6 CHAPTER II

REVIEW OF RELATED LITERATURE AND HYPOTHESIS DEVELOPMENT

1.1. Personal Finance

Personal Finance refers to the financial management done by an individual or a family to obtain, allocate, save, and spend monetary resources over time. Tyson (2010) noted that personal finance covers several key concepts: spending, taxes, saving and investing, insurance, and planning for major goals like education, buying a home, and retirement. Based on the opinion above, personal finance is not simply about current financial management of an individual or a family, but also includes their long term financial management. People who can manage their monetary resources are the people with good personal finance.

7

of personal finance. Thereby it is clear that CBB can be seen as a part of personal finance, especially of individual personal finance.

1.2. CBB

Faber dan O‟Guinn (1988) defined CBB as a detrimental condition

caused by an uncontrollable drive with the following definition:

“a response to an uncontrollable drive or desire to obtain, use or experience a feeling, substance or activity that leads an individual to repetitively engage in a behavior that will ultimately cause harm to the individual and/or to others.”

This definition implies that CBB will not only cause harm to compulsive buyers, but to others as well. In more detail, Faber et al. (1987) have identified three characteristics of CBB: (1) the presence of a drive, impulse, or urge to engage in the behavior; (2) denial of the harmful consequences of engaging in the behavior, and (c) repeated failure in attempts to control or modify the behavior.

8

definition used in this study is adopted from Black (2007) who defined CBB as excessive shopping cognitions and buying behavior that leads to distress or impairment.

1.3. Borrowing Habit

Basically people borrow money because they need it to fulfill their needs and wants, either in a small or large amount. Youth borrow money from friends in order to earn enough money to spend (Attri, 2012). When people borrow money again and again even frequently, it becomes a borrowing habit. Shefrin (2013) stated that there are a lot of people with bad borrowing habit. It implies that managing money, especially managing debt, for many people is not an easy matter as well as managing spending and saving.

According to Robb & Sharpe (2009), borrowing can be envisioned as a two-step process. They stated:

“the decision of whether or not to borrow is the first step in that process. Once a decision is made to borrow, the next step is to decide how much to borrow, taking the cost of borrowing into consideration.” Here to borrow money there are two questions to be considered: is it really needed? and if it is then the next question is how much?

9

questions more carefully may be classified as the people who have good borrowing habit, vice versa. However, since there isn‟t any explicit

definition of borrowing habit found, based on the explanation above then the definition of borrowing habit in this study is simplified as the tendency to borrow money from others.

1.4. Pocket Money

Furnham (1999) defined pocket money as „money they have been given‟ in his study on young people. Pocket money in terms of when it is

earned could be divided into two types: regular pocket money and irregular pocket money. If it is earned in every spesific period of time then it is called a regular pocket money, but if it is earned not in every spesific period of time then it is an irregular pocket money. Barnet-Verzat & Wolff (2008) argued about both kinds of pocket money: “when children are young,

irregular allowances are more frequent than regular ones, but their amounts are also lower compared to regular pocket money.”

10

It is defined as the amount of money earned by students from their parents in every month. In Indonesia it is well known as ‘uang bulanan’.

1.5. Peer Acceptance

According to Slaughter et al. (2002), peer acceptance refers to the extent to which children are accepted or rejected by their peer group. Consistent with that definition, Gifford-Smith & Brownell (2003) defined peer acceptance as: “the degree to which children are liked or disliked by the children in their peer group”. When the degree is high, it implies that they have a high peer acceptance, vice versa. Basically both definitions are essentially the same, it is the terms used that distinguishes them. The first definition used the term „are accepted‟ while the second definition used „are liked‟ to describe that a person is welcomed by his peers. The second term used differently is the term „are rejected‟ and „are disliked‟ which refers to

the condition where a person is not welcomed by his peers. The most suitable measurement of peer acceptance based on the above definitions would be to ask their peers, not the individuals.

11

thoughts, and actions of an individual. Similarly, Aral (2010) noted that rooted in utility theory, the influence is about how the behaviors of one‟s peers change the utility one expects to receive from engaging in a certain behavior and thus the likelihood that (or extent to which) one will engage in that behavior.

Here, peer acceptance is best explained by the term utilitarian influence, in which an individual is willing to satisfy a certain group‟s

expectation (Kelman, 1961). It is also noted by Yang et al. (2007) that suggesting in the advertisements that one may obtain social approval and acceptance by just using a certain commodity, will have an influence on certain groups of consumers. Based on the definition of Bristol & Mangleburg (2005), this study defines peer acceptance as the effort an individual make in order to be accepted by his peers.

