Proceedings of the International Conference

on Science and Science Education

Copyright © November 2015 by Satya Wacana University Press, Jl. Diponegoro 52–60 Salatiga 50711, Indonesia

Telephone: (+62) 298 321212

All Rights Reserved.

No part of this publication may be reproduced in any form or by any electronic or mechanical means, including photocopying, recording, or any information storage and retrieval system, without permission in writing from the publisher.

SWUP iii

Editorial Board

Proceedings of

the International Conference on Science and Science Education

(IConSSE 2015)Secretariat : Faculty of Science and Science Education, Satya Wacana Christian University Jl. Diponegoro 52–60 Salatiga 50711, Indonesia

Telephone : (+62) 298 321212 ext. 238 Email : [email protected] Website : http://fsm.uksw.edu/semnas/iconsse

Steering Committee

Prof. Dr. Ferdy S. Rondonuwu, S.Pd., M.Sc. Prof. Dr. Eko Sediyono, M.Kom.

Dr. Suryasatria Trihandaru, M.Sc.nat.

Organizing Committee

Chairman : Dr. Adi Setiawan, M.Sc.

iv

Proceedings Team

Reviewer

Prof. Dr. Ferdy S. Rondonuwu, S.Pd., M.Sc. (Satya Wacana Christian University, Indonesia) Prof. Dr. Eko Sediyono, M.Kom. (Satya Wacana Christian University, Indonesia)

Prof. Dr. Sri Wahyuni (Gadjah Mada University, Indonesia) Prof. Dr. Widowati (Diponegoro University, Indonesia)

Prof. Dr. K.H. Timotius (Krida Wacana Christian University, Indonesia) Prof. Dr. Edy Cahyono, M.Si. (Semarang State University, Indonesia) Prof. Dr. Wiyanto, M.Si. (Semarang State University, Indonesia)

Prof. Dr. J. Sardjono (BATAN - National Atomic Energy Agency, Indonesia) Prof. Dr. Slamin, M.Comp.Sc. (Jember University, Indonesia)

Prof. Ravi Prakash Vyas (Indian Institutes of Information Technology, India) Prof. Dr. P. Filzmoser (Vienna University of Technology, Austria)

Prof. Dr.rer.nat. Nuryono, MS (Gadjah Mada University, Indonesia) Prof. Dr. Purwantiningsih (Bogor Agriculture University, Indonesia) Dr. Ed. Van den Berg (Vrije Universiteit, The Netherlands) Dr. Colleen Valle (University of Deakin, Australia)

Dr. Suryasatriya Trihandaru, M.Sc.nat. (Satya Wacana Christian University, Indonesia) Dr. Hanna Arini Parhusip, M.Sc.nat. (Satya Wacana Christian University, Indonesia) Dr. Adi Setiawan, M.Sc. (Satya Wacana Christian University, Indonesia)

Dr. A. Ign. Kristijanto, MS (Satya Wacana Christian University, Indonesia) Dr. Lydia Ninan Lestario (Satya Wacana Christian University, Indonesia) Dr. Siana Halim (Petra Christian University, Indonesia)

Dr. (Candt.) Yohanes Martono, S.Si., M.Sc. (Satya Wacana Christian University, Indonesia) Alvama Pattiserlihun, S.Si., M.Ps.Ed. (Satya Wacana Christian University, Indonesia)

Editor

Prof. Dr. Ferdy S. Rondonuwu, S.Pd., M.Sc. Dr. Adi Setiawan, M.Sc.

Dr. Lydia Ninan Lestario

Dr. Hanna Arini Parhusip, M.Sc.nat.

Tundjung Mahatma, Dip.Comp., S.Pd., M.Kom. Didit Budi Nugroho, D.Sc.

Layout & Cover

SWUP v

Welcoming Address

Welcome to the 2015 IConSSE – The International Conference on Science and Science Education!

This conference, which is organized by the Faculty of Science and Mathematics, Satya Wacana Christian University Salatiga, is held at Laras Asri Resort and Spa Salatiga.

Arts, science and technology are crucial components in the advancement of human civilization. There is art in the creation of technology, and science provides strong bases for the technological development. We are proud to inherit the temple of Borobudur which is a proof that Indonesian’s ancient arts and technology are so advanced that not only is the masterpiece beautiful, but also technologically rich.

