Positioning

Despite facing unfavorable business conditions with increasing

Delivering

Sustainable

Performance

Our consistent efforts in implementing focused strategy covering

revenue management, capacity management, cost management,

increasing competitive advantage and investment management

has resulted positive performance, which are 10% increased

in revenue to Rp27.0 trillion, profit attributable to the

31.8

28.5

30.0

Towards

New

Performance Level

The capacity management implementation with the

support of new production facilities and strong distribution

networks, enabled us to pursue market growth dynamics in

all marketing areas with better efficiency level.

conservation in a structured and well-planned

Develop the

Surrounding

Community

Aligned with business progress, we have allocated the TJSL

program fund to Rp180.2 billion, disbursed the Partnership

fund of Rp88.2 billion, and Community Development

fund of Rp0.4 billion

We uphold strong commitment to take an active role in the effort

to improve the surrounding community welfares through the

Assuring

the Move

Into

Next Level

Assuring

the

Move

Continuing the grand plan to become the most reliable

cement company locally and regionally, Semen Indonesia

consistently realized several corporate actions that covering:

business development, competency enhancement of all

elements, improvement of surrounding communities’ life, and

environmental quality.

Cosnsitent business development implementation in an accountable efforts has

brought positive results - stronger positioning of the Company in the domestic

cement industry and improvement in the operational as well as financial

performances in the midst of challenging economic condition.

The realization of various competency enhancement programs also enabled the

Company’s employees to achieve excellent capability in the development of

production facility with global standard quality.

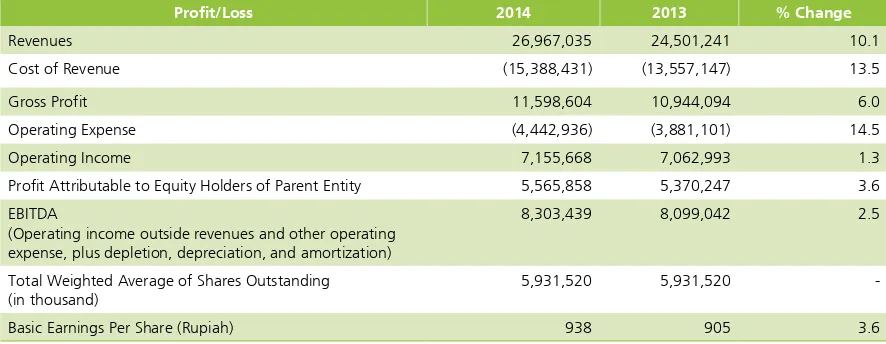

(in million Rupiah)

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 2 0 1 4 2 0 13 2 0 12

Current assets 11,648,545 9,972,110 8,231,297

Investments in associates 146,980 127,510 102,828

Fixed assets 20,221,067 18,862,518 16,794,115

Intangible assets 1,103,697 1,158,475 1,003,033

Other non-current assets 1,194,377 672,271 447,811

Total Assets 34,314,666 30,792,884 26,579,084

Current liabilities 5,273,269 5,297,630 4,825,205

Non-current liabilities 4,038,945 3,691,278 3,589,024

Total Liabilities 9,312,214 8,988,908 8,414,229

Total Equity 25,002,452 21,803,976 18,164,855

Capital expenditures 2,968,145 2,707,065 3,407,903

Net working capital 6,375,276 4,674,480 3,406,092

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Revenue 26,987,035 24,501,241 19,598,248

Gross profit 11,598,604 10,944,094 9,297,581

Operating income 7,155,668 7,062,993 6,181,524

Profit for the year 5,573,577 5,354,299 4,926,640

Total comprehensive profit for the year 5,587,346 5,852,023 4,924,791

Profit attributable to equity holders of parent entity 5,565,858 5,370,247 4,847,252

Profit/loss attributable to non-controlling interest 7,720 (15,949) 79,388

Total 5,573,577 5,354,299 4,926,640

Total comprehensive profit attributable to equity holders of parent entity 5,576,106 5,716,494 4,845,403

Total comprehensive profit attributable to non-controlling interest 11,240 135,529 79,388

Total 5,587,346 5,852,023 4,924,791

EBITDA a) 8,303,439 8,099,042 6,869,077

Market capitalization 96,090,624 83,931,008 94,014,592

Weighted average issued shares (in thousand) 5,931,520 5,931,520 5,931,520

Basic earnings per share (Rp) 938 905 817

CONSOLIDATED FINANCIAL RATIO 2 0 1 4 2 0 13 2 0 12

Gross profit margin (%) 43.0 44.7 47.4

Operating income margin (%) 26.5 28.8 31.5

EBITDA margin (%) 30.8 33.1 35.0

EBITDA on interest ratio 21.7 23.8 65.5

Return on equity ratio (%) b) 23.2 25.7 27.9

Return on total assets ratio (%) 16.2 17.4 18.2

Current ratio (%) 220.9 188.2 170.6

Return on investment (%) 29.8 33.8 35.6

Liabilities on equity ratio c) 16.3 19.6 22.2

Liabilities on total assets (%) 11.4 13.3 14.5

Liabilities on capital ratio (%) 13.5 15.8 17.5

INDUSTRIAL FIELDS Unit 2 0 1 4 2 0 13 2 0 12

CEMENTS

Total Production Capacity Thousand tons 31,800 30,000 28,500

Production in Indonesia Thousand tons 26,435 25,559 22,846

Production Regionally Thousand tons 1,825 1,355

-Total Production 28,260 26,914 22,846

Sales in Indonesia Thousand tons 26,163 25,410 21,824

Sales Regionally Thousand tons 2,363 2,405 80

PACKAGING INDUSTRY

Sewn Kraft Production Sheets 320,225 -

-Sewn Woven Production Sheets 33,312,965 19,233,600 17,277,950

Pasted Kraft Production Sheets 229,542,343 199,458,456 187,109,916

Total Packaging Production Sheets 263,175,533 218,692,056 204,387,866

REAL ESTATES INDUSTRIAL

Sales Volume

Industrial Land Sale M2 40,429 109,736 215,693

Sales Volume

Land Lease M2 46,644 42,398 41,344

MINING

Mining Services

Limestones Tons 13,101,598 13,420,122 11,8113,856

Clay Mining Tons 3,375,135 3,631,518 3,186,909

Surface Miner Tons 1,337,112 739,538

-Sub total Tons 17,813,835 17,791,178 15,000,765

Other Mining Services

Cut and fill BCM 630,258 627,779 780,063

Other minings Tons 5,991,443 9,047,420 9,642,722

Heavy equipment rental Hour 83,542 144,158 229,319

Operational Highlights

2014 2013 2012

31.8

(million tons/year)

Production Capacity

(Design Capacity)

30.0 28.5

Production capacity in 2014 increased by

to

6.0

%

31.8

million tons

2014 2013 2012

(in %)

92.0 95.0

88.9

Utilization Level

2014 2013 2012

(in million tons)

Production Volume

26.922.8

28.3 Production volume in 2014 grew by

to

5.2

%

28,3

million tons

2014 2013 2012

(in million tons)

Sales Volume

27.821.9

28.5

8,099

6,869

8,303

24,501

19,598

2014 2013 2012

(Rp miliar)

Net Profit

(attributable to equity holders of parent entity )

5,3704,847

5,566

2014 2013 2012

(%)

Operating Expenses

Ratio

15.8 15.9

16.5

2014 2013 2012

(%)

55.3

52.6

57.0

Cost of Revenue

Ratio

2014 2013 2012

(%)

Return on Assets

Ratio (ROA)

17.4

18.2

16.2

2014 2013 2012 33.1

35.0

30.8

(%)

EBITDA Margin

Ratio

(%)

Return on Equity

Ratio (ROE)

2014 2013 2012 25.7

27.9

Event Highlights

First anniversary

celebration of PT Semen

Indonesia (Persero) Tbk.

