Question 1 PRIVATE V PUBLIC SECTOR OBJECTIVES

Assume that you are a financial manager in a state owned enterprise that is about to have its majority ownership transferred from the government to the private sector and to become a listed company on the Stock Exchange.

Required:

Discuss the differences in financial objectives that you are likely to face and the changes in emphasis that are likely to occur in your strategic and operational decisions as a finance manager.

(10 marks) Question 2 CAPITAL MARKET EFFICIENCY

The following statement contains several errors with reference to the three levels of market efficiency.

“According to the efficient market hypothesis all share prices are correct at all times. This is achieved by prices moving randomly when new information is publicly announced. New information from published accounts is the only determinant of the random movements in share price.

Fundamental and technical analysis of the capital market serves no function in making the market efficient and cannot predict future share prices. Corporate financial managers are also unable to predict future share prices.”

Required:

Explain the errors in the above statement.

(10 marks) Question 3 BASIC DISCOUNTING

(a) What are the present values of the following cash flows at a discount rate of 10%?

t0 t1 t2 t3 t4 t5

$ $ $ $ $ $

(i) 30 40 50 60 70

(ii) 30 30 50 50 50

(iii) 50 60 70 80

(b) What is the present value of $500 per annum receivable for ten years if the first payment is due

(i) in a year’s time (ii) in two years’ time (iii) immediately?

(c) What annual income over five years could be purchased for a capital sum of $15,000 if the appropriate interest rate were 5% and the first of the five payments were due

(i) in one year’s time (ii) in two years’ time (iii) immediately?

(d) What is the present value of $1,500 per annum due in perpetuity at a 10% discount rate if the first payment is due

(i) in one year’s time (ii) in five years’ time?

(e) A payment of $500 is due immediately.

How much would you be prepared to pay four years from now if it were possible to defer payment until then and the appropriate discount rate were 20%?

(f) What would be the market value of an 8% debenture with a nominal value of $100 due for redemption at par in five years’ time, if the required return for that category of debt were 10%?

Ignore taxation.

(15 marks)

Question 4 ELVIRA CO PLC

The Elvira Co plc is contemplating three available investment opportunities, the cash flows of which are given below.

Initial Cash flow

investment Year 1 Year 2 Year 3 Year 4 Year 5 $000 $000 $000 $000 $000 $000 Project Adina – 100 40 40 40 40

Project Belcore – 120 10 10 10 10 200 Project Calisto – 150 100 80

In each case the initial investment represents the purchase of plant and machinery, whose realisable value will be 10% of initial cost, receivable in addition to the above flow at the end of the life of the project.

Required:

Advise the company on which project it should prefer, taking as your investment criterion the following alternative measures.

(a) Payback period. (3 marks)

(b) Accounting rate of return (based on average investment). (3 marks)

(c) Net present value at 15%. (3 marks)

(d) Internal rate of return. (3 marks)

Question 5 KHAN LTD

Khan Ltd is an importer of novelty products. The directors are considering whether to introduce a new product, expected to have a very short economic life. Two alternative methods of promoting the new product are available, details of which are as follows.

Alternative 1 would involve heavy initial advertising and the employment of a large number of agents. The directors expect that an immediate cash outflow of $100,000 would be required (the cost of advertising) which would produce a net cash inflow of $255,000 after one year. Agents’ commission, amounting to $157,500, would have to be paid at the end of year 2.

Alternative 2 would involve a lower outlay on advertising ($50,000 payable immediately) and no use of agents. It would produce net cash flows of zero after one year and $42,000 at the end of each of the subsequent two years.

Mr Court, a director of Khan Ltd, comments: “I generally favour the payback method for choosing between investment alternatives such as these. However, I am worried that the advertising expenditure under the second alternative will reduce our reported profit next year by an amount not compensated by any net revenues from sale of the product that year. For that reason I do not think we should even consider the second alternative.”

The discount rate of Khan Ltd is 20% per annum.

Required:

(a) Calculate the net present values and estimate the internal rates of return of the two

methods of promoting the new product. (6 marks)

(b) Advise the directors of Khan Ltd which, if either, method of promotion they should adopt, explaining the reasons for your advice and noting any additional information you think would be helpful in making the decision. (6 marks)

(c) Comment on the views expressed by Mr Court. (6 marks)

(18 marks) Question 6 FIORDILIGI PLC

Fiordiligi plc is evaluating a potential new product, the ottavio, in which the following costs are involved.

(a) Labour

Each ottavio requires ½ hour of skilled labour and 2 hours of unskilled labour. During the next year Fiordiligi expects to have a surplus of skilled labour, retained on contracts under which the minimum wage is guaranteed. This surplus is sufficient to complete the budgeted quantity of ottavios in the first year, but there will be no surplus thereafter. All unskilled labour will be taken on as required.

(b) Materials

(i) Material “Ping” is used in the ottavios, 2 kgs per unit. No inventory of Ping is held by the company.

(ii) Material “Pang” contributes 0.5 kg per unit. Sufficient of this material to meet the entire budgeted production is already held in inventory; it has no other use. (iii) Material “Pong” is also used; 1.5 kgs are required per unit. Some inventory is

already held, further supplies may readily be purchased. Pong is used in the manufacture of another product, the masetto, which contributes $0.85 per kg of Pong, net of the cost of Pong, and depreciation at an estimated $0.06 per kg.

The value of the various materials may be summarised as follows.

Ping Pang Pong $/kg $/kg $/kg Cost of material in inventory – 2.00 0.70 Current replacement cost 1.40 2.20 0.80 Current realisable value 1.10 1.80 0.65

Any materials requiring purchase will be bought in advance of the year for which they are needed.

(c) Overheads

(i) Variable overheads are expected to be incurred at the rate of $1.40 per skilled labour hour. This represents extra cash cost expended.

(ii) Fixed overheads will be affected by the project as follows.

(1) A new factory will be leased at an annual rental of $2,000 in advance for the life of the project.

(2) Rates on the factory (payable in arrears) will be $1,000 per annum.

(3) The equipment (see below) will be written down to its realisable value over the life of the project.

(4) The central management accounting department will absorb administration costs into production on the basis of $0.50 per unskilled labour hour. Direct administration of the project will be carried out by management without any increase in overtime or staffing levels.

It is expected that ottavios will be produced for three years at the rate of 10,000 units per annum, and then for a further two years at the rate of 8,000 units per annum. The selling price will be $18 per unit in the first three years and $14 thereafter.

Required:

Calculate the net present value of the projected production of ottavios and hence advise the directors whether or not to proceed. The company’s cost of capital for investments of this nature is 15%.

Ignore taxation.

(15 marks) Question 7 HULME LTD

Hulme Ltd is considering the manufacture of a new product, the Champ, to add to its existing range. Manufacture would commence on 1 January 19.00 and 100,000 Champs would be produced and sold each year for three years. The directors of Hulme Ltd expect to be able to charge a price of $6 per Champ during 19.00 and to increase the price during 19.01 and 19.02 in line with increases in the Consumer Price Index. The Index is expected to increase in the future at an annual compound rate of 10%.