This International Conference on Science and Science Education is attended by more than 160 participants. There are more than 67 papers is presented orally covering wide-variety subjects of science and science education. We thank you all for your participation.

We thank the Organizing Committee, Reviewers, and Steering Committee for having been working hard. Finally, we would also like to thank the Rector of Satya Wacana Christian University, and Dean of Faculty of Science and Mathematics for their support for this conference.

We hope you will enjoy our togetherness. Thank you.

Salatiga, November 30th , 2015

vi

Lessons from the 20th century for 21st century science education

[Berg] ………. AZ.1 Excited state dynamics of carotenoids free and bound to pigment-protein complexes

[Rondonuwu–Koyama] ……… AZ.12 Problem solving and reasoning in the learning of mathematics

[Vale] ………. AZ.23

Penalized spline estimator in nonparametric regression

[Andriani–Wibowo–Rahayu] ……….. MA.1 Estimation of parameter in spatial probit regression model

[Fahmi–Ratnasari–Rahayu] ………... MA.5 Parameter estimation of kernel logistic regression

[Fa’rifah–Suhartono–Rahayu] ……….……….. MA.8 Geographically weighted multinomial logistic regression model (Case study: Human development index

value and healths status areas of districts/cities 2013 in Sumatera)

[Fibriyani–Latra–Purhadi] ………..………. MA.13 Comparison of ε-insentive support vector regression and ν-support vector regression in nonlinear

regression problem

[Hustianda–Purnami–Sutikno]……… MA.20 Random forest of modified risk factor on ischemic and hemorrhagic (Case study: Medicum Clinic, Tallinn,

Estonia)

[Karisma–Kormiltsõn–Kuswanto] ………..……… MA.26 Bivariate generalized pareto distribution to predict the return level of extreme rainfall data (Case: Applied

in Ajung and Ledokombo Stations)

[Lestari–Sutikno–Purhadi] ……….. MA.42 Box–Cox realized asymmetric stochastic volatility model

[Nugroho–Morimoto] ……… MA.48 Inflow and outflow forecasting of currency using multi-input transfer function

[Reganata–Suhartono] ………..……….. MA.53 Classifying the poor household using neural network

[Ruslau–Ulama] ……… MA.66 Path analysis model estimates using generalized method of moment (Case study: Maternal mortality in

the Province of East Java)

[Sari–Otok] ……… MA.71 Simulation study of reliability coefficient and discrimination index

[Setiawan–Weku] ………. MA.79 The effect of enviromental attributes, facilities, and demographic profile on travelled option

[Subanti] ……….………..………. MA.86 The determinant of traveled expenditure and the number of visitors in Semarang District

[Subanti–Mulyanto–Kurdi]………..………. MA.90 Combination of volatility and Markov-switching models for financial crisis in Indonesia based on real exchange rate

indicators

[Sugiyanto–Zukhronah] ……….. MA.93 Inflow and outflow of currency forecasting using calendar variation model based on time series regression

SWUP vii

Performance of neural network model in forecasting Indonesian inflation

[Warsito–Suparti–Mukid] ……… MA.103 Financial crisis model in Indonesia using combined of volatility and Markov-switching models based on

international reserve ratio to M2 indicators

[Zukhronah–Susanti–Sugiyanto] ……….……….. MA.109

Proceedings of the IConSSE FSM SWCU (2015), pp. MA.48–52 ISBN: 978-602-1047-21-7

MA.48

Box

–

Cox realized asymmetric stochastic volatility model

Didit B. Nugrohoa and Takayuki Morimotob

aDepartment of Mathematics, Satya Wacana Christian University

bDepartment of Mathematical Sciences, Kwansei Gakuin University

Abstract

This study proposes a class of non-linear realized stochastic volatility model by applying the Box–Cox (BC) transformation, instead of the logarithmic transformation, to the realized estimator. The proposed models are fitted to daily returns and realized kernel of six stocks: SP500, FTSE100, Nikkei225, Nasdaq100, DAX, and DJIA using an Markov Chain Monte Carlo (MCMC) Bayesian method, in which the Hamiltonian Monte Carlo (HMC) algorithm updates BC parameter and the Riemann manifold HMC (RMHMC) algorithm updates latent variables and other parameters that are unable to be sampled directly. Empirical studies provide evidence against log and raw versions of realized stochastic volatility model.