Non Cash Loan Facility

Cooperation in Litigation

settlement

Ground Breaking of

Indarung VI Padang

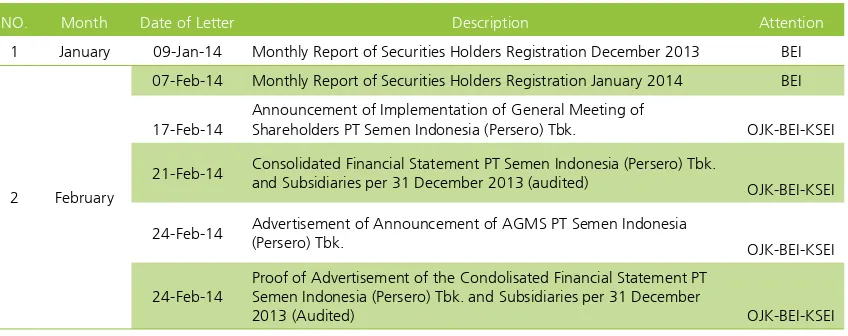

The first anniversary celebration of PT Semen Indonesia (Persero) Tbk. was marked by the inauguration of 5 strategic projects, namely Vertical Cement Mill in Tuban plant, Inauguration of Packing plant Banjarmasin, Launching Center of Engineering, E-Procurement, Launching of company communication implementation guidelines.

PT Semen Gresik, a subsidiary of PT Semen Indonesia (Persero) Tbk received the Non Cash Loan facility of Rp1.4 Trillion from Bank Mandiri for the construction of new cement plant in Rembang.

Semen Indonesia cooperated with Civil Attorney and dan State Administration of General Attorney in the litigation settlement of civil and state administration fields.

Semen Indonesia organized the Ground Breaking of Indarung VI plant construction in Padang. The plant with the investment of Rp3.25 Triliun is targeted to be operating in 2016.

21

17

26

January

March April May

Inauguration of Cement

Tonasa Unit V and PLTU

President Susilo Bambang Yudhoyono inaugurated Tonasa V Plant and power plant in Pangkep Regency, South Sulawesi. Tonasa V has the capacity of 3 million tons per year completed with 2 X 35 MW power plant, with an investment value of Rp3,5 Trillion.

19

FebruaryInauguration of Packing

Plant Banjarmasin

Semen Indonesia inaugurated the Packing Plant Banjarmasin with the capacity of 600 thousand tons per year, and investment value of Rp120 billion.

26

FebruariConstruction of

environmentally friendly

plant in Rembang

Inauguration of Subsidiary

in IT field

Syndicated loans from

Bank Mandiri, Standard

Chartered and SMBC

Semen Indonesia commenced the construction of environmentally friendly plant in Rembang with the capacity of 3 million tons per year and investment value of Rp4.4 trillion.

Semen Indonesia inaugurated a Subsidiary in IT field, namely PT Sinergi Informatika Semen Indonesia (SISI).

Semen Indonesia received

syndicated loans from Bank Mandiri, Standard Chartered and SMBC to refinancing the Thang Long Cement in Vietnam.

18

18

June

Signing of Cooperation

Agreement with JFE Japan

Semen Indonesia signed the cooperation agreement with JFE Japan for the construction of Waste Heat Recovery Power Generation (WHRPG) with the capacity of 30.6 MW.

15

JulyRamadhan Safary in

Rembang Regency

Inauguration of PT Semen

Gresik Head Office

Semen Indonesia held the Ramadhan Safary in Rembang Regency by contributing various social grants.

23

JulySemen Indonesia inaugurated the head office of Semen Gresik Tuban Regency, East Java.

08

AugustJune June

Packing Plant Mamuju

Waste processing plant

construction

UISI Establishment

Semen Indonesia Center of

The Champs (SICC)

Cash polling system

cooperation agreement

Semen Indonesia

Employee Union

Semen Indonesia signed the cooperation agreement for cash polling system with Bank Mandiri, BRI, BNI and CIMB Niaga.

Semen Indonesia through Semen Gresik Foundation commenced the construction of waste processing plant with the capacity of 240 tons per day in Gresik with the investment value of Rp13.5 billion.

Semen Indonesia inaugurated the Packing Plant Mamuju to strengthen its cement distribution in Sulawesi region.

Semen Indonesia has established the Universitas Internasional Semen Indonesia (UISI) in Gresik, which constitute the corporate responsibility towards education. Semen Indonesia not only developed

its potential in merely cement business, but also aimed to create excellent HR by the launching of Semen Indonesia Center of The Champs (SICC).

The management of Employee Union of Semen Indonesia was established for the period of 2014-2016.

09

28

29

15

19

August

September September October

August August

28

28

NovemberCSR Award 2014

Semen Indonesia Grup (SMI) received an award in Indonesian CSR Awards 2014 event, from CFCD (Corporate Forum of Community Development).

10

DecemberForbes Magazine Awards

Semen Indonesia received an award as one of top 50 companies with best performance in the event of best of the best from Forbes Magazine.

31

DecemberClosing of 2014 year end

performance

Organized the video conference of SI Grup which covering the plants of Semen Padang, Semen Gresik, Tuban, Tonasa and TLCC Vietnam to mark the last cement production in 2014.

15

OctoberWHRPG Ground Breaking

The Best Website awards

Ground Breaking of Waste Heat Recovery Power Generator (WHRPG) project in Tuban plant, with the capacity of 30.6 MW and scheduled to complete by the end of 2016. Semen Indonesia received the SOEs

Best Website awards as well as readers’ choice of favourite website for the construction sector, from Berita Satu version.

26

NovemberWarta Ekonomi Magazine

Awards

Semen Indonesia received the predicate of the Most Powerful and Valuable Company Category Cement (Basic Industry & Chemical), from Warta Ekonomi magazine.

October

Awards & Certifications

AWARDS 2014

On its achievements during 2014, the Company received 10 awards of various categories form the independent party, as follows:

Location/Date Awards

Jakarta 23 March IICD Top 50 Awards, Semen Indonesia was one of the companies with best corporate governance based on ASEAN Corporate Governance Scorecard.

