Two-stage newsboy problem for healthcare products and medical

devices with channel integration

Hui-Ming Wee a

Department of Industrial & Systems Engineering, Chung Yuan Christian University, Chungli 32023, Taiwan, ROC.

Joshua Chin Yee-Whah

School of Social Sciences, Universiti Sains Malaysia 11800 Penang, Malaysia

Tsai-Chi Kuo a

Department of Industrial & Systems Engineering, Chung Yuan Christian University, Chungli 32023, Taiwan, ROC.

Yugowati Praharsi

Department of Information Technology,

Satya Wacana Christian University, Salatiga 50711, Indonesia

Abstract

In this study, we consider a two-stage newsboy problem for healthcare products and

medical devices with channel integration. The risk of demand uncertainty is reduced

when both parties consider revenue sharing and return policies. This paper considers

channel integration strategy by manufacture and retailer with joint decision. This will

reduce bullwhip effect and demand uncertainty. The objective is to maximize the profit

of the manufacturer and retailer. A numerical example and sensitivity analysis are

provided to illustrate the theory.

1. Introduction

In recent years, healthcare products and medical devices supply chain are facing

increasing challenges due to demand uncertainty and business competitions. These

conditions may result in overstocking or shortage for the supply chain players; and it

will affect the profit of the whole supply chain. In the long run, the manufacturer and

the retailer supply/demand chains will lose their competitiveness. In viewed of this,

strategic cooperation by equitable sharing contract can be achieved through a win-win

integration strategy for the manufacturer and the retailer. It can reduce bullwhip effect

and lead to an increase in the overall supply chain profit. In this study, an optimal

decision using the integrated strategy reveals the differences between a centralized and a

decentralized decision making. Two contract strategies such as revenue sharing and

return policy are considered. Revenue sharing strategy means the supplier motivates the

retailer to increase his order quantity with preferential price; the retailer in turns will

share a certain percentage of the profit to the supplier. Because of uncertain demand,

shortage/overstocking may incur when the demand is greater/less than the order quantity.

In the supply chain partnership, the manufacturer and the retailer share both their

shortage cost as well as their revenues. A return policy is contracted to reduce the cost

of overstocking. In this research, we develop an integrated strategy for stochastic

demand environments.

In section two, we show the motivation and literature review. Section three presents a

basic model of a single manufacturer and a single retailer newsboy problem under

integrated decision environments. Sensitivity analysis and comparisons of results are

shown in Section four, and concluding remarks are given in Section five. The analysis in

achieve a win-win strategy.

2. Literature review

Return policy or buy back contract is widely used for short life cycle products.

When the product demand declines, the manufacturer would provide the retailer a return

mechanism for unsold goods. This is especially necessary for healthcare products such

as drugs which have expired dates. The policy reduces the retailers' cost of overstocking

and the risk of under-stocking, thus achieve risk pooling. Yao et al. [1] used Stackelberg game to establish return policy model under uncertain demand and price dependency.

Qin and Yang [2] discussed an optimal decision making model of profit maximization

from different viewpoints. They proposed a part of manufacturing cost paid by the

retailer at discount price. He et al. [3] discussed the relationship between demand and sale price in revenue sharing, return policy and supplier-retailer partnership strategy.

The other strategy to optimize supply chain profit is revenue sharing contract.

There are many intensive researches to analyze the benefit of revenue sharing contract

in the supply chain. Wang et al. [4] analyzed the performance of the supplier and the retailer under consignment contract with revenue sharing. Giannoccaro and

Pontrandolfo [5] developed a supply chain contract model based on revenue sharing

mechanism in a three-stage supply chain. Chauhan and Proth [6] proposed an approach

to maximize provider and retailer profits by using revenue sharing mechanism. Hou et al. [7] developed a coordination model between one supplier and one retailer under revenue sharing and bargaining. However, this cooperation is difficult to realize since

each player wants to optimize his own profit. A win-win strategy is therefore necessary.

