THE ROLE OF FINANCIAL

MANAGEMENT

Dr. H. Mustika Lukman Arief, SE, MM.

THE ROLE OF FINANCIAL

MANAGEMENT

.

•

Apa itu manajemen keuangan….?

Manajemen Keuangan meliputi semua

aktivitas yang berhubungan dengan

usaha

mendapatkan

dana

yang

dibutuhkan

perusahaan

serta

mengggunakan

dan/mengalokasikan

Manajemen keuangan digunakan

untuk menjawab pertanyaan:

1. What long-term investments should

the frma engage in?

2. How can the frm raise the money

for the required investments?

The Role of The Financial Manager

Capital Budgeting decision

decision to in tangible or intangible assets also called the

investment decision

Financing decision

raising money that the firm needs for its

investments and operations

Capital structure

Untuk kebijakan fungsi tersebut, ada 3

keputusan yang perlu diambil

1. Keputusan investasi

2. Keputusan Pendanaan

3. Kebijkan Dividen

Tujuan Perusahaan

Dalam pengertian mikroekonomi disebut bahwa tujuan perusahaan

adalah memaksimalkan keuntungan. Namun ditinjau dari sudut

keuangan tujuan ini mengabaikan berbagai kerumitan yang ada

dalam praktek pengambilan keputusan sehari-hari

Kelemahan Maksimalisasi Keuntungan:

1. Tidak mengaitkan besarnya keuntungan yang dihasilkan denga

waktu perolehannya

2. Tidak memperhatikan masalah waktu dan ketidakpastian

3. Mengabikan lamanya waktu pengembalian

Tujuan Perusahaan

Tujuan perusahaan

adalah memaksimalkan kekayaan

pemegang saham dengan cara memaksimalkan nilai

perusahaan

‘Basic goal: Maximize stockholder value’

indikatornya

- Firm’s value yang maksimal

- Stock price yang maksimal

Nilai perusahaan dicerminkan oleh harga pasar saham

Mengapa harga pasar saham mencerminkan nilai

Tujuan manajemen

Keuangan

mempelajari dan memahami bagaimana

upaya perusahaan dalam memaksimalkan nilai

perusahaannya (Value of the frm) memalui 3

macam keputusan yaitu: keputusan investasi,

keputusan pendaaan, kebijakan dividen.

Vf = f (I, F, D)

Vf = value of the firm (nilai perusahaan)

I = Investment Decision F = Financial Decision

.

The Objektive FunctionMaximime the Value of the frm

The Objektive Function

Maximime the Value of the frm

Basic corporation fnancial decision

1. How do you allocate resources across competing uses?

2. How do you raise founds to fnance the projects?

3. How much do you reinvest back into the business and how much do you return to you stockholders?

Basic corporation fnancial decision

1. How do you allocate resources across competing uses?

2. How do you raise founds to fnance the projects?

3. How much do you reinvest back into the business and how much do you return to you stockholders?

Aksioma-aksioma yang diperlukan

untuk memahami Manajemen

Keuangan

Aksioma

1

Keseimbangan risiko dan

pengembalian (the risk-return

tradeoff

Jangan menambahkan risiko

kecuali mendapatkan kompensasi

tambahan pendapatan

Aksioma

2

Nilai waktu uang (time value of

moneyf-uang yang diterima

ssekarang lebih berharga dari uang

yang diterima kemudian

Aksioma

Lanjutan…

Aksioma 4

Tambahan Arus Kas (Increment Cash Flow) satu-satunya

pertambahan nilai yang dihitung

Aksioma 5

Kondisi persaingan pasar-alasan kenapa sangat sulit mendapatkan

laba yang luar biasa

Aksioma 6

Pasar modal yang efesien-pasar yang bergerak cepat dan harga

yang tepat

Aksioma 7

Masalah keagenan-manajer tidak akan bekerja bagi pemilik

perusahaan jika tidak selaras dengan kepentingan mereka

Aksioma 8

Perpajakan yang berdampak pada keputusan bisnis

Aksioma 9

Tidak semua risiko sama, ada sebagian risiko yangd dapat

didiversifikasi

What is a Corporation?

Types of Corporations

Public Companies

Private Corporations

Organizing a Business

Types of Business Organizations

Sole Proprietorships

Partnerships

Corporations

Question

1. Why should a company concetrate primarily on

wealth maximization instead of proft maximization?

2. What are the three types of fnancial management

decisions? For each type of decision, give an

example of the business transaction that would be

relevant.

3. Firms often involve themselves in projects that do

not result directly in profts: for example, IBM and

Mobil Oil frequently support public television

Case

In early 2001, Doc and Lyn McGee formed the McGee Company. The company produced a full line of cakes, and its specialties included chess cake, le,on pound cake, and double-iced, double-chocolate cake. The couple formed the company as an outside interest, and both continued to marketing and distribution. With good product qualty and sound marketing plan, the company grew rapidly. In early 2006, the company was featured in a widely distributed entrepreneurial magazine. Later that year, the company was featured in Gourmet Desserts, sales exploded, and the company began receiving orders from all over the world.

Doc and Lyn have operated as a sole

proprietorship. They have approached you to

help manage direct the company’s growth.

Specifcally, they have asked you to answer the

following questions:

1. What are the advantages and disadvantages of

changing the company organization from a sole

proprietorship to an Limited Liabilities Company

(LLC)?

2. What are the advantages and disdvantages of

changing the company organization from a sole

proprietorship to a corporation?

Financial Statement

Analysis

Financial analysis can be defned as the

process of assessing the fnancial

condition of a frm

Basic Fianancial Statements

Balanced Sheet

The Balance Sheet

Defnition

fnancial statements that show the

value of the frms’s assets and

The Income Statement

Defnition

Financial statement that shows

the revenues, expenses, and net

income of a frm over a period of

time

(from

an

accounting

Why Evaluate Financial Statements?