Jakarta 10 June Semen Indonesia received The Best Listed Company Manufacturing Sector Basic and Best CEO 2014 from MNC Business due to the positive performances of financial, shares, and corporate governance.

Jakarta 13 June Indonesian Journalists Association (PWI) awarded the Golden Pen to the President Director of Semen Indonesia on his role to enhance the quality of Indonesian journalism.

Jakarta 18 June Semen Indonesia received the Best Green Industry Award 2014 for the category "Preservation of water resources, development of new energy, development of biodiversity, pioneering the prevention of pollution and development of integrated waste management.”

Jakarta 21 July Semen Indonesia received the Antara news CSR from Antara National News Agency (LKBN).

Jakarta 18 August Semen Indonesia received the Energi Pratama awards from the Ministry of Energy and Mineral Resources on the innovation of the renewable energy utilization.

Jakarta 19 August Semen Indonesia entered into and received the Forbes Global awards. Semen Indonesia was included in the 2.000 best companies in the world.

Jakarta 15 October Semen Indonesia received the best Website from Berita Satu in construction field of the reader’s favourite choice.

Jakarta 16 October Semen Indonesia received the Green Industry awards from the Ministry of Industry. Jakarta 17 October The President Director of Semen Indonesia, Dwi Soetjipto received CEO of the year

CERTIFICATIONS

ISO – 9001

: 2008

Quality Management Systems (Certification by SGS-UK, 2002-2015)

ISO – 14001

: 2004

Environmental Management Systems (Certification by SGS, 2010-2013)

OHSAS - 18001

: 2007

Occupational Health and Safety Management Systems (Certification by SGS-UK, 2012-2014)

SMK3

:

Occupational Health and Safety Management Systems (Certification by Sucofindo, 2014)

ISO/IEC - 17025

: 2008

Table of Contents

HIGHLIGHTS

12

Financial Highlights

13

Operational Highlights

16

Event Highlights

20

Awards & Certificates

22

TABLE OF CONTENTS

24

MANAGEMENT REPORTS

26

Message from the President

Commissioner

36

Report from the President Director

48

BUSINESS DEVELOPMENT

REPORT

57

Corporate Transformation

66

Regional Expansion

71

Domestic Expansion

75

Business Development Funds

78

COMPANY INFORMATION

80

Company’s Name

82

Vision and Mission

84

The Company at a Glance

86

Milestones

88

The Company Excellence

90

Organization Structure

92

Operational Region and

Distribution Map

94

Product Types and Supporting

Facilities

97

Office Address and Information

Access

98

Subsidiaries and Affilated

Companies

100

INFORMATION FOR INVESTORS

102

Share Performance Graphs

103

Share Highlights, Dividend Payout

and Share Listing Chronology

104

Shareholders Composition

108

Shareholding Structure

108

Share Ownership by the Board

of Commissioners and Board of

Directors

109

Dividend and Dividend Policy

110

Capital Market Condition and

Company’s Share Performance

112

Name of Capital Market Institutions

and Supporting Professions

114

OPERATIONAL REVIEW

116

Human Resources Management

128

Environmental Management

Quality Enhancement

139

Company’s Innovation

147

Information Technology and

Communication

158

Risks and Risk Management

170

MANAGEMENT DISCUSSION

AND ANALYSIS

172

Economy Overview, Industry

Overview and Business Prospects

180

Business Review

181

Cement Industry Business Segment

183

Production

187

Research and Development

190

Financial Performance Review

191

Consolidated Income Statements

198

Consolidated Financial Position

213

Work Plan Compared to

227

Conflicts of Interest Transactions

228

Material Transactions & Significant

Events

228

Regulations and Legislations

Amendment Relevant to and

Impacted the Company’s

Performance

230

Accounting Standards Changes

and Disclosures

230

Related Parties Transactions

233

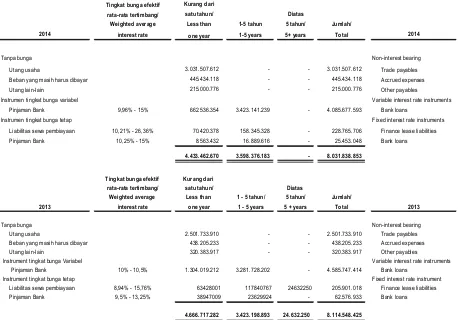

Assets and Monetary Liability in

Foreign Exchange

234

CORPORATE GOVERNANCE

IMPLEMENTATION REPORT

236

Corporate Governance

Implementation Report

256

General Meeting of Shareholders

263

Board of Commissioners

275

Board of Directors

294

Committees of the Board of

Commissioners

306

Corporate Secretary

320

Internal Control and Monitoring

System

322

Internal Audit

331

Company’s Accountant

333

Risk Management Implementation

336

Code of Conduct and Corporate

Culture

352

CORPORATE SOCIAL

RESPONSIBILITY REPORT

354

Corporate Social Responsibility

Report

360

Corporate Social Responsibility on

the Environment

361

Employment, Occupational Health,

and Safety

366

Corporate Responsibility on Social

and Community

370

Corporate Responsibility on

Consumers

374

CORPORATE DATA

376

Board of Commissioners’ Profiles

379

Board of Directors’ Profiles

383

Additional Information –

Replacement of the Commissioners

and Directors

384

Audit Committee

385

Nomination & Remuneration

Committee

386

Strategy, Risk Management and

Investment Committee

387

Secretary of the Board of

Commissioners

388

Address of Subsidiaries and

Affiliated Companies

391

Information for Shareholders

392

Statements of Responsibility of the

Board of Commissioners and Board

of Directors

394

OJK References - ARA Criteria

2014

Reports

26

Message from the President Commissioner

The Board of Commissioners viewed that the Board of Directors, the

management, and all employees have met and undergone all challenges

exceptionally well. The decision to become the Strategic Holding was

also the right decision, believed to bring many advantages presently

and going forward.

“

Unfavourable business environment in 2014 resulted in the lowest demand for

cement within the past several years. This posed a challenge and at the same

time created new opportunities for Semen Indonesia’s growth. Being at the end

of transformation journey into becoming a strategic holding company amid a

difficult year was a trying moment. However, it was also a momentum for the

Company to reflect and harness the excellence of each OpCo – bringing them

as a unity to build a strong foundation for future growth.

Semen Indonesia has become stronger and more solid, ready to address

challenges, support this country’s development, and prepared to create growth

opportunities going forward.

Assalaamu’alaikum Wr. Wb.,

Distinguished Shareholders,

First of all we thank God for the blessings upon PT Semen Indonesia (Persero) Tbk. The Company is able to journey the challenging year of 2014 with exceptional results. The Company successfully laid out resilient fundament of growth to bolster up sustainable business development in the future.

