De m o c ra tic Re p ub lic o f Tim o r - Le ste

G e ne ra l Bud g e t o f the Sta te

a nd Sta te Pla n fo r 2009

1 Ja nua ry to 31 De c e m b e r 2009

Re vise d b y the Ministry o f Fina nc e

2

Table of Contents

Ta b le o f C o nte nts ...2

Pa rt 1 Prim e Ministe r’ s Sp e e c h ...6

Pa rt 2 Exe c utive Summ a ry ...19

The C o mb ine d So urc e s Bud g e t...19

The Ec o no m y ...20

Re ve nue , Susta ina b le Inc o me a nd the Pe tro le um Fund ...21

G e ne ra l Bud g e t o f the Sta te fo r Timo r-Le ste ...21

C a p ita l Exp e nd iture ...24

Pa rt 3 – De ve lo p ing the Distric ts ...27

Intro d uc tio n ...27

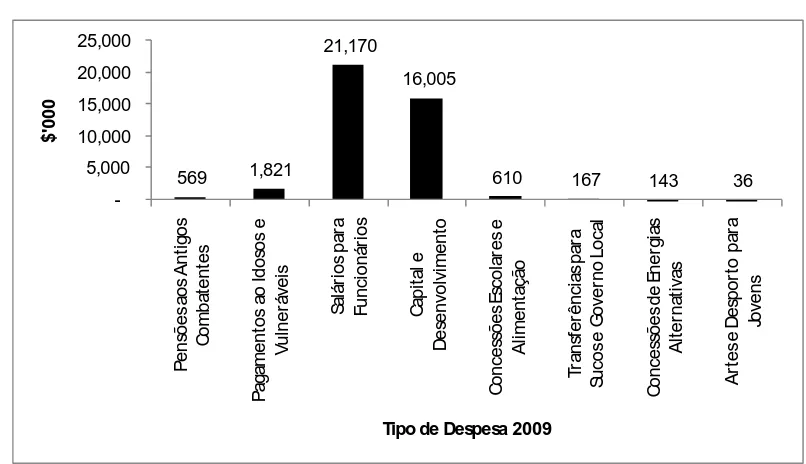

Typ e s o f Exp e nd iture in the Distric ts...27

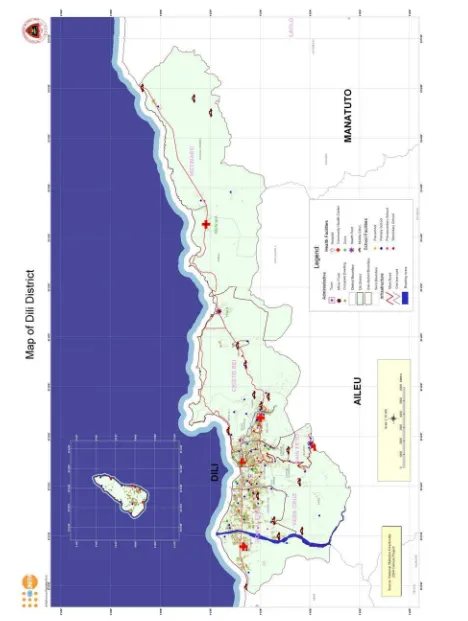

Dili...29

Ba uc a u ...35

Aile u ...42

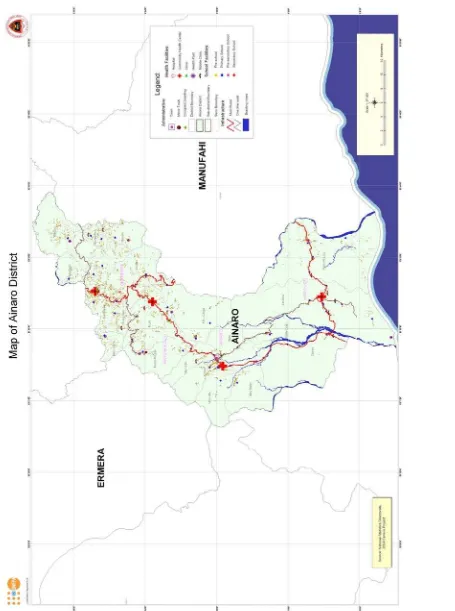

Aina ro ...48

Bo b o na ro ...54

Erme ra ...61

La ute m ...67

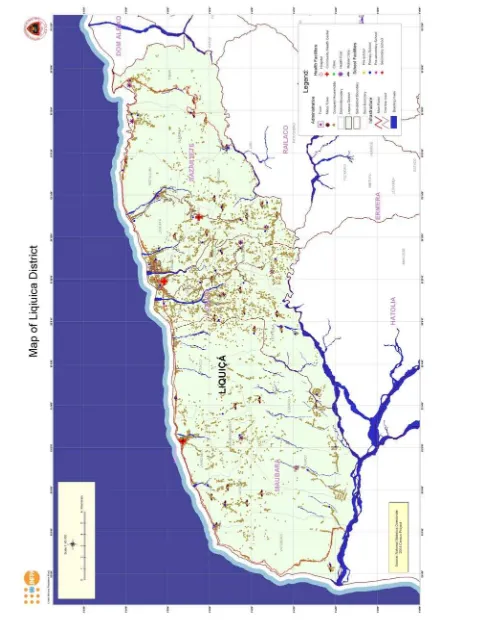

Liq uic a ...73

Ma na tuto ...79

Ma na tuto ...79

Ma nufa hi...84

Ma nufa hi...84

O e c usse ...90

C o va Lim a ...96

Viq ue q ue ...101

Pa rt 4 – G e nd e r a nd C ulture Sta te me nt ...106

3

C ulture ...106

Pa rt 5 – Ec o no m ic O ve rvie w ...107

Inte rna tio na l Ec o no m y...107

Re g io na l Ec o no m y ...108

Do me stic Ec o no my (No n O il G DP) ...109

Infla tio n ...109

Po ve rty...111

Pe tro le um Fund ...111

Pa rt 6 – Re ve nue ...113

To ta l Re ve nue ...113

Pe tro le um Re ve nue ...114

Pe tro le um Fund ...115

Pe tro le um Re ve nue s, We a lth a nd Susta ina b le Inc o me ...116

Re vie w o f Me tho d o lo g y ...119

Do me stic Re ve nue ...123

Pa rt 7 Exp e nd iture ...125

Intro d uc tio n ...125

Fund ing fro m De ve lo p me nt Pa rtne rs...131

Sa la rie s, Wa g e s a nd o the r Allo w a nc e s ...137

G o o d s a nd Se rvic e s ...138

Mino r C a p ita l...139

Pub lic Tra nsfe r Pa yme nts ...140

C a p ita l De ve lo p m e nt ...142

O ffic e o f the Pre sid e nt ...144

Na tio na l Pa rlia me nt...152

O ffic e o f the Prime Ministe r ...161

Se c re ta ry o f Sta te fo r the C o unc il o f Ministe rs...170

Se c re ta ry o f Sta te fo r Yo uth a nd Sp o rt...176

Se c re ta ry o f Sta te fo r Na tura l Re so urc e s...184

4

Se c re ta ry o f Sta te fo r Em p lo yme nt a nd Vo c a tio na l Tra ining ...194

Se c re ta ry o f Sta te fo r the Pro mo tio n o f Eq ua lity ...202

C ivil Se rvic e C o m m issio n...208

Ministry o f De fe nc e a nd Se c urity (C o nso lid a te d ) ...212

Ministry o f De fe nc e a nd Se c urity...213

Se c re ta ry o f Sta te fo r De fe nc e ...216

FALINTIL – FDTL...220

Se c re ta ry o f Sta te fo r Se c urity...224

PNTL...232

Ministry o f Fo re ig n Affa irs...236

Ministry o f Fina nc e ...251

Ministry o f Fina nc e -- Who le o f G o ve rnme nt ...256

Ministry o f Justic e ...258

Ministry o f He a lth ...264

Ministry o f Ed uc a tio n ...276

Ministry o f Sta te Ad ministra tio n a nd Te rrito ria l Ma na g e m e nt ...302

Ministry fo r Ec o no m y a nd De ve lo p me nt...310

Ministry fo r So c ia l So lid a rity ...331

Ministry o f Infra struc ture ...347

Ministry o f To urism , C o m me rc e a nd Ind ustry ...357

Ministry o f Ag ric ulture a nd Fishe rie s...363

Trib una ls...375

Pro se c uto r G e ne ra l ...380

Pro ve d o r o f Huma n Rig hts a nd Justic e ...387

Pub lic Bro a d c a sting Se rvic e o f Timo r-Le ste ...392

