THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY

USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT

POLICY

MY2017/18 rice and corn production is minimally affected by flooding during July

–

August 2017. The

government is expected to sell off its rice stocks in MY2016/17 resulting in higher rice utilization in

feed rations and more competitive rice exports.

Ponnarong Prasertsri, Agricultural Specialist

Russ Nicely, Agricultural Counselor

August 2017

Grain and Feed Update

Thailand

Flooding during July

–

August 2017 has reportedly had minimal impact on MY2017/18 rice and corn

production. On August 11, 2017, a court order ended the suspension of government rice stocks sales.

This will increase the utilization of rice in swine and poultry feed rations. Additionally, the sale of

government stocks will help boost MY2016/17 rice exports to 11 million metric tons. Almost all of the

government stocks are likely to be depleted in MY2016/17. Consequently, rice stocks are expected to

decline to normal levels in MY2017/18.

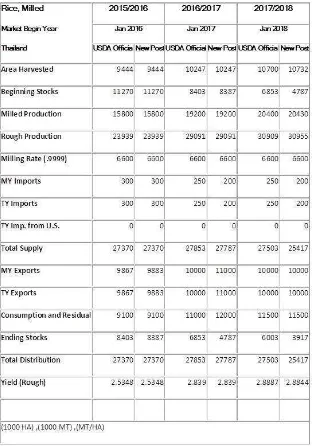

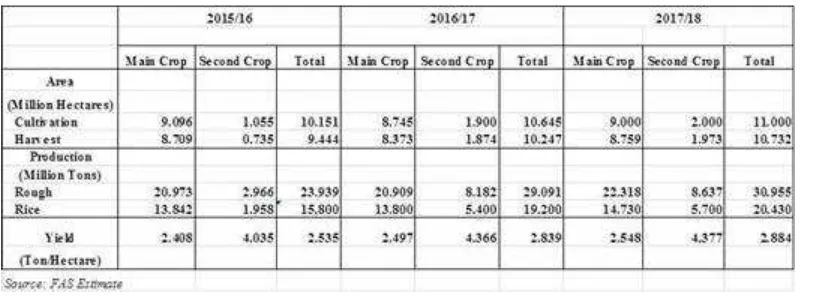

1. Rice Update 1.1 Production

The Ministry of Agriculture and Cooperatives reported that monsoon depressions during July – August 2017 caused flooding across agricultural land totaling approximately 6 million rai (0.96 million hectares). Around 90 percent of the flooding occurred in MY2017/18 main-crop rice

growing area, particularly along the riversides in the lower northern and the northeastern regions. According to the August 14, 2017 flood assessment by the Geo-Informatics and Space Technology Development Agency (GISTDA), the affected rice area accounts for 2-3 percent of total rice

production, mainly MY2017/18 main-crop rice which was mostly in the vegetative stage and can be replanted (Figure 1.1). Meanwhile, MY2016/17 off-season rice which is being harvested in the central plains was not hit by flooding. Sources report that damage from this flooding is expected to be minimal for both MY2016/17 off-season and MY2017/18 main-crop rice as flood waters have already receded. As a result, Post’s forecast for rice production in MY2017/18 remains

unchanged at 20.4 million metric tons. This is approximately a 6 percent increase from MY2016/17 due to favorable weather conditions and sufficient irrigation supplies.

Figure 1.1: Flooded Areas, As of August 14, 2017

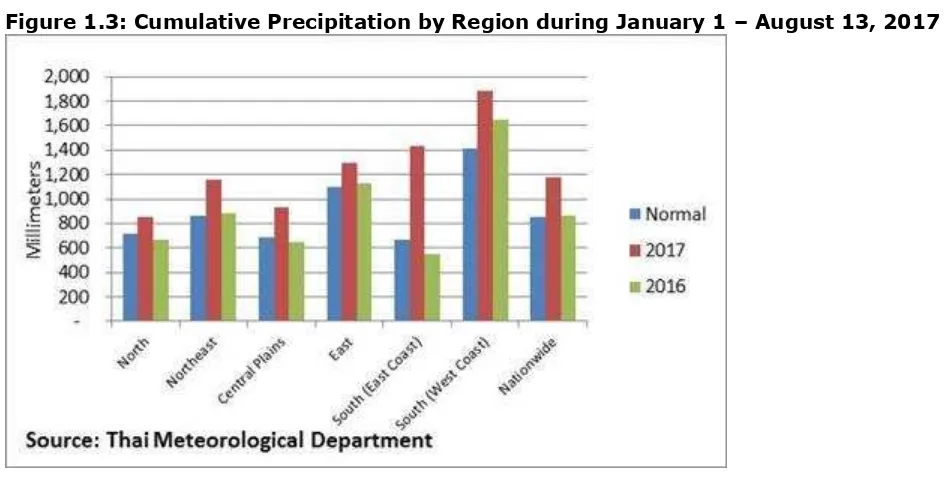

Presently, reservoirs still have excess capacity to manage incoming water from the remaining tropical storms of the 2017 monsoon. The Royal Irrigation Department reported on August 17, 2017 that water supplies in major reservoirs totaled 7.1 billion cubic meters, which is double last year’s water levels due to well above normal precipitations (Figure 1.2 and 1.3). These water supply levels account for only 40 percent of total reservoir capacity.

Figure 1.2: Water Supplies in Major Reservoirs

Figure 1.3: Cumulative Precipitation by Region during January 1 – August 13, 2017

1.2 Rice Consumption

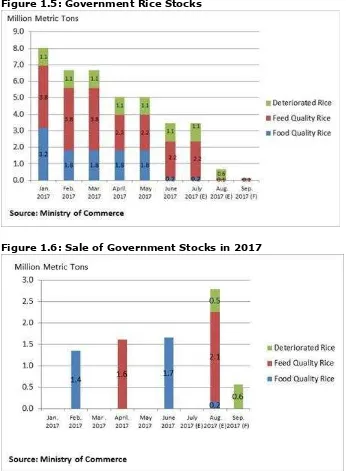

MY2016/17 rice consumption is revised up to 12 million metric tons as the government continues the sale of feed/industrial quality and deteriorated rice stocks in August 2017 after the sale suspension in June and July 2017. This is a 32 percent increase from MY2015/16 due to the utilization of rice from government stocks for the production of energy (non-ethanol), fertilizer, and poultry and swine feed. The government has sold approximately 3.7 million metric tons of feed/industrial quality rice, and 0.5 million metric tons of deteriorated rice since January 2017. Additionally, the government is expected to sell the remaining 0.6 million metric tons of

for corn.

In 2017/18, rice consumption is expected to decline to 11.5 million metric tons, down 4 percent from MY2016/17, in anticipation of a reduction in rice utilization by poultry feed producers, power plants and fertilizer producers due to limited supplies of feed/industrial rice and deteriorated rice. The government is expected to sell almost all of its rice stocks in 2017.

1.3 Rice exports

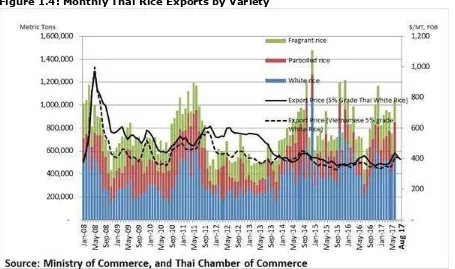

According to the Ministry of Commerce, rice exports totaled approximately 6.4 million metric tons during January – July 2017, up 17 percent from the same period last year due to strong demand from Middle Eastern and African countries. Parboiled rice exports increased to 1.5 million metric tons, up 40 percent from the same period last year driven by bumper MY2016/17 off-season rice production. Exports of white rice also increased 10-15 percent from the same period last year driven by the sale of government stocks which makes Thai rice price more competitive than Vietnamese rice.

Figure 1.4: Monthly Thai Rice Exports by Variety

Post’s forecast for MY2016/17 rice exports is revised up to 11 million metric tons. This is an 11 percent increase from MY2015/16. Traders expect that a portion of the remaining feed/industrial quality rice stocks of 2.1 million metric tons could be reprocessed for exports at competitive prices, particularly to African countries. Meanwhile, MY2017/18 rice exports are forecast to decline to 10 million metric tons, a 9 percent reduction from MY2016/17 as the government has depleted its rice stocks in MY2016/17.

1.4 Government Stocks

stocks of 0.6 million metric tons of deteriorate rice by the end of August 2017. If these rice stocks are purchased, total government stocks are likely to be only 0.1 – 0.2 million metric tons (Figure 1.5 and 1.6). However, a portion of the already sold government stocks will likely be carried over to MY2017/18 as the government allows for a delivery period up to 7 months for the tender buyers who purchase more than 0.3 million metric tons. Stocks sold to feed mills, fertilizer producers, and the energy industry are likely to be carried over to the next marketing year due to limited utilization capacity.

MY2017/18 rice stocks are expected to further decline to 3.9 million metric tons, down 19 percent from MY2016/17 due to a reduction in the government stocks which has mostly been depleted in MY2016/17. Rice stocks will be dominated by commercial stocks of millers and exporters. They normally hold average stocks of approximately 2 months of use.

