19th Annual Global CEO Survey / January 2016

Growing in complicated times

p06/ Addressing greater expectations

p12/ Transforming:

technology, innovation and talent

p18/ Measuring and communicating success

p26/

Navigating complexity to exceed expectations

p32Redefining business

success in a

changing world

CEO Survey

1,409

CEOs interviewed

in 83 countries

66%

of CEOs see more

threats today

76%

of CEOs deine

Introduction from

Dennis Nally

As they look forward to the year ahead CEOs are less conident about prospects for the global economy than they were in 2015. The same is true overall when they consider their own company’s prospects for growth.

Many CEOs do still see opportunities but they are looking to play things safe. The United States and China are far and away the most important markets that CEOs identify as offering the best prospects for growth, with Germany and the United Kingdom some way behind. That said, CEOs also see potential in India’s bullish business attitude and in Brazil despite its current political and economic struggles. Potential new opportunities in Mexico and the UAE have also made CEOs pay attention in the last year.

CEOs continue to highlight over-regulation as their biggest concern. But even as issues like an increased tax burden and governments’ response to iscal deicits and debt burdens loom large, geopolitical uncertainty (exacerbated by regional conlicts and increased terrorism attacks) is a top concern for nearly three-quarters of CEOs.

More disorienting still for CEOs is their growing feeling that our globalised economic and social fabric is fraying as divergent political, business, societal and cultural movements take hold. This is driven by digital technologies that have enabled people all over the world to be more connected, better informed, and as a result, increasingly empowered and emboldened.

It’s not lost on CEOs that a great many of these technologically empowered citizens are also their customers or potential customers. While they are better connected than ever before they must also navigate a world that is being dramatically shaped by other megatrends such as increasing urbanisation, climate change and rapid demographic and social shifts. Faced with these changes, CEOs tell us that customers will increasingly judge companies based on how they help greater society and how they live up to their own values. Notably, nearly a quarter of CEOs said their company has changed its sense of purpose in the last three years to take into account the broader impact it has on society.

To successfully address the expectations of a super-connected and technologically smart society, companies are looking to technology (of course) for answers. Internet-enabled technologies continue to help companies innovate by creating more relevant products and user experiences for customers, while ‘digital native’ talent is now deemed essential for future business growth. Yet for all the technological breakthroughs in areas like customer insight and marketing, companies still struggle to create a business proposition that both drives growth and creates value for greater society.

Dennis M. Nally

Chairman, PricewaterhouseCoopers International Limited

This could be because, in a digitally

driven world where theoretically every

part of business can be measured, CEOs haven’t yet mastered how to measure the long-term success that comes from being a trusted company and good corporate citizen. Over time, technology, once again, will no doubt help CEOs effectively measure how better

products and services, combined with a transparent relationship with customers, employees and greater society can future-proof their companies in this

uncertain world. But they have to know

what success looks like in the irst place. I’d like to thank the more than 1,400 company leaders from 83 countries who have taken the time to share their

insights with us. Their active and

Growing in complicated

times

06

09 Moving beyond globalisation

11 Steering a true course in an uncertain world

Measuring and

communicating success

26

26 A new mindset for measurement

28 Can everything be conidently measured?

30 Communicating impact

Contents

Transforming: technology,

innovation and talent

18

18 Walking the talk

20 Putting technology to work

21 The innovation edge

22 The people edge

24 Why government and business need to

work together

Addressing greater

expectations

12

13 So what do your stakeholders want?

14 Is this the era of the good consumer?

14 A central concern – the quest for trust

Navigating complexity

to exceed expectations

32

32 Linking strategy to execution

34 Looking for more data?

36 Meet the CEOs we talked to

38 Research methodology and contacts

39 Acknowledgement and thanks

Growing in

complicated times

74%

of CEOs are concerned

about geopolitical

uncertainty

Today’s CEOs face a business environment that’s becoming increasingly complicated to read and adapt to.

Seven years on from the global inancial crisis, the business landscape still hasn’t really returned to what it was. Will it ever? Last year regulation, skills, national debt, geopolitical uncertainty and taxes topped CEOs’ list of concerns about threats to business growth. None of these have gone away this year. In fact, the level of worry is higher today than at any point in the past ive years.

Concern about over-regulation in particular is still highest, cited by 79% of CEOs – making it the fourth year in a row that it’s risen (see Figure 1).

Geopolitical uncertainty, meanwhile, has become the second biggest concern, cited by 74% of business leaders. This comes at a time when

terror attacks are increasing and touching every

part of the world, many linked to the heightened conlict in Iraq and Syria. Global conlicts are also connected to anxieties about social instability and readiness to respond to crises, named by 65% and 61% of CEOs, respectively. Cyber security is also a worry for 61% of CEOs, representing as it does threats to both national and commercial interests.

Are we in an environment where change will take place at tremendous speed, whether it’s economic leadership, challenges of emerging countries or developed countries, political unrest, challenges with extremist views around the world, new technology, or new business models? That is the new normal. Companies and countries that will lead this new normal have to deal with an environment where there’s constant change, and be able to adjust to those at a faster and faster pace.

John Chambers

Executive Chairman of the Board, Cisco Systems, Inc., US

... low oil prices have ramiications in terms of social dynamics because it will put pressure on the availability of funds in the Middle East, especially as far as the oil-producing countries are concerned ... [which] have very large young populations ... there are going to be enormous budgetary pressures on the various countries.

Dr. Ahmed Heikal

Over-regulation Geopolitical uncertainty

79

%

74

%

Exchange rate volatility

73

%

Geopolitical uncertainty

Increasing tax burden

Social instability

Cyber threats

Shift in consumer spending and behaviours Exchange rate volatility

Lack of trust in business

Climate change and environmental damage

72%

71%

69%

61% 65%

60%

55%

50%

Top-four risers since 2013 79%

74%

73% Over-regulation

Availability of key skills

Government response to fiscal deficit and debt burden Key threats

Top-three threats

Bribery and corruption

Lack of trust in business

Social instability

New in 2015

Consumer spending and behaviours

2013 2014 2015 2016 2013 2014 2015 2016 41

52 51

55

37 49

53

55

49 52

60

60

60

65

F ig ure 1 CEOs are getting more concerned about a wide range of risks

Q: How concerned are you about the following potential economic, policy, social and business threats to your organisation’s growth prospects?