Na tio na l C o m m issio n fo r Ele c tio ns ...397

Anti –C o rrup tio n C o m m issio n ...400

Ele c tric ity o f Timo r-Le ste ...404

Po rts Autho rity o f Timo r-Le ste ...409

5

Institute o f Ma te ria l a nd Eq uip me nt (IG E) ...416

Anne x 1 To ta l Exp e nd iture Inc lud ing Auto no mo us Ag e nc ie s ...419

Anne x 2 To ta l Exp e nd iture Exc lud ing Auto no mo us Ag e nc ie s ...420

Anne x 3 Bud g e t Ap p ro p ria tio ns fo r 2009...421

Anne x 4 C a p ita l Pla n fo r 2009 to 2011 ...443

Anne x 5 Sta ffing Pro file fo r the Sta te ...464

C ivil Se rva nts...464

No n-C ivil Se rva nts ...483

Sta ff in Auto no mo us Ag e nc ie s...485

Po litic a l Ap p o intme nts ...485

Anne x 6 Ra te s o f Sa la rie s fo r the Pub lic Se c to r a nd Pe nsio ns Pa id b y the Sta te ...488

Anne x 7 Bud g e t La w ...491

Anne x 8 Sub sid ie s to Auto no mo us Ag e nc ie s...500

Anne x 9 Le tte r to the Pa rlia me nt Re g a rd ing the Exc e e d ing o f Susta ina b le Inc o me ...501

Anne x 10 De lo itte s Re p o rt o n Susta ina b le Inc o me ...504

Anne x 11 Re q uire me nt Fo r Tra nsfe rs Fro m Pe tro le um Fund ...510

Anne x 12 Aud it Re p o rt o n c a lc ula tio n o f Estim a te o f Susta ina b le Inc o m e (De lo itte To uc he

To hm a tsu) ...512

6

Part 1 Prime Minister’s Speech

SPEECH BY HIS EXCELLENCY

PRIME MINISTER KAY RALA XANANA GUSMÃO

ON THE OCCASION OF THE PRESENTATION OF

THE BILL FOR THE

2009 STATE GENERAL BUDGET

7

Your Excellency the President of the National Parliament Illustrious Members of Parliament Illustrious

Members of Government Ladies and Gentlemen,

We are here today in this Great House to present the 2009 State Budget and Plan, as well as to clarify and

discuss, in this National Parliament, all questions put to us, within a truly democratic and accountable spirit,

meeting our institutional goal of making this proposal as aligned as possible with national needs and priorities.

The 2009 State General Budget responds to the urgent needs of the Country:

to accelerate administrative and

legal processes leading to national reconstruction and to the reduction of poverty, to enhance

economic growth and to enhance national development!

In this sense, the 2009 budget:

Is a budget that enables making vital decisions for the

development of basic infrastructures

in all

development sectors;

Is a budget that gives priority to the implementation of

regional development policies

, so as to reduce

poverty in rural areas and to distribute resources in such a way as to achieve a greater regional balance;

Is a budget that

invests in national human capital

in all its dimensions: investment in education and

professional training, in the fight against unemployment and in a greater protection to the purchase

power of families, in the continuation of social justice measures for the most vulnerable groups and,

consequently, in the strengthening of social cohesion.

Your Excellency the President of the National Parliament Illustrious

Members of Parliament

Present times are marked by troubling international events in economic and financial terms, resulting from the

international crisis that has been affecting, above all, the leading world economies. The growth forecasts for the

world economy are being revised downwards, with the IMF estimating that global growth in 2009 will be around

2.2%.