Keywords Box–Cox transformation, HMC, MCMC, realized stochastic volatility

1.

Introduction

Volatility of financial asset returns, defined as the standard deviation of log returns, has played a major role in many financial applications such as option pricing, portfolio allocation, and value-at-risk models. In the context of SV model, very closely related studies of joint models has been proposed by Dobrev & Szerszen (2010), Koopman & M. Scharth (2013), and Takahashi et al. (2009). Their model is known as the realized stochastic volatility (RSV) model.

Recently, the Takahashi et al. (2009)'s model has been extended by Takahashi et al. (2014) by applying a general non-linear bias correction in the realized variance (RV) measure. This study extends the asymmetric version of Takahashi et al. (2014)'s models, known as the realized asymmetric SV (R-ASV) model, by applying the BC transformation to the realized measure. Here we focus on the realized kernel (RK) measure that has some robustness to market microstructure noise. The realized kernel data behave very well and better than any available realized variance statistic Goncalves and Meddahi (2011).

Adding an innovation to obtain an RSV model substantially increase the difficulty in parameter estimation. Nugroho & Morimoto (2015) provided some comparison of estimation results between HMC-based samplers and multi-move Metropolis--Hastings sampler provided by Takahashi et al. (2019) and Takahashi et al. (2014), where the RMHMC sampler give the best performance in terms of inefficiency factor. Therefore, this study employs HMC-based samplers methods to estimate the parameters and latent variables in our proposed model when draws cannot be directly sampled.

2.

Box-Cox R-ASV model

D.B. Nugroho, T. Morimoto

SWUP MA.49

measure of variance. The logarithmic transformation of RV is known to have better finite sample properties than RV. Goncalves and Meddahi (2011) provided a short overview of this transformation and suggested that the log transformation can be improved upon by choosing values of BC parameter other than zero (corresponding to the log transformation). Motivated by this result, we apply the BC transformation to the RV measure to obtain a class of R-ASV model called the BCR-ASV model that takes the following form:

ü = exp -›”ℎ .Y for realized RV defined as

7 =7 ü , G = ß $\

]o

À , if G≠0,

log ü , if G = 0. (2)

Notice that this transformation contains the log transformation for RV (when G = 0) and the raw statistic (when G = 1) as special cases.

As in previous studies, in order to adopt a Gaussian nonlinear state space form where the error terms in both return and volatility equations are uncorrelated, we introduce a

3.

MCMC simulation in the BCR-ASV model

Let = )ü +/# , ½ = )ü +/# , _= )ℎ +/# , & = -G, ¼, , …. , and & =

m, †, Æ,T . By Bayes' theorem, the joint posterior distribution of &,_ given R and V is

& ,& ,_| , ½ = & ,& × |_ × ½|& ,_ × _|& , , (3) where & ,& is a joint prior distribution on parameter & ,& .

The MCMC method simulates a new value for each parameter in turn from its conditional posterior distribution assuming that the current values for the other parameters are true values. We employ the MCMC scheme as follows:

0) Initialize & ,& ,_ .

For steps (1), (3), and (4), we implement the same sampling scheme proposed in Nugroho & Morimoto (2014, 2015). In the following, we study the sampling scheme in step (2) only.

Box–Cox realized asymmetric stochastic volatility model

which is not of standard form, and therefore we cannot sample G from it directly. In this case, we implement the HMC algorithm for sampling G because the metric tensor required to implement the RMHMC sampling scheme cannot be explicitly derived from the above distribution.

4.

Empirical results on real data sets

In this section, the BCR-ASV model and MCMC algorithm discussed in the previous section are applied to the daily returns and RK data for six different international stock indices: DAX, DJIA, FTSE100, Nasdaq100, Nikkei225, and SP500. These data sets were downloaded from Oxford-Man Institute ``realised library" and range from January 2000 to December 2013. Analyses are presented for the sampling efficiency, key parameters that build the extension models.