There are, moreover, other uncertainties CEOs must contend with. Where there’s reasonable economic growth it’s often being aided by extraordinary monetary policies, even though the United States’ Federal Reserve bucked this trend recently by raising US interest rates for the irst time in nine years. This move, together with China’s surprise devaluation of the yuan in August 2015, helps explain why exchange rate volatility, cited by 73% of CEOs, is third among their top concerns.

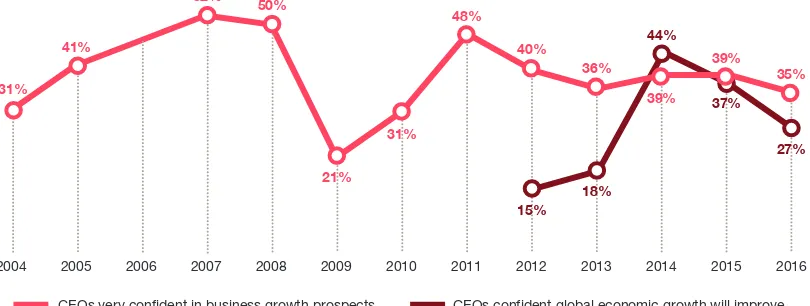

These factors are having different effects in

different places, but together they’re increasing the level of uncertainty about the global economy, and CEOs are less optimistic about prospects this year. The optimists – those who think global growth will improve over the next 12 months – have dropped to 27% from 37% last year (see Figure 2). Those who think it will worsen have increased from 17% to 23%.

As we might expect, CEOs’ conidence about their own company’s prospects for revenue growth in the coming year has also fallen, though not to the same extent as conidence about the world economy. Thirty-ive percent of CEOs are ‘very conident’ about short-term business growth compared to 39% last year (see Figure 2).

It’s become more dificult to pin down where growth will come from, but CEOs are still banking on familiar faces. The United States and China, and to a lesser extent Germany and the UK, remain the countries that most CEOs cite among their top overseas growth markets (see Figure 3).

Growing in complicated times

2011

2004 2005 2012 2013 2015 2016

CEOs very confident in business growth prospects CEOs confident global economic growth will improve 2014

Figure 2 CEOs are less confident about global economic and business growth prospects in these uncertain times

Q: How confident are you about your company’s prospects for revenue growth over the next 12 months? Do you believe global economic growth will improve, stay the same or decline over the next 12 months?

Figure 3 CEOs continue to see investment opportunities across the BRICs

Q: Which three countries, excluding the one in which you are based, do you consider most important for your overall growth prospects over the next 12 months?

Base: All respondents (2016=1,409; 2015=1,322; 2014=1,344; 2013=1,330; 2012=1,258; 2011=1,201; 2010=1,198; 2009=1,124; 2008=1,150; 2007=1,084; 2006 (not asked); 2005=1,324; 2004=1,386)

Note: In previous years, respondents were asked ‘Do you believe the global economy will improve, stay the same or decline over the next 12 months?’

UK like a situation where we will be one of the top few economies in terms of growth rates.

Chitra Ramkrishna

Managing Director and CEO, National Stock Exchange of India Limited (NSE), India I deinitely expect moderate growth in the United States. That’s the most important and resilient market for me to see growth, and the most important market for us.

Takeshi Niinami

President and CEO, Suntory, Japan

35%

of CEOs are very

After two years, Mexico is back in the list of top-ten countries and is also CEOs’ highest-ranked non-BRICs emerging market. The UAE is also in the top ten and is currently the bright spot in the Middle East given its relatively lower dependence on oil revenues.

Moving beyond globalisation This complicated world picture isn’t just being shaped by economic and geopolitical trends. We believe there is a more fundamental shift taking place, namely from a globalising world to one with many dimensions of power, growth and threats – a transition that we call multi-polar. The majority of CEOs already anticipate this shift: 59% expect multiple economic models, 75% expect increasing regionalisation in trade, over 81% see increasingly divergent systems of laws and liberties, and 83% predict differing fundamental belief systems underpinning societies (see Figure 4). No wonder there is so much concern about growth and where it will come from.

... the TPP is really the largest trading agreement we have had since the WTO. This would bring 40% of the global GDP together in one economic block. I’m very excited. 2015 is going to be fantastic for Vietnam, not just because of the TPP – where I believe Vietnam will come out as the top beneicial member of the TPP’s 12 nations – but because Vietnam is in the middle of the AEC, the ASEAN Economic Community, which will be fully integrated by the end of 2015.

Don Lam

Chief Executive Officer and Founding Partner, VinaCapital, Vietnam

Figure 4 CEOs must navigate an increasingly complicated and multi-polar world

Q: For each alternative, please select the one that you believe the world is moving more towards

Political unions Economic unions and unified economic models Single global marketplace Single global rule of law and liberties Common global beliefs and value systems Free and open access to the internet A global world bank

Nationalism and devolved nations Multiple economic models

Regional trading blocs

Multiple rules of law and liberties Multiple beliefs and value systems Fragmented access to the internet Regional

The one area where CEOs, in contrast, see greater convergence is the internet – but even this plays a core role in highlighting divergent beliefs even as it brings the world closer together.

This greater devolution of power brings both threats and opportunities. Different points of view, exacerbated by economic insecurities, are certainly leading to more conlict. But regional trading blocs, for example, can lead to better quality trade agreements and policies. There’s evidence that most business leaders, for example, are optimistic about deeper economic integration as a result of the Asia-Paciic Economic Cooperation (APEC).1

This isn’t to say that globalisation is dead. The climate change accord reached at the United Nations Climate Change Conference in Paris in December 2015 is a good example of inter-governmental cooperation.

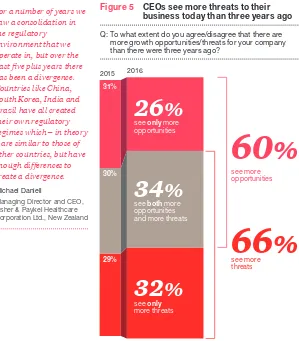

Given the plethora of uncertainties CEOs are facing, it’s little wonder that they’re divided about whether there are more threats or opportunities today. Two thirds of CEOs (66%) believe that their business faces more threats today than three years ago, while almost as many (60%) see more opportunities (see Figure 5).

32

%

see only

more threats

26

%

see only more opportunities

34

%

see both more opportunities and more threats

60

%

see more opportunities

66

%

see more threats

2015

31%

30%

29%

2016

Figure 5 CEOs see more threats to their business today than three years ago

Q: To what extent do you agree/disagree that there are more growth opportunities/threats for your company than there were three years ago?