•

Internal uses

- Performance evaluation-compensation and

comparison between divisions

- Planning for the future-guide in estimating

future cash fows

•

External uses

- Creditors

- Suppliers

- Custolers

Financial Ratio

•

The principal analytical tool of the

fnancial analyst is the fnancial ratio

•

Financial ratios help us identify some

of the fnancial strengths and

weaknesses of a company

•

The ratios give us a way of making

Categori of Financial Ratios

•

Short-term solvency or liquidity ratios

•

Long-term solvency or fnancial

leverage ratios

•

Asset management or turnever ratios

•

Proftability ratios

Liquidity Ratios

Quick ratio = current assets -

inventorie s

Current liabilitie s

Current ratio = current

assets

current liabilities

Cash ratio = cash + marketable

securities

Long-term solvency or fnancial

Debt/equity ratio = Total debt

equity

Asset management or turnover

ratios

Receivable turnover ratio = Sales

Receivable

Day’s sales in receivable = 365

Receivables turnover

Inventory turnover ratio = cost of goods sold

Inventory

Day’s sales in inventory = inventory

Asset management or turnover

ratios

Fixed asset turnover ratio = Sales

Net fxed assets

Total asset turn over= Sales

Total assets

NWC Turnover = Sales/NCW

Proftability ratios

Net proft margin = net income

Sales

Return on asset (ROA) = net Income

Total

Market value ratios

•

PE Ratio = Price per share/Earnings

per share

•

Market-to-book ratio = market value

Sample Income Statement

Numbers in millions, except EPS & DPS

Liquidity Ratios

1. Current Ratio = CA/CL

- 2256/1995= 1.13 times

2. Quick Ratio = (CA-Inventory)/CL

- (2256-604)/1995 = 83 times

3. Cash Ratio = Cash/CL

-696/1995 = 35 times

1. Current Ratio = CA/CL

- 2256/1995= 1.13 times

2. Quick Ratio = (CA-Inventory)/CL

- (2256-604)/1995 = 83 times

3. Cash Ratio = Cash/CL

Long-term Solvency ratios

•

Total Debt Ratio = (TA – TE)/ TA

- (5394 – 2556)/5394=52.61%

•

Debt/Equity = TD/TE

- (5394-2556)/2556= 1.11 times

•

Equity Multiplier = TA/TE = 1+D/E

- 1=1.11= 2.11

•

Long-term debt ratio = LTD/(LTD=TE)

- 843/(843=2556)= 24.80%

Asset management or turnover

ratios

Computing Receivables ratios

•

Receivables Turnover=

Sales/Accounts= Receivable

- 5000/956= 5. 23 times

•

Days’ Sales in receivables = 365/

Asset management or turnover

ratios

Computing Inventory ratios

•

Inventory Turnover = Cost of Goods

Sold/Inventory

- 2006/301= 6.66 times

•

Days’ Sales in Inventory =

Asset management or turnover

ratios

Computing Inventory ratios

•

Total Asset Turnover= sales/Total Assets

- 5000/5394= 93

- it is not unusual for TAT <1, especially if

a frm has a large amount of fxed assets

•

NWC Turnover = Sales/NWC

- 5000/(2256-1995)= 19.16 times

•

Fixed Asset Turnover= Sales/NFA

Proftability Measures

•

Proft Margin= Net Income/Sales

- 689/5000= 13.78%

•

Return on Assets (ROA) = Net

Income/Total Assets

- 689/5394 = 12.77%

•

Return on Equity (REO) = Net

Computing Market Value

Measures

•

Market Price = $ 87.65 per share

•

Shares outstanding = 190.9 million

•

PER ratio = Price per share/Earnings

per share

- 87.65/3.61 = 24.28 times

•

Market-to-book ratio = market value

per share/book value per share

Harley-Davidson, Inc. Ratio Analysis

1. Liquidity ratios 2002 2003 Average industries

Using the DuPont Identity

ROE = PM * TAT * EM

ROE = Net Income/sales x sales/assets x

assets/Equity

-

Proft margin is a measure of the frm’s operating

efciensy

- how well does it control costs

- total asset turnover is a measure of the frm’s asset use

efciency-how well does it manage its assets

Expanded Dupont

Analysis-Aeropostale data

•

Balance Sheet Data • income Statement Data

- cash= 138,356 - Sales= 734,868

- inventory= 61,807 - COGS+ 505,152

- other CA = 12,284 - SG&A = 141,520

- fxed assets = 94, 601 - interest = (760)

- equity = 185, 640 - taxes = 34, 702

.

ROE = net income x sales x assets

sales assets equty

= 54,254 x 734, 868 x 307, 048

734,868 307,048 185, 640

= 07383 x 2.3933 x 1.6540

•

As we study the fgure, we quickly see that

improvement in the ROE can common in one or more

of four ways:

1. Increase sales without a disproportionate increase in cost

and expenses

2. Reduce COSGS or operating expences

3. Increase the sales relative to the asset base, either by

increasing sales or by reducing the amounts invesred in

company assets. From our earlier exammination of

Harley-Davidson, we learned that the frm had excessive account

receivables and fxed assets. Thus management need to

reduce these assets to the lowest in the return on which

would in turn result in an increase in the return on assets

and then the return on equity

Limitations of ratio analysis

1. It is sometimes dincult to identify the industry category

to which a frm belongs when the frm enganges in

multiple line of business

2. Published industry averages are only approximations

and provide the user with general guidelines rather than

scientifcally determoned averages of the ratios of all or

even a representative sample of the frms within an

industry

3. Accounting practice diner widely among frms and can

lead to dinerences in computed ratio

4. An industry average may not provide a desirable target

ratio or norm

Case

Chris was recently hired by S&S Air, Inc., to assist the

company with its fnancial planning and to evaluate the

company’s performance. Chris graduated from college fve

years ago with a fnance degree. He has been employed in

the fnance departement of a fortune 500 company since

then.

.

