Refer to Important disclosures in the last page of this report

IDR/USD (median) 13,342 13,500

CA balance (% of GDP) -2.0f -1.8

Fiscal balance (% of GDP) -2.4 -2.2

GDP growth (%, yoy)

Money & Forex Reserves

latest % yoy

M1 – Nov17, Rptn 1338.1 13.1

M2 –Nov17, Rptn 5321.4 9.3

Reserves –Dec17, US$bn 130.2 11.9

Source: BI, BPS, CEIC

The prospect of and ahead of rice

Jan18 inflation subsided to 3.25% yoy, rice price among the main

culprits.

Core inflation lowered but hardly worrying.

We would be vigilant on global oil price and its upward trajectory.

BI signals toward other instruments outside rate ahead.

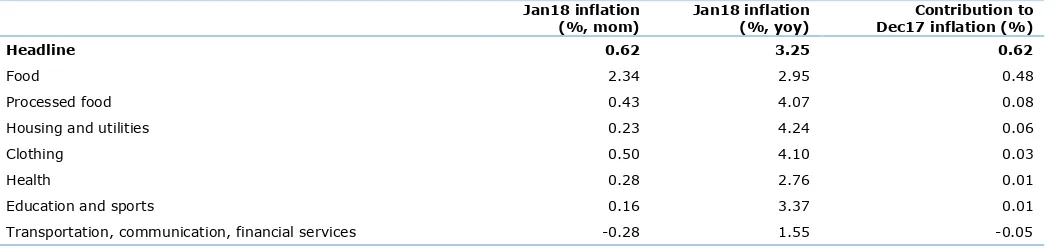

Rice-backed inflation. We believe inflation decline to 3.25% yoy (Dec17: 3.61%) goes along as expected as some items that were triggering prices increase in Dec17 were due to seasonality. We speak of lower prices in transportation, housing and utilities in that respect, which had all but made Jan18’s inflation to be at 0.62% mom. But the main account of price story last month put food on the headlines as food price notably of rice contributed the most to the month’s inflation (food: 77%, rice: 39% of monthly inflation), see Fig. 1. Wet season in January had caused rice price to soar by 3.7% mom on national average (Jakarta: +9.4% mom), the event of which was responded by 500tnd rice import by the Ministry of Trade. We should expect rice price gradually soften in upcoming months as the impact of harvest season and imported rice – due by policy – permeates.

Low but satisfactory core inflation. Core inflation, on another hand, had now again reached another low at 2.69% yoy driven by steep decline in transportation as well as housing and utilities. The extent where it was declining should be, to us, non-worrying, since core inflation had instead picked up on monthly basis (0.31% mom) against few months prior to Dec17. Moreover, where prices were lower, the contribution of which came from factors considered either seasonal (such as transportation, which picked up during holiday season but saw decline right afterward) or due to better policies such as the food supply management.

Careful on global oil price. Notwithstanding the positive developments, we would be cautious on the current trajectory of oil price, whose Brent price as of Dec17 had recorded US$64.4 per barrel (+2.7% mom). Indonesian crude oil price (or ICP) has traditionally experienced one to few months lag when it comes to adjustment with global oil price; ICP stood at US$61 by Dec17 and certainly would look for some upward revision. ICP alone to consumer prices is somewhat inelastic (~0.04 elasticity, according to our calculation) but goods categories directly or indirectly related to oil such as housing and utilities as well as food and transport make around 24-28% contribution, each. Despite the slow translation from Brent to ICP, we would consider this among risks of inflation this year.

Concentrating on measures outside reference rate. With the Federal Reserve looks firm on increasing FFR next Mar18 and better growth in developed economies such as that in the Eurozone, on top of possible upward shoot in domestic inflation, the perils of situation as of now would, at some point, weighs on BI’s consideration for rate increase. That, however, is less likely to happen this month, more probably less this quarter. The reason of which comes from BI governor, whom has signaled its preference to resort to other instruments when it comes to monetary policy. The idea will be even more resonated, given intensive capital inflow in the bond market of Rp33tn in Jan18. With average reserve-requirement ratio and other measures look to be implemented in Jul18, early months this year should be free of rate adjustments.

5.9%

MacroInsight

1 February 2018

Agnes HT Samosir

PT Indo Premier Sekuritas

agnes.samosir@ipc.co.id +62 21 5793 1168

MacroInsight

2

Refer to Important disclosures in the last page of this report

Fig. 1: Jan18’s inflation by group of goods and services

Jan18 inflation (%, mom)

Jan18 inflation (%, yoy)

Contribution to Dec17 inflation (%)

Headline 0.62 3.25 0.62

Transportation, communication, financial services -0.28 1.55 -0.05

Source: Statistics Indonesia, IndoPremier

Fig. 2: Inflation by broad category (%, mom) Fig. 3: Inflation by broad category (%, yoy)

Source : Statistics Indonesia, IndoPremier Source : Statistics Indonesia, IndoPremier

Fig. 4: Inflation (%, yoy) Fig. 5: Core Inflation (%, yoy)

Source : Statistics Indonesia, IndoPremier Source : Statistics Indonesia, IndoPremier

0.62

Headline mom - RHS Core mom - RHS Headline yoy Core yoy 3.6%

Head Office

PT INDO PREMIER SEKURITAS Wisma GKBI 7/F Suite 718 Jl. Jend. Sudirman No.28 Jakarta 10210 - Indonesia p +62.21.5793.1168 f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts’ personal views about any and all of the subject securities or issuers; and no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS