Kriteria Evaluasi Supplier

Possibilities for evaluating

suppliers’ offers

Harga termurah

total cost

total cost

of ownership terendah

Weighted scoring

Value

judgement

ITC

?

1. Harga terendah

♦

Penawaran supplier diuji dengan persyaratan minimum

♦

Jika mereka memenuhi kritreria tersebut, evaluasi dalam basis

harga:

Apakah memenuhi spesifikasi

?

Dapatkah supplier mengirim tepat waktu?

harga:

ITC

Evaluating offers for supply of office PCs

Meets minimum:

Supplier

Registered

supplier?

Specification

Delivery

schedule

Price

Selected:

A Yes Yes No

B Yes Yes Yes $ 42,300 No

C Yes Yes Yes $ 47,500 No

D No

E Yes No

F Yes Yes Yes $ 38,900 Yes

G Yes No

Action Point

4.2-1Evaluation based on lowest price

Requirements for copy

Supplier X offer Supplier Y offer Supplier Z offer

Jika ada tiga Supplier X, Y, and Z telah memenuhi persyratan

minimum, mana yang harus dipilih jika pemilihan didasarkan pada harga

terendah?

ITC

Requirements for copy

machine

Supplier X offer Supplier Y offer Supplier Z offerMinimum speed:

200 copies per minute

180

210

300

2 Years

2 years

30 months

3 years

Purchase Price

$22,000

$28,000

$35,000

Selected supplier:

Minimum Warranty:

2. total cost of ownership (TCO)

Terendah

Supplier pertama-tama dievaluasi apakah

telah memenuhi persyaratan minimum

telah memenuhi persyaratan minimum

Jika ya, evaluasi mereka dengan total cost of

ownership dari penawaran yang mereka

tawarkan

ITC

Definisi Life Cycle Costing atau

TCO

• Life cycle cost: ‘cost of an asset, or its parts

throughout its life cycle, while fulfilling the

performance requirements’ (ISO 15686-5)

6

• Life cycle costing: ‘methodology for systematic

economic evaluation of life cycle costs over a

What is Life Cycle Cost (LCC)

Analysis?

Sebuah metode untuk menghitung

biaya suatu sistem sepanjang umur

hidupnya, meliputi biaya pembelian,

hidupnya, meliputi biaya pembelian,

biaya perawatan, biaya operasional dan

biaya disposal.

Istilah lain :

Total Cost of Ownership

Whole Life Costing

Whole Life Value

Pengertian Life cycle costing

(LCC)

• Metode evalusi ekonomi

• Mempertimbangkan semua biaya yang

relevan

8

• Sepanjang periode/horison waktu tertentu

• Memperhitungkan nilai waktu dari uang

Tujuan LCC Analysis

Mengevaluasi alternatif investasi dari berbagai

pilihan yang bersifat mutually exclusive

Memutuskan alternatif terbaik secara ekonomi dengan

mempertimbangkan semua biaya yang muncul.

mempertimbangkan semua biaya yang muncul.