Although the company manufactures aircraft, its

operations are dinerent from commercial aircraft

companies S&S Air builds aircraft to oredr. By using

prefabricated parts, the company can complete the

manufacture of an airplane in only fve weeks. The

company also receives a deposit on each order, as well

as another partial payment before the order is

complete. In contras, a commersial air plane may take

one and one-half to two years to manufacture once the

order is placed

Light Airplane Industri ratios

Lower Median Upper

1 Current ratio 0.50 1.43 1.89

2 Quick ratio 0.21 0.38 0.62

3 Cash ratio 0.08 0.21 0.39

4 Total Assets turnover 0.68 0.85 1.38

5 Inventory turnover 4.89 6.85 10.89

6 Receivables turnover 6.27 9.82 14.11

7 Total debt 0.44 0.52 0.61

8 Debt-Equity ratio 0.79 1.08 1.56

9 Equity multiplier 1.79 2.08 2.56

10 Time interest earned 5.18 8.06 9.83

11 Proft margin 4.05% 6.98% 9.87%

12 Return on assets 6.05% 10.53% 13.21%

Question

1. Using the fnancial statements provided for S&S

Air, calculate each of the ratios listed in the table

for the light aircraft industry.

2. Compare the performance of S&S Air to the

TIME VALUE OF MONEY

•

Future Value-Taking an amout and

fnding its value at sometime in the

future

•

Present Value-Taking an anmout from

Future Values

Future Value – Amount to which an

invenstement will grow after earning interest

Compound Interest – Interest earned on

interest.

Future Values

Example – Simple Interest

Interest earned at a rate of 6% for fve years on a

principal balance of $100

Today Future Years

1 2 3 4

5

Interest earned

Value 100 6 6 6 6 6

106 112 118 124 130

Future Values

Example – Compound Interest

Interest earned at a rate of 6% for fve years on the

previous year’s balance

Today Future Years

1 2 3 4 5

Interest earned

Value 100 6 6.36 6.74 7.15 7.57

106 112.36 119.10 126.25 133.82Future Values

Example-FV

1. What is the future value of$100 if interest is

compounded annually at a rate 6% for fve years?

FV = $100 x (1+.06)

5= $133.82

2. What is the future value of $100 invested for fve

years at a nominal interest rate 12%,

compounded continuosly?

FV =

Compounding Periods

Compounding an investment

m

times a years for

T

years provides for future value of wealth:

FV = C

ofor example, if you

$50 for years at 12%

compounded semi-annually, your investment will

grow to

FV

=

6Enective Interest Rates

ren= (1+r/m)

m- 1Ren= (1+0,12/2)2- 1 = 12,36%

Continuous Compounding :

ren = e

m- 1Dampak dari periode pemajemukan yang berbeda atas nilai masa

depan $1.000, diinvestasikan dengan tingkat bunga nominal 8%

Jumlah Periode

Pemajemukan pada akhir 1 thFuture value tahunan efektifTingkat bunga

$1.000 Tahunan $1.080,00 8,00%

$1.000 Semi tahunan $1.081,60 8,16%

$1.000 4 bulanan $1.082,43 8,24%

$1.000 Bulanan $1.083,00 8,30%

$1.000 Harian $1.083,28 8,32%

How Long is the wait?

If we deposit $5,000 today in an account paying 10% how long

does it take to grow to $10,000?

FV = C

ox

(1+

r

)

T$10,000=$5,000x(1.10)

T(1.10)

T =$10,000 = 2

$5,000

ln(

1.10)

T =ln 2

What Rate Is Enough?

Assume the total cost of a college education will be

$50,000 when your child enters college in 12 years. You

have $50,000 to invest today. What rate of interest must

you earn on your investment to cover the cost of your

child’s education ? About 21.15%

FV = C

ox

(1+

r

)

T$50,000=$5,000 x (1.

r

)

12(1.

r

)

12=$50,000=10 (1+

r

)10

1/12$5,000

.

What is the future value three years hence of $1.000

invested in an account with a stated annual interest rate of

8%

a.

Compounded annually

b.

Compounded semiannually

c.

Compounded monthly

Present Values

Present Value

Value today of a

future cash

fow.

Discount factor

Present value of

a $1 future

payment.

Discount Rate

Interest rate used

to compute prent

TIMES VALUE OF MONEY

(APPLICATIONS)

The PV formula has many application, you can

solve for the remaining variable.

What is the present value of $ 100 to be received in 3 years if the

appropriate interest rate 1s 10%, 15%, and 20%

PV = $100 x 1/(1,1)

3= $75,13

PV = $100 x 1/(1,15)

3= $65,75

PV of Multiple cash Flows

Example

your auto dealer gives you the choice to pay $15,500 cash now, or make three

payments: $8,000 now and $4,000 at the end of the flowwing two years. If your cost of money is 8% wich do you prefer?

Immediate payment 8,000.00

PV

1= 4,000 = 3,703.70

(1+.08)

1PV

2=4,000 = 3,429.36

(1+.8)

2.

Example

you are selling your house. The Smith have offered you $115.000.

they will pay you immediately. The Joneses have offered you

$150.000, but the cannot pay you until theree years from today.

The interest rate is 10 percent. Which offer should you choose?

you have the opportunity to make invesment that cost $900.000. if

you make the investment now, you will receive $120.000 and

You are given three invesment alternatives to

anlyze. The cach fows from these three invesments

are follows:

END OF YEAR

A B C

1 $5,000 $1,000 $10,000

2 $5,000 $3,000 $10,000

3 $5,000 $5,000 $10,000

4 -$15,000 $10,000 $10,000

5 $15,000 $10,000 -$40,000

Perpetuities & Annuities

Annuity = Equally spaced level stream

of cash fows for a limited

period of time.

Annuities

FV of Annuity Formula

C = cash payment

r = interest rate

t = Number of years cash payment is received

FVAN = C X (1 +

r)

t- 1

Annuities

Example – future Value of annual payments

You plan to save $4,000 every year for 20

years and then retire. Given a 10% rate of

interest, what will be the FV of your

retirement account?