The following costs are involved in producing Champs.

Labour

Each Champ requires ¼ hour of skilled labour and 1/2 hour of unskilled labour. Current (1 January 19.00) wage rates are $3 per hour for skilled labour and $2 per hour for unskilled labour. For 19.00 only Hulme Ltd expects to have 100,000 surplus hours of unskilled labour. Whether or not Champs are manufactured, the employees concerned will be retained and paid by the company. All labour costs are expected to increase at an annual compound rate of 20%.

Materials

Each Champ requires 2 kgs of Alpha and 1 kg of Beta. Hulme Ltd currently holds in inventory 200,000 kgs of Alpha and 100,000 kgs of Beta. The inventory of Alpha originally cost $0.40 per kg and has a current realisable value of $0.30 per kg. The current buying price is $0.50 per kg. The inventory of Beta originally cost $0.80 per kg and has a current realisable value of $0.90 per kg. The current buying price is $1.10 per kg. Alpha is used regularly by the company on many products. Beta is used rarely and the only use for the existing inventory, if it is not applied to the manufacture of Champs, is to sell it immediately.

Materials required to manufacture Champs must be purchased and paid for annually in advance. Replacement costs and realisable values of Alpha and Beta are expected to increase at an annual compound rate of 10%.

Overheads

It is the policy of the company to allocate all overhead costs to its various products. The calculated overhead cost per unit for Champs, at current prices, is as follows.

$ Allocated head office fixed costs (rent, rates, administration, etc) 0.70 Depreciation $30,000 ÷ 100,000 0.30

Variable overheads 0.50

Head office costs and variable overheads are expected to increase in line with the Consumer Price Index. The machine required to manufacture Champs was bought some years ago. Its current book value is $90,000, and the above depreciation charge is based on a remaining life of three years at the end of which the machine will have no scrap or re-sale value. If it is not used to produce Champs, the machine will be sold immediately for $150,000.

Hulme Ltd has a cost of capital of 20% per annum in money terms.

Assume that all receipts and payments (except costs of materials and machine sale proceeds) will arise on the last day of the year to which they relate.

Assume also that input prices will change annually on 31 December.

Required:

(a) Prepare calculations showing whether Hulme Ltd should undertake production of the

Champ. (8 marks)

(b) Provide brief explanations of the figures you have used. (5 marks) (c) Comment on factors which are not included in your calculations but which may affect

the decision. (7 marks)

Ignore taxation

(20 marks) Question 8 BAILEY PLC

Bailey plc is developing a new product, the Oakman, to replace an established product, the Shepard, which the company has marketed successfully for a number of years. Production of the Shepard will cease in one year whether or not the Oakman is manufactured. Bailey plc has recently spent $75,000 on research and development relating to the Oakman. Production of the Oakman can start in one year’s time.

Demand for the Oakman is expected to be 5,000 units per annum for the first three years of production and 2,500 units per annum for the subsequent two years. The product’s total life is expected to be five years.

Estimated unit revenues and costs for the Oakman, at current prices, are as follows.

$ $

Selling price per unit 35.00

Costs per unit

Materials and other consumables 8.00

Labour (see (1) below) 6.00

Machine depreciation and overhaul (see (2) below) 12.50 Other overheads (see (3) below) 9.00

——– (35.50) ——–

Loss per unit (0.50)

(1) Each Oakman requires two hours of labour, paid $3 per hour at current prices. The labour force required to produce Oakmans comprises six employees, who are at present employed to produce Shepards. If the Oakman is not produced, these employees will be made redundant when production of the Shepard ceases. If the Oakman is produced, three of the employees will be made redundant at the end of the third year of its life, when demand halves, but the company expects to be able to find work for the remaining three employees at the end of the Oakman’s five year life. Any employee who is made redundant will receive a redundancy payment equivalent to 1,000 hours’ wages, based on the most recent wage rate at the time of the redundancy.

(2) A special machine will be required to produce the Oakman. It will be purchased in one year’s time (just before production begins). The current price of the machine is $190,000. It is expected to last for five years and to have no scrap or resale value at the end of that time. A major overhaul of the machine will be necessary at the end of the second year of its life. At current prices the overhaul will cost $60,000. As the machine will not produce the same quantity of Oakmans each year, the directors of Bailey plc have decided to spread its original cost and the cost of the overhaul equally between all Oakmans expected to be produced (i.e. 20,000 units). Hence the combined charge per unit for depreciation and overhaul is $12.50 [$(190,000 + 60,000) ÷ 20,000 units].

(3) Other overheads at current prices comprise variable overheads of $4.00 per unit and head office fixed costs of $5.00 per unit, recovered on the basis of labour time.

All wage rates are expected to increase at an annual compound rate of 15%. The selling price per unit and all costs other than labour are expected to increase in line with the Consumer Price Index. The Index is expected to increase in the future at an annual compound rate of 10%.

Corporation tax at 35% on net cash income is payable in full one year after the income arises. 25% writing down tax allowances are available on the machine. Bailey plc has a money cost of capital, net of corporation tax, of 20% per annum.

Assume that all receipts and payments will arise on the last day of the year to which they relate. Assume also that all “current prices” given above have been operative for one year and are due to change shortly. Subsequently all prices will change annually.

Required:

(a) Prepare calculations, with explanations, showing whether Bailey plc should

undertake production of the Oakman. (15 marks)

(b) Discuss the particular investment appraisal problems created by the existence of high

rates of inflation. (5 marks)

Question 9 STAN BELDARK

Stan Beldark is a wholesaler of lightweight travelling aids. His company employs a large number of sales representatives, each of whom is supplied with a company car. Each sales representative travels approximately 40,000 miles per annum visiting customers. Stan wishes to continue his present policy of always buying new cars for the sales representatives but wonders whether the present policy of replacing the cars every three years is optimal. He believes that keeping the cars longer than three years would result in unacceptable unreliability, and wishes to consider whether a replacement period of either one year or two years would be better than the present three year period. The company’s fleet of cars is due for replacement in the near future.

The cost of a new car at current prices is $5,500. Resale values of used cars, which have travelled similar mileages to those of Stan’s firm, are $3,500 for a one-year-old car, $2,100 for a two-year-old car and $900 for a three-year-old car, all at current prices. Running costs at current prices, excluding depreciation, are as follows.

Road fund licence Fuel, maintenance and insurance repairs, etc

$ $

During first year of car’s life 300 3,000 During second year of car’s life 300 3,500 During third year of car’s life 300 4,300

Stan uses a discount rate of 10% when making such decisions as this.

Running costs and resale proceeds are paid or received on the last day of the year to which they relate. New cars acquired for use from the start of year 1 are purchased on the last day of the previous year.