Reviewing The Board of Directors’ Performance The Board of Commissioners observed several conditions that made 2014 as a challenging period – an era that particularly put Semen Indonesia to the test. Year of 2014 was marked with the political dynamic; although the national leadership succession took place peacefully and smoothly, the overall process that saw tough competition heated Indonesia’s political situation and dampened the investments in property industry.

At the same time, global economic condition remained unfavourable and this affected the level of national economic growth. Consequently, buying power drop and with Indonesia’s export slumped on the other hand, coupled with sizeable energy subsidy (for fuel and electricity), national trade balance deficit widened – weakening Rupiah exchange rate. Bank Indonesia mitigated the exchange rate depreciation and strove to maintain the level of inflation by increasing benchmark interest rate, which had the adverse consequence on infrastructure and physical development projects.

The macro situation contributed to declining demand of cement, while construction of new units by several players in the cement industry, including Semen Indonesia, completed and moved to commercialization phase in 2014. In effect, the competition between industry players heightened.

“

In the middle of this challenging situation, Semen Indonesia was in its last stage of transformation into becoming a Strategic Holding Company with four subsidiaries or Operating Companies (OpCo), namely PT Semen Gresik, PT Semen Padang, PT Semen Tonasa, and TLCC. With the transformation project going towards its completion while business environment was not favourable, Semen Indonesia faced unique challenges at the time.

The Board of Commissioners viewed that the Board of Directors, the management, and all employees have met and undergone all challenges exceptionally well. The decision to become the Strategic Holding was also the right decision, believed to bring many advantages presently and going forward.

In terms of addressing the competition amid declining demands, the Board of Directors then carried out the maintenance program across all production facilities, a program that was previously delayed in order to spur the production and fulfil orders. Backed by strong brand equity of Semen Gresik, Semen Padang, and Semen Tonasa as well as new production facilities, the Company was able to meet demands and maintain its market share. Having a new role as Strategic Holding also allowed the Company to synergize the capabilities of each OpCo to supply cement and penetrate the potential markets in accordance with their production capacities.

In addition to ensuring sufficient cement supply, synergy also assured that maintenance programs could be carried out effectively and efficiently due to the closer cooperation in terms of spare part supply. This also secured the reliability of operations of other production units.

With strong synergy as its fuel, the Company was able to commence the construction project of new units – Rembang Plant in Central Java and Indarung VI Plant in Sumatera. Despite the challenges met during the development of the two plants, especially in Rembang, encouraging progress was visible and by the end of 2014 the two units were on track with the timeline.

Further, during that same year, the Board of Directors was also able to boost sales volume; the Company’s revenues grew and market share in Indonesia was maintained at 43.7%. Increase of costs due to the changing electricity and fuel prices was addressed by strengthening synergy in marketing and distribution.

The results were tangible; the increasing revenue and cost management initiatives generated 3.6% growth of the Company’s net income to Rp5.6 trillion. Earnings per share rose to Rp938 from Rp905, and EBITDA increased to Rp8.3 trillion from Rp8.1 trillion in the previous year.

The Board of Commissioners also noted that the net income in 2014 represented growth achieved in eight consecutive years.

In view of the accomplishments that the Company was able to attain amidst a difficult year, the Board of Commissioners commends the performance of the Board of Directors in the implementation of their operational responsibilities throughout 2014.

The progress and development that the Company achieved have been communicated to all stakeholders, especially investors in the capital market that responded positively as reflected from the Company’s share price movement. The Company’s shares was

The Board of Commissioners’ Supervisory and Advisory Responsibilities

The Board of Commissioners performed the supervisory duty throughout reporting year on the management policies and management as well as the operational mechanisms of the Company exercised by the Board of Directors. The Board of Commissioners also provided guidance to the Board of Directors. Aligned with our evaluation on the Board of Directors’ operational performance, the Board of Commissioners mandates the Board of Directors to continue exploring potentials and maximize the various benefits that the Company can gain from its Strategic Holding transformation.

In addition to the operational innovations, including four strategic focuses that covered revenue management, cost management, capacity management, and improving competitive advantage, the Board of Directors need to identify steps to optimize potential that came with its new role.

Further, with the Company’s enlarged operational coverage following TLCC acquisition, the Board of Commissioners expects that risk management can be improved and enhanced. Not only identifying and mitigating risks, risk management that applies the Enterprise Wide Risk Management (EWRM) approach should also recognize business opportunities and determine its scale of possibility.

The Board of Commissioners also supervised the Board of Directors’ performances in promoting synergy between OpCo, both in terms of product supply to certain markets, and in terms of managing the operational and distribution costs, which had been increased following the Company’s status as Strategic Holding, whereby business return was expected to improve.

Consistently, the Board of Commissioners monitor the Company’s performance against the Corporate Work and Budget Plan, capital expenditure, progress of strategic projects, and implementation of operational duties that the Board of Directors carried out through regular meetings, ad-hoc meetings, and field visits to project sites.

The Board of Commissioners have produced recommendations and solutions to address the challenges and difficulties faced by the Board of Directors, with respect to a number of grand projects that required the buy-in, and which were not included within the Board of Directors’ decision making authority.

Towards Better Corporate Governance Practices With the support from the Committees under the Board of Commissioners, the Board of Commissioners constantly provides a direction to the Board of Directors to enhance the quality of GCG practices through continuous and structured dissemination of all policies under GCG Manual, Code of Conduct, and corporate values. The Board of Commissioners appreciate the Board of Directors for completing the process of reviewing and redefining the stipulations in the Board Manual, Code of Conduct and associated policies to be in line with the current development.

The Board of Commissioners receives assistance from the Audit Committee; Strategy, Risk Management, and Investment Committee (SRMI); Nomination and Remuneration Committee (NRC); and Secretary to the Board of Commissioners. These units work full-time and with dedication to safeguard the efforts to improve the governance practices as well as ready to implement the supervisory and advisory duties.

In regards of its duties implementation, the Board of Commissioners viewed that the Committees have exercised their functions well, efficiently, and effectively. However, with growing business scale of the Company and increasing complexity of the challenges, the Board of Commissioners mandates for competency enhancement and to have greater support from all elements of the Committees under the Board of Commissioners.

Human Capital Development

The Board of Commissioners believes that the Company’s successful expansion program relied not only on capital and management capabilities, but also on the competence of human capital. Having larger business scale, more operational sites that reach across other countries, and the change of status as holding company, Semen Indonesia needs to step up the management and development of its human capital. Human capital development should be focused on not only skills, but also on growing mindset and changing perspectives of all employees.

With that in mind, the Board of Commissioners fully supports the initiatives of the Board of Directors that aim to change the mindset, enhance the competence, and bring out the human capital potentials of each OpCo.

The Board of Commissioners is committed to ensuring the mindset change of employees and the harmony of internal competencies will take place. The Board of Commissioners will also partake in the process in accordance with its authority, to see that all individuals in Semen Indonesia will be a single unity in the future, voicing dedication to move forward and support Indonesia’s development.