FVAN = 4.000 x (1 + 0,10)

20- 1

0,10

Annuities

PV of Annuity Formula

C = cash payment

r = interest rate

t = Number of years cash payment is

received

PVAN = C x (1 –

1/(1+r)

tAnnuities

Example – Annuities

you are purchasing a car. Your are scheduled to make

3 annual instllments of $4,000 per year. Given a rate

of interest of 10%, what is the price you are paying

for the car (i.e. what is the PV)

PVAN = 4.00 x 1- 1/

(1+0,1)

30,1

Annuity: Example

Your insurance agent oners to sell you an

annuity. It will pay you $400 per for fve

years. Your requred rate of return is 7%. How

much will you be willing to pay?

0 1 2 3 4 5 6

….. ……… …..…. ...……. ……… ...…

400 400 400 400 400

Annuity: Example

Your insurance agent offers to sell you an annuity. It will pay you $400

per for five years beginning of each years. Your requred rate of return is

7%. How much will you be willing to pay?

0 1 2 3 4 5 6

…... ……….. ….……. ….……. ...…….. ……

400 400 400 400 400

PAVN = C x (1 – 1/(1+r)

tx

(1 + r)

r

Your company is considering leasing $120.000

Perpetuities

PV of Perpetuity Formula

c = cash payment

r = interest rate

PV =

c

Perpetuities & Annuities

Example – Annuities

in order to create an endowment, which pays $100,000

per year, forever, how much money must be set aside

today in the rate of interest is 10% ?

PV = 100,000= $1,000,000

10

Perpetuities & Annuities

Example –continued

if the first perpetuity payment will not be

received until three years from today, how

much money needs to be set aside today?

Inflation

Inflation – Rate at which prices as a whole are

increasing.

Nominal Interest Rate – Rate at which money

inveted grows.

Real Interest Rate – Rate at which the

Inflation

1 + real interest rate = 1+nominal interest rate

1+inflation rate

Approximation formula

Questions and Problem

1. Ellen, a sophmore mechanical engineering student, receives a call from an

insurance agent, who believes that Ellen is an older woman ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her an annual fixed income. The annuities are as fllows:

If Ellen could earn 12 percent on her money by placing it in savings account, should she place it instead in any of the annuities? Which ones, if any? Why ?

Annuity Initial payment into

annuity (At t=0) Amount of money received year Duration of Annuity(Years)

A $50,000 $8,500 12

B $60,000 $7,000 25

Questions and Problem

2. You are triying to plan for retirement in 10 years and currently you have

$150,000 in savings account and $250,000 in stock. In addition, you plan

to add to your savings by depositing $8,000 per year in your saving

account at the end of each of the next five years and then $10,000 per year

at the end of each year for the final five years until retirement.

a. Assumsing your savings account returns 8 percent compounded

annually and your investment in stocks will return 12 percent

compounded annually, how much will you have at the end of 10

years? (ignore taxes)

b. if you expect to live 20 years after you retire, and at a retirement you

deposit all of your savings in a bank account paying 11 percent, how

much can you withdraw each year after retirement (20 equal

.

What Is Capital Budgeting

Capital budgeting involves the decision making

process with respect to investment in fixed assets;

specifically, it involves measuring the incremental

cash flows associated with investment proposals and

evaluating the attractiveness of these cash flows

relative to the project’s costs

Capital budgeting is decision process that managers

First, a firm’s capital budgeting decisions

define its strategic direction, because moves

into new products, services, or markets must

be preceded by capital expenditures.

Second, the results of capital budgeting

decisions continue for many years

Thied, poor capital budgeting can have serious

Projects Classifcations

1. Replacement – Worn out equipment

2. Replacement – Reduce costs

3. Expansian of existing produkcts or markets

4. Expansion into new products or markets

JENIS-JENIS PROYEK

Independent Projects

: if the cash flows of one

are unaffected by the acceptance of the other.

Acceptance or rejection of project depends upon

merits of project compared to decision criteria.

Mutualli Exclusive Prjocts

: if the cash flows of

one can be adversely impacted by the acceptance

of the other.

An Example of Mutally Exclusive

Projects

BRIDGE vs BOAT

Some Alternative Invesment

Rules

•

Payback Period

•

Discounted Payback

•

Net Present Value (NPV)

•

Proftability Index

•

Internal Rate of Return

•

Modifed internal rate of Return

Payback Period

•

How long does it take to get the initial cost

back in a nominal sense?

•

Computation

Estimate the cash flows

Subtract the future cash flows from the initial cost

until the initial investment has been recovered

•

Decision Rule -

Accept if the

Net Cash Flows for Projects

S and L

Project S : 0 1 2 3 4

-1,000500 400 300 100

Project L : 0 1 2 3 4

-1,000100 300 400 600

Advantages and Disadvantages of

Payback

Advantages

Disadvantages

Easy ro undersand

ignore the time value of

money

adjusts for uncertainly of

later

cash fows

requres an arbitrary cuton

point

Biased towards liquidity

Ignores cash fows beyond

the cuton

date

Biased againt long-term

projects,

such as recearch and

development,

Discounted Payback Period

•

Compute the present value of each cash flow

and then determinane how long it takes to

Payback on a discounted basis

•

Compare to a specified required period

•

Decision Rule –

Accept the project if it pays

Projects S and L: Discounted Payback

Period

Project S : 0 1 2 3 4

-1,000 500 400 300 100

Disc. NCF (at 10%)

-1,000 455 331 225 68

Project L : 0 1 2 3 4

-1,000 100 300 400 600

Disc. NCF (at 10%)

-1,000 91248 301 410

Net Present Value

NPV= -

C

o+ C + C +….+ C = -C

o+ C

(1+

r

) (1+

r

)

2(1+

r

)

N(1+r)T

Net Present Value – Present value

of cash

fows minus initial invesments

Opportunity Cost of Capital –

Expected rate

The Net Present Value

Method :

Minimum Acceptance Criteria: Accept if NPV > O

Ranking Criteria: Choose the highest NPV

Net Present Value (NPV)

NPV = -1,000 + 500 400 300 100

(1+0,10)1 (1+0,10)2 (1+0,10)3 (1+0,10)4 =78.82

Cash Flows

0

1 2 3 4

-1000 500 400 300 100

454.55 330.58 225.39 68.30

NPV – Decision Rule

•

A positive NPV means that the

project is expected to add value to

the frm and will therefore increase

the wealth of the owners.

