27 CHAPTER IV

RESULT AND DISCUSSION

4.1. Respondents’ Characteristics

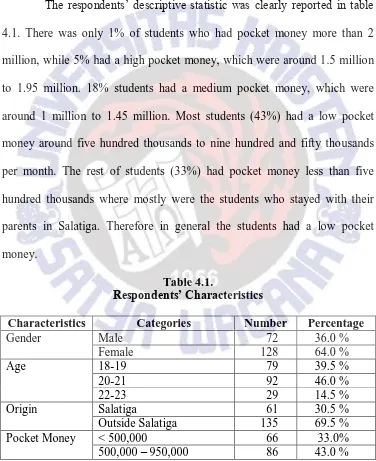

The respondents‟ descriptive statistic was clearly reported in table

4.1. There was only 1% of students who had pocket money more than 2 million, while 5% had a high pocket money, which were around 1.5 million to 1.95 million. 18% students had a medium pocket money, which were around 1 million to 1.45 million. Most students (43%) had a low pocket money around five hundred thousands to nine hundred and fifty thousands per month. The rest of students (33%) had pocket money less than five hundred thousands where mostly were the students who stayed with their parents in Salatiga. Therefore in general the students had a low pocket money.

Table 4.1.

Respondents’ Characteristics

Characteristics Categories Number Percentage

Gender Male 72 36.0 %

Female 128 64.0 %

Age 18-19 79 39.5 %

20-21 92 46.0 %

22-23 29 14.5 %

Origin Salatiga 61 30.5 %

Outside Salatiga 135 69.5 %

Pocket Money < 500,000 66 33.0%

28

1,000,000 – 1,450,000 36 18.0 % 1,500,000 – 1,950,000 10 5.0%

> 2,000,000 2 1.0 %

Set aside money for savings

Yes 160 80.0%

No 40 20.0%

In case lack of pocket money

Ask parents to give money 121 60.5%

Take from saving 37 18.5%

Borrow from friends or relatives

25 12.5%

Others 17 8.5%

Three biggest spending

Food, telecommunication, printing and copying study-related material

Source: Primary Data, 2014

29 4.2. Goodness of Fit

4.2.1. Normality

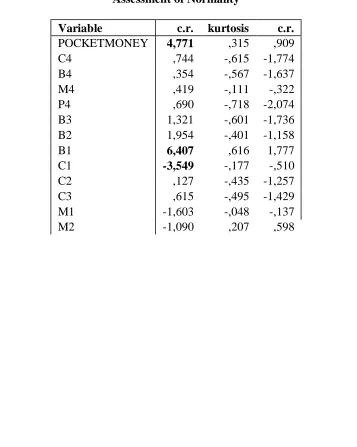

30 Table 4.2.

Assessment of Normality

Variable c.r. kurtosis c.r.

POCKETMONEY 4,771 ,315 ,909

C4 ,744 -,615 -1,774

B4 ,354 -,567 -1,637

M4 ,419 -,111 -,322

P4 ,690 -,718 -2,074

B3 1,321 -,601 -1,736

B2 1,954 -,401 -1,158

B1 6,407 ,616 1,777

C1 -3,549 -,177 -,510

C2 ,127 -,435 -1,257

C3 ,615 -,495 -1,429

M1 -1,603 -,048 -,137

M2 -1,090 ,207 ,598

M3 -2,946 ,266 ,769

P1 1,540 -,352 -1,015

P2 -1,271 -,055 -,159

P3 1,224 -,332 -,959

Multivariate 8,592 2,390

Source: appendix 8

4.2.2. Outliers

1. Univariate Outliers

31

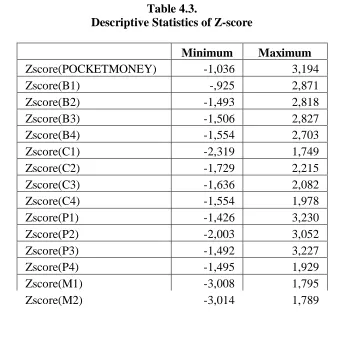

indicator B1 while the highest score was shown by indicator P1 with the score 3.23. This finding supported the conclusion from the previous normality assessment that the data was normally distributed and there was no univariate outlier.

Table 4.3.

Descriptive Statistics of Z-score

Minimum Maximum

Zscore(POCKETMONEY) -1,036 3,194

Zscore(B1) -,925 2,871

Zscore(B2) -1,493 2,818

Zscore(B3) -1,506 2,827

Zscore(B4) -1,554 2,703

Zscore(C1) -2,319 1,749

Zscore(C2) -1,729 2,215

Zscore(C3) -1,636 2,082

Zscore(C4) -1,554 1,978

Zscore(P1) -1,426 3,230

Zscore(P2) -2,003 3,052

Zscore(P3) -1,492 3,227

Zscore(P4) -1,495 1,929

Zscore(M1) -3,008 1,795

Zscore(M2) -3,014 1,789

Zscore(M3) -3,194 1,692

Zscore(M4) -2,361 1,981

Source: appendix 9

2. Multivariate Outliers

32

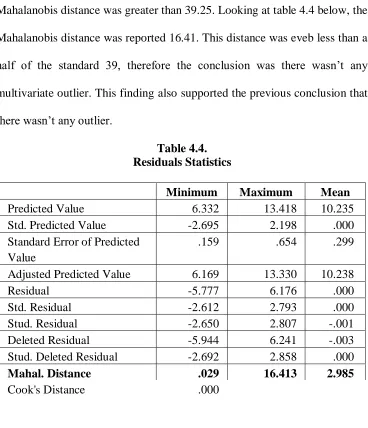

outlier. The criteria used here was the Mahalanobis distance for p < 0.01. The distance then evaluated using chi square (χ2) with the degree of freedom as much as the number of indicators used. There were 16 indicators used in this study, therefore the criteria for the Mahalanobis distance for p < 0.01 was χ2 (16, 0.001) = 39.25. Multivariate outlier was indicated when the Mahalanobis distance was greater than 39.25. Looking at table 4.4 below, the Mahalanobis distance was reported 16.41. This distance was eveb less than a half of the standard 39, therefore the conclusion was there wasn‟t any

multivariate outlier. This finding also supported the previous conclusion that there wasn‟t any outlier.

Table 4.4. Residuals Statistics

Minimum Maximum Mean

Predicted Value 6.332 13.418 10.235

Std. Predicted Value -2.695 2.198 .000

Standard Error of Predicted Value

.159 .654 .299

Adjusted Predicted Value 6.169 13.330 10.238

Residual -5.777 6.176 .000

Std. Residual -2.612 2.793 .000

Stud. Residual -2.650 2.807 -.001

Deleted Residual -5.944 6.241 -.003

Stud. Deleted Residual -2.692 2.858 .000

Mahal. Distance .029 16.413 2.985

Cook's Distance .000 .068 .006

Centered Leverage Value .000 .082 .015

33 4.3. Structural Equation Modelling

4.3.1. Confirmatory Factor Analysis (CFA) CFA for exogenous constructs

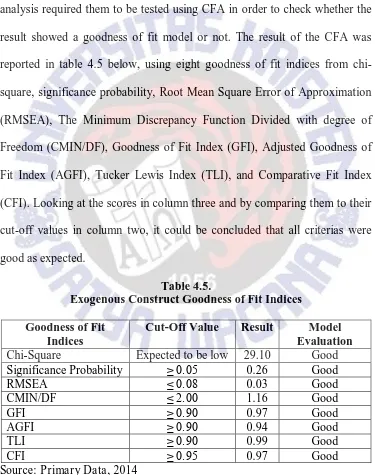

There were three independent variables used in this study and SEM analysis required them to be tested using CFA in order to check whether the result showed a goodness of fit model or not. The result of the CFA was reported in table 4.5 below, using eight goodness of fit indices from chi-square, significance probability, Root Mean Square Error of Approximation (RMSEA), The Minimum Discrepancy Function Divided with degree of Freedom (CMIN/DF), Goodness of Fit Index (GFI), Adjusted Goodness of Fit Index (AGFI), Tucker Lewis Index (TLI), and Comparative Fit Index (CFI). Looking at the scores in column three and by comparing them to their cut-off values in column two, it could be concluded that all criterias were good as expected.

