Primerjalna Analiza Poslovnega Okolja in Tveganj Držav Briics

Teks penuh

(2) UNIVERSITY OF MARIBOR FACULTY OF ECONOMICS AND BUSINESS. Work of diploma seminar. COMPARATIVE ANALYSIS OF BUSINESS ENVIRONMENT AND RISKS IN BRIICS COUNTRIES Primerjalna analiza poslovnega okolja in tveganj držav BRIICS. Candidate: Matej Domadovnik Program: Professional higher education Study field: International Business Mentor: Romana Korez-Vide, PhD, Assistant Professor Proofreading: Dayna Plummer, BA, ESL Instructor Academic year: 2013/2014. Paris, February 2014.

(3) POVZETEK Danes so najhitreje rastoče države ali tako imenovane BRIICS države zelo pomembne za svetovno gospodarstvo. Njihova moč v globalni ekonomiji narašča in imajo zato zelo pomembno vlogo tudi v političnem smislu. Brazilija, Rusija, Indija, Indonezija, Kitajska in Južna Afrika predstavljajo glavne hitro rastoče trge, ki so potencialna tržišča za tuje vlagatelje. Vsako podjetje ali vlagatelj, ki namerava vstopiti na takšen trg, se mora sočiti z drugačnim poslovnim okoljem in tveganji. Vsaka država ima svoje slabosti in prednosti, ki jih mora preučiti in nato izbrati najustreznejši trg. Tveganja – npr. politična in finančna tveganja ali korupcija – so zmeraj prisotna in potencialnim vlagateljem povzročajo veliko negotovosti, saj lahko zaradi njih izgubijo svoje vložke. Tveganja so veliko večja v državah, ki so v razvoju, saj njihovi politični ali finančni sistemi še niso dovolj razviti in implementirani. V diplomskem seminarju sem podrobneje opisal finančna tveganja in predstavil največje finančne probleme v državah BRIICS, kot so zelo nestabilna valuta, neuravnotežene javne finance in finančni problem zadolževanja na Kitajskem. Nazorno in aktualno so predstavljena tudi politična tveganja. Konflikt med Rusijo in Ukrajino, teroristični napadi na zahodu Kitajske ali izredno stanje na meji med Pakistanom in Indijo – vsa takšna politična trenja puščajo posledice na naših investicijah v državi in potrebno je oceniti, ali so takšna tveganja sprejemljiva. Zelo pomembno je tudi razumeti poslovno okolje, v katerem bomo poslovali. V večini primerov se poslovno okolje zelo razlikuje od tega, kar poznamo v Evropi. Da bi se lažje prilagodili na drugačno poslovno okolje, je potrebno dobro preučiti kulturo in njihove običaje, saj lahko, če jih ne upoštevamo dovolj, negativno vplivajo na naše poslovanje. Vsaka država ima drugačne navade in običaje, kar ima vpliv na drugačno mišljenje naših poslovnih partnerjev ali potrošnikov. Potrošnikovo mišljenje je zelo pomemben del analize nekega okolja. V diplomskem seminarju sem se podrobneje osredotočil na Rusijo, Kitajsko in Indijo. Poslovno okolje se razlikuje tudi po delovni sili, ki je pomemben dejavnik za podjetja, ki želijo izkoriščati prednost poceni delovne sile v državah v razvoju. Delovna sila se v državah BRIICS razlikuje po velikosti, kvalificiranosti, ceni in drugih značilnostih. V to analizo sem vključil podatke, ki prikazujejo razporeditev delovne sile med storitve, industrijo in kmetijstvo v državi. V diplomskem seminarju so podrobneje opisani tudi vladni predpisi in omejitve, ki so v porastu in zelo otežujejo poslovanje z državami. Večina držav se poslužuje zelo očitnih omejitev, kot so tarife in kvote, nekatere pa posegajo še globlje, predvsem v tehnološki del. Omejujejo dostop do različnih spletnih strani, ki so v tuji lasti in promovirajo svoje lokalne ponudnike. Največkrat so tarča omejenega dostopa socialna omrežja in strani s spletno prodajo. Takšne omejitve države resno vplivajo na poslovanje podjetja, še posebej če je podjetje od takšnih spletnih strani odvisno. Čeprav so države BRIICS v razvoju, to ne pomeni, da nimajo potrebe po naprednejši tehnologiji, ki jo ponujajo razvita podjetja. V diplomski seminar je vključen praktičen primer tehnološkega podjetja RELIDEA d.o.o, ki se ukvarja z digitalnim marketingom. Da bi lahko prišel do zaključka in izbral najbolj primeren trg za njihovo širitev, sem trge podrobno analiziral. Za lažje odločanje med trgi sem vključil veliko ekonomskih indikatorjev, kot so BDP na prebivalca, rast BDP, sestava BDP, brezposelnost itn., saj nam ekonomski indikatorji pomagajo ponazoriti ekonomsko stanje v državi. Vključeni so tudi podatki o glavnih izvoznih in uvoznih partnerjih ter glavne surovine oziroma izdelki izvoza in uvoza. V diplomskem seminarju sem obravnaval tudi možne scenarije za BRIICS države v prihodnosti in nove izzive. Ključne besede: BRIICS, tveganja, poslovno okolje, hitro rastoči trgi, napovedi.

(4) ABSTRACT BRIICS's power is growing in the global economy and they have become very important players in a political sense. Brazil, Russia, India, Indonesia, China, and South Africa represent fast growing markets, which are potential markets for foreign investors. Risks, like political risks, financial risks or corruption are always present, and they cause a lot of uncertainty in investors’ eyes, since they can lose their input. The risks are much higher in developing countries because their political and financial systems are not well developed or implemented. In my diploma seminar I analysed in great detail the business environments and risks of Russia, China and India. Analysis was backed up with many economic indicators which I found relative. At the end of analysis, I pointed out a country which would be a good potential market for RELIDEA ltd., a company that does digital marketing. My diploma seminar also included possible scenarios of the BRIICS and their new challenges. Key words: BRIICS, risks, business environment, potential markets, forecast.

(5) TABLE OF CONTENTS 1. Introduction ........................................................................................................ 1 1.1 1.2. 1.3. 1.4. 2. Presentation of BRIICS ..................................................................................... 4 2.1 2.2 2.3 2.4 2.5 2.6. 3. Definition of the problem and description of the topic.................................................... 2 Purpose and aims................................................................................................................ 2 1.2.1 Purpose ...................................................................................................................... 2 1.2.2 Aims .......................................................................................................................... 2 Assumptions and limitations ............................................................................................. 3 1.2.1 Assumptions .............................................................................................................. 3 1.2.2 Limitations................................................................................................................. 3 Investigation methods ........................................................................................................ 3 Brasil.................................................................................................................................... 4 Russia .................................................................................................................................. 5 India ..................................................................................................................................... 6 Indonesia ............................................................................................................................. 7 China ................................................................................................................................... 8 South Africa ........................................................................................................................ 9. Comparative analysis of Russia, China and India ......................................... 11 3.1 Business environment ...................................................................................................... 11 3.1.1 Consumers and their behavior ..................................................................................... 11 3.1.2 Labour force ................................................................................................................. 13 3.1.3 Government regulations and restrictions ..................................................................... 15 3.1.4 Comparison of business enviornments between the countries ...................................... 16 3.2 Risks .................................................................................................................................. 18 3.2.1 Political risks ................................................................................................................ 18 3.2.2 Financial risks ............................................................................................................... 20 3.2.3 Corruption .................................................................................................................... 22 3.2.4 Comparison of risks between the countries ................................................................. 24 3.3 Suitable investment location for a company that does digital marketing ................... 26. 4. Future of the BRIICS in the world's economy .............................................. 28 4.1 4.2. 5 6. Long-term scenarios ........................................................................................................ 28 New challenges ................................................................................................................. 28. Conclusion ........................................................................................................ 30 Literature and sources ..................................................................................... 31.

