EXECUTIVE SUMMARY

RESEARCH ON

POTENCY, PREFERENCE AND SOCIETY BEHAVIOR

TOWARD SYARIAH BANKING SYSTEM

IN CENTRAL JAVA AND YOGYAKARTA PROVINCES

BANK INDONESIA

AND

RESEARCH CENTER ON DEVELOPM ENT STUDIES RESEARCH INSTITUTE

DIPONEGORO UNIVERSITY SEM ARANG

CONTENTS

PART THREE : GENERAL DESCRIPTION OF RESPONDENTS AND

RESEARCH AREAS………. 5 3.1. Demography……… 3.2. Social and Economic Conditions………. 3.3. Respondent’s Identity………..

5 5 6

PART FOUR : POTENCIAL FACTORS AFFECTING THE DEVELOPMENT

OF SYARIAH BANKING SYSTEM……….. 8 4.1. Perception to Bank’s Interest………... 4.2. Knowledge on Syariah Bank’s Products………. 4.3. Logit Estimation Model………... 4.4. Preference to Syariah System……….. 4.5. Attitude toward Syariah Principles and Products……… 4.6. Behavior toward Syariah Banking System……….. 4.7. Comparison of Syariah Banking Perception based on Areas of Study………...

8

PART FIVE : SOCIETAL CHARACTERISTICS OF SYARIAH BANKING

SYSTEM………. 15

PART SIX : CONCLUSION AND RECOMMENDATION………. 20 6.1. Conclusion………... 6.2. Recommendation……….

20 21

PART ONE : INTRODUCTION

1.1. Background

In developing Syariah Banks actually depends not only on legal framework and moral values which are applied mostly in the banks’ operation, but also on the basis of market driven. Syariah Banks will grow well if they consider the society’s demand for their products and services. By the legal framework and moral values, Syariah Banks have to prove that their existence could meet the need of the society, from both sides namely as surplus spending unit and deficit spending unit. Even though the existence of Syariah Banks is relatively new, but their development is not based on infant industries argument which needs protection and special rights. The different treatment or regulation of Syariah Banks from the conventional banks is due to the different nature or characteristics in their operation. However, Bank Indonesia should not treat them as step child as happened in several countries whereas the operation of Syariah Banks are not supported by proper regulation as back up such that their operation is not in optimal condition.(Mulya E. Siregar, Dani G. Idat and Nasirwan, 2000)

The Syariah Banks in Indonesia do not grow fastly in terms of their networking as well as size of production compared to the conventional banks. Until July 2000, there were only two pure Syariah Banks (Bank Muamalat and Bank Syariah Mandiri), three conventional banks with special counters of syariah system ( Bank IFI, Bank BNI, and Bank Jabar), and 79 syariah Society Credit Banks (BPR syariah). Meanwhile, there were 161 conventional banks with 6,624 branches, and 2,427 BPR.

Many problems and obstacles faced by Syariah Banks especially in Indonesia. The crucial problems were the limited knowledge of the society about Syariah Banks and the strong domination of conventional banks is very strong. In more details, Subardjo and Antonio (1999) stated several obstacles in developing Syariah Banks, i.e. :

1. Limited knowledge of the society about the operation of Syariah Banks;

2. The existing bank’s regulation has not yet fully accommodated Syariah Banks activities;

3. Limited Syariah Banks offices or branches; and

4. Limited human resource with appropriate skill in Syariah Banking.

1.2. Research Objectives

The specific objectives of this research are as follows :

1. To map potentiality in developing syariah banking network, which are focused on (i) economic potentiality, and (ii) social tendency in choosing syariah banks.

2. To identify the characteristics of social groups in the research areas and their attitude and behavior toward syariah banking system. This identification is needed to increase the effectivity of socialization program and the determination of marketing strategy for syariah banks which operates in specific regions.

1.3. Conceptual Framework

The conceptual framework used to conduct this research was as follows.

1.4. Scope of the Study

Beside collecting basic and general information about the society, this information would be expanded such that at least covered :

(1) The knowledge about the sharing system as the basic system of syariah banking; (2) Important factors influencing the society to choose Syariah Banks and their

knowledge about the products of Syariah Banks;

(3) Identification of self-driven efforts and information through interpersonal relationships.

This research used 15 counties and municipalities in Central Java and Yogyakarta Provinces.

Potentiality : Demographic, economic,

Social value and social system

Preferences : Relative advantages

Compatibility Comprehensiveness Trialibility/Observability

Attitude ( accept/reject principles and

products)

Behaviour (Accept/Reject Saving/Financing

Lo

ca

ti

PART TWO : METHODOLOGY

2.1. Data Collection

Primary and secondary data were collected in this study. The primary data collection was done through interview with the respondents to information about the potency and preference of the society and economic players or agents to syariah banks. Identification of characteristics and behavior of customers or prospecting customers was done through focus group discussion and in-depth interview. The focus group discussion was also attended by banks officials from both syariah banks and conventional banks.

The secondary data were collected from several sources such as government agencies, banks, Central Body of Statistics, Regional Government, and other relevant institutions in connection with the identification of social and economic potency as well as economic activities in the research areas.

