Ekonomi Unpar, Vol. 18, No. 1.

Harahap, Yenni Ramadhani, 2014, Kemampuan Menyusun Laporan Keuangan Yang Dimiliki Pelaku UKM Dan Pengaruhnya Terhadap Kinerja UKM, Jurnal Riset Akuntansi Dan Bisnis, Vol 4, No.1.

Izati,Chaerunisa dan Margaretha, Farah, 2014, Faktor-Faktor Yang Mempengaruhi Kinerja Keuangan Pada Perusahaan Basic Industry And Chemicals Di Indonesia, e-Journal Manajemen Fakultas Ekonomi Universitas Trisakti, Volume. 1, Nomor.2, Hal. 21 -43. Kasmir, 2008, Analisis Laporan Keuangan, Edisi 1, Rajawali Pers, Jakarta.

Khalifa, Mohamed Khalifa dan Shafii, Zurina, 2013, Financial Performance and Identify Affecting Factors in this Performance of Non-oil Manufacturing Companies Listed on Libyan Stock Market (LSM), European Journal of Business and Management, Vol.5, No.12.

Kurniawan, Albert, 2014, Metode Riset Untuk Ekonomi & Bisnis, Cetakan Kesatu, Penerbit ALFABETA, Bandung.

Mishra, Ashok; Wilson, Christine; Williams, Robert, 2009, Factors Affecting Financial Performance Of New And Beginning Farmers, Agricultural Finance Review, Vol. 69 No. 2., pp. 160-179.

Munawir, S., 2007, Analisis Laporan Keuangan, Penerbit Liberty, Yogyakarta.

Noor, Akhmad Syafrudin, 2011, Analisis Faktor-Faktor Yang Mempengaruhi Kinerja Keuangan Perusahaan Telekomunikasi Yang Go Public Di Bursa Efek Indonesia,

Jurnal Manajemen dan Akuntansi, Volume 12, Nomor.1.

Pathirawasam,Chandrapala and Wickremasinghe, Guneratne, 2012, Ownership Concentration And Financial Performance: The Case Of Sri Lankan Listed Companies, Corporate Ownership & Control, Volume 9, Issue 4.

Prihadi, Toto, 2008, Deteksi Cepat Kondisi Keuangan: 7 Analisis Rasio Keuangan, Penerbit PPM, Jakarta.

Sembiring, Eddy Rismanda, 2003, Kinerja Keuangan, Political Visibility, Ketergantungan Pada Hutang, Dan Pengungkapan Tanggung Jawab Sosial Perusahaan, Simposium Nasional Akuntansi VI, Surabaya.

Shakoor, Faisal; Khan, Abdul Qayyum; Nawab, Samina, 2012, The Inter-Linkages Of Working Capital And Profitability In Pakistan (2001-2010), Academic Research International, Vol. 3, No.2.

Suliyanto, 2009, Metode Riset Bisnis, Edisi II, Penerbit ANDI, Yogyakarta.

APPENDIX I

DATA COMPANY, FINANCIAL RATO AND OTHER FACTORS

No Nama

Perusahaan Tahun

Rasio Keuangan

Total

Assets Size

Tahun

Berdiri Umur Rasio

Likuiditas

Rasio

Solvabilitas Rasio Aktivitas

Rasio Profitabilitas CR DER TATO Inv Turnover ROA

1 ABBA

2009 2.1611 0.44 0.6419 1.041 0.62 229,920 5.361577 1992 22 2010 0.8539 2.11 0.4445 1.2146 0.46 399,906 5.601958 1992 22 2011 0.8156 2.23 0.5827 1.3697 0.66 425,864 5.629271 1992 22 2012 0.8211 2.25 0.5991 1.0028 0.92 441,554 5.644984 1992 22