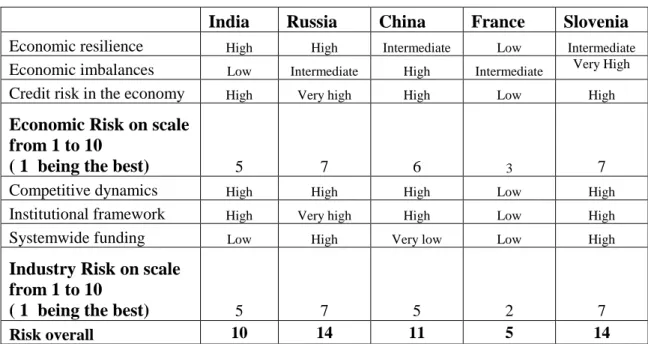

(6) TABLE OF FIGURES Graph 1: Internet users per (per 100 people) from 2004 to 2012..………………………………….…17 Picture 1: Corruption amongst the BRIICS countries…………………………………………………23 Table 1: Economic and Industry Risk…………………………………………………………………24.

(7) 1. INTRODUCTION. 1.1. Definition of the problem and discription of the topic. The countries like Brazil, Russia, India, Indonesia, China and South Africa are the countries that have recorded the biggest economic growth in the last years. They used to be not very competitive and they had many problems in the past. However, nowadays they have become very important actors in international relations. Not only because of the economic strength but also because of the demography for example their population represent more than 40 % of the world’s total population and will grow even more in the future. They represented 30% of the world’s BDP in the years 2000 and 2005 and they can achieve 60% of the world’s BDP until 2025. Some economists believe that until the year 2040 these countries will be as strong as G8 countries (Fondation méditerranéenne d’études stratégiques 2012, 106-120). The BRIICS countries have no connection to each other in a political way like EU or other economic integrations. The reason why we put them in the same group is a grace to their extensive growth rates. Each of the countries has its own strengths, which makes it so dominant in the world market. For example, Brazil is known as a world’s farm because of its huge agriculture. China is called workshop of the world since there are produced huge amount of products within its borders. India is known as an office of the world since they have huge a focus on the tertiary sector. All those new emerging economies are offering big opportunities for everyone. Those countries are very attractive for foreign investors. Investors are interested for those countries, due to their high economic growth. Investment in these countries could increase the company’s value much faster than in the other countries. However, when multinationals are investing in these countries it also increases the technology in the country they invest. Therefore, by doing so they are reducing the gap between the developed countries and the emerging countries. Therefore, this is a good thing for both sides. For the company that is investing and the host country. The consequences of the fast development of BRIICS countries will be their higher control position in the world’s economy in the future. This means that the competition will be even higher between the developed countries and the emerging countries. The developed countries still keep an advantage in terms of technology and infrastructure but this could change very fast in the future. Therefore, the developed countries will have to take this more seriously, if we do not want to lose strength in the world market. Bad point as well for the BRIICS countries is that they are having still many international conflicts regarding climate change or agreeing with other countries on military intervention. Like the case in year 2013 when China and Russia did not allow military intervention in Syria to stop the civil war. These actions are definitely not good for the world’s economy and especially their own. In addition, they have no common ground in the future or a strong political project, which could make them more connected. Some of the people still consider BRIICS countries as uncertain areas. There is also a huge difference between the BRIICS countries regards, their geographical position. This means that they have very different climate, which can also play a huge importance in starting a business in a new country. It is the key thing that distinguishes their business environment.. 1.

(8) 1.2. Purpose and aims. 1.2.1 Purpose In the first chapter of my diploma seminar I will present the countries of BRIICS. I will give brief description of those countries, since I believe it is important to know all the background before you go any deeper into the analysis of business environment and risks. I will try to show the strengths and political strategy of each country and present the things that are making them so successful on the global market. Besides, I will try to present relevant decisions that the successful countries have made in the past to boost their economic growth. The main part of the diploma seminar will be comparative analysis in the BRIICS countries and of course, I will try to go deeper and try to find the main risks, which we can encounter when we are making business in those areas. There are many political and financial risks in those countries but on the other hand higher is the risk we take more money we can earn. Therefore, we need to do good analysis before entering the market. For that reason, my main part here will be to find out which country could be the most attracting for the certain business. Besides the risks in each of the countries of BRIICS, there is a different business environment, which can be very important for the company that is trying to invest in certain country. Since business, environment can play an important role in prospering at a foreign market. At the end of the research, I will try to point out a country, which can be most suitable investment location for a company that provides services of with digital marketing. Personally, I believe that just for the marketing field it is hard to compete against emerging countries since they can have things done much cheaper. Therefore, I will mostly focus on digital solutions and systems, which require more knowledge. That is the area where the company can be more competitive. I worked in such a company as a student intern and that is the main reason why I wish to find out which market could be appropriate. In the last part of my diploma seminar I will try to show the long-term plans for BRIICS countries, in which direction they are moving and what the possible scenarios are in the future. How they will catch up in technologies and innovations. 1.2.2 Aims The objectives that I wish to present in my work are: -. Briefly present each country in the group of the BRIICS countries; Comparatively analyse of the business environment and risks in Russia, China and India; Point out the most suitable investment location for a company that does digital marketing. Present the possible development scenarios of BRIICS countries.. The facts that I wish to prove as well in my diploma seminar is that countries of BRIICS are in a huge uprising, which is impossible for anyone to stop. In the next years they will become even more powerful therefore it is necessary to consider them already now as a very important players on the world stage.. 2.

(9) 1.3. Assumptions and limitations. 1.3.1 Assumptions I assume that there will be no extraordinary events in the world or in the local environment of BRIICS countries in the near future otherwise my forecasts for the future will be false. I also assume that all the data, which I found online, are reliable. Therefore, I will make all my conclusions based on that. 1.3.2 Limitations The topic that I have chosen for my diploma seminar is very extensive. I will focus on the detailed analysis of three countries in the group of BRIICS: Russia, India and China. I have chosen them, since I think they could be the most attractive potential markets for me. When describing the BRIICS I will describe just information that is relevant to my topic. Even in the terms of risk indicators and business environment indicators, I will just focus on the main indicators, which I will also describe in detail.. 1.4. Investigation methods. The applied investigation methods include description and compilation method. Main source of the diploma seminar will be foreign literature in English and French language that is available in Bibliothèque de Pompidou or in Bibliothèque Nationale de France. Besides that, I will also use all appropriate literature that I will find on the World Wide Web. I will mostly use up-todate literature and sources.. 3.