Required:

(a) Prepare calculations for Stan Beldark showing whether he should replace the cars of sales representatives every one, two or three years. (7 marks) (b) Discuss how investment appraisal procedures are affected by the existence of high

rates of inflation. (3 marks)

Ignore taxation.

Question 10 TALEB LTD

Taleb Ltd is a manufacturing company which makes a wide range of products. One of these, the Bat, requires the use of a special Dot machine. The company’s present policy is to replace each Dot machine at the end of its physical productive life of four years. The directors are now considering whether to replace the machine more frequently than once every four years, in view of the fact that its productive capacity declines as it gets older and potential sales of Bats are lost. There is insufficient demand for the company’s Bats to justify the purchase of a second Dot machine.

Taleb Ltd charges a selling price of $0.12 per Bat, at which price it is able to sell up to 500,000 per annum. Variable costs, excluding machine depreciation and running costs, amount to $0.04 per Bat. Details of productive capacities and running costs (including maintenance) of the Dot machine are as follows.

Annual running costs are independent of the number of Bats manufactured.

The directors wish to continue their present policy of always buying new Dot machines, at a price of $60,000 each. Resale values of Dot machines are $40,000 for one-year-old machines, $25,000 for two-year-old machines, $10,000 for three-year-old machines and zero for four-year-old machines. The company provides depreciation on all its fixed assets using the straight-line method.

All costs and revenues are paid or received in cash at the end of the year to which they relate, with the exception of the initial price of the Dot machine which is paid immediately on purchase. Taleb Ltd has an annual cost of capital of 10%.

Required:

Prepare calculations for the directors of Taleb Ltd showing whether they should replace the Dot machine every one, two, three or four years.

Ignore inflation and taxation. (10 marks)

Question 11 STICKY FINGERS PLC

After paying $15,000 for a preliminary investigation, the costing department of Sticky Fingers plc was able to calculate the cash flows for the following investment projects.

You have only just taken up the appointment of financial analyst. The cash flows from the various projects, as shown above, have been given to you with a memorandum from the managing director outlining your first task.

Required:

Advise the company in the following circumstances.

(a) The company’s cost of capital has been calculated as 15%. Cash is freely available, and all projects are independent and divisible.

Prepare calculations showing which projects should be accepted. (3 marks) (b) The amount of cash available for investment at time 0 has been limited to $3 million.

None of the projects can be delayed.

Which projects should be accepted? (3 marks)

(c) The amount of cash available for investment at time 1 has been limited to $200,000. None of the projects can be delayed. There is now no rationing at time 0.

Which projects should be accepted? (5 marks)

(d) The situation is as in part (b) except that now all projects are independent but indivisible, and $3.5 million is available.

Which projects should now be accepted? (2 marks)

(e) Now there is capital rationing at both t1 ($200,000) and t0 ($3,000,000). Formulate a linear programming model to maximise NPV.

(7 marks)

(20 marks) Question 12 ARMSTRONG

Armstrong plc manufactures a range of electric kitchen gadgets from its own factory in East Anglia. In recent years sales of product ZP28, an egg-blower for the use of senior citizens, have been decreasing and the directors are considering whether or not to substitute an alternative product.

The sales director’s estimates of the maximum possible sales of ZP28 are as follows.

Year 1 2 3 4 5

Demand (000) 20 15 3 3 –

This product has yielded a contribution of $1.50 per unit in recent years. This should continue until the end of year 3, but the sales price will need to be reduced by $1 for year 4 if any sales are to be made.

The best estimates of sales of the new XK72 are as follows.

Year 1 2 3 4 5

Demand (000) 15 25 30 35 35

Initially its contribution will be $2 per unit, but an aggressive advertising campaign in year 3 (which will cost $14,200 payable at the end of that year) will mean that the price can be raised by $1.50 thereafter).

The new machinery required for the burnishing department has a cost of $100,000. This machinery is expected to have no salvage value in year 5.

Purchase of the machinery entitles the owner to claim writing down allowances at the rate of 25% per annum for tax purposes. There is the possibility of entering into a non-cancellable finance lease to obtain the use of this machinery. Such a lease would require an initial payment of $21,800 at the start of the lease, followed by four similar payments made at strictly yearly intervals. Such payments are tax-deductible expenses. The alternative to leasing is to finance the purchase of the machinery by borrowing at an after-tax interest rate of 10% per annum, the current competitive market interest rate for debt.

Armstrong plc is a profitable company and can utilise in full all tax allowances at the earliest opportunity. The tax rate is 35% (for the whole life of the project) and the tax delay is one year. If the project is accepted it will commence at the end of a tax year, and the initial payments and any lease rentals will be included in that tax year. All cash flows not associated with the commencement of the project will arise at the end of the year to which they relate.

The company uses 15% as an estimate of its cost of capital, as it believes that this rate reflects the level of risk attaching to its activities.

Required:

(a) Advise Armstrong plc whether or not the proposed change of products is worthwhile. (12 marks)

(b) Determine whether purchase or leasing, on the terms specified, would be the better

alternative for the new machinery. (8 marks)

Question 13 COMPOUNDING AND DISCOUNTING

(a) Assume a 10% time value of money. Compute the sum to which $1 will accumulate at compound interest at the end of:

(i) one year (ii) two years (iii) three years (iv) ten years.

(b) Compute the sum which must be invested today at 10% to accumulate to $1 at the end of one year, two years, three years and ten years respectively.

(c) Using the present value tables, find the present value of the following stream of cash flows at 10%.

Time (end of year) 1 2 3 4

Cash flow ($) 2,000 1,500 3,000 1,000

(d) Using the present value tables, compute the present value of the following stream of cash flows at 10%.

Time (end of year) 1 2 3 4

Cash flow ($) 1,000 1,000 1,000 4,000

(e) $1.00 is to be invested at the end of each year for the next four years. Calculate the amount to which the fund will accumulate by the end of year four if the interest rate is 10%.

(f) How much would be in the fund by the end of year 4 in (e) above, if the cash deposits occurred at the beginning of each year?

(g) Calculate the terminal value at the end of year 5 of the following stream of cash flows at 8%.

Year end 1 2 3 4 5

$ $ $ $ $

Cash flow 450 525 500 425 350

(h) Calculate the effective annual interest rate of

(i) 12% per annum nominal compounded twice yearly (ii) 12% per annum nominal compounded quarterly (iii) 24% per annum nominal compounded monthly.

(i) $600 is invested half yearly in a fund earning 8% per annum nominal. If the first investment of $600 is made on 30 June 19X1, how much will be on deposit by 31 December 19X3?

(j) A project requires an initial investment of $23,000 and produces the following stream of cash inflows.

End of year 1 2 3

$ $ $

Required:

(i) Calculate the net present value of the project at 10% (ii) Calculate the net present value of the project at 20% (iii) Determine the internal rate of return for the project. (k) Find the NPV at 10% of a project with the following cash flows.

