Bio3 Research: An

Entrepreneurial Process

in the Market

for Patents

Alfredo D’Angelo

Mario Benassi

This case concerns Bio3 Research, a small biotechnology company established in Italy in 2001 that focuses on cardiovascular disorders, connective tissue regeneration, and renal disorders. The case reports on Dr. Pilato, founder and chief executive officer of Bio3 Research, while reflecting with his chief operating officer on the investments required to finance his patents and products pipeline. The case offers a discussion around the entre-preneurial process of Bio3 Research, from opportunity identification to opportunity devel-opment and exploitation. The case then reveals Bio3 Research’s business model and examines its activities and management practices in the patent market. In a recessive world economy, Bio3 Research has an exciting portfolio of patents and products in high-growth markets but must decide between financial options, as the company cannot exploit all of these opportunities on its own.

Introduction

January 28th 2013, 10am—It was a freezing but sunny morning in Milan (Italy). Dr. Pilato, the founder and chief executive officer (CEO) of Bio3 Research, could clearly see snow-covered mountains from his top floor office in the center of the city. The situation he was facing at work, however, was far from clear. Dr. Pilato met Dr. Gardini, chief operating officer (COO), to discuss the company’s future development. “Our company’s future could be more successful if we were able to attract the right funding,” Dr. Pilato said as he started the meeting, with the knowledge that the company’s limited cash resources could restrict any prospects of development. Dr. Pilato had invested $3.2 million of his personal savings over the last 12 years to build his patents and products portfolio. Today, he could license or sell the entire portfolio and generate almost $20 million, but the real rewards could yet happen in the future if the company achieved phase IIA of its clinical studies (see Figure 1).

Please send correspondence to: Alfredo D’Angelo, tel.:+44 (0)141 330 4132; e-mail: Alfredo.D’Angelo@ glasgow.ac.uk, and to Mario Benassi at mario.benassi@unimi.it.

P

T

E

&

1042-2587

© 2014 Baylor University

1 August, 2014

DOI: 10.1111/etap.12132

September, 2015 1247

DOI: 10.1111/etap.12132

1042-2587

Figure 1

The Business Model of Bio3 Research

DISCOVERY/PRECLINICAL TESTING

2013 2015 2017 2021 2023

$20m

VALUE†

†Values reflect approximate estimations considering that not all the innovations/applications which the company will develop can be successful. Values also reflect depreciation for all the

possible failures which may occur in the company’s pipeline.

More than an additional $40 million was needed to finance this development, but the potential reward could exceed $250 million. However, a smaller investment of an addi-tional $18 million to reach at least the end of the preclinical testing and to cover the costs for the Investigational New Drug (IND) application could potentially more than double the value of the company’s portfolio and generate almost $50 million. Dr. Pilato knew that the company’s future was bright as its patents and products pipeline were positioned in market segments with high growth perspectives. Still, more investment was needed to capitalize on this growth.

Bio3 Research, with its headquarters in Milan and a research and development (R&D) subsidiary in Walnut Creek, CA (USA), was operating at the intersection of the pharma-ceutical, biotechnology, and nutraceutical/dietary supplement industries. With 17 patents in its portfolio, the company was active in the areas of cardiovascular disorders, connec-tive tissue regeneration, and renal disorders, all of which were predicted to experience substantial growth. According to the latest industry reports, the global market for cardio-vascular disease treatments was estimated to reach $17 billion by 2017 with an annual growth rate of 15% (Global Data, 2010), and the global tissue engineering and regenera-tive medicine industry was projected to grow to $11.8 billion by 2022 (Global Healthcare Network, 2010). The global market for nutraceuticals1

was also estimated to exceed $243 billion by 2015 (Global Industry Analysts, 2010).

Most of Bio3 Research’s targeted diseases were related to aging—diseases affecting hundreds of millions of people worldwide every year. The patient base for Bio3 Research’s applications and treatment methods was likely to expand further, thanks to an aging population and improvements in the quality of life. Many companies’ patents were expiring across the pharmaceutical industry, which meant that sales were being diverted to generic alternatives. Thus, the company’s portfolio of patents and products could have potentially attracted interested specialized investors and other pharmaceutical and large biotechnology companies, as Bio3 Research would provide access to the largest segments of the pharma-ceutical market. Another positive development was that patients were seeking more effective and less expensive treatment options and were demanding new products.

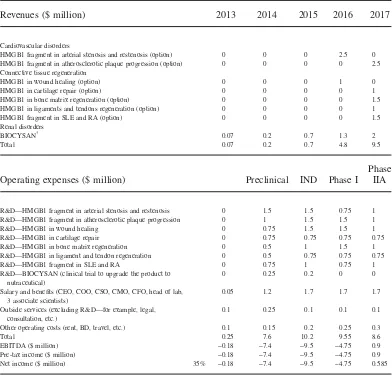

Bio3 Research, with its promising patents and products pipeline, received positive signals from the market, but the company had to face a very critical juncture. Since 2001, Dr. Pilato had invested a great deal of money from his own pocket, yet the company was still in the cash burn phase and had very limited revenue (see Table 1).

Bio3 Research’s scarce cash resources put the company’s future development in question. “What should we do?”, Dr. Gardini asked shivering with apprehension on that cold winter morning. Dr. Pilato foresaw several possibilities for promoting the company’s development. Financial partners, such as venture capital (VC)/private equity firms could provide extra cash and expertise, but they could also change the ownership and gover-nance structure of the company. Bio3 Research could also enter into a strategic alliance for co-development with other pharmaceutical companies that could provide critical resources such as a capital infusion in addition to R&D expertise for additional testing as well as marketing resources. Exiting the business and monetizing by licensing or trading Bio3 Research’s portfolio of patents and products was yet another possibility.