(10) 2. PRESENTATION OF BRIICS. 2.1. Brazil. Brazil is one of the BRIICS countries, which is dominating in South America, grace to its size and the population in the area. Brazil is fifth largest country in the world, it represents 47% of the territory in South America, and it has population of more than 200 million inhabitants. Since the year 2005, their GDP has not been growing as rapid as other BRIICS countries. The growth in Brazil was average 4% but in other BRIICS, it was from 8-10 %. The only exception for Brazil was the year 2009 when there was an economic crisis in the world so their GDP growth was negative. They recorded the biggest growth just 1 year after the crisis in the year 2010 where they reached 7.5% increase (Gaulard 2011, 7). Brazil is also part of a big international integration MERCOSUR. It is an economic integration in South America with Argentina, Paraguay, Venezuela and Bolivia. This integration makes them more connected to each other and trading is simplified. It is also good for any foreign investors when they invest in Brazil they do not have to limit themselves to one country. Investments in Brazil are not always attractive, since the country is not enjoying constant growth. However in year 2010 FDI have grown for almost 60 % then the year before. In addition the unemployment has decreased drastically. The current unemployment in Brazil is only 5.5%, which is very low if we compare it to European Union unemployment rate, which is about 12% (EUROSTAT, 2014). When comparing Brazil in terms of GDP per capita with other countries of BRIICS we can see that Brazil is only behind Russia, but the gap between them is huge. Therefore, Brazil’s life standard is much more similar to China. Brazils current GDP per capita is $11239. The growth of Brazil was in the last two years minor comparing to the years before. However, it will slowly improve in the upcoming years. It should go back to 3% growth annually. Especially in the year 2014, it will be a huge change since Brazil is hosting a huge worldwide event, the football world cup that will give many opportunities for the companies and create more jobs (OECD, 2013c). The important thing about Brazilian market is that the middle class is in huge uprising. Over 54% of the people in the country are in so-called middle class. Since year 2002 and until year 2010 middle class has extended for 11%. The rich class is growing as well in the past years but it is a minor change. The class that is disappearing are people between poverty and middle class (Gaulard 2011, 122). Brazil is very depended on world’s trade. When we look at the balance sheet of Brazil, we can see that it is making positive outcome in trade of goods. Brazil is focused in agriculture and it produces so much that it can afford a huge exportation. Agriculture land represents 35% of their total land and it is growing every year. Brazil is number one in exporting sugarcane, oranges, pineapple and coffee. They are second in exporting beef, tobacco, soya and black wheat. Even though it seems that Brazil’s agriculture plays a big part in their GDP structure it only represents 6 % of the total GDP, but it employees 23 % of the population active in 2009. However, when we look more in general and we add agribusiness. We get 37% of total GDP in the balance sheet and 31% of all employments from the active population. Therefore, it is justified to call Brazil the world’s farm, due to its huge food supplies for the world (Gaulard 2011, 62-63).. 4.

(11) 2.2. Russia. Russia is the largest country in the world, almost twice as big as Canada; however, its population is very low considering the size. The population of Russia today is roughly around 143.5 million, which makes the population density very low. Furthermore, the majority of the population is located in the European part of Russia next to the Ural Mountains. There are two major cities in Russia: Moscow is the capital with over 10 million inhabitants, and Saint Petersburg has 4 million inhabitants. The country is also very centralized, with the majority of economic activates in Moscow (THE WORLD BANK, 2014). Russia has the highest life standard among the BRIICS countries. The current GDP per capita is $22,408, and the total GDP has been growing in the last decade constantly, with the exception of 2008 – 2009 when Russia faced the world crisis and its GDP went down to 7.8%. Nevertheless, Russia has made fast progress in reducing poverty and catching up with income levels of advanced countries over the past decade. However, this progress has been largely supported by rising oil prices rather than the reconstruction of their economy. To continue improving living standards they will have to lower their dependence on natural resources and modernise the economy furthermore. To succeed in the future, Russia can rely on their low debt and high labour force participation (OECD 2013, 2-4; OECD, 2013f). The key to the Russian economy is the energy sector; it represents half of the country’s revenue. Energy exports represent 70% of the total export revenue. However, it is crucial for Russia to modernise the energy sector, since the consumption of global gas and oil is supposed to grow. They need to develop new oil and gas production sites and build a new transmission infrastructure. Russia is among the top five energy consumers in the world, they are consuming excessive amounts of energy for their needs. Russia is not being rational with their natural resources; however they could cut up to 30 % of their energy consumption. The main cause for this enormous consumption is the old infrastructure as well as the population, since they consider oil and gas prices low so they do not pay much attention to saving energy (Dubien, 2013, 89-91). The most important investors for Russia are Germany and United States, followed by the United Kingdom, Finland and Sweden. The main targets for foreign investors are real estate and the automobile part industry, with the biggest investors being General Motors and IKEA. The reasons why foreign investors find the Russian market attractive is its bigger GDP growth than other European countries, it is relatively close to other European markets, and the business environment is decent. Russia has exactly 83 regions, and many of those regions are way below the average income of the country. Only 15 regions have recorded higher than average GDP per capita income. Therefore, there is huge imbalance between the regions, and according to OECD research, only Mexico has a higher inequality across the regions. The reason for this lies in the country’s size, which makes it harder to develop a quality infrastructure between the regions. Especially in the north and eastern parts of Russia, the standard of life is far below average. Not only are the wages are much lower, but also the prices of commodity goods are much higher than average due to geographical and infrastructure limitations. However, the government is trying hard to cut the differences between the regions by sending financial aid to poor regions (OECD 2013, 25).. 5.

(12) 2.3. India. India is another country that is part of the BRIICS group. It has earned that position due to its intensive growth rate. India is located in south Asia and has 1.237 billion inhabitants, which makes it the second most populated country in the world just behind China. This makes India the biggest democracy in the world. India still has a caste system, which makes very hard for people that are born poor to become rich. In general, the population is very poor; therefore 29.8% of Indians are under the poverty line. Agricultural land represents 57% of India’s land, and forested area represents 16 %. The capital city in India is New Delhi but the most populated city is actually Mumbai, and it is also the city with the highest GDP in the country. The official language is Hindi and is the primary language of 30% of the population. English is an additional language, mostly used in business circles (EIU, 2014; THE WORLD BANK, 2014a). India’s GDP per capita is currently $3,339 and it is the poorest country among the G20 countries, even though it is the world’s fourth largest economy in the world. However, there is still a huge diversity between life in the provinces and the city. Therefore, India still has a lot of potential to maintain its growth rate, since the people are increasing their quality of life and are moving to cities. India has been enjoying a huge GDP growth in the last decade. Even in the years of the economic crisis, India had solid growth compared to other emerging countries. The biggest growth recorded was in 2010 where the GDP expanded to 10.4%. Its average growth in the last decade was around 8% annually; however, this growth slowed down in the year 2012 and it was just 3%. Therefore, investments are currently paying off less than before. For instance, the most productive kind of capital investment, by private firms that build factories and buy machinery, has dropped from 14% in 2008 to just 10% today (OECD, 2013e). In India, GDP composition by sector of origin is very different from emerging countries. The services contribution is very high in India, which is very similar to developed countries, but on the other hand, industry contribution is very low. Industry represents only 17% of the total GDP, agriculture is 16.9% and services 66.1%. The main sectors in industry are the textiles industry, chemicals, food processing and steel, while the main products in agriculture are rice, wheat, cotton, tea and sugarcane. The main export partners for India in 2012 were UAE (12.3%), US (12.2%), China (5%), Singapore (4.9%) and Hong Kong (4.1%). The main import partners were China (10.7%), UAE (7.8%), Saudi Arabia (6.8%), Switzerland (6.2%) and US (5.1%) (CIA, 2014). Offshoring services in India have greatly increased in the last decade. India invented service offshoring and is now the world leader. They specialized so much in services that they are now called the office of the world. Their trade in services is very important for their economy; therefore they employ more than 2 million engineers and technicians, and it is rising continuously. Most people believe that the services done in India are of low quality. On the contrary, the main advantage that India has over other competing countries is that the high quality of services as well as reliability, which are offered at low prices. Therefore, all the big multinationals are offshoring activities in India. Nevertheless, in the future many things will change so India has to adapt to its changes. The forecast for the service sector is supposed to triple from 2010 to the year 2020. Since now, the main market for India is Western countries, mostly the United Kingdom. However, in the near future emerging countries will create a much bigger demand for services and they will be demanding much more complex services as well. The market tends to more global solutions that are more innovative and more efficient. Therefore, if India wishes to keep its leading position in the future, they will have to keep up. 6.