End of year 0 1 2 3

$000 $000 $000 $000 Cash flows (50) 10 20 30

(l) If $50,000 were borrowed to finance the project in (k) above and the loan repaid by the cash flows of the project, what balance would be outstanding at the end of year 3 and how is this figure related to the NPV previously calculated?

(m) A project requires an initial investment of $33,000 and is expected to generate the following stream of cash flows.

End of year 1 2 3

$ $ $

Cash flows 10,000 20,000 10,000

Required:

(i) Calculate the net present value of the project at 8% (ii) Calculate the net present value of the project at 12% (iii) Determine the internal rate of return of the project.

(n) By solving a quadratic equation, calculate the internal rate of return of a project requiring an initial investment of $1,440 and generating cash flows of $700 at the end of year 1 and $900 at the end of year 2.

(o) SCR Ltd is considering launching a new product. An initial investment in equipment of $30,000 is required.

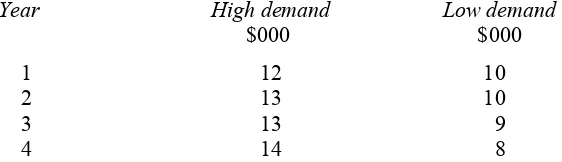

The project life will be four years. Market research has indicated a 75% chance of demand for the new product being high and a 25% chance of it being low. Cash inflows are forecast as follows:

Assume that all cash flows occur at year ends. The cost of capital is 14%. The equipment can be sold at the end of the project for $2,000.

Required:

Calculate the net present value of the project.

Question 14 DESPATCH CO

Despatch Co is considering a project involving a capital outlay of $12,000 and producing annual cash inflows of $2,000 for ten years. At the end of that period the asset initially purchased will have a scrap value of $500. Despatch Co uses a discount rate of 14% in all investment appraisals.

Required:

Determine whether or not the project is worthwhile.

(4 marks) Question 15 DISCOUNTED CASH FLOW

(a) Two alternative machines are being considered for purchase, one at a cost of $10,000 and the other at a cost of $9,000. The revenue cash flows resulting from their operation over their expected lives have been estimated as follows:

Net cash flows at year end

Year Machine 1 Machine 2

1 1,000 1,200

2 1,600 1,500

3 2,500 3,500

4 2,500 2,000

5 2,500 2,000

6 1,500 1,000

7 1,000 Life over

The listed cash flows do not include salvage values at the end of the machines’ useful lives of $1,500 and $1,000 respectively.

Required:

(i) If a company can borrow money at 8%, determine which machine you would recommend for purchase.

(ii) Comment on your results. (12 marks)

(b) An electrical firm is planning to produce a device. Development of the device would cost $40,000 payable at the end of the first year and thereafter would produce net receipts of $2,000 for an estimated 28 years.

Required:

If the firm’s cost of capital is 7% determine whether the device should be produced. (5 marks)

(c) A company is considering investing in a crusher costing $6,000 and producing net cash savings of $1,200 per annum in perpetuity. However, the first saving will only be receivable three years from now. The company’s cost of capital is 12%.

Required:

(d) J can invest in a scheme which requires a capital expenditure of $5,000 and will produce annual returns of $475 in perpetuity.

Required:

Calculate the internal rate of return of the scheme. If J can earn 8.96% in a building

society should he invest in the scheme? (3 marks)

(e) A demolition firm is considering investing in a new ball and crane costing $20,000 payable in two equal annual instalments on 1 January 19X3 and 1 January 19X4 with no scrap value. It is hoped that the plant will produce additional annual income of $4,000 for the first two years of operation (first income receivable on 1 January 19X5) and $3,000 for the next eight years.

The firm requires a rate of return in excess of 10%.

Required:

(i) Calculate the IRR to see if investment is worthwhile.

(ii) How else could one evaluate the viability of the project? (6 marks) (30 marks) Question 16 GERRARD

Gerrard runs a small printing business with rather limited resources. He plans to ask his bank manager to increase his overdraft facilities to enable him to buy one more printing machine, a collator and machine for perfect binding. Gerrard’s discount rate, which reflects the cost of borrowing from the bank, is 12%.

He has drawn up a cash budget for the next five years which shows that the machinery has to be paid for in two instalments: $50,000 now and $25,000 in a year’s time. Over the next five years sales will increase, pushing up receipts by $30,000 per annum (receivable in arrears). This will result in annual paper purchases (payable in advance) increasing by $8,000 and a small increase in annual wages (assumed payable in arrears) of $500.

Required:

(a) Calculate the NPV at 12%. (4 marks)

(b) Calculate the NPV at 14%. (4 marks)

(c) Find the IRR and determine whether the expansion is worthwhile. (4 marks) (12 marks) Question 17 CARTER LTD

Carter Ltd is considering whether to invest in a machine which will enable a process, at present carried out manually, to be performed more efficiently. The machine will cost $35,000.

It is estimated that the new machine will save $6,500 per annum in labour costs at an additional annual cost of $1,500. The machine has an expected life of 15 years at the end of which it will have zero scrap value. The mechanisation will involve the scrapping of some loose tools and equipment which have zero book value but a scrap value of $3,000. In 15 years’ time these would be worthless.

Required:

(a) Calculate the following to decide whether project should be accepted. (i) Net present value

(ii) Internal rate of return. (6 marks)

(b) Determine how your answer to (a)(i) above would alter if: (i) existing equipment had a book value of $2,000 (ii) the new equipment had a life of only ten years

(iii) fixed overheads were reapportioned and an extra $1,000 allocated to this process (iv) the existing equipment had a scrap value of $2,000 in 15 years’ time.

(7 marks)

(13 marks)

Question 18 ABC

A company wishes to use a five-year time scale over which to appraise the following projects, with no allowance for scrap values. Its required rate of return is 17%.

Project A

Capital investment in additional equipment to produce a “de-luxe” version of one of its existing products. The equipment will cost $285,000, payable in three equal annual instalments, the first to be paid immediately.

The de-luxe version has an estimated annual demand of 10,000 in the first two years after which it is expected to increase at a rate of 10% pa. The net cash flow per unit is estimated at $8.

The existing product was expected to be sold at a rate of 25,000 units pa at a net cash contribution of $5 per unit. If the new version is introduced, however, it is expected that this demand will be reduced by 15% of the volume of new product sold in the corresponding year.

Project B

Purchase of patent rights to a new process at an initial cost of $320,000 payable immediately.

The new process will enable the company to reduce its labour force, at present incurring a total wages bill of $280,000, by a quarter; and will allow an increased production capacity of 5,000 units pa of another existing product which at present is sold at $12 per unit with direct costs of $6. There is an 80% chance that the extra potential production could all be sold, with a 20% chance of demand only taking up an extra 3,000 units pa. Production would be adjusted to match demand. This product is made with hardly any labour.

Project C

Required:

Determine which (if any) of the projects are worth further consideration based upon the information given, assuming all cash flows arise at the end of the year to which they relate unless otherwise stated.