Table 4.5.

Exogenous Construct Goodness of Fit Indices Goodness of Fit

Indices

Cut-Off Value Result Model Evaluation

Chi-Square Expected to be low 29.10 Good

Significance Probability ≥ 0.05 0.26 Good

RMSEA ≤ 0.08 0.03 Good

CMIN/DF ≤ 2.00 1.16 Good

GFI ≥ 0.90 0.97 Good

AGFI ≥ 0.90 0.94 Good

TLI ≥ 0.90 0.99 Good

CFI ≥ 0.95 0.97 Good

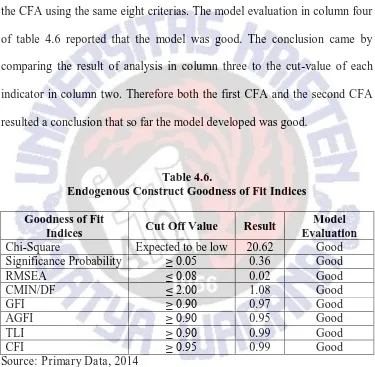

34 CFA for endogenous constructs

Two endogenous constructs were used in this study, CBB as the intervening variable and borrowing habit as the dependent variable. As well as the exonegous variables, both of the endogenous variables must also pass the CFA using the same eight criterias. The model evaluation in column four of table 4.6 reported that the model was good. The conclusion came by comparing the result of analysis in column three to the cut-value of each indicator in column two. Therefore both the first CFA and the second CFA resulted a conclusion that so far the model developed was good.

Table 4.6.

Endogenous Construct Goodness of Fit Indices Goodness of Fit

Indices Cut Off Value Result

Model Evaluation

Chi-Square Expected to be low 20.62 Good

Significance Probability ≥ 0.05 0.36 Good

RMSEA ≤ 0.08 0.02 Good

CMIN/DF ≤ 2.00 1.08 Good

GFI ≥ 0.90 0.97 Good

AGFI ≥ 0.90 0.95 Good

TLI ≥ 0.90 0.99 Good

CFI ≥ 0.95 0.99 Good

35 Figure 4.1.

36 Figure 4.2.

CFA of Endogenous Construct

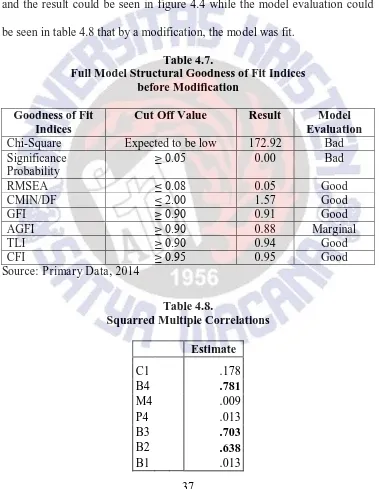

4.3.2. Full Structural Equation Model Analysis 4.3.2.1. Model Fit

37

with loading factor that less than 0.5 was not valid and must be cut. The loading factor of all indicators used could be seen in table 4.8 and based on it, there were actually four indicators that were not valid (B1, C1, P4, and M4). After cut the four unvalid indicators, the model fit test be done again and the result could be seen in figure 4.4 while the model evaluation could be seen in table 4.8 that by a modification, the model was fit.

Table 4.7.

Full Model Structural Goodness of Fit Indices before Modification

Goodness of Fit Indices

Cut Off Value Result Model Evaluation

Chi-Square Expected to be low 172.92 Bad

Significance Probability

≥ 0.05 0.00 Bad

RMSEA ≤ 0.08 0.05 Good

CMIN/DF ≤ 2.00 1.57 Good

GFI ≥ 0.90 0.91 Good

AGFI ≥ 0.90 0.88 Marginal

TLI ≥ 0.90 0.94 Good

CFI ≥ 0.95 0.95 Good

Source: Primary Data, 2014

Table 4.8.