(13) with those demands and even increase their share in the global market. There is great potential in this sector in the future (Testard, 2010, 13-37).. 2.4. Indonesia. Indonesia is the world’s third largest democracy and it is also considered to be a country in BRIICS. In the year 2012, its population was 244 million inhabitants, and the population is still growing rapidly. Ninety percent of the population is Muslim, which makes it the biggest Muslim country in the world. Indonesia has a great potential to become a huge economy in the world due to its population size. In fact, the government has made a long-term plan how to become one of the ten largest economies in the world by 2025. Since the year 2009 when Indonesia became a G20 member, the investments in the country rose by four times. According to the latest A.T. Kearney FDI confidence index, Indonesia moved from the 20th to the 9th most attractive FDI destination from 2010 to 2012. The air pollution in Indonesia is very high, about the same as China per square meter. So the Indonesian government has recently been promoting and trying to support the green economy, which is playing an important role in growing tourism (A.T. Kearney, 2013). The standard of living is not low in Indonesia compared to the other countries in the region and there is huge potential for the country to improve. The current GDP per capita is $4,344. In the past 10 years, the average growth rate of the Indonesia GDP was 5.5%. In addition, for the year 2013, the growth was supposed to be 6%, which is still much lower that what was planned in the year 2011. The government set the annual strategic growth rate at 7-9%. That growth rate would bring them to their goal, which they set in 2011 to be among the top 10 largest economies in the world. At this point, it is crucial for Indonesia to enhance its productivity, which will raise prosperity. The main drivers for growth are private consumption and investment. According to the OECD overview of Indonesia, import growth is likely to exceed export gains. These trends are concerning developing countries (OECD 2012, 3-8). Indonesia will face huge problems as it expands; people have a bigger need for a social security system and a more advanced infrastructure. These improvements require a high amount of money, which can be obtained through taxation. However here lies the problem, since Indonesia has extremely low taxation. The money they get from taxation represents less than 12% of their total GDP. If they wish to develop their economy and improve the standard of living, they will have to consider raising the amount of money gained through taxation. In addition, they must generalise their taxation system more, since the biggest burden is currently on the enterprises. In particular, high transport costs are huge disadvantage for companies in Indonesia. This slows the trade process and lowers the country’s productivity. Despite some improvements in recent years, the railway remains in poor condition and the capacity of the seaports is limited (OECD 2012, 18-19). The unemployment rate is very low in Indonesia just like the other countries of BRIICS. It has dropped from 11% to 6% in the last six years. Indonesia has one of the highest minimum wages compared to the country’s average wages, equal to 65% of the average wage. To gain more productivity, the country has to raise the general level of skill in the workforce. At the moment, the workforce often does not meet employers’ expectations. The downside of the Indonesian labour market is that there are many children between the ages of 10 – 17 years old engaged in employment. The child workforce represents roughly about 3.2 million. The result of this is that many companies are afraid to do business in Indonesia, especially garment companies where their reputation may fall by producing clothes in countries where children are used in the labour 7.

(14) force. The reason for that lies mostly in the thinking of Western countries where a child workforce is seen as a violation, while in Indonesia it is not an issue (OECD 2012, 23).. 2.5. China. China is the world’s most populated country, with 1.355 billion people in the year 2014. Fifty percent of the population lives in the huge cities that are located in the east part of China. The capital of China is Beijing, with 16 million inhabitants. However, the most populated city is Shanghai, with 16.5 million inhabitants. The main language in China is Mandarin and majority of the population speaks it; however, China has many other official languages as well, which are spoken by around 30% of the population. Therefore, in past years China’s government has been trying to generalize Mandarin in all parts of China, which will make the country more connected, since the language differences are huge amongst them. The majority of China’s population is between 25-54 years old, which represents 46% of the total population. However the interesting aspect of China’s population structure is that there are more males then females. It is one of the top three countries in the world with that kind of ratio. The reason for the dominance of men lies in the previous laws: for a long time was an allowance of one child per family. Therefore, many families in the countryside, where labour was of high importance, decided to reject female children and send them to neighbouring countries. However at the end of 2013, the government removed the law, mostly because of the fear in the future that developed countries are facing when it comes to an ageing population (OECD, 2013d). China is the world’s second biggest economy just behind the USA, but they should overcome them by the year 2016, according to an OECD survey report. China’s economy was expanding rapidly in the past, but in recent years it has experienced a slowdown. Despite that, China’s economy is still growing very quickly compared to the other countries of BRIICS and the western world. Therefore, it will soon become the biggest economy in term of percentage of the world’s total GDP. However, China’s income per head will be only one quarter of the USA’s income due to China’s population. The GDP per capita in China is currently $9,095. However, the GDP per capita in the cities is much higher, so the migration from the countryside to the cities and away from agriculture to industry and services is continuing to rise. The real GDP growth in China was highest in the year 2007 where it recorded a 14% rise. However, since then all the way to the year 2014, the growth has been on average 9%. High GDP growth is mostly supported by a rapid and sustained expansion in the industry and services. On the contrary, there is a huge excess of the labour force in agriculture where the added value is very low or even non-existent (OECD 2013a, 5-19). Nowadays the China has become very competitive in the world market, mostly because of its liberalization that has given a chance to local and foreign companies to seek opportunities worldwide. However, China remains very conservative compared to European countries. Nevertheless, it is the number one exporter in the world if we do not count European Union as one country. The main partners for China are the USA with 17.2% of total exports, Hong Kong with 15.8%, Japan with 7.4% and South Korea with 4.3% from 2012. The main export products are data processing equipment, apparel, radio telephone handsets and integrated circuits. However, even though China is exporting a huge amount of products and is making 2 trillion dollars annually from exportation, it is definitely not making any difference in its balance sheet, not directly at least. Their exportation almost matches the import of the goods; they import as much as they export, but it makes them the second most importer in the world, just behind the USA. The main import partners for China are Japan at 9.8%, South Korea at 9.2%, the USA at 7.1%, Germany at 5.1%, and Australia at 4.3% from 2012. The main products of import are 8.