(20 marks) Question 19 MOORGATE COMPANY

The Moorgate Company has issued 100,000 $1 par ordinary shares which are at present selling for $3 per share. The company has plans to issue rights to purchase one new share at a price of $2 per share for every four existing shares.

Required:

(a) Calculate the theoretical ex-rights price of Moorgate’s shares. (5 marks) (b) Calculate the theoretical value of a Moorgate right. (5 marks) (c) The chairman of the company receives a telephone call from an angry shareholder who owns 1,000 shares. The shareholder argues that he will suffer a loss in his personal wealth due to this rights issue, because the new shares are being offered at a price lower than the current market value.

The chairman assures him that his wealth will not be reduced because of the rights issue, as long as the shareholder takes appropriate action.

(i) Is the chairman correct?

(ii) What should the shareholder do?

Prepare a statement showing the effect of the rights issue on this particular shareholder’s wealth, assuming

(i) he sells all the rights

(ii) he exercises half the rights and sells the other half

(iii) he does nothing at all. (10 marks)

(d) Are there any real circumstances which might lend support to the shareholder’s claim?

Explain. (5 marks)

(25 marks) Question 20 GREINER LTD

Required:

Write a report to Mr and Mrs Greiner which deals with the following issues. (i) The steps to be taken prior to obtaining a quotation.

(ii) An evaluation of the two main methods (placing and offer for sale) of raising equity capital on the Stock Exchange.

(iii) Which of the two methods better meets the requirements of Mr and Mrs Greiner.

(12 marks) Question 21 MR FIDELIO

Mr Fidelio has recently been made redundant. He intends to start his own business as a manufacturer of electronic components and estimates that he will require $250,000 to purchase fixed assets and to provide working capital. He has $50,000 available from his own savings and redundancy payments, and is seeking advice as to how to raise the remaining $200,000.

Aida Ltd is a long-established private limited company which operates a chain of ten discount furniture stores. The directors of Aida wish to expand the company’s activities by opening a new store in a location not presently served by the company. They estimate that the proposed expansion will cost $2 million, and they need advice as to how to raise the necessary finance.

Required:

Describe briefly the characteristics of the sources of finance available to Mr Fidelio and to Aida Ltd, identifying sources which are likely to be available only to Mr Fidelio, those which are likely to be available only to Aida Ltd, and those which are likely to be available to both Mr Fidelio and Aida Ltd.

(10 marks) Question 22 COST OF CAPITAL

(a) Calculate the current pre-tax cost of the following loans. (i) A 10% coupon irredeemable debenture issued at par.

(ii) A 10% irredeemable debenture trading at $85 per cent.

(iii) A 10% redeemable debenture trading at $74 per cent with three years until redemption at par.

(iv) A 10% redeemable debenture trading at par, with three years until redemption at par.

(v) A 5% irredeemable $1 preference share trading at 65c.

(4 marks)

(b) Calculate the current post-tax cost with a corporation tax rate of 35% of the loans in (a)

(c) Given the following data about share prices, compute the cost of equity in each case. (i) Market price per share $1.50 ex-dividend. Dividend just paid 7.5c, which is

expected to remain constant.

(ii) Market price per share $1.65 cum-dividend. Dividend about to be paid 15c, which is expected to remain constant.

(iii) Market price per share $1.20 ex-dividend. Dividend just paid 24c, with expected annual growth rate of 5%.

(iv) Market capitalisation of equity $10 million. Dividends just paid $1.5 million, which are expected to remain constant.

(4 marks)

(d) Compute the market price of the following equities.

(i) W has 50,000 $1 ordinary shares in issue, current dividends 10c per share expected to remain constant; cost of equity 10%.

(ii) X has 1,000 $1 ordinary shares in issue, total dividend $500, no growth expected; cost of equity 15%.

(iii) Y has 1 million ordinary shares, the dividend just paid was 10c and it is expected to grow at 5% per annum; cost of equity 15%.

(iv) Z has 10,000 shares in issue, dividends for the next five years are expected to be constant at 10c per share and then grow at 5% per annum to perpetuity; cost of equity 15%.

(4 marks)

(15 marks) Question 23 KELLY PLC

On 1 July 19X5 Kelly plc had the following three classes of debenture, all of which had been in issue for some years and have $100 par value.

Coupon Year(s) of Date of Dates of Market price

rate redemption redemption interest payments at 1 July 19X5 14% 19X9 31 December 1 July, 31 December $110.43 ex-interest 14% 19X8–19X10 1 July 1 July, 31 December $110.15 ex-interest 6% 19X10 1 April 1 April, 1 October Unlisted

All the company’s debentures will be redeemed at par. Market evidence suggests that the 6% 19X10 debentures should have a six-monthly gross redemption yield (i.e. internal rate of return to maturity) of 6%. The prevailing level of market interest rates can be assumed to remain unchanged over the next six years.

Required:

(a) Calculate the six-monthly gross redemption yield of the 14% 19X9 debenture. (3 marks) (b) Determine when investors are likely to assume that Kelly plc will redeem the 14% 19X8–19X10 debentures, and hence calculate their effective annual gross redemption

(c) Estimate the price on 1 July 19X5 that an investor should be prepared to pay for the 6%

19X10 debentures. (5 marks)

(d) Discuss the factors that will influence the market price of issued corporate debentures. (8 marks) Ignore taxation in parts (a), (b) and (c), but not (d).

(20 marks) Question 24 REDSKINS PLC

Redskins plc is a holding company owning shares in various subsidiary companies. Its directors are currently considering several projects to increase the range of the business activities undertaken by Redskins plc and its subsidiaries. The directors would like to use discounted cash flow techniques in their evaluation of these projects but as yet no weighted average cost of capital has been calculated.

Redskins plc has an authorised share capital of 10 million 25c ordinary shares, of which 8 million have been issued. The current ex-dividend market price per ordinary share is $1.10. A dividend of 10c per share has been paid recently. The company’s project analyst has calculated that 18% is the most appropriate cost of equity capital. Extracts from the latest balance sheets for both the group and the holding company are given below.

Redskins and Subs Redskins $000 $000

Issued Share Capital 2,000 2,000

Share Premium 1,960 1,960

Reserves _____ 3,745 _____ 708

Shareholders funds _____ 7,705 _____ 4,668

Redskins and Subs Redskins current cum-interest market prices for $100 nominal value are $31.60 and $103.26 for the 3% and 9% debentures respectively. Both the 9% debentures and the 6% bonds are redeemable at par in ten years’ time. The 6% bonds are not traded on the open market but the analyst estimates that its actual pre-tax cost is 10% per annum. The bank loans bear interest at 2% above base rate (which is currently 11%) and are repayable in six years. The effective corporation tax rate of Redskins plc is 30%.