Squarred Multiple Correlations

Estimate

C1 .178

B4 .781

M4 .009

P4 .013

B3 .703

B2 .638

38

Estimate

C4 .631

C3 .651

C2 .615

M1 .536

M2 .655

M3 .657

P1 .825

P2 .644

P3 .745

Figure 4.3.

39 Figure 4.4.

40 Table 4.9.

Full Model Structural Goodness of Fit Indices after Modification

Goodness of Fit Indices Cut Off Value Result Model Evaluation

Chi-Square Expected to be low 58.88 Good

Significance Probability ≥ 0.05 0.37 Good

RMSEA ≤ 0.08 0.02 Good

CMIN/DF ≤ 2.00 0.15 Good

GFI ≥ 0.90 0.96 Good

AGFI ≥ 0.90 0.93 Good

TLI ≥ 0.90 0.99 Good

CFI ≥ 0.95 0.99 Good

Source: Primary Data, 2014

4.3.2.2. Reliability

Before performing the hypotheses testing, it must be checked that all indicators that had passed the validity test also passed the reliability test. This must be done to make sure that all indicators used here, including the borrowing habit indicators were reliable and could be employed in the future. The reliability test here done by calculating and evaluating the construct reliability score.

The formula to calculate the construct reliability was:

Construct Reliability = ( standardized loading ) 2

( standardized loading 2)+ εj

41

of the calculation was reported in table 4.9 that the lowest score was only 0.8, shown by money retention. Therefore all twelve indicators had passed the reliability test and proved as reliable indicators.

Table 4.10. Construct Reliability

Estimate Construct Reliability P3 <--- PEER_ACCEPTANCE .865

0.939 P2 <--- PEER_ACCEPTANCE .803

P1 <--- PEER_ACCEPTANCE .907 M3 <--- MONEY_RETENTION .812

0.896 M2 <--- MONEY_RETENTION .810

M1 <--- MONEY_RETENTION .732 C4 <--- COMPULSIVE_BUYING .805

0.904 C3 <--- COMPULSIVE_BUYING .803

C2 <--- COMPULSIVE_BUYING .784 B2 <--- BORROWING_HABIT .801

0.903 B3 <--- BORROWING_HABIT .840

B4 <--- BORROWING_HABIT .881 Source: appendix 12

4.4. Statistic Descriptive

42

their peers and to get their peers‟ acceptance. The total average of money retention came as the highest score of all with the score 3.54, it was in the interval of 3.41-4.20. The meaning of this score was that the students were capable on managing their pocket money, they saved their extra money, and they did not easily spend their pocket money. In contrast, the total average of CBB was low since it was only 2.31. The meaning of this score was that the students did not have the tendency as compulsive buyers. The last total score reported on table 4.10 was the score of borrowing habit, which was 2.41. Similar to the tendency of peer acceptance and CBB, the students also showed a low tendency of borrowing habit. They did not easily decide to borrow money from their friends even from their closest friends and relatives.

Table 4.11.

Descriptive Statistic of Peer Acceptance, Money Retention, CBB, and Borrowing Habit

Statement Mean Standard

Deviation Peer Acceptance

I use trendy products. 2.23 0.86

I use high quality products in order to be

accepted by my friends. 2.58 0.79

I often follow my friends to buy produts. 2.27 0.85

Total Average 2.45

Money Retention

I don‟t spend money easily. 3.51 0.83

43 so that I seldom experience lack of money.

In times when I have extra money, I save it. 3.61 0.82

Total Average 3.54

CBB I often have a strong urge and spontaneous

desire to go and buy something. 2.31 0.76

I find it isn‟t hard to restrain my self not to

shop. * 2.31 0.81

For me, shopping is a way of facing the

stress 2.32 0.84

Total Average 2.31

Borrowing Habit I try as much as possible not to borrow

money. * 2.39 0.93

I will think carefully before deciding to

borrow money. * 2.39 0.92

I am not used to borrow money when I need

it. * 2.46 0.94

Total Average 2.41

Source: appendix 13 Note: * reverse statement

** The answers’ interval categories: 1.00-1.80 (very low); 1.81-2.60 (low); 2.61-3.40 (medium); 3.41-4.20 (high); 4.21-5.00 (very high).

