Today we estimate JCI to be bearish with the support range of 5961-5966 and

Teks penuh

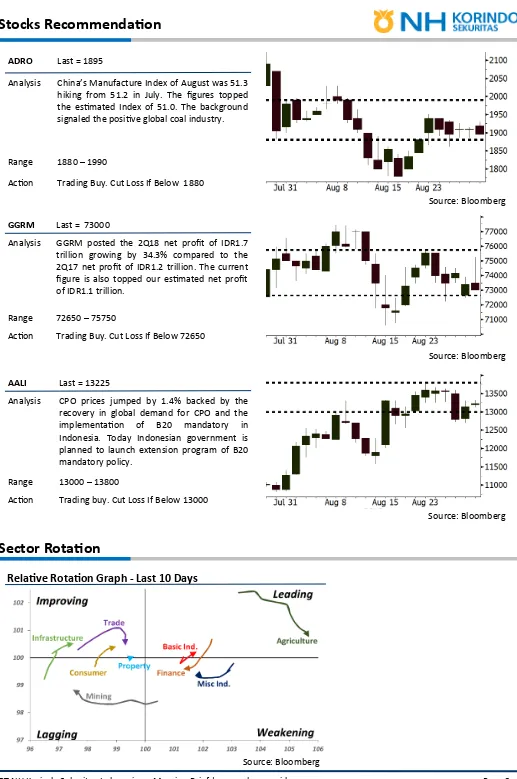

Gambar

Dokumen terkait

PT NH Korindo Sekuritas Indonesia, its affiliated companies, respective employees, and agents disclaim any responsibility and liability for claims, proceedings,

Neither is PT NH Korindo Sekuritas Indonesia, its affiliated companies, employees, nor agents are liable for errors, omissions, misstatements, negligence, inaccuracy contained

PT NH Korindo Sekuritas Indonesia, its affiliated companies, employees, and agents are held harmless form any responsibility and liability for claims, proceedings, action,

PT NH Korindo Sekuritas Indonesia — Morning Brief | www.nhsec.co.id Page 33..

SGRO : Posts Profit Decrease of 34.90% in 2017 BUMI : Targets Coal Production of 92 Million Tons HERO : Appoints New President Director.. ADRO : Purchases 80% of Kestrel

Parliament Panel Endorses Warjiyo as Bank Indonesia Governor Final reading on US Q4 GDP is up 2.9%.. Indonesia

The decline was attributable to the incline of USD637 per ton in prices of raw material, naphtha; indeed, the inclining naphtha prices are triggered by the soaring

The construction of new factory enables AALI to has the production capacity of 1,555 tons per hour.. Additionally, the