Metode Analisis LCC

Present Worth

Equivalent Uniform Annual Cost

Future Worth

Internal Rate of Return

Benefit/Cost Ratio

Benefit/Cost Ratio

Payback Period

Purchase cost

Operating costs

Preventive maintenance costs

Repair costs

KomponenTCO

Repair costs

Cost of disposal

Capital costs

Other costs, e.g. insurance

Other considerations, e.g.: output levels

ITC

Contoh

Purchase price

Electricity

Maintenance contract

Disposal

65%

21%

11%

3

%

Kuantifikasi masing-masing

Biaya

Breakdown of total cost of ownership a HV electric motor

Element of cost

Year 1

Year 2

Year 3

Year 4

Year 5

Purchase price

$50,000

Electricity

$30,000

$30,000

$30,000

$30,000

$30,000

Maintenance

$5,000

$5,000

$5,000

$5,000

$5,000

Disposal

$7,000

ITC

Quantifying each cost

kuantifikasi dan tabulasikan menurut

waktu hidup produk

dalam banyak kasus, tidak cukup melihat

dalam banyak kasus, tidak cukup melihat

total biaya tahunan

ITC

Tingkat penting dari waktu pembiayaan

♦

Lihat contoh tabel dibawah dimana total

biaya sama

♦

Keduanya berbeda dalam harga jual dan

biaya tahunan

♦

Pilih sesuai strategi penganggaran

♦

Pilih sesuai strategi penganggaran

perusahaan

ITC

Purchase of production machinery: Summary of costs over time

Offers

Year 0

Year 1

Year 2

Year 3

Total cost

Supplier

X

Purchase price:

$60,000

$5,000

$20,000

$5,000

$90,000

Supplier

Y

Purchase price:

$80,000

$3,000

$3,000

$4,000

$90,000

Penghitungan TCO dengan Pendekatan

Net Present Value (NPV)

NPV menggunakan waktu-nilai uang

dalam penghitungan the total cost

of ownership

Menyatakan semua biaya dalam

12

3

6

9

=

Menyatakan semua biaya dalam

ekuaivalen nilai sekarang

ITC

Contoh . Pada bunga 15%, nilai $23,000 satu tahun

yad = $20,000 nilai sekarang

NPV

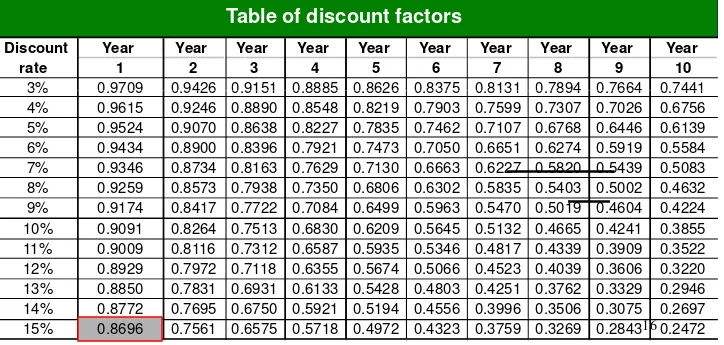

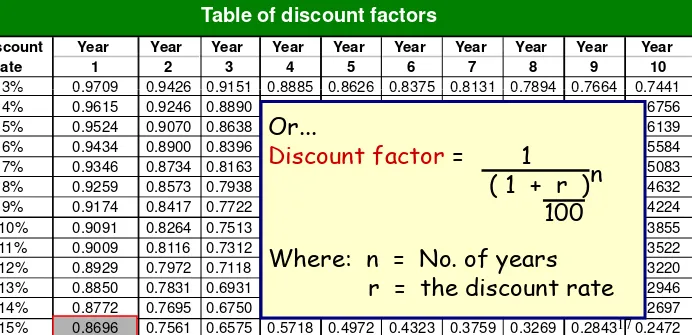

Tabel:

Present-day = (future cost) x ( applicable discount

cost factor)

Year Year Year Year Year Year Year Year Year Year

1 2 3 4 5 6 7 8 9 10

3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441

Discount rate

Table of discount factors

3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 5% 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 6% 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 7% 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 9% 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 11% 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 12% 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 13% 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 14% 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 15% 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472

ITC

NPV

Tabel:

Present-day = (future cost) x ( applicable discount

cost factor)

Year Year Year Year Year Year Year Year Year Year

1 2 3 4 5 6 7 8 9 10

3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441

Discount rate

Table of discount factors

3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 4% 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 5% 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 6% 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 7% 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 8% 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 9% 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 11% 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 12% 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 13% 0.8850 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2946 14% 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 15% 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472

Or...

