1

PT Bank Tabungan Negara (Persero), Tbk.

Pengungkapan

Leverage Ratio

Posisi 30 Juni 2017

(Dasar : Surat OJK No. S-196/PB-11/2014)

I.

Informasi

Leverage Ratio

Utama

a.

Modal Inti

Modal Inti (Tier I) Bank posisi 30 Juni 2017 sebesar Rp 16,21 Triliun (atau 15,08 % dari ATMR), telah

sesuai dengan Peraturan Otoritas Jasa Keuangan yang tertuang dalam POJK No.11/POJK.03/2016

sebagaimana diubah dengan POJK No. 34/POJK.03/2016 tanggal 22 September 2016 tentang

Kewajiban Penyediaan Modal Minimum Bank Umum, yang mensyaratkan modal inti paling rendah

sebesar 6%.

b.

Exposure Measure

Jumlah

Exposure Measure

Bank posisi 30 Juni 2017 sebesar Rp 225,10 Triliun yang terdiri dari

eksposur aset di neraca, transaksi derivatif, SFT dan eksposur transaksi rekening administratif.

c.

Leverage Ratio

Leverage Ratio

posisi 30 Juni 2017 dibandingkan dengan angka 3 (tiga) triwulan terakhir, sebagaimana

Tabel 1 berikut ini :

Tabel 1

Leverage Ratio

Keterangan

30 Juni 2017

31 Maret 2017

31 Desember 2016 30 September 2016

Leverage Ratio

7,20 %

7,47 %

7,59%

7,80%

II.

Summary Information Table

Tabel Perbandingan antara total aset di neraca (

accounting asset

) dengan perhitungan eksposur

Leverage

Ratio

(

leverage ratio exposure measure

) sebagaimanaTabel 2 berikut ini :

Tabel 2

Summary Comparison Of Accounting Assets Vs Leverage Ratio Exposure Measure

Posisi Juni 2017 (Rp Juta)

1 Total consolidated assets as per published financial statements 224,066,811

2 Adjustment for investments in banking, financial, insurance or commercial entities that are consolidated for accounting purposes but outside the scope of regulatory concolidation 3 Adjustment for fiduciary assets recognised on the balance sheet pursuant to the operative

accounting framework but excluded from the leverage ratio exposure measure 4 Adjustment for derivative financial instruments

5 Adjustments for securities financing transactions (ie repos and similar secured lending) 3,413,714 6 Adjustments for off-balance sheet items (ie conversion to credit equivalent amounts of off

balance sheet exposures)

3,456,492

7 Other adjustments (5,828,674)

8 Leverage Ratio Exposure 225,108,343

2

III.

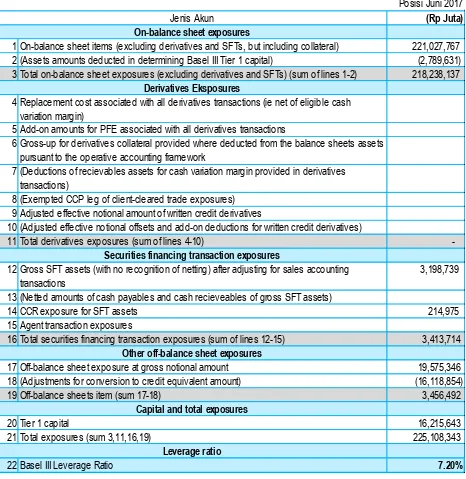

Common Disclosure Template

Tabel 3 berikut ini adalah

template Leverage Ratio Common Disclosure

Bank posisi 30 Juni 2017.

Tabel 3

Leverage Ratio Common Disclosure

IV.

Informasi Kualitatif Pendukung

Mengacu pada POJK No.11/POJK.03/2016 sebagaimana diubah dengan POJK No. 34/POJK.03/2016

tanggal 22 September 2016 tentang Kewajiban Penyediaan Modal Minimum Bank Umum, Bank telah

melakukan penyesuaian terhadap perhitungan Modal Inti (Tier 1) yang digunakan dalam perhitungan

Leverage Ratio

posisi 30 Juni 2017.

Posisi Juni 2017

(Rp Juta)

1 On-balance sheet items (excluding derivatives and SFTs, but including collateral) 221,027,767 2 (Assets amounts deducted in determining Basel III Tier 1 capital) (2,789,631) 3 Total on-balance sheet exposures (excluding derivatives and SFTs) (sum of lines 1-2) 218,238,137

4 Replacement cost associated with all derivatives transactions (ie net of eligible cash variation margin)

5 Add-on amounts for PFE associated with all derivatives transactions

6 Gross-up for derivatives collateral provided where deducted from the balance sheets assets pursuant to the operative accounting framework

7 (Deductions of recievables assets for cash variation margin provided in derivatives transactions)

8 (Exempted CCP leg of client-cleared trade exposures) 9 Adjusted effective notional amount of written credit derivatives

10 (Adjusted effective notional offsets and add-on deductions for written credit derivatives)

11 Total derivatives exposures (sum of lines 4-10) -

12 Gross SFT assets (with no recognition of netting) after adjusting for sales accounting transactions

3,198,739

13 (Netted amounts of cash payables and cash recieveables of gross SFT assets)

14 CCR exposure for SFT assets 214,975

22 Basel III Leverage Ratio 7.20%