Each available financing and strategic option had its own “pros” and “cons.” The two men sat down around the table in the Milan office to review previous performance and discuss their now crucial funding requirements.

1. Nutraceuticals are defined as functional food, beverages, and supplements fortified with bioactive ingre-dients including fiber, probiotics, protein and peptides, omega, phytochemicals, and vitamins and minerals.

3 August, 2014

Origins

Dr. Pilato founded Bio3 Research at the end of 2001. Initially, the company was formed on the basis of a collaboration agreement with Professor Bianchi of the San Raffaele Research Institute for the development of the protein high mobility group box 1 (HMGB1), a new, potentially therapeutic agent for cardiovascular disorders and connective tissue regeneration. The two met one afternoon in the summer of 2001 at the San Raffaele University in Milan during Professor Bianchi’s presentation of his new discovery.

Table 1

Company’s Financial Projections

Revenues ($ million) 2013 2014 2015 2016 2017

Cardiovascular disorders

HMGB1 fragment in arterial stenosis and restenosis (option) 0 0 0 2.5 0

HMGB1 fragment in atherosclerotic plaque progression (option) 0 0 0 0 2.5

Connective tissue regeneration

HMGB1 in wound healing (option) 0 0 0 1 0

HMGB1 in cartilage repair (option) 0 0 0 0 1

HMGB1 in bone matrix regeneration (option) 0 0 0 0 1.5

HMGB1 in ligaments and tendons regeneration (option) 0 0 0 0 1

HMGB1 fragment in SLE and RA (option) 0 0 0 0 1.5

Renal disorders

BIOCYSAN† 0.07 0.2 0.7 1.3 2

Total 0.07 0.2 0.7 4.8 9.5

Operating expenses ($ million) Preclinical IND Phase I

Phase IIA

R&D—HMGB1 fragment in arterial stenosis and restenosis 0 1.5 1.5 0.75 1

R&D—HMGB1 fragment in atherosclerotic plaque progression 0 1 1.5 1.5 1

R&D—HMGB1 in wound healing 0 0.75 1.5 1.5 1

R&D—HMGB1 in cartilage repair 0 0.75 0.75 0.75 0.75

R&D—HMGB1 in bone matrix regeneration 0 0.5 1 1.5 1

R&D—HMGB1 in ligament and tendon regeneration 0 0.5 0.75 0.75 0.75

R&D—HMGB1 fragment in SLE and RA 0 0.75 1 0.75 1

R&D—BIOCYSAN (clinical trial to upgrade the product to nutraceutical)

0 0.25 0.2 0 0

Salary and benefits (CEO, COO, CSO, CMO, CFO, head of lab, 3 associate scientists)

0.05 1.2 1.7 1.7 1.7

Outside services (excluding R&D—for example, legal, consultation, etc.)

0.1 0.25 0.1 0.1 0.1

Other operating costs (rent, BD, travel, etc.) 0.1 0.15 0.2 0.25 0.3

Total 0.25 7.6 10.2 9.55 8.6

EBITDA ($ million) −0.18 −7.4 −9.5 −4.75 0.9

Pre-tax income ($ million) −0.18 −7.4 −9.5 −4.75 0.9

Net income ($ million) 35% −0.18 −7.4 −9.5 −4.75 0.585

†BIOCYSAN will be “upgraded” from dietary supplement to nutraceutical (R&D 2013–2014; revenues as dietary

supple-ment until 2014; revenues as nutraceutical as of 2015).

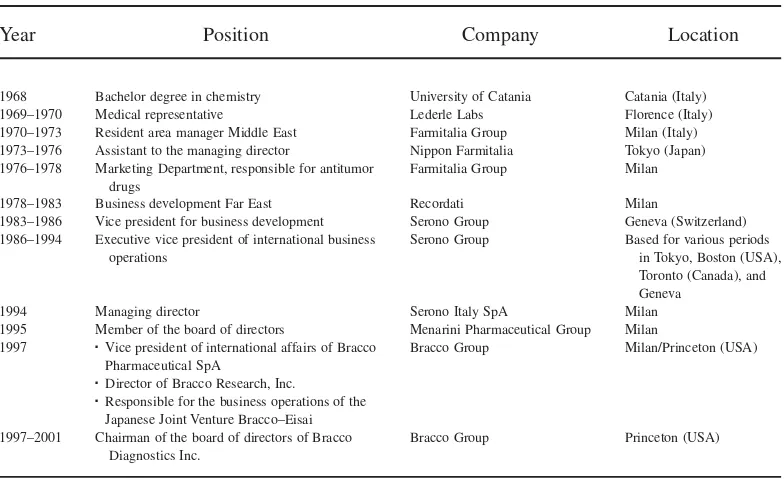

At the time of their first meeting, Dr. Pilato was chairman of the board of Bracco Diagnostics Inc. (Princeton, NJ) and vice president of international affairs at Bracco Pharmaceutical, an Italian pharmaceutical company with its headquarters in Milan. Pro-fessor Bianchi was group leader of the Chromatin Dynamics Unit at the San Raffaele Research Institute. The two men were introduced during refreshments after Professor Bianchi’s presentation and animatedly discussed the Institute’s lack of interest in the potential of this new discovery, the protein HMGB1. The development of applications of the protein would require legal protection through patenting, but disappointingly, the Institute did not intend to provide Professor Bianchi with the financial support he needed. Dr. Pilato considered the San Raffaele Research Institute’s short-term view of Profes-sor Bianchi’s innovation an open door for a promising partnership. Many university departments in Italy considered patents a financial burden and usually did not invest in them; contrarily, Dr. Pilato saw them as potential opportunities and an investment. Having gained extensive commercial experience by working as a top executive for big pharmaceu-tical companies all around the world for more than 30 years (see Table 2 for Dr. Pilato’s resume), he immediately recognized the business potential of HMGB1 (Shane, 2000).

Dr. Pilato thought of two possible strategic alternatives for generating and extracting value from this innovation. The first was to finance the patenting process of HMGB1 and then use his connections in the industry to reassign the patents while still keeping his managerial job. The second was to start a new company to manage the development of the product. These two alternatives kept Dr. Pilato preoccupied for months afterwards. “I felt the desire and the passion to create new things, and HMGB1 represented a real opportu-nity. At the end of the summer 2001, I resigned from my previous job and a few months later I started my own biotech company,” Dr. Pilato remembered.

Table 2

Dr. Pilato, the Entrepreneur

Year Position Company Location

1968 Bachelor degree in chemistry University of Catania Catania (Italy)

1969–1970 Medical representative Lederle Labs Florence (Italy)

1970–1973 Resident area manager Middle East Farmitalia Group Milan (Italy)

1973–1976 Assistant to the managing director Nippon Farmitalia Tokyo (Japan)

1976–1978 Marketing Department, responsible for antitumor

drugs

Farmitalia Group Milan

1978–1983 Business development Far East Recordati Milan

1983–1986 Vice president for business development Serono Group Geneva (Switzerland)

1986–1994 Executive vice president of international business

operations

Serono Group Based for various periods

in Tokyo, Boston (USA), Toronto (Canada), and Geneva

1994 Managing director Serono Italy SpA Milan

1995 Member of the board of directors Menarini Pharmaceutical Group Milan

1997 Ë Vice president of international affairs of Bracco

Pharmaceutical SpA

Ë Director of Bracco Research, Inc.

Ë Responsible for the business operations of the

Japanese Joint Venture Bracco–Eisai

Bracco Group Milan/Princeton (USA)

1997–2001 Chairman of the board of directors of Bracco

Diagnostics Inc.

Bracco Group Princeton (USA)

5 August, 2014

Dr. Pilato made an initial investment of $150,000 in order to sign a collaboration agreement with HMGB1’s inventor, start the initial operations activities for the company, and cover the first patent application costs (refer again to Figure 1). He established Bio3 Research’s headquarters in Milan in order to be close to the most important universities and R&D centers in Italy, as well as to make the most of the personal networks he had developed in the biotechnology and pharmaceutical industries during the course of a long career. He was also able to use his contacts within Assobiotec, a national biotech asso-ciation of which he was one of the first associate members (Ozgen & Baron, 2007). In January 2003, Dr. Pilato employed Dr. Gardini, a young and highly dedicated Bocconi School of Management graduate, to manage the business operations and marketing activities of his small but ambitious biotechnology company.

The Industry

From the 1970s through the end of the 1990s, large, integrated multinational compa-nies led the innovation process in the pharmaceutical and biotechnology industries (Gassmann & Reepmeyer, 2005). These vertically integrated companies covered all the phases of the Drug Development and Approval (DDA) process (see Table 3).

In the late 1990s, however, the integrated model of the DDA process was dramatically revolutionized. “The innovation process in the pharmaceutical industry proved to be less effective for several reasons,” Dr. Pilato stated. First, innovation had become very complex, requiring a level of expertise that a single company could not always provide internally. Second, the innovation process had become more uncertain, as new scientific discoveries shifted technological trajectories (Pisano, 2006). Increasing uncertainty sug-gested that firms share the risks and costs with other companies. As shown in Table 3, an experimental drug takes more than 15 years on average to develop, from the discovery/ preclinical phase to the commercialization stage and then on to consumers. Only five in 5,000 compounds that enter preclinical testing make it to clinical studies in humans. One out of these five compounds tested on people is then approved. The success rate in the preclinical phase that evaluates the drug’s toxic and pharmacological effects through laboratory animal testing is less than 0.1%. However, of every 100 drugs for which applications are submitted to the regulatory authorities (Food and Drug Administration and/or European Monitoring Centre for Drugs and Drug Addiction), about 70 will suc-cessfully complete phase 1 trials and go on to phase 2 of the clinical studies,2

about 33 of the original 100 will complete phase 2 and go to phase 3, and 25–30 of the original 100 will clear phase 3 (DiMasi, 2001).

“Thus, developing a successful new product/drug is a long process that required the high risks and huge investments that a single company couldn’t always afford,” Dr. Pilato continued. In the late 1990s, big pharmaceutical companies favored the externalization of the riskier but less expensive activities of the discovery/preclinical phases to smaller companies, while keeping the more expensive but less risky activities of the clinical trials within the internal boundaries of the firm (Pisano, 2006). The costs involved in clinical studies accounts on average for more than 70% of the total costs occurring throughout the DDA process (Bigliardi, Nosella, & Verbano, 2005). “These costs still represent an

Table 3

The Drug Development and Approval Process

Discovery/preclinical testing

Laboratory and animal studies 20–100

volunteers

Purpose Assess biological (pharmacology, toxicology, etc.) activities and formulations

Success rate 5,000 compounds evaluated Five enter trials One approved

†The Food and Drug Administration (FDA) is the branch of the U.S. Department of Health and Human Services responsible for, among other things, granting drug approvals. The European Monitoring Centre for Drugs and Drug Addiction (EMCDDA)

extremely high entry barrier for micro and small biopharmaceutical companies that want to complete the entire DDA process from the discovery/preclinical phases up to the commercialization stage,” Dr. Pilato noted.