2.2. Sampling Technique

Among 40 counties and municipalities in the two provinces, 15 counties and municipalities were selected as region samples, based on (1) Islamic religion and (2) economic potency. Indicators adopted to detect Islamic religion are (a) the number of mosques and mushollas, )b) proportion of hajs to the total islamic population in the region, and (c) the proportion of islamic population to the total population in the region. Whereas the economic potency was based on (1) the economic growth, (2) regional gross domestic product (PDRB), and (3) the proportion of genuine regional revenue to the regional budget. The result of selected research areas is shown in Table 2.1.

Table 2.1. Sample Survey Areas

in Central Java and Yogyakarta Provinces

RELIGION INDICATOR ECONOMIC INDICATOR

Then from each sample area was selected randomly at least 100 respondents which consisted of 20 respondents from productive sector and 80 respondents from households or consumptive sector. Due to the large size of sample areas and time constraints, practically incidental sampling was applied with regard to islamic population between districts of each sample area.

2.3. Data Analysis

The validity and reliability tests were used to ensure each item or indicator in the questionnaire. This validity test was adopted by using simple correlation technique between items, and the use of split sample was done to prove the reliability of the questionnaire.

The Logit Estimation Model will be used to test preferences and attitude of the society toward Syariah Banks. Several formulas constructed in the Logit Estimation Model are as follows (Gujarati, 1995 p. 555).

PART THREE : GENERAL DESCRIPTION OF RESPONDENTS AND RESEARCH AREAS.

3.1. Demography

The total population of Central Java Province were 29,659,176 persons in 1994 and became 30,385,445 persons in 1998, with the rate of population growth 0.6 percents annually. In the same period the total population of Yogyakarta Province were 3,124,286 persons and 3,237,628 persons, with the rate of population growth 0.89 percents per year. The large number of population in both provinces showing high potentiality for the development of Syariah Banks.

The average level of education in the two provinces was still low. The number of population in Central Java finishing the primary school were 35.96 percents, while those finishing higher education were only 2.40 percents. In Yogyakarta this condition was a little bit better than Central Java. Those finishing primary school were 22.47 percents and 7.86 percents had finished higher education.

3.2. Socio Economic Condition

The majority of population in Central Java worked in agricultural sector (43.9 %). Trading sector occupied the second rank (12.29 %) and the third rank was industrial sector with 14.73 % of the population. In Yogyakarta, agricultural sector was the dominant sector with 31.47 % of the population, then followed by trading sector (24.95 %) and service sector (18.49 %).

In 1993, the regional gross domestic product (PDRB) in Central Java, based on constant price 1993, was Rp 33.98 trillions, and became Rp 43.12 trillions in 1997. The growth rate in this period was 6.0 percents per year. Meanwhile, in the same period the growth rate in Yogyakarta was 6.5 percents annually. Based on these growth rate, the prediction of PDRB of Central Java is about Rp 54.37 trillions and Yogyakarta is about Rp 6.83 trillions in 2001.

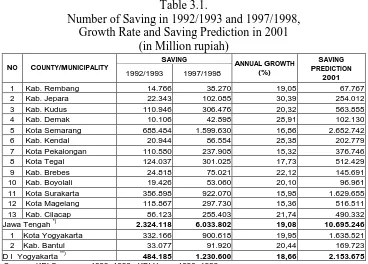

Table 3.1.

Number of Saving in 1992/1993 and 1997/1998, Growth Rate and Saving Prediction in 2001

(in Million rupiah) SAVING

NO COUNTY/MUNICIPALITY

1992/1993 1997/1998 5 Kota Semarang 688.484 1.599.630 16,86 2.652.742 6 Kab. Kendal 20.944 86.554 28,38 202.779 7 Kota Pekalongan 110.580 237.908 15,32 376.746 8 Kota Tegal 124.037 301.025 17,73 512.429 9 Kab. Brebes 24.818 75.021 22,12 145.691 10 Kab. Boyolali 19.426 53.060 20,10 96.961 11 Kota Surakarta 356.898 922.070 18,98 1.629.655 12 Kota Magelang 118.867 297.730 18,36 516.511 13 Kab. Cilacap 86.123 255.403 21,74 490.332 Jawa Tengah *) 2.324.118 6.033.802 19,08 10.695.246

1 Kota Yogyakarta 332.166 900.618 19,95 1.638.521 2 Kab. Bantul 33.077 91.920 20,44 169.723 D I Yogyakarta **) 484.185 1.230.600 18,66 2.153.675

Source : KBI Semarang 1993, 1998 ; KBI Yogya 1993, 1998

3.3. Respondents’ Identity

Based on their age group, most respondents (91 %) were more than 30 years of age. Only 9 percents of them less than 30 years. The age group between 31-40 years occupied 32.87 percents, between 41-50 years were 32.33 percents, and there were 26.87 percents above 50 years. This age composition were not the same for the two provinces, whereas the respondents from Yogyakarta were generally older than those from Central Java. (See Table 3.2.)

Table 3.2.

Distribution of Respondents Based on Their Age Group. AGE DISTRIBUTION

NO COUNTY/MUNICIPALITY

S.D. 30 31-40 41-50 > 50 TOTAL

Total Central Java 126 422 413 339 1300

Percentage 9,69 32,46 31,77 26,08 100,00

1. Kota Yogyakarta 4 25 37 34 100 2. Kab. Bantul 4 31 35 30 100

DI Yogyakarta 8 56 72 64 200

Percentage 4,00 28,00 36,00 32,00 100,00

Central Java and Yogyakarta 134 478 485 403 1500

Percentage 8,93 31,87 32,33 26,87 100,00

From their main occupation, 26.53 percents of the respondents worked as civil servants or government officials, then followed by self employed (23.53 %) and officials of private firms (16.80 %). This composition also happened in Central Java Province. However, the composition of their main occupation in Yogyakarta is slightly different. The rank of their main occupation were civil servants (32.00 %), self employed with help of other workers (20.00 %), and self employed (16.00 %). The details of this description can be seen in Table 3.3.

Table 3.3.

Distribution of Respondents Based on Their Main Occupation MAIN OCCUPATION

NO CCCCOUNTYOUNTYOUNTYOUNTY/M/M/M/MUNICIPALITYUNICIPALITYUNICIPALITYUNICIPALITY

PART FOUR : POTENTIAL FACTORS AFFECTING THE DEVELOPMENT OF SYARIAH BANKING SYSTEM.

4.1. Perception to Interest

Most respondents (48.47 %) stating that bank interest was prohibited (Haram), about 20.47 % stating that they accepted it (Halal), and the rest (31.06 %) were still indecisive (Subhat). The large proportion of indecisive group may be as result of the lack of Syariah Banks which operate around their home. This result led to the need for special attention to indecisive (Subhat) group, because this group would become prospective customers for syariah system when they received proper promotion about Syariah Banking system. Of course beside those who stated that bank interest as Haram.

4.2. Knowledge on Syariah Bank’s Products

The knowledge of the society about Syariah Bank’s product were diverse among research areas. The Syariah Bank’s products had been well known in Brebes County (83 %), Pekalongan Municipality (77 %), and Cilacap County (78 %). Meanwhile Demak County (46 %) and Magelang Municipality (51 %) were considered as in the stage of low or moderate knowledge about Syariah Bank’s products.

This result was not so disappointing since the existence of Syariah Banks in the two provinces was very limited. Some cities which had Syariah Banks were Jepara, Semarang, Surakarta, Pekalongan, and Yogyakarta.

4.3. Logit Estimation Model

In order to detect dominant factors affecting the people’s behavior toward Syariah Banks, namely in the willingness to save and the willingness to get financing, the Logit model could be used as the tool of analysis. Before executing the Logit estimation model, the raw scores of the willingness to save and the willingness to get financing should be converted into the binary score, i.e. score “1” for those who wanted to save or to get financing and score “0” for those who reject to save or to get financing from Syariah Banks.

Firstly this research tested 25 factors covered demographic potency, economic potency, social values, social system and preference aspects. Demographic potency was represented by age group, sex, and level of education. Economic potency was represented by family spending, job, and regional accessibility. Social value was measured by social status, religiosity, acceptance to new technology, social activities, family mobility, typology of the family, and marital status. Social system was measured by family norms, flexibility of religious rule compliance, flexibility to different culture, and information accessibility. People preference was measured by relative advantages, compatibility, comprehensiveness, and triability or observability.

4.3.1. The willingness to save at Syariah Banks

As a result of the Logit estimation there were 5 factors which had strong influence to the willingness to save. These factors were age group, acceptance to new technology, family mobility, flexibility of religious rule compliance, and comprehensiveness

The age group factor had a positive value and significant at 96 % (α = 4 %). This result gave description that in general the respondents of older age group were more willing to save to Syariah Banks.

The acceptance to new technology factor had a positive value and significant at 96 % (α = 4 %). This factor reflected the degree of social openness to new value or norms in the society. So, part of people who could accept new technology easily, would have bigger willingness to save at Syariah Banks.

The family mobility factor had positive and significant at 99 % (α = 1 %). It meant that the willingness to save at Syariah Banks was stronger from those with higher family mobility. This result was very reasonable because by mobility they had chance to find more information.

The flexibility of religious rule compliance factor had a positive value. This meant that the willingness to save was bigger for those who firmly kept religious rule compliance. The comprehensiveness factor describing that respondents viewed Syariah Banks had comprehensive characteristics, they gave attentiveness not only for worldliness but also for heavenliness. This factor had a positive value, in other word the willingness to save at Syariah Banks was determined by people’s view about the comprehensiveness of Syariah Banks.

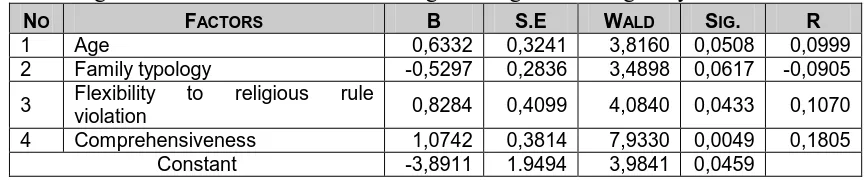

4.3.2. The willingness to get financing from Syariah Banks

As a result of the Logit estimation there were 7 factors which had strong influence to the willingness to save. These factors were sex, agricultural sector, service sector, government sector, acceptance to new technology, social status, and flexibility to different culture.

Table 4.1.

Logit Estimation Model to the Willingness to Save at Syariah Banks

NO FACTOR B S.E WALD SIG R

1 Sex 0,5562 0,2027 7,5275 0,0061 0,0719 2 Age -0,0552 0,1273 0,1878 0,6648 0,0000 3 Education 0,0794 0,1061 0,5599 0,4543 0,0000 4 Spending 0,0396 0,0931 0,1815 0,6301 0,0000 5 Agriculture 0,6270 0,3757 2,7846 0,0952 0,0271 6 Industry 0,0344 0,3145 0,0119 0,9130 0,0000 7 Trading 0,1043 0,2436 0,1833 0,6686 0,0000 8 Service 0,5268 0,2801 3,5388 0,0599 0,0379 9 Government 0,5112 0,2487 4,2274 0,0398 0,0456 10 Accesibility -0,1045 0,0959 1,1884 0,2757 0,0000 11 Social level 0,2088 0,0999 4,3708 0,0366 0,0471 12 Religiosity 0,0296 0,1303 0,0517 0,8201 0,0000 13 Acceptance to new technology 0,3096 0,1562 3,9256 0,0476 0,0424 14 Social Activity -0,0519 0,2024 0,0658 0,7975 0,0000 15 Mobility 0,1264 0,1022 1,5295 0,2162 0,0000 16 House typology -0,1083 0,1220 0,7880 0,3747 0,0000 17 Marital status 0,3826 0,3996 0,9169 0,3383 0,0000 18 Household norm -0,2685 0,1647 2,6576 0,1031 -0,0248 19 Flexibility to Cultural tolerance -0,2923 0,1755 2,7736 0,0958 -0,0269 20 Flexibility to Religion tolerance 0,0867 .0,1747 0,2462 0,6198 0,0000 21 Information access 0,0474 0,1427 0,1103 0,7398 0,0000 22 Relative advantages 0,3727 0,2655 1,9704 0,1604 0,0000 23 Compatibility 0,2657 0,3184 0,6964 0,4040 0,0000 24 Comprehensiveness 0,3207 0,2308 1,9308 0,1647 0,0000 25 Observability 0,1400 0,0866 2,6100 0,1062 0,0239

Constant -1,5599 1,3566 1,3222 0,2502

Table 4.2. .

Logit Estimation Model to the Willingness to get financing at Syariah Banks

NO FACTORS B S.E WALD SIG. R

1 Age 0,6332 0,3241 3,8160 0,0508 0,0999 2 Family typology -0,5297 0,2836 3,4898 0,0617 -0,0905

3 Flexibility to religious rule

violation 0,8284 0,4099 4,0840 0,0433 0,1070 4 Comprehensiveness 1,0742 0,3814 7,9330 0,0049 0,1805

Constant -3,8911 1.9494 3,9841 0,0459

4.3.3. Productive sector

In the productive sector there were four factors which had significant influence to the willingness to save at Syariah Banks, i.e. age group, family typology, flexibility to religious rule violation, and comprehensiveness.

Table 4.3.

Logit Estimation Model to the Willingness to Save at Syariah Banks for Productive Sector

NO FACTOR B S.E WALD SIG. R

1 Social activities -0,7781 0,4128 3,5532 0,0594 -0,0771

2 Family norms -0,5187 0,3095 2,8092 0,0937 -0,0557

3 Flexibility to different Cultural -0,4208 0,3684 1,3048 0,2533 0,0000

4 Flexibility to religious rule violation 0,5480 0,3269 2,8111 0,0936 0,0557

Constant 5,4346 2,1738 6,2505 0,0124

Table 4.4.

Logit Estimation Model to the Willingness to get financing at Syariah Banks for Productive Sector

NO FACTOR B S.E WALD SIG. R

1 Sex 0,7936 0,2805 8,0043 0,0047 0,1084

2 Service 1,1363 0,4610 6,0765 0,0137 0,0893

3 Accessibility -0,4731 0,1647 8,2481 0,0041 -0,1106

4 Acceptance to new technology 0,7267 0,2388 9,2632 0,0023 0,1192

5 Social activity 0,7895 0,3188 6,1324 0,0133 0,0899

6 Family mobility 0,5898 0,1811 10,6020 0,0011 0,1297

7 Flexibility to religious rule violation 0,7048 0,3038 5,3820 0,0203 0,0813

8 Observability 0,5431 0,1188 20,8966 0,0000 0,1923

Constant -5,1998 1,5375 11,4372 0,0007

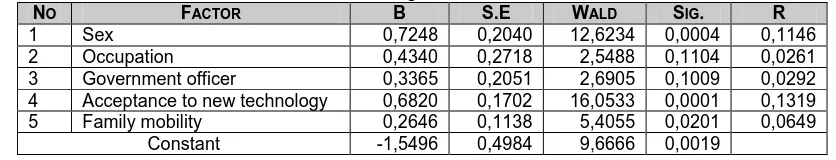

4.3.4. Consumptive sector

In the consumptive sector there were six factors which had significant influence to the willingness to save at Syariah Banks, i.e. regional accessibility, acceptance to new technology, family mobility, flexibility to religious rule violation, and observability/triability.