(15) electrical and other machinery, oil and mineral fuels, medical equipment, metal ores and motor vehicles (CIA, 2014a).. 2.6. South Africa. South Africa is the last country in the group of BRIICS. South Africa has a population of 48 million, which gives it rank of the twenty-seventh most populated country in the world and the fifth most populated in Africa. The majority of the population is black Africans, which represents 79% and the white Africans represent 9.6%. White people in South Africa are mostly in high level positions and come from rich families. The religion in South Africa is 72% Christian; the reason for this lies in the Dutch colonization of South Africa, which was strategically important for them to be able to trade with the Far East. The major cities in South Africa are Johannesburg with a population of 3.6 million, Cape Town with 3.3 million people, Ekurhuleni with 3.1 million people, and Pretoria with 1.4 million inhabitants. Life expectancy in South Africa is very low; in 2013 life expectancy at birth was 49 years. It is the second country in the world with the lowest life expectancy at birth, just behind Chad. The main reason for such a low life expectancy is mostly because of AIDS. South Africa has the largest proportion of people living with HIV/AIDS in the world; eighteen percent of the total population officially has HIV/AIDS (CIA, 2014b). South Africa is an emerging market with abundant supply of natural resources. Its current GDP per capita is $10,798, and the total GDP is $600 billion, which makes South Africa the largest economy in Africa. The GDP growth compared to other BRIICS countries is considerably low. The average GDP growth in South Africa for the year 2000 to 2010 was just 3.5% annually. Unlike some emerging countries, South Africa felt the world crisis in year 2009 and its GDP fell by 2%. South Africa has experienced weak recovery since the year 2009, with post-crisis growth more similar to the OECD average countries than the BRIIC group. South Africa’s biggest amount in the GDP composition by sector of origin is the service sector with 68.4%; after that comes industry with 29% and agriculture represents only 2.6%. From 29% of the industry, the largest contribution is mining, since South Africa is known to be the largest producer of platinum, gold and chromium in the world. Therefore, the main commodities exported are gold, diamonds, platinum and other metal minerals. However, recently the prices of several major export commodities have dropped. The key reason for that is because South Africa’s main export partner is China, which has slowed down in its growth and eventually reduced the need for certain commodities. The drop in prices led to lower salaries and workers being unhappy, which led to strikes in the mining sector. However according to the OECD, in 2013/14 the South African mining sector should recover, since China’s growth should be back on its former path of intense growth, which will increase the need of goods provided by South Africa (OECD, 2013b, 11-17). The labour market is another problem that South Africa has been facing for long time already, with the employment rate being dismally low. Just over 40% of the working age population is employed, compared to the OECD average of 65%. The unemployment rate in South Africa has been over 20% for the last 16 years. The latest unemployment rate says that it is just under 25%. Comparing to the BRIIC group, again there is an enormous difference where countries have the unemployment rate under control and are keeping it low. Unemployment is especially high among the youth: 51% of them are unemployed, and a difference exists as well between ethnic groups, where 28% of black Africans and only 5% of white are unemployed. The gap is mostly because of the difference in the educational system, where white people with higher living standards than Africans could afford better quality education. Nevertheless, the majority 9.

(16) of the labour force is employed in the service sector, while industry employs 26% of the population and agriculture represents 9% (OECD, 2013b, 26).. 10.

(17) 3. COMPARATIVE ANALYSIS OF RUSSIA, CHINA AND INDIA. 3.1. Business environment. The examination of the business environment is very important for companies when trying to enter new markets. This research gives us the necessary information to choose the right market and be able to operate within it. A business environment consists of many indicators, which gives us a clear picture of the selected market and makes it possible to distinguish markets from each other. 3.1.1 Consumers and their behaviour Not all consumers have the same way of thinking around the globe. Therefore, it is crucial to know the consumers we are dealing with. Knowing the consumers better than our competitors could help us be more successful, since we know exactly what they want. Consumer behaviour is becoming more generalized due to globalization; however, it is still very connected to religion and culture. Therefore, these still have to be taken into consideration when entering new markets. Russia is huge potential market for all companies due to its population and its growth, which can provide long-term success. The population purchasing power is growing rapidly and the standard of living is improving quickly. This causes people to look for more and more goods, which are not basic anymore. However, about 73% of the population is urban and makes up to 85% of the purchasing power. Therefore, the majority of companies are trying to make their way into the Russian market through the main cities, because this is where Russia’s power is actually located. Russia is becoming more and more of a middle class country; nowadays, 82% of Russian households are middle class. In addition, poverty is reducing as well: in the last decade, poverty levels have reduced from 29% to 13.3%, making it almost comparable with Western countries. According to a survey done by Nielsen (2013), Russian consumers are very open to new products and new technology, and when looking only at fast-moving consumer goods, the Russians are very traditional. Around 53 % of Russian consumers shop for the whole family compared to 45% globally. Russian consumers are especially brand loyal; many of them already know which brand they will buy before entering a certain shop. This especially applies to the accessories, technology and garment sectors. Russians in general believe that services and products that come from the Western world are much better in quality and are willing to pay more for them. This is the opportunity for all Western companies to offer their products on the Russian market, because they will be wining the consumers easier than domestic companies. On the other hand, Carrefour, the second largest retailer in the world, failed to enter the Russian market. The main reason for its failure was in the consumers’ rejection of more expensive goods. Carrefour wanted to be in the city centre and bought a few expensive locations, which led to higher prices than what competitors had. Therefore, Carrefour closed all its operations in the largest market in Europe. The potential for the Russian market is not only in its size but also in the consumers’ purchasing power considering percentages of disposable income for other spending. For instance, Western consumers are left with around 40% of their total income compared to the Russian 70%. The reason for this difference is mostly in cheap housing and utilities, which put more money in the hands of the consumers (Thomas White International, 2014; Ernst & Young, 2014).. 11.

(18) China has the largest population in the world, which leads to a great number of consumers. Again, the huge economic growth that is present in China for the last two decades has improved the standard of living, which leads to higher consumption. All of China’s economic activities are mostly located on the east side, close to the sea where the capital is located. However when talking about consumers in China, they are still very different from the European consumers. On average, China’s workers spend much more time at work then Western countries; therefore, at the time of major holidays in China, for instance, all of the shops stay open. There are four major holidays in China, and people actually spend money on those days, since during the work period they do not find the time. Therefore, the majority of shops are open 365 days a year. In Europe, shops are strictly closed on the holidays or their schedule is adjusted to times that are more casual, mostly because European consumers do not consider going shopping on holidays. In China, the easiest way to reach consumers’ attention is by advertising on TV. It is by far the most effective way of advertising in China. In addition, Chinese consumers are disloyal to brands and are not willing to pay additional money for the brand name. They usually have a very short list of brands which they will prefer over others. From the technological point of view of consumption in China, I mentioned above that China is the first exporter in the world, and exportation is mostly done overseas. Therefore, China is building the world’s largest port, which is already operating, but they are extending it. When it will be completed in a few years, it will become the busiest port in the world. Therefore, I see huge potential for western European companies to develop systems that are capable of efficiently running the world’s busiest port. Yangshan port is just one of those potential ports that could use the latest technology and improve the flow of goods. Not only do ports need the latest systems for operating more efficiently, but retail companies themselves must readjust to growing internet consumption. Our companies already have experience in tackling those tasks; therefore, they have a technological advantage over local companies and are more likely to be successful (National Geographic, 2014). The Indian market has huge potential in the future. Consumers are getting richer, allowing them to consume more. Like in all the emerging countries the middle class is on the rise. A person in India is considered to be middle class when your earrings are between 101€ to 485€ per month; all those above 485€ are considered the rich class. When looking at Indian consumption we have to take into consideration that India is still much less developed than other emerging countries, therefore we cannot generalize and make the same assumptions for them. For instance, the population of China and India are about the same, but the market for cars or other sophisticated consumer goods is 10 times smaller in India. India is a tough market for all companies that decide to enter the market because of huge diversity, not only the income diversity across the country and its regions, but also a huge diversity in culture. India has 1,500 different dialects and a multitude of faiths which make the market more complex. The percentage of internet usage in India is very low. According to The Economist report in 2011, 10% of the total population is using the internet daily. If we turn the percentage into a number, we come up with 122 million people that use the internet daily. Two thirds of internet connections are done by mobile telephone. The number of people connecting daily to the internet is of course growing, and people will feel the need to have certain applications and technologies more and more. In the year 2014 and the following year, connections to the internet will increase immensely due to lower smart phone prices in the Indian market. Therefore, it is expected that the percentage of internet usage will soon go up much faster. However, telephone applications should be adapted to the needs of Indian consumers. Companies in India will start using internet channels to promote their products more often and try to win consumers’ attention. This is where international companies can come and offer their technology and knowledge to support the complex systems needed to run a huge market like 12.