Developing countries have not registered losses as great in the financial sector, however they are still feeling the

consequences of tighter credits and a smaller demand for their exports. This gloomy and uncertain global

scenario is also contributing towards inflationary pressures, as we saw in the sudden increase of food and fuel

prices within the last few years, shooting inflation up to levels we had not seen for over a decade.

This impact was mostly felt in developing countries, and Timor-Leste was no exception. However, with the

8

by the Timorese consumer would not increase along with the price of rice sold in international markets.

This measure, which was vital for the stability of the People, must be interpreted in a very clear and responsible

manner by all political agents in this Country, especially by those who insist on using crisis situations, with

consequences that may be dramatic for our population, to gain political influence in a most irresponsible

manner, to discredit this Government and to defend purely partisan interests.

Ladies and Gentlemen,

The Economic Stabilization Fund has achieved its goal

! It has prevented disturbances and popular

demonstrations similar to the ones we have seen in other countries. It has prevented food insecurity and

regulated the prices of rice, cement and other goods, just by showing that this Government would not allow

some more opportunistic traders to make use of speculative inflation to increase prices in our Country. The

existence of the Fund neutralized bad practises in our market!

More than preventing a situation of crisis with unpredictable consequences, this instrument for monitoring price

pressure has achieved its mission of stabilization. Also, as we promised, out of the 240 million approved by this

National Parliament, we have used only the necessary amount for regulating the market, using public monies in

a wise and prudent manner.

This is another sign by this Government that the People can have confidence in our governance. We have used

only 29 million out of this Fund, returning the rest to the Treasury – this shows that

this Government is

rigorous and has budget discipline; that the priority of this Government is to protect the Timorese,

their families and their companies.

Your Excellency the President of the National Parliament Illustrious

Members of Parliament

Despite the international crisis, the Timorese economy is ready to keep on growing. Our 2009 plan relies on a

policy for maximizing expenses that create employment, making use of the policies that have been implemented

since this Government entered into office.

Step by step, we have begun to build solid foundations for the gradual growth of a resilient economy. If we

compare this process to the process of building a house, everyone will agree that if the foundations are not solid,

any stronger rain or wind will quickly bring the house to the ground.

9

vital reforms in sectors that are the basis for good economic growth. Step by step, we have been paving the way

to include Timor-Leste in the ranking of the countries designated as emergent economies. To be more precise:

Firstly,

we have ensured political and social stability

, including the resolution of national security problems

and the introduction of a thorough reform in the sector of defence and security. Security and economic

development are connected, since only with peace, tranquillity and confidence will it be possible to develop the

activities required for the economic, social and political growth of the Country.

Secondly, we have carried out a

series of reforms within the administrative operations of the Government

and of the Civil Service

, as this is a vital component of the formal economy. In order to conduct economic

growth it is necessary to have technical capacity and administrative competence, i.e. productivity,

professionalism, integrity and efficiency in Public Administration. The maximum outcome of this achievement

by the Government is the creation of the Civil Service Commission, which will become operational later this

year.

Thirdly, we have approved and submitted to the National Parliament the

legislation for the creation of the

Anti-Corruption Commission

, which will have a fundamental role to play in improving good governance,

required for the correct mobilization of national resources towards economic growth.

Fourthly,

we have produced a series of legislative documents

that are essential for the development of

Timorese society, from which we can highlight: The Base Law on Education; The Tax Regime Law; a set of

Conventions under CPLP in the area of justice and within the scope of language; the Base Law on Witness

Protection; the Law on Martial Arts; the Law on Authorization in Penal Matters; the Statute of Public Defence;

as well as regimes of adoption; responsibility for minors; parental responsibility exercise; and, particularly

important for the area of Justice, the draft Civil Code already being discussed by the Council of Ministers.

Also being discussed by the Council of Ministers, and to be sent very soon to the Parliament, we have the new

Investment Law and the package of decentralization, which includes a legislation proposal on administrative and

territorial division, a legislation proposal on Local Government and a legislation proposal on Municipal

Elections.

Fifthly,

we have increased investment in the public sector

, financing new constructions, improvements in

public services and public transfer programs. These policies have improved the purchase power of the

population and indirectly benefited the private sector, as well as creating around 31 thousand fulltime jobs in

2008.

10

stability.

Seventhly,

we have increased the agricultural production levels of some important crops

, doubling the

export value of coffee and achieving a 21% increase in the production of rice, as a result of the increase in the

cultivated area and of other measures taken by the Government to enhance agricultural production.

Eighthly, we have improved the

financial management processes and systems, and increased

significantly the budget execution rate

! The total budgeted for 2008, already including the rectification, was

548.3 million, excluding the Economic Stabilization Fund. From this amount, 365.1 million have already been

spent.

We must also consider the 29 million executed in the Economic Stabilization Fund and the

69.5 million as carryovers, adding up to 463.6 million, which were injected into our economy.

Illustrious Members of Parliament,

These figures speak for themselves! Our Government, in its first year of work, in 2008, within a process of

reforms and needing to solve countless social problems,

has managed to increase budget execution by

257%, comparing with the best execution in the past, which was 180 million in cash, in fiscal year

2006/7.

Ninthly,

we have carried out a financial reform to act according to the Law, respecting the best public

finance management practises

. Thus, since 1 January 2009 no State institution will be authorized to carry

funds over from previous year appropriations. Only during the present year, for purposes of adjustment and

adaptation to this new practise, will State institutions be allowed to pay capital development and minor capital

projects up to 28 February.

This reform will improve the connections between the State Budget and the actual economic activity, being

more transparent and enabling a better analysis of the economic activity and a better approach in relation to

activity planning.

These are just some examples that enable us to say that

indeed this Government has obtained results

!

Furthermore I must add that these results were obtained in particularly adverse conditions, in a year where most

the energy of this executive was spent in solving problems left to us by previous governments, in a year where

we suffered a most serious attack on our national sovereignty, in a year where foreign economic situations have

once again threatened our stability.

11

“with your very own eyes” the new dynamic that streets, commerce, homes, schools and Universities have

recently acquired. Look at the young people, who are a vital component of our society, and deny, if you can, that

they are more united and closer to each other!

Your Excellency the President of the National Parliament Illustrious Members of Parliament Ladies and

Gentlemen,

We are seeing change! A change of attitudes and behaviours, a change of mentalities and a change of priorities:

the Timorese want stability and national development, and they are all willing to contribute towards it.