Required:

(b) Discuss the problems that are encountered in the estimation of a company’s weighted average cost of capital when

(i) bank overdrafts, and (ii) convertible bonds

are used as sources of long-term finance. (6 marks)

(c) Outline the fundamental assumptions that are made whenever the weighted average cost of capital of a company is used as the discount rate in net present value calculations. (6 marks)

Ignore personal taxation. (20 marks)

Question 25 BERLAN

(a) Berlan plc has annual earnings before interest and tax of $15 million. These earnings are expected to remain constant. The market price of the company’s ordinary shares is 86 cents per share cum-div and of debentures $105.50 per debenture ex-interest. An interim dividend of six cents per share has been declared. Corporate tax is at the rate of 35% and all available earnings are distributed as dividends.

Berlan’s long-term capital structure is shown below:

$000 Ordinary shares (25 cents par value) 12,500

Reserves ______ 24,300

36,800 16% debenture 31 December 19X4 ($100 par value) ______ 23,697

60,497 ______ Required:

Calculate the weighted average cost of capital of Berlan plc according to the traditional theory of capital structure. Assume that it is now 31 December 19Xl. (8 marks) (b) Canalot plc is an all equity company with an equilibrium market value of $32.5 million and a

cost of capital of 18% per year.

The company proposes to repurchase $5 million of equity and to replace it with 13% irredeemable bonds.

Canalot’s earnings before interest and tax are expected to be constant for the foreseeable future. Corporate tax is at the rate of 35%. All profits are paid out as dividends.

Required:

Use the assumptions of Modigliani and Miller to explain and demonstrate how this change in the capital structure of Canalot plc will affect:

– the market value – the cost of equity

– the cost of capital (7 marks)

Question 26 WEMERE

The managing director of Wemere, a medium-sized private company, wishes to improve the company’s investment decision-making process by using discounted cash flow techniques. He is disappointed to learn that estimates of a company’s cost of capital usually require information on share prices which, for a private company, are not available. His deputy suggests that the cost of equity can be estimated by using data for Folten plc, a similar sized company in the same industry whose shares are listed on the AIM, and he has produced two suggested discount rates for use in Wemere’s future investment appraisal. Both of these estimates are in excess of 17% per year which the managing director believes to be very high, especially as the company has just agreed a fixed rate bank loan at 13% per year to finance a small expansion of existing operations. He has checked the calculations, which are numerically correct, but wonders if there are any errors of principle.

Estimate 1: capital asset pricing model

Data has been purchased from a leading business school:

Equity beta of Folten 1.4

Market return 18%

Treasury bill yield 12%

The cost of capital is 18% + (18% – 12%) 1.4 = 26.4%.

This rate must be adjusted to include inflation at the current level of 6%. The recommended discount rate is 32.4%.

Estimate 2: dividend valuation model

Year Folten plc

Average share price Dividend per share

(cents) (cents)

19X5 193 9.23

19X6 109 10.06

19X7 96 10.97

19X8 116 11.95

19X9 130 13.03

D1 14.20

The cost of capital is 11.01%

P 138

G 9%

where D1 = expected dividend P = market price

g = growth rate of dividends (%)

Other financial information on the two companies is presented below:

Wemere Folten $000 $000

Fixed assets 7,200 7,600

Current assets 7,600 7,800

Less: Current liabilities ______ 3,900 ______ 3,700

10,900 11,700

(1) The current ex-div share price of Folten plc is 138 cents.

(2) Wemere’s board of directors has recently rejected a take-over bid of $10.6 million. (3) Corporate tax is at the rate of 35%.

Required:

(a) Explain any errors of principle that have been made in the two estimates of the cost of capital and produce revised estimates using both of the methods.

State clearly any assumptions that you make. (14 marks)

(b) Discuss which of your revised estimates Wemere should use as the discount rate for

capital investment appraisal. (4 marks)

(c) Discuss whether discounted cash flow techniques, including discounted payback, are

useful to small unlisted companies. (7 marks)

(25 marks) Question 27 CRESTLEE

Crestlee plc is evaluating two projects. The first involves a $4.725 million expenditure on new machinery to expand the company’s existing operations in the textile industry. The second is a diversification into the packaging industry, and will cost $9.275 million.

Crestlee’s summarised balance sheet, and those of Canall plc and Sealalot plc two quoted companies in the packaging industry, are shown below (20X2) :

Crestlee plc Canall plc Sealalot plc

Financed by:

1 Crestlee and Sealalot 50 cents par value, Canall 25 cents par value. Debentures $100 par

2 Crestlee 12% debentures 20X8–20Y0, Canall 14% debentures 20Y3, Sealalot medium-term bank

loan.

Crestlee proposes to finance the expansion of textile operations with a $4.725 million 11% bond issue, and the packaging investment with a $9.275 million rights issue at a discount of 10% on the current market price. Issue costs may be ignored.

Crestlee’s managers are proposing to use a discount rate of 15% per year to evaluate each of these projects.

The risk free rate of interest is estimated to be 6% per year and the market return 14% per year. Corporate tax is at a rate of 33% per year.

Required:

(a) Determine whether 15% per year is an appropriate discount rate to use for each of these projects. Explain your answer and state clearly any assumptions that you make.

(19 marks)

(b) Crestlee’s marketing director suggests that it is incorrect to use the same discount rate each year for the investment in packaging as the early stages of the investment are more risky, and should be discounted at a higher rate. Another board member disagrees saying that more distant cash flows are riskier and should be discounted at a higher rate. Discuss the validity of the views of each of the directors. (6 marks) (25 marks) Question 28 MUGWUMP LTD

The following data relate to Mugwump Ltd, a manufacturing company.

On average

(a) customers take 2½ months credit

(b) raw materials are in inventory for 3 months

(c) work in progress represents 2 months’ half-produced goods

(d) finished goods represent 1 month’s production

(e) credit is taken as follows

(i) materials – 2 months (ii) direct labour – 1 week (iii) variable overheads – 1 month (iv) fixed overheads – 1 month (v) selling and distribution – ½ month

Work in progress and finished goods are valued at materials, labour and variable overhead cost.

Required:

Compute the working capital requirement of Mugwump Ltd, assuming that the labour force is paid for 50 working weeks.

(10 marks) Question 29 DYER LTD

Dyer Ltd manufactures a variety of products using a standardised process which takes one month to complete. Each production batch is started at the beginning of a month and is transferred to finished goods at the beginning of the next month. The cost structure, based on current selling prices, is as follows.

% $

Sales price 100

Variable costs

Raw materials 30

Other variable costs 40 ——

Total variable costs – used for inventory valuation (70) ——

Contribution 30

——

In order to facilitate the envisaged increases, several changes would be required in the long term. The relevant points are as follows.

(1) The average credit period allowed to customers will increase to 70 days.

(2) Suppliers will continue to be paid on strictly monthly terms.

(3) Raw material inventory held will continue to be sufficient for one month’s production.

(4) Inventory of finished goods held will increase to one month’s output or sales volume.

(5) There will be no change in the production period and “other variable costs” will continue to be paid for in the month of production.

