www.pwc.com/ceosurvey

Fit for the future

Capitalising on global

trends

1,344

CEOs in 68 countries

39%

of CEOs are very conident about their company’s growth prospects See page 5

86%

Preface

The global economic recovery continues to be fragile, but with immediate pressures easing. CEOs are feeling more optimistic and gradually switching from survival mode to growth mode. As the latest PwC Annual Global CEO Survey shows, the changes they’re making within their organisations now have less to do with sheltering from economic headwinds and more to do with preparing for the future.

The number of CEOs who believe that the global economy will improve over the next 12 months has doubled to 44%, compared to the previous year. Only 7% of CEOs, compared with 28% last year, think that things will get worse in the year ahead. CEOs are also feeling better about their own companies’ prospects, with 39% now very conident of revenue growth in 2014.

So how are CEOs responding to these nuanced shifts in global growth? Our indings show that nearly a third of them are focusing on opportunities for growth in the countries where they already do business, with just 14% planning to explore new geographic markets. Many are also revising the portfolio of overseas markets where they will concentrate their efforts. As well as turning to the US to a greater extent than last year, they believe Germany and the UK now look more promising than some of the BRICS economies.

More seismic shifts loom on the horizon. CEOs told us that three global trends – technological advances, demographic changes and shifts in economic power – would have a huge impact on their businesses over the next ive years. And the interplay between them will be as signiicant as the trends themselves.

Quite simply, everything is now in lux – from where and how people live and work, to the wider social and political contexts in which companies interact with their stakeholders. These developments will create many new opportunities for innovation and growth. But to seize these opportunities, companies must be ready to radically reassess how they function. In this new world, the very purpose of business – not just its practices – will come into question.

We believe organisations must overcome three particular challenges in their race to become it for the future. They’ll need to harness technology to create value in totally new ways; capitalise on demographic shifts to develop tomorrow’s workforce; and, just as important, understand how to serve increasingly demanding consumers across the new economic landscape.

CEOs recognise that as these trends unfold, the demands placed on them will increase exponentially. They will have to encourage innovation that’s both radical and methodical; connect with employees and consumers who don’t look, think or act like them; experiment with new operating models while preserving existing eficiencies; and deliver value without compromising on quality or integrity. In short, CEOs will have to become hybrid leaders who are comfortable straddling two worlds – drawing on the best of the old while operating at the frontiers of the new.

My sincere thanks go to the more than 1,300 company leaders from 68 countries who shared their thinking with us. Their active and candid participation is the single greatest factor in the success of PwC’s Annual Global CEO Survey, now in its 17th year. We greatly appreciate our respondents’ willingness to free up their valuable time to make this survey as comprehensive and accurate as possible. We’re especially grateful to the 34 CEOs who sat down with us to hold deeper and more detailed conversations. You’ll see their

comments throughout this report.

Dennis M. Nally

Chairman,

PricewaterhouseCoopers International Limited CEOs told us that

Contents

The glass half-full 4

Three trends that

will transform

business 10

A revolution in the ofing 11

Creating value in

totally new ways 12

It’s all happening very fast! 14

Focusing on breakthrough innovation 15

Putting a robust innovation

framework in place 16

Collaborating with an ecosystem

of partners 16

The global

rebalancing act

6

The BRICS aren’t a single brick 7

A changing global footprint 8

Developing

tomorrow’s

workforce 18

Reverse migration and rising wages 19

Time’s running out 20

Finding the right people 20

Redeining the workplace 21

Addressing social issues 22

So you want

more data?

24

Serving the new

consumers 26

A wealthier world 26

A fragmenting customer base 27

Incumbents in the line of ire 28

Moving to new markets 29

Serving distinct demographic

segments 30

Targeting the bottom of the pyramid 30

Joining the shared economy 31

The need

for hybrid

leadership 32

Adopting a multifocal perspective 32

Looking at the whole footprint 33

Hybrid leadership 35

Methodology

and credits

38

Notes and sources 40

CEO survey

face-to-face

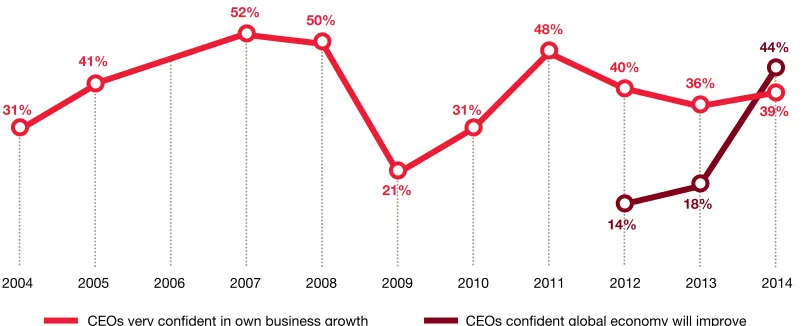

CEOs are more positive about the state of the global economy than they were last year. Twice as many think it will improve over the next 12 months (see Figure 1). Conversely, just 7% think it will deteriorate, compared with 28% in 2013.

But there are marked regional differences in sentiment. Only a quarter of CEOs in Central and Eastern Europe believe the global economy is recovering, versus half of all CEOs in Western Europe and the Middle East. The optimism some CEOs display may therefore stem from relief that certain risks (such as the collapse of the eurozone) have been averted for now, rather than the conviction that things are really getting better.

Moreover, CEOs are still cautious about whether greater global growth will translate into growth for their own companies. They’re slightly more hopeful about the short-term outlook (see Figure 1), but just as wary about opportunities over the next three years as they were 12 months ago.

The glass half-full

In the second half of 2013, we have seen signs of recovery in the global economy and respectively, recovery in shipping [an early indicator of economic activity]… We are optimistic that this positive trend will continue in 2014.

Angeliki Frangou, CEO & Chairman, Navios Group of Companies

44%

Many CEOs also remain very nervous about government efforts to balance reform with growth. Overregulation tops the list of potential threats to their organisations’ growth prospects, with 72% expressing concern about this. And the ability of debt-laden governments to tackle soaring deicits has been one of the biggest clouds on CEOs’ horizons for the past four years, with 71% worrying about this, compared to 61% in 2011.

So, in essence, CEOs still have serious concerns, but their conidence regarding the immediate economic outlook has stabilised over the past 12 months. They seem to think – as Mark Carney, governor of the Bank of England, observed of the British economy in November 2013 – that, for the irst time in a long time, you don’t need to be an optimist to see the glass as half-full.1

Base: All respondents (2014=1,344; 2013=1,330; 2012=1,258; 2011=1,201; 2010=1,198; 2009=1,124; 2008=1,150; 2007=1,084; 2006 (not asked); 2005=1,324; 2004=1,386)

Source: PwC 17th Annual Global CEO Survey

Figure 1 CEOs are more confident the global economy will improve than they are about their own business growth prospects

2011

2004 2005 2012 2013 2014

CEOs very confident in own business growth CEOs confident global economy will improve 41%

We do have forward momentum in the economy. [But] it’s not what it should be. The reason it hasn’t rebounded in a much more vigorous way is that we’re bearing the burden of too much uncertainty in almost every area, whether it’s

in the inancial area with

banking regulations, Basel III and Volcker rules, uncertainty on tax reform, or healthcare uncertainties with the Affordable Care Act.