One of the reasons that motivated the people to demand this change was the fact that the Timorese could feel

that they were getting poorer every year. We all suspected this reality, but the recent work produced by the

World Bank and the Ministry of Finance on the national poverty index in Timor-Leste has confirmed that we

are poorer now than we were 5 years ago.

Between 2001 and 2007 the percentage of Timorese people living in poverty increased from 36.3% to 49.9% of

the overall population, meaning that over 200 thousand people were thrown below the poverty line, thus

increasing the number of poor people to half a million.

This sad legacy left to us by previous Governments is due to the lack of application of actual measures towards

economic development. Previous governments have simply failed in managing the economy and providing

opportunities for our People.

Therefore this Government has the moral duty to change the situation of poverty in which it found the Country.

A Country where half the population lives with less than 88 cents a day, and where half of these people are

children, suffering from hunger and malnutrition,

requires a Government that will work “day and night” to

change this situation

!

And this, Illustrious Members of Parliament, is what this Government has been doing. Thus I ask those who

were responsible for the situation in which they left the Country to, at least now, show some respect for our

work! For the good of the poor, for the good of democracy, for the good of the Country!

Between 2002 and 2006 there was a negative growth, even though oil revenues increased. In opposition to this,

the IMF estimates a growth of 8% in 2007 and a growth of 10% in 2008.

12

and reducing poverty, as well as improving education and health systems.

Our 2009 budget policy is designed to take another step towards setting our foundations, thus enabling

economic growth, i.e. the development of basic infrastructures, as without infrastructures there can be no

development of the production sector, no increase in the Country’s competitiveness, and no increase in non-oil

revenues to free us from the dependence on our natural wealth for funding the State Budget.

With this 2009 budget, we want to achieve a real growth up to 10%

. Still, we do not want to leave it at that,

we have the vision and the strategy to grow even more, and this is the right time to make the decisions that will

enable us to achieve this.

Your Excellency the President of the National Parliament Illustrious

Members of Parliament

Ladies and Gentlemen,

The total expenditure by the State of Timor-Leste in 2009 is estimated at

$680.873 million

, with the total

non-oil revenues being estimated at

91.1 million

. The tax deficit is therefore

589.828 million

, which must be met through the Petroleum Fund.

As the sustainable income is estimated at

407.8 million

, the Government proposes to withdraw an amount

exceeding the Sustainable Income of the Petroleum Fund by

181.2 million

, in order to meet the tax deficit.

Illustrious Members of Parliament, the Government, like you, recognizes the extreme importance of the

Petroleum Fund as a source of wealth for our future generations. However, it also recognizes that our Country

cannot rely forever on this Fund to meet public expenses – on the contrary, we know that the only way to

overcome a stagnated economy that depends exclusively from the petroleum sector is to invest in other

products with potential to be exported, so as to level our trade balance, i.e. increase our exports in view of our

imports.

Yet, this cannot happen without public investment! Nothing will happen without the audacity and vision to

invest immediately in potential economic development areas, namely infrastructures, agriculture and fisheries,

tourism, education and professional training.

13

year.

In order to contribute to this reflection, I would like to mention the following items:

Firstly, we have already demonstrated here the historical improvement in our budget execution, which is

undoubtedly something that gives us confidence to choose the path towards development;

Secondly, despite having spent a relatively large amount in 2008, the assets of the Petroleum Fund went from

about 1.6 billion dollars in August 2007 to 4.2 billion dollars in December 2008. It is estimated that the Fund

will continue to increase gradually in the medium term, adding up to 5.4 billion dollars by the end of 2009.

Although oil prices have been going down every day, this budget was calculated, as always, according to prudent

assumptions and reflecting international best practises, taking into consideration the volatility of oil prices. For

the period from 2009 to 2013 the calculations in terms of petroleum wealth and sustainable income are based on

a steady nominal oil price of USD 60 per barrel, therefore USD 10 per barrel below the prices used in the New

York Market Exchange for the period between December 2008 and December 2013.

This approach should be a sufficient guarantee against the overestimation of future revenues, in conformity with

the prudence requirements of the Petroleum Fund Law.

Thirdly, at present there is only one operational field in the Joint Petroleum Development Area, namely the

Bayu-Undan field, which is still in its initial production stage and which will generate revenues at least until 2023,

with these revenues being calculated under the low production scenario. However the calculation of petroleum

wealth also takes into consideration expected future revenues from petroleum resources still in the sea bed of

Timor Sea.

New and potential sources have been discovered in the Joint Area and in the area close to the sea of

Timor-Leste. Kitan, which was recently discovered, was declared to be commercially feasible by ENI, and should start

in 2010 – this field’s revenues may soon be included in the calculation of Petroleum Wealth, thereby increasing

even more the estimate balance of the Petroleum Fund. Also, in relation to the Greater Sunrise field, the

Government is seriously considering the option of bringing the pipeline and the Liquefied Gas plant into

Timor-Leste, and when this happens the additional revenues from the operations will flow into the Petroleum

Fund.

14

spent. Fourthly, the detail of the Annual Action Plans contained in this budget shows clearly the activities

sought by the Government, the consideration of the main priorities for the Country and the manner in which

the 2009 Plan is drafted, including investment in the productive sectors, without neglecting essential issues in

our society, such as gender equality, social inclusiveness – especially by young people – and the fight against

regional asymmetries.

I would also like to stress that we have already drafted the State of the Nation Report and we have begun to

draft the National Development Strategic Plan.

I am aware that we have not met the timings desired by the Illustrious Members of Parliament, but you must

understand that a plan such as this, in a Country with so many priorities, cannot be improvised! This Plan must

be coherent and duly considered, analysing all factors in detail, so that its implementation is a reality and not just

the completion of a requirement. In other words, we do not want to come here with a “fancy document” void

of content, but rather with a document that makes the difference for the Country, and this means it will have to

be executable!