In recent years, there has been a proliferation of small biotech companies despite the presence of established big pharmaceutical companies that still undertake the entire innovation process (Nosella, Petroni, & Verbano, 2005). These companies are highly specialized in specific scientific and technological areas within the DDA process. For example, drug agent companies operate in the preclinical phases intending to discover and develop new compounds to patent and out-license. Product biotech companies are involved in the R&D (preclinical and/or clinical) stages. Platform companies or contract research organizations provide complementary services and infrastructure throughout all stages of the DDA process.

“The revolution within the pharmaceutical industry opened up a window of opportu-nity for new companies and business models to emerge,” Dr. Gardini agreed while pouring hot coffees.

The Company’s Business Model

“We couldn’t think of becoming a fully integrated pharmaceutical company as the costs to complete the entire DDA process are simply too high,” Dr. Pilato reminded Dr. Gardini while writing the words “Funding alternatives for Bio3 Research” on the black-board in the Milan office.

Bio3 Research’s initial strategy, Dr. Pilato recalled, was “. . . to identify commercially promising innovations/patents, to acquire exclusive rights over innovations/patents, to extend the protection of the original innovation/patents throughout the world, and to add value to the patent portfolio by means of pre-clinical testing.”

Bio3 Research was, to a large extent, different from the highly specialized biotech companies populating the industry. The company was not involved in the initial R&D activities of the discovery phase the way that drug agent companies are. Instead, Bio3 Research was originally built around a particular innovation. In 2001, Dr. Pilato started his business by identifying the protein HMGB1 as a promising innovation with potential applications in the pharmaceutical and biotechnology industries. He offered financial support for the initial patenting and signed an agreement with Professor Bianchi for the further development of the protein. He leveraged a knowledge-based innovation to create a patent-oriented business (Arora, Fosfuri, & Gambardella, 2001; Gassmann & Reepmeyer, 2005; Hargadon, 1998). The arrangement with Professor Bianchi was based on 50/50 ownership of the first patent, once granted, but exclusive usage rights were given to Dr. Pilato on the remaining 50% owned by Professor Bianchi. When Dr. Pilato obtained the exclusive usage right for HMGB1, he did not limit the patent’s coverage to Italy, but took steps to achieve global protection. During the period 2001–2013, the extension procedures for worldwide coverage took place. In the meantime, Bio3 Research secured the remaining 50% of the intellectual property (IP) rights for the use of HMGB1 from Professor Bianchi, who was not interested in the commercial side of the innovation and was fully dedicated to applied research in academia. Bio3 Research’s coverage, including patent applications and patents granted, were located not only in Europe, the United States, and Japan, but also in Canada, China, and Australia (see Table 4).

Table 4

Bio3 Research’s Patents Coverage

Patent class WO02074337†‡ WO2005074984§ WO2006077614¶ WO02074337†,†† WO2005058305‡‡ WO2007116428§§

Application Cardiovascular disorders

Connective tissue

regeneration Renal disorders

2001 Patent application in Italy

2004 Patent application to extend the coverage of

WO02074337 to proliferation factors

Patent application in Italy Patent application in Italy Patent application in Italy

2005 Granted in Italy

2006

2007 Granted in Australia Granted in Australia

2008 Granted in Italy, Europe, Mexico

2009 Granted in Italy Granted in Italy

2010 Granted in Europe, Mexico, Japan,

the United States (1st divisional application)

Granted in Europe, Mexico and Japan Granted in Italy

2011 Granted in the United States, China Granted in China, the United States

(2nd divisional application)

2012 Granted in Hong Kong

Patent pending in: Canada, the United States (2nd divisional applications), China (1st divisional application)

Granted in Hong Kong Patent pending in: Canada,

and China (1st divisional application)

Granted in the United States and Canada

Patent pending in Japan

Patent pending in Mexico and Argentina

†The patent class WO02074337 is the “mother patent” that covers both (a) the use of inhibitors/antagonists (such as Abs, Abs fragments, high mobility group box 1 [HMGB1] fragments, small molecules) in cardiovascular disorders related to HMGB1

overexpression, and (b) the use of HMGB1 and its fragments in connective tissue regeneration.

‡Patent that claims the use of inhibitors/antagonists (such as Abs, Abs fragments, HMGB1 fragments, small molecules) in cardiovascular disorders related to HMGB1 overexpression. §Patent that claims the proliferation of inhibitors/antagonists (such as Abs, Abs fragments, HMGB1 fragments, small molecules) in cardiovascular disorders related to HMGB1 overexpression. ¶Patent that claims the use of HMGB1 inhibitors/antagonists to block atherosclerotic plaque progression.

††Patent that claims the use of HMGB1 and its fragments in connective tissue regeneration. ‡‡Patent covering oral use of Cysteine/Cystina (BIOCYSAN) in end-stage renal disease. §§Patent covering oral use of Cysteine/Cystina

+Glutathione (BIOCYSAN Plus) in end-stage renal disease.

9

A

ugust,

2014

September,

2015

to protect its innovations, but extending patent coverage turned out to be more than a simple administrative issue (Somaya, 2012). Bio3 Research had to leverage additional resources and rely on patent consultants who had legal as well as scientific competencies. The drafting process in patent applications required a complex interplay among scientific, business, and juridical expertise, as IP rights carried both scientific and technical obliga-tions that were likely to affect future patent licensing contracts. Securing the services of patent attorneys, who combine expertise in law with other specialized areas of technology, had the potential to have a financial impact on the patenting output of firms equal to R&D spending. As such, these professionals were an important resource for Bio3 Research’s patenting strategy (Somaya, Williamson, & Zhang, 2007).