For a number of years we saw a consolidation in the regulatory environment that we operate in, but over the past ive plus years there has been a divergence. Countries like China, South Korea, India and Brazil have all created their own regulatory regimes which – in theory – are similar to those of other countries, but have enough differences to create a divergence.

Michael Daniell

Managing Director and CEO, Fisher & Paykel Healthcare Corporation Ltd., New Zealand

Base: All respondents (2016=1,409; 2015=1,322)

We have a lot of treaties, a lot of rules, a lot of conventions – we need to make sure they can handle the problems of today. We also need to be sure we don’t replace them with something worse.

Michael Møller

Director-General, United Nations Office at Geneva (UNOG), Switzerland

?

Have you adjusted your operational model to accommodate

future potential increases to your cost of capital as interest

rates rise and currency markets become more volatile?

Are you tracking the right risks around new political dynamics

such as geopolitical uncertainty and cybersecurity as they

replace concerns related to coping with the inancial crisis?

What’s your organisation doing to prepare itself to respond

to and recover from crisis?

Do you have a strategy in place for a more divergent world

where authority and inluence are more widely distributed?

How are you preparing your organisation to face

non-traditional competitors now and in the future?

Tough questions to ask about

growing in complicated times

Steering a true course in an uncertain world

CEOs understand that despite the tremendous challenges they face in managing their business for today, they also need to look ahead and build a business that’s ready for the more complex global marketplace of the future. To equip themselves for this challenge, CEOs are focusing on three core capabilities that we will examine in more detail.

The irst capability is based around addressing greater expectations. CEOs

acknowledge that their customers as well as other stakeholders increasingly want them to do more to tackle important problems. The response for many has been to focus even more strongly on customer needs as well as drawing on their companies’ own sense of purpose – what they stand for – to deine a more comprehensive view of how their businesses operate within society. Some CEOs are taking concrete steps to align this broader mission to their company’s core goal of proitability.

The second harnesses technology, innovation and talent to execute the strategies that meet these greater

expectations. CEOs are using technology to get

closer to consumers but are being challenged to align all parts of their operating model behind customer strategies. Some companies are bridging what we call an ‘execution gap’ by shaping their entire value proposition, strategy, operations and capabilities tightly around a strong commitment to what they stand for. They’re also looking to build better innovation and people capabilities to address changing customer expectations.

The inal capability CEOs are looking to develop are methods of measuring and communicating success. CEOs are seeking

to better measure the impact and value of

innovation and key risks for stakeholders.

Companies are addressing these challenges

through a greater focus on data and technology

to gain better insight into business processes and to measure a broader range of variables. They’re also looking to better communicate a range of ‘softer’ issues in a reliable and consistent way across multiple channels.

You’ve got to run a company for proit, you’ve got to run it for revenue growth, but you also have to run it to be around ten years from now doing the right things. That’s one of the biggest issues most CEOs face today.

Ajay Banga

As technology and other factors create an

environment of higher transparency, CEOs have

set their radar on a wide range of stakeholders.

Customers remain the top priority, with 90% of

CEOs indicating they have a high or very high

impact on their business strategy (see Figure 6). But government and regulators come in second (cited by 69% of CEOs). That’s higher than industry competitors and peers (67%) and no doubt relects CEOs’ enduring concerns about over-regulation in the marketplace.

The views of these and other stakeholders, including employees and investors, aren’t just evolving but diverging, as CEOs have told us. Customer behaviour, in particular, has become more complicated as values and buying preferences evolve. The three biggest trends CEOs see as most inluencing those views – technological advances, demographic changes and global economic shifts – as well as the interactions between them, are only going to continue to drive change (see Figure B, Looking for more data?, page 34).

Addressing greater

expectations

Customers and clients

90

%

Providers of capital (including activist investors)

41

%Supply chain partners

48

%

Government and regulators

69%

Employees (including trade unions)

51

%

Industry competitors and peers

67

%

Figure 6 Customers and clients are top priority for CEOs

Q: What impact do the following wider stakeholder groups have on your organisation’s strategy?

The way we deal with our customers and charge our customers and delight our customers has changed completely from the old way of doing business.

Johan Dennelind

CEO, TeliaSonera AB, Sweden

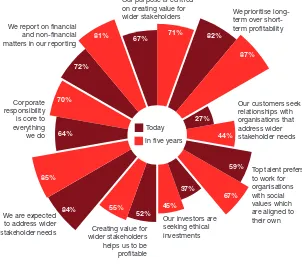

So what do your stakeholders want? We were not surprised to see that the majority of CEOs (70%) feel their customers are most interested in cost, convenience and functionality. But we were surprised to discover that more than a quarter (27%) of CEOs believe that their customers are seeking relationships with

organisations that address wider stakeholder

needs (Figure 7). This surges to 44% when CEOs consider what their customers will prioritise in ive years’ time. In the future it seems clear that CEOs believe customers will put a premium on the way companies conduct themselves in global society.

That’s a lot of change in a relatively short time. And it isn’t just happening on the customer front. On the talent side it’s even more pronounced. Fifty-nine percent of CEOs believe that top

talent wants to work with organisations that

share their social values and 67% feel it will be important in ive years. Meanwhile, 37% of CEOs believe their investors seek ethical investments and 45% believe this will be the case in ive years.

At the heart of this evolution in values lies technology. CEOs are convinced it will

transform stakeholder expectations of business in the next ive years, with 77% of business leaders naming it as a top-three inluencer.

Mobile connectivity and social media in particular have become fundamental ways to get information and buy goods and services.2 The ‘Uberization’ of a growing number of sectors – offering quick, simple and dynamic ways to access goods and services using mobile apps – is also becoming an important trend in changing customer perceptions of value. At the same time, these technologies are giving more people more access to more information about what companies do and the impact of their actions. Together, these factors are helping to reshape how people interact with and think about brands, albeit in very different ways.

... as a consequence of the internet and the digital way of doing things, customers basically want to do a lot of things themselves. They’re self-directed, as we call it. They know everything. They Google everything. Therefore they come to the bank with a completely different expectation.

Ralph Hamers

CEO, ING Group, Netherlands

Our purpose is centred on creating value for

wider stakeholders We prioritise long-term over short-term profitability

Our customers seek relationships with organisations that address wider stakeholder needs

Top talent prefers to work for organisations with social values which are aligned to their own Our investors are

seeking ethical investments Creating value for

wider stakeholders helps us to be profitable We are expected

to address wider stakeholder needs We report on financial

and non-financial

matters in our reporting 67%

72% In five years

Figure 7 CEOs believe customers are seeking relationships with organisations that address wider stakeholder needs

Q: Thinking about the wider stakeholder expectations you see, which of these statements best describes your organisation today?