Factors influencing the willingness to get financing from Syariah Banks were acceptance to new technology and family mobility.

Table 4.5.

Logit Estimation Model to the Willingness to Save at Syariah Banks for Consumptive Sector

NO FACTOR B S.E WALD SIG. R

1 Sex 0,7248 0,2040 12,6234 0,0004 0,1146

2 Occupation 0,4340 0,2718 2,5488 0,1104 0,0261

3 Government officer 0,3365 0,2051 2,6905 0,1009 0,0292

4 Acceptance to new technology 0,6820 0,1702 16,0533 0,0001 0,1319

Table 4.6.

Logit Estimation Model to the Willingness to Get Financing at Syariah Banks for Consumptive Sector

Central Java and DI Yogyakarta 106 421 844 129 1500

Percentage 7,07 28,07 56,27 8,60 100,00

Sourcer: Primary data , 2000

4.4. Preference to Syariah System

4.4.1. Preference to Relative Advantages of Syariah Banks.

About 51.80 percents of respondents agreed that Syariah Banks had relative advantages compared to conventional banks and only 2.27 percents of them did not agree that Syariah Banks had relative advantages. While the rest, about 44.00 percents ware still in doubt because they hadn’t known precisely about Syariah Banks. Some cities with large proportion of respondents who were still in doubt position were Pekalongan (48.00 %), Tegal (46.00 %) and Jepara (44.00 %). Other cities which had large proportion agreed to relative advantages were Semarang (61.00 %) and Magelang (66.00 %).

4.4.2. Preference to Compatibility Level of Syariah Banks

The compatibility level describing that the application of Syariah Banks was very suitable to the people’s need due to their consideration about the strong point of Syariah Banks. From this study, only 0.73 percents stated that Syariah Banks had high level of compatibility. There were 52.93 percents of respondents did not agree to Syariah Banks compatibility, and 45.07 percents were still in doubt position. It implied that most people had not yet known promptly about Syariah Banks.

4.4.3. Preference to Comprehensiveness Level of Syariah Banks.

4.4.4. Preference to Triability/Observability Level of Syariah Banks

The triability/observability level describing the efforts to find more information that Syariah Banks had some benefit to them. As a whole, 53.3 percents stated to agree with such statement, and those who did not agree in about 29.47 percents.

4.5. Attitude toward Syariah Principles and Products

People attitude toward Syariah Banks generally agreed to the application of Syariah principles in the banking practices. There were 63.93 percents of respondent supported this agreement. This agreement seemed not to be separated from emotional tie of the society, since most of them were moslem such that they had positive thinking about the sharing system which was adopted in Syariah banking system.

4.6. Behavior toward Syariah Banking System

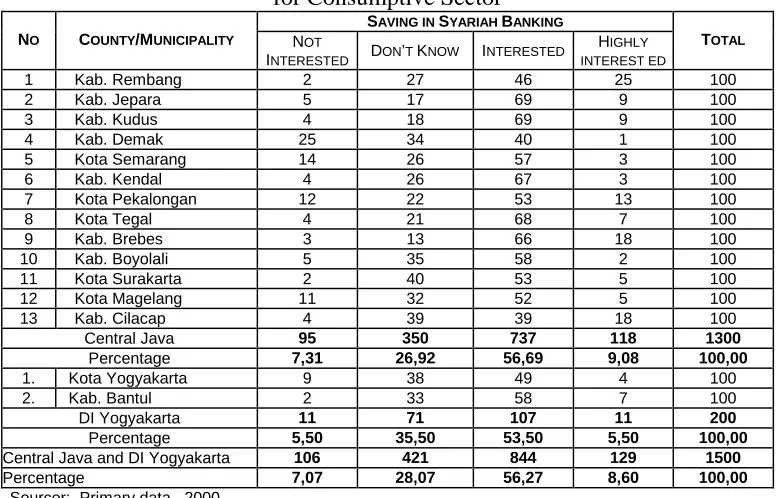

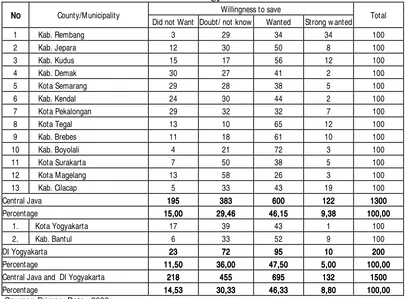

People’s behavior toward Syariah Banks could be seen from both aspects, willingness to save and willingness to get financing aspects. There were 64.8 percents of respondents wanted to save their money in Syariah Banks, and who did not want to save were only 7.1 percents. Some potential regions to collect fund through saving were Brebes, Tegal, Jepara and Kudus.

Table 4.7.

The Willingness to Save at Syariah Banks by Region In Central Java and Yogyakarta Provinces.