Figure 1.5: Government Rice Stocks

Figure 1.6: Sale of Government Stocks in 2017

In MY2017/18, the government is likely to maintain the measures implemented in MY2016/17 to help stabilize farm-gate prices of main-crop rice paddy, as followed: (1) On-Farm Pledging

Program, (2) Interest Rate Subsidy Program for rice millers and traders to stockpile rice paddy for 2-6 months, and (3) Soft Loans for Farmer Institutions to buy rice paddy from farmers during October 1, 2017 – September 30, 2018. The details of the on-farm pledging program have not been finalized, but the program will only support fragrant rice paddy in the northeastern region. Rice farmers will also receive a storage cost subsidy of 1,500 baht per metric ton (U.S. $45/MT) and certain harvest and postharvest handling costs of 12,000 baht per household (U.S. $364). Although intervention prices for the on-farm pledging program were set below market prices, participating farmers are expected to receive net payments that were higher than market prices when the supplemental payments are included like in MY2016/17 when the net payment was 20-40 percent above market prices.

Under the MY2016/17 On-Farm Rice Paddy Pledging Program, the program received total pledge of approximately 1.6 million metric tons (mostly fragrant rice paddy) from farmers. Most of the pledged rice paddy has been redeemed as the current market price (10,095 baht per metric ton (U.S. $300/MT)) is far above the intervention price (9,500 baht per metric ton (U.S. $284/MT)).

2. Corn

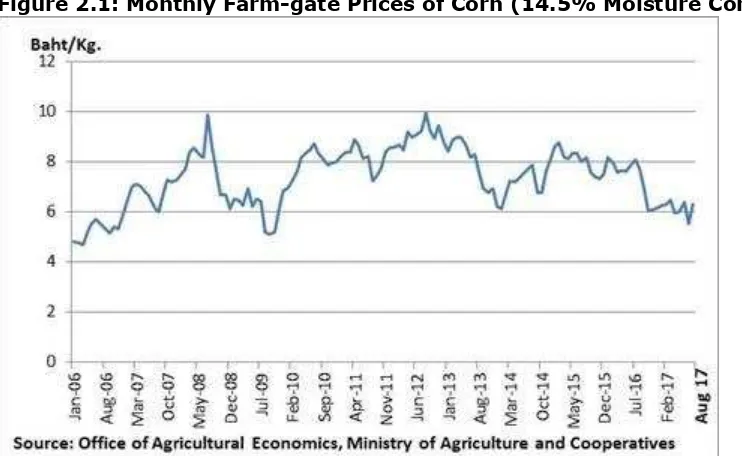

The MY2017/18 corn harvest is well underway. The flooding during July – August 2017 has had minimal impact on corn production. Post’s forecast for MY2017/18 production remains unchanged at 4.9 million metric tons. This is a 6 percent reduction from last year due to both unattractive corn prices and the seizure of corn planted in illegally deforested areas. In August 2017, farm-gate prices for corn are around 6.0 - 6.5 baht per kilogram (U.S. $181 - 196/MT) which is 18 percent below last year’s price of about 7.5 – 8.0 baht/kg (U.S. $227 – 242/MT) despite the government’s implementation of domestic corn purchase requirements for imported feed wheat.

Figure 2.1: Monthly Farm-gate Prices of Corn (14.5% Moisture Content)

According to the Thai Customs Department, MY2016/17 corn exports totaled 728,772 metric tons. This is double last year’s export levels due to larger exportable supplies as large feed mills avoided using corn from illegally deforested areas. Additionally, in MY2016/17 feed mills substituted corn with relatively cheaper feed-quality rice stocks and imported feed wheat in swine and poultry feed rations. Corn exports are mostly destined to the Philippines and Vietnam. However, in

wheat import restrictions cause greater use of domestic corn by poultry industry.

3. Wheat

MY2016/17 wheat imports totaled 4.1 million metric tons which is a 13 percent reduction from MY2015/16 due to a reduction in the import of feed wheat. Feed wheat imported totaled 2.6 million metric tons, down 21 percent from last year due to the new import regulations which have restricted feed wheat imports since January 2017. Meanwhile, milling wheat imports increased to 1.2 million metric tons, up approximately 4 percent from MY2015/16. Imports of U.S. wheat increased to 0.7 million metric tons, up 12 percent from MY2015/16 due to strong demand for high-protein wheat for bakery products as supplies of high protein Canadian wheat are limited. Imports of Canadian wheat declined to 91,817 metric tons, down 33 percent from MY2015/16. Post’s forecast for MY2017/18 wheat imports remain unchanged at 3 million metric tons, down 27 percent from MY2016/17 due to a further reduction in feed wheat imports following the import restriction to protect domestic corn. The government is considering lifting the domestic absorption requirement for imported feed wheat. However, if they do so, the government will raise the

import tariff on feed wheat.

Appendix Tables

Table 2: Thailand’s Corn Production, Supply and Demand

Corn 2015/2016 2016/2017 2017/2018

Market Begin

Year Jul 2015 Jul 2016 Jul 2017

Table 3: Thailand’s Wheat Production, Supply and Demand

Wheat 2015/2016 2016/2017 2017/2018

Market Begin

Year Jul 2015 Jul 2016 Jul 2017