Q: Which of these statements best describes successful organisations in your sector in five years' time?

90%

of CEOs say customers have the biggest impact

Is this the era of the good consumer? It’s long been assumed that only a small percentage of consumers seek out ethical and sustainable products and services. There’s growing evidence, however, that this is changing. Take the consumer goods giant, Unilever. Its portfolio of so-called ‘Sustainable Living’ brands now equals half of the company’s

total growth and is growing twice as fast as

Unilever’s other brands.3 It’s just one of nine

companies globally that generate a billion dollars or more in annual revenue from sustainable products or services.4 Indeed, in

2015 sales of consumer goods from brands with a demonstrated commitment to sustainability grew more than 4% globally.5 As Wilson Ferreira Jr., CEO of CPFL Energia, observes, “Today’s consumers make choices not only based on the quality of the service provided, but even based on the causes that a company supports. In fact, we are living in the era of the good consumer.”

Part of this change is being ampliied by

demographics: the millennial generation and its growing purchasing power. Globally, 10,000 people turn 30 every day and it appears they’re more likely to buy from companies that take action on sustainability issues.6 Campbell Soup

is one company that’s taking notice. It’s just bought Plum Organic Baby Food, giving the company “a window into millennial parents and an understanding of how to improve the way children are eating and making healthier

selections at a very young age ... Training the

taste-buds of the next generation is meaningful to us, and very much aligned with our company purpose,” according to Denise Morrison, President and Chief Executive Oficer of US-based Campbell Soup Company.

And what about the expectations of emerging markets consumers? They face the challenges of forging a middle-class lifestyle amid diminishing access to natural resources and rapid urbanisation, with its associated problems like pollution and overcrowding. CEOs in Africa and Asia Paciic are more likely to say that their customers seek out organisations that address the needs of a wider set of stakeholders (39% and 31%, respectively) compared to the global total (27%).

Yet interpreting customer views isn’t a simple black-or-white picture. Those same emerging markets consumers, in Asia Paciic for example, are still happy to drive SUVs as opposed to more fuel-eficient vehicles.7 And there’s evidence

that those same millennials who value so-called green products and services are also driven by getting the best deal.8

A central concern – the quest for trust It’s hard enough for companies to juggle current customer expectations while delivering results year in, year out. Yet CEOs know that they must take on an even more challenging task and that is to start preparing their businesses today for the more complex customers of tomorrow. They worry that not doing so could impact trust in their brand, creating a signiicant risk to the long-term viability of their business. CEOs are all too familiar with the fallout from breaches of trust. Over half the CEOs surveyed (55%) are concerned about the lack of trust in business today – compared with 37% just three years ago. The Edelman Trust Barometer 2015 also showed that public levels of trust in business

in 2015 had declined to the lowest level since

2008 – and that CEOs were seen as among the least credible sources of information.9 The challenge facing business leaders is this: are they trusted to help navigate this increasingly complex landscape?

Perhaps the most eloquent description of the problem was articulated by John Nelson, chairman of Lloyd’s, the global specialist insurance market. As he explained to a meeting of business leaders in 2015, “Most concerning of all in my mind is that we are seeing a deinite shift in the attitudes towards business of populations around the world. There is a lack of trust in business – big business in particular – and this is leading – in terms of real issues in some cases – to mistrust in capitalism.”10

There is a body of research supporting the idea that, when there is a high level of trust in a company, it drives business performance by attracting new customers and retaining existing ones.11 A high level of trust also makes employees more committed to staying with the company, partners are more willing to collaborate and investors more prepared to entrust stewardship of their funding. Consequently, those organisations that can build trust seem to garner signiicant beneits.

Addressing greater expectations

I think our social purpose and the associated emotional engagement from our colleagues is one of the keys to developing a winning successful strategy for Legal & General. Why that is important is it creates tremendous trust amongst our customers and the other politicians who are helping shape the future, whether those are local politicians or national politicians, and they want to engage with trustworthy companies.

Dr. Nigel Wilson

What do you stand for?

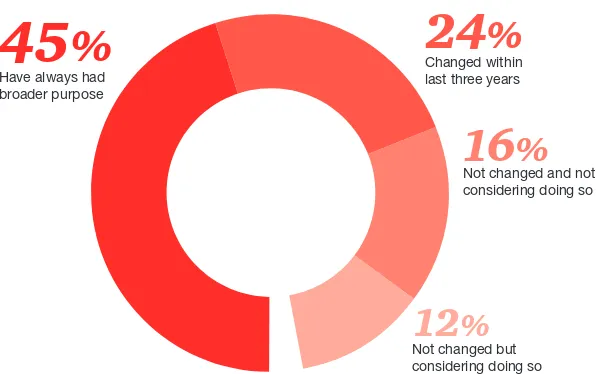

In this increasingly complex world, are leaders altering their organisation’s purpose in order to relect greater expectations of business? We found that almost one in four (24%) said their organisation’s purpose had changed within the last three years to relect broader stakeholder expectations, and an additional 45% felt that this had always been the case. In total 69% of all CEOs linked their organisation’s purpose to a broad set of constituents in society (see Figure 8).

But what do CEOs really mean by purpose? For some, it’s why their business exists; for others it’s more around what their businesses do or aim to achieve, or how business is done. And how do they perceive their organisation’s broader impact on society? When asked to describe their corporate purpose, CEOs talked about value for one or more of a variety of stakeholders, including shareholders, supply chain partners, employees, customers and society at large – as well as their business itself, in terms of things like growth, productivity or costs (see Figure 9).

24

%

16

%

Changed within last three years

45

%

Have always had broader purpose

Not changed and not considering doing so

12

%

Not changed but considering doing so

Figure 8 A majority of leaders have an organisational purpose that reflects greater expectations of business

Q: In which of the following ways has your organisational purpose been impacted by wider stakeholder expectations?

Figure 9 CEOs describe their corporate purpose in terms of value for a variety of stakeholders

Q: In your own words, what is the purpose of your organisation today? To create value for...

Our customers Wider society Our business

Our supply chain Our shareholders an effective, responsible champion of low- carbon electricity.

Jean-Bernard Lévy

CEO and Chairman, EDF, France

Purpose is something you carry in your heart, not something an ad agency makes up. So we pulled the company’s purpose out of our people’s hearts and manifested it in seven words: Real food that matters for life’s moments. We validated those words with consumers and our employees. Consumers told us stories about how our brands really matter to them. That’s led to an umbrella over all of our brands, that purpose can encompass and motivate our people around why what we do every day matters.