Willingness to save N

NN

NOOOO County/Municipality

Did not Want Doubt/ not know Wanted Strong w anted Total

1 Kab. Rembang 3 29 34 34 100

2 Kab. Jepara 12 30 50 8 100

3 Kab. Kudus 15 17 56 12 100

4 Kab. Demak 30 27 41 2 100

5 Kota Semarang 29 28 38 5 100

6 Kab. Kendal 24 30 44 2 100

7 Kota Pekalongan 29 32 32 7 100

8 Kota Tegal 13 10 65 12 100

9 Kab. Brebes 11 18 61 10 100

10 Kab. Boyolali 4 21 72 3 100

11 Kota Surakarta 7 50 38 5 100

12 Kota Magelang 13 58 26 3 100

13 Kab. Cilacap 5 33 43 19 100

The willingness to get financing from Syariah Banks was lower compared to the willingness to save. There were only 55.13 percents of respondents interested to get financing from Syariah Banks. Those interested in getting financing mostly came from Tegal (77.00%), Brebes (71.00 %), and Boyolali (75.00 %).

4.7. Comparison of Syariah Banking Perception based on Areas of Study

The last step to test the significance different of the proportion interested in saving their money to and in getting financing from Syariah Banks was done by applying t-test. This t-test would prove whether there was significance different between North regions and South regions of the two provinces. The North regions covered 6 counties (Rembang, Jepara, Kudus, Demak, Kendal, and Brebes) and 3 municipalities (Semarang, Pekalongan, and Tegal). The South regions covered 3 counties (Boyolali, Bantul, and Cilacap) and 3 municipalities (Surakarta, Yogyakarta, and Magelang).

Table 4.8.

Percentage and Category of Respondents

Who Will Save to and Get Financing from Syariah Banks by North and South Regions.

SAVING FINANCING

NO COUNTY/

MUNICIPALITY PERCENT CATEGORY PERCENT CATEGORY

North areas

1 Kab. Rembang 71 3 68 3 2 Kab. Jepara 78 3 58 2 3 Kab. Kudus 78 3 68 3 4 Kab. Demak 41 1 43 2 5 Kota Semarang 60 2 43 2 6 Kab. Kendal 70 2 46 2 7 Kota Pekalongan 66 2 39 2 8 Kota Tegal 75 3 77 3 9 Kab. Brebes 84 3 71 3

Rata-rata 69 58

South areas

10 Kab. Boyolali 60 2 75 3 11 Kota Surakarta 58 2 43 2 12 Kota Magelang 57 2 19 1 13 Kab. Cilacap 57 2 62 3 14 Kota Yogyakarta 53 1 44 2 15 Kab.Bantul 65 2 61 3

Rate 58 51

Sourcer: Primary Data , 2000

PART FIVE : SOCIETAL CHARACTERISTICS IN SYARIAH BANKING SYSTEM.

5.1. Productive Sector

One market segment of bank operation was productive sector (business firms) from small, medium and large scales. The general perception of businessmen to the existence of Syariah Banks was very high. In other words, they showed great acceptance to Banks which were adopting syariah system in their operation. They need additional capital to enlarge their firms. From 379 businessmen respondents, 252 persons (66,5 %) stated the they wanted to save their money to Syariah Banks. And 218 persons (58.1 %) wanted to get financing from Syariah Banks. Some strong reasons are suitability to Islam, profit sharing application, safe and beneficial, and if they have surplus money.

Table 5.1.

Reasons for Being Syariah Banks’ Customer for Productive Sector (Businessmen)

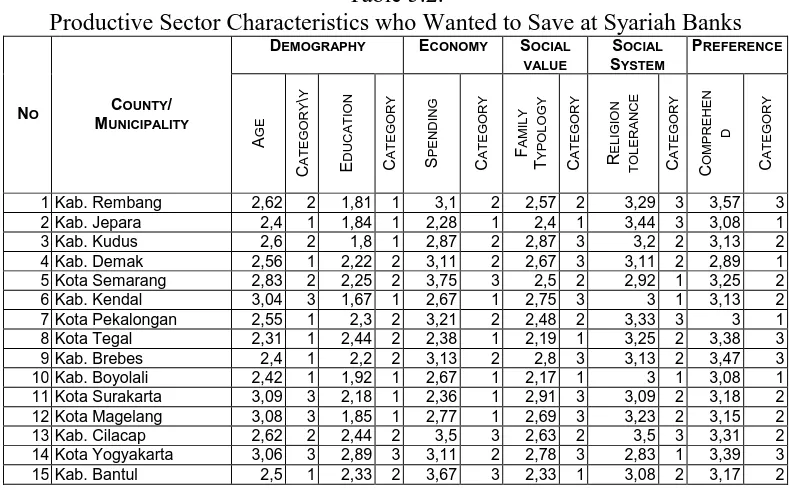

Furthermore, the detail characteristics of productive sector who wanted to save and to get financing from Syariah Banks could be seen from Table 5.2. and Table 5.3. as follows.

Table 5.2.

