IT spending in the midst of the Asian economic

downturn: a Singapore perspective

C. Soh*, B.S. Neo

Information Management Research Centre, Nanyang Business School, Nanyang Technological University, Singapore, Singapore

Received 26 October 1998; accepted for publication by Dr. Chris Sauer 2 February 1999

Abstract

The Asian economic downturn has severely affected the revenue and profitability of companies operating in Asia. This has in turn caused a significant number of companies to reduce their spending on IT, particularly in the countries that have been most affected by the downturn. While IT spending is an immediate and visible effect of the downturn, less visible changes in managerial attitudes towards IT, and approaches to controlling IT spending are likely to have longer term implications to the IT capabilities of companies in the region. In this paper, we examine these issues in the Singapore context, paying particular attention to how companies plan to control and reduce IT infrastructure spending. We found that in the participating firms, managers appear to pay more attention to the links between business strategy and IT after the downturn. We also found that deferring investments in physical infrastructure and outsourcing were the main approaches to IT cost reduction. q1999

Elsevier Science B.V. All rights reserved.

Keywords:IT spending; IT infrastructure; Asian economic crisis

1. Introduction

The Asian economic downturn was precipitated in July 1997 when Thailand abandoned its fixed exchange rate and floated the baht. The downward slide of foreign exchange rates of the four other East Asian countries with fundamental current account deficits soon followed. In all, by January 1998 the Indonesian rupiah had fallen by 77% of its value as at 1 July 1997, while the Thai baht had fallen by 53%, the South Korean won by 42%, the Malaysian ringgit by 40% and the Philippine peso by 38% (Lim, 1998). The current account surplus economies were also affected, although less severely. The Singapore

Journal of Strategic Information Systems 8 (1999) 13–20

0963-8687/99/$ - see front matterq1999 Elsevier Science B.V. All rights reserved. PII: S 0 9 6 3 - 8 6 8 7 ( 9 9 ) 0 0 0 1 0 - 4

dollar fell by 17%, the Taiwanese dollar by 17% and the Japanese yen by 9%. The stock market and the property market in these countries also experienced serious declines.

How have these major economic setbacks affected IT spending by companies operating in the previously buoyant East Asian economies? A survey conducted by MIS Asia, 1998 in March 1998 found that companies operating in different East Asian countries were responding differently to the economic crisis, depending on the severity of the economic downturn in their country. Companies in Singapore and the Philippines generally indi-cated that their IT spending would remain stable or even grow in 19981. Companies in Indonesia, Thailand and Malaysia, the countries most affected by the economic downturn, generally indicated that they would cutback on their IT spending. Not surprisingly, compa-nies most likely to cutback on IT spending were smaller in size, and were more likely to be local rather than multinational.

The MIS Asia study also found that the areas of IT expenditure which were more affected by cutbacks were hardware (37% of respondents were planning to reduce expen-diture), and software (36%). Areas of expenditure which were less affected by cutbacks were network infrastructure (28%), IT staff (27%), and IT services and maintenance (30%).

The percentage of respondents from Singapore who planned to reduce IT spending were much lower in all areas of IT expenditure: hardware (22%), software (19%), network infrastructure (15%), IT staff (18%), and IT services and maintenance (24%).

Our study takes a closer look at firms in Singapore. We examine the impact of the economic downturn on IT management’s view of IT. Has the economic downturn resulted in management becoming more cost-focused? We also examine the expected changes in overall IT spending in 1998 and 1999, as well as the tactics that firms use to save on IT costs. Finally, we focus on the important area of IT infrastructure, as firms’ spending on and management of infrastructure projects have long term implications for firm capability. The senior IT person from 21 large organizations was asked to provide detailed infor-mation on company performance, management perspectives, IT expenditure and approaches to managing IT during the economic downturn. The following sections provide a brief profile of the companies, and the key findings.

2. Profile of participating companies

The companies represent a variety of sectors, with three to four companies each from manufacturing, government, IT services and financial services. The companies were rela-tively large in the Singapore context, with more than half having over 1000 employees, and over S$100 million in annual revenues.