2 AIMS

2009 1.1303 7.78 1.2241 1.202 0.36 182,576 5.261444 1997 17 2010 1.1731 5.88 1.5818 1.5649 0.31 146,195 5.164933 1997 17 2011 1.1579 6.49 1.4379 1.4173 0.35 163,296 5.212976 1997 17 2012 1.9974 1.05 5.5355 5.4677 1.14 45,766 4.660543 1997 17

3 ASIA

2009 2.1932 0.56 2.037 6.3212 7.47 74,906 4.874517 1989 25 2010 8.2159 0.27 1.4579 5.1191 5.08 65,266 4.814687 1989 25 2011 9.3999 0.39 0.1262 1.3737 -15.09 58,681 4.768498 1989 25 2012 7.5494 0.44 0.0953 8.7559 -12.36 51,672 4.713255 1989 25

4 BAYU

2011 2.2377 0.54 0.409169368 1.083560453 5.19 18,857,504 7.275484 1989 25 2012 3.0181 0.42 0.359113067 0.875685896 7.25 27,253,915 7.435429 1989 25

6 BNBR

2009 0.6343 3.64 0.27871703 3.662266966 -5.03 27,381,757 7.437461 1951 63 2010 2.434 1.69 0.412657172 1.862805105 -22.03 31,768,029 7.50199 1951 63 2011 1.0072 1.07 0.383218647 1.19745293 0.34 25,212,651 7.401619 1951 63 2012 1.4976 1.87 0.988615615 4.293805917 2.27 15,657,587 7.194725 1951 63

7 CENT

2009 5.6313 0.17 0.645253766 3.143741033 10.49 102,555 5.010957 1987 27 2010 1.2359 2.76 0.882748199 1.509153643 1.11 327,560 5.515291 1987 27 2011 7.2143 0.17 0.577388632 2.199288551 -0.01 105,416 5.022907 1987 27 2012 3.4259 0.3 0.513432447 3.426049678 -6.81 107,352 5.03081 1987 27

8 CLPI

2009 1.9135 0.9 2.043604214 3.426526046 14.1 219,199 5.340839 1988 26 2010 1.8454 1.05 1.875812935 3.514768193 10.33 275,391 5.43995 1988 26 2011 1.5827 1.43 1.67046199 3.384395914 7.42 373,969 5.572836 1988 26 2012 1.6047 1.21 1.488446065 2.745592803 7.66 439,201 5.642663 1988 26

9 CNKO

2009 2.039 0.34 0.400142293 8.986171884 0.31 878,470 5.943727 1999 15 2010 1.46 0.67 0.628483952 2.721589719 5.83 1,212,739 6.083767 1999 15 2011 1.3249 1.04 0.605899728 1.884593559 5.35 1,710,689 6.233171 1999 15 2012 1.6302 0.64 1.007926837 6.102332086 5.43 1,503,500 6.177103 1999 15

10 DNET

2009 1.1898 0.16 0.926557263 23.40408163 1.09 17,306 4.238197 1995 19 2010 2.8722 0.15 0.987079327 17.5 2.64 16,640 4.221153 1995 19 2011 0.9959 0.33 1.073193528 11.65667808 4.05 17,119 4.233478 1995 19 2012 0.8627 0.32 0.828012603 4.903724928 1.31 16,821 4.225852 1995 19

11 EPMT

2009 1.9353 0.86 2.863230372 6.486775521 11.02 2,986,182 6.475116 1988 26 2010 1.9268 0.81 2.984506739 6.92461841 7.91 3,254,770 6.51252 1988 26 2011 1.98 0.79 2.427522115 6.309383729 8.03 4,370,747 6.640556 1988 26 2012 1.8137 0.92 2.700701862 6.909722664 8.13 4,951,688 6.694753 1988 26