4.5. Hypothesis Testing

44

influence on CBB, it did not influence borrowing habit. Looking at the effect of CBB to borrowing habit, it was found that CBB influenced borrowing habit in level 10%, since the p value was 0.76 as reported in table 4.11 below. Therefore only money retention that had significant influence on CBB and borrowing habit that could be further analyzed whether CBB mediated the effect of money retention to borrowing habit.

45 Table 4.12. Regression Weights

Estimate S.E. C.R. P COMPULSIVE_BUYING <--- MONEY_RETENTION -.371 .085 -4.371 *** COMPULSIVE_BUYING <--- PEER_ACCEPTANCE .289 .072 4.045 ***

COMPULSIVE_BUYING <--- POCKETMONEY .041 .051 .805 .421

BORROWING_HABIT <--- POCKETMONEY -.017 .053 -.319 .750

BORROWING_HABIT <--- COMPULSIVE_BUYING .172 .097 1.775 .076* BORROWING_HABIT <--- PEER_ACCEPTANCE -.083 .077 -1.077 .282 BORROWING_HABIT <--- MONEY_RETENTION -.549 .101 -5.418 *** Source: appendix 14

Note: *significant value at 10%, ***significant value at 1%

Table 4.13.

Standardized Regression Weights

Estimate COMPULSIVE_BUYING <--- MONEY_RETENTION -.360 COMPULSIVE_BUYING <--- PEER_ACCEPTANCE .310

COMPULSIVE_BUYING <--- POCKETMONEY .057

BORROWING_HABIT <--- POCKETMONEY -.021

BORROWING_HABIT <--- COMPULSIVE_BUYING .158

BORROWING_HABIT <--- PEER_ACCEPTANCE -.082

BORROWING_HABIT <--- MONEY_RETENTION -.492

46

The first step was to see the influence of money retention to borrowing habit. The influnce was significant and the standardized estimate was -.543 (see appendix 19). The second step was to see the effect of money retention to CBB as the intervening variable which resulted a significant effect (see appendix 20). The last step was to see the influence of money retention to borrowing habit by also adding CBB as an additional predictor. The influence was found to be significant, but the standardized estimate was -.413 (see appendix 21). The estimate was lower then the estimate in the first step (-.543 to -.413). When intervening variable was included as an additional predictor and the estimate score was reduced but remained significant, then partial mediation was supported (Hair et al., 2009). Therefore the conclusion was that CBB played a role to be a partial mediator of the effect of money retention to borrowing habit.

Hypotesis 1 Testing

Hypothesis H1 stated that pocket money had a positive and significant effect on CBB. The result of the first hypothesis testing thar reported in table 4.12 and table 4.13 didn‟t support the hypothesis. In this

47

the hypothesis since the score was 0.805, less than 2 as the standard score of evaluation. Beside reflecting the unsignificant effect of pocket money to CBB, the C.R. score that was positive also showed that the effect was positive, meaning that the greater the pocket money the greater the tendency of the students to be compulsive buyers even not significant.

Hypothesis 2 Testing

The p value of this hypothesis testing was 0.000 while the C.R. score was 4.045. Based on both standard of evaluations where p value must be less than 0.05 and the C.R. score must be greater than 2, hypothesis 2 could be accepted. Moreover, the p value indicated a significant effect on 1% level of this effect. Therefore it could be concluded that peer acceptance had a very significant effect on CBB. Based also on the C.R. score that was positive, it was also proved that the significant effect was positive, meaning that the greater the effort the students made to be accepted by their friends the greater their possibility to be compulsive buyers.

Hypothesis 3 Testing

48

hypothesis 2, which was 0.000. As well as the effect of peer acceptance to CBB, here the effect of money retention to CBB was also very significant. However the effect of money retention to CBB was negative as reflected by the C.R. score that was greater than -2 (the C.R. score was -4.371). The conclusion of the acceptance of this third hypothesis would be the greater money retention the students had, the lower their opportunity to be compulsive buyers.