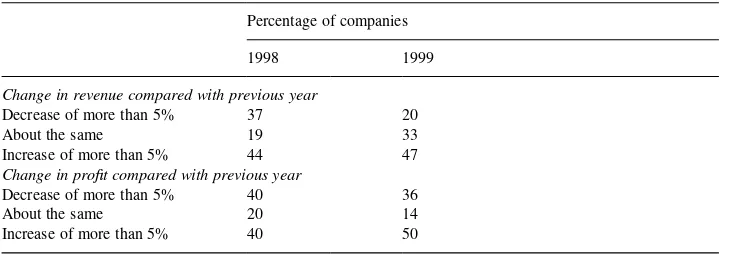

Companies’ expectations regarding financial performance in 1998 and 1999 are shown in Table 1. These represent their expectations as of August 1998, when the data was collected. There is fairly even representation in the sample of companies which expect to do better and those which expect to do worse in the two years. Most expected the magnitude of any changes in revenue and profit to be between 5 and 20%. Very few firms

anticipated changes to revenue or profit of more than 20%. Generally, companies indicated that they expected to perform somewhat better in 1999 than in 1998.

3. Management’s view of IT

We were interested to know whether the management’s view on IT had undergone changes as a result of the crisis. We adapted Weill’s (1992) three views of IT infrastructure to IT as a whole. The three views are: (1) IT as a utility providing necessary services at the lowest cost, (2) IT as primarily for supporting current business strategy, and (3) IT as a means of enabling and influencing future business strategy. We drew on the questions used in the study by Broadbent et al. (1996) to assess management’s view of IT. Table 2 summarizes the respondents’ assessment of the most important topics of discussion between business managers and senior IT managers at meetings before and after the downturn. Table 3 presents respondents’ assessment of the primary management view of IT in their organization.

Table 2 shows that the use of IT to support current business strategies and to enable new

Table 2

Focus of discussions between senior IT and business managers

Topic Percentage of companies where topic was frequently

discussed at meetinga

Before the downturn After the downturn

Cost and quality of IT services 62 62

IT support for the current

aRespondents were asked to indicate on a five point scale the frequency with which each topics was discussed.

The scale was as follows: (1) never, (2) rarely, (3) sometimes, (4) usually, (5) always. This Table summarizes the responses for those who indicated 4 (usually) or 5 (always).

Table 1

Expected changes in: (a) revenue; (b) profit

Percentage of companies

1998 1999

Change in revenue compared with previous year

Decrease of more than 5% 37 20

About the same 19 33

Increase of more than 5% 44 47

Change in profit compared with previous year

Decrease of more than 5% 40 36

About the same 20 14

business strategies is receiving much more management attention after the economic downturn. Surprisingly, the cost and quality of IT services has not received a similar increase in management attention. This is consistent with the results presented in Table 3 which shows that increasingly managers in many organizations are viewing IT as enabling new business strategies and are moving away from a cost-based, utility view of IT. The results suggest that managers may be viewing IT as one possible way of riding out the downturn through more effective deployment of current strategy, or through enabling new strategies.

4. IT spending

For most firms, IT spending accounts for a relatively small portion of their operating budget. The majority of the respondents (70%) indicated that their organizations spent less than 5% of operating budget on IT in 1997.

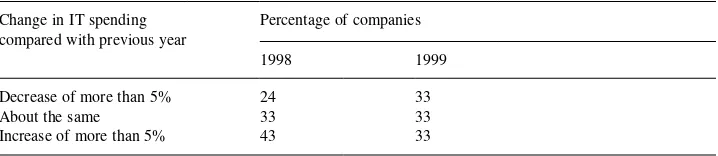

Estimated levels of IT spending for 1998 and 1999 are fairly robust. 43% of the companies in the study expect to increase IT spending by 5–20% compared with 1997, and a third expect to spend about the same amount in both 1998 and 1999 (Table 4).

Interestingly, even though about 40% of the companies expect a decrease in revenues and profits (Table 1), we do not see a corresponding proportion of companies decreasing IT expenditure in 1998—only 24% expect a decrease in IT spending. This may, in part, be due to the time lag in adjusting IT expenditures. For in 1999, we note that the proportion of companies that expect a decrease in IT expenditure rises to 33%. The majority of these companies expect to decrease spending by between 5 and 20% compared with the previous year, and only a handful expect IT expenditure to decrease by more than 20%.