(6) The current end of month working capital position is as follows.

$000 $000

Raw materials 60

Work in progress 140

Finished goods 70

—— 270

Accounts receivable 200

—— 470

Accounts payable (60)

—— Net working capital – excluding cash 410

—— Compliance with the long-term changes required by the expansion will be spread over several months. The relevant points concerning the transitional arrangements are as follows.

(i) The cash balance anticipated for the end of May is $80,000.

(ii) Up to and including June all sales will be made on one month’s credit. From July all sales will be on the transitional credit terms which will mean

60% of sales will take two months’ credit 40% of sales will take three months’ credit.

(iii) The sales price increase will occur with effect from the sales in August.

(iv) Production will increase by 50% with effect from production in July; raw material purchases made in June will reflect this.

(v) Sales volume will increase by 50% from sales in October.

Required:

(c) Using your findings from (a) and (b) above, make brief comments to the management of Dyer Ltd on the major factors concerning the financial aspects of the expansion which

should be brought to their attention. (4 marks)

Assume that there are 360 days in a year and that each month contains 30 days.

(20 marks) Question 30 PUNTER BOOKMAKERS LTD

Punter Bookmakers Ltd runs a chain of betting shops in the Midlands. There are no fixed assets subject to depreciation. The company’s finance director has prepared budgets for the company’s overall annual performance about which he is fairly confident. As a result he has provided that funds should be set aside week-by-week for investment in short-term securities sufficient not only to meet tax liabilities but also to cover expected dividend payments, which it is intended should absorb after-tax net profits.

However, because of the nature of the business he feels he is unable to forecast daily cash inflows and outflows with any accuracy. Nevertheless he takes the view that the company is in danger of carrying too high a liquid cash balance. He would prefer to invest some of the money, although this would mean the company would incur transaction costs if it had to liquidate securities to meet unforeseen demands.

The finance director approaches you for advice. He explains that a major problem in the betting shop business is that cash flows are uncertain but, unlike those of firms in most other industries, they are only affected to a limited extent by general economic events. He then describes the main features of the betting shop business as follows.

A bookmaker taking bets on horse races will attempt to calculate the odds so that the size of the bets placed and the probability of horses wining and losing will, on a particular race or over a short period, balance out, after leaving him with a margin to cover overheads and profit. If he finds himself particularly exposed, he will generally reinsure himself by laying off bets with other bookmakers. It follows, therefore, that if his predictions of outcomes are on average correct, the cash flow over a reasonable period of time should equal the planned margin. However, for day-to-day purposes the incidence of cash inflows and outflows may be largely unpredictable, since the race results themselves can be viewed as random variables. Moreover, this is true even though the bookmaker knows that certain events (e.g. the Grand National or the Derby) generate more business than others; he may take more in bets on such occasions, but he will have to pay out more, particularly if the favourite wins and the odds offered do not quite balance the books. More generally, a bookmaker will have to ensure that he has a reasonable amount of liquid cash in hand at each betting shop to cover the claims that might arise – or at least he should have ready access to cash (on deposit, etc) should exceptionally large claims have to be met.

Required:

(a) Advise the finance director on how, given the uncertain environment described, he might best try to manage the cash position of the business without – for general day-to-day purposes – carrying too high a liquid cash balance. (10 marks) (b) Comment briefly on the nature of the securities in which the finance director might

invest any potentially surplus funds. (6 marks)

Question 31 MR COLORADO

Mr Colorado is a map retailer. His business has operated at a constant level for many years; sales have been $14,500 per month, purchases have represented 60% of sales and overhead costs have been $4,000 per month, all directly variable with the amount of sales. The business has no fixed assets.

One half of sales are paid for as they are made. The remainder are on credit. Mr Colorado offers no cash discount for early payment and credit customers pay, on average, two months after the date of sale.

All purchases are on credit. Mr Colorado’s suppliers each offer 2.5% cash discount for payment within one month, and at present Mr Colorado takes advantage of the cash discount offered for all purchases. Overhead costs are paid in the month in which they arise.

Mr Colorado estimates that his bank overdraft at 31 December 19.01 will amount to $14,800 and that his inventory at the same date will be $18,500.

The present limit on Mr Colorado’s overdraft is $15,000. He is now expecting a steady expansion of his business from 1 January 19.02 and is concerned that he might exceed his overdraft limit if he does not change his present policy for giving and taking credit. Mr Colorado expects his sales in January 19.02 and in subsequent months to increase at a monthly compound rate of 2% indefinitely.

Mr Colorado is considering whether to offer his credit customers 2.5% cash discount for payment within one month of sale. If he does so, he expects that all credit customers will take advantage of the discount, which will be available in respect of all credit sales made on or after 1 January 19.02. He is also considering whether to delay paying his suppliers until two months after the date of purchase for purchases made on or after 1 January 19.02. In addition, he wishes to increase his inventory level so that he always has sufficient inventory to meet sales requirements for three months at predicted levels.

Mr Colorado currently pays 2.5% interest per month on his bank overdraft, calculated on the balance at the beginning of each month. This rate of interest is expected to continue indefinitely.

You may assume that all receipts and payments are made on the last day of the month and that, but for the possibility of maintaining three months’ inventory, Mr Colorado would have held inventory at the $18,500 level.

Required:

(a) Predict Mr Colorado’s bank balance or overdraft at 31 March 19.02 under both his present and proposed policies for giving and taking credit. (10 marks) (b) Comment on the figures you have calculated in (a), and describe and justify how you would evaluate the long-term effects of the alternative credit policies on Mr Colorado’s business. (You are not required to calculate the long-term effects.) (10 marks) Ignore taxation.

Question 32 WORRAL LTD

Worral Ltd is a wholly-owned subsidiary of Grandus plc. Grandus has always allowed its subsidiaries considerable freedom of action, but the board of directors of Grandus are concerned about Worral’s recent performance and working capital management. As a result Grandus’ board of directors has given the managers of Worral one year in which to increase the company’s current ratio to at least the industry average, without adversely affecting other aspects of the company’s performance.

Worral’s managers are considering three possible alternative courses of action.

(1) Increase long-term loans by $300,000 and use the proceeds to reduce the company’s overdraft.

(2) Offer a cash discount of 3% for payment in 14 days. The normal terms of sale allow 60 days’ credit. All sales are on a credit basis. If the cash discount is offered, 50% of customers are expected to take it, and bad debts are expected to be halved. The annual cost of administering the cash discount scheme would be $30,000.

(3) Use the services of a non-recourse factoring company at a commission of 2.5% of turnover and finance charges of 3% over bank base rate on funds advanced immediately. Worral would take the full finance facility available on all credit sales, and would use the proceeds to reduce current liabilities. The use of a factor is expected to result in credit management cost savings of $135,000 per year.

Bank base rate is 11%. Worral pays 2% above bank base rate for its overdraft.