Productive Sector Characteristics who Wanted to Save at Syariah Banks

DEMOGRAPHY ECONOMY SOCIAL

Note

Age Category Education Spending

2,31 – 2,57 = 1 (low) 1,67 - 2,08 = 1 low) 2.28 - 2,77 = 1(low) 2,58 – 2,83 = 2 (middle) 2,09 - 2,48 = 2 (middle) 2,78 - 3,26 = 2 (middle) 2,84 – 3,09 = 3 (high) 2,49 - 2,89 = 3 (high) 3,27 - 3,75 = (high)

Family typology Religion tolerance Comprehensive

2,17 – 2,42 2,83 - 3,05 2,89 - 3,12 2,43 – 2,66 3,06 - 3,28 3,13 - 3,34 2,67 – 2,91 3,29 - 3,50 3,35 - 3,57

Table 5.3.

Productive Sector Characteristics who Wanted to Get Financing from Syariah Banks

DEMOGRAPHY ECONOMIC SOCIAL

VALUE SOCIAL SYSTEM

NO COUNTY/MUNICIPALITY

E

Education Age Spending Social activity

1,64 - 2,12 = 1 (low) 2,21 - 2,52 = 1 (low) 2,29 - 2,82 = 1 low) 2,84 - 2,98 = 1 (low) 2,13 - 2,59 = 2 (middle) 2,53 - 2,82 = 2 (middle) 2,83 - 3,34 = 2 (middle) 3,11 - 3,11 = 2 (middle) 2,60 - 3,07 = 3 (high) 2,83 - 3,13 = 3 (high) 3,35 - 3,87 = 3 (high) 3,25 - 3,25 = 3 (high)

Family norm Religion tolerance Cultural tolerance

3,00 - 3,21 = 1 (low) 3,40 - 3,60 = 1 (low) 2,75 - 3,00 = 1 (low) 3,22 - 3,43 = 2 (middle) 3,61 - 3,80 = 2 (middle) 3,01 - 3,25 = 2 (middle 3,44 - 3,64 = 3 (high) 3,81 - 4,00 = 3 (high) 3,26 - 3,50 = 3 (high)

5.2. Consumptive Sector

Table 5.4.

Reasons for Being Syariah Banks’ Customer for Consumptive Sector (Households)

SERVICE

REASONS

SAVING FINANCING

1 Equal Islamic Syariah 46,3 40,0 2 Safe & beneficial 18,4 17,0 3 Near home 11,3 - 4 Clear information 14,0 - 5 Simple procedure - 5,0 6 Increase investment - 26,4 7 Don’t know 10,0 5,0

TOTAL N=813 N=689

Source : Primary data, 2000

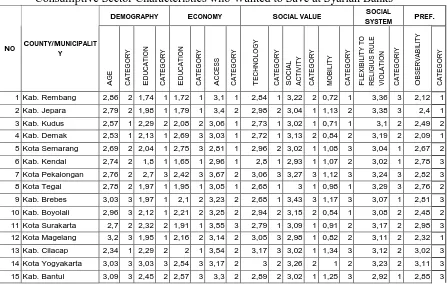

Furthermore, the detail characteristics of consumptive sector (households) who wanted to save and to get financing from Syariah Banks could be seen from Table 5.5. and Table 5.6. as follows.

Table 5.5.

Consumptive Sector Characteristics who Wanted to Save at Syariah Banks

DEMOGRAPHY ECONOMY SOCIAL VALUE SOCIAL

SYSTEM PREF.

NO COUNTY/MUNICIPALIT Y

A

GE

CATEGORY EDUCATION CATEGORY EDUCATION CATEGORY ACCESS CATEGORY TECHNOLOGY CATEGORY SOCIAL ACTIVITY CATEGORY MOBILITY CATEGORY FLEXIBILITY TO RELIGIUS RULE VIOLATION CATEGORIY OBSERVABILITY CATEGORY

Mobility Religion tolerance Observe

0,54 - 0,81 = 1(low) 2,92 -3,07 = 1(low) 2,09 -2,43 = 1(low) 0,82 - 1,07 = 2 (middle) 3,08 -3,23 = 2 (middle) 2,44 -2,77 = 2 (middle) 1,08 - 1,34 = 3 (High) 3,24 -3,38 = 3 (High) 2,78 -3,11 = 3 (High)

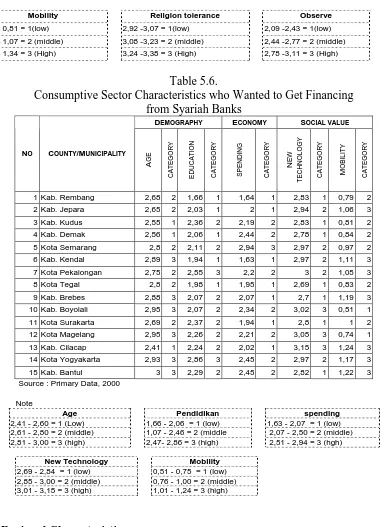

Table 5.6.