Hypothesis 4 Testing

49 Hypothesis 5 Testing

The p value for hypothesis 5 as reported in table 4.11 was also greater than 0.05 since the score was 0.282. Therefore the students‟ peer

acceptance did not significantly affect borrowing habit. In contrast with the prediction stated by hypothesis 5 that the effect would be positive, here the C.R. score was -1.077, meaning that the effect was negative. The greater the effort the students made to gain acceptance from their friends would not increase their borrowing habit, instead it would lead them to be more careful before deciding to borrow money. Finally, based on the p value and the C.R. score, hypothesis 5 was rejected since there wasn‟t any positive and

significant effect of peer acceptance to borrowing habit.

Hypothesis 6 Testing

50

push their borrowing habit down. Therefore hypothesis 6 was proved to be acceptable.

Hypothesis 7 Testing

The report in table 4.11 for hypothesis testing of hypothesis 7 showed that the p value was 0.076. The value was greater than 0.05, meaning that the effect of CBB to borrowing habit was not significant at 5% level. However by using the standard 10%, the effect would be positive. Therefore it was proved that at 10% level, CBB significantly effect borrowing habit of the students. The C.R. score was 1.775, it was near 2 which supported the conclusion that the effect was significant at 10% level. The positive value of the C.R. score also confirmed that the effect of CBB to borrowing habit was positive, meaning that the higher the tendency of the students to be compulsive buyers the greater their tendency to borrow money from their friends or relatives. Finally, based on the explanation above, hypothesis 7 was proved acceptable.

Hypothesis 8 Testing

51

pocket money to borrowing habit. The result of this hypothesis testing did not reported in table 4.11 but the table did help to made conclusion about the acceptance of this hypothesis. The result in table 4.11. indicated that pocket money did not have any significant effect on both CBB and borrowing habit. It didn‟t pass the requirement to test the mediating effect of CBB since the

requirement was pocket money as the independent variable must had significant effect on CBB as the intervening variabel and on borrowing habit as the dependent variable. Therefore hypothesis 8 was rejected.

Hypothesis 9 Testing

Hypothesis 9 stated that CBB mediated the effect of peer acceptance on borrowing habit. Unfortunately it did not pass the requirement to be tested since peer acceptance only significantly affect CBB as the intervening variable and it did not significantly affect borrowing habit. Therefore CBB did not mediate the effect of peer acceptance on borrowing habit. As well as hypothesis 8, hypothesis 9 was also rejected due to the rejection of the previous hypothesis 5.

Hypothesis 10 Testing

52

53 Table 4.14.

Hypothesis Testing Result

Hypotheses Hypothesis Statements C.R and P Values Conclusion H1 Pocket money has a positive and

significant effect on CBB.

CR= 0.805

P = 0.421 Rejected H2 Peer acceptance has a positive

significant effect on CBB.

CR = 4.045

P = 0.000 Accepted H3 Money retention has a negative

significant effect on CBB.

CR = -5.3711

P = 0.000 Accepted H4 Pocket money has a positive significant

effect on borrowing habit.

CR = -0.319

P = 0.750 Rejected H5

Peer acceptance has a positive significant effect on borrowing habit.

CR = - 1.077

P = 0.282 Rejected H6

Money retention has a negative significant effect on borrowing habit.

CR = -5.418

P = 0.000 Accepted H7

CBB has a positive significant effect on borrowing habit.

CR = 1.775

P = 0.076 Accepted H8 CBB plays mediating role between

pocket money and borrowing habit. - Rejected

H9 CBB plays mediating role between peer

acceptance and borrowing habit. - Rejected

H10 CBB plays mediating role between

54 4.6. Discussion

4.6.1. The Effect of Pocket Money on CBB

Previous studies had shown different results regarding the effect of pocket money and income to CBB. Faber et al. (1987) noted that the CBB problem might be confined to the middle or lower income individuals who had a high desire for things and little willpower to resist urges. Different result came from Ergin (2010) who found that the level of income was a significant predictor of CBB. This study however seemed to confirm that compulsive buyers appeared to come from all income groups as stated by O‟Guinn & Faber (1989) as well as by Scherhorn et al. (1990) since there was no significant effect of pocket money to CBB.