Supply chain management for healthcare and medical devices is important as they

Our study investigates its significant and ways to improve the existing system. The

operations management theory and methodologies together with information technology

can provide flexible and robust mechanism that could drives the industry to function

more orderly. Kuo and Shen [8] made a review on the development of lean healthcare,

and King et al. [9] discussed the application of lean thinking to health care in emergency

department. Acharyulu and Shekhar [10] did an empirical study in India on the role of

value chain strategy in healthcare supply chain management. Callender and Grasman,

[11] studied the barriers and best practices for material management in the healthcare

sector. Mustaffa and Potter [12] developed a case study on the healthcare supply chain

management in Malaysia.

Price is the most significant factor in purchasing behavior from the downstream to

the upstream of a supply chain. Researches on stochastic demand have been conducted

extensively. Emmons and Gilbert [13] discussed the optimal ordering, pricing and return

policy with uncertain demand. Petruzzi and Dada [14] explored the newsboy problems

and developed a two-level newsboy inventory and pricing model. Lau and Lau [15]

discussed how to reduced uncertainty and resolved the newsboy problem with uncertain

demand. Taylor [16] suggested that the manufacturers should compare different data of

demands to coordinate the supply chain. Granot and Yin [17] suggested the

manufacturer can focus on the wholesale price and the retailer can focus on pricing and

ordering method in newsboy model with uncertain demands.

From our literature research, there was no research that analyzes the integrated

strategy for healthcare products and medical devices supply chain using newsboy

problem. This research tries to fill the gap in this area.

Due to the bullwhip effect in a supply chain, uncoordinated chains usually lead to a

higher risk of overstocking or shortages. This study considers profit sharing, shortage

cost sharing, and return policy to develop an integrated strategy model. The assumptions

and parameters are as follows:

(1) All stockouts entails shortage cost.

(2) A single manufacturer and a single retailer are considered.

(3) Delivery is instantaneous.

(4) Demand is uncertain.

(5) The manufacturer production capacity is unlimited

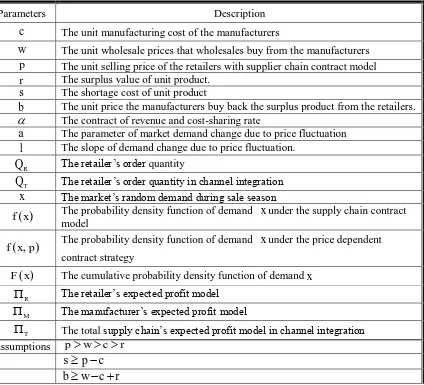

All the parameters used in this study are summarized in Table 1.

---

Table 1 ---

The classical newsboy model is extended for a single-retailer and a

single-manufacturer with one-time ordering. When a transaction occurs, the

manufacturer incurs a manufacturing cost c with a product wholesale price w. The retailer offers a retail price p to its customers. At the end of the selling season, if the demand is greater than the production quantity, a shortage cost, s, is incurred. On the other hand, excessive products resulting in inventory cost of r per unit. The basic assumption is expressed as pwcr, ands pc. The process flow for the model is depicted in the Figure 1 below:

--- Figure 1

---

shortage cost, and surplus value of products. This can be expressed as:

The manufacturer’s total expected profit consists of the retailer’s wholesale revenue and

the manufacturing cost. It can be modeled as: Q

c w M ( )

(3)

The total expected profit for the supply chain can be calculated by summing (2) and (3).

( )

( ) ( ) ( ) ( ) 0Solving the second derivative of (2) and (4) with respect to Q, one has:

0

concave. Thus, the retailer can maximize its individual profits under the optimal order

quantities Q*R and QT*.

The difference between the retailer’s order quantity in the channel integration and his independent order quantity is shown by the following equation:

0

The result in (9) indicates that:

1. The retailer’s order quantity under coordination would be greater than his order

under the non-coordination model; and

2. The retailer’s order quantity for the coordination model leads to higher

manufacturer’s profit than the non-coordination model as shown by the equation

Hence, the manufacturer can encourage the retailer to increase his order quantity

considering profit sharing. An integration policy is presented and discussed in the

subsequent sections.

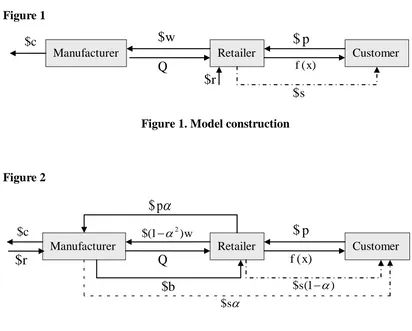

4. Strategic contract model

This study extends the revenue sharing model by Qin and Yang (2008) and considers

the shortage cost sharing and return policy by Leng and Parlar (2010). The channel integration is applied to examine results under different business environments. In the

revenue and shortage cost sharing contract, high sharing rate α of the manufacturer leads

to a preferred wholesale price for the retailer as a feedback mechanism. In the return

policy contract, manufacturers will buy back the entire surplus product with price b. To avoid double profit, the price b follows the condition: bwcr.

We define the following conditions:(0,1]and s(1) where p and s

denotes respectively the sharing rate and shortage cost shared by both players in the

contract. The flow of the contract is shown in Figure 2.

--- Figure 2 ---

The manufacturer adopts shortage cost sharing and buy-back mechanism to

encourage the retailer to co-operate in the revenue sharing contract. Under the cost

sharing contract, the unit shortage cost is the unit product retail price minus the

manufacturing cost plus reputation/goodwill loss (g). The unit shortage cost can be expressed ass pcg, whereg0. Under the revenue sharing contract, when the

'

w to the retailer as a feedback mechanism. The relationship can be expressed as:

w

w'(12) (11)

Similar feedback mechanism has been used by Qin and Yang (2008).

According to the basic assumptions, the manufacturer’s wholesale price is greater than

his manufacturing cost. Thusw'cand

w

Channel integration model

The supply chain's total expected profit is the sum of R and M. It can be

5. Numerical examples and sensitivity analysis

5.1 Numerical examples

Table 2 shows the calculation results. It shows that the retailer’s ordering quantity in

the integrated model is 17.98% higher than the independent model. The total expected

supply chain profit for the integrated model is also 5.84% higher than the independent

model. Substituting the optimal ordering quantity of the integrated model into the

equation (2) and (3), we can derive the retailer and the manufacturer’s expected profit

respectively. The profits for the manufacturer and the retailer deviate from the

independent policy by nearly 18% and -16.7% respectively. In the integrated model, the

difference between the manufacturer and the retailer’s expected profit is 14.91% more

than the independent model. However, the retailer‘s profit is reduced by 16.70%; it is

therefore not in the interest of the retailer to integrate. There is a need to provide some

incentives for the retailer

--- Table 2

---

Since α is a known parameter, substituting it into (19) and (20), one has the optimal

order quantity QT* 224.3589 and the expected profit for the integrated channel T = $ 6,192.3076.

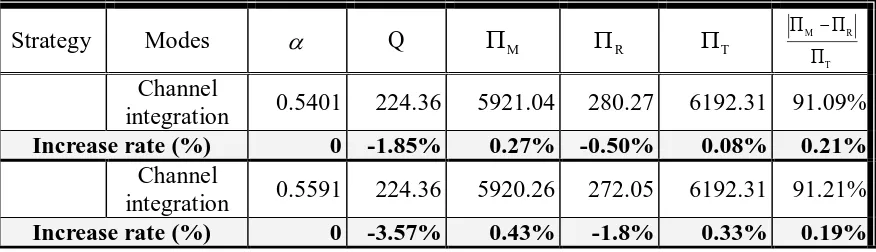

The comparison of the model is summarized in Table 3. The expected retailer’s

profit and the optimal order quantity in the channel coordination are less than without

coordination. The expected manufacturer’s profit in the channel distribution is higher

than coordination. The result supports a common insight that coordination with known

information in a business environment is better than unknown information.