Table 3

Managers’ primary view of IT

Relationship between IT and business strategy

Percentage of companies

Before the downturn After the downturn

IT is primarily for cost reduction 24 19

Business strategy drives IT expenditure 62 52

Business strategy influences and is

Decrease of more than 5% 24 33

About the same 33 33

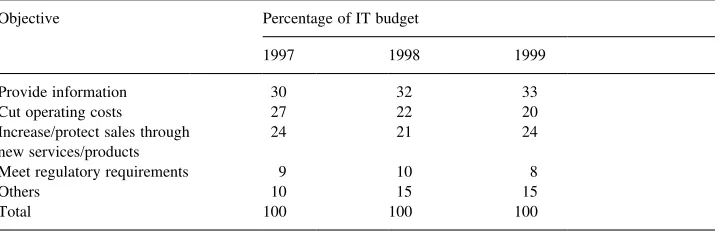

While the size of the IT spending pie will see some changes in most firms, the allocation of the IT pie to different business objectives is expected to remain fairly stable (Table 5). The major objective for IT spending continues to be information provision for decision making and control, which accounts for over 30% of IT spending. Enabling new services or products, and increasing operating efficiency are the other two major categories of objectives for IT spending.

While only a third of the respondent firms expect to see a reduction intotalIT spending, about half the respondent firms are planning to take steps to save onsomeIT costs. The approaches most frequently used by firms for reducing IT cost are deferring investment in physical IT infrastructure and outsourcing (Table 6). Firms expect these approaches to contribute between 10 and 20% to the total IT cost reduction. The other approaches to IT cost reduction, such as reducing IT headcount, reducing IT training, deferring new appli-cations, and consolidating physical infrastructure or appliappli-cations, are used less frequently. About half of the companies that are looking into cost reduction do not use these approaches at all. A few firms were looking to reduce IT spending by 30% or more. Such firms were most likely to do so by consolidating physical IT infrastructure, deferring investment in physical IT infrastructure, or by outsourcing IT activities.

5. Spending on IT infrastructure

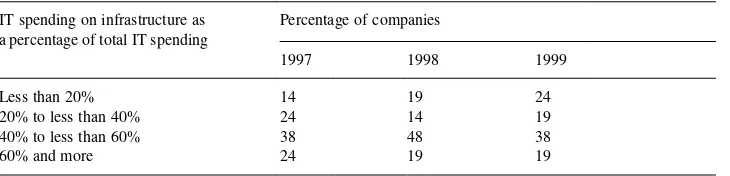

Given the long-term, capability-enhancing role of IT infrastructure, we were also inter-ested in the pattern of IT infrastructure spending before and after the onset of the economic downturn.

Infrastructure spending is more likely to lag firm performance because current infra-structure projects in progress may take longer to complete. However, firms looking to cut back on IT spending are also most likely to cut back on planned infrastructure projects, as these do not affect the firm’s current operations. We therefore expect to see a lower proportion of IT budget being allocated to infrastructure, especially by 1999.

The results in Table 7 suggest that the proportion of the total IT pie allocated to infrastructure will remain fairly stable. A few firms plan to spend a lower proportion of their IT budget on infrastructure in 1999. The number of firms spending less than 20% of

Table 5

Purpose of IT spending

Objective Percentage of IT budget

1997 1998 1999

Provide information 30 32 33

Cut operating costs 27 22 20

Increase/protect sales through new services/products

24 21 24

Meet regulatory requirements 9 10 8

Others 10 15 15

their IT budget on infrastructure increases in 1999, while those that spend more than 60% of their IT budget on infrastructure decreases in 1999.

Firms were also asked to list infrastructure projects that would be put on hold, and those that would be accelerated. We found that firms were far more likely to accelerate infra-structure projects rather than to put them on hold. In all, the firms in the sample indicated that 25 infrastructure projects were being accelerated, and only nine were put on hold. This is understandable given that if commitments have been made to an infrastructure project, some costs would already have been incurred. Unless the company is in dire straits, it is unlikely that projects will be abandoned once begun. However, the economic downturn is likely to put pressure on infrastructure projects to be completed as quickly and cost-effectively as possible, and to begin to show returns.