12 FAST

2012 1.7679 0.8 1.997572263 32.84402037 11.56 1,781,906 6.250885 1978 36

13 FISH

2009 1.2217 2.7 3.734052764 27.50845791 5.85 557,385 5.746155 1992 22 2010 1.1623 4.42 3.786707563 18.89264095 5.05 1,101,333 6.041919 1992 22 2011 1.0984 7.64 3.776461672 32.97052695 1.76 2,020,101 6.305373 1992 22 2012 1.1289 6.45 5.103101333 37.0520633 4.29 2,481,578 6.394728 1992 22

14 FORU

2009 1.7186 1.37 1.772998489 2.995077564 2.86 230,276 5.362249 1970 44 2010 1.6255 1.63 1.772791664 2.596267441 3.49 276,011 5.440926 1970 44 2011 1.7412 1.29 1.900895888 2.731174616 4.87 265,993 5.42487 1970 44 2012 1.8509 1.05 1.866438875 2.888305353 4.92 257,253 5.41036 1970 44

15 GEMA

2009 1.129 4.29 1.193757859 6.279666412 1.82 319,698 5.50474 1984 30 2010 1.3855 3.02 1.289711776 4.046064069 7.52 347,611 5.541094 1984 30 2011 1.5595 2.31 1.383308064 9.03227829 7.38 374,636 5.57361 1984 30 2012 1.6126 2.02 1.394580315 7.082474884 6.7 428,881 5.632337 1984 30

16 GMCW

2009 0.6053 1.59 1.064916553 7.009508716 11.64 16,837 4.226265 1989 25 2010 0.6445 0.82 1.226078495 7.06851312 12.82 15,415 4.187944 1989 25 2011 1.316 0.8 1.070620605 2.678126557 17.87 19,626 4.292832 1989 25 2012 1.9552 0.52 1.03788563 5.060189166 13.95 21,037 4.322984 1989 25

17 HOME

2009 0.3256 0.67 0.147959656 5.301848642 0.73 183,523 5.26369 1986 28 2010 0.9767 0.66 0.179009177 5.564744944 1.43 186,996 5.271832 1986 28 2011 1.2204 0.55 0.235440682 2.915606336 0.46 176,193 5.245989 1986 28 2012 1.2212 0.32 0.143029625 3.154492646 -3.38 268,350 5.428702 1986 28

18 ICON

2009 0.7699 3.15 0.264577679 1.349775785 -7.72 12,159 4.084898 2001 13 2010 0.3497 9.04 0.346045694 2.697674419 -15.78 11,380 4.056142 2001 13 2011 1.071 4.5 1.194044188 3.01852146 0.68 91,608 4.961933 2001 13 2012 1.0231 3.15 1.490850875 3.136375095 1.44 82,139 4.914549 2001 13

19 INPP

20 INTA

2009 1.7461 1.91 1.07642151 3.088203359 3.6 1,039,511 6.016829 1975 39 2010 1.2255 2.91 1.121277457 6.869907724 5.17 1,634,904 6.213492 1975 39 2011 0.8397 5.96 0.802672236 4.427629038 3.22 3,737,918 6.57263 1975 39 2012 0.866 7.53 0.607364531 4.191472293 0.29 4,268,975 6.630324 1975 39

21 INTD

2009 0.488 -1.95 2.254241638 29.43109541 -2.11 35,069 4.544923 1976 38 2010 1.6075 3.67 1.91213281 13.51982741 4.69 42,587 4.629277 1976 38 2011 1.6845 2.72 1.919642078 5.047293381 10.95 57,331 4.75839 1976 38 2012 2.1646 1.79 1.906613845 7.12037286 7.23 53,766 4.730508 1976 38

22 ITMA

2009 0.2322 0.59 0.581122227 0 15.5 13,794 4.13969 1987 27 2010 0.1406 1.92 0 0 -28.89 12,414 4.093912 1987 27 2011 2.0499 2.44 0.016656526 0 -11.34 13,148 4.11886 1987 27 2012 5.3711 0.02 0.075783254 0 31.52 266,708 5.426036 1987 27