Table 3

---

The summary with/without the contract strategy is shown in Table 5. It shows that

the contract strategy results in a higher profit in all business environments than the

non-contracted strategy. It can be observed that channel integration model can improve

the total expected supply chain profit. If a contract strategy is used for the integrated

channel, with a value of =0.11412, the manufacturer's expected profit and the

retailer's expected profit can effectively be increased by 5.84%. Table 4 shows the

differences between with integration and without integration. The manufacturer

receives more profit in the integration strategy at the expense of the retailer.

---

Table 4 ---

5.2. Sensitivity analysis

The parameters (Ф) are set to be fixed at values Ф = {c=20, w=40, p=70, r=5, s=52,

b=25}. The sensitivity is performed by increasing and decreasing the values of Ф by

-30%, -20%, -10%, 0%, 10%, 20%, and 30%. The correlation and sensitivity analysis of

the parameters are shown in Table 5.

--- Table 5

---

For the channel integration, p and c are the most sensitivity parameters to )

, ( T* * T Q

. When p and c are increased or decreased by 30%, the expected total profit

s, and b are moderately sensitivities to the expected total profit.

From the sensitivity analysis, we find p and c are the most sensitive parameters to )

, ( *R * T Q

in the scenario. It shows that the total profit increase dramatically for

decreasing the unit manufacturing cost of the manufacturers c and increasing the unit selling price of the retailers p. It helps the supply chain members pay more attention to the key parameters to dramatically increase their profits.

6. Conclusions and Future Research

This study discusses a contract strategy under channel integration using a newsboy

model. To depict real life business scenarios, the contract strategy adopts the

revenue/cost sharing, and return policy for collaborative decision-making strategy in a

supply chain. It is found that the total supply chain profit can be increased by the

contract strategy using revenue/cost sharing and return policies. The manufacturer and

retailer’s profit can effectively increase when the supply chain achieves channel

coordination with the contract strategy.

Several possible extensions of this study can be conducted for possible research endeavors. Multi-products can be explored in future research instead of single product.

Multiple-manufacturer or retailers and three-level supply chain model can also be

considered to reflect the global supply chain environment. The buy-back price and

return percentage for the return policy can also be considered as the manufacturer’s

decision variable.

References:

factors on the returns policy in coordination supply chain”, European Journal of Operational Research, 187, 275-282, (2008).

[2] Qin, Z., and J. Yang, “Analysis of a revenue-sharing contracts in supply chain management”, International Journal of Logistics:Research and Applications, 11(1), 17-29, (2008).

[3] He, Y., X. Zhao, L. Zhao, and J. He, “Coordinating a supply chain with effort and price dependent stochastic demand”, Applied Mathematical Modeling, 33, 2777-2790, (2009).

[4] Wang Y., L. Jiang, and Z.J. Shen, “Channel performance under consignment contract with revenue sharing”, Management Science, 50(1), 34 – 47, (2004).

[5] Giannoccaro I., and P. Pontrandolfo, “Supply chain coordination by revenue sharing contracts”, International Journal of Production Economics, 89(2), 131–139, (2004). [6] Chauhan S.S., and J.M. Proth, “Analysis of a supply chain partnership with revenue

sharing”, International Journal of Production Economics, 97(1), 44 – 51, (2005). [7] Hou J., A.Z., Zeng, and L. Zhao, “Achieving better coordination through revenue

sharing and bargaining in a two-stage supply chain”, Computers & Industrial Engineering, 57(1), 383 – 394, (2009).

[8] Kuo, T. and Shen, J.P., The Review and Development of Lean Healthcare, Service Science and Management 服务科学和管理, 2013, 2, 27-31

doi:10.12677/ssem.2013.21005 Published Online February 2013

(http://www.hanspub.org/journal/ssem.html)

[9] King, D. L., D. Iben-Tovim and J. Bassham. Redesigning emergency department

patient flows: Application of lean thinking to health care. Emergency Medicine Australasia, 2006, 18(4): 391-397.