Summarised financial details of Worral Ltd

19.04 19.05 19.06 19.07 Industry average $000 $000 $000 $000 19.07

Turnover 8,234 8,782 8,646 9,182 –

Profit after tax 486 492 448 465 –

Current ratio 1.84 1.61 1.52 1.48 1.60

Acid test 0.97 0.93 0.90 0.84 0.95

Summarised balance sheet as at 31 December 19.07

The long-term loan is from Grandus plc. Long-term loans to subsidiaries are charged at their current cost to Grandus. Grandus’ 12% $100 debentures are currently trading at $82.75 and can be redeemed between 11-15 years from now.

Required:

(a) Critically evaluate the three suggestions and recommend which should be selected. (All relevant calculations must be shown. The effects of taxation may be ignored.) (15 marks) (b) Briefly describe three ways, other than factoring, that a company might obtain finance

by using accounts receivable as security. (5 marks)

(20 marks) Question 33 DIRE PLC

At 31 December 19.01 Dire plc has an overdraft of $1m. Interest at a rate of 10% per annum is being charged on the overdraft.

The directors are concerned at the size of the overdraft and ask the finance manager to take steps to reduce the figure. Additionally, the directors suspect that improvements could be made within the working capital cycle.

Sales during 19.01 were $5m, with cost of sales at $3m. The following working capital ratios at 31 December 19.01 had been calculated.

At present cash sales represent 10% of turnover, and 20% of all trade purchases were cash on delivery (COD).

The finance manager feels that the working capital ratios could be improved to

Accounts receivable collection period 2 months Inventory holding period 3 months Accounts payable period 2½ months

Additionally, no further COD purchases will be made. Cash sales will continue to represent 10% of sales.

After negotiations with the bank it was agreed that $200,000 of the overdraft could be converted to a fixed loan on which 7% interest would be charged per year. The loan comes into effect on 1 January 19.02.

Required:

Assuming that the 19.01 levels of sales and cost of sales are repeated in 19.02 and that any improvements in working capital will give rise to a whole year of interest charge saved, calculate the total amount of interest saved solely as a result of the financial manager’s proposed improvements.

(6 marks) Question 34 MOORE LTD

Moore Ltd, a small retailing business, has been trading for many years. Figures for next year are predicted to be

Sales $10,000 per calendar month (pcm)

Purchases $6,000 pcm, a constant gross profit margin of 40% being made Administration costs $1,000 pcm

Customers pay as follows.

20% one month after invoice 78% two months after invoice 2% go bad

All sales are invoiced at the end of the month.

Two months inventory are held. Suppliers are paid after one month. This will result in a bank balance of $20,000 at the end of the year.

The directors are considering offering a 2% discount for payment after the first month.

Estimates

New payment pattern

60% take discount and pay after one month 37% pay after two months

3% go bad

Cost of capital is 1% per month) Required:

(a) Use DCF to appraise the discount scheme (5 marks)

(b) Calculate profits for next year under the old and new schemes (4 marks) (c) Calculate the cash operating cycle under the old and new schemes (3 marks) (d) Calculate both the quick ratio and current ratio in one year’s time under the old and

new schemes. (5 marks)

(17 marks) Question 35 WAGTAIL LTD

Wagtail Ltd uses the “economic order quantity” formula to determine optimal levels of raw materials inventory. Material B is consumed at a steady rate of 4,000 units per annum. The costs of ordering B are independent of order size; clerical costs of ordering have been calculated at $30 per order. Each order is checked by an employee who is engaged in using B in production and who earns $5 per hour irrespective of his output. The employee generates a contribution of $4 per hour when not involved in materials checks; the inventory check takes five hours. Holding costs amount to $15 per unit per annum.

The supplier of material B has very recently offered Wagtail Ltd a quantity discount of 24p a unit on the current price of $24 for all orders of 400 or more units.

Required:

(a) Calculate the optimal batch size for material B, ignoring the quantity discount. (b) Evaluate whether the quantity discount offered should be taken up by Wagtail Ltd.

Question 36 TIPEX LTD

Tipex Ltd carries on business as a supplier of office equipment, one of its lines being typewriters. The lead time for obtaining further supplies from the manufacturers is one month.

Analysis of past data suggests that the probability of monthly demand is as follows. Demand Probability

The cost of each typewriter is $280. Annual inventory-holding costs are estimated at 20% of average inventory value. Delivery cost is estimated at $15 for each order placed. Stock-out costs are estimated at $40 per typewriter.

Required:

Calculate the re-order level and order quantity which will minimise the total cost to the company of supplying the typewriters.

(10 marks) Question 37 ORION PLC

Orion plc is a company operating a nation-wide chain of superstores. All purchasing is undertaken by a head office buying department, the goods then being stored in a central warehouse from which they are despatched to individual stores as ordered by the store managers. This buying department is currently reviewing its ordering and inventory policy relating to all the company’s major inventory lines.

The following information has been obtained in relation to one such item.

(1) The daily demand from the individual stores is normally distributed, averaging 2,800 items per day with a standard deviation of 400 items. The company’s warehouse and stores are open 250 days per annum.

(2) The supplier charges a basic purchase price of $1.19 per item but offers to reduce this to $1.18 if the company orders at least 20,000 items at a time. The lead time on orders is always exactly 2 days.

(3) Regression analysis of historic warehousing costs indicates that directly variable warehousing costs amount to $0.1715 per annum for each item stored.

(5) The company’s cost of capital is 15% pa and it is company policy to provide a service level of 98% on all major line items.

(6) Normal distribution tables indicate that 2% of observations lie 2.05 standard deviations above the mean.

Required:

(a) Calculate the optimal order size, ignoring the discount opportunity offered by the

supplier. (3 marks)

(b) Determine the optimal order size, allowing for the discount opportunity. (4 marks) (c) Calculate the minimum discount which the supplier must offer on orders for 20,000 or more items at a time to make it attractive to the company. (5 marks)

(d) Calculate the re-order level required. (3 marks)

(15 marks) Question 38 3 SMALL COMPANIES

The managers of three small UK companies are discussing their strategies towards foreign exchange risk.

Company one exports to several countries in Europe, Africa and the Americas. Company two exports to and imports from Europe. Company three is not engaged in any form of foreign trade. All three companies believe themselves to be risk averse.

All three have decided that there is no need to take any action due to foreign exchange risk. Their reasons for no action are:

Company one:» Foreign exchange markets are efficient, and on balance my company is as likely to gain from foreign exchange movements as to lose from them. There is, therefore, no point in paying for hedging foreign exchange risk as overall the company will not gain by using such hedges.”

Company two: “My company only trades with Europe and the existence of the European Single Currency prevents foreign exchange losses.”

Company three: “As my company is not engaged in any form of foreign trade, foreign exchange rates are irrelevant to me.”

Required:

Discuss the validity of-the views of each of the three managers. Assume that exports are denominated in the foreign currency concerned, and that imports are denominated in sterling.