Lastly, I would also like to say that the additional withdrawal from the Petroleum Fund is clearly justified by the

long term interests of Timor-Leste and of its citizens. We are investing in our agricultural and rural sectors,

developing our human resources base, establishing operation systems that encourage the development of private

sector, developing an integrated infrastructure plan (Timorese infrastructures are among the poorest in the

world) that includes the supply of power throughout the entire Country in the mid term, the improvement of

telecommunications, and the development of our ports, airports, roads, sewage and drinkable water distribution

systems.

Without these infrastructures, any agricultural, industrial or business development policy cannot succeed. What

is more, education and health cannot be provided as the People requested in the document Vision 2020 without

proper infrastructural support.

Evidently, if when this Government entered into office it had already found an Infrastructure Development

Plan ready to be implemented, and if the Country had already a minimum system of basic infrastructure, we

would not need to be here today justifying the need to use our natural resources on this structural project for

our Nation. Furthermore, everyone knows that public investment in infrastructures has shown to be, in all

countries in the world, an important engine for growth and employment creation. It is an expensive investment,

but one that is known to be profitable for future generations.

15

by the international community or, ultimately, by some kind of miracle.

Timor-Leste is a sovereign Country that is entitled to use its own resources, provided it does so in a balanced

and prudent manner. This is precisely what we are doing!

Your Excellency the President of the National Parliament Illustrious Members of Parliament Ladies and

Gentlemen,

The presentation of the State General Budget covers a combined sources budget that results from the

articulation with Development Partners in the obtaining of this information, and which for the first time also

covers information district by district concerning the sums to be invested in each one.

At this time, I would like to highlight the fact that the Government estimates to invest, outside of Dili, around:

28 million in pensions for National Liberation Fighters, elderly persons and vulnerable groups;

26 million for paying wages to staff members;

50.5 million in new projects identified specifically in the districts;

3.14 million in local and suco administration;

3.34 million in school grants (including school meals) to benefit students; and

1.7 million in other grants in the areas of arts, sport and alternative energy sources;

These are measures for combating poverty in rural areas, including greater support to agricultural initiatives

through more and better infrastructures, seeds, fertilizers and equipments for enhancing productivity. This

policy follows measures already implemented in 2008, such as the decentralization of services to farmers,

materialized in the construction of 8 Regional Centres and in the absolute priority of the purchase of their stocks

by the Government, in detriment of importing goods.

Also, at district level, we will be implementing 3 Regional Health Centres to provide decentralized education

services, 5 new Professional Training and Employment Regional Offices, 8 Notary Offices to provide civil

registration services, as well as new initiatives in terms of Integrated Health Services. Furthermore we will be

building new Maternities, 3 Community Health Centres and 14 new Health Posts, along with lodging. These

measures are associated with the establishment of Local Government, through the establishment of

district-elected Municipal Assemblies.

16

With all these projects, we expect to create over 26 thousand jobs!

Ladies and Gentlemen,

Public investment in human capital is an essential condition for national development

. Therefore, in

addition to sector-crossing institutional capacity building actions, the 2009 budget considers the attribution of

public grants of around 2 million towards activities directed specifically to young people, within the scope of the

Secretary of State for Youth and Sport, as well as the attribution of Scholarships in the amount of 1 million to

Timorese persons, to study in the area of natural resources.

Within the scope of the Secretary of State of Professional Training and Employment, we will be starting 4 new

transfer programs in the amount of $2.55 million, throughout four years, including the Temporary Labour

Program, which will employ and qualify around 6,900 young people (50% women), support the National Centre

of Professional Training in Tibar and other Professional Centres, as well as train around 3,000 persons in

Korean language, so that they can access to foreign labour market.

In the area of education, the implementation of the Base Law on Education, together with the construction and

rehabilitation of schools and universities and with the capacity building of teachers in several areas, will

contribute to create a workforce better prepared and qualified to play a relevant role in the development of the

Country.

Other vital sectors for national development will be covered by training and professional capacity building

programs, either directly through public investment or through international partnerships, such as tourism,

trade, industry, companies, primary sector, security and justice.

In relation to the sector of justice, I would like to underline that 2009 will see the start of the capacity building

for the police in terms of criminal investigation, as well as the training of Timorese staff in order to set up a

Chamber of Accounts, which is a fundamental step for verifying the legality of public expenses and the

judgement of State accounts, in conformity with the Constitution of the Republic.

Lastly, because we consider that investing in human capital is first and foremost investing in the people who are

the starting engine of the economy, from 2009 on we will be paying special attention to civil servants, namely

those who manage and administrate public investment.

This is achieved through the Civil Service Commission, which I have already mentioned today, but also through

training and institutional capacity building programs, and just as important through reforms in terms of their

wages, which will contribute towards greater motivation, greater commitment and greater accountability.

17

their tasks with greater efficiency and greater professionalism.

The increase in salaries and wages, which go from a total of 58.9 million in 2008 to 93.1 million in 2009,

according to the implementation of new Career Regimes, is a measure that seeks to benefit these staff members

according to their merits, and consequently benefit every citizen of Timor-Leste.

Still, I must underline the responsibility that is given to them. Civil servants, presently rewarded for their service

to the Nation as administrative officers or managers, as security and defence officers, as holders of public

offices, as health professionals, as teachers – are responsible for improving the living conditions of all Timorese.

They must be aware of this responsibility and they must bring credit to their profession!

Ladies and Gentlemen,

2009 will be the year of decision in relation to infrastructure projects. This will entail the drafting of a project

development and implementation plan covering roads, bridges, ports, airports, dams, electricity and basic

sanitation.

A stable and regular supply of electricity is vital for developing industry and improving the lives of the

Timorese

.

Timor-Leste will build two power plants, with staged schedules for completion. It is estimated that by late 2009

all districts will have power 24/7, and that by late 2010 this will be extended to all sub-districts.

Furthermore, ten transforming stations will be built in the Country, namely in Dili, Baucau, Liquica, Manatuto,

LosPalos, Viqueque, Same, Maliana, Suai and Bobonaro. A total 630 kilometres of overhead power lines will

also enable national distribution.

In addition to enabling the development of many other employment-generating sectors, this project will in itself

create over 20 thousand jobs already in 2009.

This electricity project will not be an isolated project, but rather part of a broader strategy to be presented during

2009 and that will include surveys and feasibility studies for the implementation of projects, along with the

socialization and establishment of financial, technical and legal mechanisms, in order to start the projects

considered as top priority.