Consumptive Sector Characteristics who Wanted to Get Financing from Syariah Banks

DEMOGRAPHY ECONOMY SOCIAL VALUE

NO COUNTY/MUNICIPALITY

A

GE

CATEGORY EDUCATION CATEGORY SPENDING CATEGORY

N

Age Pendidikan spending

2,41 - 2,60 = 1 (Low) 1,66 - 2,06 = 1 (low) 1,63 - 2,07 = 1 (low)

Table 5.7.

The Logit Model Estimation

for Saving and Financing from Syariah Banks

SAVING FINANCING

NO COUNTY/MUNICIPALITY

Z CATEGORY Z CATEGORY for Productive and Consumptive Sectors

PRODUCTIVE CONSUMTIVE

SAVING FINANCING SAVING FINANCING

NO COUNTY/MUNICIPAL ITY

PART SIX : CONCLUSION AND RECOMMENDATION 6.1. Conclusion

Based on the previous analysis to the potency, preference, attitude and behavior of the society toward Syariah Banks, some conclusions were :

(1) Demographic factors such as age group and education level had positive impact on the preference to Syariah Banks. Most respondents of age group 30 – 50 years, and the average level of education was high school (SLTA).

(2) Regional accessibility as one of economic factors was considered as high category for Semarang, Pekalongan, Kendal, Surakarta, and Yogyakarta. Those considered as low category were Rembang, Jepara, Kudus, Demak, Boyolali, and Cilacap.

(3) Most respondents agreed that Syariah Banks had relative advantages, comprehensiveness, and triability/observability. But most of them did not agree about the compatibility of Syariah Banks.

(4) Perception of the society to bank’s interest was divided into three broad categories. In about 48.27 percents respondents stated that Bank’s interest was haram, 20.47 percents stated halal, and 31.46 percents stated subhat.

(5) In the willingness to save some dominant factors were age group, acceptance to new technology, family mobility, flexibility to religious rule violation, and comprehensiveness.

(6) In the willingness to get financing some dominant factors were sex, main occupation (agriculture, service, and government sectors), acceptance to new technology, and flexibility to different culture.

(7) From the Logit model estimation to the willingness to save and the willingness to get financing for productive sector (businessmen), Rembang county and Magelang municipality showed high potency. For the detail see Table 6.1.

Table 6.1.

Category of Saving and Financing Potentiality for Productive Sector By Region

MIDDLE Kab. Brebes Kab. Kendal

Kab. Kudus

HIGH Kota Semarang Kab. Rembang Kota Yogyakarta

Table 6.2.

Category of Saving and Financing Potentiality for Consumptive Sector By Region

HIGH Kab.Brebes Kota Pekalongan

Kota Yogyakarta Kab. Cilacap

(9) From the overall result of the Logit model estimation, Cilacap was the one region with high potentiality not only on the willingness to save but also on the willingness to get financing from Syariah Banks. For the detail see table 6.3.

Table 6.3.

Category of Saving and Financing Potentiality By Region

(4) Strengthen the relation among Syariah Banks by making an association, such that the overall and real picture of the syariah working mechanism became clear for ordinary people.

(5) Need deep exploration and feasibility study for each prospective region whenever Syariah bank would be built in certain region. Some of prospective regions as the result of this study were Cilacap, Kendal, Pekalongan, Jepara, Brebes, Magelang, and Yogyakarta.

BIBLIOGRAPHY

Ancok, Djamaludin,1995, “Tehnik Penyusunan Skala Pengukur”, Pusat Penelitian Kependudukan, Universitas Gadjah Mada, Yogyakarta.

Antonio, M.Syafei, 1999, “Bank syariah : Suatu Pengenalan Umum”, Tazkia Institute dan Bank Indonesia, Jakarta.

Antonio, M.Syafei, 1999, “Bank Syariah : Wacana Ulama dan Cendikiawan”, Tazkia Institute dan Bank Indonesia, Jakarta.

Bank Indonesia, 2000, “Informasi Mengenai Peraturan Bank Indonesia Bagi Bank Umum Berdasarkan Prinsip Syariah”.

Bank Indonesia, 2000, “Petunjuk Pelaksanaan Pembukaan Bank Syariah “.

Gibson L, James, Ivancevic, John M., Donelly, James H., 1987, “Organisasi: Perilaku, Struktur

dan Proses”, Penerbit Erlangga, Jakarta.

Gujarati, Damodar N. 1995. Basic Econometric. Mc Graw-Hill International Edition.

Kaynak, E and Yavas, 1985, “Segmenting the Banking Market by Account Usage : An Empirical Investigation”, Journal of Profesional Services Marketing, Vol.1 No.1/2.

Loudon, David.L. and Bitta A.D.,1984. “Consumer Behavior : Concepts and Applications”, Mc Graw Hill, Singapore.

Mulya E. Siregar, Dhani G.Idat dan Nasirwan, Kebijakan Pengembangan Perbankan Syariah di Indonesia, Paper pada Seminar Nasional: Kontribusi Perbankan Syariah Sebagai Lembaga Pembiayaan Dalam Upaya Pemulihan Ekonomi Nasional, LPM Unpad, Bandung, Oktober 2000.

Pindick, Robert S., and Rubenfield, Daniel. 1981. Econometric Models and Economic Forecast. International Student Edition, Mc Graw-Hill.