23 ITTG

2009 0.9163 -3.03 1.581249096 4.720016486 -44.72 27,668 4.441978 1999 15 2010 0.5817 -1.6 1.287128713 5.726027397 262.83 3,333 3.522835 1999 15 2011 4.0312 -2.08 4.653950954 515.953125 -16.53 7,340 3.865696 1999 15 2012 51.64 0.04 0 0 -3.97 93,979 4.973031 1999 15

24 JSPT

2009 0.8486 1.15 0.368753873 2.86742756 5.7 2,598,210 6.414674 1975 39 2010 0.9788 0.91 0.418215072 2.444219768 6.86 2,480,133 6.394475 1975 39 2011 1.5478 0.78 0.373483552 1.5963095 6.97 2,873,492 6.45841 1975 39 2012 1.6661 0.83 0.36466759 2.134691169 7.11 3,308,945 6.51969 1975 39

25 JTPE

2009 1.4174 0.82 1.69067675 6.486928211 15.83 160,266 5.204841 1990 24 2010 2.2945 0.54 1.886805065 18.57298283 31.97 236,371 5.373594 1990 24 2011 1.4904 0.68 1.627735096 21.1108589 25.57 311,735 5.493786 1990 24 2012 1.3712 1.16 0.93749986 3.664641053 9.5 446,703 5.650019 1990 24

26 KBLV

2010 1.1506 3.09 1.431873336 3.819757152 1.22 510,960 5.708387 2001 13 2011 0.9075 16.45 2.282219832 4.493966605 -35.1 307,753 5.488202 2001 13 2012 1.1516 5.58 2.611621984 3.625509056 9.95 336,896 5.527496 2001 13

28 KONI

2009 1.0588 3.22 0.557900276 4.163551402 5.89 93,117 4.969029 1987 27 2010 1.12 2.62 0.918058486 6.006717124 1.62 84,841 4.928606 1987 27 2011 1.3226 1.84 0.894217488 4.954915649 4.09 75,296 4.876772 1987 27 2012 1.3816 1.88 0.946060247 4.534442544 2.7 82,759 4.917815 1987 27

29 LMAS

2009 1.1679 4.59 0.916024455 3.705323004 -1.59 217,218 5.336896 1996 18 2010 0.9792 4.19 1.061851407 5.906307863 4.42 256,324 5.408789 1996 18 2011 1.1892 2.46 0.978470199 4.60730779 0.13 254,020 5.404868 1996 18 2012 1.1701 2.84 0.721568902 3.36628668 -1.29 271,859 5.434344 1996 18

30 LPLI

2009 10.23 0.1 0.084759078 3.025023941 -13.37 957,219 5.981011 1983 31 2010 15.95 0.07 0.053081852 0.619879858 23.92 1,363,969 6.134804 1983 31 2011 12.51 0.1 0.085132651 2.196900086 -17.4 1,177,715 6.07104 1983 31 2012 21.79 0.06 0.05843699 1.806926278 18.36 1,590,431 6.201515 1983 31

31 LPPF

2009 0.6917 5.38 0.405189301 56.25208284 -1.2 1,523,789 6.182925 1982 32 2010 1.0044 4.04 0.755818481 61.48939847 11.54 5,413,870 6.733508 1982 32 2011 0.9175 -1.9 1.940460819 24.07037557 19.22 2,422,472 6.384259 1982 32 2012 0.8037 -2.52 1.917203914 25.9709816 26.31 2,929,752 6.466831 1982 32

32 MAMI

2009 1.4676 0.06 0.092290092 3.619269502 0.49 617,997 5.790986 1970 44 2010 1.0277 0.12 0.090220958 3.513716753 0.17 653,019 5.814926 1970 44 2011 1.0373 0.14 0.108481958 3.644720636 0.23 669,079 5.825477 1970 44 2012 1.0119 0.2 0.104944608 3.147428146 0.33 705,334 5.848395 1970 44