To assure the achievement of this aspiration, the Board of Commissioners promotes and oversees the implementation of Human Capital Master Plan (HCMP) that was designed in line with the Company’s change of corporate status. The Board of Commissioners is in support of the Board of Directors’ policies to apply the competency-based approach in managing the employees, both in terms of career progression and remuneration.

The Board of Commissioners also supports the inventive efforts from all employees of the Company, reflected by Semen Indonesia Award on Innovation (SIA) event that has been held for the fifth time.

Corporate Social Responsibility

The Board of Commissioners would like to provide a direction to the Board of Directors to improve the quality of corporate responsibility programs by initiating better coordination and, therefore to achieve better output of the Company’s various programs in the community and environmental development, as well as other responsibilities. With regards to the Company’s growing business scale, the Board of Commissioners recommends for the success story of CSR program in one site is reviewed and replicated in other locations, thereby ensuring that triple bottom line goal that upholds the harmony between Profit (economic goals), Planet (environmental goals), and

The Board of Commissioners highlights the management’s consistent efforts in environmental preservation through a variety of programs that are able to utilize wastes from other industry in the production process. In addition, the Board of Commissioners supports the Company’s involvement in the endeavours to mitigate global warming impacts through Clean Development Mechanism (CDM) program, and global scale CO2 emission reduction program that is planned to be realized through WHRPG unit in Tuban.

We believe that the efforts demonstrate the Company’s commitment to preserve the environment hand in hand with other global citizens of the world.

Future Outlook and Projections

The Company’s success in journeying through the challenging 2014 and able to delivering exceptional performance illustrated the potential that the Company can harness from its status as Strategic Holding. With the status, the Company has many more opportunities to integrate competence and potential, including maximizing the benefits of having widely reputable brand equity, and present synergized operational pattern. The operational efficiency and synergy in many aspects, including raw material procurement, maintenance, distribution, and marketing, have proven to enable the Company in retaining market share despite of strong competition.

Looking at the national cement industry prospects, the Board of Commissioners predicts that the challenges will remain in the coming year, although Indonesia’s economy will continue to grow in the future. The infrastructure projects are expected to commence after being delayed due to licensing and the state’s lack of capacity to facilitate the development of certain projects, such as inter-region road, seaports, and electricity infrastructure.

Assuming the conservative economic growth, the Board of Commissioners forecasts that, in the short-term, the national cement demand will grow at around 6-7% and will gradually increase in the following years.

Nevertheless, the Board of Commissioners would like to remind that growth opportunities in the cement sector in the long-term would attract other players in the industry to invest in Indonesia and add the competition for the Company.

To that end, the Board of Commissioners expects the Board of Directors to consistently applies long-term strategic initiatives, among others by boosting the production capacity, securing energy, enhancing the corporate brand, meeting the consumer needs, and managing risks to ensure that the Company can benefit from the existing business opportunities and record sustainable performance growth.

The Board of Commissioners and the Committees will supervise the programs defined in the action plan under the Corporate Long-Term Plan document submitted by and agreed with the Board of Directors, and will be ready to provide insights and recommendations to ensure the realization of all plans.

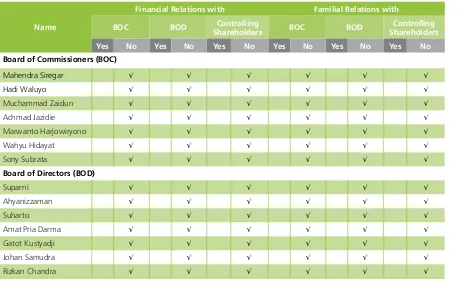

Changes in the Composition of the Board of Commissioners

On 23 January 2015, in Extraordinary General Meeting Shareholders, Sony Subrata was appointed as Commissioner; we congratulate his appointment and welcome him as a new member of the Board of Commissioners.

Closing

We, the Board of Commissioners, would like to take this opportunity to thank God for the Company’s outstanding performance, enabled by the support and true dedication from the Board of Directors as well as all employees of PT Semen Indonesia (Persero) Tbk. We also would like to convey our appreciation to all stakeholders for their input, so that the Company can bring the best results for shareholders, the people, and the Government of Indonesia. May all of us be eternally bestowed with the, compassion, and blessings of God.

Jakarta, 23 March 2015

Wassalamu’alaikum WrWb. The AGMS also approved new members of the

Board of Commissioners; Marwanto Harjowiryono, Commissioner, Wahyu HIdayat, Commissioner, Muchamad Zaidun, Independent Commissioner, and Farid Prawiranegara, Independent Commissioner. We congratulate the new members, and welcome them to the Board of Commissioners of PT Semen Indonesia (Persero) Tbk.

At the time of the formulation of this report, the Board of Commissioners lost 1 of its member, Farid Prawiranegara, who passed away on 21 August 2014. We would like to express our deepest condolences to the family and we thank Farid Prawiranegara for his contribution as member of the Board of Commissioners, PT Semen Indonesia (Persero) Tbk.

The Company inaugurated and commenced the operation of a new plant, several

packing plant units, and grinding plant; officially started the construction of 2

new plants, and continued its programs as strategic holding company. Growth

of profit attributable to the equity holders of parent entity was posted at 3.6%

to Rp5.6 trillion and signified the Company’s excellent achievement. Semen

Indonesia also successfully improved the operational foundation through the

consolidation and synergy between OpCo in order to overcome the challenging

2014 as well as to provide stronger fundament for sustainable future growth

Dear Esteemed Shareholders,

First and foremost, on behalf of the Board of Directors, we thank the Lord for grace and blessings that have accompanied the Company in journeying the challenging year of 2014, and have enabled us to deliver sound achievements. The year 2014 was unfavourable for the Company’s business development. Nevertheless, the Company was able to withstand the obstacles during the same year, a testament to the resiliency of all individuals in PT Semen Indonesia (Persero) Tbk, as the leading player in Indonesia and regional cement industry.

National Economic Conditions in 2014

The global economic recovery was going at a slower pace than expected. In the United States, the country’s economy was showing fundamental improvements, and prompted the Government and the Fed to carry out quantitative easing program. On the other hand, Europe’s economy was stagnant, as in Asia, China, and Japan where growth have not improved, although India was progressing.

The sluggish economy in China, the world’s second largest economy, directly affected Indonesia’s primary commodity demand, especially palm oil, coal, and other mineral commodities.

This in turn impacted Indonesia’s trade balance. Trade balance deficit moved up following increase of fuel subsidy, as more vehicles enter Indonesian roads. Seeking to reallocate subsidy budget to capacity enhancement programs for the national production. The government then adjusted the subsidized fuel price as electricity subsidy was revoked. This contributed to inflation hike, reaching 8.36% higher than 4,5+1% at the beginning of the year. To countervail trade balance deficit and mitigate inflation rise, Bank Indonesia increased benchmark interest rate to 7.75%. This step was able to fend off foreign exchange depreciation to a stable rate at Rp12,440/USD from Rp12,189/USD.