It makes it more dificult

to plan and to have

general conidence, with

so many things still to

be determined, ive

years after the onset

of the inancial crisis. Stephen A. Schwarzman,

Chairman, Chief

Executive Oficer

and Co-Founder, Blackstone, US

88%

of CEOs in North America are concerned about government response

to iscal deicit and debt

burden, compared to 71% globally.

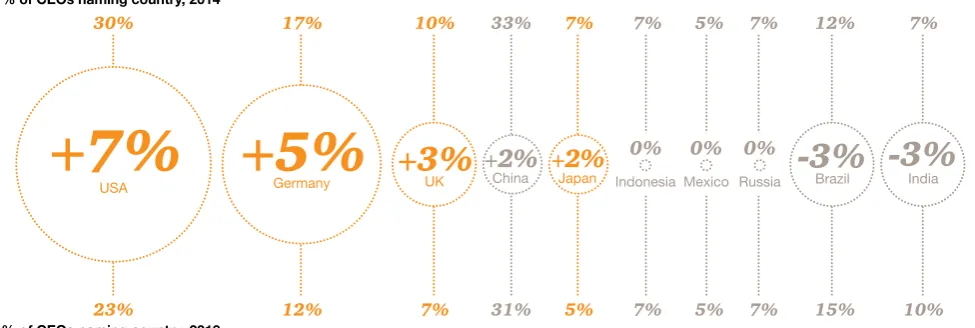

CEOs are coming out of survival mode, but the search for growth is getting increasingly complicated as the global economy gradually rebalances itself. In 2012, the advanced economies were spluttering, while the emerging economies sizzled. In 2013, the picture became more nuanced. The advanced economies are mending, while some emerging economies are slowing down – and separating out in the process.

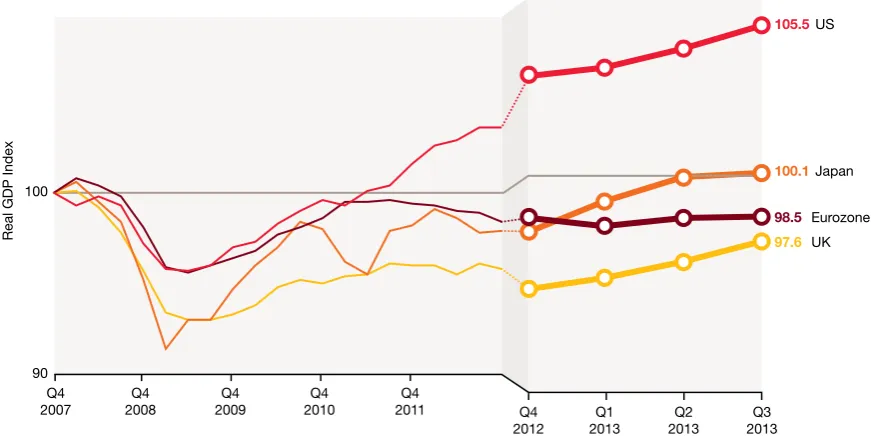

By the third quarter of 2013, the US economy was already 4% bigger than it was in 2007, before the inancial crisis was in full swing. The Japanese economy had also recovered all the ground it lost, although a listless

performance in the second half of 2013 dented hopes that the eurozone had done likewise (see Figure 2).

While the advanced economies are recovering, some of the emerging economies have been decelerating. The prospect of a shift in monetary policy in the US (which materialised in

December 2013) and other advanced economies triggered substantial capital outlows from some emerging countries. These macroeconomic changes have revived interest in a number of the mature markets and exposed the weak spots in some of the emerging economies, as well as the extent to which they’re diverging.

Source: PwC

Figure 2 The advanced economies have recovered lost ground

90 92 94 96 98 100 102 104 106

Q4 2012

Q1 2013

Q2 2013

Q3 2013

US

Japan

Eurozone

UK

Q4 2007

Q4 2008

Q4 2009

Q4 2010

Q4 2011

105.5

98.5

97.6

100.1

Real GDP Index

The global

The BRICS aren’t a single brick China remains robust, thanks to vast foreign-exchange reserves and extensive reform measures introduced by the central government. But Brazil is suffering from a huge debt hangover and India has been slow to open up its markets. Meanwhile, Russia is unduly reliant on

commodity exports and South Africa’s growth has been impeded by heavy regulation.

The business leaders in our survey have sensed the change in the weather. Last year, 53% of CEOs in Latin America were very conident they could increase their company’s revenues over the next 12 months. This year, only 43% feel so sanguine. CEOs in the Middle East, by contrast, have become more upbeat: 69% believe they can boost revenues – up from 53% in 2013. CEOs in Western Europe are also feeling more heartened, although they remain less conident than CEOs in other regions. There’s been a similar shift in regional views about the outlook for the next three years.

And though CEOs are more worried about sluggish growth in the advanced economies than a slowdown in the emerging economies, the gap is surprisingly small (see below).

The hidden costs of doing business in some emerging economies are likewise becoming more apparent. Institutional ineficiencies are one key source of concern. But CEOs in Africa, Latin America and the Middle East are also more apprehensive about infrastructure problems, supply chain disruptions and bribery and corruption than those in the rest of the world.

CEOs worry almost as much about a

slowdown in the emerging economies

as they do about sluggish growth in

the advanced economies

Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey Somewhat concerned Extremely concerned

47%

24%

46%

19%

Continued slow or negative growth in developed economies

Slowdown in high-growth markets

We’ve got to decouple even within the global growth markets themselves, and the opportunities then appear with more clarity and are many… It’s not going to be about a BRIC in a wall. It’s going to be about many such BRICS in the wall and continued and sustainable growth.

Arif Naqvi, Founder and Group Chief Executive, The Abraaj Group

I think the global economy is going to be a real patchwork over the next few years. So, it’s going to be really crucial to consider where you’re playing as a company.

Alison Watkins, CEO, GrainCorp, Australia2

The global rebalancing act

A changing global footprint

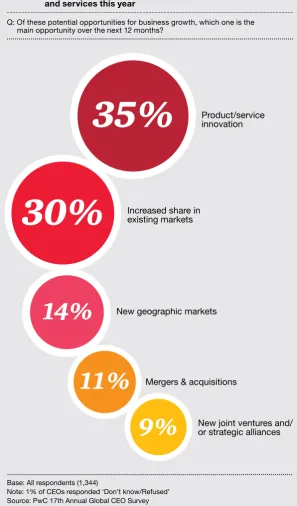

So how are CEOs responding to these changes? Nearly a third see increased share in existing markets as the main opportunity for growth over the coming year, compared to only 14% who say the same for new geographic markets.

CEOs are also looking on multiple fronts for growth opportunities. Many are revising the portfolio of overseas markets on which they will concentrate. They’re turning to the US to a greater extent than they did last year. And they think Germany and the UK now look more promising than some of the BRICS markets (see Figure 3).

But those aren’t the only places they’re exploring. When we asked CEOs which countries, other than the BRICS, offered the best prospects for growth in the next three to ive years, Indonesia, Mexico, Turkey, Thailand and Vietnam all featured in the top 10.