(19) India. However, the issue that companies find in Indian consumers is a lack of trust to buy online, and besides that even the percentage of people owning a credit card is very low. Only about one fifth of Indians own a credit card, and the ones that use them to buy over the internet are unsatisfied due to payment processes not working properly (The Economist, 2011). 3.1.2 Labour force Labour force is an important key factor when determining a new business environment, especially for industrial companies and those that require high knowledge of the field. When we open new facilities in a new country, it is crucial to have a qualified labour force that will meet our requirements. It is quite common that new emerging markets are boosting their educational systems to achieve a highly educated labour force which has higher added value. Russia has the highest levels of educational attainment in the world. According to OECD (2013) research, 88% of adults have attained at least an upper secondary education and the ambition of students remains high. However, the problem remains in Russia to find the right match for employers’ needs. Many graduates are struggling to find a job, and many companies are complaining that they cannot find workers with the right skills. The fact that they are highly educated does not mean that their performance is guaranteed. Surveys show that Russian students’ performance at age 15 is much lower than the performance of western European countries. Moreover, Moscow has recorded below average performance in Russia, and most of the graduates are actually in Moscow. Therefore, we cannot assume that added value by a student who has graduated will be the same as in other Western countries. Besides that, the labour force in Russia is definitely not cheap as compared to other emerging countries; Russia is much more developed and the wages are therefore set higher. Furthermore, a problem for companies is they have to pay for additional workplace training for the workers because their school education is wider and does not fit the company’s needs perfectly. Labour in Russia is spread out by occupation, very much alike in developed countries. The total labour force is 75 million, and from that, 67% is working in service sector 27% in industry and 6% in agriculture. Distribution is the sector that employs the highest amount of people at 13 million. However, the highest added value is done by extraction of raw materials which employs just 1 million people. The total work force has not changed in the last 3 years in Russia, but jobs were created and therefore Russia has reached a very low unemployment rate of 5.6 % and is continuing to improve, which is very low compared to the other Western countries. Work in the private sector has been rising as well, and it now accounts for 60% of all employment. Agriculture and manufacturing employment has been decreasing in the past 10 years; the reason for that lies mostly in the automatization which decreases the need for a labour force in those sectors. Anyway, the Russian retirement age is 60 and it is rather low, but this is because Russian men are expected to die at the age of 59, which means they do not reach retirement age according to statistics. This is also one of the problems for companies when they train a worker well and he begins giving higher added value to the company due to his experience, but there is a risk that he will die and the asset will be lost. On the other hand, females are expected to live until the age of 76 on average. One of the reasons for low life expectancy amongst the male population is a high percentage of smokers that eventually leads to premature death. Besides that, the government’s spending is very low in the labour market, for instance, support for unemployed workers is very low. The spending is currently 0.3 % of the GDP, when European countries spend around 2%. Therefore, in this aspect Russia still has to invest more in workforce security, because some people do not even register as unemployed since there are no benefits. Therefore, there is a huge gap between registered unemployed and unregistered unemployment (OECD 2013, 29-32; CIA, 2014c; Adomanis, 2013). 13.

(20) The labour force in China is 800 million people, making China’s labour force largest in the world. When looking at China’s labour force by occupation, we can see that the country is somewhere between developed countries and less developed countries, since in less developed countries the majority is employed in agriculture and in developed countries the service sector prevails. In China, agriculture employs 34%, services 36%, and 30% in industry. We can see that agriculture and services are about equal according to the labour occupation. However, the industry is the most important for China at the moment. It represents a great deal of the total GDP and it is the engine of China. Moreover, many companies are still under the impression that the labour force is cheap in China and that offshoring would reduce their cost per unit greatly. However, those times have passed: China has become very expensive to offshore nowadays. This is partly because of the higher taxation, land prices and safety regulations, but mostly because of the labour force cost increase. The wages in China have been increasing very quickly, on average 20% annually in the past 4 years, which is a great expense for companies. One of the reasons for this high wage increase in China is that worker productivity is increasing, so they are paid more because they produce more. Therefore, manufacturing in China today is not as cheap as it used to be. Companies are now considering moving their operations to neighbouring countries where the labour force is much cheaper than China’s. However, by moving the companies to another country, you have to search for new local suppliers, which are more unreliable than in China, and the cost of materials can be even higher due to economy of scale. Therefore, most companies have decided to stay in China and automate more processes in the factory, which leads to a lower dependence on an expensive labour force. The other fact why they remain in China is the efficiency of workers. Currently China’s unemployment rate is 6.5%, but it can increase if companies decide to manufacture in other countries, so China has to be careful not to scare companies away and try to hold advantages that they possess; otherwise the country will face unemployment problems. The Chinese educational system is very well formed, and the students at the age of 15 from Shanghai have scored the number one ranking in the world in reading, science and math. The labour force is becoming more qualified and will be looking for more and more high-tech jobs in the future (Kristie Lu Stout 2013; CIA, 2014a; The Economist, 2012). India on the other hand has a much smaller labour force with regard to its total population. However, with 490 million it is the second largest work force in the world. Labour occupation is very similar to underdeveloped countries, where more than half of the work force is employed in agriculture. The unemployment rate at 8.8% is also rather high. However, the potential of the Indian labour force is the average age of employees, 27 years, which is why the labour force is currently very small. Many are going to enter the labour market in the near future. Therefore, India is creating new jobs very rapidly to meet the requirements from the market and to secure jobs for newcomers. Despite the growth of the labour force, India is short of engineers and architectures and the need will be even bigger in the future. The government is supporting education with constant financial support and is trying to encourage the population to continue their education in universities, because improving the enrolment rate of students is the key factor to increasing growth. On the other hand, quality of education is at stake. Therefore, the unemployment rate among youth is 5 times higher than the rate of adults, meaning that the transition from school to work is often hard. In addition, the problem in India is that there is a lot of informal employment. Such employment is much higher than in other emerging countries; in India it represents 85% of total employment. In a working environment like that, workers experience low wages and weak job security, meaning extra shifts and unsafe working conditions. A worrying fact is that female participation in the labour force is falling, unlike in other developing countries. The female declaim is more noticeable in rural areas of the country, while in cities, it is growing (OECD 2012a, 26-29; The Economist, 2012a). 14.