Denise Morrison

President and Chief Executive Officer, Campbell Soup Company, US

... once you have done

your bit – fulilled your

social responsibilities and formed a community with shared interests, with local people – they will welcome your projects and provide huge support. So a company’s own interest and the social value it provides are closely connected. In fact, this is also a kind of investment, and it always brings returns.

Li Huaizhen

President, China Minsheng Investment Corp., Ltd., China

Addressing greater expectations

Over half of CEOs (53%) deine their organisation by the value that’s created for customers. But of those CEOs, over a third (35%) also talk about value for wider society, employees and/or supply chain partners, relecting a clear recognition of the changing expectations of their customers.

This acknowledgement of the changing needs of customers – as well as those of other stakeholders, including their employees – is relected in other ways that CEOs describe their organisation. Eighty-four percent of CEOs believe their companies are expected to address wider stakeholder expectations; 82% tell us their company prioritises long-term over short-term views; 64% say that corporate social responsibility is core to their business rather than being a stand-alone programme; and 72% say their company reports on non-inancial as well as inancial matters (see Figure 7).

52%

of CEOs say creating value for wider stakeholders

Such efforts, moreover, are seen to be

compatible with proitability, albeit in different ways. Fifty-two percent of CEOs say that

creating value for a wider set of stakeholders

helps proitability. Richard Goyder, Managing Director of Wesfarmers, a diversiied

conglomerate headquartered in Australia, puts it this way, “I don’t think, as a listed company, there’s any doubt that our primary objective is

to generate returns for our investors. But we

have to do that sustainably, we have to do it

ethically and we have to do it in a way that

contributes to the communities in which we operate. That’s for our own good anyway. Because if we help the communities in which we operate then those communities will have more capacity to do business with us in the future.”

Forty-six percent of CEOs, meanwhile, say proitability is the platform that helps provide value for a wider set of stakeholders. As Don Lam, Chief Executive Oficer and Founding Partner of Vietnam-based investment management and real estate development irm VinaCapital, says, “... our core objective as an investment irm is always making money for investors, irst and foremost. The reason why I’m saying that ... is that you need to make money so that you can use that proit and give it back to society.”

CEOs aren’t only responding to customer and other stakeholder needs however; they’re very aware that their competitors and peers are also preparing for the future. Five years from now, CEOs believe that the most successful

organisations in their sector will have shifted

their views and priorities in terms of recognising changing expectations and the value in addressing them, embedding corporate responsibility into their business, reporting on non-inancial matters and taking the long-term view.

You know, very recently we reviewed the company’s purpose, and we made a slight change. It used to be ‘Building the Future’. Now it’s ‘Building a Better

Future’. CEMEX is a company that embraced sustainability a long time ago – and we believe that sustainability is creating a new economy, a different type of economy, reshaping certain economic activities. And we’re saying that the

irst companies to

understand and embrace this will be the companies that will be on top of the trend and doing better business than others.

Fernando Gonzalez Olivieri

CEO, CEMEX, Mexico

Has your organisation undertaken scenario modelling or

other initiatives to better understand how global trends like

technological advances, demographic changes and global

economic shifts are driving customer expectations today

and tomorrow?

How are your CIO and CMO working together to make the

best use of data analytics for a full picture of your customers

now and into the future? How about your workforce?

As customers, employees and other stakeholders

increasingly care about what companies stand for, how are

you demonstrating your organisation’s purpose and values?

How is your organisation building trust by better understanding

Tough questions to ask about

addressing greater expectations

Transforming: technology,

innovation and talent

We have to have propositions which are based on sound ethics but which customers are prepared to pay a commercial price for. And getting that balance right is fascinating and not necessarily straightforward.

Richard Pennycook

CEO, The Co-operative Group, UK

Walking the talk

It’s evident that most businesses today, in deining what they stand for, recognise the

needs of a wider set of stakeholders – and

their customers’ expectations about how they address those needs. Translating a broader corporate purpose into the everyday, however, is another matter entirely. Even the most committed can ind it challenging in the extreme to reshape their company while facing day-to-day battles on every front to ight off competition, grow revenues and cut costs.

There are a number of barriers that CEOs say they’re encountering when responding to the changing expectations of customers and other stakeholders. Chief among these are the additional costs of doing business, cited by 45% of CEOs (see Figure 10). Compliance with unclear or inconsistent regulations, cited by 42% of CEOs, also incur costs, which are often passed onto customers via higher prices (see

Why government and business need to work together, page 24). This adds to the premium

that customers often have to pay for goods and services deemed sustainable – something that 31% of CEOs don’t think they’re willing to pay.

45%

45

%

42

%

33

%

31

%

31

%

24

%23

%20

%Additional costs to doing business

Unclear or inconsistent standards or regulations

Conflict between stakeholder interests and financial performace expectations

Customers’ unwillingness to pay Lack of the right capabilities

Insufficient information about wider stakeholder expectations

Inability to effectively execute on our strategy

Misalignment between stakeholder interests and business strategy

Figure 10 CEOs are facing a number of barriers to execution when responding to changing customer and stakeholder expectations

Q: Which of the following barriers, if any, is your organisation encountering when responding to wider stakeholder expectations?

These barriers to execution are creating conlicts for companies trying to balance changing stakeholder expectations with pursuing business growth and proitability over both the short and long term.

Putting technology to work

Technology, as in most situations nowadays, can help.

As we’ve seen in the previous section, business

leaders understand all too well how technology

is transforming their relationship with customers as well as other stakeholders. So it makes sense that they see technology as the best way to assess and deliver on changing customer expectations, with 51% of CEOs making signiicant changes in this area (see Figure 11).

At the top of CEOs’ minds is the use of technology to better interpret the complex and evolving needs of customers in order to better engage with them. Nearly a quarter of CEOs (24%) feel they don’t have enough information about what customers or other stakeholders want, and a recent PwC survey showed that the top-three challenge most cited by global operations leaders (63%) is understanding what customers value.12 Sixty-eight percent of CEOs back the power of

data and analytics to deliver these results and

65% favour customer relationship management (CRM) systems (see Figure 12).

Indeed, CEOs’ growing faith in, and dependence on, data and analytics signals just how far a data-based, scientiic mindset has penetrated even the complex world of stakeholder management. And as big data, cloud computing and the Internet of Things become even more important in modern business, the role that technology plays in helping understand wider stakeholder expectations is also being applied to meeting and even surpassing those expectations.