In Bio3 Research’s business model, patenting was a way to generate and potentially extract value from innovation. However, Dr. Pilato knew that in order to add value to the IP, Bio3 Research had to develop R&D activities in the preclinical trials up to the proof of concept (PoC) stage. Bio3 Research worked closely with national and international university departments, research institutions, and individual scientists in the preclinical phases, enabling the development and exploitation of the specific business opportunity (Ardichvili, Cardozo, & Ray, 2003; George & Bock, 2011) offered by the protein HMGB1. These included co-development activities, licensing-out to leverage third-party resources, licensing-in other companies’ IP, and signing up ownership and usage agree-ments with other innovators to complement its own patent portfolio (Arora et al., 2001). Over the period of 2001–2013, the company had spent $3.2 million ($500,000 in pat-enting activities alone) in order to create its portfolio of patents and products worth $20 million in 2013 according to Dr. Pilato’s and Dr. Gardini’s estimates (refer again to Figure 1).

The economic logic (Magretta, 2002) behind Bio3 Research’s business model was “to build a portfolio of patents and products in segments of the market where treatment methods and applications did not adequately meet patient needs in terms of efficacy, cost and safety,” Dr. Pilato emphasized. “This could generate interest from outside third parties, such as pharmaceutical and biotechnology corporations for future licensing agree-ments in the areas of cardiovascular disorders, connective tissue regeneration and renal disorders,” he concluded.

IP Portfolio Management

Cardiovascular Disorders

of patients due to an aging population represented a promising outlook for companies with new patents.

Bio3 Research had been active in the area of cardiovascular diseases since 2005, when the company entered into a cross-license agreement with Creabilis Therapeutics, an Italian drug discovery and development company, to develop the protein HMGB1. In the same year, Bio3 Research and Creabilis Therapeutics signed a research agreement with Cephalon Inc. (Frazer, PA, USA), a U.S. biopharmaceutical company, to develop a research compound designed to meet specific milestones for new cardiovascular disease treatments. Under the agreement, Cephalon had an exclusive option to develop and commercialize any products resulting from research performed by Creabilis Therapeutics and Bio3 Research. However, Cephalon decided after initial analysis not to proceed further with the research on the specific compound HMGB1, and the agreement between Bio3 Research and Creabilis Therapeutics was ended (Pisano, 2006). Dr. Pilato and Dr. Gardini committed the company further into this market segment by entering into strategic alliances with two U.S. biotech companies: Syngen Inc. in California in 2007 and Protelix Inc. (also California) in 2008. Under a nonexclusive research licensing agreement, they agreed to engineer, through their proprietary technological platform, a new family of HMGB1 inhibitors/antagonists in the cardiovascular field and in atherosclerotic plaque progression inhibition. Bio3 Research reserved the option to negotiate an exclusive licensing-in agreement on these compounds under already-agreed terms. Although the initial research was promising, Bio3 Research, Protelix, and Syngen decided not to continue with their collaboration. The alliance failed for two main reasons. First, the companies discovered that their strategic visions of the business were different. Second, they realized that cooperation was difficult to achieve because of a personality clash among the three CEOs (Forrest & Martin, 1992).

In the area of cardiovascular diseases, Bio3 Research was able to achieve two appli-cations in the preclinical stage (see Table 5). According to Edwards (2008), a financial deal for only one application at this stage of development was worth between $3 and $10 million.

Connective Tissue Regeneration

Bio3 Research’s patent portfolio also covered connective tissue regeneration. The company was particularly active in the segments of chronic wounds and cartilage regen-eration. The total global wound care market was projected to reach $20 billion by 2015 (PharmaLive, 2010). Wound care treatments range from traditional wound management, which involves supplies such as gauze and tape, to more advanced and active wound management, which incorporates tissue-engineered skin. The traditional wound care product market was worth approximately $14 billion globally, and the advanced and active segments were estimated at $6 billion. Several artificial skin products were already available on the more advanced wound management market, such as Dermagraft, Apligraf, TheraSkin, TransCyte, Laserskin, Epicel, OrCel, and Hyalograft. Experts esti-mated, however, that approximately 15% of patients with chronic wounds would be willing to pay for more advanced treatment if the treatment produced superior results (Hüsing, Bührlen, & Gaisser, 2003).

The global worldwide market for advanced orthopedic technologies, implants, and regenerative products was estimated to be $27.7 billion and was predicted to grow to $32.4 billion by 2015, with an average annual growth of 2.7% (BCC Research, 2011). Within that market, the bone repair and regenerative product segment was estimated to be $3.1

11 August, 2014

Table 5

†Free sale certificate—dietary supplement.

Source:http://www.bio3research.com/

HMGB1, high mobility group box 1; IND, Investigational New Drug; PoC, proof of concept; RA, rheumatoid arthritis; SLE, systematic lupus erythematosus.

billion, and the joint replacement, implant, and regenerative product segment at $23.2 billion (Business Insights, 2010).

Bio3 Research had been operating in this area since 2006 via a collaboration agree-ment with the Veterinary Faculty of the University of Milan. This collaboration was intended to perform a pilot animal pharmacological study for the project in cartilage repair (CTR-1). Bio3 Research had also been working since 2009 on a project on wound healing (CTR-2) with Bio-Quant Inc. (La Jolla, CA, USA) to perform another pilot animal pharmacological study (refer again to Table 5).

In the connective tissue regeneration area, Bio3 Research achieved two applications at an advanced stage of the preclinical phase, while also retaining three other applications under development, such as the CTR-3 and CTR-4 projects and FRAG A–HMGB1 fragment (systematic lupus erythematosus [SLE]–rheumatoid arthritis [RA]). In the area of cardiovascular diseases, a financial deal for even one patent at this stage of development could be worth $3–10 million.