One of two reasons that might explain why pocket money did not have a significant influence on CBB in this study was about the students‟ biggest spending. The additional information showed that generally the students‟ biggest proportion of spending were for food, telecommunication,

55

The second reason was that 80.0% of the students had saving, meant that they saved some of their pocket money. After spending much of their money on food and their needs as students, many of them only had a little money left to save since the descriptive statistic showed that generally the students had low pocket money. However, 80% of the students still saved the money. This habit they built made it possible that no matter how much pocket money they received every month, they still prefered to spend it on their basic needs and saved the rest of their money to spend it on shopping or buying things they did not need. In conclusion, regardless how much their pocket money, the students chose to spend it for their needs and for saving, and not for buying things they did not need. Their good habit about to prefer needs than wants and their saving habit saved them from being compulsive buyers.

56

accounted for extraversion. The same result also came from the study conducted by Mikolajczak (2012).

4.6.2. The Effect of Peer Acceptance on CBB

The students‟ peer acceptance tended to be low, meaning that they

57

Peer acceptance was found to be a significant predictor of CBB in some previous studies as well. Chaplin & John (2010) ever commented about the relationship between adolescents‟ peer acceptance and their buying

behavior:

“when adolescents communicate with their peers about consumption and observe the acquisitive desires of their peers, they are likely to model such behavior and want the same things their peers want or have.”

Noted here that adolescents were also more likely to want the same things their peers wanted. Without trying to evaluate whether they needed the things or not, peer acceptance pushed them to buy that things. It was also noted by Furaiji et al. (2012) that as a part of social factors, reference groups have significant influence on consumers purchasing behaviors. The result of current study that peer acceptance had a positive significant effect on CBB supported the result of some previous studies and proved the comment of Chaplin & John and also Furaiji et al.

4.6.3. The Effect of Money Retention on CBB

58

explain this result. They were capable on managing their pocket money even made saving as reported by the additional information that 80.0% of the students had saving. This information that the students loved to save money supported by the high score of the statement „in times when I have extra

money, I save it‟. The students also did not spend money easily since the

score of this statement reported in table 4.10 was high. They did not spend money easily for buying things they did not need since they were capable of managing their pocket money. Therefore the students could restrain themselves to be compulsive buyers and they did not buy just to face the stress.

59

4.6.4. The Effect of Pocket Money on Borrowing Habit

As well as the effect of pocket money to CBB that found not significant, the effect of pocket money on borrowing habit was also found not significant. This result suggested that higher pocket money did not lead the students to have a high tendency of borrowing habit. In the other side, lower pocket money also did not lead the students to have a high tendency of borrowing habit. Therefore no matter how much pocket money the students received every month, the tendency to borrow money from others might exist.

However in this study it was found that the students had low tendency of borrowing habit. They would think carefully before deciding to borrow money and tried as much as possible not to borrow money. A reason why pocket money did not affect borrowing habit might be explained by the fact that 60.5% of all students would ask their parents to give them more money in case they needed more money, while 18.5% of them chose to take from their savings. Only 12.5% of them that chose to borrow money from their friends and relatives when they needed more money. This data supported the unsignificant effect of pocket money to borrowing habit.

60

effect. People with large amount of pocket money had enough money to cover their needs and wants. In the other side, people who had limited or small amount of pocket money would need extra money to cover their needs and wants. Therefore they would borrow money to get that extra money. The more often they borrowed because of their needs for extra money, the higher their borrowing habit.

4.6.5. The Effect of Peer Acceptance on Borrowing Habit

Peer acceptance was not a predictor of borrowing habit as found in this study. Moreover, the negative value of C.R. indicated that even not significant, the effect of peer acceptance to borrowing habit was negative, meaning that the higher peer acceptance would reduce the borrowing habit. It was in contrast with the prediction as stated by hypothesis H5 that the effect would be positive.

The question arised here was why did peer acceptance have a negative effect on borrowing habit. The fear of not gaining acceptance would be the possible answer. As it was noted before, peer acceptance was the effort to gain acceptance. The students might think that by borrowing money from their friends was not a way of getting acceptance. Instead, borrowing money would make them looked like „poor‟ students to their friends. In the

61

from their friends. Then it was possible that the higher their peer acceptance, they would also be very careful about deciding to borrow money.