Base: All respondents (2014=1,344; 2013=1,330) Source: PwC 17th Annual Global CEO Survey

Figure 3 CEOs are turning back to certain advanced economies for growth

Advanced economies Emerging economies

China

UK

-India

-Brazil Russia

Indonesia Mexico

Japan Germany

USA

% of CEOs naming country, 2014

% of CEOs naming country, 2013

We’re concentrating our capital on markets where we believe we have more of a comparative advantage and where we can better assess risk. So we’re getting simpler, we’re getting more focused.

We’re relecting carefully

on where the growth will come over the next 20 years, and making sure that we’ve got the

irepower to address

those markets as opposed to being spread too thin.

Douglas Flint, Chairman, HSBC Holdings Plc., UK For the next few years, we are planning to make the most of the countries where we are already operating. We are aiming to diversify our operations, and to expand and diversify our investments, mainly in Angola, Peru, Mexico, Venezuela, Argentina and the United States. In terms of new markets, our focus is on Africa, a continent where we foresee the highest growth rate.

Marcelo Odebrecht, CEO, Odebrecht, Brazil

Difficult questions about inding

growth in a rebalancing economy

What are you doing to ensure the accuracy of the information you use to make critical decisions?

How are you adjusting your funding plans to prepare your business for a world where the cost of debt increases (on the back of tighter monetary conditions)?

In what ways have you adjusted your strategy to capitalise on the pickup in economic activity in the advanced economies?

Is your organisation prepared for emerging markets becoming your core markets in the longer term?

How are you positioned in newer emerging markets that will increasingly become the source of tomorrow’s growth?

Among the emerging markets, we think that

Africa – for the irst time

in many centuries – is going to contribute quite

signiicantly to global

economic growth. While it’s coming from a low base, the continent is beginning to grow at about 5%, making it the fastest-growing region in the world.

Three trends that will

transform business

So what does the future hold? CEOs told us they think three big trends will transform their businesses over the coming ive years. Four-ifths of them identiied technological advances such as the digital economy, social media, mobile devices and big data. More than half also pointed to demographic luctuations and global shifts in economic power (see below).

Of course, these trends aren’t new. What has changed is the pace at which they’re unfolding – and the way they’re colliding to create a completely different environment.

The digital revolution has put more power in the hands of more people than ever before. Collaborative networks are replacing conventional corporate modes of operating. Consumers are swapping information and advice on the virtual airwaves. And citizens are assuming the journalist’s mantle.

Meanwhile, demographic shifts caused by slow – or no – population growth in some countries are causing a massive redistribution of the world’s workforce. And since work is what generates wealth, that will have a huge bearing on future consumption patterns as well.

You can’t continue to think that the world is

the same as it was ive

years ago. It is incredibly different now: it’s even changed from how it was

ive weeks ago or ive

months ago. The spiral of change is speeding up. Leaders of society and institutions should communicate this new state of constant change in the world and live accordingly, so that they can lead from an awareness of this change.

Juan Béjar, CEO, Fomento de Construcciones y Contratas (FCC), Spain

Technology is an all-pervasive megatrend. So that is going to impact banking and revolutionise it.

Chanda Kochhar, MD & CEO, ICICI Bank, India

Technological advances

Shift in global economic power Demographic

shifts

CEOs identiied three transformative global trends

Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey

These global forces are also changing society in fundamental ways. On the positive side, for example, a billion people will be better off than they are now, as incomes in the emerging economies rise. On the negative side,

unemployment and resource shortages could be exacerbated.

The business community won’t be divorced from such problems. On the contrary, it will be expected to engage with them – and there will be a pay-off for those that get it right.

Companies that come up with innovative solutions to serious social issues will earn more revenues and more trust.

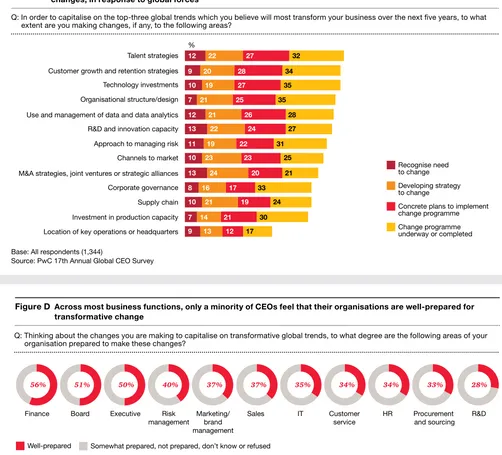

But CEOs also know that responding to such powerful global swings has major organisational repercussions. This is evident in the way CEOs are changing their cost structures (see Figure E on page 25) and in the changes they’re making in areas like organisational design, technology investments and the supply chain, in response to global trends (see Figure C on page 25). The key question is how to create an operating model and cost base that’s aligned with changing markets and customer offerings in order to grow proitably.

A revolution in the ofing

To sum up, technological advances, demographic changes and global economic shifts will continue to generate enormous change over the next few decades. And the interplay between these three trends will be as signiicant as the trends themselves. Together, they will create many new opportunities for innovation and growth, but they will also raise many new challenges.

Where people live and work, how they live and work, the social and political context in which they live and work – everything’s in lux. And

that means the way companies function must alter as well. But incremental adaptations won’t sufice. In a world that’s changing beyond all recognition, the very purpose of business – not just its practices – will come into question.

In the following pages, we’ll look more closely at what these trends mean for CEOs and how they’re making their organisations it for the future. We’ll focus on three particular challenges: • Harnessing technology to create value

in totally new ways.

• Capitalising on demographic shifts to develop tomorrow’s workforce. • Serving consumers in a new economic

landscape.

Nowadays, the biggest threat to companies is the companies themselves. If you don’t adapt to the circumstances, if you don’t understand that, now, competitiveness has to be generated internally, as well as through external opportunities, then your business is at risk.

Raul Baltar Estevez, CEO, Banco Exterior, Venezuela

76%

of CEOs have cut costs in the last 12 months and 64% plan to do so over the next 12 months.

Internal eficiency means

not only reducing staff in our call centres, for instance, but also enhancing our business model through more simple interfaces, more convenient use of our services.

Source: Richard Lipsey, Kenneth I. Carlaw and Clifford T. Bekhar

Figure 4 The pace of innovation is accelerating dramatically

16th & 17th Century 18th Century 19th Century 20th Century 21st Century

Printing

Factory system

Railway

Automobile

Lean production

Nanotechnology (process) Steam engine Internal

combustion engine

Aeroplane

Internet Electricity

Mass production

Biotechnology Computer

Iron steamship

Creating value in

totally new ways

The world has beneited from the development of more general-purpose technologies in the past century than in the previous four combined (see Figure 4).3 Consumers are embracing these advances ever more rapidly. The telephone took 76 years to reach half of all US households. The smartphone reached the same level of penetration in less than a decade.4

The number of digital natives (i.e. those those actively using social media and multiple devices regularly) is expected to grow at a rapid pace. In the UK, for example, 61% of consumers are expected to be digital natives by 2020 – up from 19% in 2013.5

World population

Connected devices per person

Connected devices

50bn

25bn

12.5bn

500m

6.3bn

7.2bn 7.6bn 6.8bn

2010

2003 2015 2020

2

1

3

7

more networked devices than people in the world By 2020 there will be nearly

7 times

Source: Cisco Internet Business Solutions Group

Figure 5 The number of connected devices is increasing dramatically

Good business

Dow Chemical has developed a seed line for making cooking oils that produce high yields and oils with a longer shelf life and less saturated fat than competing products. What’s good for farmers, food manufacturers and consumers has been good for Dow; the seed line has become a best seller. Similarly, Becton Dickinson has developed a syringe to protect health workers from needlestick injuries, which spread HIV and other infections. Needleless injection systems now account for a quarter of the company’s revenues. The digital revolution has given birth to

a new generation of consumers who want ever more accessible, portable, lexible and customised products, services and experiences. They expect to move seamlessly – in real time – between the physical and virtual worlds. And they’re prepared to disclose quite a lot about themselves to achieve their desires.