Renal Disorders

Initially, Bio3 Research was not active in the treatment of renal disorders. The protein HMGB1 only covered cardiovascular disorders and connective tissue regeneration. In 2004, the company signed an ownership and exclusive usage agreement for two more patents with another independent scientist to operate in this area (refer again to Table 4). Renal disorders, better known as chronic kidney disease (CKD), cause serious complica-tions for millions of patients. An estimated 500 million people in the world, or about 10% of the adult population, have CKD (National Kidney Foundation, 2010). The majority of CKD patients had been treated with three drugs: Epogen, Aranesp, and Procrit. In 2009, these drugs had combined sales of $6.3 billion (Perrone, 2010).

The strategic thinking behind Bio3 Research’s investment in the area of renal disor-ders was the company’s decision not to focus exclusively on patents, IP management, and R&D activities. In 2010, Bio3 Research was granted a free sale certificate for BIOCYSAN by the Italian Ministry of Health that allowed the company the right to market the product as a dietary supplement.3

Bio3 Research entered into a manufactur-ing agreement with the Italian company S.I.I.T. for the production of BIOCYSAN. BIOCYSAN had been marketed worldwide via e-commerce, and exclusive local distribu-tors were used in Greece, Bulgaria, Cyprus, and Lebanon. Bio3 Research also engaged in extensive discussions with European distributors in order to expand the geographic scope of BIOCYSAN to other European countries while also scouting for partners in the United States and Japan.

What Next?

Bio3 Research had progressed from one innovation—HMGB1—to multiple patents, then to R&D collaboration activities, and finally to a saleable product—BIOCYSAN— over a period of 12 years. During this time, the company strengthened its inter-organizational network and enhanced its reputation and confidence (Pisano, 2006; Teece, 2010). In 2008, the company also opened its own fully owned R&D subsidiary, Bio3

3. Dietary supplements are vitamins that do not require the same approval process by regulatory agencies (FDA and/or EMCDDA) as drugs.

13 August, 2014

Research Inc., within a biotechnology cluster in the San Francisco Bay Area just north of Silicon Valley. There were several reasons for opening a U.S. subsidiary (Florida, 1997). First, Bio3 Research wanted to have a team of qualified researchers to carry out in-house R&D activities and better manage R&D results. Second, the company wanted to strengthen its ongoing strategic alliances in the United States. Third, having a U.S.-based company allowed Bio3 Research access to the American capital market. Bio3 Research Inc. received a Qualifying Therapeutics Discovery Project Grant from the U.S. Treasury to fund 50% of the company’s R&D investments in the United States during the period of 2009–2010 as a result of opening a U.S.-based operation.

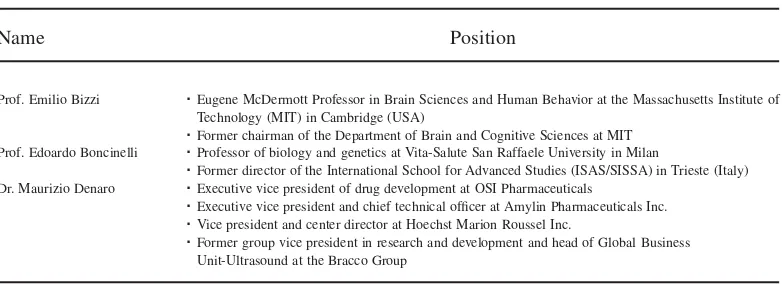

The two friends and colleagues agreed that Bio3 Research had come a long way over the years. The company, with nine employees (including the founder), 17 granted patents, and one R&D subsidiary in the United States, had successfully survived the start-up stage (Nosella et al., 2005). “Credit for these extraordinary results has to be shared by all the team members and the Advisory Board,” Dr. Pilato noted (see Tables 6 and 7).

However, Bio3 Research was still in the phase of cash burn and very limited revenue (refer again to Table 1). This put into question the company’s future development. Dr. Pilato added two columns labeled “Pros” and “Cons” under the “Funding Alternatives for Bio3 Research” title he had written on the blackboard a few hours before.

The first option for Dr. Pilato and Dr. Gardini to finance Bio3 Research’s R&D pipeline was to get investment from VC firms or other investors, thus relinquishing partial control of the company (Spinelli & Adams, 2012). In the biotech field, investors tend to finance companies where PoC (i.e., the end of the preclinical phase) has already been achieved, meaning that the company had demonstrated in preliminary experiments that the compound was effective, at least on animals (Pisano, 2006). The positive results on PoC should encourage financial investors to make realistic predictions of success in subsequent human trials which, in turn, would increase the potential return on investment. “We are not quite there yet,” Dr. Pilato said, adding that “if we sell an equity stake to a VC, Bio3 Research would still need to hire a third company to get the compounds through the DDA process, as the company cannot conduct these activities alone from its own US R&D laboratory.”

Table 6

The Team†

Name Position Degree and duties

Dr. Francesco Pilato CEO Graduated in chemistry, he is the founder of Bio3 Research

Dr. Federico Gardini COO Graduated in business administration, he also acts as general operations

manager of the Californian R&D subsidiary

Dr. Gabriella Messina Head of Special Projects

and Logistics

Graduated in modern literature, she is in charge of the administrative and HR department of the company

Dr. Domenico Criscuolo Scientific officer PhD in hematology from the University of Rome and a PhD in clinical

oncology from the University of Pavia. Prior to his involvement with Bio3 Research, he worked for several companies as clinical researcher. In 2008, he founded Genovax, a biotech company spin-off from the University of Genova

†The team also includes five other members employed on a collaborative basis (including the CFO and those based in the

U.S. R&D subsidiary).