Transforming: technology, innovation and talent

39%

How we use technology to assess and deliver on wider stakeholder expectations How we define and manage risks

How we manage our brand, marketing and communications How we measure success and what we hold ourselves accountable for How we partner and who we partner with Workforce rights and wellbeing

How we minimise social and environmental impacts of our business operations Our values, ethics and codes of conduct How we maximise societal value of our R&D and innovation

How we develop new ‘ethical’ products and services

How we minimise social and environmental impacts of our supply chain How we manage our tax affairs

No change at all Some change Significant change

Figure 11 Technology and risk management are the top areas in which CEOs are making significant changes to respond to

stakeholder expectations

Figure 12 Most CEOs see data and analytics technologies as generating the greatest return for stakeholder engagement

Q: Select the connecting technologies you think generate the greatest return in terms of engagement with wider stakeholders

R&D and innovation

Social media communications and engagement

Web-enabled collaboration tools

Online reporting technologies

Personal data security

Social listening tools

Investor relationship tools

The innovation edge

Over half of CEOs ranked R&D and innovation

technologies as generating the greatest return

in terms of successful stakeholder engagement (see Figure 12). The winners in the innovation game, however, will be those that harness technology and innovation to deliver products and services that are cost-effective, convenient,

functional and sustainable.

Today, some of the most in-demand products relect customers’ changing values. Take Nest’s energy eficiency home monitors for example, or Nike’s shoes and clothing developed with tools enabling suppliers and designers to quickly assess sustainability criteria. Companies like GE, meanwhile, are pioneering innovation in healthcare and smart cities.

Digitisation is central to these efforts, allowing companies to obtain and utilise data about business processes that’s necessary to support innovation efforts, and to remove costs from the system through greater eficiencies.

And while technology plays a critical role in innovation, often it’s in conjunction with business model change as epitomised by the likes of Airbnb and its ‘sharing economy’ peers.

Most companies, however, struggle to achieve innovation-led growth. Innovating to meet customers’ changing demands for sustainable

and ethical goods and services adds a

challenging dimension to this pursuit, one that many companies are only just beginning to address. This probably explains why fewer numbers of CEOs are making signiicant change in maximising the societal value of their R&D and innovation and developing ethical products and services (see Figure 11).

The major trend that all industries face is the impact of technology on every single aspect of a company. Whether it’s your operational

eficiency in applying

technology to traditionally manual processes. Whether it’s enhanced intelligence, from big data analysis to help managing marketing, risk, product creation, or assessment of ideas … technology is going to lead to sea changes in how companies are organised and run across all industries, and ours is no different.

Brian Moynihan

Chief Executive Officer, Bank of America Corporation, US

Our company was founded by Thomas Edison almost 130 years ago and he has a great quote that I like repeating very much. He said: “I

ind out what the world

needs. Then, I go ahead and invent it.” And that has been exactly the core value of our company over 130 years. We listen to our customers. We understand what they need and we continuously innovate around customer needs. While we’re doing that, the area that we have chosen for ourselves is solving tough world problems.

Canan M. Özsoy

President and CEO, General

... the biggest opportunity for us is digitalisation ... and based on [that] we will improve all our business and create added value for all our stakeholders.

Mikko Helander

Transforming: technology, innovation and talent

To meet these new expectations, we’re leveraging our R&D and our 2000 researchers, who are developing innovations for the smart grid, new energies, carbon storage, and more. We’re also developing new offers, with household management services like the Linky metre, EDF & Moi and e-equilibre.

Jean-Bernard Lévy

CEO and Chairman, EDF, France

The people edge

As companies look to meet the complicated expectations of stakeholders and society, they will need a new generation of people with an entrepreneurial mindset who can harness

technology and drive innovation.

Sometimes it’s easy to equate technology-led success solely with Silicon Valley internet models. However, PwC’s comprehensive study of the world’s self-made billionaires showed that over 80% of these mega-wealthy individuals made their fortunes in highly competitive markets like consumer products, retail or business services.13 This means that almost

any market can be reinvented.

I believe shareholder value is not about increasing the short-term stock price but about a set of strategic actions led by innovation and employee commitment that aim at long-term value creation in a sustainable manner.

André Calantzopoulos

Chief Executive Officer, Philip Morris International, Inc., Switzerland

Our focus on our pipeline of future leaders Workplace culture and behaviours

Effective performance management

Pay, incentives and benefits we provide for our workforce Our focus on skills and adaptability in our people Our reputation as ethical and socially responsibile employers Our focus on diversity and inclusion

Our use of predictive workforce analysis

Our focus on productivity through automation and technology

38%

30

%

22%

4

%

16

%

49%

41

%

33%

29

%

Figure 13 CEOs are most likely to change their talent strategy to focus on their leadership pipeline

Think about the new skills that CEOs need to be comfortable with, if current CEO predictions are right. They'll need to be able to operate in a world with multiple stakeholders, different

values and diverse attitudes toward law and

rights, all in an increasingly volatile economic context. In addition, they will have to be comfortable with data, analytics and many new technologies. This type of leader will also need to be able to develop new leaders with the right skills and adaptability to deliver the ‘people edge’ required.

Focusing on the leadership pipeline will also help ensure that future leaders can present consistent messages to the wider employee base, and the visibility and ‘tone from the top’ that’s necessary

to turn words into action.

The ability to align the entire workforce behind business and growth goals, however, is also critical to execution. As Susan Lloyd-Hurwitz, CEO and Managing Director of Australia-based asset management company Mirvac Group says, “Aligning people to the business, the changes, the expectations and our purpose is absolutely key.”

We have a very strong corporate culture. It is very much centred on being a responsible owner, being a

responsible employer and having a role in society, as well as of course

creating proitable

companies ... I think it’s also a competitive edge to have in the coming 10 to 20 years.

Susanna Campbell

CEO, Ratos AB, Sweden It’s no wonder, then, that 72% of CEOs are

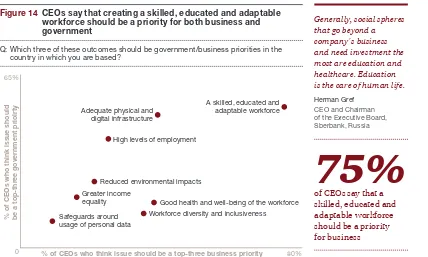

concerned about the availability of key skills, particularly with 48% planning to increase headcount in the coming year. And it explains why by far the most CEOs (75%) say that a skilled, educated and adaptable workforce should be a priority for business in the country where they’re based (see Figure 14). This is such a vital factor that CEOs see it as a top priority for both business and government – together. Brian Moynihan, Chief Executive Oficer at Bank of America Corporation acknowledges the importance of people, “Even with all the new technology, people skills are actually more important now. Whether it’s providing day-to-day services in our bank branches or managing our data analytics: it’s all about people.”