33 MICE

2011 1.484 0.76 0.721833985 38.20395529 0.67 14,314,707 7.155782 1975 39 2012 1.4901 1 0.897402454 44.90687134 1.18 14,088,183 7.148855 1975 39

35 MYRX

2009 0.004 -1.01 0 0 1,547.77 901 2.954725 1971 43 2010 0.3167 -2.18 0.818565337 1.42273101 25.28 133,216 5.124556 1971 43 2011 0.2224 -27.05 0.21284028 2.13322549 11.82 861,975 5.935495 1971 43 2012 0.4549 3.41 0.105638364 0.588058405 2.52 1,116,299 6.047781 1971 43

36 OKAS

2009 1.797 4.25 1.318556709 3.689645965 6.96 1,005,868 6.002541 2003 11 2010 1.4103 5.28 1.086306772 3.675740694 4.62 1,287,118 6.109618 2003 11 2011 0.9155 2.63 0.7698051 3.855837847 -0.84 1,552,441 6.191015 2003 11 2012 0.7097 3.73 0.817782464 2.484489105 -2.25 2,138,455 6.3301 2003 11

37 PDES

2009 2.2125 0.57 1.351725185 15.71823689 1.76 171,199 5.233501 1999 15 2010 1.4942 0.79 1.269091711 6.920823657 1.72 208,546 5.319202 1999 15 2011 1.2942 0.92 1.033595608 5.410817472 3.23 245,925 5.390803 1999 15 2012 1.29 0.67 1.220791661 5.270297872 3.98 229,669 5.361102 1999 15

38 PGLI

2009 0.6481 0.17 0.349527824 3.91744066 0.75 42,463 4.628011 1999 15 2010 0.6913 0.14 0.354657285 3.386654479 0.33 41,784 4.62101 1999 15 2011 2.002 0.18 0.349339873 1.262504372 0.78 43,628 4.639765 1999 15 2012 2.3301 0.22 0.346563066 1.098471034 0.56 45,302 4.656117 1999 15

39 PLAS

2009 2.8686 0.3 0.123340323 0 3.74 225,571 5.353283 1992 22 2010 1.8391 0.66 0.41299947 1.157501893 9.85 335,906 5.526218 1992 22 2011 2.4419 0.36 0.25686792 1.203756824 1.13 292,119 5.46556 1992 22 2012 2.5996 0.44 0.150025863 0.209856948 2.74 320,918 5.506394 1992 22

40 PNSE

2009 1.4955 1.28 0.649338801 2.850071895 14.86 290,457 5.463082 1970 44 2010 1.6754 1.11 0.633100443 2.785142025 12.58 321,325 5.506945 1970 44 2011 1.9012 0.69 0.688353115 3.878081173 12.75 347,037 5.540376 1970 44 2012 1.9808 0.55 0.70771763 3.691501856 11.7 353,593 5.548504 1970 44

41 POOL

2012 4.933 0.18 0.095591832 1.812792512 8.93 143,098 5.155634 1958 56

42 PTSP

2009 1.1689 4.07 2.501351098 36.96483318 13.04 90,667 4.957449 1983 31 2010 1.2437 1.86 2.270482254 31.09240321 15.26 109,009 5.037462 1983 31 2011 1.4199 0.9 2.19194652 44.4215904 20.32 133,433 5.125263 1983 31 2012 1.4736 0.72 1.735261947 36.68665437 17.55 203,877 5.309368 1983 31

43 RIMO

2009 0.1659 -2.25 4.227795757 514.8522727 -172.83 16,686 4.222352 1987 27 2010 0.1349 -1.72 0.780302176 96.81318681 -63.07 17,738 4.248905 1987 27 2011 0.0736 -1.28 0.634360393 40.21186441 -121.68 10,483 4.020486 1987 27 2012 0.0218 -1.14 0.81428781 69.86486486 -172.9 6,817 3.833593 1987 27