•

Since our goal is to increase owner

Goo Attributes of the NPV

Rule

1. Uses csh fows

2. Uses ALL cash fows of the project

3. Discounts ALL cash fows properly

Proftability Index (PI)

PI = Total PV of Future Cash Flows

Initial Investment

Pls = $1,078.82/$1,000=1.079

Minimum Acceptance Criteria:

Accept if PI > 1

Ranking Criteria:

Proftability Index (PI)

•

Disadvantages

problem with mutually exclusive

invesments

•

Advantages:

maybe usesful when available

invesment funds are limited

Easy to undersantand and communicate

Correct decision when evaluating

Internal Rate of Return (IRR)

•

Defnition : IRR is the return that

makes the NPV= 0

•

Decision Rule: Accept the project if

CF

o+ C

F

1+

CF

2+……+

CF

n=

0

(1+IRR)

(1+

0,10)

2(1+IRR

)

n-

1,000 + 500

+ 400 + 300 + 100 + = 0

(1+r)

(1+r)2 (1+r)3 (1+r)4CF

o+ C

F

1+

CF

2+……+

CF

n=

0

(1+IRR)

(1+

0,10)

2(1+IRR

)

n-

1,000 + 100 + 300 + 400 + 600 +

= 0

(1+r)

(1+r)2 (1+r)3 (1+r)4NPV Vs. IRR

•

NPV and IRR will generally give us the

same decision

•

Exceptions

non-conventional cash fows – cash

fow signs change more than once

Mutually exclusive projects

•

initial invesments are substantially dinerent

Example - Non – conventional Cash

fows

•

Suppoese an investment will cost

$90,000 initially and will generate

the following cash fows:

Year 1: 132,000

Year 2: 100,000

Year 3:-150,000

•

The required return is 15%

•

Should we accept or reject the

IRR and Mutually Exclusive

Projects

•

Mutually exclusive projects

If you choose one, you can’t choose the

other

Example: you can choose to attend

graduate scholl at either Havard or

Standard, but not both

•

Intuitively you would use the

following decision rules:

NPV – choose the project with the higher

NPV

IRR - choose the project with the higher

Example With Mutually Exclusive

Projects

The required return

for both projects is 10%

Which project should

you accept and why?

Period Project A Project B

0 -500 -400

1 325 325

2 325 200

IRR 19.43% 22.17%

Conficts Between NPV and

IRR

•

NPV directly measures the increase

in value to the frm

•

Whenever there is a confict

between NPV and another decision

rule, you should

always

use

NPV

IRR

is unrealiable in the following

situations

non-conventaional cash fows

Managers like rates—prefer IRR to

NPV comparisons. Can we give them

•

Yes, MIRR is the discount rate that

causes the PV of a projec’ts terminal

value (TV) to equal the PV of cost. TV is

found by compounding infows at WACC

•

Thus, MIRR assumes cash infow are

reinvested at WACC.

Modifed Internal Rate of

Return

Your division is considering two

invesment projects:

a. Compute the payback, discounted payback, NPV, PI, IRR, and MIRR for the following two projects. Assume the required return is 10%

b. If two project mutually exclusive and COC 5%, which project should the frm undertake?

c. If two project mually eclusive and COC 15%, which project should the frm undertake?

d. What is the crossover rate?

Year Project A Project B

0 -$25 -$25

1 5 20

2 10 10

3 15 8

Case

• Your frst assigment in your new position as assistant fnancial

analyst at Caledonia Products is to evaluate two new

capital-budgeting proposals. Because this is your frst assigment, you have been asked not only to provide a recommendation, but also to

respond to a number budgeting process. This is a standard procedure for all new fnancial analysts at Caledonia and will serve to determine whether you are moved directly into the capital-budgeting analysis departement or are provided with remedial training. The

memorandum you received outlining your assgment follows: to : The New Financial Analyst

from : Mr. V. Morrison, CEO, Caledonia Products RE : capital-budgeting analysis

provide an evaluation of two proposed projects, both with fve-year expected lives and identical initial outlays of $110,000. Both of these projects involeve addition to Caledonia’s highly successful Avalon

product line, and as a result, the required rate of return on both

In evaluating these projects, please respond to the following quetsions: a. Why is the capital-budgeting process so important?

b. Dtermine the payback, discounted payback, NPV, PI, IRR and MIRR, should they be accepted?

c. What would happen to the NPV and PI, if the required rate of return increased? If the required rate of return decreased?

d. How does a change in the required rate of return anect the project’s IRR?

Project A Project B

Initial Outlay -$110,000 -$110,000

Year 1 20,000 40,000

Year 2 30,000 40,000

Year 3 40,000 40,000

Year 4 50,000 40,000

The Dilemma at Day-Pro

• the Day-Pro Chemical Corporation, established I 1995, has managed to earn a consistently high rate of return on its

investments. The scret of its success has been strategic and timely development, manufacturing, and marketing of

innovative chemical product that have been used in various industries. Currently, the management of the company is considering the manufacture of a thermosetting resin as

packaging material for electronical products. The company’s recearch an development teams have come up produce initially but would have greater economies of scale. At the initial

.

•

In order to resolve this dilemma, Tim Palmer, the

Assistant Treasurer, and a recent MBA from a prestigious

mid-western university, has been assigned the task of

analyzing the costs and benefts of the two proposals

and presenting his fndings to the board of directors. Tim

knows that this will be an uphill task, since comes to

fnancial concepts. The Boar has historically had a

strong preference for using rates of return as its decision

criteria. On occasion it has also used the payback period

approach to decide between competing projects.

.

•

After obtaining the cash fow projections for each

project (see Tables 1 & 2), and crunching out the

numbers, Tim realizes that the hill is going to be

steeper than he thought. The various capital

budgeting techniques, when applied to the two

series of cash fows, provide inconsistent results.