“

In addition to strong macro economic pressure, there were two national political agenda that marked a new milestone in Indonesian history in 2014; the legislative elections for the national and regional parliament DPR, DPD, and DPRD, as well as the elections for the succession of the nation leadership.

These conditions eventually weakened the purchasing power of the consumers, hampered growth of property and infrastructure businesses, and therefore hindered cement demand in Indonesia. Cement market growth in 2014 reached only 3.3% below 6% projection.

On the other hand, cement producers including the Company have concluded new production units in 2014 as well as their supporting facilities. In effect, as competition heightened, all players in the national cement industry realized the operational strategies to maintain business performance.

Strengthening Growth Foundation, Ensuring Optimum Performance

Considering macro economic condition and market competition, the Company had to address a number of fundamental issues. The Company improved the internal consolidation and synergy in terms of operations and strategic planning. The focus of the strategy was cost management, whereby innovative efforts were taken to control increasing production and distribution costs. In terms of energy cost, which is the main component in cement production, the Company also applied energy conservation program.

Addressing the declining trend of demand, the Company exerted to boost the operational efficiency, among others by decreasing the intensity of energy consumption, lower energy cost, aimed for efficient maintenance cost, and stepped up the distribution cost efficiency by construction packing plant to reach lower operational cost per ton.

To achieve efficient energy cost, the Company maximized the performance of WHRPG unit that had commenced operations in Padang, maximized power plant operations in Tonasa, used low-calorie coal, and innovated to use the alternative energy sources to produce slag.

The Company’s strategy of improving the competitive advantage enabled the Company to maintain, even increased customer loyalty, and its ability to keep track with the increasing dynamics of cement industry. As the result, in 2014, the Company posted 2.6% growth of sales volume to 28.5 million tons from 27.8 million tons in 2013. The Company also covered 43.7% of national market share.

Further, the Company consistently implemented revenue management strategy to optimize revenue, focusing on key regions, developing potential market, and boosting synergy with the group. The Company successfully improved revenues by 10.1% to Rp27.0 trillion from Rp24.5 trillion in the previous year on the back of these strategies.

The stakeholders, including investors in the capital market, responded positively to the growth and development of the Company’s performance. This was illustrated by the Company’s share price movement, which stood at Rp16,200 per share at the end of 2014, grew 14.5% from the price at the closing trading day in 2013 at Rp14,150 per share.

Reinforcing Foundation for Sustainable Growth in the Future

Aside from posting 2014 performances, the Company also continually carries out various strategic initiatives as part of its commitment to reinforce the foundation for sustainable growth in the future. The strategic measures that are carried out and planned covering:

• Enhancing production capacity: developing new plant in Central Java and West Sumatera, construction of cement mill, quarry upgrading and extension.

• Improving distribution facilities by building packing plant in 3 potential markets

• Cost efficiency improvement: building WHRPG in Tuban with 30.6 MW capacity and encourages more use of Alternative Fuel Resources (AFR). • Strengthening supporting elements: carry out

HR competence and complete ICT enhancement program

• Continue programs post-transformation as Strategic Holding

The efforts around cost management initiative were also able to control the increase of production cost per ton. Despite the increase in energy costs, especially electricity tariff, cost of goods sold in 2014 rose only by 13.5% from 2013. Moreover, through efficiency programs, the Company successfully managed the growth of operating expense, maintaining operating expense ratio at 16.5% from 15.8% in the previous year. The Company’s EBITDA grew by 2.5% to Rp8.3 trillion compared to a previous year.

Overall, total profit attributable to the equity holders of parent entity stood at 3.6% growth to Rp5.6 trillion from Rp5.4 trillion in the previous year. Earnings per share attributable to the equity holders of parent entity was up by 3.6% from Rp938 to Rp905.

The operational results allowed the Company to manage strong fundament. ROE stood at 23.2% and ROA at 16.2%. Debt to Equity Ratio (DER) at the end of 2014 stood at 16.3% from 19.6% and liability to asset ratio stood at 11.4% from 13.3% in 2013, due to utilization of loans facility for expansion purposes. Although the position increased, the liability ratio remained sound and presented the Company’s strong financial capability to support the implementation of its development plans in the future.

The following presents brief overview on the Company’s operational performance, which signified positive results amid the market competition:

Description 2014 2013 Growth %

Cement Production Volume (million ton) 28.3 26.9 5.2%

Sales Volume (million ton) 28.5 27.8 2.6%

Revenues (Rp billion) 26,987 24,501 10.1%

Operating Income (Rp billion) 7,156 7,063 1.3%

EBITDA (Rp billion) 8,303 8,099 2.5%

On the back of various strategic steps that were successfully carried out in 2014 and will be continued going forward, the Company ensured that the foundation for its future growth is sound and strong. The Company also made sure that it would accomplish the Company’s vision as a leading, international cement company in South East Asia.

The Company was able to overcome challenges in 2014 and initiated a number of strategic measures as

part of its strategic program to bolster foundation for sustainable business growth in the future

Realizing Strategic Programs Post Corporate Transformation

The development of 2 new units in Rembang and Indarung, West Sumatera, are among the strategic programs following the corporate transformation project. Progress of physical construction is underway, however there are environmental and social issues in respect of unit development in Rembang that are currently under settlement.

The Company continued to convince the community on the compliance of the unit’s development with the environmental and social standards and policies. The Company applied sophisticated technology in the structure’s design and operations, ensuring that the unit will be environmentally friendly. With the approaches, explanation, and clarification, the Company expects that the unit’s construction project in Rembang will be completed as scheduled.

Meanwhile, to ensure the readiness of its human capital competency; ready to compete in the regional and global environment, the Company continued realizing various strategic initiatives. The goal is to capitalize all architectural capacities and innovative abilities in cement to serve as the Company’s features of excellence and backbone for business growth in the future.

Report from the President Director

Continuing Semen Indonesia Centre of the CHAMPS (SICC), the Company sharpens the functions of its pillars, covering Dynamic Learning, building Centre of Engineering, Centre of Research, and eventually establish Semen Indonesia International University.

Innovation

The Company has rolled-out innovative programs, which were part of the Company’s intellectual capital that differentiated competitive advantage in order to achieve sustainable growth. To nurture the spirit of innovation, the Company continuously explores creative ideas that are in line with the Company’s strategies and recognize selected innovators. In 2014, the Company organized the sixth Semen Indonesia Award on Innovation (SIAI), in which innovations were grouped into several key categories, among others raw material, technology and process, as well as management.

The Company implemented the innovative solutions captured from the competition into its operational activities to get better efficiency and enhance competitiveness. For its consistency in championing and introducing innovations to its operations, the Company attained Technology Pioneer award for the fourth time. The Company also received a number of other awards that recognized the Company as the front-runner of innovations, including innovations in the environment from the Ministry of Industry, and from the Ministry of Environment, which granted Green Proper award.

Enhancing the Quality of Corporate Governance Best Practice Implementation

Continuing its transformation into a holding company and a regional player in the cement industry, the Company carries out improvements on regulations and policies that guide the day-to-day operations. Committed to enhance the quality of corporate governance, the Company completed its review on regulations and policies concurrently with the commencement of relevant work programs.

The Company is highly dedicated to improve best practices implementation of GCG, as reflected by its initiative to complete the corporate governance soft structure and infrastructure. The Company has also been prepared to refine standard operating procedures in order to meet changes in the corporation’s structure. Several programs conducted to enhance the quality of GCG implementation in 2014 covered:

• Review and adjustment to Whistleblowing System Manual

• Improvement of Integrated Enterprise Wide Risk Management (IEWRM), which now allows all risk owners to identify, calculate, and mitigate main risks

• Review and adjustment to the Board Manual • Review and adjustment to the Company’s Code

of Conduct

Balancing Business Sustainability with Efforts to Bring a Better Living Quality for Future Generation

Business development activities carried out in Rembang and Padang follow this commitment. The Company has complied with all statutory procedures, including the formulation and presentation of Environmental Impact Analysis document (AMDAL), complemented with Environment Management and Monitoring document (UKL-UPL) to ensure the fulfilment of environmental preservation requirements. The Company took a further step to design and use the environmentally friendly mining and plant operations technologies. The Company is committed to replicate the success of environmental management efforts in Tuban, where the Company obtained GOLD PROPER award from the Ministry of Environment, as well as in other plants.

In addition, the Company is also consistently implementing efforts to enhance environmental quality, reflecting Semen Indonesia’s participation in climate change mitigation initiatives. Aside from replanting, the Company implements Clean Development Mechanism (CDM), which covers energy conservation through WHRPF operationalization and development, using biomass, applying AFR, and absorbing certain types of industrial wastes in producing slag.

With these efforts, the Company successfully lowered its CO2 emission and obtained Carbon Emission Reduction (CER) certificate as proof of recognition from the global community towards the tangible efforts that Semen Indonesia undertake to improve the environmental quality.

Illustrating its strong commitment to Corporate Social and Environmental Responsibilities (CSER), in 2014 the Company commenced with the implementation of its CSR blueprint, which translated CSER concept as an element that was not only mandatory for the Company, but moreover as a way for the Company to improve its reputation and ensure business continuity. The Company’s CSR four pillars program are:

• “SI Cerdas” (SI Smart) – focusing on competence building through educational programs

• “SI Prima” (SI Excellent) – a synergy with programs under Marketing and Research and Development.

• “SI Lestari” (SI Sustainable) – focusing on environmental programs

• “SI Peduli” (SI Care) – a host of social and economic programs

Under pillar “SI Cerdas”, the Company continued its workers’ certification program. Until 2014, around 4,000 workers have been certified. The Company also continued “KIRANA”, a program that shapes the character of young generation through singing and children’s song composition competition, held in 28 cities across Indonesia. KIRANA aims to stimulate song creation for children, nurturing the children of Indonesia with songs that are appropriate with their age development.

The Company also provided Information, Communication, and Technology (ICT) training for students in elementary, junior-high, and high school to raise IT-literacy among young generation around the Company. This program also serves as the Company’s platform to contribute to competence development and character building for teachers in order to improve education quality.

Through pillar “SI Lestari”, the Company stepped up its Waste to Zero program and developed Mangrove Centre Tuban as centre of learning and biodiversity protection development to preserve the habitat of various land and water organisms as well as to help recover coastal environment disrupted by abrasion and develop ecotourism. In addition, the Company develops part of ex-mining land into pilot plantation and living laboratory that will be valuable for learning and education purposes, raising environmental awareness of young generation.

The Company was also consistent in improving its Green Belt activities across all mining areas and realized replanting program in certain locations. These are environmental programs that are outside of programs with close association with the Company’s operations.

Meanwhile, through “SI Peduli” program, until 2014 the Company has worked with 30,067 partners who created jobs opportunity for 61,156 people and generated a turnover amounting to Rp1.71 trillion. The Company also distributed fund support for education, sports, arts, health, public facility, and disaster relief efforts in Indonesia. In Vietnam, the Company aided schools and provided medical treatment for students around the plant.

Projections and Strategy in 2015

The Company forecasted that Indonesia’s economy in the coming year would still be facing macro challenges. The domestic consumption and investments will still be the main contributors to Indonesia’s economic growth, while inflation and exchange rate volatility are predicted to keep benchmark interest rate at a high level. Although plans of infrastructure projects realization going forward are promising, their impacts to economic progress will not be immediate.

Economic growth projection clearly signals another challenging time for cement industry. Demand for growth will be limited, and expected to stay around 6-7%. The Company needs to put greater concern on maintaining its performance in terms of cost management and operational efficiency.

Today, the Company is in a better position to meet the growth of market demand. Maintenance and upgrading programs that are slated for completion next year will enhance the Company’s competitive advantage, which will be even stronger once the distribution infrastructure development, including packing plant construction project, are completed. This will allow the Company opportunity to win over the competition and fulfil the development opportunities.

To ensure the Company ability to secure competitiveness and at the same time deliver optimum performance, the Company will consistently implement strategic and critical initiatives with respect to: capacity growth, energy security, corporate image strengthening, meeting consumer demand, reinforcing supporting units and risk management as well as focusing management efforts on revenue, cost, capacity, competitive advantage improvement, and investment.

Changes in the Composition of the Board of Directors

During reporting year 2014, there were changes in the composition of the Board of Directors. Given the duty with a new responsibility by the Government as shareholder of Serie A shares, Dwi Soetjipto resigned as the Company’s President Director effective as of 28 November 2014. The Company appointed myself, Suparni, as Acting President Director until Extraordinary GMS is held in 2015.

Through Extraordinary General Meeting of Shareholders held on 23 January 2015, the meeting appointed me, Suparni, as President Director. My term of office is effective henceforth until GMS 2017 or in accordance with the prevailing regulations.

Closing

Hereby we conclude the operational performance overview for 2014. We would like to respectfully request the shareholders to approve the Annual Report and the Company’s management in 2014, to ratify the Financial Statements, and to acquit and discharge the Board of Directors and Board of Commissioners from their management and supervisory responsibilities during fiscal year 2014.

Finally, on behalf of the Company’s Board of Directors, we would like to thank and appreciate shareholders for their trust and support; to the Board of Commissioners, who constantly provides direction and guidance; and to the Company’s customers and partners for their support and cooperation.

We also acknowledge our Employees and thank them for their hard work, dedication, and contribution to the Company. All of those have enabled Semen Indonesia to achieve the outstanding results in 2014. We are optimistic that the efforts resulted from our solid work, as a team will boost the Company’s ability to benefit from promising growth potentials and to produce the best, sustainable performance in the future.