When we asked CEOs what they thought would be the next big thing that would revolutionise their business, industry or society over the next 10 years, technology was unsurprisingly their top pick (see Figure A on p.24). The social, mobile, analytic and cloud technologies that underpin this revolution are creating numerous opportunities for companies to generate value in entirely different ways – and even, indeed, to redeine the businesses they’re in.

Moreover, the ramiications go far beyond serving customers better in order to expand. Armed with new technologies, CEOs have the leadership opportunity to drive social change by addressing complex needs. And this doesn’t have to be a philanthropic exercise; as some irms have proved, it’s quite possible to solve pressing social problems proitably (see sidebar,

Good business).8

We’re constantly thinking about how we engage with, and embrace, technology, but in a way that actually engages our customers.

Craig Donaldson, Chief Executive Oficer,

Product/service innovation

Increased share in existing markets

New geographic markets

Mergers & acquisitions

New joint ventures and/ or strategic alliances

It’s all happening very fast!

How, then, are the CEOs we surveyed preparing for the future? A third of them are pinning their hopes on new products or services, primarily to fuel organic growth in existing markets (see Figure 6). Most also want to improve their company’s ability to innovate: 86% aim to alter their R&D functions, while 88% are exploring better ways of using and managing big data and 90% are changing their technology investments.

But there’s a glaring gap between aspiration and action. Only 27% of CEOs have already started or completed the changes they’re planning, to make their companies more innovative. Only 28% have made any headway in getting to grips with big data and only 35% have altered their technology investments. This is despite 65% thinking the R&D function is insuficiently prepared to capitalise on the trends now transforming business and society.

So what’s holding CEOs back? One factor may be uncertainty about how to convert those ‘a-ha’ moments into systematic innovation. A second may be concern that a newer technology could negate their efforts. Nearly half of CEOs are worried about the speed at which technology is advancing – and getting on the ‘wrong side’ has major consequences: witness the diverging fortunes of the Blu-ray and HD DVD formats. Many companies are also unsure about how to use the data they collect.

Faced with these challenges, it’s no wonder that many CEOs feel they can’t move fast enough on the innovation front. But the most successful CEOs are doing three things to ‘industrialise’ innovation, i.e. to make it repeatable, dependable and scalable: they’re focusing on breakthrough innovation in all its forms; putting disciplined innovation techniques in place; and collaborating much more actively.9

Creating value in totally new ways

Base: All respondents (1,344)

Note: 1% of CEOs responded ‘Don’t know/Refused’ Source: PwC 17th Annual Global CEO Survey

Figure 6 CEOs are focusing more heavily on new products and services this year

Focusing on breakthrough innovation

The smartest CEOs are concentrating on breakthrough, or game-changing, innovation. They’re explicitly incorporating it in their strategies. And they’re using technology not just to develop new products and services, but also to create new business models, including forging complete solutions by combining related products and services. In fact, they don’t think in terms of products and services so much as outcomes, because they recognise that products and services are simply a means to an end.

Breakthrough innovation can help a company rewrite the rules and leapfrog long-established competitors, as some irms in the emerging economies are doing. Khosla Ventures is one such instance. The company has funded a Kenyan start-up that combines physical schools with online learning via mobile phones, instead of textbooks. It’s already operating hundreds of schools that break even at $5 per child per month, which is locally affordable.10

New blends of the physical and virtual offer many other opportunities for turning the status quo on its head – and alleviating serious social challenges in the process. Using smart diagnostic systems, delivered via mobile phones, to help patients distinguish illnesses that can be self-medicated from those that require a doctor’s attention could cut the cost of healthcare provision, for example.

As Preetha Reddy, Managing Director of India’s Apollo Hospitals observes, “We have to invest in [technology] and ind ways and means to be extremely cost-effective in taking the point of care from within the hospital system to the doorstep of the consumer. I think that will revolutionise the way healthcare is delivered… We should be able to take the point of care literally to their homes.”

We are focusing on innovation and have already taken various important steps to that end.

Stavros Lekkakos,

CEO, Piraeus Bank, Greece

47%

of CEOs are concerned about the speed of technological change as a potential threat to their organisation’s growth prospects, up from 42% last year.

The costs for acquiring ICT [Information and Communications Technology] and information have fallen to incredibly low levels – and whoever takes advantage of information innovation will win in the marketplace... We have formed a task force to investigate how ICT is going to impact our company’s business and how we can take advantage of it. We are also working on big data to see how we can use it.

Shigetaka Komori,

Chairman and Chief

Executive Oficer,

Putting a robust innovation framework in place

The most successful executives not only focus on breakthrough innovation, they treat it like any other business process. Close collaboration at board level is crucial here. Companies in which the chief information oficer has a strong working relationship with the other members of the C-suite typically fare better at fostering systematic innovation.11

Such companies set clear ground rules on the sort of innovation they want, how they plan to measure it and the trade-offs they’re willing to make. They also create a disciplined R&D structure, with dedicated units and rigorous processes that can be reiterated and scaled up. Intel is a good example. The chipmaker has established a global innovation centre, uses systematic R&D processes akin to those used for quality control and routinely captures feedback from the people who are closest to its customers.12

Collaborating with an ecosystem of partners

The top innovators don’t try to do everything themselves, though. On the contrary, they collaborate extensively with a wide range of partners, both inside and outside their industries. They regularly co-create new products and services with customers. And they experiment with different ways of innovating, including open innovation, incubation and networked innovation.

The CEOs in our survey are well aware of the importance of collaboration: 44% are actively developing an innovation ecosystem. Partnerships also feature prominently in their plans: 44% intend to enter into a new joint venture or alliance in the next 12 months. But more than three-quarters of all CEOs concede that they either need to change, or are already changing, their strategies for initiating such arrangements (see below).

Creating value in totally new ways

CEOs are

overhauling

their strategies

for partnering

Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey

13%

Recognise need to changeDeveloping strategy to change

24%

20%

Concrete plans to implement change

21%

Change programme underway or completed My personal view is that,

at the moment, organic growth is necessary in many aspects and therefore it is critical to have the right partner in a strategic alliance.

Chen Long, Chairman, China Resources Enterprise, Limited, Hong Kong

44%

of CEOs say their organisation is focusing on developing an innovation ecosystem which supports growth, as a priority over the next three years.

Difficult questions about creating value in totally

new ways

What are you doing to become a pioneer of technological innovation? Do you have a strategy for the digital age? And the skills to deliver it?

How are you using ‘digital’ as a means of helping customers achieve the outcomes they desire – rather than treating it as just another channel?