The project with the higher NPV has a longer

payback period, as a lower Accounting rate of

.

• The day-Pro Chemical Corporation, established I 1995, has managed

to earn a consistently high rate of return on its invesments. The scret of its success has been strategic aand timely development,

manufacturing, and marketing of innovative chemical products that have been used in various industries. Currently, the management of the company is considering the manufacture of a thermosetting resin as packaging material for electronic products. The company’s

Recearch and Development teams have come up presentations and provided sufcient documentation in support of their proposals.

However, since the products are mutually exclusive, the frm can only fund one proposal.

.

The Board has historically had a strong preference for using rates of return as its decision creteria. On occasion it has also used the payback period approach to decide between competing projects. Howerer, Tim is convinced that the net present value (NPV)

method is least fawed and when used correctly will always add the most value to a company’s wealth.

after obtaining the cash fow projections for each project (see

Table 1&2) and crunching out the numbers, Tim realizezs that the hill is going to be steeper to the two series of cash fows, provide inconsistent results. The project with the higher NPV has a longer payback period, as well as a lower Accounting Rate of Return

.

Syntetic

Resin Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Net Income 150,0

00 200,000 300,000 450,000 500,000 Depreciatio

n 200,000 200,000 200,000 200,000 200,000

Net cash

fow (1000,000) 350,000 400,000 500,000 650,000 700,000

Epoxy Resin

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Net Income 440,0

00 240,000 140,000 40,000 40,000 Depreciatio

Questions

1. Calculate the payback period of each project. Expalin

what argument Tim should make to shaow the payback

period is not appropriate is this case.

2. Calculate the Discounted Payback Period (DPP)using 10%

as the discount rate. Should the tim ask the board to use

DPP as the deciding factor? Explain.

3. Calculate the two project’ IRR. How should Tim convince

the Board that the NPV method is the way to go?

4. Explain how Tim can show that the Modifed Internal Rate

of Return (MIRR) is the more realistic measure to use in

the case of mutually exclusive projects

.

PROSES PENGANGGARAN

MODAL

1. Tentukan biaya proyek

2. Perkirakan aliranb kas yang diharapkan dari proyek,

termasuk nilai akhir aktiva

3. Risiko dari lairan kas proyek harus dietimasi. (memakai

distribusi probabilitas aliran kas)

4. Dengan mengetahui risiko dari proyek, manajemen harus

menentukan biaya modal (cost of capital) yang tepat

untuk mendiskon aliran kas proyek

5. Tentukan nilai sekarang aliran kas masuk yang

diharapkan digunakan untuk memperkirakan nilai aktiva.

6. Terakhir, nilai sekarang dari lairan kas yang diharapkan

HAL PENTING DALAM ESTIMASI ALIRAN

KAS

1. Keputusan dalam capital budgeting harus

didasarkan pada aliran kas setelah pajak.

2. Hanya memeperhatikan

incremental cash fow

yang

relevan.

3. Memperhatikan aliran kas yang timbul karena

keptusan investasi, aliran kas dari keputusan

pendanaan tidak perlu diperhatikan (ex: bunga,

cicilan, deviden)

4. Tidak memasukan sunk cost (biaya yang telah

terjadi)

Project Cash Flows

•

Initial outlay. This include the cost of the fxed

assets associated with the project plus any initial

invesment in net operating working capital, such

as raw materials

•

Opertaing cash fow. The operating cash fow is the

net operating proft after taxes plus depreciation

Project Cash Flows

When deciding whether or not to make an invesment, we

must frst estimate the cash fows that the invesment will

provide

Generally, these cash fows can be categorized as follows:

the initial outlay (IO)

operating cash Flows

The terminal cash fows (TCF)

Operating Cash fow

Initial terminal Outlaycash fow

Sebagai manejer keuangan yang baru ditunjuk di Blooper Industries, Anda akan menganalisis sebuah proposal penambangan dan penjualan biji magnisium kelas satu yang langka. Proyek ini memerlukan investasi $10 juta. Setelah 5 tahun kandungan biji magnesium habis, metode

penyusutan adalah garis lurus, dengan nilai buku pada kahir tahun

menjadi nol. Pada tahun ke enam peralatan mungkin dapat dijual senilai $2 juta. Untuk itu perusahaan dikenal tagihan pajak pada tahun ke

enam senilai 35%+ x $2= $0.70. sehingga arus kas bersih dari

penjualan aktiva tahun ke enam adalah $2- $0.7= $1.3 juta. Ramalan modal kerja dari Blooper Industries adalah sbb:

Perusahaan memperkirakan mampu menjual 750.000 pon magnesium per tahun dengan harga $20, harga akan meningkat sesuai dengan tingklat infasi, beban operasi diperkirakan sebesar 2/3 dari

pendapatan. Tingkat infasi 5%, dari tarif pajak 35%. Tentukan Cash

Flows

1.575 1.654 1.736 1.823 0 0

M. kerja 1.50

0 1 2 3 4 5 A. Aktiva Tetap

Investasi aset tetap -100.000

Penjualan asset tetap 21,758

Opportunity cost -150,000 150,000

Arus kas, investasi aset tetap -250,000 171,758

B. Modal Kerja

Modal kerja 10,000 10,000 16,320 24,969 21,224 0

Perubahan modal kerja 10,000 0 6,320 8,649 -3745 -21,224

Arus kas investasi modalkerja -10,000 0 -6,320 -8,649 3,745 21,224

C. Operasi

Pendapatan 100,000 163,200 249,696 212,242 129,892

Beban operasi 50,000 88,000 145,200 133,100 87,846

Depresiasi 20,000 32,000 19,200 11,520 11,520

Laba sebelum pajak 30,000 43,200 85,296 67,622 30,526

pajak 10,200 14,688 29,000 22,991 10,526

Laba setelah pajak 19,800 28,512 56,296 44,631 20,147

Arus kas dari operasi 39,800 60,512 75,496 56,151 31,667

D. Penilaian

Total arus kas proyek -260,000 39,800 54,192 66,847 59,896 224,649

Analisis Arus kas Proyek Penggantian

PT Tekstil membeli mesin pintal 10 tahun yang lalu dengan $75.000. mesin tersebut memiliki usia ekonomis selama 15 tahun dan

sisusutkan dengan metode garis lurus, tanpa nilai sisa. Jadi nilai

buku mesin saar ini adalah $25.000. perusahaan merencangkan akan mengganti mesin lama dengan mesin baru. Mesin baru yang sejenis dapat dibeli dengan harga $120.000, dengan usia ekonomis 5 tahun, disusutkan dengan MACRS. Nilai sisa jika dijual rugi $15.000. pajak perusahaan 40%. Apabila penggantian itu dilakukan dapat