1.6. Money Retention

12

thrift, hoarding, and obssesive personality. Power prestige as the last domain of money attitude covers status, self interest, superiority, and acceptance. Accordingly, a person‟s money attitude can be assessed based on these three

domains.

This study focuses specifically on one domain of money attitude: money retention. Money retention wasn‟t defined explicitly by Yamauchi &

Templer, but they did make the questionnaires to measure it. In this study it is the definition by Furnham (1984) as well as Blaszczynski & Nower (2008) that is used, they defined retention time really simple as being careful with money. People with high retention time are them who are carefully on using their money, vice versa.

1.7. HYPOTHESIS DEVELOPMENT 1.7.1. The Effect of Pocket Money on CBB

13

The effect of pocket money on buying behavior, especially to impulsive buying behavior was investigated by Lin & Lin (2005). They found that this behavior tended to increase when there was an increasing of the amount of pocket money. As well as the effect on impulsive buying behavior, the effect of pocket money on compulsive buying behavior is also positive because it increases the chance to do both negative buying behaviors.

H1 : Pocket money has a positive and significant effect on CBB

1.7.2. The Effect of Peer Acceptance on CBB

People who are not accepted by their peers tend to do greater effort to be accepted than those who are already accepted by their peers. Those who aren‟t accepted in some cases will try to do whatever is required by

their peers. They also will buy things that their peers already have to look the same as their peers.

The study conducted by Guo & Cai (2011) also found peers as one of several determinants of CBB. More clearly they explained the relationship beetween peer acceptance and CBB as follow:

14

It is noted by this definition that peer acceptance is an important factor for people, that to gain such acceptance they can buy things only to impress their peers.

H2 : peer acceptance has a positive significant effect on CBB.

1.7.3. The Effect of Money Retention on CBB

People who are careful with money will be able to restrain themselves for not wasting money to buy things they don‟t need. These are

the people with high retention time. Because of their money retention, they prefer saving to spending, even when they have extra money. Hence, their consumption behavior can be managed better and they become more capable on controlling compulsive buying behavior.

One of the factors that influence consumer behavior according to Wang (2004) is money attitude. The same conclusion is also made by Li et al. (2009), where they stated that retention time has significant effect on CBB. Besides having a significant effect on CBB, money attitude is also found as a factor that shape people‟s money behavior (Taneja, 2012).

15

1.7.4. The Effect of Pocket Money on Borrowing Habit

People who have small amount of money tend to be less confidence on borrowing money because they don‟t believe on their ability to pay back

the loan. Supporting this statement, Callender & Jackson (2005) found that students from low-income family are more debt-averse. In case of using loan to pay college expenses, Linenmeier, Rosen, & Rouse (2006) concluded that the low-income students are less willing to use loan. Another similiar finding comes from De La Rosa (2012) who found that those low-income students are more likely to commit themselves to minimal borrowing.

The same logical thinking can be used to analyze the effect of pocket money on borrowing habit. Students with lower pocket money may have less willingness to borrow money or commit themselves to minimal borrowing because they don‟t believe on their ability to pay the loan. In

contrast, the high-pocket money students may show the opposite attitude: higher borrowing habit.

H4 : Pocket money has a positive significant effect on borrowing habit.

1.7.5. The Effect of Peer Acceptance on Borrowing Habit

There is a strong influence of peers on a person‟s attitude,

16

found by Rindfleisch, Burroughs, & Denton (1997), who stated that peers can influence materialism. Moreover, according to Ponchio & Aranha (2008), materialistic consumers are willing to carry heavier debt loads. When people have credit cards, there is a positive relationship between materialism and credit overuse (Richins, 2011). If credit card is seen as a person to whom people borrow money, than the amount of money people borrow is too much when there is a credit overuse. These findings suggest that it is possible that when peer acceptance is high, people tend to be more materialistic, and being materialistic increases their demand of money. To cover this demand of money, some people gets credit overuse and some may increase their borrowing from family or friends.

H5 : Peer acceptance has a positive significant effect on borrowing habit.

1.7.6. The Effect of Money Retention on Borrowing Habit

17

The money that people usually borrow when they want to make purchases are not needed by these people. The first reason is because they have their saving to cover it so instead of borrowing money, they will take money from their saving. The second reason is that people with high retention time usually have their budget for everything so it‟s rarely happen

that they need extra money. These people with high retention time who are called budget-minded individuals by Engelberg & Sjoberg (2006) also found to have less favorable attitudes toward borrowing money on previous studies.

H6 : Money retention has a negative significant effect on borrowing

habit.

1.7.7. The Effect of CBB on Borrowing Habit

Generally, compulsive buyers need more money than normal people do. The reason is because their willingness to buy can easily come whenever they feel unhappy, sad, or depressed. For these people, when the willingness to buy come they will try hard to make it happen. When they want to make purchases but in the same time they do not have money, these people will try to get the money.

18

enough money, the more they borrow. The more often they borrow, the worse their borrowing habit. In the end they usually have a lot of debt to be paid (Joireman et al., 2010) without having the ability to pay. This conclusion is also supported by Edwards (1993) who stated on his paper that many cases of excessive borrowing are resulted from compulsive spending. Workman (2010) even called the people who love to borrow money because of their compulsive buying behavior as compulsive debtor.

The effect of CBB on borrowing habit can also be analyzed using the prospect theory by Kahneman & Tversky (1979). Compulsive buyers are those who are in the „loss domain‟ since they tend to be risk takers and tend

to take irrational actions, including borrowing money. Therefore they do not hesitate on making decision about borrowing money although they realize that borrowing money means more debt to pay, a bigger risk.

H7 : CBB has a positive significant effect on borrowing habit.

1.7.8. The Mediating Role of CBB on the Effect of Pocket Money to Borrowing Habit

19

Similarly, when people have larger amount of money, they have greater chance to make purchases than those who have limited amount of money.

The effect of pocket money on buying behavior, especially to buying behavior has been investigated by Lin & Lin (2005). The authors found that impulsive buying behavior tend to increase when there is an increasing of the amount of pocket money. As well as the effect on impulsive buying behavior, the effect of pocket money on CBB is also positive as found by Guo & Cai (2011). By having large amount of money that will lead people to be compulsive buyers, these people will also suffer from their unmanageable debt because of their CBB. It is because compulsive buyers continually need to borrow money from family and friends, not only for shopping but to pay their credit card debt.

H8 : CBB plays mediating role between pocket money and borrowing

habit

1.7.9. The Mediating Role of CBB on the Effect of Peer Acceptance to Borrowing Habit

20

try to do whatever is required by their peers. They also will buy things that their peers already have to look the same as their peers in order to adapt.

The study conducted by Guo & Cai (2011) also found peers as one of several determinants of CBB. More clearly the authors explained the relationship beetween peer influence and CBB as follow:

“in order to gain acceptance and support from their peers, both of complying with the expectations of others and buying products that are recognized and approved by others are key success factors to adolescents”.

It is noted by this definition that peer influence is an important factor for people, that to gain acceptance they can buy things only in order to impress their peers. Since buying things to improve peers is noted as a key success factor, many people are finally trapped in CBB and have debt problems because of their CBB. This debt problems indicate that many compulsive buyers used to overuse their credit cards or they used to borrow money from their friends or relatives that they finally get problem about paying their credit card or giving back the money they‟ve borrowed from their friends. Particularly about giving back the money they‟ve borrowed, it may happen

for some reasons. An explanation that may be the reason is that they‟ve borrowed money from time to time in many friends that it has became a habit that they can not control.

H9 : CBB plays mediating role between peer acceptance and borrowing

21

1.7.10. The Mediating Role of CBB between Money Retention and Borrowing Habit

People who are careful with money are able to restrain themselves for not wasting money to buy things they don‟t need. These are the people

with high retention time. Because of their money retention, they prefer saving to spending, even when they have extra money. Hence, their buying behavior can be managed better and they become more capable on controlling CBB. The same conclusion is also made by Li et al. (2009), by stating that retention time has a significant effect on CBB.

As noted in the previous chapter, the percentage of compulsive buyers is continually increasing. Hence, trying to control CBB is a good advice for all of us. As it is found that by being careful with money people can hold down CBB, being careful with money is a way to control CBB. By being careful with money, compulsive buying tendency will be reduced and therefore compulsive buyers won‟t need an increasing amount of money.

Finally they can control their debt and making minimal borrowing.

H10 : CBB plays mediating role between money retention and borrowing

22

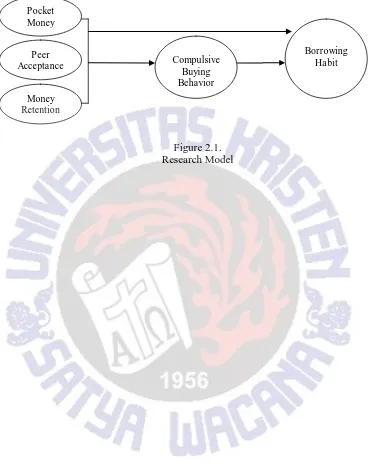

Figure 2.1. Research Model

Compulsive Buying Behavior

Borrowing Habit Pocket

Money

Peer Acceptance

[image:17.516.80.448.82.552.2]