44 SDPC

2009 1.4862 2 3.771958823 7.310510951 3.55 268,013 5.428156 1952 62 2010 1.4202 2.05 3.026819425 5.947124793 0.55 276,516 5.44172 1952 62 2011 1.3738 2.41 3.008668528 6.001957769 1.24 323,469 5.509833 1952 62 2012 1.3677 2.69 3.041868727 5.997535909 2.55 385,610 5.586148 1952 62

45 SHID

2009 0.1044 1.42 0.140766257 2.272860114 1.29 711,250 5.852022 1969 45 2010 0.9931 0.99 0.200271698 2.843786473 2.89 619,069 5.791739 1969 45 2011 1.0902 0.36 0.132244691 1.724262229 0.81 1,236,647 6.092246 1969 45 2012 1.6288 0.41 0.137834013 1.079642724 0.97 1,304,366 6.115399 1969 45

46 SONA

2009 0.731 1.69 1.040869658 41.70814772 5.3 503,968 5.702403 1978 36 2010 1.0096 1.47 0.925962496 3.67333017 10.36 623,873 5.795096 1978 36 2011 2.4998 0.56 1.143021179 23.11062358 10.72 677,550 5.830941 1978 36 2012 3.3193 0.76 0.922102607 42.68765303 9.79 929,094 5.96806 1978 36

47 SUGI

2009 69.43 0.01 0.48918196 11.44013158 -6.15 37,761 4.577043 1990 24 2010 90.08 0.03 0.01175923 0 5.55 40,819 4.610862 1990 24 2011 90.08 0.03 0.01175923 0 5.47 40,819 4.610862 1990 24 2012 1.442 0.41 0.019967979 0.088950893 0.76 3,659,459 6.563417 1990 24

48 TGKA

49 TIRA

2009 1.2494 1.51 1.179890876 2.815945559 1.43 201,789 5.304897 1974 40 2010 1.4367 1.35 1.23476728 3.329204756 2.33 217,837 5.338132 1974 40 2011 1.4627 1.18 1.326313015 3.704960438 3.33 223,874 5.350004 1974 40 2012 1.3776 1.23 1.159014497 3.010639706 2.97 240,324 5.380797 1974 40

50 TKGA

2009 0.9701 23.64 13.6544075 1318.608696 0.21 101,747 5.007522 1905 109 2010 0.7327 -40.16 15.10276899 1640.800218 -6.54 104,623 5.019627 1905 109 2011 0.7619 -14.2 16.33949527 1193.087491 -5.18 112,140 5.049761 1905 109 2012 0.9747 -7.92 0 0 0 103,096 5.013242 1905 109

51 TMPO

2009 1.6401 0.93 1.314286751 2.310167863 1.05 137,750 5.139092 1996 18 2010 1.7243 1.01 1.183811632 2.255180191 3.46 154,506 5.188945 1996 18 2011 2.0114 1.02 1.353978587 2.364885606 5.89 176,344 5.246361 1996 18 2012 2.6512 0.82 1.240583489 1.951848764 13.95 212,446 5.327249 1996 18

52 TRIL

2009 10.20 0.12 0.530750951 1.643898098 0.58 270,577 5.432291 1992 22 2010 3.4377 0.35 0.444637803 1.076738382 0.53 324,671 5.511443 1992 22 2011 48.05 0.06 0.415373077 1.946467662 -3 246,665 5.392108 1992 22 2012 68.11 0.05 0.142352426 1.067691591 -9.19 223,888 5.350031 1992 22

53 WAPO

2009 1.4096 1.52 0.573216997 1.807254672 0.05 207,445 5.316903 1993 21 2010 1.2435 2.01 0.200393522 0.604364588 -6.93 204,817 5.311366 1993 21 2011 0.4892 -51.33 0.259154155 10.87523719 -86.92 79,991 4.903041 1993 21 2012 1.0688 39.79 1.282461071 9.339189083 4.08 97,486 4.988942 1993 21

54 WICO