In any case, Dr. Pilato was reluctant to relinquish the control of the company. In addition, VC firms might have a different time horizon than Dr. Pilato for their calcula-tions of expected return on investment. However, this option could secure enough capital to develop R&D activities at least until the end of the preclinical phase, so as to potentially generate higher rewards in return in case of exit (sale). Indeed, the potential reward could exceed $50 million if Bio3 Research developed the pipeline to the end of the preclinical phase and reached the application to the regulatory authorities (IND) (refer again to Figure 1). The reward could be greater, even exceeding $250 million, if Bio3 Research developed the pipeline to phase IIA of the DDA. “We would need an additional $18 million to reach the end of the preclinical phase and to cover the costs of application to the regulatory authorities, and more than $40 million to develop the pipeline until phase IIA of the DDA,” Dr. Pilato said, looking at the total costs row of the company’s financial prospects (refer again to Table 1).

The second option was to enter a strategic alliance for co-development with a large biotech or pharmaceutical company that could possibly provide a capital injection and other critical R&D resources in return for an equity stake or a share of the profit or licensing. The expiration of patents and the corresponding growth in sales of generic substitutes was driving the industry toward consolidation, forcing pharmaceutical com-panies with expiring patents to look for alternative ways to compensate for lost sales, such as acquisitions or licensing agreements (Deloitte, 2008). “Large biotech and pharmaceu-tical companies heavily rely on licensing agreements and acquisitions to develop their product pipelines nowadays,” Dr. Gardini said. “They tend to work with small partners that perform initial testing and do preliminary analyses before more expensive trials in the clinical phase. They usually start out with a licensing agreement for a compound and end up by acquiring part or all of the smaller biotech companies,” he explained. However, the patent “cliff,” combined with the current financial crisis, was pushing pharmaceutical companies to prefer later-stage compounds (i.e., in the clinical phases) in both mergers and acquisitions and pharmaceutical–biotech strategic alliances (Deloitte, 2008). “Bio3 Research could sign a strategic R&D agreement for the co-development process. This could completely change our business model and transform our company into a product biotech company,” Dr. Pilato concluded. Moreover, this option would still require a large financial commitment by Bio3 Research, but the company had little cash and few R&D structures to co-sustain the innovations throughout the DDA process.

Table 7

The Scientific Advisory Board

Name Position

Prof. Emilio Bizzi ËEugene McDermott Professor in Brain Sciences and Human Behavior at the Massachusetts Institute of

Technology (MIT) in Cambridge (USA)

ËFormer chairman of the Department of Brain and Cognitive Sciences at MIT

Prof. Edoardo Boncinelli ËProfessor of biology and genetics at Vita-Salute San Raffaele University in Milan

ËFormer director of the International School for Advanced Studies (ISAS/SISSA) in Trieste (Italy)

Dr. Maurizio Denaro ËExecutive vice president of drug development at OSI Pharmaceuticals

ËExecutive vice president and chief technical officer at Amylin Pharmaceuticals Inc.

ËVice president and center director at Hoechst Marion Roussel Inc.

ËFormer group vice president in research and development and head of Global Business

Unit-Ultrasound at the Bracco Group

15 August, 2014

The third option for Dr. Pilato and Dr. Gardini could be to sell or license the entire portfolio of patents to a large biotech or pharmaceutical company against license fees and royalties. Bio3 Research, with a very promising pipeline of patents and products, could potentially generate high returns on its investment as BIOCYSAN had already earned governmental approval in Italy. The markets for the other applications in the areas of cardiovascular disorders and connective tissue regeneration also presented favorable per-spectives. According to the estimates of an external consultant (Edwards, 2008), a financial deal for each application in Bio3 Research’s portfolio at its current stage of development was worth between $3 and $10 million. The company had seven applications in the pipeline in the areas of cardiovascular disorder and connective tissue regeneration (refer again to Table 5), and Dr. Pilato and Dr. Gardini cautiously estimated their value to be around $20 million (refer again to Figure 1). By selling or licensing the entire portfolio, the company could avoid additional R&D costs and risks, recover the money spent in recent years, and hopefully generate a very good return on investment for Dr. Pilato and his team. However, this option presented the same issues as option two because pharmaceutical companies tended to prefer later-stage compounds (i.e., already in the clinical phases) for acquisition. Alternatively, Dr. Pilato and Dr. Gardini could liquidate each individual specific segment/application in the company’s pipeline. This option would allow the company to break even by selling one or two applications (refer again to Table 5) and potentially generate a good return on investment for Dr. Pilato, who could continue the business activity of Bio3 Research in nutraceuticals, which is a less regulated sector. “We have recently upgraded BIOCYSAN from a dietary supplement to a nutraceutical,” Dr. Pilato announced, adding that “the company is expecting to generate up to $2 million in revenues from this update by 2017” (refer again to Table 1).

In Dr. Pilato’s view, all the available alternatives involved clear trade-offs. “These alternatives have to be considered contingent upon a projected realistic return,” he added. The duo was just back from the New England Venture Summit in Boston where they had presented Bio3 Research’s pipeline of patents and products to an exclusive audience of venture capitalists, investors, and strategic partners in the United States. Dr. Pilato and his team were at a crucial stage, but the situation was still evolving as a number of meetings with other investors and scientific partners were about to follow in the coming months on this side of the ocean. It was already 2pm, and Dr. Pilato had spent the entire morning discussing these options with his COO. Dr. Pilato stared for a few seconds at the black-board with the “pros” and “cons” starkly listed. He turned to Dr. Gardini: “Let’s go for lunch, then continue.”

REFERENCES

Alazraki, M. (2010, April 7). Pfizer’s post-Lipitor plan: Focus on Alzheimer’s cancer and pain.Daily Finance.