18

acquisition of patrol boats for maritime security and the improvement of border security posts, among other

projects.

Ladies and Gentlemen,

This year is marked by the celebration of the 10

thanniversary of the Referendum, where the Timorese have

voted for National Sovereignty and Independence! In average, ten years is the time that countries with a history

similar to ours take to emerge from post-conflict situations.

If we can now manage to put the Country on the right track, with national stability and unity, moving towards

development, we can move away definitively from a gloomy setting of conflict and poverty.

This can only be achieved through strategic policies that conciliate short term needs with medium and long term

needs. This will require work and willingness by all Timorese people.

Therefore we thank the Illustrious Members of Parliament for their constructive contributions, making this draft

2009 Budget Plan a turning point in the fight against poverty in its various aspects, as well as putting

Timor-Leste on the path towards sustainable development.

I count on your dedication, cooperation and energy to meet this vital NATIONAL CHALLENGE

!

19

Part 2 Executive Summary

The Combined Sources Budget

The Combined Sources Budget for 2009 is estimated to be $902 million, this is made up of $681m in State Budget

expenditure, and an estimated $221m in spending by Timor Leste’s development partners. Funds from development

partners exclude the cost of the security services provided by the International Stablisation Force (ISF) and the United

Nations Police (UNPOL). Tables 2.1 and 2.2 provide a summary of the combined sources budget from the Transition

period 2008 to 2012.

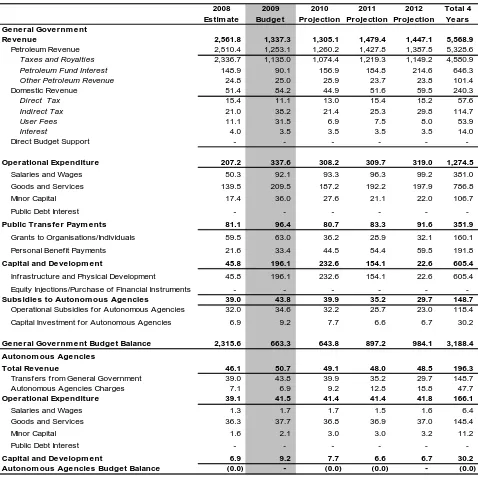

Table 2.1

Combined Sources Budget 2008 to 2012 ($m)

2008

Estim ate 2009 Budget

2010 Projection

2011 Projection

2012 Projection

Total 4 Years

Revenue 242 312 177 143 138 770

Domestic Revenue 51 84 45 52 60 240

Direct Budget Support - - - - - -Autonomous Agency Revenue 7 7 9 13 36 65

Confirmed Donor Funding 184 221 123 79 42 465

Expenses 564 902 793 674 524 2,893 Recurrent Expenditure 494 679 544 502 491 2,215 State Budget Funding 327 476 430 434 452 1,792 Confirmed Donor Funding 167 203 113 68 39 423

Capital Expenditure 70 223 250 171 33 677

State Budget Funding 53 205 240 161 29 636

Confirmed Capital Funding 17 18 9 11 3 42

Financing Transfer f rom the Petroleum Fund 396 589 - - - 589

Existing Cash Reserves 74 (1) - - - (1)

Table 2.2

Financing of the Combined Sources Budget 2008 to 2012 ($m)

2008 Estim ate 2009 Budget 2010 Projection 2011 Projection 2012 Projection Total 4 years Total State Revenue 2,569 1,344 1,314 1,492 1,466 5,617 Total State Expenditure 380 681 671 595 482 1,441 Fiscal Balance 2,189 663 644 897 984 4,176 Non Petroleum Fiscal Balance (392) (625) (616) (531) (403) (2,176) Conf irmed Funding f rom Development Partners 184 221 123 79 42 465 Total Combined Sources Spending 564 902 793 674 524 1,905Over the period 2009 to 2012, a total of $465 million will be provided from external sources to support the Government

sector and its core activities.

20

The Economy

The Timorese domestic economy is poised for continued growth despite difficult conditions elsewhere in the world.

Through improvements in budget execution, public sector spending will continue to provide a strong stimulus to overall

demand. Moreover, as the composition of public sector expenditure shifts towards much needed infrastructure

development, each dollar of public spending will have a greater impact, with more jobs being created and acting as a

lever for attracting complementary private investment and activity. Given the size and composition of the budget, it is

expected that non-oil GDP will continue to grow by 10% in real terms during 2009. This follows an estimated growth

rate of 8% in 2007 as the economy recovered from the 2006 crisis.

The increase in public sector expenditure has funded new construction, improvements in public services, and transfer

programs that have raised the purchasing power of the population. Indirectly, by raising demand, public sector

expenditures also helped support strong growth in the private sector. There are strong anecdotal signs that investors

have been further buoyed by the improved security environment. Going forward, the mid-2008 reform program that

reduced direct and indirect taxes and import duties should provide additional incentives for future private sector

growth.

The agricultural sector has benefited from favourable weather conditions and an increase in the area under cultivation

and harvest. As a result, production levels are up markedly for some key crops. Coffee exports in the first nine months

of 2008 reached almost 14 thousand tons, double the amount of previous years. Rice production during the 2007-08

season grew by 21% from the previous year. The increase in production has mainly resulted from an increase in the

actual harvest area. In 2007-08 40,577 hectares were harvested for a production of 67 thousand tonnes of paddy

compared to 31,386 hectares harvested in 2006-07 for 55 thousand tonnes of paddy. Further increases in production

are expected in 2009, as measures to boost agricultural activity undertaken by the Government in 2008, such as the

regional agricultural centres and improved mechanisation, begin to be utilised and result in improved productivity.

Consumer prices rose by 9.1% in the year to September 2008, more than double the rate in 2004-2006 but down from

a peak of over 10% in June 2008. Most of the rise in inflation over the past two years can be attributed to higher food

and fuel prices, which have been affecting countries around the world.

High domestic inflation has been a concern but now appears to be abating. The price of rice and other commodities

has now come down in international markets and this should help moderate inflationary pressures going forward.