Gresik, 23 March 2015

SUPARNI

1. Suparni

President Director

2. Gatot Kustyadji

Director

3. Amat Pria Darma

Director

4. Ahyanizzaman

Director

5. Rizkan Chandra

Director

6. Johan Samudra

Business

Development

Report

57

Corporate Transformation

66

Regional Expansion

71

Domestic Expansion

The Company has formulated business strategy to ensure the creation

of growth acceleration, at the same time to assure the Company’s

sustainable growth. The business strategy was formulated to provide

optimum benefits for the Stakeholders and Shareholders by taking into

account the risks appetite level.

“

Business Development Report

Anticipating the recovery of cement demand in Indonesia and regional

markets through the construction of new production facility, production

supporting facility as well as distribution facility, followed by the long term

business implementation, which had been properly designed to create a long

term quality sustainable growth

The Company has formulated business stratety to ensure the creation of growth acceleration as well as to assure the Company’s sustainable growth. The business strategy was formulated to provide optimum benefits for the Stakeholders and Shareholders by taking into account the risks appetite level.

The following are brief descriptions of all strategic initiatives implemented by the Company.

LONG TERM STRATEGIC PLAN

The Company forecasted sustainable growth of cement demand in the future based on at least the

“

To anticipate growth potential of this increasing cement consumption, the Company has stipulated six important issues as the foundation of sustainable growth, as follows:

1. Capacity Growth 2. Energy Reservation

3. Consumers Requirements Fulfillment 4. Corporate Image Enhancement 5. Capability to Maintain Growth 6. Controlling Major Risks

1. Capacity Growth

The Company strives to increase its production capacity, both through organic or anorganic strategy. The organic strategy is implemented through the additional capacity in existing plants. One of the implementation was the operating of vertical cement mill in Dumai, with 0.9 million tons capacity. The organic strategy is also implemented by the construction of new plant in subsidiaries, construction of Indarung VI Plant in West Sumatra, and Rembang Plant in Central Java.

The total production capacity in the Group at the end of 2014 will reach 31.8 million tons cement per annum, and it’s expected to reach 55 million tons per annum by 2020.

2. Energy Reservation

The Company has conducted and continued to evaluate the energy reservation to ensure coal supply reserve and to maintain the balance between electricity supply from the third party with the Company’s owned power plants.

To reserve coal requirements, the Company held long term procurement contract that periodically reviewed, both by subsidiary, PT SGG Energi Prima or other third parties.

First, the tremendous amount of Indonesian population followed by high growth constituted a significant potential to boost the cement demand improvement.

Second, the Government’s commitment to add infrastructure expenditures, in which among others by diverting part of fuel subsidy to infrastructure sector in order to support the development of connectivity between economic centres in Indonesia, thereby will increase the cement demand.

Third, below average of cement consumption per capita in Indonesia compared to the Asia’s average consumption per capita, will provide growth opportunity for cement demand in the future.

Fourth, Indonesia’ long term economic prospects will continue to grow despite the sluggish economic condition in 2013 and 2014. Although several of key nations have experienced economic slowdown, Indonesia’s economic growth is relatively remain high. This condition will boost the growth of cement demand.

Fifth, Indonesia remains an investment destinations both in the industrial sectors as well as in basic infrastructure development, which will generate economic potential in all regions, thereby will increase cement demand.

In order to reserve energy supply by utilizing the hot gas residual, the Company has begun the construction of WHRPG project in Tuban with 30,6 MW capacity. In addition to procure energy through hot gas residual, WHRPG will also provide benefits by reducing the electricity cost and reduce the usage of electricity through PT PLN (Persero).

To reserve the energy supply, the Company constantly equipped the new plant with its owned power plant with vast capacity. Among others is the construction of 2 x 35 MW power plant in Tonasa V Plant in Pangkep Regency, South Sulawesi, the biggest power plant constructed integratedly with cement industry.

The Company also increased the alternative fuels portion to reduce the cost of fossil-based energy expenditure, at the same time to ensure the manifestation of environmental sustainability.

3. Consumers Requirements Fulfillment

The objective of consumers requirements fulfillment is to maintain cement market share in Indonesia and Regionally. The Company sets three strategy in this effort, which are to ensure cement availability in every market segment, the Company’s products becoming the customer’s main choice, and product diversification to meet the consumers’ needs.

To assure the adequacy of cement in every market segment, the Company continues to expand its distribution networks by accumulating the sales partners up to 361 partners throughout Indonesia. To ensure cement supply to reach every

region, the Company has built 24 packing plants across Indonesia and Vietnam. The Company strives to manage the distribution facility of every existing production unit, thus to achieve reliable supplies and optimum distribution cost through OpCo synergy.

The Company realized the importance of brand equity enhancement through marketing programs that will support the sales, such as the development of communities program and effective marketing communication, with the objectives to make the Company’s products as the customers’ first choice. To respond to the customers’ complaint, the Company prepared contact service and if necessary will delegate mobile laboratory to directly visit the customers’ location.

The Company also developed products diversification, such as ready mix concretes, precasts, as well as building materials through the Company’s subsidiary, PT SGG Prima Beton.

The Company has implemented innovation on several cement products and its derivatives with high quality, in order to meet the consumers’ needs. One of the innovation is product with rapid strength concretes and pervious concretes.

4. Corporate Image Enhancement

One of the Company’s growth pillar is the development of environmental and social management. Thus the objective of the Company’s image enhancement was focused on the two aspects.

Tinjauan Kinerja

In environmental management, the Company is committed in the implementation of CO2

reduction program, industrial waste utilization usage of Alternative Fuel Resources, as well as hot gas residual utilization.

The Company also continues to implementing its sustainable Corporate Social and Environmental Responsibility by building conducive plants environment as well as building corporate image in the public.

5. Capability to Maintain Growth

To propel business growth, the Company has refined all of its supporting infrastructures to become a direct catalyst in accelerating business growth, which covering the organization governance, quality improvement on information technology and communication, and human resources (HR) management. The refinement was conducted in an integrated manner in all the Company’s group environment.

6. Major Risks Control

Prudence principles become the basis in the Company’s business operations. The Company improved its risk management through monitoring and mitigation on all major risks, thereby it’s able to maximize every potential in enhancing the performance.

From all the formulated strategy frameworks, the Company confident in aligning the implementation into a short term activity through five strategy management focus, which are revenue management, cost management, capacity management, increasing competitive advantage and investment management. The objective is to support growth acceleration within the next 10 year and coming years.

STRATEGY MANAGEMENT FOCUS

To boost growth acceleration, the Company aligned its long term strategy implementation into short term activity through five strategy management focus, which are revenue management, cost management, capacity management, increasing advantage and investment management.

Revenue Management

This strategy is closely linked with the Company’s marketing activities. With the revenue management strategy, the Company conducted the revenue potential management by mapping the distribution patterns and marketing strategy, with the concentration on products sales primarily to the regions with optimum operating income margin, yet remain to take new market opportunities in other potential regions.

Cost Management

With this strategy, the Company strives to focus on cost efficiency efforts through the management of raw materials, packaging, energy, maintenance, distribution patterns and transportation methods, thus the Company’s products will gain maximum competitive edge.

Capacity Management