Tabel: Estimasi Arus Kerja

37.600 43.360 37.216 33.530 40.442

Soal

Scoty Corporation pembuat komponen elektronik. Scoty

mempertimbangkan untuk mengganti satu mesin perakit yang dioperasikan dengan tangan dengan mesin baru nyang otomatis. Mesin perakit tersebut dibeli 5 thaun yang lalu dengan harga

$50,000, umur ekonomis 10 tahun. Harga mesin baru $60,000, usia ekonomis 5 tahun, tanpa nilai sisa

Buatlah estimasi cash fows, apakah proyek layak dijlankan bila biaya dana 16%

Situasi sekarang (mesin perakit manual)

Situasi yang diajukan (mesin perakit otomatis)

Gaji operator $25,000 Gaji operator 0

Tabel: Estimasi Arus Kas

Keterangan Tahun

0 1 2 3 4 5

Initial cash Flow

1. Harga mesin baru

ditambha pemasangan &

13. Operating cash fow (12=8)

25.000

14. Nilai jual mesin baru 15. Pajak: 34%(20,000-0)

Proyeksi cash fow -54,200 20,608 20,608 20,608 20,608 33,808

Problem

•

PT. A sedang mempertimbangkan pembelian

panggangan baru yang hemat energi.

Panggangan ini berharga $40,000 dan akan

disusutkan menurut skedul MACRS 3 tahun.

Panggangan ini akan ndijual sebagai besi tua

setelah 3 tahun senilai $10,000. panggangan

ini tidak berdampak pada penerimaan tapi

akan menghemat biaya energi sebesar

$20,000. tingkat pajak 35%, dan biaya modal

12%.

The Unequal Lives Problem

•

There are two ways to correctly deal with the

unequal lives problem

The replacement chain approach

The equivalent annual annuity approach

•

Misalkan Anda harus memilih di antara 2 mesin,

yang umurnya berbeda, tapi memiliki kapasitas

iidentik dan melakukan pekerjaan yang persis

sama.

Mesin mana yang sebaiknya dipilih ?

Biaya (ribuan dolar) PV

Memilih di antara 2 proyek yang

mutually exclusive

Jika discount rate = 10% NPV proyek A = $928,11 NPV proyek B = $612,32

EAA untuk proyek A = $213,11 EAA untuk proyek B = $246,21

0 1 2 3 4 5 6

Metode Penyusutan

•

Metode garis lurus: metode penyusutan

yang mengalokasikan biaya secara merata

selama usia penyusutan aktiva

•

Sum of year’s digit method: metode

penyusutan dengan penjumlahan angka

tahunan

•

Double decline balance method: dengan

formulasi 2(1/n) NBV

•

MACRS : dengan menggunakan tabel tarif

Tahun Kelas Properti Pemulih

an 3 tahun 5 tahun 7 tahun 10 tahun

1 33,33% 20,00% 14,29% 10,00%

2 44,45% 32,00% 24,49 18,00%

3 14,81% 19,20 17,49% 14,40%

4 7,41% 11,52% 12,49% 11,52%

5 11,52% 8,93% 9,22%

Capital Rationing

(limit set on the amount of funds available for investment)

•

Firms should implement all positive

NPV projects

this will maximize shareholder wealth

•

Firms often limi the projects that are

considerations

•

Capital Rationing: process of limiting

Capital Rationing

Anggaplah biaya modal 10%, dan perusahaan memiliki sumber daya total $20 juta, saat ini perusahaan dihadapkan pada beberapa proposal proyek sbb:

Karena dana terbatas $20 juta, maka Proyek yang dipilih: L,J,M, dan N Jika dana terbatas 10 juta, proyek mana yang dipilih?

Capital Rationing

Hat company is considering seven capital investment propoasl, for

which the funds available are limited to a maximum of $12 million. The projects are independent and have the following cost and proftability index associated with them:

Under strict capital rationing, which projects should be selected ?

Study Problems

Jack tar, CFO sheetbend Inc, membuka amplo rahasia perusahaan. Isinya adalah draft tawaran untuk kontrak memasok kanvas ransel pada angkatan Laut AS. Surat memo dari CFO sheetbend meminta mengkaji tawaran itu sebelum diajukan.

Tawaran dan dokumen pendukungnya disiapkan oleh staf penjualan

sheetbend. Sheetbend diminta memasok 100.000 yard kanvas ransel selama 5 tahun, dengan harga jual adalah tetap sebesar $30 per yard

Tn. Tar tidak biasanya terlibat dalam penjualan. Tapi tawaran ini tidak akan berkomitmen pada Sheetbend dengan kontrak jangka panjang dan harga tetap. Kedua memproduksi kanvas ransel membutuhkan $1.5 Tar mulai bekerja pada akhir minggu mengumpulkan fakta dan asumsi sbb:

- Pabrik di Oleasantoro dibangun tahun 1900 an dan sekarang menganggur. Pabrik ini diusutkan penuh di permukaan Sheetbend, kecuali biaya

pembelian tanah (19470 senilai $10,000

- Sekarang tanah itu adalah properti pinggir pantai yang bernilai. Tar berfikir tanah dan pabrik yang menganggur itu bisa dijual dalam waktu dekat

- Merenovasi pabrik akan berbiaya $500,000. invetasi ini

akan diusutka secara garis lurus selama 10 tahun

- Mesin baru akan berbiaya $1 juta. Investasi ini bisa

diusutkan secara garis lurus selama 5 tahun

- Pabrik yang direnovasi dan mesin baru akan berusia

bertahun-tahun. Akan tetapi, pasar yang tersisa untuk

kanvas ransel itu kecil, dan tidak jelas apakah order

tambahan bisa diperoleh begitu kontrak AL berakhir. Mesin

ini khusus dan hanya nbisa digunkan untuk kanvas ransel .