So what are CEOs doing to develop the workforce they need for today and tomorrow? Nearly half are making changes to how they develop their leadership pipeline (see Figure 13). It’s not hard to understand why. This new generation of leaders has grown up in a different world and is better equipped to tackle

thorny societal issues.

49%

Why government and business need to work together

Across every industry, tensions abound between companies, who believe they can be trusted to do the right thing, and governments that aren’t so sure. The regulations governments are trying to enforce are intended to be in the best interests of the public, as consumers or employees. But they can involve reforms, penalties or higher taxes for business that result in higher costs - including those that arise when business doesn’t have enough clarity about how regulations should be interpreted and implemented. These costs, in turn, are likely to be passed onto customers in the form of higher prices.

This no doubt contributes to CEOs’ near

universal frustration that over-regulation is

a threat to their company’s growth, and why 42% cite unclear or inconsistent regulations as a barrier to responding to changing customer expectations. What’s more, increasingly divergent political and legal systems around the world make it harder for multinationals to comply with rules or standards in their countries of operation without falling foul of their home country’s laws.

Regulators have to understand the new environment in which we operate in order to make public policies that really respond to the new situations – rather than getting carried away by the sort of political situations or populism that sometimes lead to inadequate public policies, which can slow down development and, in our case, can hinder us in our task of creating value and trust.

David Bojanini

President, Grupo SURA, Colombia

But viewing government through a combative lens is unlikely to help companies in the long run. For one thing, government and regulators have a big impact on companies, with 69% of CEOs citing them as highly inluential on business strategy. And, despite their complaints about government interference, many companies expect the state to provide considerable help, whether it’s improving workforce skills and education or the infrastructure needed by any modern economy.

As both business and government navigate changing public expectations, they’re going to need each other more than they might think. In the end, businesses want to create the best value they can for customers, and doing that increasingly means creating the best value

they can for society at large. These are the

same goals government shares – a win-win.

For business, understanding why regulation is there in the irst place, rather than focusing only on interpretation and compliance can help ease the stand-off. Regulations are often irst introduced in response to a market failure or to embed good business practice in legislation. Recognising the spirit of what government is trying to achieve can help businesses pre-empt the need for regulation by establishing core principles and values to guide decision-making. It also paves the way for active alignment with government goals and programmes in order to help shape them and improve their

effectiveness. Such actions will also serve

to rebuild trust with regulators.

On the other hand, more recognition is needed by government of the extent to which regulation can create additional burdens and costs, which must be weighed against societal beneits. If business expects constant legislative change, a climate of uncertainty will threaten investment, national growth and competitiveness. What’s needed is regulation that’s proportionate, accountable, consistent, transparent and targeted. Streamlining public sector processes through digitisation − and involving business in the co-design of implementation − can also go a long way toward enabling this process and easing the compliance burden for companies.

Generally, social spheres that go beyond a company's business and need investment the most are education and healthcare. Education is the care of human life.

Herman Gref

CEO and Chairman of the Executive Board, Sberbank, Russia

80% 65%

0 % of CEOs who think issue should be a top-three business priority

% of CEOs who think issue should be a top-thr

ee gover

nment prioirty

A skilled, educated and adaptable workforce Adequate physical and

digital infrastructure

High levels of employment

Reduced environmental impacts Greater income

equality Good health and well-being of the workforce Workforce diversity and inclusiveness Safeguards around

usage of personal data

Figure 14 CEOs say that creating a skilled, educated and adaptable workforce should be a priority for both business and government

Q: Which three of these outcomes should be government/business priorities in the country in which you are based?

?

How are you ensuring you’re investing in the right

technologies to enable open engagement with your

customers and wider stakeholder groups?

Have you identiied the right capabilities to support you

from strategy to execution?

Is your innovation geared towards generating offerings that

meet big societal needs and generate good long-term ROI?

What are you doing to enable your people to work towards

better meeting new and wider stakeholder expectations?

How are you working with government to create better

outcomes for customers and employees?

Tough questions to ask about

transforming: technology,

innovation and talent

This is, however, proving challenging for organisations to achieve. Despite the

importance of getting the right talent, just 30% of CEOs are making changes to their focus on skills and adaptability in their people (Figure 13). And despite their embrace of technology in all things customer-related, companies are

doing little to change either how they use

technology to improve productivity or their use of workforce analytics, with only 4% of CEOs seeking change in that area (see Figure 13).

CEOs also recognise the importance of tying workplace culture to behaviour, with 41% making changes to this aspect of their talent strategies (see Figure 13). Indeed, companies

that are highly coherent – those with strong

alignment between their value proposition, capabilities, and products and services – view

their culture as their greatest asset.14 But despite

the cultural changes that CEOs are making in their people strategies, such developments don’t loom large in the context of the wider organisation. Just 31% of CEOs are pursuing signiicant changes to values, ethics and codes of conduct – compared to 51% for technology.

75%

Measuring and

communicating success

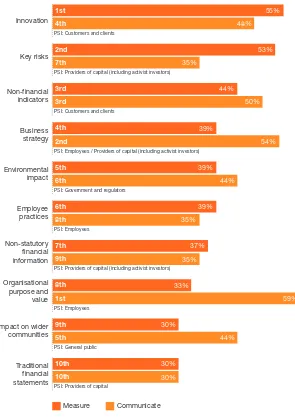

In a complex and rapidly changing world, we

were interested in understanding which areas

CEOs want to better measure and which areas they want to better communicate to the multiple stakeholders who interact with their organisations. We found that the key metrics CEOs would like to improve are the ones traditionally seen as ‘harder’ drivers of business success like innovation and risks, while the areas they want to better communicate are emotional, ‘softer’ issues around values and purpose (see Figure 15).

But customers are seeking information about both the ‘hard’ and ‘soft’ drivers of business success. Indeed, real-time dashboards created and managed by users themselves are becoming feasible, raising expectations for more fresh and relevant information and ways of viewing it.

Ultimately the CEO must deal with matters of the head and the heart, the rational and the emotional. Our research suggests that there is much room to improve on both the assessment and communication of key business areas, including of course, core inancial data.