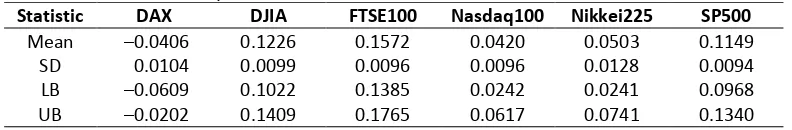

We run the MCMC algorithm for 15,000 iterations but discard the first 5,000 draws. From the resulting 10,000 draws which have passed the Geweke (1992)'s convergence test for each parameter, we calculate the posterior mean, standard deviation (SD), and 95% highest posterior density (HPD) interval. Summary of the posterior simulation results for G are presented in Table 1.

Table 1. Summary of the posterior sample of parameter G in the BCR-ASV model for six

data sets from January 2000 to December 2013.

Statistic DAX DJIA FTSE100 Nasdaq100 Nikkei225 SP500

Mean –0.0406 0.1226 0.1572 0.0420 0.0503 0.1149 SD 0.0104 0.0099 0.0096 0.0096 0.0128 0.0094 LB –0.0609 0.1022 0.1385 0.0242 0.0241 0.0968 UB –0.0202 0.1409 0.1765 0.0617 0.0741 0.1340

Note: LB and UB denote lower and upper bounds of 95% HPD interval, respectively.

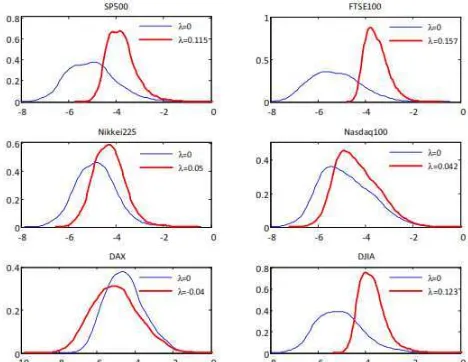

The posterior means of G are positive for DJIA, FTSE100, Nasdaq100, Nikkei225, and SP500 and negative for DAX. In all cases, the 95% HPD interval of G exclude 0 (the log transformation) or 1 (the raw version). Although not reported, we find that even 99% HPD interval of G exclude 0 or 1, providing significant evidence to transform the RV series using the BC transformation against both the logarithmic transformation and no transformation cases.

D.B. Nugroho, T. Morimoto

SWUP MA.51

Figure 1. Marginal densities of the log RV and BC-RV for six different international stock

indices.

5.

Conclusions and extensions

This study presented an extension to the R-ASV models, in which the Box-Cox transformation is applied to realized measure. The HMC and RMHMC algorithms were proposed to implement the MCMC method for updating several parameters and the latent variables in the proposed model, taking advantage of updating the entire latent volatility at once. The model and sampling algorithms were applied to the daily returns and realized kernels of six international stock indices. The estimation results showed very strong evidence supporting the Box-Cox transformation of realized measure. The model can be extended by assuming a non-Gaussian density of return errors.

References

Dobrev, D., & Szerszen, P. (2010). The information content of high-frequency data for estimating equity return models and forecasting risk. Working Paper, Finance and Economics Discussion Series. Geweke, J. (1992). Evaluating the accuracy of sampling-based approaches to the calculation of

posterior moments. In J. M. Bernardo, J. O. Berger, A. P. Dawid, & A. F. M. Smith (Eds.), Bayesian Statistics 4 (pp. 169–194 (with discussion)). Clarendon Press, Oxford, UK.

Goncalves, S., & Meddahi, N. (2011). Box-Cox transforms for realized volatility. Journal of Econometrics, 160, 129–144.

Kim, S., Shephard, N., & Chib, S. (2005). Stochastic volatility: likelihood inference and comparison with ARCH models. In N. Shephard, ed., Stochastic Volatility: Selected Readings (pp. 283–322). Oxford University Press, New York.

Koopman, S.J., & Scharth, M. (2013). The analysis of stochastic volatility in the presence of daily realized measures. Journal of Financial Econometrics, 11(1), 76–115.

Nugroho, D.B., & Morimoto, T. (2014). Realized non-linear stochastic volatility models with asymmetric effects and generalized Student's t-distributions. Journal of The Japan Statistical Society, 44, 83–118.

Nugroho, D.B., & Morimoto, T. (2015). Estimation of realized stochastic volatility models using Hamiltonian Monte Carlo-based methods. Computational Statistics, 30(2), 491–516.

Box–Cox realized asymmetric stochastic volatility model

MA.52