There were some variables that might affect borrowing habit although pocket money and peer acceptance were not significantly affect borrowing habit. As well as it affected CBB, personality was also played a role in influencing borrowing habit. Nyus and Webley (2001) found that introversion personality reduced borrowing behavior. They also found that emotional instability had negative and significant effect on borrowing behavior. Since borrowing behavior was also about the tendency to borrow money, it was possible that the two mentioned variables above did significantly reduce borrowing habit.

4.6.6. The Effect of Money Retention on Borrowing Habit

Money retention was the only independent variable that had significant effect on borrowing habit among the three independent variables tested in this study. The hypothesis „money retention has a negative and

62

The capability on managing their pocket money that was proved to be high helped the students a lot. They managed their spending very well by buying their basic needs as their priority as reported in table 4.1. The ability to manage their pocket money lead them to make saving even with limited pocket money. They also seldom experienced lack of money since they were capable on managing their pocket money as shown by the score of the statement „I am capable on managing my pocket money so that I seldom experience lack of money‟ in table 4.10. Even when they experienced lack of

money, only 12.5% of the students chose to borrow money from their friends or relatives when they needed extra money.

4.6.7. The Effect of CBB on Borrowing Habit

This study proved that CBB significantly increase borrowing habit. This result was in line with the result of previous studies that investigated the effect of CBB to the amount of debt a compulsive buyer had, such as the study of Dittmar (2005) and Wilczaki (2006). The higher the tendency of the students to be compulsive buyers, the tendency to have a high borrowing habit would be increased.

63

easily restraining themselves not to shop and did not considered shopping as a way of facing the stress that they had a low borrowing habit. They tried hard not borrow money and one way that they did for this purpose was by restraining themselves not to involved in excessive shopping.

4.6.8. The Mediating Role of CBB on the effect of Pocket Money on Borrowing Habit

Pocket money as explained previously, did not have significant effect on both CBB and borrowing habit. Although in some previous studies it was found as a significant predictor of CBB, this study did not support that result. Then, it was impossible to analyse whether CBB mediated the effect of pocket money to borrowing habit since pocket money did not have a significant effect on borrowing habit.

A survey by FinScope Consumer Survey South Africa 2012 would help to understand the reason. The survey explored a number of factors that might be the reasons for people to borrow money and it was shown that the reasons for borrowing were closely related to the economic challenges people experienced. The economic challenges here were about their financial that was getting worse compared to the previous year. It indicated that the worse people‟s financial situation would lead to increasing borrowing. The

64

well. The survey also reported that to start a new bussiness was the number one reason why the people of South Africa borrowed money, while only 6% mentioned buying clothes as the reason. The survey helped us to understand that even financial situation might afect borrowing habit, people borrowed for investing not for buying their wants such as clothes which would be an indication of CBB.

4.6.9. The Mediating Role of CBB on the effect of Peer Acceptance on Borrowing Habit

In this study, the students‟ peer acceptance was found as a factor

that influenced their CBB. Unfortunately it did not affect borrowing habit significantly and the usignficant effect was negative. Therefore without further analysis, it could be said that CBB did not mediate the effect of the students‟ peer acceptance to their borrowing habit even peer acceptance

would lead to higher tendency of CBB and higher CBB would lead to higher borrowing habit.

65

accepted. Borrowing money however would give them a label as a „poor‟

student that they considered as a negative thought of their friends about them. Negative thoughts their friends had about them might affect their friends‟ that their friends might not accept them.

4.6.10. The Mediating Role of CBB on the effect of Money Retention on Borrowing Habit

Money retention was quite important for people since in this study it was found to have a negative effect on CBB and borrowing habit. Money retention helped the students to control their CBB and their borrowing habit as well. The capability of managing pocket money brought the students to a safe financial situation where they seldom experienced lack of money. This capability also helped them to avoid being frequent borrowers. This study also proved that the effect of money retention to borrowing habit was mediated by CBB. This result indicated that firstly money retention influenced CBB, and higher tendency of CBB lead to higher borrowing habit.

66