AN INVESTIGATION OF THE THEORY OF PLANNED BEHAVIOUR AND THE ROLE OF TAX AMNESTY IN TAX COMPLIANCE - Perbanas Institutional Repository

Teks penuh

Gambar

Dokumen terkait

“He said that he’d seen something in you, and you didn’t disappoint him.” Roxanne lifted her arms straight up.. The rush of air felt glorious on her

Karena berbagai kandungnan minyak dan zat yang ada di dalamnya, jeruk nipis juga dimanfaatkan untuk mengatasi disentri, sembelit, ambeien, haid tak

keadilan umum dan distribusi beban pajak, timbal balik pemerintah, ketentuan ketentuan yang diberlakukan secara khusus, struktur tarif pajak yang lebih disukai,

"The Effect of Religiosity and Tax Socialization on Taxpayer Compliance With Taxpayer. Awareness as an

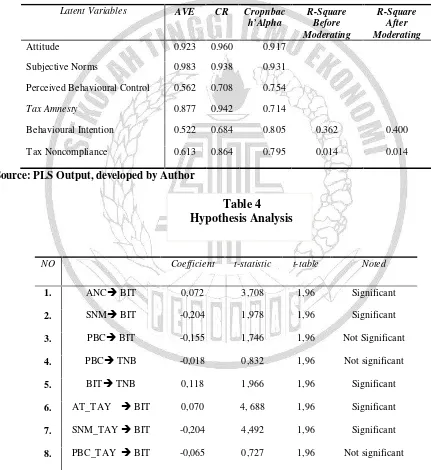

To investigate the effect of consciousness, the sanctions, the attitude of the tax authorities, environment, knowledge of tax regulations influence simultaneously on tax compliance

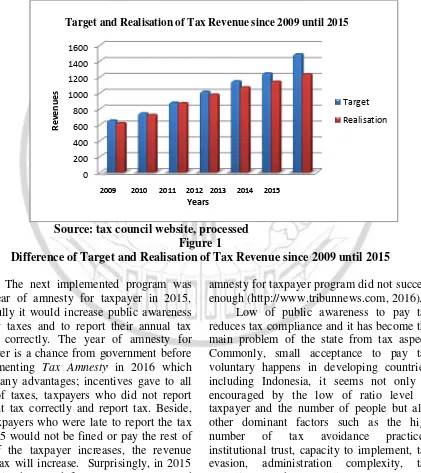

Abstract. Generally Definition of Tax Amnesty is a government policy that is given to taxpayers about tax amnesty, and in exchange for the forgiveness of the taxpayer is required

Attitudes, norms, identity and environmental behaviour: Using an expanded theory of planned behaviour to predict participation in a kerbside recycling programme..

What is the effect of the simultaneous dissemination of taxation information, tax rates, and tax sanctions on individual taxpayers' annual tax return reporting compliance at