Discount factor

= 1

( 1 + r )n

100

Where: n = No. of years

r = the discount rate

ITC

Summary of costs

Supplier

Today’s

purchase

cost

End of

Year 1

End of

Year 2

End of

Year 3

End of Year 4

Supplier A’s

offer

$35,000

$5,000

$7,000

$7,000

Net cash inflow of

$5,000

Supplier B’s

offer

$38,000

$3,000

$3,000

$3,000

Net cash inflow of

$1,000

Contoh...

offer

$1,000

Year

Year

Year

Year

1

2

3

4

8%

0.9259

0.8573

0.7938

0.7350

Discount

rate

Discount factors

Pada discount rate 8%:

ITC

Supplier A

Period

Cost

8% Discount

rate

Equivalent present-day value

Today –

purchase cost

35,000

N/A

35,000

Year 1

5,000

0.9259

5,000 x 0.9259 =

4,630

Year 2

7,000

0.8573

7,000 x 0.8573 =

6,001

The result for...

Year 2

7,000

0.8573

7,000 x 0.8573 =

6,001

Year 3

7,000

0.7938

7,000 x 0.7938 =

5,557

Year 4

-5,000

0.7350

-5,000 x 0.7350 =

- 3,675

Net present

value

35,000 + 4,630 + 6,001 + 5,557 –

3675

= $47,513

ITC

Hasil...

Supplier B

Period

Cost

8% Discount

rate

Equivalent present-day value

Today –

purchase cost

38,000

N/A

38,000

Year 1

3,000

0.9259

2,778

Year 2

3,000

0.8573

2,572

Year 2

3,000

0.8573

2,572

Year 3

3,000

0.7938

2,381

Year 4

-1,000

0.7350

-735

Net present

value

$44,996

Kesimpulan :

NPV Supplier B lebih rendah, maka dipilih

supplier B.

ITC

Dengan informasi pada tabel dibawah, tentukan nilai NPV dan

tentukan supplier yang terpilih. Gunakan bunga 12%.

Summary of costs

Supplier

Today’s

purchase

cost

End of

Year 1

End of

Year 2

End of

Year 3

End of Year 4

4.3-4

Net present value peralatan

Action Point

NPV of Supplier A’s offer:______________

NPV of Supplier B’s offer:______________

Selected Supplier: ______

cost

Supplier A’s

offer

$45,000

$7,000

$5,000

$7,000

Net cash inflow of

$5,000

Supplier B’s

offer

$56,000

$6,000

$6,000

$6,000

Net cash inflow of

$8,000

ITC

3. Weighted scoring models

Suppliers diskor berdasar pada kriteria yang telah

diberi bobot yang merefleksikan tingkat kepentingan

supplier dengan skor tertinggi dipilih

Biaya diberlakukan sama dengan kriteria yang lain

Masalah jika skor tertinggi bukan merupakan yang

ITC

Masalah jika skor tertinggi bukan merupakan yang

termurah

Scoring capability: some criteria…

Ability to meet essential and desirable requirements

(specifications, quantity, lead-time…)

Quality assurance

Customer service

Supply capacity

Past performance

ITC

Past performance

Strategic issues (location, distribution network…)

Supplier innovation

Financial strength

Risk management (including insurance)

Contoh:

Evaluating offers - Purchase item: measuring equipment

Bid evaluation criteria

(

and components with allocated weights)

Overall weight

(1-10)

1. Technical performance

♦

♦

♦

♦

Precision in measurement

(10)

10

2. Product reliability

♦

♦

♦

♦

Low meantime between failures

(3)

♦

♦

♦

♦

10

ITC♦

♦

♦

♦

Low meantime between failures

(3)

♦

♦

♦

♦

Low outage rate

(3)

♦

♦

♦

♦

Durability of the equipment

(4)

10

3. Lead-time to delivery

♦

♦

♦

♦

Delivery of the main equipment

(9)

9

4. Continued availability of spares

♦

♦

♦

♦

Offer of continuity of supply

(1)

♦

♦

♦

♦

Financial stability

(3)

♦

♦

♦

♦

Core product for supplier

(3)

♦

♦

♦

♦

Sustainable market position

(3)