Moreover, Timor-Leste’s consumers will benefit in the short term from the recent appreciation of the USD against the

currencies of those nations from which Timor-Leste sources its imports.

Up to 2007, Timor-Leste had yet to experience progress in poverty alleviation and in the achievement of the

Millennium Development Goals (MDGs). The 2007 Timor-Leste Survey of Living Standards (TLSLS) conducted by the

National Directorate of Statistics and the World Bank shows that approximately 50% of the population lives below the

poverty line. That is a significant increase from the 36% of the population estimated to have been below the poverty

line in 2001.

The TLSLS finds that the increase in poverty has been entirely due to a decline in average consumption per capita

from $42 per month to $31 per month, a 26% fall).

21

Revenue, Sustainable Income and the Petroleum Fund

2008 is expected to be a very good year in terms of total revenue due to the unexpected increase in oil revenues

resulting from the increased price of oil. Given the recent sharp decline in oil price, total petroleum revenue for 2009

is expected to fall by $1,257 million relative to the high levels of estimated revenue collections in 2008 Total

petroleum revenue is estimated to fall from an estimated total of $2,510 million in 2008 to $1,253 million in 2009. Non

petroleum revenue is estimated to increase from an estimated total of $59 million in 2008 to $96 million in 2009.

Table 2.3

Total Revenue 2008 to 2012 ($m)

2008

Estimated Petroleum Revenue and Sustainable Income 2007-2012 ($m)

2008 Sustainable Revenue 396.0 407.8 401 401 400 Actual Widthdraw al f rom Petroleum Fund 396.0 589.0 401 401 400 Financing Requirement Cash Deficit 391.6 625.2 616 531 403Table 2.5

Estimated Balances of the Petroleum Fund 2008 to 2012 ($m)

2007General Budget of the State for Timor-Leste

22

The Government has for the first time in the 2009 State Budget published information on the budgetary impact of its

activities by District.

Outside of Dili the Government estimates that it will be:

•

providing $28.1 million in pensions to the aged and vulnerable, and former combatants in the struggle for

liberation;

•

spending approximately $25.7 million making payments to employees;

•

investing approximately $50.5 million in new projects specifically identified in the districts; and

•

providing approximately $6.9 million in public grants to sucos and primary schools in the districts outside of Dili,

•

Chart 2.1 illustrates the distribution by district on a per capita Basis of direct Government spending.

Chart 2.1

Government Spending in the Districts on a Per Capita Basis

Table 2.6

Budget of the State Whole of State Aggregate Figures 2008 to 2012 ($m)

2008 Es tim ate

2009 Budget

2010 Projection

2010 Proje ction

2011 Projection

Total 4 ye ars

Total Expe nditure 380 681 664 588 475 2408

Salary & Wages 52 93 95 98 101 387

Good & Services 176 248 224 229 235 936

Minor Capital 19 38 31 24 25 118

Public Transfers 81 96 81 83 92 352

Public Debt Interest 0 0 0 0 0 0

Capital Development 53 205 234 154 23 616

Salaries

Major reforms with implications for public sector salaries and wages were completed in 2008. This has resulted in a

total salary budget of $93 million in 2009. The reforms include:

•

implementation of the new career regime for civil servants;

23

•

implementation of new remuneration system for defence and security forces;

•

reform of salaries for holders of public office;

•

introduction of allowances for health professionals;

•

re-categorisation of allowances previously included within goods and services such as overseas living allowance

for diplomats (note – this increase in salaries is offset by a decrease in the goods and services category);

•

payment of teachers of non government schools;

•

introduction of new institutions; and

•

additional staff being employed in existing Ministries and Institutions.

Goods and Services

A total of $248 million has been provided for goods and services budgeted for 2009. Major items in the goods and

services budget include:

•

long term food security;

•

fuel to subsidise power generation;

•

costs associated with the operations of the PNTL and FFDTL;

•

costs associated with school materials and consumables;

•

payment of Government Tax Liabilities;

•

payments for Cuban Health Professionals; and

•

general running costs of the State.

Public Transfers

The Government will be making over $96 million in public transfer payments during 2009. These include public grants

of $63 million which include the finalisation of the payments to IDP’s and $33 million for pensions and subsidies to:

•

former holders of public office and former members of government;

•

the aged and the vulnerable; and

24

Capital Expenditure

As 2008 marked the beginning of a period of stabilisation and initial reform of public institutions so 2009 marks the

beginning of a period in which Timor-Leste will begin to invest in the infrastructure needed to ensure the future

prosperity of the nation.

Currently, Timor-Leste lacks basic infrastructure in all sectors. Roads are inadequate and crumbling, water both for

human consumption and agriculture is often in short supply, reliable sanitation is rare, communications by air and sea

are inadequately served, telecommunications are patchy and costly and electricity remains a distant dream for many

Timorese whilst many of the rest suffer from intermittent and unreliable power.

25

Table 2.7

General Budget of the State Timor-Leste 2008 to 2012 ($m)

2008 Estim ate

2009 Budget

2010 Projection

2011 Projection

2012 Projection

Total 4 Years General Governm ent

Revenue 2,561.8 1,337.3 1,305.1 1,479.4 1,447.1 5,568.9

Petroleum Revenue 2,510.4 1,253.1 1,260.2 1,427.8 1,387.5 5,328.6

Taxes and Royalties 2,336.7 1,138.0 1,074.4 1,219.3 1,149.2 4,580.9

Petroleum Fund Interest 148.9 90.1 156.9 184.8 214.6 646.3

Other Petroleum Revenue 24.8 25.0 28.9 23.7 23.8 101.4 Domestic Revenue 51.4 84.2 44.9 51.6 59.5 240.3

Direct Tax 15.4 11.1 13.0 15.4 18.2 57.6

Indirect Tax 21.0 38.2 21.4 25.3 29.8 114.7

User Fees 11.1 31.5 6.9 7.5 8.0 53.9

Interest 4.0 3.5 3.5 3.5 3.5 14.0 Direct Budget Support - - - - -

-Operational Expenditure 207.2 337.6 308.2 309.7 319.0 1,274.5

Salaries and Wages 50.3 92.1 93.3 96.3 99.2 381.0 Goods and Services 139.5 209.5 187.2 192.2 197.9 786.8 Minor Capital 17.4 36.0 27.6 21.1 22.0 106.7 Public Debt Interest - - - - -