Nilai jual bekasnya diakhir tahun ke lima mungkin nol.

- Modal kerja pada awal tahun adalah $300.000, dan modal

kerja ini diperkirakan 10% dari total pendapatan.

- Ramalan laba staf penjualan dari kontrak AL, dapat dilihat

pada tabel 1

- Saat ini ada tawaran dari penjualan dari perusahaan

Tabel 1

Dalam Ribuan

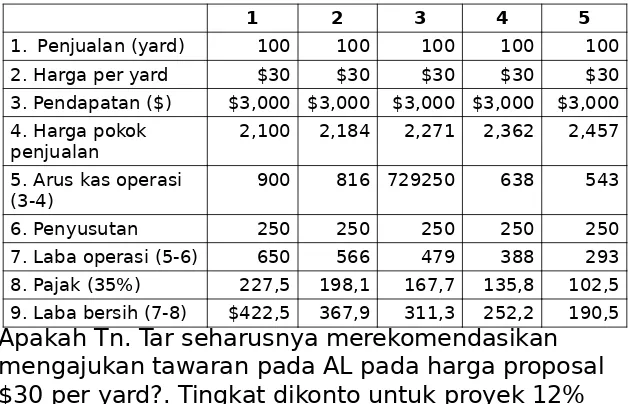

Apakah Tn. Tar seharusnya merekomendasikan

mengajukan tawaran pada AL pada harga proposal

$30 per yard?. Tingkat dikonto untuk proyek 12%

1 2 3 4 5

1. Penjualan (yard) 100 100 100 100 100

2. Harga per yard $30 $30 $30 $30 $30

3. Pendapatan ($) $3,000 $3,000 $3,000 $3,000 $3,000 4. Harga pokok

penjualan

2,100 2,184 2,271 2,362 2,457

5. Arus kas operasi

(3-4) 900 816 729250 638 543

6. Penyusutan 250 250 250 250 250

7. Laba operasi (5-6) 650 566 479 388 293

8. Pajak (35%) 227,5 198,1 167,7 135,8 102,5

.

2. PT. “Dallas” sedang mengevaluasi proyek

pembelian mesin baru. Harga mesin Rp 175 juta,

dengan tambahan biaya pemasangan Rp 25 juta.

Usia mesin adalah 5 tahun. Nilai buku mesin pada

akhir tahun ke 5 adalah 0, tapi mesin masih dapat

dijual sebagi besi tua dengan harga 5 juta. Mesin

memerlukan tambahan modal kerja bersih Rp 10

juta, dan dengan penggunaan mesin tersebut

What measure of risk is relevant in

capital budgeting

•

In capital budgeting, a project can be

looked at on three levels:

Stand Alone Risk

Mengukur stand-alone risk berarti mengukur

ketidakpastian keuntungan atau kepastian arus kas

E(CF) = 5.000 E(V)= 5.000

Ơ A=1.095 ƠB=894

Usulan Investasi A Usulan Investasi B Probabilitas Arus kas Probabilitas Arus kas

.

Apabila E(V) dari kedua investasi tidak

sama, maka penggunaan

Ơ

sebagai

indikator risiko menjadi sulit dilakukan,

untuk itu digunakan coefcient of

variation (CV) CV = Ơ/E(V)

C DE(V) 1.000 1.500

Ơ 400 500

Problem

• Misalkan saudara diminta untuk memilih salah satu diantara kedua proyek berikut ini:

Pertanyaan:

a. Dengan menggunakan NPV maksimum yang diharpkan, proyek mana yang saudara pilih?

b. Dengan menggunakan coenfdient of variation, proyek mana yang saudara pilih?

A B

NPV Prob NPV Prob

$100 0,30 $300 0,30

$400 0,40 $500 0,40

Risiko Proyek

Beberapa metode yang bisa digunakan

antara lain:

a. Analisis Sensitivitas

b. Analisis Scenario

Mean-standard deviation Analysis

•

Dilakukan dengan memasukan arus kas dari

setiap kondisi perekonomian, yang akan

membentuk probabilitas untuk NPV kemudian

menghitung probabilitas untuk NPV tertentu.

•

Pendekatan ini mengasumsikan bahwa arus kas

bersifat independen dari waktu ke waktu.

Rata-rata (mean) distribusi probabilitas NPV adalah:

krf= suku bunga bebas risiko

Mean-standard deviation Analysis

krf =10%

Kondisiperokonomian Arus kas masuk bersih

Prob Thn 1 Thn 2 Thn 3 Thn 4

Resesi 0,25 $4.300 $4.570 $4.400 $19.71

6

Rata-rata 0,50 $7.302 $7.747 $7.333 $23.71

6

Baik 0,25 $9.812 $10.400 $10.45

0 $30.880

CFT $7.179 $7.616 $7.397 $24.50

7

Ơ $1.952 $2.065 $2.139 $4.025

NPV =$9.103

Problem

perusahaan Anda memperoleh informas arus kas

proyek sbb:

a. Tentukan expected NPV, dan standard deviasi NPV

b. Berapa probabilitas proyek akan menghasilkan NPV=0

Thn 1 Thn 2 Thn 3

Prob Arus kas Prob Arus kas Prob Arus kas

0,1 $1.000 0,2 $1.000 0,2 $1.000

0,2 $2.000 0,3 $2.000 0,3 $2.000

0,3 $3.000 0,4 $3.000 0,4 $3.000

0,4 $4.000 0,1 $4.000 0,1 $4.000

CFT $1.967,5