How are you adapting your sales cycle to avoid product obsolescence, as new technologies emerge at breakneck speed? And how are you accelerating innovation to increase revenues? What sort of beneit/risk-sharing models will you need to encourage innovation within

collaborative networks?

A helping hand from government

The US government made a major

contribution to the creation of Silicon Valley. In the early years, it provided funding – both directly and through contracts for spin-offs from Stanford University. That fostered close ties between industry and local research institutions. Flexible labour and immigration laws, together with robust intellectual property rules, also helped to bring in the big brains; between 1995 and 2005, immigrants were responsible for founding more than half the irms in the region. And, under Chapter 11, it’s relatively easy for bankrupts to get back on their feet, creating a culture in which it’s acceptable to fail.

The UK government has replicated this approach in developing London’s Silicon Roundabout, with entrepreneurs’ visas, R&D tax credits and signiicant tax breaks for investors. It also set up an agency to promote the area and launched a scheme where 50 irms a year get support to help them expand. The result? In 2008, there were 15 tech start-ups at the Silicon Roundabout; today, there are more than 1,300.

That’s partly, perhaps, because it’s getting harder to ind good allies, as more and more irms collaborate. So any organisation that wants a irst-rate partner has to bring more to the table itself. Some companies are also redeining the skills they require, as they redeine the businesses they’re in. Google is a case in point. It normally works with other technology irms, but is now seeking a partner in the auto insurance industry to help get its driverless cars on the road.13

Working with government likewise features on the boardroom agenda: 30% of CEOs think it’s part of government’s job to foster an innovation ecosystem. Yet only 18% of CEOs think government has been effective in this respect. And 40% say that regulation has impeded their efforts to innovate, although 33% say the opposite.

In fact, supportive government policies have been critical in developing innovation clusters like Silicon Valley and Silicon Roundabout (see sidebar, A helping hand from government).14

Breakthrough innovation comes from: jettisoning old ideas and habits; practising and evolving; and adapting as circumstances change. It also requires a culture that nurtures innovation. A company’s culture alters only when the people who work in it alter how they think, talk, decide and act – and that happens only when top management shows the way.

We are now in the age of collaborating with our customers and service providers… Our corporate customers keep changing their business models. Amidst a host of megatrends, cloud computing included, I want our company to be their partner capable of helping them carry out the transformation they need. Meanwhile, our consumer customers are looking for a life that is richer and more convenient in an increasingly digitalised society. We also want to be their partner helping them to change their lifestyle.

Hiroo Unoura,

Demographic trends are having profound implications for the workplace. The global population is expanding; it will hit 8 billion in 2025. But this growth won’t be uniform, since declining fertility rates will hit some countries much harder than others. By 2020, the median age will be 43 in Europe, 38 in China and just 20 in Africa.15

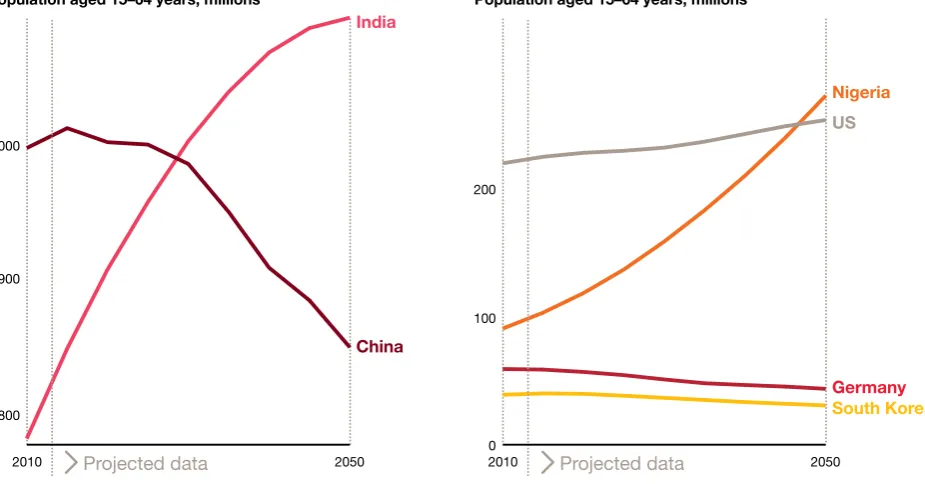

The working-age population is, as a result, undergoing major geographic shifts. It’s still growing rapidly in countries like India, where nearly a million workers will swell the labour force every month for the next 20 years. But it’s already peaked in China and South Korea, and has been falling for more than a decade in Germany (see Figure 7).

Urbanisation is causing further upheavals, with the number of city dwellers projected to rise by 72% over the next four decades. The concentration of people and resources in a compact area is a powerful combination. Cities currently generate about 80% of global economic output.16 But uncontrolled urbanisation can also result in overcrowding, poverty and poor schooling – conditions that neither attract nor nurture talent.

And it’s talent that’s the main engine of business growth. So one of the biggest issues CEOs face, as these huge demographic changes occur, is inding and securing the workforce of tomorrow – particularly the skilled labour they need to take their organisations forward.

Source: Population Division of the Department of Economic and Social Affairs of the United Nations Secretariat, ‘World Population Prospect: The 2010 Revision’.

Figure 7 In two generations, China will have lost 150 million workers while India will have gained 317 million

800 1,000

900

200

100

2050 2010

Population aged 15–64 years, millions

India

China

2050 2010

Population aged 15–64 years, millions

Nigeria

South Korea Germany

US

0

Projected data Projected data

Developing tomorrow’s

workforce

63%

of CEOs are concerned about the availability of key skills.Reverse migration and rising wages

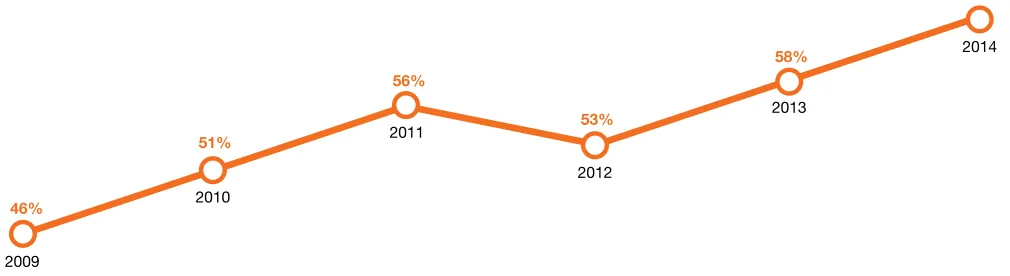

The business leaders in our survey are acutely aware of the challenge. Half of CEOs want to hire more people in the coming year (see Figure 8) and nearly two-thirds are concerned about inding the right skills. In fact, they’re getting steadily more anxious on this score (see Figure 9).

They have reason to worry. The problem is not just that the working-age population in the advanced economies is contracting. Some of the other sources of talent to which companies in these countries have turned are also shrinking, with the industrialisation of the emerging economies. That’s had two effects. It’s triggered a reverse brain drain, as highly educated foreigners go back home, attracted by opportunities that weren’t previously available. It’s also driving up wages in the manufacturing sector.

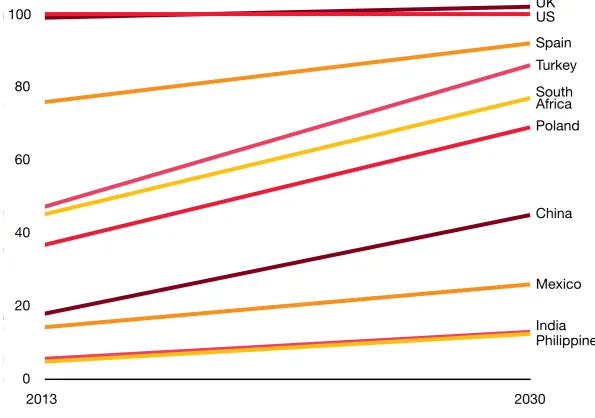

More than half of all CEOs are already concerned about labour costs in the emerging economies. But corporate payrolls will get a lot bigger over the next 15 years, as greater competition for labour and social pressure to raise salaries in line with productivity growth cause even greater wage convergence (see Figure 10).

Technological advances will make it both easier and harder to ind skilled workers. They will make it easier by providing eficient new ways to recruit talent, via digital platforms, and allowing employees who might otherwise have had to leave the workforce to keep working, for example.

Base: All respondents (2014=1,344; 2013=1,330; 2012=1,258; 2011=1,201; 2010=1,198; 2009=1,124) Source: PwC 17th Annual Global CEO Survey

Figure 9 CEOs are becoming more worried about finding key skills

2011

2012

2013

46%

51%

56%

53%

58%

63%

2014

2009

2010

But technology will simultaneously help competitors to poach good staff and talented individuals to set up, independently. It will also raise the level – or change the kind – of education that’s required to perform many jobs. And if it ultimately eliminates the need for a large swathe of workers, that will have serious social

consequences.

Figure 8 50% of CEOs plan to increase headcount over the next 12 months

say headcount will remain the same

(28% in 2013)

29%

50%

say headcount will increase

(45% in 2013)

20%

say headcount will decrease

(23% in 2013)

Q: What do you expect to happen to headcount in your company globally over the next 12 months?

Q: How concerned are you about the following potential economic and policy/business threats to your organisation’s growth prospects? (Availability of key skills was one of the threats CEOs named.)

Base: All respondents (1,344)

Developing tomorrow’s workforce

Time’s running out

So how are CEOs responding to these challenges? A full 93% recognise the need to change, or are changing, their strategies for attracting and retaining talent (see sidebar,

Nestlé woos younger workers).17 But 61% haven’t acted on their plans – possibly because they don’t think the HR function could cope: nearly two-thirds of CEOs believe the HR function isn’t well-prepared for the changes needed to respond to transformative trends. Conversely, the CEOs who do think their company’s HR team is well-prepared are more likely to have already taken steps to strengthen their talent strategies.

This disconnect isn’t new. CEOs have routinely told us they’re revising their talent strategies, without appearing to make much progress from one year to the next. But they can’t afford to wait any longer – and tinkering at the edges won’t be enough. They’ll have to look for new sources of labour to build tomorrow’s workforce. They’ll also have to reconceive the workplace: the way people work and the conigurations in which they work.

Source: PwC, ‘Global wage projections to 2030’ (September 2013)

Figure 10 Wages in the emerging economies are gradually catching up

2030 Average wage per month (US = 100)

2013

Nestlé woos younger workers

Swiss food giant Nestlé is one irm that has seized the initiative. Worried by the prospect that up to 15% of the 93,000 employees in Europe will retire by 2024, as greying baby boomers leave the workplace, the company has launched a drive to recruit 20,000 young workers. Over the next three years, Nestlé hopes to hire 10,000 people under the age of 30. It will also create 10,000 positions for trainees, who may eventually be offered permanent jobs.

Finding the right people

One obvious step is to follow the talent – not only to the big emerging economies like China, but also to places like Indonesia, Vietnam and the Philippines, as the former becomes less competitive. Wage convergence has also beneited advanced economies, with US irms like Ford going back to North America.18

There are other sources of talent, too. The female labour force, for example, remains a largely untapped asset in many emerging economies. Women still bear most of the domestic load, so family-friendly measures, like maternity breaks, part-time work, day care and elder care, can ease such problems (see sidebar, Breaking down gender barriers).19

32%

Older workers will likewise play a much more active role in tomorrow’s workforce, and some irms are trying to alleviate the challenges facing these employees. German carmaker BMW has adopted a particularly imaginative approach. In 2007, the company staffed one of its production lines with employees whose average age equalled the projected average age of BMW’s workforce in 2017. Then it asked them for ideas. Some simple design changes costing less than $50,000 to implement – such as better lighting, adjustable magnifying glasses, computer displays with variable font sizes and forgiving looring material – made all the difference.20

But it’s not always necessary to employ people in order to tap their skills. Mobile telecoms provider giffgaff relies on its customers as key enablers of the business, doing critical work normally done by employees; they earn points whenever they participate in a marketing campaign, recruit a new customer or post an answer to a problem on the community forum.21 And there are many other ways of accessing external resources, such as using online job matchmakers like oDesk to ind qualiied freelancers.

Redeining the workplace

We’ve talked about various strategies for securing tomorrow’s skilled workers. But there’s another – more radical – option: to redeine the workplace itself.

The rise of the networked society has already made it much easier to operate virtually. The workplace is becoming less and less place-speciic, as one observer noted.22 Cultural changes will reinforce the shift. Younger generations, in particular, want lat and lexible structures; expect to inluence the decision-making processes of the companies that employ them; and often prefer to work outside a conventional ofice setting.

So, what does this mean for employers? Among other things, it means providing digital tools for communication and training. It also entails establishing conditions that allow individuals to work independently and manage their own time. Managing digital natives and autonomous workers has major implications, too, requiring people who are highly skilled at assembling teams and resolving conlicts, and who have collaborative management styles.

Moreover, given how easily employees can now reach a global audience on the internet, how companies engage with their workforce will be paramount. This is particularly the case with younger workers, who are looking for employers that espouse their values.

Raul Baltar Estevez, CEO of Banco Exterior, a major private inancial institution in Venezuela, believes investors should be focusing

on employees’ values: “I say to the shareholder: ‘I think you should be interested in knowing what your employees want from your companies because understanding what they want will generate much more wealth and added value, because they are the ones who are generating it now and will generate it in the future.’”

Breaking down gender barriers

Infosys has stemmed the lood of women leaving work after having a child, with one-year sabbaticals for new mothers, part-time job options, day care centres located close to its ofices and onsite supermarkets. And Cisco, GE and Intel all host networking events for female employees in Southeast Asia, where they can forge helpful connections and ind moral support.

Young people Google me before they accept a job in the company. They look at ethical issues, the sustainability work of the company. We are being tested as much as we are testing them.

Jan Johansson, CEO, Svenska Cellulosa AB (SCA), Sweden

We have been working for some years on an organisational design that empowers the contribution of [the] new working generation.

Addressing social issues

Some of the measures outlined previously would not only alleviate the talent shortage, but would also deliver social beneits, such as enfranchising women or helping senior citizens supplement their pensions.

Offering employee beneits such as affordable housing in cities where property is very expensive, or healthcare in countries without socialised medicine can likewise alleviate social problems and make an employer more attractive. So, too, can providing support for employees who want to do voluntary work in their local communities.