(21) 3.1.3 Government regulations and restrictions Governments have the right to protect their own economy from global competitors by enforcing different restrictions like quotas, tariffs or subsidiaries, etc. However protecting your economy and closing your market from world trade does not always have good consequences. Most of the time when such actions are taken, consumers are the ones hit because competition in the country will be reduced and local companies that are protected become sloppy and consumers no longer get the right product at the right price. Countries mostly take those actions to protect local companies that are having problems adapting to globalization, and by protecting them they preserve the local workforce. Russia is huge actor in the world market, it was the world’s sixth importer and eleventh exporter in 2011. After 18 years of negotiations, Russia took a huge step into the world market in 2012 when it joined the WTO, which was a great success for everyone; it reduced many trade barriers for the rest of the world. Nonetheless, Russia has maintained some important trade barriers, which are restricting world trade and remains very protectionist. To integrate even further into the market they should lower their tariffs that remain very high. The border procedures are longer than average, so the increase of speed would improve the flow of goods. Despite all the improvements Russia has made in the past years, in 2013 it was still pronounced as the most protectionist country in the world. Furthermore, the high trade restrictions are spread through all the Custom Union where Russia with Kazakhstan and Belorussia has accounted for 15 times as many protectionist measures than China, which has 8 times more population. The main Russian protectionist policies are direct subsidiaries and targeted bailouts for local companies. Together they represent 43% of all protectionist activities. Nevertheless, by joining the WTO Russia has shown to the world that it wishes to improve its business climate even more with which it will increasingly attract foreign investors. However, 90% of the companies operating in Russia said that since membership was granted nothing has changed. Environmental regulations are present in Russia, but not as much as in Western countries. Since Russia is still emerging, its industry has to show competiveness to the world that can be achieved with lower prices. However lower prices come from low production costs, and to have low production costs in an underdeveloped country the environment is at risk. Therefore, Russia is struggling to improve environmental conditions and is launching regulations that will reduce pollution. Moreover, Russia has around 4,000 regulatory documents that are very difficult for companies to follow, and sometimes some of them even contravene. However, many companies cannot even apply all those new environmental regulations since the technology they use is very old and it is impossible for them to adopt them from a technical point of view. Therefore, the Russian government is having many problems with enforceability, where Russian companies are privileged and are less likely to be the target of an inspection (The Moscow Times, 2014; OECD 2013, 16). China is often accusing other economies of being protectionist and enforcing tariffs and quotas on Chinese products, which could easily out-price most of the goods in developed countries. China can achieve a very low production cost due to economy of scale, and this is their main advantage when competing with other economies. Because of the protectionism from other countries, China has begun negotiations to make a free trade pact with Japan and South Korea, which will give it free access to two very important markets for its economy. On the other hand, China uses protectionist methods as well, so even though they denounce other countries for it, they are not much different. China is accused of giving subsidies to its local companies in many cases, and by doing so it makes them even more competitive in the global economy. Subsides were especially given to car companies and car parts production. Most of that exportation went 15.

(22) to the USA, which forced local companies to stop production and look for opportunities overseas. Besides subsidies, China is also accused of “playing” with its currency exchange. In many cases, they devalue the yuan compared to the dollar, which leads to an increase of exports. Besides the obvious protectionism in China, there is also a hidden example. If a company is trying to export to China they will be asked to fill in the document where they have to include a full description of the product they are exporting. Therefore, it is very risky to export hightechnology products in China because there is a great possibility it will be copied based on the description given. If you want to avoid giving them a full description of your products they ask you to produce them locally where there is no need for it. Due to this exportation protectionism, companies rarely decide to launch their latest products in China, because the respect for intellectual property is very low. Moreover, China has very strict regulations when it comes to internet freedom. Several applications and internet sites that are available to the modern world are prohibited in China. For instance, we cannot use Google ads as a communication channel because Google sites are actually banned in China. Besides Google search engine, China has banned YouTube, Facebook, Twitter, Vimeo and many other websites that can be used for internet sales, such as Google Appspot. Those actions make it hard for Information Technology (IT) companies, especially those focusing on internet technology, to benefit from the huge market in China. However, China has some of its own applications such as Weibo, which is China’s mixture of Facebook and Twitter, and Baidu, their main search engine. These are meant to replace the ones that are banned, so it requires companies to adjust their methods of distribution when entering China’s market (Qin, 2014; Plummer, 2012; The Economist, 2011a). India joined the WTO in 1995 and it is one of the founding members. Therefore, nowadays it is a very open country and an easy accessible market. In recent years they have signed trade agreements with neighbouring countries such as China, Sri Lanka and Bangladesh to improve the flow of goods amongst them. They have reduced their tariffs in almost all the sectors in recent years. However, in the last few months India increased custom duties by 25% for highend cars. Most car companies see India as a very important future market, since more and more people are able to afford a car. Therefore, India wants to make the most of it and apply big duties on imported cars, or companies can just decide to produce locally and avoid them. Besides the high-end car protectionism, there are many bureaucratic obstacles in cosmetics. For instance, they demand cosmetic firms first register with the Indian government, and only after they resister are they allowed to do marketing. India has enacted 33 trade-restricting measures in the last 5 years. They are just following the global trend where everyone is just adopting new restrictions in international trade. However, the Indian government is very soft when it comes to internet technology. The only sites that cause problems in India are torrent sites, which had been banned several times in the past but are now permitted again. The fact that India has not applied any regulations or restrictions on internet access can give us many advantages when it comes to generalizing and simplifying distribution. We can consider the market as an open market for new technology and we can use the same distribution channels as in Europe, which can greatly reduce our costs. The Google Play store for selling and buying applications was released in India at the end of 2012, and its use has been increasing since then. This also gave local producers in Bangalore, which is known to be India’s Silicon Valley, a chance to sell their own applications and launch them into the world. Foreign companies, same as local companies, can launch their products in the Indian market without any obstacles by using Google Play (Pitts, 2013). 3.1.4 Comparison of business environments between the countries. 16.

(23) Russia, China and India are the most important emerging markets for European companies because they are relatively close. Even though they are all located in Asia, there is a great difference between them when looking at business environments. Each of the countries has its strengths and weaknesses that can affect our performance. Consumer behaviour in Russia is very similar to European, so sometimes it might be easier for European companies to understand their habits. From this aspect, the Russia has an advantage over China and India, which are markets further away than Russia and are therefore less known to us. However, one thing all of them have in common is that they are collectivist societies. The cost of labour force can play a significant role when trying to reach the optimum price for a specific product. India has the lowest labour force cost by far, but when compared with Russia they are much less educated and they are less qualified for the jobs that require more knowledge than the Russians are. However, India and China are catching up with wages very fast, so the advantage they have now is growing smaller each year. The main advantage that Russia has over other countries is the proximity to natural resources. The supply chain for a local company is considerably cheaper than supplying certain materials to India or China. Prices of oil and gas are much cheaper as well in Russia. India and China are much bigger markets than Russia, so your product can have higher sales in those countries due to the high populations those countries have, especially if the company considers selling products that are seen as basic products. However, when it comes to products with a higher value which require higher revenue than the number of potential consumers in India for specific product can be easily compared to Russia. Because the Russian average consumer is wealthier than a consumer found in China or India, a bigger amount of consumers can afford such products. The majority of economic activities in Russia are based in Moscow, while in China and India they are spread over dozens of cities. So in Russia you are basically forced to start your company in Moscow, otherwise you are not considered to be a serious competitor, while in India and China you have much more freedom and you can choose the city that best suits your production needs. If we compare the business environment from a financial point of view, we can see that China the leader by far with GDP growth; no other country has similar growth, even though it is currently slowing down. The huge economy of scale in China helps lower the prices of all the products found in the local market. The currency is stable, which is very important for local trade. The business environment in China is prepared for every task, for any kind of production, and no matter what scale of production you want to have, China can satisfy the needs. Protectionism is present in all countries, but all of them encourage local production over exportation to create more jobs in the local environment. When it comes to internet freedom, India is by far the most liberal country and allows file sharing sites and online trade. However, the weakness is that Indian consumers have very low access to internet compared to Russia and China, and internet sales will not reach the full potential of the country’s population. The population in India is also much less comfortable with online transactions. The amount of internet users in a country is a very important indicator for high technology companies, where internet sales represent the main part of their income. However, this is changing very rapidly, since India has a very young population which is more ambitious and open to change (Graph 1).. 17.