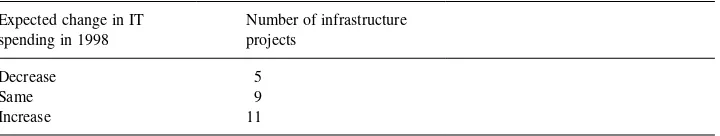

The nine projects that were put on hold were from firms that expected total IT spending to either remain the same or to decrease (Table 8). The projects that were most frequently mentioned as being put on hold were Enterprise Resource Planning systems. Other projects being put on hold appear to fall into the category of “nice-to-have” but not mission critical. They included computer room renovation, network upgrades, standardiz-ing the PC platform. The infrastructure projects that are to be accelerated are largely from

Table 7

Spending on IT infrastructure

IT spending on infrastructure as a percentage of total IT spending

Percentage of companies

Percentage of firms using the various approaches to IT cost reduction

Tactics for cost reduction Percentage of total IT cost reduction

0 10–20% 30–50% .60%

Percentage of companies

Deferring investment in physical IT infrastructure

17 66 17 0

Outsourcing IT 33 50 0 17

Reducing IT headcount 59 25 8 8

Reducing IT training 50 34 8 8

Deferring investment in IT

firms which expected IT spending to either increase or stay the same in 1998 (Table 9). A quarter of the projects are about building or upgrading the network infrastructure. This is consistent with the findings of the MIS Asia study that found that spending on network infrastructure was less affected by cutbacks than other areas of IT spending. This is because the network infrastructure is a prerequisite for many of the strategic IT initiatives that firms have begun. Examples of such initiatives provided by respondents include data warehousing, knowledge management, and e-commerce. The next most frequently mentioned infrastructure projects being accelerated relate to downsizing from mainframe to client–server environment and standardizing desktop computing. The rest of the infra-structure projects reflect necessary investments (such as Y2K compliance) and operational concerns such as data center consolidation and security infrastructure.

6. Conclusions and implications for practice and research

A number of trends from the sample of Singapore firms are clear from the findings:

• The economic downturn is prompting more managers to take a closer look at IT

spending in terms of supporting current business strategy and enabling future business strategy.

• there is a lag in the impact of the economic downturn and IT spending, as the number of

firms that expect a decrease in IT spending grows between 1998 and 1999;

• the main approaches to IT cost cutting are deferral of physical IT infrastructure

invest-ments, and outsourcing;

• firms are more likely to try to accelerate infrastructure projects to which they have

committed rather than put them on hold.

What are the implications for companies of these emerging patterns of IT spending?

That two-thirds of the companies expect IT spending to increase or stay the same even in 1999 is encouraging, as is the increasing management focus on the strategic use of IT. However, there is also worrying evidence from about half the companies surveyed that investments in physical infrastructure will be deferred. If this is carried on for the next three to five years (the estimated time before the economy recovers), there may be deterioration of organization-wide IT capability.

The second major approach to cost saving is IT outsourcing. Most Singapore companies have not outsourced much of their IT services previously. Hence, we are of the view that some increase in selective outsourcing will benefit most firms, and help them to focus on more value-added IT functions. However, firms must be careful not to adopt a primarily cost-oriented focus that may result in incorrect outsourcing decisions, where short term cost savings are obtained at the expense of long term competitiveness. For example, core IT capabilities may be outsourced because insufficient consideration is given to longer term issues such as the firm’s ability to provide innovative, IT-enabled products and services. Firms’ IT investment decisions during the next few years, particularly in the area of IT infrastructure, both physical and human, are likely to have significant impact on their ability to respond to the business environment when the economy recovers. A long-itudinal tracking of firms’ IT spending and resultant capabilities is likely to provide useful insights to managing the IT resource in a lean environment.

References

Broadbent, M., Weill, P., O’Brien, T., Neo, B.S., 1996. Firm context and patterns of IT infrastructure capability. In: Proceedings of the International Conference on Information Systems, pp. 174–194.

Lim, C.Y., 1998. The solution to the Asian Economic Currency Crisis, key note address at the International Conference on The New Role of Government in a Market Economy, Nanyang Technological University, Singapore, February.

MIS Asia, 1998. Snapshot Survey 1998, May.