A new mindset for measurement

How should business be doing more to measure impact and value as stakeholder expectations evolve? We put this question to CEOs and the top-two areas they identiied brought to mind the fabled Chinese character for crisis – a combination of the symbols for risk and opportunity. Over half of CEOs (55%) cited

55%

of CEOs think business could do more to measure the impactand value of innovation

We like to measure things. We say internally that if you cannot measure it, it doesn’t exist. That’s something that we always mention because that’s the way that we approach things.

Dr. Nuno Amado

the need to measure innovation, with the measurement of risk coming a close second (53%) (see Figure 15). This complex, combined theme resonates in many CEOs’ responses – they

recognise the world has changed and that they

must deal both with the new while protecting the old; they’re forging ahead to serve multiple

stakeholders while focusing on delivering a

proit for shareholders and better convenience, price and functionality for customers.

With most companies not yet having cracked the code on measuring innovation, it’s little surprise that this is the area most CEOs want to better measure. And it could help explain why CEOs struggle with how to optimise the societal value of R&D and innovation.

A large part of the challenge lies in the adoption and use of technology. There’s a digital divide between those organisations that have grown up in the digital world, and everyone else. ‘Digital native’ companies have a comprehensive set of online data about their entire business, with feedback response loops at every point of their processes. They are, indeed, constantly managing metrics, making them very effective at process change and quick, effective execution

– a key driver of successful innovation.

And it’s not simply about digitalisation and moving everything online, but continuously generating, collecting, analysing and reporting information, with coverage that’s both deep and broad.

It's clear that CEOs recognise the importance of data and analytics, with most citing this as the technology that they think provides the highest return for stakeholder engagement (see Figure 12). The thirst for better speed and accuracy in this more dynamic environment is growing and new competitors who start with a fresh, faster measurement system are driving entire industries forward at a quicker pace.

Innovation Impact on wider communities

PSI: Customers and clients

PSI: Providers of capital (including activist investors) PSI: Customers and clients

PSI: Employees / Providers of capital (including activist investors) PSI: Government and regulators

PSI: Employees

PSI: Providers of capital (including activist investors) PSI: Employees

PSI: General public PSI: Providers of capital

55%

Figure 15 CEOs are seeking to better communicate ‘softer’ issues and to better measure ‘harder’ drivers of business success

Q: In which of the following areas do you think business should be doing more to measure/communicate impact and value for wider stakeholders?

Can everything be confidently

measured?

Getting a good grip on measuring innovation and people processes is fundamental. But as customer expectations change, CEOs also recognise the need to widen the scope of what they measure to include stakeholder inputs that lie outside their immediate business environment.

Seventy-two percent of CEOs – spread across all regions – say their company reports on both inancial and non-inancial matters. In ive years’ time, 81% think that the most successful organisations in their sector will be doing this. And 76% say that business success in the 21st century will be deined by more than just inancial proit (see Figure 16).

The ability of companies to consider non-inancial indicators of success is testament to how dramatically the ield of sustainability reporting and measurement has grown in the last 15 years. Going forward, the adoption of the United Nations’ Sustainable Development

Our Integrated Report evaluates and demonstrates this value while responding to the GRI (Global Reporting Initiative) indicators, which represent the current standard in sustainability reporting. This report calls on us to identify the key issues for our stakeholders and to measure the management results and information from our entire organisation.

Manuel Manrique

President and CEO, Sacyr, Spain

... in 2002 we introduced the GRI (Global Reporting Initiative) standards in Brazil, together with two other companies. We incorporated and translated these standards and now we have become an agent that reports its results based on this methodology. In the last two years we have moved towards the integrated report – hence the issues of transparency, corporate governance, shareholder equity and accountability. I would say that these themes may have been optional for some companies, but they have not been optional for CPFL for quite some time.

Wilson Ferreira Jr.

CEO, CPFL Energia, Brazil

Measuring and communicating success

... we are driven by the bottom line in our balance sheet. I am convinced, however, that this result is really genuine as long as it observes the sustainability principles. This for me is an indicator of success. We are also motivated by the fact that the company is always listed in the top 10 in ranking of prestige. I don’t know if it can be considered an indicator of success, but it is very gratifying.

Luis Pagani

Goals will help drive the measurement of a wider range of impacts. Technology and data again are key: digitising and instrumenting business processes can improve eficiencies, recognise and account for hidden costs, and create greater transparency around areas like resource consumption and waste generation.

Existing frameworks for reporting on environmental, social and governance (ESG) standards are an important starting point to improve the visibility of corporate actions for customers and other stakeholders. The Global Reporting Initiative (GRI), for example, provides sustainability reporting guidelines, while the International Integrated Reporting Council (IIRC) supports integrated reporting for annual reports, and the Sustainability Accounting Standards Board (SASB) is aimed at sustainability content for regulatory inancial ilings for US-listed companies.

Moving forward, companies will need to call on a broader (and more detailed) set of tools to measure indirect value.

Non-proit organisation B Lab, for example, which certiies companies that use their business as a force for good – so-called B Corps – provides detailed and standardised impact assessment indicators and a customised platform for measuring those impacts.15 Another approach is PwC’s own Total Impact Measurement and Management (TIMM) model that integrates sustainability, economic and tax indicators to evaluate an organisation’s total impact. This helps decision makers understand

the net effect of their actions and assess the

trade-offs they have to make.16

Of course no one is saying it is easy to apply robust methodologies to measure indirect value. No matter what tools are used, some things may not lend themselves to precise metrics. Yet without attempting to measure more of these areas, there’s simply no way that companies can effectively allocate inite

resources in a cost-effective way to address

the things that their customers increasingly want them to address.

... if you want to be

proitable consistently,

you need to provide your customers with value the way they measure it ... You need also to measure levels of success such as the impact you have in the communities you serve, the impact you have in the society you are part of and, above all, you need to do this in a consistent and coherent way.

Eduardo Stock da Cunha

CEO, Grupo Novo Banco, Portugal

Figure 16 A majority of CEOs agree that business success will be defined by more than financial profit

Q: To what extent do you agree that business success in the 21st century will be redefined by more than financial profit?

39%

of CEOs think business should be doing more to measureThere’s always that challenge of determining whether the metrics of success will be for today or for the future. Looking at the short-term and the long-term there’s always been that tradeoff between the business imperative and the social imperative. I believe that they both have to strike the right balance but the challenge is how to get that right balance. I also believe strongly that the search for responsible

private proit can

sometimes lead to the creation of social good.

Larry Ettah