-Public Transfer Paym ents 81.1 96.4 80.7 83.3 91.6 351.9

Grants to Organisations/Individuals 59.5 63.0 36.2 28.9 32.1 160.1 Personal Benef it Payments 21.6 33.4 44.5 54.4 59.5 191.8

Capital and Developm ent 45.8 196.1 232.6 154.1 22.6 605.4

Infrastructure and Physical Development 45.8 196.1 232.6 154.1 22.6 605.4 Equity Injections/Purchase of Financial Instruments - - - - -

-Subsidies to Autonom ous Agencies 39.0 43.8 39.9 35.2 29.7 148.7

Operational Subsidies f or Autonomous Agencies 32.0 34.6 32.2 28.7 23.0 118.4 Capital Investment for Autonomous Agencies 6.9 9.2 7.7 6.6 6.7 30.2

General Governm ent Budget Balance 2,315.6 663.3 643.8 897.2 984.1 3,188.4 Autonom ous Agencies

Total Revenue 46.1 50.7 49.1 48.0 48.5 196.3

Transf ers from General Government 39.0 43.8 39.9 35.2 29.7 148.7 Autonomous Agencies Charges 7.1 6.9 9.2 12.8 18.8 47.7

Operational Expenditure 39.1 41.5 41.4 41.4 41.8 166.1

Salaries and Wages 1.3 1.7 1.7 1.5 1.6 6.4 Goods and Services 36.3 37.7 36.8 36.9 37.0 148.4 Minor Capital 1.6 2.1 3.0 3.0 3.2 11.2 Public Debt Interest - - - - -

26

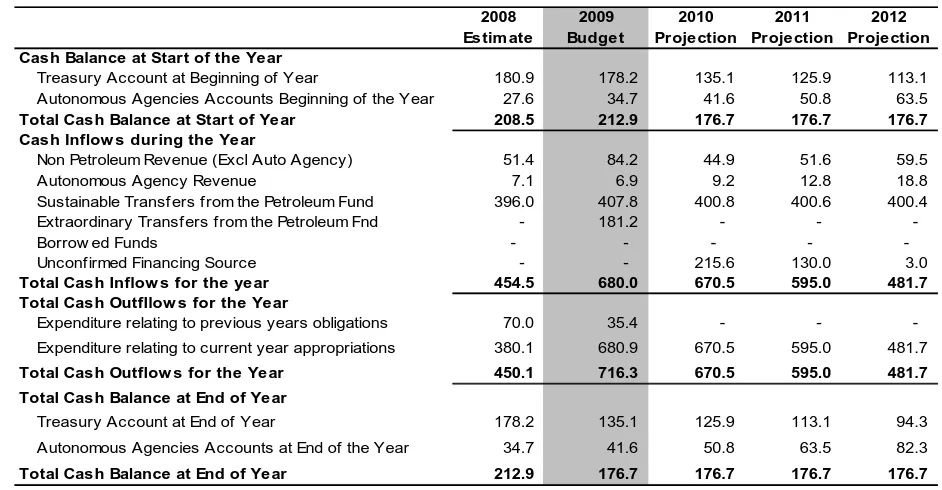

Table 2.8

Estimated Cash Flows for the State Timor-Leste 2008 to 2012 ($m)

2008 Estim ate

2009 Budget

2010 Projection

2011 Projection

2012 Projection Cash Balance at Start of the Year

Treasury Account at Beginning of Year 180.9 178.2 135.1 125.9 113.1 Autonomous Agencies Accounts Beginning of the Year 27.6 34.7 41.6 50.8 63.5

Total Cash Balance at Start of Year 208.5 212.9 176.7 176.7 176.7 Cash Inflow s during the Year

Non Petroleum Revenue (Excl Auto Agency) 51.4 84.2 44.9 51.6 59.5 Autonomous Agency Revenue 7.1 6.9 9.2 12.8 18.8 Sustainable Transf ers from the Petroleum Fund 396.0 407.8 400.8 400.6 400.4 Extraordinary Transf ers from the Petroleum Fnd - 181.2 - - -Borrow ed Funds - - - - -Unconf irmed Financing Source - - 215.6 130.0 3.0

Total Cash Inflow s for the year 454.5 680.0 670.5 595.0 481.7 Total Cash Outfllow s for the Year

Expenditure relating to previous years obligations 70.0 35.4 - - -Expenditure relating to current year appropriations 380.1 680.9 670.5 595.0 481.7

Total Cash Outflow s for the Year 450.1 716.3 670.5 595.0 481.7 Total Cash Balance at End of Year

Treasury Account at End of Year 178.2 135.1 125.9 113.1 94.3 Autonomous Agencies Accounts at End of the Year 34.7 41.6 50.8 63.5 82.3

Total Cash Balance at End of Year 212.9 176.7 176.7 176.7 176.7

Table 2.9

Financing of the General Budget of the State Timor-Leste 2008 to 2012 ($m)

2007 Actual

2008 Estim ate

2009 Budget

2010 Projection

2011 Projection

2012 Projection

Total 4 Years Total Petroleum Revenue 707.2 2,561.8 1,337.3 1,305.1 1,479.4 1,447.1 5,616.5 Total Non Petroleum Revenue 40.9 58.5 91.0 54.1 64.4 78.3 287.9 Total Cash Expenditure (Incl Prev Yrs Liabilities) - 450.1 716.3 670.5 595.0 481.7 1,440.6 Fiscal balances

Whole of State Fiscal Balance 707.2 2,111.7 621.0 634.6 884.4 965.3 3,105.3 Whole of State Fiscal Balance Non Petroleum 40.9 (391.6) (625.2) (616.4) (530.6) (403.4) (2,175.7)

Total Financing Requirem ent (40.9) 391.6 625.2 616.4 530.6 403.4 2,175.7

Cash Required from the Petroleum Fund (40.9) 396.0 589.0 - - -Financing from Borrow ings - - - - - -Financing from Existing Cash Balances - (4.4) 36.2 - -

-Financial Position of the Governm ent