[10] Acharyulu, G.V.R.K. and Shekhar, B. R., Role of Value Chain Strategy in

Healthcare Supply Chain Management: An Empirical Study in India, International Journal of Management, Vol. 29 No. 1 Part 1 Mar 2012, 91-97

[11] Callender, C and Grasman, S. E., Barriers and Best Practices for Material

Management in the Healthcare Sector, Engineering Management Journal Vol. 22 No. 4, December 2010, 11-19.

[12] Mustaffa, N. H. and Potter, A., Healthcare supply chain management in Malaysia: a case study", Supply Chain Management- an international journal, 14, (2009)

[13] Emmons, H. and S.M. Gilbert, “Note. The role of returns policies in pricing and inventory decisions for catalogue goods”, Management Science, 44(2), 276-283, (1998).

[14] Petruzzi, N.C., and M. Dada, “Pricing and the newsvendor problem:A review with extensions”, Operation Research, 47(2), 183-194, (1999).

[15] Lau, A.H.L., and H.S. Lau, “The effects of reducing demand uncertainty in a manufacturer-retailer channel for single-period products”, Computers & Operations Research, 29, 1583-1602, (2002).

[16] Taylor, T.A., “Supply chain coordination under channel rebates with sales effort effects”, Management Science, 48(8), 992-1007, (2002).

newsvendor model with multiplicative and price-dependent demand”, Operations Research, 56(1), 121-139, (2008).

Table 1. The notations of parameters

Parameters Description

c The unit manufacturing cost of the manufacturers

w The unit wholesale prices that wholesales buy from the manufacturers p The unit selling price of the retailers with supplier chain contract model

r The surplus value of unit product.

s The shortage cost of unit product

b The unit price the manufacturers buy back the surplus product from the retailers. The contract of revenue and cost-sharing rate

a The parameter of market demand change due to price fluctuation

l The slope of demand change due to price fluctuation.

R

Q The retailer’s order quantity

T

Q The retailer’s order quantity in channel integration x The market’s random demand during sale season

) (x

f The probability density function of demand xunder the supply chain contract

model

) , (x p

f The probability density function of demand xunder the price dependent

contract strategy

) (x

F The cumulative probability density function of demandx R

The retailer’s expected profit model

M

The manufacturer’s expected profit model

T

The total supply chain’s expected profit model in channel integration Assumptions pwcr

c p s

r c w b

Table 2. The numerical example results

supply chain

type

Q R M T M R

/T

Independent 190.1709 2047.0085 3803.1488 5850.4273 30.01%

Integrated 224.3598 1705.1282 4487.1794 6192.3076 44.92%

decrease

Table 3. Comparison for under the different business decision-making models

Strategy Modes Q M R T

T R M

Channel

integration 0.5401 224.36 5921.04 280.27 6192.31 91.09%

Increase rate (%) 0 -1.85% 0.27% -0.50% 0.08% 0.21%

Channel

integration 0.5591 224.36 5920.26 272.05 6192.31 91.21%

Increase rate (%) 0 -3.57% 0.43% -1.8% 0.33% 0.19%

Table 4. Differences between with contract and without contract

Strategy Models Q M R T

T R M

No-contract Individual 0 190.17 3803.15 2047.09 5850.43 30.47%

Contract Channel integration

0.114

1 224.36 4025.63 2166.68 6192.30 30.02%

Increase rate (%) — 0 5.84 5.84 5.84 -0.45

Table 5. The correlation and sensitivity analysis

Channel integration

Correlative analysis

Positive correlation p、r Negative correlation c、s

Non-Correlation w、b

Sensitivity analysis

High sensitivity p、c Medium sensitivity w、r、s、b

Figure 1

Figure 1. Model construction

Figure 2

Figure 2. The contract flow

Manufacturer Retailer Customer

c

$

p

$

) 1 ( $s

p

$

) (x f

s $

Q

b

$

r

$

w ) 1 $( 2

Manufacturer Retailer Customer

c

$

$

w

s $

p

$

) (x f