And there are other ways in which companies can help society, even as they help themselves. In Africa, for example, the youth bulge is far outstripping the ability to create new jobs, producing a large population of disaffected youngsters. So several multinationals have launched schemes to nurture local enterprise. Coca-Cola’s micro-distribution centres – locally owned businesses that distribute and sell its drinks in remote regions – are one such case.23

Swelling the skills base

The South Korean government gives parents with three or more children tax breaks. The German Bundestag has likewise introduced incentives to raise the birth rate, as well as lifting the retirement age and encouraging inbound immigration. Meanwhile, the Chinese central government is relaxing its one-child policy: married couples can now have two children, if one spouse is an only child. Beijing is also promoting high-tech industries that require fewer workers.

But it’s not just the governments of ‘shrinking’ countries that need to act. If nations with growing populations are to reap the ‘demographic dividend’, they will have to equip their youth with the right skills, as more and more jobs requiring few skills get automated.

Developing tomorrow’s workforce

We need to work very closely with the universities in Mexico, which – by the way – are producing almost 100,000 engineers a year. But their skills need some adaption in order to be productive for our industry… We have created a corporate university in order to certify our employees on various tasks and also provide training on leadership skills. This is important in the new landscape where we will need to compete with private players. I foresee that as one of our key challenges.

Emilio Lozoya, CEO, Petroleos Mexicanos (Pemex), Mexico

64%

of CEOs say creating a skilled workforce is a priority for their organisation over the next three years.Working with the policymakers

CEOs think government must shoulder its share of the responsibility for developing the future labour supply. While some policymakers have been quite proactive (see sidebar, Swelling the

skills base), CEOs are generally dubious about how well government is doing.

Fewer than a quarter of the 41% of CEOs who believe creating a skilled workforce should be a top government priority think policymakers have proved effective. Some also consider regulation a barrier: 52% say it’s impeded their efforts to ind skilled workers.

Difficult questions about developing

tomorrow’s workforce

How well-prepared is your organisation to ind, attract and keep tomorrow’s workforce – even as you deal with today’s talent challenges? What are you doing to make your workforce more diverse?

And how will you utilise the beneits of diversity?

How will you manage employees with different needs, aspirations and experiences from those of your generation?

How will you address the challenges of dealing with an increasingly autonomous workforce?

So you want more data?

Business model change

New market opportunities Changes to

consumer demand

New product/ service offerings Changes to

costs/pricing

People and skills

Technology Consumer behaviour

Sustainability and climate change

Role of government

Sustainable sources of energy

Products/services

Innovation

Supply chain

Technological advances

Mean rank: 2.31

50

30

19

81

Demographic shifts

Mean rank: 1.95

28

39

33

60

Resource scarcity and climate change

Mean rank: 1.87

29 30

41

46

Urbanisation

Mean rank: 1.84

25 34

41

40

Shift in global economic power 30

37

34

Mean rank: 1.96

59

% ranking 2nd % ranking 1st

% ranking 3rd % ranking 1st, 2nd or 3rd

Figure A The ‘next big thing’ according to global CEOs

Figure B CEOs believe technological advances, demographic changes and global economic shifts will have a huge impact on their businesses over the next five years

Q: Which of the following global trends do you believe will transform your business the most over the next five years? Q: What’s the next big thing that you think will impact your business,

industry or society over the next 10 years?

Base: All respondents (1,344) plus additional CEO interviews. Total = 2,053.

Source: PwC 17th Annual Global CEO Survey. To explore CEOs’ specific responses to these questions, go to www.pwc.com/ceosurvey.

Base: All respondents (1,344)

Somewhat prepared, not prepared, don’t know or refused Well-prepared

Finance Board Executive Risk management

Marketing/ brand management

Sales IT Customer service

HR Procurement and sourcing

R&D

56% 51% 50% 40% 37% 37% 35% 34% 34% 33% 28%

Technology investments Organisational structure/design Customer growth and retention strategies

Corporate governance Talent strategies

Approach to managing risk

Investment in production capacity Use and management of data and data analytics

R&D and innovation capacity

Channels to market

Supply chain M&A strategies, joint ventures or strategic alliances

Location of key operations or headquarters

Recognise need to change

Developing strategy to change

Concrete plans to implement change programme

Change programme underway or completed

10 19 27 35

7 21 25 35

9 20 28 34

8 16 17 33

12 22 27 32

11 19 22 31

7 14 21 30

12 21 26 28

13 22 24 27

10 23 23 25

10 21 19 24

13 24 20 21

9 13 12 17 %

Implement a cost-reduction initiative Insource a previously outsourced business process or function Outsource a business process or function

64%

25%

14%

Figure D Across most business functions, only a minority of CEOs feel that their organisations are well-prepared for transformative change

Figure E CEOs plan to cut costs, as operating models evolve

Q: In order to capitalise on the top-three global trends which you believe will most transform your business over the next five years, to what extent are you making changes, if any, to the following areas?

Q: Thinking about the changes you are making to capitalise on transformative global trends, to what degree are the following areas of your organisation prepared to make these changes?

Base: Respondents who stated ‘recognise need to change’, ‘developing strategy to change’, ‘concrete plans to implement change programme’ or ‘change programme underway or completed’ to any option listed in the question ‘In order to capitalise on the top-three global trends which you believe will most transform your business over the next five years, to what extent are you currently making changes, if any, in the following areas?’ (1,338)

Source: PwC 17th Annual Global CEO Survey

Q: Which, if any, of the following restructuring activities do you plan to initiate in the coming 12 months? Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey

Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey

Serving the new

consumers

The technological and demographic trends we’ve discussed are causing massive economic shifts, both between and within countries – and, as a result, equally momentous swings in consumption. The business leaders in our survey are intensely aware of the implications: 52% are concerned about changes in the way consumers behave.

CEOs face three key challenges. They have to chase a moving target, as consumers evolve in different ways in different markets. They have to address the needs of more diverse – and demanding – customer segments. And they have to ight off increasingly intense competition.

A wealthier world

The world is getting wealthier; the number of middle-class consumers is projected to rise dramatically over the next 15 years, especially in Asia (see Figure 11).24 That’s creating all sorts of new opportunities, particularly for companies in the sectors in which richer consumers typically spend their money, such as culture and recreation, services and healthcare.25

With urbanisation, this afluence is also becoming more geographically concentrated. Shanghai is already as wealthy as the

Netherlands.26 By 2025, Istanbul’s GDP could be comparable to that of Austria, and New Delhi’s GDP could nearly rival that of New Zealand.27

Source: Brookings Institute

Figure 11 The global middle class is expanding

2030 2020

2009

Sub-Saharan Africa

Middle East and North Africa

Central and South America

North America

Europe

Asia-Pacific

0 1,000 2,000 3,000 4,000 5,000

52%

of CEOs are concerned about shifts in consumer spending and behaviour.

World GDP growth is coming down, but I think there’s a lot of opportunity. I look at Asia and I see the fundamental need of people wanting to improve their quality of life and I see that incredible population coming into the world. So, I remain positive.

David Thodey, CEO, Telstra, Australia

A fragmenting customer base

But major inequalities in income remain. Average incomes in the E7 countries are still less than a third of those in the G7 countries, for example (see Figure 12).28 And the gap between rich and poor has widened in all but three of the OECD states over the past two decades.29

The customer base is becoming more diverse in other respects as well. Urbanisation is exacerbating the rural/urban divide. The structure of the household is evolving, as the nuclear family gives way to a much wider variety of family types. And intranational demographic movements are reshaping the distribution of wealth.