Ardichvili, A., Cardozo, R., & Ray, S. (2003). A theory of entrepreneurial opportunity identification and development.Journal of Business Venturing,18(1), 105–123.

Arora, A., Fosfuri, A., & Gambardella, A. (2001).Markets for technology: The economics of innovation and corporate strategy. Cambridge, MA: The MIT Press.

BCC Research. (2011). Advanced orthopedic technologies, implants and regenerative products. Available at http://www.bccresearch.com/report/orthopedic-implants-products-hlc052a.html, accessed 6 December 2011.

Business Insights. (2010, August 27). The top 10 orthopedic device companies: Financial performance, research activities, and growth strategies. Business Insights. Available at http://www.marketresearch .com/Business-Insights-v893/Orthopedic-Device-Companies-Financial-performance-2801204/, accessed 27 December 2010.

Deloitte. (2008). Acquisitions versus product development: An emerging trend in life sciences. Avail-able at http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/MA/us_ma_LS %20Industry%20Advantage_Acquisitions%20versus%20product%20development_091609.pdf, accessed 11 February 2011.

DiMasi, J.A. (2001). Risks in new drug development: Approval success rates for investigational drugs.

Clinical Pharmacology and Therapeutics,69(5), 297–307.

Edwards, M. (2008). Valuation in licensing and M&A: BioLatina 2008. Deloitte Recap LLC 2008. Available at www.recap.com, accessed 20 April 2011.

Florida, R. (1997). The globalisation of R&D: Results of a survey of foreign-affiliated R&D laboratories in the USA.Research Policy,26(1), 85–103.

Forrest, J.E. & Martin, M.J.C. (1992). Strategic alliances between large and small research intensive organi-zations: Experiences in the biotechnology industry.R&D Management,22(1), 41–53.

Gassmann, O. & Reepmeyer, G. (2005). Organizing pharmaceutical innovation: From science-based knowl-edge creators to drug-oriented knowlknowl-edge brokers.Creativity and Innovation Management,14(3), 233–245.

George, G. & Bock, A.J. (2011). The business model in practice and its implications for entrepreneurship research.Entrepreneurship Theory and Practice,35(1), 83–111.

Global Data. (2010). Atherosclerosis or coronary artery disease (CAD)—Pipeline assessment and market forecasts to 2017. Available at http://www.marketresearch.com/GlobalData-v3648/Atherosclerosis-Coronary-Artery-Disease-CAD-6057599/, accessed 27 December 2010.

Global Healthcare Network. (2010). Wound care—The emerging market. Available at http:// globalhealthcarenetwork.com/profiles/blogs/wound-care-the-emerging, accessed 27 October 2010.

Global Industry Analysts. (2010). Nutraceuticals: A global strategic business report. Available at http:// www.prweb.com/releases/nutraceuticals/dietary_supplements/prweb4563164.htm, accessed 27 October 2010.

Hargadon, A. (1998). Firms as knowledge brokers: Lessons in pursuing continuous innovation.California Management Review,40(3), 209–227.

Hüsing, B., Bührlen, B., & Gaisser, S. (2003, April 28).Human tissue engineered products—Today’s markets and future prospects. Karlsruhe, Germany: Fraunhofer Institute for Systems and Innovation Research.

Magretta, J. (2002). Why business models matter.Harvard Business Review,80(5), 86–92.

National Kidney Foundation. (2010). What is chronic kidney disease (CKD)? Available at http:// www.kidney.org/professionals/kdoqi/pdf/Med2003CKDguideline.pdf, accessed 25 April 2012.

Nosella, A., Petroni, G., & Verbano, C. (2005). Characteristics of the Italian biotechnology industry and new business models: The initial results of an empirical study.Technovation,25(8), 841–855.

Ozgen, E. & Baron, R.A. (2007). Social sources of information in opportunity recognition: Effects of mentors, industry networks, and professional forums.Journal of Business Venturing,22(2), 174–192.

Perrone, M. (2010, October 14). FDA may limit anemia drug use for kidney disease.AP Health Writer. Available at http://www.boston.com/news/health/articles/2010/10/14/fda_may_limit_anemia_drug_use_for _kidney_disease/, accessed 27 December 2010.

17 August, 2014

PharmaLive (2010, October 29). The global wound care market. Special Reports. Available at http://www.mddionline.com/blog/devicetalk/global-wound-care-market-expected-reach-203-billion-2015-pharmalive-special-reports, accessed 5 September 2014.

Pisano, G. (2006). Can science be a business? Lessons from biotech. Harvard Business Review,84(10), 114–124.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities.Organization Science,

11(4), 448–469.

Somaya, D. (2012). Patent strategy and management: An integrative review and research agenda.Journal of Management,38(4), 1084–1114.

Somaya, D., Williamson, I.O., & Zhang, X. (2007). Combining patent law expertise with R&D for patenting performance.Organization Science,18(6), 922–937.

Spinelli, S. Jr & Adams, R. (2012).New venture creation. Entrepreneurship for the 21st century(9th ed., International ed.). New York: McGraw-Hill/Irwin.

Teece, D. (2010). Business models, business strategy and innovation.Long Range Planning,43(2/3), 172– 194.

World Health Organization. (2004). The atlas of heart disease and stroke. Mackay, J. and Mensah, G. eds. Available at http://www.who.int/cardiovascular_diseases/resources/atlas/en/, accessed 7 April 2010.

Alfredo D’Angelo is a lecturer in international management, Adam Smith Business School, University of Glasgow, West Quadrangle, Gilbert Scott Building, G12 8QQ Glasgow, UK.

Mario Benassi is a professor in strategy and innovation management, Department of Economics, Business and Statistics, Università degli Studi di Milano, Via Conservatorio 7, 20122 Milan, Italy.