(24) Graph 1: Internet users (per 100 people) from 2004 to 2012. Internet users (per 100 people) 90 80 70 60 50 40 30 20 10 0. 66,1 40,8. 54. 46,8 42,9. 12,9 7,3 2. 15,2 8,5 2,4. 18 10,5 2,8. 2004. 2005. 2006 China. 77,3. 71,6. 70. 64 56,7. 46,9 39,2. 70,7. 58 26,8. 28,9. 43 34,3. 79,6. 83. 69. 70. 49 38,3. 53,3 42,3. 24,7 16. 22,6 4,4. 5,1. 7,5. 10,1. 12,6. 4 2007. 2008. 2009. 2010. 2011. 2012. India. Russia. France. Slovenia. Adapted from: THE WORLD BANK (2014b). 3.2. Risks. For each investor, risks are of great importance to their decision making when it comes to entering new markets. They are exposed to them and their main idea is to get a higher return with small amount of risk. Countries with high risk are not attractive to investors, since their return is not guaranteed and therefore they avoid them. In emerging markets, it is very common that the risks are high, since the market is still trying to develop strategies on how to reduce risks and make investors more comfortable for investing. However, the investors find it difficult to resist investments in BRIICS; they are tempted due to their high economic growth. 3.2.1 Political risks Political risk refers to political changes in a country, meaning changes that a new government could bring, endangering investments with new policies. The occurrence of an international conflict is a political risk, and can also lead to instability or uncertainty in the country and have a negative effect on business operations in the country. That is why it is sometimes called a geopolitical risk (INVESTOPEDIA, 2014). Russia has a lot of political interference in the key sectors of the Russian economy. The government is authoritarian which tends to be more risky than democratic governments. President Vladimir Putin encountered many demonstrations in Moscow when he was elected; the public was under the impression that the vote results were out of place. The anti-Putin demonstrations were shut down with force at the time, and the people generally still have bad opinion on Putin. New demonstrations could break out anytime and past decisions are not in favour of Putin. The latest incident in which Russia participated in the capture of Crimea, when Russia took back the part of Ukraine where the majority of the population are Russian, Western countries saw that as an illegal invasion. The situation is still far from solved; the USA is continuing to apply sanctions on the key sectors of the Russian economy, and by doing so American companies are in danger as well as Russian. The European Union is currently holding back and does not want to go the same way as the USA. European leaders just do not want to risk the investments that they have made in Russia, with the biggest European investor being 18.

(25) Germany. Besides that, Russia is a very important exporter of gas and oil for Europe, on which we are very dependant and we do not want to weaken our relationship with Russia, which could potentially lead to higher prices. Even though no serious sanctions have been applied to the Russian economy, companies could still feel the tension in the Russian market and it can affect their performance. However, the Russians have not yet finished their activities in Ukraine. The eastern part of Ukraine is very similar to Crimea and the same thing could happen there. If Russia continues its operations in Ukraine the situation might become much more serious than it is now. The West will be forced to act to prevent further conflicts in this territory. However, personally I believe Russia will not continue in this direction anymore and they will let the things calm down now. Russia is known to have many political conflicts with other nations. Besides Crimea, there was another conflict with Japan about the Kuril Islands: Japan wants to get them back under their control while Russia refuses to give. Japan claims that they have the legal right to those islands while Russia disagrees. Russia is also a very diverse country population wise; for instance, it has the largest population of Muslims in Europe, and they are claiming their rights more and more while the government does not act. Therefore, Russia is a target for numerous terrorist attacks that are a great risk for the country’s stability. This is leading a growth of nationalism and can consequently result in further conflicts between the ethnic groups. Those international conflicts, minor or great, have an influence on economic activities and the country’s risk evaluation (The Guardian, 2014). Political risk is fairly low in China compared to other emerging countries. The leadership is very stable because of the one-party-system. Business is mainly interrupted due to internal instability such as riots, strikes or the interruption of the energy supply. However, because of the governmental system, transparency is very low and regulation laws can be passed very fast, which can be a great risk for certain companies. There is a unique form of political risk present in China. The country has one central government, one provincial government and one local government; therefore there is a constant misunderstanding of governmental laws. Companies are very often confused which laws are enforced. Besides governmental issues there is also a huge difference between the courts deepening on their locations. For instance, the court in Shanghai operates at higher standards than courts in less developed cities. The east side of the country is considerably more stable and safe while the western side can be more problematic, especially Xinjiang province where Uighur separatists are under huge governmental pressure. Xinjiang has now about 40% Han Chinese and 45% of the Uighur ethnic group, of which the majority are Muslims. Due to the rising population in China, the government is encouraging its population to relocate to the western provinces and the Uighur ethnic group feels threatened, since the population of Chinese in Xinjiang province is rising and they fear a loss of their culture. To warn the government of its actions they are holding demonstrations and even attacks on the local Chinese population. The most recent attack was when Uighur terrorists attacked the train station in Kunming. The attack was very brutal with knifes, and 130 people were injured and 30 killed. In the past five years the region has been under constant pressure of separatists which has caused instability in the region. These attacks are throwing a bad light on China’s safety, especially on the western part of China that is considered undesirable for business. Another conflict that might have a great influence on China’s economy is with Japan. A few islands between China, Japan and Taiwan have caused a lot of military tension in recent months, and it is possible that the situation will escalate. The reason why China wants those islands is symbolic: They wish to demonstrate their superiority in the region by planting a flag on those islands, and by doing so claiming them for themselves. This move could start a war and would cripple all the economic operations in the region (Blodget, 2014; China Risk Management, 2014).. 19.

Gambar

Dokumen terkait

Pejabat Pengadaan Barang/Jasa Kegiatan APBD pada Bagian Administrasi Pembangunan dan Perekonomian Sekretariat Daerah Kabupaten Musi Banyuasin Tahun Anggaran 2012, berdasarkan

Panitia Pengadaan pada Rumah Sakit Umum D aerah Sungai Bahar Kabupaten M uaro Jambi akan melaksanakan Pelelangan Umum dengan pascakualifikasi untuk paket peker jaan

[r]

masyarakat yang memiliki anak dengan kecacatan rungu wicara akan turut.. terganggu kehidupannya, selama anak dengan kecacatan rungu

Perencanaam (planning adalah fungsi dasar (fundamental) manajemen, karena pengorganisasian, pengarahan, pengoordinasian, dan pengendalian pun harus terlebih

Kedua efek sama dalam kedua hal ini, derajat orientasi molekul polar terimbas dalam arah medan yang dapat dihitung dari muatan listrik yang terimbas pada salah satu permukaan

Berdasarkan latar belakang masalah di atas, maka penelitian difokuskan pada rumusan masalah: “Bagaimana Pengembangan Kemampuan Analisis Hubungan Matematis Siswa SMP

Menjalin Relasi dengan Sponsor/Instansi/ Kampus lain Mempermudah koordinasi komunikasi publik eksternal kampus Instansi pemerintah, pengusaha, Perbankan, kampus sahabat,