Canada

Brazil

US

UK

Mexico

France

Germany Russia

Japan

China

Indonesia

India

Italy

Turkey

E7 G7

In the US, for example, the number of Hispanic households making more than $100,000 a year has climbed by 41% since 2000.30 And female buying power is on the increase; more than a billion women will join the global middle class by 2020, as they migrate to cities and swap agricultural work for clerical or professional jobs.31 The average Chinese

person [is] being transformed into a major consumer [at a time when the country’s] investment boom still isn’t over. This has been quite a long time coming and the fact that Americans are being replaced by the Chinese as the main consumers for the Chinese economy is a very important trend.

Alexei Yakovitsky,

Global CEO, VTB Capital, Russia

The consumer has so much more information available to them because of all the technology that’s out there. The way they communicate is different, what they’re looking for is different. We have to help our clients reach those consumers in a relevant and trustworthy way, and every day that’s changing.

Michael I. Roth,

Chairman and Chief

Executive Oficer,

Interpublic Group, US

Source: International Monetary Fund, ‘World Economic Outlook: Hopes, Realities, Risks’ (April 2013)

Cumulative annualised

growth rate

2003−2012 Trade value:

$1.33tr

Trade value: $1.02tr

Trade value: $0.42tr

E

Trade value: $2.11tr

Serving the new consumers

Incumbents in the line of ire

As if this weren’t challenging enough, the shift in the balance of global economic power is making it easier for emerging-market competitors to ight for the same consumers that mature-market companies are targeting. Higher domestic spending on infrastructure and education, together with increased foreign direct investment, has brought rapid productivity improvements. Some emerging-market irms are also investing heavily in R&D, and they may be faster to market because they’re often willing to launch products that aren’t yet perfect and reine them later.

Economic reforms and greater demand for commodities have reinforced these advances, culminating in the development of a powerful trading bloc of interconnected emerging markets. Between 2003 and 2012, intra-E7 trade lows grew at nearly double the rate of G7–E7 lows – and ive times the rate of

intra-G7 lows (see Figure 13).

This helps to explain why nearly half of all CEOs are nervous about new market entrants. But technology has also lowered the barriers to entry in many industries – and some of the most disruptive new players could come from completely unexpected quarters. In the internet age, skilled freelancers can rapidly band together and buy commoditised services like data inputting via eficient online marketplaces. With improvements in 3D printing, they will also be able to manufacture bespoke goods quickly, economically and locally.

Figure 13 The E7 economies have become a close-knit trading bloc

46%

of CEOs are concerned about new market entrants.

Moving to new markets

So how are CEOs reacting? They’ve been quick to adapt to the geographical drift in the customer base. Six of the ten overseas markets in which they expect to generate most growth over the next 12 months are emerging countries.

Some also say that government has been helpful here: 35% report that regulation has helped them pursue new market opportunities, although more – 40% – claim the opposite. Similarly, 51% think regulation has raised production and service delivery standards.

But CEOs have been slower to address the many ways in which consumers’ expectations are evolving – partly, perhaps, because of the sheer pace at which those expectations are altering and the time necessary to achieve transformation in turbulent times. The vast

majority of CEOs plan to change their customer growth and retention strategies and channels to market. But fewer have embarked on these changes (see below). And only about a third think the marketing, sales and customer service functions charged with carrying out these tasks are it for purpose.

But some of the CEOs we spoke with are only too aware of the need for action in changing how they market and sell to consumers in a completely new economic landscape. Let’s take a closer look at some of the opportunities they’re exploring.

Most CEOs see the need to change the

customer-facing parts of their business

Customer growth and retention strategies

Channels to market

Recognise need

to change Developing strategy to change Concrete plans to implement change programme

Change programme underway or completed

9%

20%

28%

34%

10%

23%

23%

25%

Base: All respondents (1,344)

Source: PwC 17th Annual Global CEO Survey

At Michelin we support regulations and have our say in various debates across the globe. Regulations reassert the idea of quality and demonstrate that research is useful, therefore promoting the technology that goes into Michelin tyres. However, regulations can also pose a threat when they become protectionist in different areas of the world.

Jean-Dominique Senard, Chief Executive

Oficer, Michelin

Group, France

Targeting the bottom of the pyramid

Chasing wealth isn’t the only route to growth, however. Savvy CEOs recognise that focusing on underserved populations can be as proitable as it’s socially desirable. Collectively, the billions of world’s poorest people possess immense buying power. And the governments of many emerging countries now take a dim view of multinationals that enter their markets without supporting the communities in which they work. So catering for the needs of these local communities can protect a company’s ‘licence to operate’.

Qualcomm Incorporated, a US-based global provider of wireless technology and services, is one company that sees both revenue opportunity and social beneit in serving this segment of consumers. Chairman and Chief Executive Oficer Dr. Paul E. Jacobs says: “All around the world, cellular is touching everybody’s lives, and so the opportunities in Africa, in Southeast Asia, in areas that are not traditionally thought of as huge growing markets, are big for us, because people are moving from the second-generation phone, or maybe no phone…[to] the internet.

“We’re not just investing at the high end and trickling technology down, but focusing heavily to drive cost out at the very low end... We’ll be able to change people’s lives and improve standards of living in emerging markets. People will have access to information they never had before, access to education, to healthcare, to governance. We’ve been using technologies in Africa for voter fraud detection. Things not necessarily associated with a cellular telephone now are possible.”

Serving distinct demographic segments

Creating customised products and services for clearly deined demographic clusters isn’t new, of course. But global trends are upping the ante, as the size, location and tastes of different consumer segments evolve in signiicant ways.

New Zealand entertainment and gaming business SKYCITY Entertainment Group Limited sees the upside of changing demographic segments: “There is an opportunity for us on the positive side of demographic shifts, with the increasing Asian population, Chinese population, Indian population in Auckland and so on,” says CEO Nigel Morrison. “In terms of aging communities… having great destinations where people can meet and enjoy great dining and entertainment experiences is hugely important in enabling people to come together as they get older. The other demographic shift is around younger people and technology. The way young people have grown up with different interactive technologies is a challenge for us.”

Switzerland-based global healthcare solutions provider Novartis also sees huge opportunities in catering to older populations. As CEO Joseph Jimenez says: “The biggest trend is the ageing population… If you look at the number of people who will be over 65 in a few decades, it is a staggering igure. But then you realise this is going to create demand for disease-modifying new agents. The IT explosion and what we are working on right now is going to lend itself to managing the challenges that come with the ageing population.”

Serving the new consumers

As faster economic growth shifts to places in Africa, across Asia, and Latin America, consumer goods companies have to adapt with the right products in the right stores at the right prices at the right time to meet the needs of new consumers.

Muhtar Kent,

Chairman and Chief

Executive Oficer, The

Coca-Cola Company, US

We are moving more and more from a product-orientated company to a client-orientated company.

So we put the client at the centre of our strategy and activities, and – linked to a very strong segmentation strategy – this gives us the opportunity to identify new products and services that can be offered to the client to better satisfy their information needs.