10

5. Technical support

♦

♦

♦

♦

In installation and commissioning

(2)

♦

♦

♦

♦

Training of staff on-site

(3)

♦

♦

♦

♦

Response time to queries

(2)

♦

♦

♦

♦

Response time to maintenance and repair

(3)

10

6. Life-cycle cost

♦

♦

♦

♦

Purchase price

(2)

Contoh:

♦

♦

♦

♦

Purchase price

(2)

♦

♦

♦

♦

Cost of spare parts

(2)

♦

♦

♦

♦

Cost of staff training

(1)

♦

♦

♦

♦

Cost of maintenance support

(2)

7

TOTAL:

56

ITC

Contoh:

Scoring suppliers’ offers –

Measuring equipment

Evaluation criterion: meantime between failures

Not acceptable – has not met

the required criteria

May not be acceptable – only barely meets minimum requirements Acceptable (baseline) Acceptable – has met all requirements and exceeded some Acceptable – has well exceeded all requirements

0

1

2

3

4

ITC

Avge. less than 100 days between failures Avge. 100-119 days between failures Avge. 120-129 days between failures Avge. 130-149 days between failures

Avge. 150 or more days

between failures

Supplier A

X

Supplier B

X

Supplier C

X

Contoh:

Evaluating offers - Purchase item: measuring equipment

Supplier

A

Supplier

B

Supplier

C

Bid evaluation criteria

(

and components with allocated weights)

Score Wtd.Score Score Score ScoreWtd. ScoreWtd.

1. Technical performance ♦

♦ ♦

♦ Precision in measurement (10) 4

40

110

220

2. Reliability

3. Lead-time to delivery

♦ ♦ ♦

♦ Delivery of the main equipment (9) 2

18

436

327

4. Supply horizon – continuity of spares

♦ ♦ ♦

♦ Offer of continuity of supply (1) 3

3

33

44

♦ ♦ ♦

♦ Financial stability (3) 3

9

39

13

♦ ♦ ♦

♦ Core product for supplier (3) 4

12

26

39

♦ ♦ ♦

♦ Sustainable market position (3) 4

12

26

00

2. Reliability

♦ ♦ ♦

♦ Low meantime between failures (3) 3

9

26

39

♦ ♦ ♦

♦ Low outage rate (3) 3

9

26

26

♦ ♦ ♦

♦ Durability of the equipment (4) 4

16

28

312

ITC

Contoh:

Evaluating offers - Purchase item: measuring equipment

Supplier

A

Supplier

B

Supplier

C

Bid evaluation criteria

(

and components with allocated weights)

Score Wtd.Score Score Score ScoreWtd. ScoreWtd.

5. Technical support

♦ ♦ ♦

♦ In installation & commissioning (2) 2

4

36

36

♦ ♦ ♦

♦ Training of staff on-site (3) 2

6

412

39

♦ ♦ ♦

♦ 3

6

36

4

Max. score possible =

224

Total weighted score:

160

148

129

6. Life-cycle cost

♦ ♦ ♦

♦ List price (2) 1

2

36

48

♦ ♦ ♦

♦ Cost of spare parts (2) 1

2

36

12

♦ ♦ ♦

♦ Cost of staff training (1) 1

1

44

22

♦ ♦ ♦

♦ Cost of maintenance support (2) 1

2

36

12

♦ ♦ ♦

♦ Response time to queries (2) 3

6

36

24

♦ ♦ ♦

♦ Response time to maintenance & repair (3) 3

9

412

26

Scores (as % of 224) =

71%

66%

58%

ITC

Value judgement

Membandingkan aspek non biaya terbobot terhadap

biaya yang ditawarkan

Biaya dapat berupa harga atau total cost of

ownership

Akhirnya,

skor dibandingkan dengan biaya

ITC

Akhirnya,

skor dibandingkan dengan biaya

untuk men-judge

kombi

nasi mana

mewakili nilai terbaik

Weig

hted

score

Thank You